News sentiment analysis for MNST

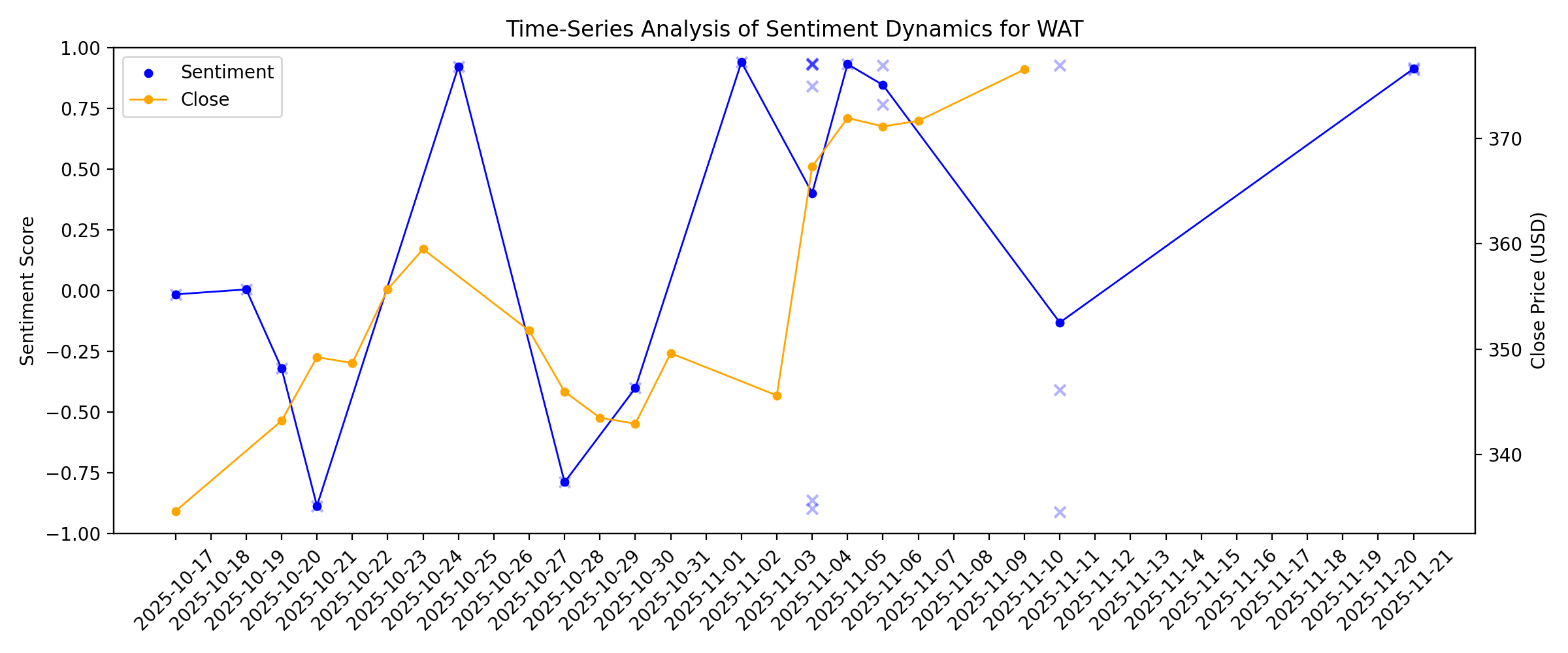

Sentiment chart

2026-01-14

2026-01-13

2026-01-12

Jim Cramer Says Dollar Stores Like Dollar General Are “Wall Street Faves”

Description: Dollar General Corporation (NYSE:DG) is one of the stocks from different market sectors that Jim Cramer commented on. Cramer discussed the stock while showing optimism around dollar stores, as he remarked: “How about the plight of the consumer staples cohort? This was the second worst group in the market last year, was up just 1.3%. […]

2026-01-11

Monster Beverage (NASDAQ:MNST) Knows How To Allocate Capital

Description: There are a few key trends to look for if we want to identify the next multi-bagger. Firstly, we'll want to see a...

2026-01-10

2026-01-09

2026-01-08

Why Monster Beverage Stock Is Worth Holding in Your Portfolio Now

Description: MNST's strong brand, innovation and global reach make it a resilient growth story despite cost and regulatory pressures.

2026-01-07

Investors in Monster Beverage (NASDAQ:MNST) have seen respectable returns of 61% over the past five years

Description: When you buy and hold a stock for the long term, you definitely want it to provide a positive return. Better yet, you'd...

2026-01-06

2026-01-05

2026-01-04

2026-01-03

Has Monster Beverage Corporation's (NASDAQ:MNST) Impressive Stock Performance Got Anything to Do With Its Fundamentals?

Description: Most readers would already be aware that Monster Beverage's (NASDAQ:MNST) stock increased significantly by 13% over the...

