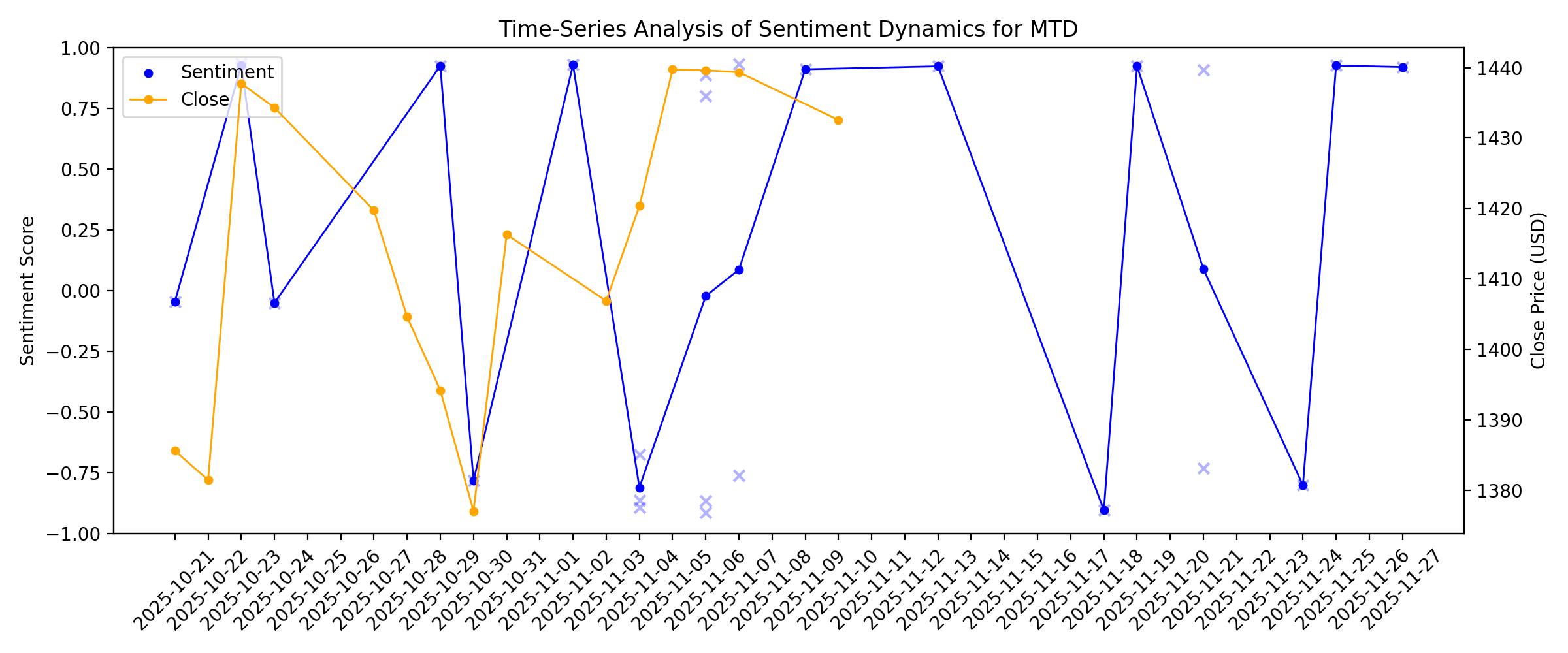

News sentiment analysis for MTD

Sentiment chart

2026-01-14

2026-01-13

2026-01-12

Is It Too Late To Consider Mettler-Toledo International (MTD) After Recent Share Price Strength?

Description: If you are wondering whether Mettler-Toledo International is priced attractively today, it helps to step back from the headline share price and look closely at what you are actually paying for. The stock last closed at US$1,491.99, with returns of 3.1% over 7 days, 7.1% over 30 days, 5.7% year to date, 17.7% over 1 year, a 4.2% decline over 3 years and 22.5% over 5 years. Taken together, these figures give a mixed picture of how sentiment has shifted over different time frames. Recent news...

