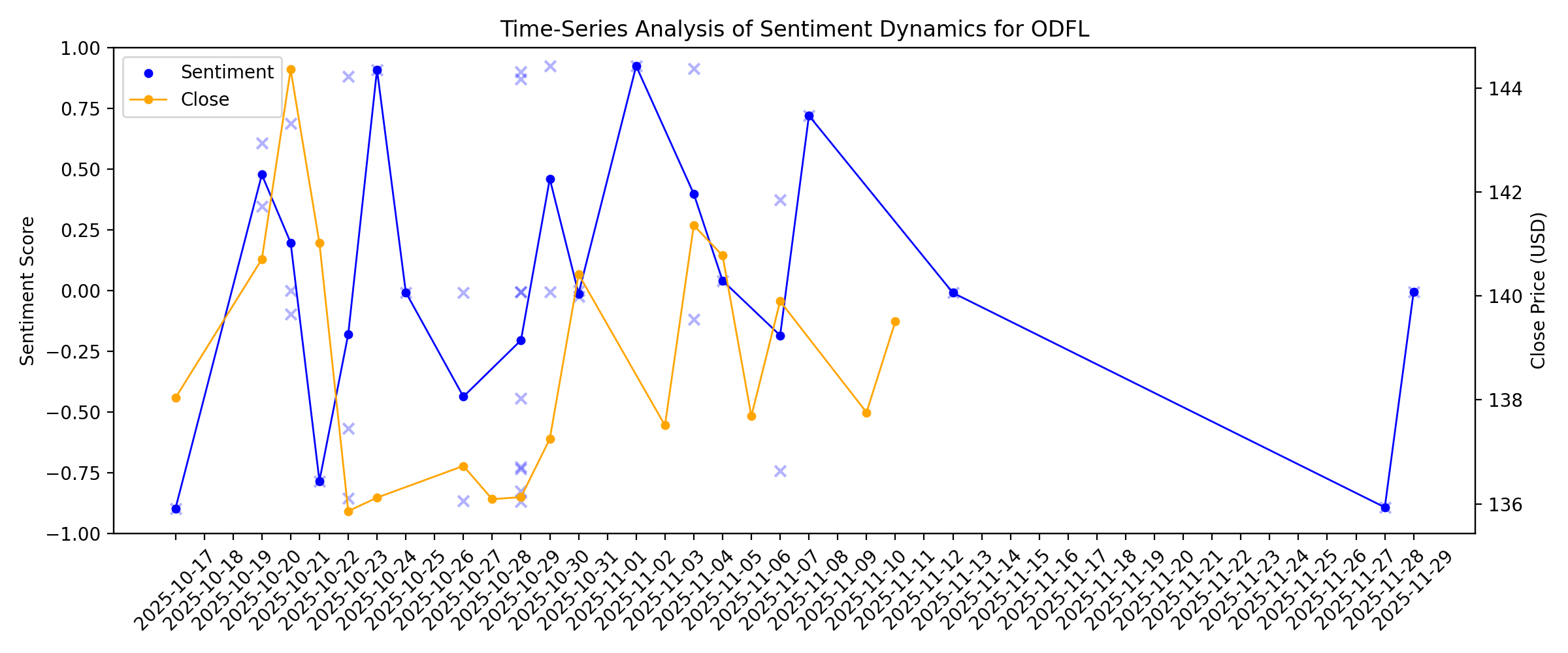

News sentiment analysis for ODFL

Sentiment chart

2026-01-14

Want a real read on the economy? Forget the jobs report, try transportation stocks.

Description: As the Dow Jones Transportation Average hits record highs, analysts say the "physical" economy is signaling a 2026 breakout.

2026-01-13

2026-01-12

Up 38% From Its Lows in November, is it Too Late to Buy Shares of This Rebounding Stock?

Description: Old Dominion Freight Line has bounced hard off its late-2025 lows. Has the buying opportunity passed?

ODFL Stock Down 4.2% Y/Y: Will the Plunge Continue Throughout 2026?

Description: ODFL shares slid 4.2% in a year as weak freight demand cut volumes, revenues and EPS, with pricing gains unable to offset falling shipments.

2026-01-11

2026-01-10

2026-01-09

Following a 4.1% decline over last year, recent gains may please Old Dominion Freight Line, Inc. (NASDAQ:ODFL) institutional owners

Description: Key Insights Given the large stake in the stock by institutions, Old Dominion Freight Line's stock price might be...

