News sentiment analysis for MLM

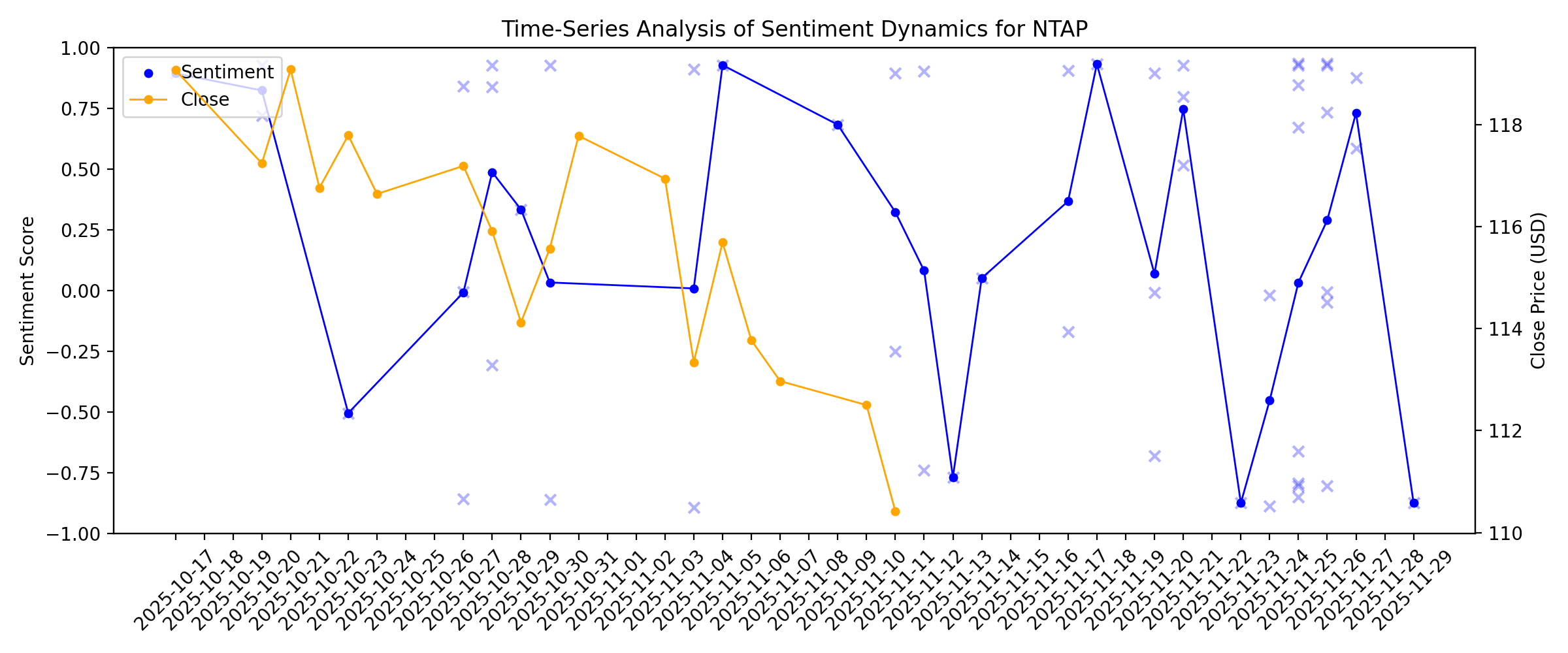

Sentiment chart

2026-01-14

Here's What to Expect From Martin Marietta Materials' Next Earnings Report

Description: Martin Marietta Materials is scheduled to report its fourth-quarter results soon, with analysts anticipating a marginal earnings growth.

2026-01-13

2026-01-12

2026-01-11

What The Q3 Narrative Shift Means For Martin Marietta Materials's Valuation

Description: What the New Fair Value Estimate Signals Analysts have nudged their modeled fair value for Martin Marietta Materials to US$676.43 from US$666.29, paired with a nearly unchanged 8.21% discount rate that keeps the core risk view steady. The forecast now blends slightly softer revenue growth of 7.22% versus 7.34% with a modestly higher implied valuation, reflecting the push and pull between optimism around Q3 themes like volume recovery and infrastructure demand, and caution around weather and...

2026-01-10

2026-01-09

2026-01-08

2026-01-07

2026-01-06

2026-01-05

2026-01-04

2026-01-03

2026-01-02

2026-01-01

Martin Marietta Materials (NYSE:MLM) Misses Q3 CY2025 Revenue Estimates

Description: Construction materials supplier Martin Marietta Materials (NYSE:MLM) missed Wall Street’s revenue expectations in Q3 CY2025, but sales rose 12.4% year on year to $1.85 billion. The company’s full-year revenue guidance of $6.16 billion at the midpoint came in 11.7% below analysts’ estimates. Its non-GAAP profit of $6.85 per share was 2.5% above analysts’ consensus estimates.

