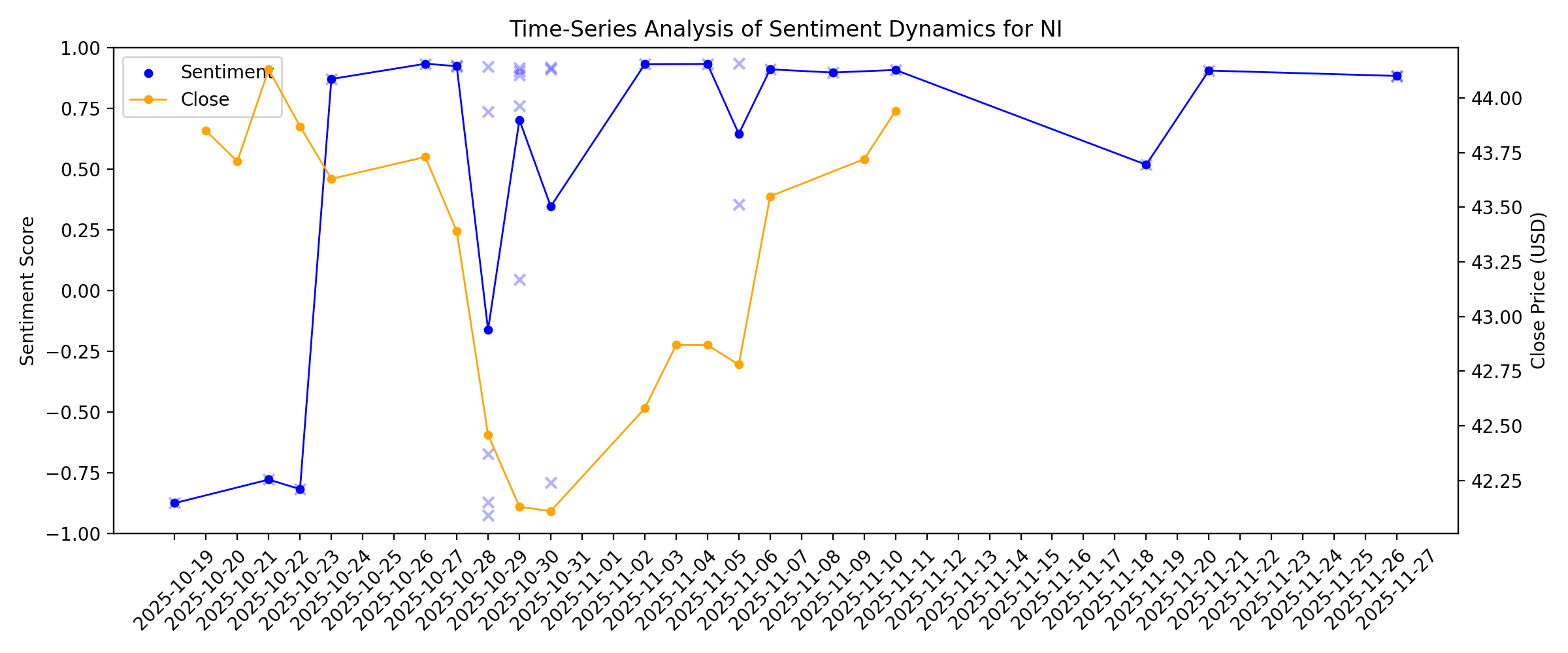

News sentiment analysis for NI

Sentiment chart

2026-01-14

2026-01-13

A Look At NiSource (NI) Valuation As Long‑Term Returns And Models Signal Mixed Pricing

Description: With no single headline event driving NiSource (NI) today, the focus for investors shifts to its recent share performance, income profile, and how its regulated utility operations might fit into a portfolio. See our latest analysis for NiSource. NiSource’s recent 1-month share price return of 2.37% and current share price of $42.39 sit against a relatively flat year to date share price return of 0.55%, while its 1-year total shareholder return of 19.95% and 5-year total shareholder return of...

2026-01-12

2026-01-11

2026-01-10

2026-01-09

Entergy and NiSource Could Be Winners as Utilities Spend $1 Trillion on AI. Dividend Investors Not So Much

Description: Utilities are plowing growing profits into new power plants, and their soaring share prices mean that dividend yields are dropping.

Here's Why You Should Add NI Stock to Your Portfolio Right Now

Description: NiSource upgrades its grid, transitioning away from coal and maintaining shareholder payouts while investing up to $28.4B through 2030.