2026-01-08

What to Expect From Old Dominion’s Q4 2025 Earnings Report

Description: Old Dominion is due to report its fourth-quarter results early next month, and analysts expect earnings to contract by a low-double-digit percentage.

2026-01-07

Old Dominion Freight Line to Webcast Fourth Quarter and Year-End 2025 Conference Call

Description: THOMASVILLE, N.C., January 07, 2026--Old Dominion Freight Line, Inc. (Nasdaq: ODFL) announced today that it plans to release its fourth quarter and year-end 2025 financial results before opening of trading on Wednesday, February 4, 2026. The Company will also hold a conference call to discuss its financial results and outlook at 10:00 a.m. (Eastern Time) on Wednesday, February 4, 2026.

2026-01-06

Canal Capital Management adds Akre Focus ETF

Description: Canal Capital added the Akre Focus ETF to its equity portfolio during the fourth quarter.

2026-01-05

Investing in Old Dominion Freight Line (NASDAQ:ODFL) five years ago would have delivered you a 61% gain

Description: The main point of investing for the long term is to make money. Better yet, you'd like to see the share price move up...

2026-01-04

2026-01-03

This Stock Has Soared About 4,000% in Just 2 Decades. After Declining Last Year, Is It Finally a Buy?

Description: This trucking stock has been one of the market's best long-term compounders. But a stubborn freight slump has put that reputation to the test.

2026-01-02

Here's Why Investors Should Give Old Dominion Stock a Miss Now

Description: ODFL faces earnings estimate cuts, weak price performance, and a tough freight market, giving investors reasons to stay cautious.

2026-01-01

2025-12-31

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

2025-12-21

2025-12-20

Old Dominion Freight Line (NASDAQ:ODFL) Is Investing Its Capital With Increasing Efficiency

Description: There are a few key trends to look for if we want to identify the next multi-bagger. One common approach is to try and...

2025-12-19

Implied Volatility Surging for Old Dominion Stock Options

Description: Investors need to pay close attention to ODFL stock based on the movements in the options market lately.

2025-12-18

2025-12-17

Old Dominion price target raised to $173 from $160 at Stifel

Description: Stifel raised the firm’s price target on Old Dominion (ODFL) to $173 from $160 and keeps a Buy rating on the shares. For 2026, the firm believes the focus for transport stocks will be on supply rationalization and cost-driven self-help, says the analyst, who continues to position “more conservatively in high-quality names that preserve or even expand share in a mild pullback.”Claim 50% Off TipRanks Premium and Invest with Confidence Unlock hedge-fund level data and powerful investing tools desig

2025-12-16

Port Of Los Angeles 'Feeling OK' About 2026 After 'Roller Coaster' First Year Of Trump's Trade War

Description: After nearly a year of President Donald Trump's trade-war policies, which upended international shipping, the Port of Los Angeles expects only a slight decline in import volumes in 2026 but warned that uncertainty remains. In a media briefing Tuesday, Port of Los Angeles Executive Director Gene Seroka discussed the impact of Trump's tariffs on trade and the economy, calling 2025 a "roller coaster" and adding that port volumes are unlikely to fall "off a cliff" in 2026. "We'll probably see single-digit declines in overall volume on the import side compared to this year, mainly because you've still got some pretty high inventories throughout the nation," Seroka said of the 2026 outlook.

An Insider At Old Dominion Freight Line Lowered Their Holding Recently

Description: Looking at Old Dominion Freight Line, Inc.'s ( NASDAQ:ODFL ) insider transactions over the last year, we can see that...

2025-12-15

2025-12-14

2025-12-13

Jim Cramer Says “I Like Old Dominion”

Description: Old Dominion Freight Line, Inc. (NASDAQ:ODFL) is one of the stocks on Jim Cramer’s radar recently. When a caller mentioned that ODFL looks like “an interesting stock to play”, Cramer replied: “I agree with you. I agree with you. I do. Now, just so you know, I like Old Dominion. I really, really, really like […]

2025-12-12

Should Investors Hold Old Dominion Stock Despite Its Higher Valuation?

Description: With ODFL's shares moving south, we assess the current positioning of the stock to determine if it's a good investment at this juncture.