Assessing Mettler-Toledo International (MTD) Valuation After Recent Share Price Momentum

Description: Why Mettler-Toledo International (MTD) is on investors’ radar Mettler-Toledo International (MTD) has drawn attention after a period of steady trading, with the stock recently closing at US$1,485.12. Investors are weighing this price against the company’s current fundamentals and recent return profile. See our latest analysis for Mettler-Toledo International. Recent trading has been relatively upbeat, with a 1-day share price return of 1.36% and a 90-day share price return of 13.97%,...

Take the Zacks Approach to Beat the Markets: Indivior, FIGS & Ulta Beauty in Focus

Description: Zacks highlights how Indivior, FIGS and Ulta Beauty delivered outsized gains as its ranks, recommendations and focus lists beat a volatile market.

Here's What to Expect From Mettler-Toledo's Next Earnings Report

Description: Mettler-Toledo will release its fourth-quarter earnings next month, and analysts anticipate a single-digit bottom-line growth.

2026-01-11

2026-01-10

2026-01-09

Mettler-Toledo International Inc. to Host Fourth Quarter 2025 Earnings Conference Call

Description: COLUMBUS, Ohio, January 09, 2026--Mettler-Toledo International Inc. (NYSE: MTD) announced it will release its fourth quarter 2025 financial results after the market close on Thursday, February 5, 2026. The Company will host a conference call the following morning at 8:30 a.m. Eastern Time to discuss the results. To listen to the live audio webcast of the call, visit Events and Presentations on the Investor section of the Company’s website, investor.mt.com.

2026-01-08

2026-01-07

2026-01-06

2026-01-05

Mettler-Toledo International Inc. to Present at the 44th Annual J.P. Morgan Healthcare Conference

Description: COLUMBUS, Ohio, January 05, 2026--Mettler-Toledo International Inc. (NYSE: MTD) today announced it will present at the 44th Annual J.P. Morgan Healthcare Conference in San Francisco, California on Monday, January 12, 2026 at 4:30 p.m. Pacific Standard Time. A live webcast of the presentation will be available on the Company’s investor relations website at investor.mt.com.

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

2025-12-21

2025-12-20

Can Mettler-Toledo’s 2025 Rebound Justify Its Premium Valuation?

Description: If you have been wondering whether Mettler-Toledo International is still worth its hefty price tag, you are not alone. This article is going to unpack what that valuation really implies. The stock is up 14.9% year to date and 14.0% over the last year, even though the 3 year return is slightly negative at -2.5%. This suggests the market is cautiously rebuilding confidence after a choppy period. Recent commentary has focused on how Mettler-Toledo continues to lean on its strong position in...

2025-12-19

2025-12-18

2025-12-17

2025-12-16

2025-12-15

2025-12-14

2025-12-13

2025-12-12

2025-12-11

2025-12-10

2025-12-09

2025-12-08

Mettler-Toledo Stock: Is MTD Underperforming the Healthcare Sector?

Description: Although Mettler-Toledo has underperformed its sector peers recently, analysts remain moderately optimistic about the stock’s prospects.

2025-12-07

2025-12-06

2025-12-05

2025-12-04

2025-12-03

2025-12-02

2025-12-01

2025-11-30

2025-11-29

2025-11-28

2025-11-27

Is Mettler-Toledo’s Valuation Justified After 21.8% Price Rally in 2025?

Description: Wondering if Mettler-Toledo International is truly worth its current price tag? You are not alone. Many investors are eager to figure out if there is value hiding beneath the surface. The stock has picked up momentum, returning 5.8% over the past week and an impressive 21.8% year-to-date. The market may be sensing new opportunities or shifting its risk outlook. Recent headlines have spotlighted the company's expansion into advanced lab technologies and increased demand for precision...

2025-11-26

2025-11-25

Is Wall Street Bullish or Bearish on Mettler-Toledo Stock?