Best Stock to Buy Right Now: Coca-Cola vs. Monster Beverage

Description: Should investors looking for a beverage company go with the industry giant or a smaller, more focused player?

2026-01-02

Will Monster Beverage's Expansion Strategy & Innovations Aid?

Description: MNST is riding global energy drink demand as product innovation and international momentum fuel sales growth and market share gains.

2026-01-01

2025-12-31

Is Monster Beverage Driving Momentum Through Innovation and Marketing?

Description: MNST is fueling growth by blending new flavors, zero-sugar innovation, disciplined pricing and high-impact marketing into a unified global strategy.

Warren Buffett Says Goodbye Today With 65% of Berkshire Hathaway in 5 of His Favorite Stocks

Description: Despite Warren Buffett’s departure, these five dividend stocks are likely to stay in the Berkshire Hathaway portfolio for decades to come.

2025-12-30

Low-Beta Stocks to Own as We Head Into 2026: MNST, TDC, NGS & COCO

Description: With markets on edge, low-beta picks MNST, TDC, NGS and COCO stand out as steady plays as investors await signals from the Fed.

2025-12-29

Take the Zacks Approach to Beat the Markets: Castle Biosciences, Hamilton Insurance & Monster Beverage in Focus

Description: Castle Biosciences surged 77.9% after a Zacks upgrade, highlighting how the firm's stock picks outpaced the broader market in recent months.

Celsius Holdings Bets on Brand Synergies to Drive Long-Term Scale

Description: CELH sees tighter brand integration across Celsius, Alani Nu and Rockstar as a path to greater scale, efficiency and retail execution.

2025-12-28

2025-12-27

Monster Beverage Corporation (NASDAQ:MNST) Shares Could Be 26% Above Their Intrinsic Value Estimate

Description: Key Insights Using the 2 Stage Free Cash Flow to Equity, Monster Beverage fair value estimate is US$61.22 Current share...

2025-12-26

Monster Beverage (MNST) Is Up 3.10% in One Week: What You Should Know

Description: Does Monster Beverage (MNST) have what it takes to be a top stock pick for momentum investors? Let's find out.

CELH vs. MNST: Which Energy Drink Stock Is the Better Bet Now?

Description: Monster Beverage's global scale and margin strength face off against Celsius' rapid growth and innovation.

2025-12-25

2025-12-24

2025-12-23

Monster Beverage price target raised to $87 from $81 at Morgan Stanley

Description: Morgan Stanley raised the firm’s price target on Monster Beverage (MNST) to $87 from $81 and keeps an Overweight rating on the shares. The firm is citing its building confidence in sustainably higher growth than peers, upside vs. consensus following more detail at Analyst Day, strong U.S./European scanner data, and in-depth discussions with the management, the analyst tells investors in a research note.Claim 70% Off TipRanks This Holiday SeasonUnlock hedge-fund level data and powerful investing

Monster Beverage (MNST) Valuation Check as Coca-Cola Partnership and Strong Western Sales Lift Optimism

Description: Monster Beverage (MNST) is back in the spotlight after recent analyst commentary linked stronger U.S. and Western European sales, as well as supportive pricing, to growing optimism around its expanding Coca Cola distribution partnership. See our latest analysis for Monster Beverage. Those fundamentals are starting to show up in the tape, with the share price at $77.66 and a roughly 48 percent year to date share price return pointing to clear, building momentum rather than a quick trading...

How Investors Are Reacting To Monster Beverage (MNST) Upbeat Sales Sentiment And Coca-Cola Expansion Partnership

Description: In recent days, Monster Beverage has attracted fresh attention as analyst and AI-driven research pointed to strong near-term sentiment supported by solid sales performance, favorable pricing trends, and its global distribution reach. Analysts specifically highlighted Monster’s deepening partnership with Coca-Cola as a potential accelerator for international expansion, reinforcing the brand’s positioning in key overseas markets. We’ll now examine how this upbeat analyst commentary around...

Is Monster Beverage’s 2025 Surge Justified After Strong Cash Flows and New Product Launches?

Description: If you have ever wondered whether Monster Beverage is still a buy after its huge run, you are not alone. This article is written with exactly that question in mind. The stock has climbed about 3.8% over the last week, 7.8% over the past month, and is now up roughly 48.5% year to date, with a 49.7% gain over the last year and 71.0% over five years that has clearly caught the market's attention. Recent headlines have focused on Monster's ongoing innovation pipeline and brand expansion, from...

2025-12-22

Monster Beverage Positioned for Sustainable High Growth Versus Peers, Morgan Stanley Says

Description: Monster Beverage's (MNST) clear long-term strategies and management depth position the company for s

Warren Buffett Departs With 64% of Berkshire Hathaway in 5 Stocks to Hold Forever

Description: Despite Warren Buffett’s impending departure, these five dividend stocks are likely to stay in the Berkshire Hathaway portfolio for decades to come.

