News sentiment analysis for NDSN

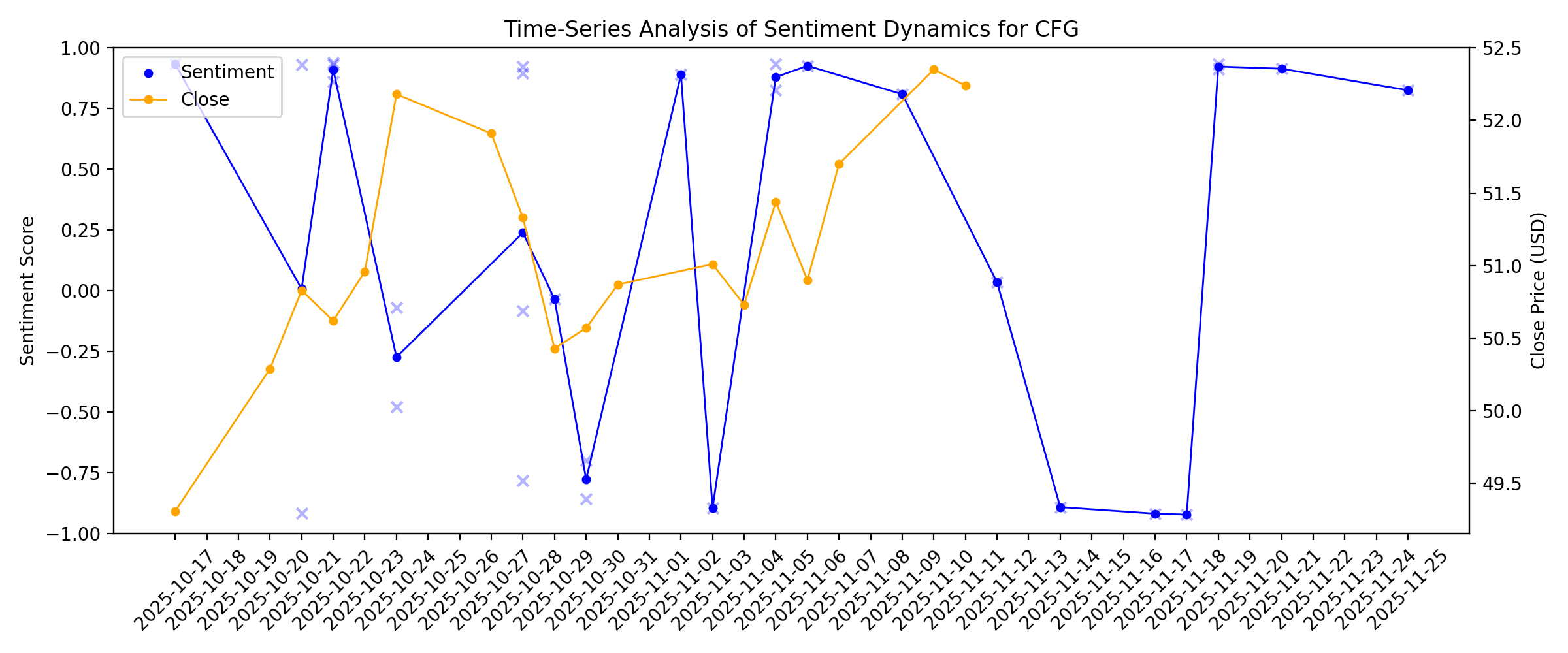

Sentiment chart

2026-01-14

2026-01-13

2026-01-12

MWA vs. NDSN: Which Stock Is the Better Value Option?

Description: MWA vs. NDSN: Which Stock Is the Better Value Option?

2026-01-11

2026-01-10

2026-01-09

Why Is Nordson (NDSN) Up 8.9% Since Last Earnings Report?