2026-01-08

ED Benefits From Long-Term Capital Spending and Renewable Growth

Description: Consolidated Edison is boosting grid reliability with major infrastructure investments, but regulatory rate risks could limit cost recovery.

2026-01-07

2026-01-06

2026-01-05

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

EIX to Gain From Infrastructure Upgradation & Renewable Expansion

Description: EIX is ramping up grid investments and clean energy to meet AI data center and EV-driven demand supports its outlook.

2025-12-29

2025-12-28

2025-12-27

2025-12-26

CMS Energy Poised to Gain From Renewable Expansion & Investments

Description: CMS to invest $20B in grid upgrades and clean power, with plans to add major solar, wind, and battery capacity despite regulatory and debt pressures.

2025-12-25

The Bull Case For NiSource (NI) Could Change Following Mandated Delay To Coal Plant Retirement

Description: Earlier this week, federal authorities ordered NiSource subsidiary Northern Indiana Public Service Company (NIPSCO) to keep its R.M. Schahfer coal-fired generating station operating for 90 days beyond its previously scheduled 31 December 2025 retirement to support grid reliability amid rising power demand. The move highlights how surging electricity needs from data centers and higher natural gas prices can slow coal retirements, complicating NiSource’s decarbonization and long-term resource...

Revisiting NiSource (NI): Assessing Valuation After a Steady Multi‑Year Total Shareholder Return Run

Description: NiSource (NI) has quietly outperformed many utility peers this year, and that steady climb has some investors revisiting the stock as a potential mix of income, defensiveness, and measured growth. See our latest analysis for NiSource. At around $41.88, the stock has given investors a solid year to date share price return while the one year total shareholder return of about 17 percent and five year total shareholder return above 100 percent suggest steady momentum rather than a speculative...

2025-12-24

The Zacks Analyst Blog Highlights Invesco, Johnson & Johnson, NiSource, Bunge Global and Morgan Stanley

Description: Invesco leads Zack' list of five high-yield S&P 500 stocks, highlighting dividend strength and steady income potential for 2026.

Federal Order Delays NIPSCO’s R.M. Schahfer Generating Station’s Retirement

Description: MERRILLVILLE, Ind., December 24, 2025--NIPSCO received a federal order requiring the continued operation of its R.M. Schahfer Generating Station beyond a planned Dec. 31, 2025 retirement.

2025-12-23

Here's Why You Should Add Ameren to Your Portfolio Right Now

Description: AEE's clean energy push, rising 2025 earnings estimates, massive infrastructure spending and a growing dividend make the utility stock stand out now.

Top 5 High-Yield S&P 500 Stocks to Buy for Reliable Returns in 2026

Description: High-yield S&P 500 stocks IVZ, JNJ, NI, BG and MS offer steady income, compounding returns and portfolio stability as moderate growth and easing inflation shape 2026.

2025-12-22

2025-12-21

If EPS Growth Is Important To You, NiSource (NYSE:NI) Presents An Opportunity

Description: It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story...

2025-12-20

2025-12-19

2025-12-18

2025-12-17

2025-12-16

2025-12-15

Is NiSource Stock Underperforming the S&P 500?

Description: While NiSource has underperformed relative to the S&P 500 Index on a YTD basis, analysts are bullish about the stock’s prospects.

2025-12-14

2025-12-13

2025-12-12

2025-12-11

2025-12-10

2025-12-09

2025-12-08

2025-12-07

2025-12-06

2025-12-05

2025-12-04

2025-12-03

2025-12-02

2025-12-01

2025-11-30

Is NiSource’s Recent Grid Modernization News Reflected in Its 2025 Stock Price?

Description: If you have ever wondered whether NiSource’s stock is trading at a fair price or if there is hidden value still on the table, you are not alone. Uncovering this is exactly what this article is all about. NiSource has seen some impressive moves lately, with the stock rising 3.2% in the last week, 21.4% year-to-date, and a striking 117.9% gain over the past five years. Recently, NiSource has featured in news headlines for its ongoing grid modernization projects and a steady push towards clean...

A Closer Look at NiSource (NI) Valuation After Recent Utility Sector Gains

Description: NiSource (NI) shares edged higher today, catching investors’ attention as the utility sector posted modest gains across the board. A quick look at recent performance reveals solid returns over the past month and year. See our latest analysis for NiSource. Momentum has been strong, with a 21.37% year-to-date share price return and NiSource’s 1-year total shareholder return hitting 19.13%. This steady upward trend signals growing confidence in the utility’s long-term story, even as day-to-day...