Description: Mettler-Toledo has outperformed the broader market over the past year, and analysts are moderately optimistic about the stock’s prospects.

2025-11-24

Jim Cramer on Mettler-Toledo: “A Very Poorly Covered Company That Happens to Be a Very Good Company”

Description: Mettler-Toledo International Inc. (NYSE:MTD) is one of the stocks Jim Cramer recently shed light on. Noting that Stifel increased the price target on the stock, a caller asked if it is a buy. Here’s what Mad Money’s host had to say in response: “You know, this is a very, a very poorly covered company that […]

2025-11-23

2025-11-22

2025-11-21

Mettler-Toledo, Agilent, Waters Corporation, Merck, and Regeneron Shares Skyrocket, What You Need To Know

Description: A number of stocks jumped in the afternoon session after comments from a key Federal Reserve official bolstered hopes for an interest rate cut. New York Federal Reserve President John Williams stated he sees “room for a further adjustment” in the near term, sparking a significant market rally. Following his remarks, the probability of the central bank cutting rates at its December meeting jumped from 39% to over 73%, according to the CME FedWatch tool. This positive sentiment provided relief to

3 Profitable Stocks We’re Skeptical Of

Description: Not all profitable companies are built to last - some rely on outdated models or unsustainable advantages. Just because a business is in the green today doesn’t mean it will thrive tomorrow.

2025-11-20

2025-11-19

A Fresh Look at Mettler-Toledo (MTD) Valuation Following Recent Share Gains

Description: Mettler-Toledo International (MTD) shares have climbed 3% over the past month, following stable financial performance and ongoing investor interest in precision instruments. The company's consistent growth invites a closer look at its recent activity and valuation. See our latest analysis for Mettler-Toledo International. After a steady climb, Mettler-Toledo International’s 1-year total shareholder return now sits at 20.3%, comfortably outpacing many peers. This momentum follows a solid run...

2025-11-18

Mettler-Toledo International Inc. to Present at Upcoming Investor Conferences

Description: COLUMBUS, Ohio, November 18, 2025--Mettler-Toledo International Inc. (NYSE: MTD) today announced it will present at the 8th Annual Evercore Healthcare Conference on Tuesday, December 2 at 9:10 a.m. EST, and at the Citi 2025 Global Healthcare Conference on Wednesday, December 3 at 10:30 a.m. EST.

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

5 Insightful Analyst Questions From Mettler-Toledo’s Q3 Earnings Call

Description: Mettler-Toledo delivered a quarter that met Wall Street’s expectations, with management attributing the performance to robust growth in its Industrial and Laboratory segments, especially in the Americas. CEO Patrick Kaltenbach highlighted the impact of the Spinnaker sales and marketing program and the launch of new products such as the NineFocus pH Meter as key drivers. The company also benefited from strong bioprocessing demand and continued expansion in service offerings. However, operating ma

2025-11-12

2025-11-11

2025-11-10

2025-11-09

The Bull Case For Mettler-Toledo (MTD) Could Change Following $2.75B Buyback and Upbeat Guidance

Description: Mettler-Toledo International reported strong third quarter 2025 results, raising its full-year guidance and authorizing an additional US$2.75 billion share repurchase program. The company emphasized continued focus on small bolt-on acquisitions and supply chain actions to offset tariff headwinds, reinforcing management's confidence in operational and financial performance. We'll examine how this major share repurchase authorization and upbeat outlook may influence Mettler-Toledo's...

2025-11-08

2025-11-07

Mettler-Toledo (MTD) Q3 Earnings: Taking a Look at Key Metrics Versus Estimates

Description: Although the revenue and EPS for Mettler-Toledo (MTD) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Mettler-Toledo Q3 Earnings Top Estimates, Sales Decline Y/Y

Description: MTD posted stronger-than-expected Q3 results, lifted by segment growth and solid guidance for 2025 and 2026.