2025-12-31

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

These 4 Companies Are Fighting For Infrastructure Dollars

Description: The construction materials sector is riding a wave of infrastructure investment and industrial demand, and several companies are positioned to benefit. But when you look at the fundamentals, the winners aren’t equal. We examined four stocks exposed to this trend to see who actually captures the most value. The Players in Construction Materials United States ... These 4 Companies Are Fighting For Infrastructure Dollars

2025-12-21

2025-12-20

2025-12-19

2025-12-18

Who Actually Benefits From the $200 Billion Infrastructure Boom? We Compared 3 Stocks.

Description: The construction materials sector is riding a wave of public infrastructure spending, but not every company stands to benefit equally. With billions in federal and state funding flowing into roads, bridges, and public works, investors are eyeing three major players: Amrize (NYSE:AMRZ), Vulcan Materials (NYSE:VMC), and Martin Marietta Materials (NYSE:MLM). All three serve the same ... Who Actually Benefits From the $200 Billion Infrastructure Boom? We Compared 3 Stocks.

2025-12-17

2025-12-16

2025-12-15

Martin Marietta Materials (MLM) Surged Following an Asset Swap Deal

Description: TimesSquare Capital Management, an equity investment management company, released its “U.S. Focus Growth Strategy” third-quarter 2025 investor letter. A copy of the letter can be downloaded here. In the third quarter, all the major asset classes posted positive returns except fixed income assets outside the US. The strategy returned 4.00% (gross) and 3.78% (net) compared […]

2025-12-14

2025-12-13

2025-12-12

2025-12-11

Martin Marietta Materials (MLM): Assessing Valuation After a Strong Multi‑Year Share Price Run

Description: Martin Marietta Materials (MLM) has been quietly grinding higher, with shares up over the past year as steady revenue and earnings growth backstop its premium valuation. Investors are watching whether that momentum can reasonably continue. See our latest analysis for Martin Marietta Materials. The recent move to a $623.41 share price caps a strong year to date, with a 22.1% share price return reflecting steady demand for infrastructure exposure and a three year total shareholder return of...

November’s Infrastructure Winner: The $43B Company Beating Industry Titans on Every Metric

Description: Infrastructure stocks delivered mixed signals in Q3 2025, with companies navigating margin pressures, strong demand dynamics, and varying operational efficiency. This ranking evaluates the sector’s leaders based on revenue growth, profitability margins, EBITDA performance, and strategic positioning heading into 2026. 5. Caterpillar Inc. (CAT) The world’s largest construction equipment manufacturer generated $17.64 billion in Q3 ... November’s Infrastructure Winner: The $43B Company Beating Indus

2025-12-10

Construction Slump to Continue Through 2026 With Recovery Expected in 2027, Morgan Stanley Says

Description: US non-residential construction spending is expected to remain under pressure through 2026 before re

2025-12-09

2025-12-08

2025-12-07

2025-12-06

2025-12-05

Is Martin Marietta Materials Stock Underperforming the Nasdaq?

Description: Martin Marietta Materials has notably underperformed the Nasdaq Composite over the past year, but analysts remain moderately bullish on the stock’s prospects.

2025-12-04

Why Is Martin Marietta (MLM) Up 0.9% Since Last Earnings Report?

Description: Martin Marietta (MLM) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-12-03

2025-12-02

2025-12-01

2025-11-30

Martin Marietta Materials: De-Risking the Portfolio for Margin and FCF Acceleration

Description: The company is transforming into a pure-play aggregates leader, boosting margins, free cash flow, and valuation through strategic portfolio realignment and infrastructure-driven growth.

Is Martin Marietta Materials, Inc.'s (NYSE:MLM) Recent Performance Tethered To Its Attractive Financial Prospects?

Description: Most readers would already know that Martin Marietta Materials' (NYSE:MLM) stock increased by 3.3% over the past week...

2025-11-29

2025-11-28

2025-11-27

2025-11-26

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

Is Wall Street Bullish or Bearish on Martin Marietta Materials Stock?

Description: Despite Martin Marietta's weak performance relative to the SPX over the past year, Wall Street analysts maintain a moderately optimistic outlook about the stock’s prospects.

2025-11-20

2025-11-19

2025-11-18

Dycom to Report Q3 Earnings: Here's What Investors Must Know

Description: Is DY set to extend its third-quarter fiscal 2026 momentum as the AI and fiber demand surge continues?