2025-12-21

2025-12-20

2025-12-19

Monster Beverage Insider Sale Leads to Investor Scrutiny

Description: MNST draws scrutiny after its largest insider sale in a year, with executives selling near multi-year highs and no recent insider buys.

2025-12-18

Buy 5 Non-Tech Nasdaq Stocks for 2026 That Helped It Surge in 2025

Description: MNST, EXPE, FIVE, FOXA and RGLD are five non-tech Nasdaq stocks that surged in 2025, as strong consumer demand fueled gains beyond Big Tech.

Insiders At Monster Beverage Sold US$4.3m In Stock, Alluding To Potential Weakness

Description: The fact that multiple Monster Beverage Corporation ( NASDAQ:MNST ) insiders offloaded a considerable amount of shares...

2025-12-17

2025-12-16

2025-12-15

2025-12-14

Does Monster Beverage (NASDAQ:MNST) Deserve A Spot On Your Watchlist?

Description: For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to...

2025-12-13

2025-12-12

Monster Beverage and Bassett Furniture have been highlighted as Zacks Bull and Bear of the Day

Description: Monster's record momentum contrasts sharply with Bassett's estimate cuts, while HOOD, IBKR and TW showcase divergent paths in trading-platform innovation.

Bull of the Day: Monster Beverage (MNST)

Description: Everyone is still drinking energy drinks.

2025-12-11

Is Monster Beverage's Pricing Strategy a Catalyst for Margin Growth?

Description: MNST's third-quarter 2025 pricing moves fuel sharp margin gains as strong demand and mix shifts lead to higher earnings growth rates compared to sales.

2025-12-10

Why You Should Care About Monster Beverage's (NASDAQ:MNST) Strong Returns On Capital

Description: What are the early trends we should look for to identify a stock that could multiply in value over the long term...

2025-12-09

The Zacks Analyst Blog Highlights Monster Beverage, MongoDB and Lumentum

Description: As markets await the final Fed decision of 2025, Monster Beverage, MongoDB and Lumentum stand out among momentum leaders in a volatile macro week.

2025-12-08

2025-12-07

2025-12-06

What Monster Beverage (MNST)'s Ultra Momentum and FLRT Launch Reveal About Its Growth Strategy

Description: In late November 2025, Monster Beverage held an investor update where management highlighted broad-based market share gains, rapid growth of its zero-sugar Ultra line in the U.S., and strong early traction in emerging markets such as China and India. A key insight from the update was Monster’s focus on supply chain modernization and the planned FLRT launch, targeting female consumers with zero-sugar functional energy drinks starting in early 2026. We’ll now assess how Monster’s strong Ultra...

2025-12-05

Coca-Cola's Margins Soar: Can It Sustain the Efficiency Push?

Description: KO's Q3 margin gains highlight its efficiency push and spark questions about how long its operating momentum can hold.

Investing in Monster Beverage (NASDAQ:MNST) five years ago would have delivered you a 66% gain

Description: The main point of investing for the long term is to make money. But more than that, you probably want to see it rise...

2025-12-04

Monster's 'Girly' Energy Drink Reveal Riddled With Big Promises – But Not Everyone Loves The Name

Description: Monster Beverage Corporation (NASDAQ:MNST) is preparing to launch a new energy drink brand specifically designed for female consumers, marking the company’s latest strategic move in an increasingly competitive market segment. FLRT Brand Details and Launch Timeline Monster is entering the female-focused energy drink space with FLRT, a new zero sugar brand rolling out in early 2026, CEO Hilton Schlosberg said on the company’s Q3 earnings call last month. The drink launches with four flavors includ

2025-12-03

Are You Looking for a Top Momentum Pick? Why Monster Beverage (MNST) is a Great Choice

Description: Does Monster Beverage (MNST) have what it takes to be a top stock pick for momentum investors? Let's find out.

2 Energy Drink Stocks to Buy for a Stable Portfolio in 2026

Description: MNST and PEP gain from expanding energy drink demand, stronger margins and global growth, offering steady portfolio support for 2026.

2025-12-02

Buy These 3 Consumer Staple Stocks to Navigate Market Volatility

Description: COCO, MNST and SCI emerge as low-beta consumer staples offering investors a steadier path through mounting market volatility.

Is Monster Beverage Stock Outperforming the Dow?

Description: Soft drinks giant Monster Beverage has significantly outperformed the Dow over the past year, and analysts remain bullish on the stock’s prospects.

2025-12-01

Monster Beverage Seen Posting 10% US Revenue Growth in 2026, RBC Says

Description: Monster Beverage's (MNST) US revenue is expected to grow close to 10% in 2026, supported by steady d

Monster Beverage (MNST): Assessing Valuation After Record Sales and Surging International Growth

Description: Monster Beverage (MNST) stock is in focus after the company delivered a record-breaking quarter. Net sales, gross profit, and overall earnings all reached previous highs, supported by a 17% increase in revenue and strong international growth. See our latest analysis for Monster Beverage. Monster Beverage’s stellar quarter comes alongside impressive share price momentum, with the stock climbing 43% year-to-date. That surge reflects not just growing optimism around its international expansion,...