Is Old Dominion Freight Line, Inc.'s (NASDAQ:ODFL) Stock's Recent Performance Being Led By Its Attractive Financial Prospects?

Description: Most readers would already be aware that Old Dominion Freight Line's (NASDAQ:ODFL) stock increased significantly by 14...

2025-12-11

2025-12-10

2025-12-09

2025-12-08

Great week for Old Dominion Freight Line, Inc. (NASDAQ:ODFL) institutional investors after losing 23% over the previous year

Description: Key Insights Institutions' substantial holdings in Old Dominion Freight Line implies that they have significant...

2025-12-07

2025-12-06

2025-12-05

2025-12-04

Does BMO’s Upgrade Reveal Old Dominion (ODFL) Has More Durable Pricing Power Than Believed?

Description: BMO Capital recently upgraded Old Dominion Freight Line’s rating to “Outperform,” citing the LTL carrier’s strong execution, service reliability, pricing power, and robust free cash flow generation despite an industry freight slowdown. Analysts at BMO also pointed to Old Dominion’s emphasis on industrial freight exposure and active share repurchases as reasons the company may be well placed when freight demand eventually improves. We’ll now examine how this upgrade, particularly the emphasis...

Is Old Dominion Freight Line Stock Underperforming the Nasdaq?

Description: While Old Dominion Freight Line has lagged behind the broader Nasdaq Composite over the past year, Wall Street analysts remain moderately optimistic about the stock’s prospects.

2025-12-03

5 Transport Stocks Are Spiking After Slumps. Analysts Debate Their Future.

Description: Collectively, the 19 stocks in IBD's Transportation-Truck industry group gained 10% for the week.

Old Dominion Unveils Weak LTL Unit Performance for November

Description: ODFL's revenue per day fell 4.4% year over year in November 2025, owing to a 10% decrease in LTL tons per day, partially offset by an increase in LTL revenue per hundredweight.

Old Dominion Freight Line (ODFL) Stock Is Up, What You Need To Know

Description: Shares of freight carrier Old Dominion (NASDAQ:ODFL) jumped 4.3% in the morning session after investors focused on improved pricing power despite a drop in shipping volumes reported in the company's November operational update.

Werner (WERN) Shares Skyrocket, What You Need To Know

Description: Shares of freight delivery company Werner (NASDAQ:WERN) jumped 5.5% in the morning session after positive operational updates from peer Old Dominion Freight Line (ODFL) lifted sentiment for the trucking industry.

Old Dominion again sees yields improve as volumes sag

Description: Old Dominion Freight Line’s November update showed modest improvement from October. The post Old Dominion again sees yields improve as volumes sag appeared first on FreightWaves.

2025-12-02

Old Dominion Freight Line Provides Update for Fourth Quarter 2025

Description: THOMASVILLE, N.C., December 02, 2025--Old Dominion Freight Line, Inc. (Nasdaq: ODFL) today reported certain less-than-truckload ("LTL") operating metrics for November 2025. Revenue per day decreased by 4.4% as compared to November 2024 due to a 10.0% decrease in LTL tons per day that was partially offset by an increase in LTL revenue per hundredweight. The decrease in LTL tons per day was attributable to a 9.4% decrease in LTL shipments per day and a 0.6% decrease in LTL weight per shipment. For

2025-12-01

Wall Street Retreats After 5-Day Winning Streak

Description: Wall Street's main equity benchmarks fell on Monday, snapping their five-day winning streak as trade

Equities Fall Intraday as Survey Shows Continued Manufacturing Contraction

Description: US benchmark equity indexes were lower intraday as a survey showed continued contraction in the manu

Old Dominion Freight Line (ODFL) Stock Trades Up, Here Is Why

Description: Shares of freight carrier Old Dominion (NASDAQ:ODFL) jumped 5.7% in the afternoon session after BMO Capital upgraded the stock's rating to "Outperform" from "Market Perform". The analyst, Fadi Chamoun, pointed to the company's strong market position and its ability to maintain high service levels and pricing power, even during a broader slowdown in the freight industry. Despite the upgrade, the firm slightly lowered its price target to $170 from $172. The positive outlook was also based on the i

Top Stock Movers Now: Coinbase, Robinhood, Moderna, Synopsys, and More

Description: Major U.S. equities indexes lost ground Monday afternoon, as shares of tech and cryptocurrency-related companies pulled back.