2025-11-06

Mettler-Toledo’s (NYSE:MTD) Q3 Sales Beat Estimates

Description: Precision measurement company Mettler-Toledo (NYSE:MTD) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 7.9% year on year to $1.03 billion. On the other hand, next quarter’s revenue guidance of $1.08 billion was less impressive, coming in 2.4% below analysts’ estimates. Its non-GAAP profit of $11.15 per share was 4.5% above analysts’ consensus estimates.

Mettler-Toledo (MTD) Beats Q3 Earnings and Revenue Estimates

Description: Mettler-Toledo (MTD) delivered earnings and revenue surprises of +4.99% and +3.84%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Mettler-Toledo: Q3 Earnings Snapshot

Description: The results topped Wall Street expectations. The average estimate of four analysts surveyed by Zacks Investment Research was for earnings of $10.62 per share. The maker of precision instruments posted revenue of $1.03 billion in the period, also exceeding Street forecasts.

Mettler-Toledo International Inc. Reports Third Quarter 2025 Results

Description: COLUMBUS, Ohio, November 06, 2025--Mettler-Toledo International Inc. (NYSE: MTD) today announced third quarter results for 2025. Provided below are the highlights:

2025-11-05

2025-11-04

Mettler-Toledo (MTD) To Report Earnings Tomorrow: Here Is What To Expect

Description: Precision measurement company Mettler-Toledo (NYSE:MTD) will be announcing earnings results this Thursday after the bell. Here’s what to expect.

Curious about Mettler-Toledo (MTD) Q3 Performance? Explore Wall Street Estimates for Key Metrics

Description: Besides Wall Street's top-and-bottom-line estimates for Mettler-Toledo (MTD), review projections for some of its key metrics to gain a deeper understanding of how the company might have fared during the quarter ended September 2025.

Waters (WAT) Tops Q3 Earnings and Revenue Estimates

Description: Waters (WAT) delivered earnings and revenue surprises of +5.92% and +2.59%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

2025-11-03

2025-11-02

Has Mettler-Toledo’s Recent 16% Rally Shifted Its True Valuation in 2025?

Description: If you have ever wondered whether Mettler-Toledo International is a hidden gem or priced for perfection, you are in the right place to get answers that go beyond the surface. Despite a slight dip of 1.3% in the last week, the stock has gained 7.8% over the past month and is up an impressive 16.0% year-to-date. This hints at renewed investor interest and potential growth shifts. Recently, market sentiment has been shaped by industry-wide discussions around innovation and competitive...

2025-11-01

2025-10-31

2025-10-30

Mettler-Toledo (MTD) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Description: Mettler-Toledo (MTD) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2025-10-29

Mettler-Toledo (MTD): Buy, Sell, or Hold Post Q2 Earnings?

Description: Mettler-Toledo’s 31.7% return over the past six months has outpaced the S&P 500 by 7.8%, and its stock price has climbed to $1,403 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

2025-10-28

2025-10-27

2025-10-26

2025-10-25

2025-10-24

1 Cash-Producing Stock to Consider Right Now and 2 Facing Headwinds

Description: A company that generates cash isn’t automatically a winner. Some businesses stockpile cash but fail to reinvest wisely, limiting their ability to expand.

2025-10-23

Earnings Preview: What to Expect From Mettler-Toledo's Report

Description: Mettler-Toledo will release its third-quarter earnings next month, and analysts anticipate a single-digit bottom-line growth.

Assessing Mettler-Toledo International (MTD) Valuation After Recent Share Price Gains

Description: Mettler-Toledo International (MTD) has been catching investors' eyes lately, with shares showing steady gains over the past month. The company's stock climbed nearly 10% in that period, reflecting positive underlying sentiment. See our latest analysis for Mettler-Toledo International. After a robust 9.8% share price return over the past month, Mettler-Toledo International is showing clear signs of growing momentum. This recent push caps a year where the stock’s 1-year total shareholder...

2025-10-22

2025-10-21

3 Overrated Stocks That Fall Short

Description: The stocks featured in this article have all approached their 52-week highs. When these price levels hit, it typically signals strong business execution, positive market sentiment, or significant industry tailwinds.