Is Monster Beverage's International Push the Next Big Driver of Sales?

Description: MNST's international momentum accelerates as Q3 overseas sales jump 23%, expanding margins and boosting global brand reach.

Is Monster Beverage (MNST) Stock Outpacing Its Consumer Staples Peers This Year?

Description: Here is how Monster Beverage (MNST) and United Natural Foods (UNFI) have performed compared to their sector so far this year.

Take the Zacks Approach to Beat the Markets: MBX Biosciences, Garrett Motion & Monster Beverage in Focus

Description: MBX Biosciences' sharp rally highlights how Zacks' stock recommendations outpaced broader market gains across multiple portfolios.

Celsius Holdings Posts 51.3% Gross Margin in Q3: Is It Sustainable?

Description: CELH posts a 51.3% Q3 gross margin, but acquisitions, tariffs and integration costs raise questions about sustaining the gains.

2 High-Flying Stocks on Our Buy List and 1 We Find Risky

Description: Expensive stocks typically earn their valuations through superior growth rates that other companies simply can’t match. The flip side though is that these lofty expectations make them particularly susceptible to drawdowns when market sentiment shifts.

2025-11-30

2025-11-29

2025-11-28

Has Monster Beverage Corporation's (NASDAQ:MNST) Impressive Stock Performance Got Anything to Do With Its Fundamentals?

Description: Most readers would already be aware that Monster Beverage's (NASDAQ:MNST) stock increased significantly by 20% over the...

2025-11-27

Monster (MNST) Q3 2025 Earnings Call Transcript

Description: Also on the call are Tom Kelly, our Chief Financial Officer; Emelie Tirre, our Chief Commercial Officer; Rob Gehring, our Chief Growth Officer; Guy Carding, our President of EMEA and OSP; and Mark Astrachan, our Senior VP of Investor Relations and Corporate Development. In the United States, according to Nielsen, for the recently reported 13-week period through October 25, 2025, sales in dollars in the energy drink category, including energy shots for all outlets combined, namely convenience, grocery, drug, mass merchandisers, increased by 12.2% versus the same period a year ago.

2025-11-26

Zacks Industry Outlook Highlights The Coca-Cola, Monster Beverage, Keurig Dr Pepper and Vita Coco

Description: The Coca-Cola, Monster Beverage, Keurig Dr Pepper and Vita Coco have been highlighted in this Industry Outlook article.

2025-11-25

2025-11-24

Monster Beverage Announces Webcast Details for Investor Meeting December 2, 2025; Company Announces Participation in Morgan Stanley Global Consumer & Retail Conference

Description: CORONA, Calif., Nov. 24, 2025 (GLOBE NEWSWIRE) -- Monster Beverage Corporation (NASDAQ: MNST) announced today that its Chief Executive Officer, Hilton Schlosberg (the “CEO”), and members of its senior executive team will host an investor meeting Tuesday, December 2, 2025, to provide an update on the Company’s business and operations. The Company’s presentation will be open to all interested parties as a live webcast at www.monsterbevcorp.com, under the “Events & Presentations” section, at approx

2025-11-23

2025-11-22

Looking at the Narrative for Monster as Analysts Boost Targets Amid Changing Growth Outlook

Description: Monster Beverage stock has garnered renewed attention as the consensus analyst price target has risen notably from $68.64 to $72.23. This uptick signals increased confidence in the company’s growth prospects following a series of positive analyst updates. Stay tuned to find out how you can stay ahead of future developments and keep up with the evolving story behind Monster Beverage’s stock. Analyst Price Targets don't always capture the full story. Head over to our Company Report to find new...

2025-11-21

2025-11-20

Does Celsius Holdings' Buyback Plan Signal Stronger Growth Ahead?

Description: CELH's $300 million buyback plan, supported by soaring revenues, rising margins and strong cash reserves, underscores its long-term confidence.

Monster faces modest tariff impact from aluminum costs

Description: The beverage maker attributed higher can prices to a duty-driven increase in the Midwest premium for aluminum.

2025-11-19

Collegium Pharma and Entegris have been highlighted as Zacks Bull and Bear of the Day

Description: COLL's momentum and value appeal contrast sharply with ENTG's slide on weak guidance and falling estimates, highlighting a split in market sentiment.

Record Sales, Bullish Buys Power Monster’s Comeback

Description: Sales jump, overseas performance, and Big Money buying help Monster Beverage Corporation (MNST) shares rise 58% since February.

2025-11-18

2025-11-17

Will Monster Beverage's Expansion Strategy & Energy Drinks Unit Aid?

Description: MNST rides global energy-drink momentum and innovation strength to fuel growth across key markets and its core portfolio.

Buy 5 Consumer Staples Stocks Despite the Sector's Weak Show in 2025

Description: Consumer staples lag in 2025, but PEP, MNST, LW, UNFI and OLLI are five stocks that show improving growth drivers for 2026.