2025-11-17

2025-11-16

2025-11-15

How Analyst Views Are Shaping the Evolving Story for Martin Marietta Materials

Description: Martin Marietta Materials stock has recently seen its consensus analyst price target increase slightly, rising from $663.65 to $666.29. This adjustment comes as analysts consider both the company’s demonstrated volume recovery and robust infrastructure spending, while also taking into account expectations for near-term demand softness and gradual recovery timelines. Stay tuned to discover how you can stay informed as analysts continue to provide updates on the evolving outlook for Martin...

2025-11-14

AECOM Gears Up to Report Q4 Earnings: Key Factors to Note

Description: ACM gears up to report Q4 results as estimates point to year-over-year gains amid strong infrastructure spending and broad market momentum.

Zacks Industry Outlook Highlights Vulcan Materials and Martin Marietta Materials

Description: Zacks highlights Vulcan Materials and Martin Marietta as infrastructure spending, pricing power and resilient demand bolster the concrete & aggregates outlook.

2025-11-13

Martin Marietta Declares Quarterly Cash Dividend

Description: RALEIGH, N.C., Nov. 13, 2025 (GLOBE NEWSWIRE) -- Martin Marietta Materials, Inc. (NYSE: MLM) (“Martin Marietta” or the “Company”) today announced that its Board of Directors has declared a regular quarterly cash dividend of $0.83 per share on the Company’s outstanding common stock. This dividend will be payable on December 31, 2025, to shareholders of record at the close of business on December 1, 2025. Martin Marietta, a member of the S&P 500 Index, is an American-based company and a leading su

2 Concrete & Aggregates Stocks to Gain From the Infrastructure Boom

Description: Federal infrastructure spending should help the Zacks Building Products - Concrete & Aggregates industry players like VMC and MLM. Yet, high rates and expenses are risks.

2025-11-12

2025-11-11

2025-11-10

2025-11-09

2025-11-08

2025-11-07

Martin Marietta Materials (MLM) is Moving to Optimize Its Product Offerings

Description: Diamond Hill Capital, an investment management company, released its “Large Cap Fund” third-quarter 2025 investor letter. A copy of the letter can be downloaded here. Markets continued their YTD rally in the third quarter of 2025, with the Russell 3000 Index gaining 8%, bringing the calendar-year returns to over 14%. The portfolio declined and underperformed the […]

Should Martin Marietta Materials' (MLM) Record Q3 Results and Raised Guidance Prompt Investor Reassessment?

Description: Martin Marietta Materials announced in the past week that it achieved record third-quarter financial results for 2025, with US$1.85 billion in revenues and significant growth in earnings per share, raising its full-year guidance and highlighting recent acquisitions including Premier Magnesia and an asset exchange with Quikrete Holdings. The company completed its long-term share repurchase program without additional buybacks in the most recent quarter, underscoring its focus on portfolio...

2025-11-06

Martin Marietta (MLM) Reports Q3 Earnings: What Key Metrics Have to Say

Description: While the top- and bottom-line numbers for Martin Marietta (MLM) give a sense of how the business performed in the quarter ended September 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Martin Marietta (MLM): Net Margin Decline Challenges Bullish Narratives Despite Five-Year Earnings Growth

Description: Martin Marietta Materials (MLM) has delivered 19.6% annual earnings growth over the past five years, but net profit margins have narrowed to 17.2% from last year’s elevated 30.5%. The trailing twelve-month results were boosted by a one-off $1.3 billion gain. The company’s earnings are forecast to grow at 10.42% per year, which is slower than the projected 16% for the overall US market. Revenue growth is also expected to lag at 6.5% versus the 10.5% market average. With margins under pressure...

2025-11-05

2025-11-04

Martin Marietta Materials Inc (MLM) Q3 2025 Earnings Call Highlights: Record Growth in ...

Description: Martin Marietta Materials Inc (MLM) reports significant revenue and profit increases, raising full-year EBITDA guidance amid strong infrastructure demand.

Martin Marietta's Q3 Earnings & Revenues Miss, Gross Margin Up Y/Y

Description: Can MLM sustain its infrastructure momentum after the third-quarter estimate miss despite strong aggregates growth?

CX vs. MLM: Which Stock Is the Better Value Option?

Description: CX vs. MLM: Which Stock Is the Better Value Option?

Martin Marietta (MLM) Q3 Earnings and Revenues Lag Estimates

Description: Martin Marietta (MLM) delivered earnings and revenue surprises of -10.23% and -9.92%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Martin Marietta: Q3 Earnings Snapshot

Description: RALEIGH, N.C. (AP) — Martin Marietta Materials Inc. MLM) on Tuesday reported third-quarter net income of $414 million. The Raleigh, North Carolina-based company said it had net income of $6.85 per share.