2025-11-29

2025-11-28

2025-11-27

Here's Why NI Stock Deserves a Spot in Your Portfolio Right Now

Description: NiSource accelerates clean-energy expansion with a 14.7% revenue growth outlook for 2025.

Here's Why You Should Include FirstEnergy Stock in Your Portfolio Now

Description: FE's grid-modernization plans, rising earnings outlook and consistent dividends position it as a compelling utility investment pick.

2025-11-26

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

Consolidated Edison Rides on Investments & Renewable Energy Expansion

Description: ED's massive capital plan and expanding renewables aim to boost reliability and advance its net-zero push despite regulatory constraints.

2025-11-20

2025-11-19

CMS Gains Momentum From Grid Modernization and Renewable Investments

Description: CMS Energy leans on regulated utility strength and major infrastructure and renewable investments, even as coal-ash costs pose challenges.

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

2025-11-11

AES Gains Momentum From Renewable Energy Expansion and LNG Growth

Description: AES boosts its renewable and LNG portfolios with major solar, wind and gas projects as it targets long-term clean energy growth.

2025-11-10

2025-11-09

NiSource (NI): Exploring Valuation After Recent Share Gains and Growth Outlook

Description: NiSource (NI) shares have changed only slightly over the past week, building on a moderate gain for the past month. Investors are weighing recent performance while also considering the company's long-term growth trends and stability. See our latest analysis for NiSource. After steadily climbing this year, NiSource’s latest share price of $43.55 reflects the company’s strong momentum. The year-to-date share price return stands at 19.77%. In addition, its 1-year total shareholder return sits at...

2025-11-08

2025-11-07

PEG Q3 Earnings Surpass Estimates, Revenues Increase Y/Y

Description: PSEG posts a solid Q3 with earnings and revenues beating estimates, driven by stronger operating income and narrowed 2025 guidance.

2025-11-06

Ameren Q3 Earnings Higher Than Expected, Revenues Increase Y/Y

Description: AEE's Q3 earnings surge past expectations with higher revenues, stronger operating income and improved segment performance.

Are Wall Street Analysts Bullish on NiSource Stock?

Description: As NiSource has outpaced the broader market over the past year, Wall Street analysts remain bullish about the stock’s prospects.

2025-11-05

AES Q3 Earnings Miss Estimates, Revenues Increase Y/Y

Description: AES posts higher Q3 earnings and revenue gains despite missing estimates, reaffirming its 2025 outlook and long-term growth targets.

2025-11-04

2025-11-03

Record Backlog and Major NiSource Deal Could Be a Game Changer for Quanta Services (PWR)

Description: Quanta Services recently reported strong third quarter results, featuring record sales of US$7.63 billion, a record-high backlog of US$39.2 billion, raised full-year revenue guidance, and the expansion of its total solutions platform with a major 3-gigawatt infrastructure contract awarded by NiSource. This combination of robust financials and a significant new client partnership highlights the company’s ability to capitalize on rising demand for energy infrastructure, particularly as...

2025-11-02

2025-11-01

2025-10-31

Sector Update: Energy Stocks Advance Friday Afternoon

Description: Energy stocks were rising Friday afternoon, with the NYSE Energy Sector Index up 0.4% and the Energy

Dominion Energy Q3 Earnings & Revenues Beat, '25 EPS Guidance Narrowed

Description: D beats third-quarter earnings and revenue estimates, boosts profits across segments and narrows its 2025 EPS outlook.

NiSource Announces $1.5 Billion At-The-Market (ATM) Equity Issuance Program Through 2028

Description: MERRILLVILLE, Ind., October 31, 2025--NiSource Inc. (NYSE: NI) ("NiSource", "we" and "our") announced today that it has established an "at-the-market" equity offering program under which NiSource may sell shares of its common stock, par value $0.01 per share ("Common Stock"), having an aggregate gross sales price of up to $1.5 billion through December 31, 2028 (the "Offering").

2025-10-30

NiSource (NI) Delivers 20.7% Earnings Growth, Raising Questions About Valuation and Dividend Risks

Description: NiSource (NI) closed the year with a 20.7% jump in annual earnings and a net profit margin of 14.1%, inching up from 14% a year ago. The stock is trading at $42.13, sitting well above its estimated fair value of $34.34 and commanding a premium compared to industry averages with a 22.2x P/E. Looking forward, both earnings and revenue are projected to grow but at a slower pace than the broader US market. This puts future results and the company's valuation under the spotlight for investors. See...