2025-11-16

A Look At The Intrinsic Value Of Monster Beverage Corporation (NASDAQ:MNST)

Description: Key Insights Using the 2 Stage Free Cash Flow to Equity, Monster Beverage fair value estimate is US$62.09 Monster...

2025-11-15

2025-11-14

Is Monster Beverage's Zero-Sugar Push Reshaping Energy Drink Trends?

Description: MNST's expanding zero-sugar lineup is capturing shifting consumer tastes and fueling strong momentum across global energy drink markets.

2025-11-13

Is Monster Beverage (MNST) Outperforming Other Consumer Staples Stocks This Year?

Description: Here is how Monster Beverage (MNST) and Turning Point Brands (TPB) have performed compared to their sector so far this year.

5 Must-Read Analyst Questions From Monster’s Q3 Earnings Call

Description: Monster Beverage delivered better-than-expected results in Q3, reflected in a significant positive market reaction following the report. Management attributed the quarter’s performance to robust category growth globally, particularly in international markets, and successful new product launches. CEO Hilton Schlosberg highlighted the company’s strong execution in the U.S. and EMEA, as well as the continued outperformance of the Monster Energy Ultra line, which benefited from viral marketing and s

2025-11-12

Warren Buffett Stepping Down With 31% of Berkshire in Cash: His 3 Ultra Safest Stocks

Description: These three longtime Warren Buffett favorite stock picks are likely to stay in the Berkshire Hathaway portfolio long after he steps down.

2025-11-11

Is Monster Stock Worth the Hype After Its 37.5% Surge in 2025?

Description: Curious whether Monster Beverage is actually worth its current price? Let’s cut through the market noise and break down the real value behind this well-known stock. Lately, Monster Beverage has been catching attention with a 7.5% jump this past week and a solid 37.5% return year-to-date, hinting at renewed momentum and changing investor sentiment. The stock’s movement comes alongside industry headlines around shifting consumer preferences and competitive launches in the energy drink space...

Celsius Holdings' Q3 Revenues Hit $725M: Will the Momentum Last?

Description: CELH posts $725 million in 3Q25 revenues, fueled by Alani Nu and Rockstar gains. However, timing effects cloud the true growth picture.

2025-11-10

Company News for Nov 10, 2025

Description: Companies in The News Are: AQN, CEG, TSLA, MNST

Don't Overlook Monster Beverage (MNST) International Revenue Trends While Assessing the Stock

Description: Review Monster Beverage's (MNST) international revenue performance and how it affects the predictions of financial analysts on Wall Street and the future prospects for the stock.

As Warren Buffett Waves Goodbye, 5 Dividend Stocks That Never Leave Berkshire Hathaway

Description: Given Warren Buffett’s impending retirement, which dividend stocks are likely to remain in the Berkshire Hathaway portfolio for the long term?

2025-11-09

2025-11-08

Monster Beverage (MNST): Evaluating Fair Value After Strong Shareholder Returns and Recent Price Rally

Description: Monster Beverage (MNST) continues to draw interest among investors as its stock moves steadily upward over the past month, supported by consistent revenue and net income growth. The steady performance keeps it in focus for growth investors. See our latest analysis for Monster Beverage. Monster Beverage’s share price keeps powering higher, rallying over 5% in the last day and up more than 33% year-to-date, which puts it well ahead of most peers. That momentum has helped deliver a 28.8% total...

Did Record Quarterly Sales and Global Expansion Just Shift Monster Beverage's (MNST) Investment Narrative?

Description: Monster Beverage Corporation reported record third-quarter 2025 results, with net sales rising to US$2.20 billion and net income reaching US$524.46 million, significantly outperforming the prior year. International sales accounted for 43% of total net sales, the highest ever for a single quarter, highlighting the company's successful efforts to expand globally and diversify revenue streams. We'll explore how Monster Beverage's record global sales and strong international performance...

As Warren Buffett Waves Goodbye – 5 Dividend Stocks That Never Leave Berkshire Hathaway

Description: If any investor has stood the test of time, it’s Warren Buffett, and with good reason. For years, the “Oracle of Omaha” has had a rock star-like presence in the investing world, and his annual Berkshire Hathaway shareholders meeting draws thousands of loyal fans who are investors. They were stunned at this year’s meeting when ... As Warren Buffett Waves Goodbye – 5 Dividend Stocks That Never Leave Berkshire Hathaway

2025-11-07

CELH Stock Plummets 30%. This Analyst Sees Only Gains Ahead.

Description: Celsius stock fell 30% in two days. One analyst was undaunted, calling the reaction "overdone" and recommending investors scoop up shares.

Stocks to Watch Friday Recap: Tesla, Affirm, Block

Description: ↘️ Tesla (TSLA): Shareholders approved a $1 trillion pay package for Chief Executive Elon Musk, but gave mixed support to the idea of the carmaker investing in his xAI ventures. The stock closed 3.7% lower.