2025-11-30

2025-11-29

A Fresh Look at Old Dominion Freight Line’s (ODFL) Valuation Following Recent Share Price Decline

Description: Old Dominion Freight Line (ODFL) shares have caught the attention of investors after recent movements in the transportation sector. As the freight market experiences changes, it is worth considering how the company’s fundamentals stack up in the current environment. See our latest analysis for Old Dominion Freight Line. Old Dominion Freight Line’s share price has slipped 23% since the start of the year, reflecting some of the cautious sentiment across transportation stocks, while the 1-year...

2025-11-28

Why Is Old Dominion (ODFL) Down 1.7% Since Last Earnings Report?

Description: Old Dominion (ODFL) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-11-27

2025-11-26

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

2025-11-20

2025-11-19

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

Are Wall Street Analysts Bullish on Old Dominion Freight Line Stock?

Description: Old Dominion Freight Line has continued to underperform the broader market over the past year, and analysts remain cautious about the stock’s prospects.

2025-11-12

2025-11-11

2025-11-10

2025-11-09

2025-11-08

Old Dominion Freight Line (ODFL): Exploring Valuation as Shares Remain Quiet and Recent Returns Disappoint

Description: Old Dominion Freight Line (ODFL) shares edged up less than 1% in recent trading, reflecting a relatively quiet period for the stock. Investors are weighing its longer-term performance as well as the underlying business fundamentals heading into the rest of the year. See our latest analysis for Old Dominion Freight Line. Despite trading quietly today, Old Dominion Freight Line has faced persistent selling pressure, with a year-to-date share price return of -20% and a 1-year total shareholder...

2025-11-07

Consensus Forming in Trucking – What the Big Guys Are Saying About the Near Future

Description: The heavy hitters in trucking just finished their Q3 calls, and what they’re saying is loud enough for small carriers to hear: things are messy, but there’s a glimmer of opportunity if you play tight. From the Covenant Logistics team seeing “all‑time high” contract bids, to Old Dominion Freight Line eyeballing shrinking tonnage, the message […] The post Consensus Forming in Trucking – What the Big Guys Are Saying About the Near Future appeared first on FreightWaves.

What Makes Old Dominion Freight Lines (ODFL) a Lucrative Investment?

Description: Pelican Bay Capital Management, an investment management company, released its third-quarter 2025 investor letter. A copy of the same can be downloaded here. PBCM Concentrated Value Strategy returned 7.8% in the quarter, compared to a 5.3% return for the Russell 1000 Value Index. YTD, the fund returned 11.2% compared to 11.6% for the index. In addition, […]

2025-11-06

2025-11-05

5 Revealing Analyst Questions From Old Dominion Freight Line’s Q3 Earnings Call

Description: Old Dominion Freight Line’s third quarter results reflected the ongoing softness in U.S. freight demand, with management citing a continued decline in shipment volumes as the primary factor weighing on financial performance. The company’s leadership highlighted that average daily tonnage fell 9% year over year, offset to some extent by improvements in pricing and operational efficiency. CEO Marty Freeman noted, “We continue to operate efficiently during the quarter and were able to manage our di

2025-11-04

Should You Hold Old Dominion Freight Line (ODFL)?

Description: The London Company, an investment management company, released “The London Company Large Cap Strategy” third-quarter 2025 investor letter. A copy of the letter can be downloaded here. US equities continued their rally in the third quarter, driven by the Fed rate cut, solid corporate earnings, and enthusiasm around AI. The economy retained most of its […]

1 Nasdaq 100 Stock on Our Watchlist and 2 We Avoid

Description: The Nasdaq 100 (^NDX) is home to some of the biggest success stories in tech and growth investing. However, certain stocks in the index face challenges like profitability concerns, rising costs, or shifts in market trends.

2025-11-03

2025-11-02

XPO Speeds Past the Competition Again. AI Could Give It Another Leg Up

Description: In a challenging environment, XPO delivered an impressive round of results.

2025-11-01

2025-10-31

TFI operating income drops amid US woes

Description: Challenges with the carrier’s OEM and federal government customers come from tariff policy and the congressional funding-based shutdown.