Description: Nordson (NDSN) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2026-01-08

Assessing Nordson (NDSN) Valuation After Strong Q4 Results And Upbeat Earnings Guidance

Description: Nordson (NDSN) is back in focus after a strong fourth quarter, where research firms highlighted improving operating margins in Medical and Fluid Solutions, solid order activity in Advanced Technology Solutions, and guidance for higher sales and adjusted earnings. See our latest analysis for Nordson. Those stronger Q4 numbers come after a steady run in the shares, with the current Nordson share price at $255.26, a 1-month share price return of 9.35% and a 1-year total shareholder return of...

Is It Too Late To Consider Nordson (NDSN) After Strong 1 Year Share Price Return?

Description: If you have been watching Nordson and wondering whether the current share price still makes sense, this article walks through the numbers so you can judge the value for yourself. The stock most recently closed at US$252.86, with returns of 5.2% over 7 days, 7.9% over 30 days, 4.9% year to date, 27.0% over 1 year, 7.7% over 3 years and 31.4% over 5 years. These returns sit against a backdrop of ongoing company updates and industry news that keep Nordson on investors' radar. Together, these...

2026-01-07

Analysts Turn More Bullish on Nordson (NDSN) After Strong Q4 Results

Description: Nordson Corporation (NASDAQ:NDSN) is included among the 14 Best Dividend Growth Stocks to Buy and Hold in 2026. On December 15, Vertical Research upgraded Nordson Corporation (NASDAQ:NDSN) to Buy from Hold and set a $270 price target. A few days earlier, on December 12, DA Davidson raised its price target on Nordson to $290 from […]

2026-01-06

2026-01-05

2026-01-04

2026-01-03

2026-01-02

2026-01-01

The 3 Best Dividend Aristocrats to Buy in 2026

Description: Investing in Dividend Aristocrats can anchor your portfolio by providing solid dividend growth from proven, successful businesses that have endured multiple business cycles. These companies, part of the S&P 500, have increased dividends for at least 25 consecutive years, demonstrating their durability through economic challenges like recessions, world wars, and market shifts. The steady income ... The 3 Best Dividend Aristocrats to Buy in 2026

When Should You Buy Nordson Corporation (NASDAQ:NDSN)?

Description: Nordson Corporation ( NASDAQ:NDSN ) saw significant share price movement during recent months on the NASDAQGS, rising...

2025-12-31

Strength in Medical & Fluid Solutions Unit Drives Nordson: Can It Sustain?

Description: NDSN is gaining momentum as its Medical and Fluid Solutions segment delivers solid organic growth and margin expansion.

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

Here's Why It is Worth Investing in Nordson Stock Right Now

Description: NDSN is benefiting from end-market recovery, acquisition synergies and strong capital returns, making the stock attractive for long-term investors.

2025-12-21

2025-12-20

2025-12-19

2025-12-18

Is The Middleby (MIDD) Stock Outpacing Its Industrial Products Peers This Year?

Description: Here is how Middleby (MIDD) and Nordson (NDSN) have performed compared to their sector so far this year.

2025-12-17

Nordson (NDSN): Assessing Valuation After This Year’s Steady Share Price Climb

Description: Nordson stock snapshot after steady multi month climb Nordson (NDSN) has quietly pushed higher this year, with the share price up about 16% year to date and roughly 5% over the past month, inviting a closer look. See our latest analysis for Nordson. The latest move takes Nordson's share price to about $238, with the year to date share price return of roughly 16 percent signalling steady, if unspectacular, positive momentum backed by solid revenue and earnings growth. If Nordson's slow and...

The Top 5 Analyst Questions From Nordson’s Q3 Earnings Call

Description: Nordson’s third quarter saw flat sales compared to the previous year, as the company navigated persistent softness in selected industrial and advanced technology product lines. Management highlighted that strong operational execution, portfolio optimization—including the divestiture of its medical contract manufacturing business—and successful restructuring efforts helped drive a notable expansion in adjusted operating margin. CEO Sundaram Nagarajan credited broad-based demand in medical product

2025-12-16

2025-12-15

Is Nordson Stock Underperforming the S&P 500?