Sector Update: Consumer Stocks Rise Late Afternoon

Description: Consumer stocks advanced late Friday afternoon with the Consumer Staples Select Sector SPDR Fund (XL

Monster Beverage's Strong Q3 Seen Largely Priced In, UBS Says

Description: Monster Beverage (MNST) delivered a strong Q3 but further upside appears largely priced into the sto

Sector Update: Consumer Stocks Mixed in Afternoon Trading

Description: Consumer stocks were mixed Friday afternoon, with the Consumer Staples Select Sector SPDR Fund (XLP)

Monster Beverage (MNST) Q3 Earnings: Taking a Look at Key Metrics Versus Estimates

Description: Although the revenue and EPS for Monster Beverage (MNST) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Monster Beverage Q3 Earnings Beat, Higher Sales on Growth Across Segments

Description: MNST posts double-digit Q3 sales and profit growth as new product launches and global demand power momentum.

Why Are Monster (MNST) Shares Soaring Today

Description: Shares of energy drink company Monster Beverage (NASDAQ:MNST) jumped 5.9% in the afternoon session after the company reported strong third-quarter financial results that surpassed Wall Street's expectations.

Monster Beverage's Q3 Sales Surge on International Growth, Margin Gains, RBC Says

Description: Monster Beverage (MNST) delivered a strong Q3 with 16.8% sales growth, beating estimates on topline

MNST Q3 Deep Dive: International Expansion and Innovation Drive Margin Gains

Description: Energy drink company Monster Beverage (NASDAQ:MNST) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 16.8% year on year to $2.20 billion. Its non-GAAP profit of $0.56 per share was 17.5% above analysts’ consensus estimates.

Stocks Down Pre-Bell as Tech Weakness, Labor Market Concerns Weigh

Description: The benchmark US stock measures were lower before the open Friday amid continued weakness in tech sh

Monster Beverage Third-Quarter Results Top Street Views Amid Strong Energy Drinks Demand

Description: Monster Beverage (MNST) shares rose early Friday as the company recorded better-than-expected third-

Monster Beverage Corp (MNST) Q3 2025 Earnings Call Highlights: Record Sales and Strong ...

Description: Monster Beverage Corp (MNST) reports a 16.8% increase in net sales, driven by robust international performance and strategic brand growth, despite challenges in the Alcohol Brand segment.

2025-11-06

Why Analysts Say The Monster Beverage Story Is Shifting Amid New Growth and Competition

Description: Monster Beverage stock has seen a modest increase in its consensus analyst price target, rising from $68.00 to approximately $68.64 per share. This upward adjustment reflects growing optimism among bullish analysts, who point to strong sales performance and successful product innovations as driving factors. Stay tuned to discover how you can monitor future updates and stay ahead of changes in Monster Beverage’s investment narrative. Stay updated as the Fair Value for Monster Beverage shifts...

Monster Beverage Sales Climb on Growing Demand for Energy Drinks

Description: The energy-drink maker posted a double-digit gain in sales for its latest quarter on increased demand for energy drinks.

Monster Beverage (MNST) Surpasses Q3 Earnings and Revenue Estimates

Description: Monster Beverage (MNST) delivered earnings and revenue surprises of +16.67% and +4.10%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Monster (NASDAQ:MNST) Delivers Impressive Q3

Description: Energy drink company Monster Beverage (NASDAQ:MNST) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 16.8% year on year to $2.20 billion. Its non-GAAP profit of $0.56 per share was 17.5% above analysts’ consensus estimates.

Monster Beverage: Q3 Earnings Snapshot

Description: CORONA, Calif. AP) — Monster Beverage Corp. MNST) on Thursday reported third-quarter profit of $524.5 million.

Monster Beverage Reports 2025 Third Quarter Financial Results

Description: 2025 Third Quarter Highlights Record Quarterly Net Sales rise 16.8 percent to $2.20 billion Operating Income increases 40.7 percent to $675.4 millionNet Income increases 41.4 percent to $524.5 millionNet Income Per Diluted Share increases 41.1 percent to $0.53 per share CORONA, Calif., Nov. 06, 2025 (GLOBE NEWSWIRE) -- Monster Beverage Corporation (NASDAQ: MNST) today reported financial results for the three- and nine-months ended September 30, 2025. Net sales for the 2025 third quarter increase

Equities Fall Intraday as Report Shows Surge in Job Cuts

Description: US benchmark equity indexes were lower intraday as a report showed a surge in job cut announcements

Celsius Doubled Its Market Share This Year. Why The Stock Took a Dive.

Description: Celsius posted triple-digit revenue growth, widened gross margins, and took a bigger slice of the energy-drink aisle in the third quarter. For the quarter ended in September, Celsius posted revenue of $725 million, up 173% from a year ago, as the company’s widened portfolio kicked into gear. Two years ago, Celsius held a 10% share in the energy-drink market.