Old Dominion Freight Line (ODFL): Margin Decline Challenges Bullish Narratives on Pricing Power

Description: Old Dominion Freight Line (ODFL) reported revenue growth of 5.7% per year, which is below the broader US market’s 10.3% annual growth forecast. Annual earnings are projected to grow at 9.7%, trailing the US market’s expected 15.7% pace, and profit margins have slipped to 19% from 21% a year prior. While ODFL’s impressive five-year earnings growth averaged 7.9% per year, the company saw negative earnings growth in the most recent year. This leaves investors with a picture of steadier but...

2025-10-30

Old Dominion Freight Line Inc (ODFL) Q3 2025 Earnings Call Highlights: Navigating Revenue ...

Description: Despite a revenue dip, Old Dominion Freight Line Inc (ODFL) leverages technology and operational efficiency to maintain its market leadership.

ODFL Q3 Deep Dive: Volume Weakness Persists, Cost Control and Network Positioning Take Focus

Description: Freight carrier Old Dominion (NASDAQ:ODFL) met Wall Streets revenue expectations in Q3 CY2025, but sales fell by 4.3% year on year to $1.41 billion. Its non-GAAP profit of $1.28 per share was 5.2% above analysts’ consensus estimates.

2025-10-29

Old Dominion Q3 Earnings & Revenues Surpass Estimates, Down Y/Y

Description: ODFL beats Q3 earnings and revenue estimates despite year-over-year declines, backed by strong yield growth and cost control.

Old Dominion leaning on cost controls, yield management amid tonnage declines

Description: Old Dominion Freight Line remains focused on yield management and controlling costs as it awaits a reprieve from tonnage declines. The post Old Dominion leaning on cost controls, yield management amid tonnage declines appeared first on FreightWaves.

Old Dominion reports market softness, tonnage declines

Description: Q3 operating revenue dropped 10% year over year, and early Q4 data also suggested further challenges.

Compared to Estimates, Old Dominion (ODFL) Q3 Earnings: A Look at Key Metrics

Description: While the top- and bottom-line numbers for Old Dominion (ODFL) give a sense of how the business performed in the quarter ended September 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

First look: Old Dominion Q3 earnings

Description: Belt tightening and higher yields helped Old Dominion Freight Line limit margin degradation in the third quarter. The post First look: Old Dominion Q3 earnings appeared first on FreightWaves.

Old Dominion Freight Line (ODFL) Q3 Earnings and Revenues Surpass Estimates

Description: Old Dominion (ODFL) delivered earnings and revenue surprises of +4.92% and +0.70%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Old Dominion Freight Line’s (NASDAQ:ODFL) Q3 Earnings Results: Revenue In Line With Expectations

Description: Freight carrier Old Dominion (NASDAQ:ODFL) met Wall Streets revenue expectations in Q3 CY2025, but sales fell by 4.3% year on year to $1.41 billion. Its GAAP profit of $1.28 per share was 5.2% above analysts’ consensus estimates.

Old Dominion: Q3 Earnings Snapshot

Description: THOMASVILLE, N.C. (AP) — Old Dominion Freight Line Inc. ODFL) on Wednesday reported third-quarter earnings of $270.9 million. On a per-share basis, the Thomasville, North Carolina-based company said it had profit of $1.28.

Old Dominion Freight Line Reports Third Quarter 2025 Earnings Per Diluted Share of $1.28

Description: THOMASVILLE, N.C., October 29, 2025--Old Dominion Freight Line, Inc. (Nasdaq: ODFL) today announced financial results for the three-month and nine-month periods ended September 30, 2025.

2025-10-28

2025-10-27

Old Dominion Freight Line (ODFL) Reports Earnings Tomorrow: What To Expect

Description: Freight carrier Old Dominion (NASDAQ:ODFL) will be reporting earnings this Wednesday before market open. Here’s what to expect.

Old Dominion's Q3 Earnings Coming Up: What's in Store for the Stock?

Description: ODFL's top line in the third quarter of 2025 is expected to have been hurt by freight market softness, inflationary pressure and tariff-related uncertainties.

2025-10-26

2025-10-25

Should You Reconsider Old Dominion After a 22% Drop in 2025?