Description: Nordson has underperformed the S&P 500 over the past year, but analysts are moderately optimistic about the stock’s prospects.

2025-12-14

2025-12-13

There's A Lot To Like About Nordson's (NASDAQ:NDSN) Upcoming US$0.82 Dividend

Description: Nordson Corporation ( NASDAQ:NDSN ) is about to trade ex-dividend in the next three days. The ex-dividend date is...

2025-12-12

NDSN Q3 Deep Dive: Margin Expansion Offsets Flat Sales, Cautious Outlook for Year-End

Description: Manufacturing company Nordson (NASDAQ:NDSN) fell short of the markets revenue expectations in Q3 CY2025, with sales flat year on year at $751.8 million. Next quarter’s revenue guidance of $650 million underwhelmed, coming in 0.9% below analysts’ estimates. Its non-GAAP profit of $3.03 per share was 3.4% above analysts’ consensus estimates.

2025-12-11

Nordson Corp (NDSN) Q4 2025 Earnings Call Highlights: Record Sales and Strong EPS Growth Amid ...

Description: Nordson Corp (NDSN) reports a robust fiscal year with record sales and earnings, despite facing headwinds in certain segments.

Nordson's Earnings Surpass Estimates in Q4, Revenues Miss

Description: NDSN tops earnings forecasts as Medical and Fluid Solutions strength lifts margins, though Q4 revenues fall short of expectations.

2025-12-10

Nordson (NDSN) Q4 Earnings: How Key Metrics Compare to Wall Street Estimates

Description: Although the revenue and EPS for Nordson (NDSN) give a sense of how its business performed in the quarter ended October 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Nordson (NDSN) Tops Q4 Earnings Estimates

Description: Nordson (NDSN) delivered earnings and revenue surprises of +3.41% and -2.23%, respectively, for the quarter ended October 2025. Do the numbers hold clues to what lies ahead for the stock?

Nordson: Fiscal Q4 Earnings Snapshot

Description: On a per-share basis, the Westlake, Ohio-based company said it had profit of $2.69. Earnings, adjusted for one-time gains and costs, came to $3.03 per share. The results exceeded Wall Street expectations.

Nordson (NASDAQ:NDSN) Misses Q3 CY2025 Sales Expectations

Description: Manufacturing company Nordson (NASDAQ:NDSN) fell short of the markets revenue expectations in Q3 CY2025, with sales flat year on year at $751.8 million. Next quarter’s revenue guidance of $650 million underwhelmed, coming in 0.9% below analysts’ estimates. Its non-GAAP profit of $3.03 per share was 3.4% above analysts’ consensus estimates.

Nordson Corporation Reports Record Fourth Quarter and Fiscal Year 2025 Results

Description: WESTLAKE, Ohio, December 10, 2025--Nordson Corporation (Nasdaq: NDSN) today reported results for the fiscal fourth quarter ended October 31, 2025. Sales were $752 million, a 1% increase compared to the prior year’s fourth quarter sales of $744 million. The increase in fourth quarter 2025 sales included favorable currency translation of 2% and a 1% acquisition impact, which was partially offset by the medical contract manufacturing divestiture and an organic sales decrease of 1%.

Equity Markets Mixed Ahead of Fed Decision

Description: US benchmark equity indexes were mixed intraday ahead of the Federal Reserve's announcement of its l

Stocks Fall Pre-Bell Ahead of Fed Rate Decision

Description: The main US stock measures were pointing lower in Wednesday's premarket activity as traders await th

2025-12-09

FLS vs. NDSN: Which Stock Is the Better Value Option?

Description: FLS vs. NDSN: Which Stock Is the Better Value Option?