Martin Marietta Reports Third-Quarter 2025 Results

Description: Achieves Record Quarterly Aggregates Revenues, Profitability and Margin Establishes Record Quarterly Revenues and Third Quarter Gross Profit in Specialties Business Raises Full-Year 2025 Guidance RALEIGH, N.C., Nov. 04, 2025 (GLOBE NEWSWIRE) -- Martin Marietta Materials, Inc. (NYSE: MLM) (Martin Marietta or the Company), a leading national supplier of aggregates and heavy building materials, today reported results for the third quarter ended September 30, 2025. Third-Quarter Highlights(Financial

2025-11-03

2025-11-02

2025-11-01

Looking at the Narrative for Martin Marietta Materials After Analyst Price Target Revisions and New Guidance

Description: The Fair Value Estimate for Martin Marietta Materials stock has edged up, rising from $658 to about $664 per share. Recent research reflects a shifting narrative in the industry. Analysts have updated their outlooks based on a blend of positive near-term factors and ongoing sector challenges, with updated price targets showing cautious optimism. Stay tuned to discover how you can keep track of future changes in sentiment and analysis for this evolving stock story. Stay updated as the Fair...

2025-10-31

Martin Marietta to Report Q3 Earnings: What to Expect This Season?

Description: MLM's Q3 earnings are likely to benefit from strong pricing, infrastructure demand and a strategic portfolio shift under SOAR 2025.

Here's What to Know Ahead of Great Lakes Dredge & Dock's Q3 Earnings

Description: Can GLDD ride the coastal protection demand to stronger margins amid mixed segment performance in the upcoming third quarter?

Gear Up for Martin Marietta (MLM) Q3 Earnings: Wall Street Estimates for Key Metrics

Description: Besides Wall Street's top-and-bottom-line estimates for Martin Marietta (MLM), review projections for some of its key metrics to gain a deeper understanding of how the company might have fared during the quarter ended September 2025.

2025-10-30

Eagle Materials (EXP) Lags Q2 Earnings Estimates

Description: Eagle Materials (EXP) delivered earnings and revenue surprises of -2.76% and +0.96%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

2025-10-29

Does Martin Marietta’s Recent 20.8% Surge Still Justify Its Premium Price in 2025?

Description: Thinking about whether you should buy, hold, or trim your position in Martin Marietta Materials? You're not alone. Plenty of investors are weighing their next move after a steady stretch for this construction aggregates leader. Shares are up an impressive 20.8% this year, with a strong five-year run of 130.6%. In the last week, however, the stock dipped 2.4%. This mix of short-term volatility and long-term growth has caught a lot of eyes. Behind these numbers, the company has attracted...

2025-10-28

Quanta is Set to Report Q3 Earnings: Here's What Investors Must Know

Description: Will PWR's robust grid and renewables momentum help it power past third-quarter estimates once again?

Quanta to Report Q3 Earnings: What Investors Should Know?

Description: PWR gears up to report Q3 earnings, with strong infrastructure tailwinds and double-digit revenue growth expected.

Vulcan Materials to Report Q3 Earnings: What Should Investors Watch?

Description: VMC's third-quarter results may see a rebound from weather-hit quarters, powered by strong infrastructure demand and pricing gains.

Martin Marietta (MLM) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Description: Martin Marietta (MLM) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2025-10-27

Top Analyst Reports for Microsoft, Alphabet & Berkshire Hathaway

Description: Microsoft, Alphabet, and Berkshire Hathaway shine in fresh analyst reports highlighting AI growth, insurance strength, and strategic execution.

2025-10-26

2025-10-25

2025-10-24

Why Investors Need to Take Advantage of These 2 Construction Stocks Now

Description: Investors looking for ways to find stocks that are set to beat quarterly earnings estimates should check out the Zacks Earnings ESP.

2025-10-23

Want Better Returns? Don't Ignore These 2 Construction Stocks Set to Beat Earnings

Description: Finding stocks expected to beat quarterly earnings estimates becomes an easier task with our Zacks Earnings ESP.

2025-10-22

2025-10-21

2025-10-20

2025-10-19

Jim Cramer on Martin Marietta: “Just Hold it. I Wouldn’t Buy More”

Description: Martin Marietta Materials, Inc. (NYSE:MLM) is one of the stocks Jim Cramer recently offered insights on. A caller, who began buying MLM shares before a recent rally, noted the stock hit a 52-week high, and despite a pullback, they are up 36% and asked what they should do with their position. Cramer stated: “Just hold […]