Stocks Mostly Up Pre-Bell as Traders Assess Supreme Court Hearing on Trump Tariffs

Description: US equity markets were mostly pointing higher before Thursday's opening bell as investors assess the

2025-11-05

2025-11-04

Monster (MNST) Q3 Earnings Report Preview: What To Look For

Description: Energy drink company Monster Beverage (NASDAQ:MNST) will be reporting earnings this Thursday after market close. Here’s what to look for.

Axon’s (NASDAQ:AXON) Q3: Beats On Revenue But Stock Drops 14.1%

Description: Self defense company AXON (NASDAQ:AXON) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 30.6% year on year to $710.6 million. Guidance for next quarter’s revenue was better than expected at $752.5 million at the midpoint, 1.3% above analysts’ estimates. Its non-GAAP profit of $1.17 per share was 24.1% below analysts’ consensus estimates.

Kratos (NASDAQ:KTOS) Surprises With Q3 Sales But Stock Drops

Description: Aerospace and defense company Kratos (NASDAQ:KTOS) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 26% year on year to $347.6 million. Revenue guidance for the full year exceeded analysts’ estimates, but next quarter’s guidance of $325 million was less impressive, coming in 2.5% below expectations. Its non-GAAP profit of $0.14 per share was 17.5% above analysts’ consensus estimates.

Warren Buffett Has Been Waiting For The Sell-Off – His 4 Safest Dividend Stocks

Description: Berkshire Hathaway Inc. (NYSE: BRK-B) reported better-than-expected results for the third quarter, thanks to some outstanding performance from the insurance companies in the portfolio. The company’s Q3 2025 earnings increased to nearly $30.8 billion, a substantial rise driven by improved operating profits and higher investment gains. The company’s cash reserves increased to a record $382 ... Warren Buffett Has Been Waiting For The Sell-Off – His 4 Safest Dividend Stocks

2025-11-03

Warren Buffett’s Cash Up to $382 Billion: 2 Dividend Stocks He Never Sells

Description: Despite Berkshire Hathaway being a net seller of stocks for the past three years, Warren Buffett would never sell these two dividend stocks.

Monster Beverage's (NASDAQ:MNST) earnings growth rate lags the 10% CAGR delivered to shareholders

Description: If you buy and hold a stock for many years, you'd hope to be making a profit. Furthermore, you'd generally like to see...

2025-11-02

Celsius: From Hype to Habit--Can the $16B Energy Challenger Keep Compounding?

Description: The fastest-growing energy drink in America just proved it's no fad.

2025-11-01

2025-10-31

Monster Beverage Expected to Deliver 'Strong' Q3 Growth, UBS Says

Description: Monster Beverage (MNST) is expected to deliver another quarter of "strong" top-line growth, with UBS

Why AbbVie (ABBV) Shares Are Falling Today

Description: Shares of pharmaceutical company AbbVie (NYSE:ABBV) fell 3.9% in the afternoon session after the company reported third-quarter results that were overshadowed by a steep drop in profitability and a reduced earnings forecast for the full year. Although AbbVie's quarterly revenue of $15.78 billion and adjusted earnings per share (EPS) of $1.86 both surpassed Wall Street's estimates, investors focused on underlying weaknesses. The company's operating margin fell sharply to 12.1% from 26.5% a year a

After Skyrocketing, Energy Drink Maker Celsius Hits Latest Buy Point. But Earnings Loom.

Description: Celsius stock hit its latest buy point before retreating. And third-quarter earnings results are due out in early November.

Monster (MNST): Buy, Sell, or Hold Post Q2 Earnings?

Description: Even though Monster (currently trading at $65.28 per share) has gained 8.6% over the last six months, it has lagged the S&P 500’s 22.6% return during that period. This might have investors contemplating their next move.

2025-10-30

Why Tesla (TSLA) Shares Are Trading Lower Today

Description: Shares of electric vehicle pioneer Tesla (NASDAQ:TSLA) fell 3.8% in the morning session after investor concerns grew as one of the United States' largest pension funds, the California Public Employees' Retirement System (Calpers), stated it would vote against CEO Elon Musk's 2025 performance award.

Monster Beverage (MNST) Earnings Expected to Grow: What to Know Ahead of Q3 Release

Description: Monster Beverage (MNST) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Altria (NYSE:MO) Reports Sales Below Analyst Estimates In Q3 Earnings, Stock Drops

Description: Tobacco company Altria (NYSE:MO) fell short of the market’s revenue expectations in Q3 CY2025, with sales falling 1.7% year on year to $5.25 billion. Its non-GAAP profit of $1.45 per share was in line with analysts’ consensus estimates.

Monster Beverage (NASDAQ:MNST) Might Become A Compounding Machine

Description: If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for...