2025-12-08

Nordson (NDSN) Reports Earnings Tomorrow: What To Expect

Description: Manufacturing company Nordson (NASDAQ:NDSN) will be reporting results this Wednesday after market close. Here’s what to look for.

2025-12-07

Crucial Fed decision looms as stocks fly high near records: What to watch this week

Description: This week, we're closely watching the Fed's comments and dot plot, a nervous bond market, bitcoin, and signs of a Santa Claus rally.

2025-12-06

2025-12-05

Curious about Nordson (NDSN) Q4 Performance? Explore Wall Street Estimates for Key Metrics

Description: Get a deeper insight into the potential performance of Nordson (NDSN) for the quarter ended October 2025 by going beyond Wall Street's top-and-bottom-line estimates and examining the estimates for some of its key metrics.

2025-12-04

2025-12-03

Nordson Corporation Declares First Quarter Dividend for Fiscal Year 2026

Description: WESTLAKE, Ohio, December 03, 2025--Nordson Corporation Declares First Quarter Dividend for Fiscal Year 2026

2025-12-02

Nordson (NDSN): A Fresh Look at Valuation After Recent Outperformance in Industrial Stocks

Description: Nordson (NDSN) has quietly outperformed the broader industrial space over the past month, and that move deserves a closer look, especially given its steady revenue and earnings growth in a choppy market. See our latest analysis for Nordson. Zooming out, Nordson’s 15.4% year to date share price return and modestly positive 3 year total shareholder return of 5.1% suggest steady, not explosive, momentum as investors cautiously re rate its growth profile. If Nordson’s quiet compounding appeals to...

2025-12-01

2025-11-30

2025-11-29

2025-11-28

2025-11-27

2025-11-26

2025-11-25

Nordson Stock: Analyst Estimates & Ratings

Description: Nordson has notably lagged behind the broader market over the past year, yet analysts remain moderately optimistic about the stock’s prospects.

2025-11-24

2025-11-23

2025-11-22

2025-11-21

FLS or NDSN: Which Is the Better Value Stock Right Now?

Description: FLS vs. NDSN: Which Stock Is the Better Value Option?

2025-11-20

2025-11-19

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

Intellicheck Mobilisa, Inc. (IDN) Q3 Earnings and Revenues Beat Estimates

Description: Intellicheck Mobilisa (IDN) delivered earnings and revenue surprises of +200.00% and +8.46%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

2025-11-11

2025-11-10

Nordson EFD Delivers Four "Mastering Micron-Level Assembly" Demonstrations in Stand D01/Hall 8a at Compamed 2025, November 17 - 20, 2025

Description: EAST PROVIDENCE, R.I., November 10, 2025--Nordson EFD will feature four "Mastering Micron-Level Assembly" demonstrations at the Compamed 2025 show in Düsseldorf, November 17 – 20, 2025.

2025-11-09

2025-11-08

2025-11-07

Could Management Moves and Analyst Optimism Shift the Long-Term Narrative for Nordson (NDSN)?

Description: Earlier this week, Nordson director Milton Morris Mayo sold US$61,000 of company shares while acquiring 822 Restricted Share Units set to vest in 2026. This activity occurred alongside several analyst firms raising their outlook for Nordson, citing stronger-than-expected operating performance and improved market guidance. We'll explore how recent analyst optimism, backed by solid operating results, could influence Nordson's overall investment story. The latest GPUs need a type of rare earth...

Nordson (NDSN): Evaluating Current Valuation Following Upbeat Analyst Upgrades and Strong Demand Signals

Description: Nordson (NDSN) is attracting attention as several analyst firms have recently restated positive ratings and raised their outlook. They highlight the company’s strong operating performance, healthier guidance, and consistent demand across key markets. See our latest analysis for Nordson. Momentum has started to build for Nordson, with the share price climbing over 9% in the past 90 days even as total shareholder return for the past year remained negative at -10%. Recent director stock sales...