Description: Thinking about what to do with Old Dominion Freight Line stock right now? You are not alone. With logistics and transport names back in the headlines, ODFL has found itself at the center of the action, and investors are weighing their next move. After a bumpy run this year, closing recently at $136.12, the stock is down 22.5% year-to-date and has slipped 30.7% over the past twelve months. The short-term picture has been softer as well, with a 1.4% dip over the last week and 3.5% over the last...

2025-10-24

Should Old Dominion Freight Line's (ODFL) Rate and Dividend Hikes Signal a Shift in Margin Strategy?

Description: Old Dominion Freight Line recently announced a 4.9% general rate increase for its freight services, effective November 3, 2025, to help offset rising operational costs, alongside a quarterly dividend increase to US$0.28 per share payable on December 17, 2025. This combination of higher rates and a raised dividend underscores the company's approach to balancing cost management with shareholder returns amid ongoing industry pressures. We’ll examine how Old Dominion’s earlier-than-usual freight...

2025-10-23

Marten Transport, Ltd. (MRTN) Lags Q3 Earnings and Revenue Estimates

Description: Marten Transport (MRTN) delivered earnings and revenue surprises of -25.00% and -2.88%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Saia (SAIA) Expected to Beat Earnings Estimates: Can the Stock Move Higher?

Description: Saia (SAIA) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Old Dominion Freight Line Announces $0.28 Per Share Quarterly Cash Dividend

Description: THOMASVILLE, N.C., October 23, 2025--Old Dominion Freight Line, Inc. (Nasdaq: ODFL) today announced that its Board of Directors has declared a quarterly cash dividend of $0.28 per share of common stock, payable on December 17, 2025, to shareholders of record at the close of business on December 3, 2025. This dividend payment represents a 7.7% increase to the quarterly cash dividend paid in December 2024.

2025-10-22

Earnings Preview: Old Dominion Freight Line (ODFL) Q3 Earnings Expected to Decline

Description: Old Dominion (ODFL) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2025-10-21

Old Dominion Freight Line (ODFL): Evaluating Valuation After 4.9% Rate Hike Announced for November 2025

Description: Old Dominion Freight Line (ODFL) is putting a 4.9% general rate increase into effect starting November 3, 2025. The company aims to help manage higher costs tied to real estate, equipment, technology, and employee compensation. This move fits with the company’s ongoing strategy for pricing and running an efficient operation. See our latest analysis for Old Dominion Freight Line. Alongside the new rate increase, Old Dominion Freight Line has also rolled out its latest Sustainability Report,...

Old Dominion Freight Line plans 4.9% rate increase

Description: The change will occur Nov. 3 due to factors such as rising costs in real estate, new equipment and employee compensation packages, the LTL carrier said.

Raymond James Reduces PT on Old Dominion Freight Line (ODFL) Stock to $160, Keeps Outperform

Description: Old Dominion Freight Line, Inc. (NASDAQ:ODFL) is one of the Best Beaten Down Stocks to Buy According to Hedge Funds. On October 14, Raymond James reduced the price target on the company’s stock to $160 from $165, while keeping an “Outperform” rating. As per the firm, upcoming rate cuts might eventually fuel activity, mainly in the […]

2025-10-20

LTLs hold pricing line; Old Dominion announces 4.9% GRI

Description: Old Dominion Freight Line is the latest less-than-truckload carrier to implement a general rate increase ahead of schedule. The post LTLs hold pricing line; Old Dominion announces 4.9% GRI appeared first on FreightWaves.

Old Dominion Freight Line, Inc. Announces General Rate Increase

Description: THOMASVILLE, N.C., October 20, 2025--Old Dominion Freight Line, Inc. (Nasdaq: ODFL) today announced a general rate increase (GRI) of 4.9 percent applicable to rates established under the existing ODFL 559, 670, and 550 tariffs effective November 3, 2025.

2025-10-19

2025-10-18

2025-10-17

Old Dominion Freight Line Releases 2024 Sustainability Report

Description: THOMASVILLE, N.C., October 17, 2025--Old Dominion Freight Line, Inc. (Nasdaq: ODFL) announced today the release of its 2024 Sustainability Report. The 2024 Sustainability Report content has been informed by the Sustainability Accounting Standards Board (SASB) Road Transportation Sustainability Accounting Standard and is reported with reference to the Global Reporting Initiative (GRI) standards. Old Dominion received a limited assurance verification opinion for its 2024 Scope 1 and Scope 2 Greenh