NiSource Inc (NI) Q3 2025 Earnings Call Highlights: Strong Financial Performance and Strategic ...

Description: NiSource Inc (NI) reports robust Q3 results, reaffirms EPS guidance, and outlines significant capital investments for future growth.

Zachry Group Awarded Engineering, Procurement, and Construction (EPC) Contract for NiSource’s Combined Cycle Generation Project

Description: SAN ANTONIO, October 30, 2025--Zachry Group is proud to announce that it has been awarded the EPC contract for NiSource’s Combined Cycle Generation Project.

Building Upon Decades of Power Generation Experience, Quanta Expands Its Total Solutions Platform And Announces Its Selection By NiSource To Provide Power Generation And Grid Infrastructure Solutions For A Large Load Customer

Description: Quanta Services, Inc. (NYSE: PWR) today announced the expansion of its total solutions platform, which builds upon Quanta's world-class craft-skill labor capabilities and decades of experience constructing power generation through its industry-leading renewable energy and battery energy storage solutions for utility scale power consumers, as well as other forms of generation. This platform is focused on providing a fully integrated solution to high-quality customers for their power generation de

QUANTA SERVICES REPORTS THIRD QUARTER 2025 RESULTS

Description: Quanta Services, Inc. (NYSE: PWR) today announced results for the three and nine months ended September 30, 2025. Revenues in the third quarter of 2025 were $7.63 billion compared to revenues of $6.49 billion in the third quarter of 2024, and net income attributable to common stock was $339.4 million, or $2.24 per diluted share, in the third quarter of 2025 compared to net income attributable to common stock of $293.2 million, or $1.95 per diluted share, in the third quarter of 2024. Adjusted di

2025-10-29

NiSource (NI) Q3 2025 Earnings Call Transcript

Description: Joining me today are President and Chief Executive Officer, Lloyd Yates; Executive Vice President and Chief Financial Officer, Shawn Anderson; Executive Vice President of Technology Customer, Chief Commercial Officer, Michael Luhrs; and Executive Vice President and Group President of NiSource Utilities, Melody Birmingham. Slides for today's call are available in the Investor Relations section of our website.

NiSource Q3 Earnings Lag Estimates, Revenues Rise Y/Y, Capex Up

Description: NiSource's third-quarter EPS misses estimates despite higher revenues. The utility boosts its long-term capex to $28 billion through 2030.

NiSource (NI) Misses Q3 Earnings Estimates

Description: NiSource (NI) delivered earnings and revenue surprises of -5.00% and +8.33%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

NiSource: Q3 Earnings Snapshot

Description: MERRILLVILLE, Ind. AP) — NiSource Inc. NI) on Wednesday reported profit of $94.7 million in its third quarter.

NiSource announces third quarter results

Description: MERRILLVILLE, Ind., October 29, 2025--NiSource Inc. (NYSE: NI) today announced, on a GAAP basis, net income available to common shareholders for the three months ended September 30, 2025, of $94.7 million, or $0.20 of earnings per diluted share, compared to net income available to common shareholders of $85.7 million, or $0.19 of earnings per diluted share, for the same period of 2024. For the nine months ended September 30, 2025, on a GAAP basis, NiSource's net income available to common shareh

2025-10-28

Dominion Energy to Post Q3 Earnings: What to Expect for the Stock?

Description: D's third-quarter results may show revenue growth, while expected higher costs weigh on regulated gains.

Xcel Energy to Post Q3 Earnings: What's in the Cards for the Stock?

Description: XEL eyes Q3 revenue growth, driven by data center demand and economic expansion, but tempered by storm costs.

2025-10-27

NiSource to Release Q3 Earnings: Here's What You Need to Know

Description: NI's third-quarter results are likely to reflect gains from rate case approvals and data center investments, though higher expenses may limit upside.

2025-10-26

2025-10-25

2025-10-24

Will NiSource (NI) Beat Estimates Again in Its Next Earnings Report?

Description: NiSource (NI) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

2025-10-23

IdaCorp (IDA) Reports Next Week: Wall Street Expects Earnings Growth

Description: IdaCorp (IDA) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2025-10-22

Analysts Estimate NiSource (NI) to Report a Decline in Earnings: What to Look Out for

Description: NiSource (NI) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2025-10-21

2025-10-20

2025-10-19

Is NiSource Inc. (NYSE:NI) Expensive For A Reason? A Look At Its Intrinsic Value

Description: Key Insights NiSource's estimated fair value is US$33.54 based on Dividend Discount Model NiSource is estimated to be...