2025-11-06

Nordson Corporation Announces Earnings Release and Webcast for Fourth Quarter and Fiscal Year 2025

Description: WESTLAKE, Ohio, November 06, 2025--Nordson Corporation (Nasdaq: NDSN) today announced it will release fourth quarter and fiscal year 2025 earnings on December 10, 2025, after the close of the market. Nordson will host its quarterly webcast on:

2025-11-05

2025-11-04

2025-11-03

2025-11-02

2025-11-01

2025-10-31

2025-10-30

2025-10-29

2025-10-28

Innovation and Global Reach Drive Nordson (NDSN) Corporation’s Long-Term Strength

Description: Nordson Corporation (NASDAQ:NDSN) is included among the 10 Best Rising Dividend Stocks to Buy Now. Nordson Corporation (NASDAQ:NDSN) designs and produces equipment and systems that accurately apply adhesives, coatings, sealants, biomaterials, and other specialized materials. Its products are used across a wide variety of industries, including electronics, medical, packaging, and general manufacturing. Roughly two-thirds of the […]

Nordson’s ESG Update Hints at Long-Term Margin and Growth Levers

Description: Nordson Corporation (NASDAQ:NDSN) is one of the most profitable manufacturing stocks to buy now. On October 21, 2025, Nordson released its 2025 Corporate Responsibility Update, with several details that quietly matter to investors. The report revealed that the company has begun executing on its climate strategy with targeted energy-efficiency upgrades at core facilities, a move […]

What You Need to Know Ahead of Nordson's Earnings Release

Description: Nordson is all set to announce its fiscal fourth-quarter earnings soon, and analysts project a single-digit profit rise.

2025-10-27

3 Profitable Stocks That Concern Us

Description: Not all profitable companies are built to last - some rely on outdated models or unsustainable advantages. Just because a business is in the green today doesn’t mean it will thrive tomorrow.

2025-10-26

2025-10-25

2025-10-24

2025-10-23

Does Nordson's Push Into AI and Medical Tech Redefine Its Growth Profile and Peer Group (NDSN)?

Description: In recent weeks, Nordson Corporation has accelerated its transformation into a growth-focused industrial company, marked by high-profile acquisitions such as CyberOptics and Atrion, and accompanied by increased analyst attention including a new coverage initiation from D.A. Davidson. This combination of targeted acquisitions and an articulated strategy under CEO Sundaram Nagarajan has positioned Nordson in high-growth sectors like AI and medical technologies, potentially altering its peer...

2025-10-22

Is Nordson (NDSN) Stock Outpacing Its Industrial Products Peers This Year?

Description: Here is how Nordson (NDSN) and Napco (NSSC) have performed compared to their sector so far this year.

2025-10-21

Nordson Corporation (NDSN): A Bull Case Theory

Description: We came across a bullish thesis on Nordson Corporation on Value investing subreddit by SniperPearl. In this article, we will summarize the bulls’ thesis on NDSN. Nordson Corporation’s share was trading at $226.95 as of September 30th. NDSN’s trailing and forward P/E were 28.55 and 20.53 respectively according to Yahoo Finance. Nordson Corporation, a 70-year-old industrial stalwart, […]

Nordson Publishes Its 2025 Corporate Responsibility Update, Highlights Progress on Key Social and Environmental Initiatives

Description: WESTLAKE, Ohio, October 21, 2025--Nordson Corporation (Nasdaq: NDSN) today published its 2025 Corporate Responsibility Update, a continuation of the strategies and commitments outlined in its previous reports. The report includes select highlights and updates about the Company’s progress toward its corporate responsibility initiatives, reflecting its commitments to sustainability, innovation, employee wellbeing and community engagement.

2025-10-20

2025-10-19

Investors in Nordson (NASDAQ:NDSN) have seen returns of 19% over the past five years

Description: The main point of investing for the long term is to make money. But more than that, you probably want to see it rise...