Monster Beverage to Report Financial Results for 2025 Third Quarter on November 6, 2025

Description: Company to Conduct Conference Call at 2 p.m. Pacific TimeCORONA, Calif., Oct. 30, 2025 (GLOBE NEWSWIRE) -- Monster Beverage Corporation (NASDAQ: MNST) announced today that results for its third quarter ended September 30, 2025 will be reported on Thursday, November 6, 2025 after the close of the market. The company also said that Chief Executive Officer, Hilton Schlosberg, will host an investor conference call that same day at 2 p.m. Pacific Time to review the company’s financial results and ope

Is Wall Street Bullish or Bearish on Monster Beverage Stock?

Description: Monster Beverage has been beating the market over the past year, and Wall Street remains fairly bullish, with analysts expecting the company to keep delivering steady growth.

2025-10-29

20 Years on Wall Street Taught Me: Dividend Blue-Chips You Never Sell

Description: These are the kind of stocks that growth and income investors can buy now, tomorrow, next week, or next year and hold for the long term.

2025-10-28

If You Invested in These Penny Stocks That Went Gangbusters in 1993, You’d Be Rich Today

Description: Discover the 1993 penny stocks that skyrocketed in value—see how a small investment back then could be worth thousands today. Don't miss these hidden gems.

2025-10-27

2025-10-26

2025-10-25

2025-10-24

Top Technology and Security Executives Recognized at the 2025 SoCal ORBIE Awards

Description: LOS ANGELES, Oct. 24, 2025 (GLOBE NEWSWIRE) -- The 2025 SoCal ORBIE Awards recognized the exceptional leadership and innovation of top technology executives from Monster Beverage Corp, Epson America, AMN Healthcare Services, Emanate Health, LA Clippers and Intuit Dome, UCLA Anderson School of Management, Skyworks Solutions, Inc., and Sharp HealthCare. Hosted by SoCalCIO and SanDiegoCIO, and introducing SoCalCISO, chapters of the Inspire Leadership Network, the prestigious awards honor CIOs and C

2025-10-23

Why Beyond Meat (BYND) Shares Are Falling Today

Description: Shares of plant-based protein company Beyond Meat (NASDAQ:BYND) fell 14.5% in the afternoon session after the recent, unsustainable 'meme stock' rally appeared to collapse, with the stock reversing sharply after a massive surge in the previous week.

Monster Beverage (MNST): Exploring the Stock’s Current Valuation After a Strong Three-Month Performance

Description: Monster Beverage (MNST) has demonstrated strong stock performance lately, with shares climbing nearly 16% over the past 3 months. Investors are watching closely as the company's annual revenue and net income both continue to grow. See our latest analysis for Monster Beverage. Monster Beverage’s momentum has picked up speed, with a 33% year-to-date share price return and a 30% total shareholder return over the past year. These returns signal that investors see plenty of growth potential...

These 2 Consumer Staples Stocks Could Beat Earnings: Why They Should Be on Your Radar

Description: The Zacks Earnings ESP is a great way to find potential earnings surprises. Why investors should take advantage now.

Blackstone (NYSE:BX) Reports Sales Below Analyst Estimates In Q3 Earnings

Description: Alternative investment manager Blackstone (NYSE:BX) missed Wall Street’s revenue expectations in Q3 CY2025, but sales rose 26.6% year on year to $3.09 billion. Its GAAP profit of $0.80 per share was 34.8% below analysts’ consensus estimates.

What to Expect From Monster Beverage's Q3 2025 Earnings Report

Description: Monster Beverage will release its third-quarter earnings soon, and analysts anticipate a double-digit bottom-line growth.

2025-10-22

C3.ai, Upstart, UiPath, Zeta Global, and SoundHound AI Stocks Trade Down, What You Need To Know

Description: A number of stocks fell in the afternoon session after new trade tensions and disappointing earnings from major tech companies weighed heavily on investor sentiment.

Why Vertiv (VRT) Stock Is Falling Today

Description: Shares of data center products and services company Vertiv (NYSE:VRT) fell 5.2% in the morning session after it gave back some of the strong gains it made after reporting impressive third-quarter results.

TOCA Football Appoints Emelie Tirre to Board of Directors

Description: TOCA Football (TOCA), North America's largest soccer training and entertainment company, today announced the appointment of Emelie Tirre to its Board of Directors, effective immediately.

2025-10-21

4 High-Yielding Warren Buffett Stocks Are Recession-Resistant

Description: With the markets near all-time highs, it makes sense for investors to exercise caution. These four Warren Buffett high-yield dividend stocks may be ideal now.

Why Are RTX (RTX) Shares Soaring Today

Description: Shares of aerospace and defense company Raytheon (NYSE:RTX) jumped 9.5% in the morning session after the company reported strong third-quarter 2025 results that beat expectations and raised its full-year financial forecast.

2025-10-20

2025-10-19

2025-10-18

Is Monster Beverage Corporation's (NASDAQ:MNST) Latest Stock Performance A Reflection Of Its Financial Health?

Description: Monster Beverage (NASDAQ:MNST) has had a great run on the share market with its stock up by a significant 19% over the...