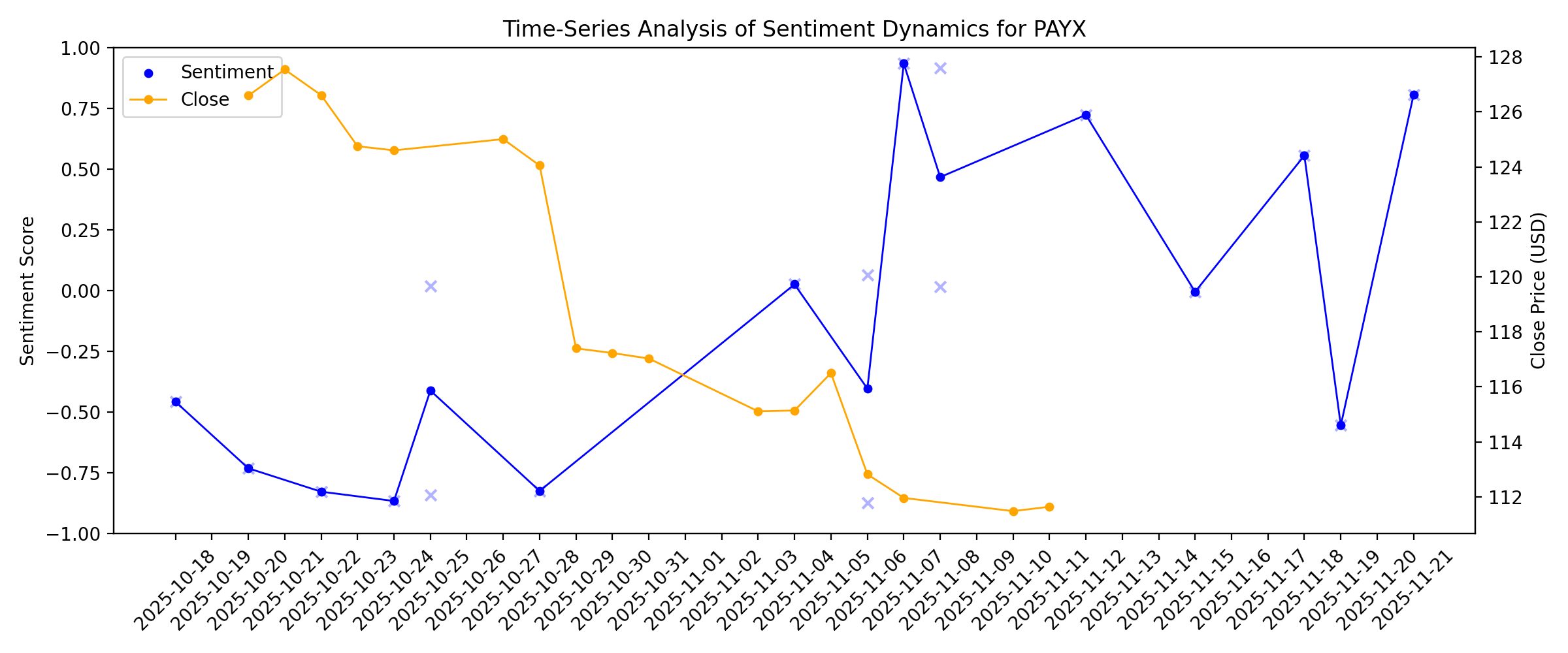

News sentiment analysis for PAYX

Sentiment chart

2026-01-14

2026-01-13

2026-01-12

Jim Cramer on Paychex: “People Didn’t Like the Last Quarter, I Thought It Was Okay”

Description: Paychex, Inc. (NASDAQ:PAYX) is one of the stocks from different market sectors that Jim Cramer commented on. Cramer discussed the market sentiment and his thoughts on the company’s latest earnings, as he said: “Other economically sensitive names like Paychex, we have them all the time, and people didn’t like the last quarter. I thought it […]

2026-01-11

Susquehanna Lowers PT on PayPal Holdings (PYPL) Stock

Description: PayPal Holdings, Inc. (NASDAQ:PYPL) is one of the Oversold Fundamentally Strong Stocks to Buy Right Now. On January 8, Susquehanna reduced the price target on PayPal Holdings, Inc. (NASDAQ:PYPL)’s stock to $90 from $94, while keeping a “Positive” rating, as reported by The Fly. Notably, the firm trimmed the company’s Q4 2025 estimates, highlighting that the branded experiences might […]

Is Paychex (PAYX) Pricing Reflect Its Mixed Recent Returns And Cash Flow Outlook?

Description: If you are wondering whether Paychex at around US$113.77 is giving you fair value for your money, you are not alone. This article walks through what the current price might mean for potential risk and reward. Over the last week the stock returned 4.8%, while the 30 day return was a 1.5% decline and the return over the last year was a 15.6% decline, so recent moves have been mixed and may be shifting how investors view its potential and risk. Recent headlines around Paychex have focused on...

2026-01-10

Paychex–PayPal Early Pay Partnership Might Change The Case For Investing In Paychex (PAYX)

Description: In early January 2026, Paychex, Inc. announced a partnership with PayPal within its Paychex Flex Perks marketplace, allowing employees of Paychex clients to set up PayPal Direct Deposit for up to two-day early pay access and broader digital financial tools, including cashback cards and high-yield savings. This collaboration directly targets unbanked and underbanked workers by offering paycheck access and benefits without requiring traditional bank accounts, potentially enhancing the appeal...

2026-01-09

2026-01-08

Paychex and PayPal Team Up to Bring Direct Deposit Alternatives Into Paychex Flex® Perks

Description: ROCHESTER, N.Y., January 08, 2026--Paychex, Inc. (Nasdaq: PAYX), an industry-leading human capital management (HCM) company, announced today a new partnership with PayPal (Nasdaq: PYPL) within its Paychex Flex® Perks platform, Paychex’s digital marketplace of curated employee benefits. Through this collaboration, employees of Paychex customers have the ability to easily set up PayPal Direct Deposit, providing up to two-day early access to their paychecks.

2026-01-07

Reasons Why You Should Retain Paychex Stock in Your Portfolio

Description: PAYX's growth is driven by rising SaaS adoption, the Paycor acquisition and AI launches, with FY26 revenues projected to rise 16.5% and earnings gains ahead.

2026-01-06

Paychex (PAYX) Q1 2025 Earnings Call Transcript

Description: John Gibson: Thank you, Bob, and good morning, everyone. As we enter the post-pandemic era of Paychex, we are off to a good start in fiscal year 2025 with total revenue growth exceeding expectations during the first quarter. Excluding the impact of the non-recurring benefits from the ERTC program and having one less processing day in the quarter, revenue growth was 7%.

U.S. Small Business Employment Remains Consistent Throughout 2025

Description: ROCHESTER, N.Y., January 06, 2026--According to the Paychex Small Business Employment Watch, 2025 marked a year of consistency for U.S. small business job and wage growth trends. The monthly report’s Small Business Jobs Index, which reflects the payroll data of Paychex’s customers with fewer than 50 employees, experienced minimal change throughout the year and averaged 99.67 in 2025. Meanwhile, hourly earnings growth (2.71%) closed the year below three percent for the 17th consecutive month.

2026-01-05

2026-01-04

Paychex (PAYX): Exploring Valuation After a 20% Share Price Drop Despite Growing Earnings

Description: Paychex (PAYX) has been drifting lower, with the stock down about 20% over the past year even as revenue and net income keep growing. That disconnect raises some interesting questions for investors. See our latest analysis for Paychex. The recent slide in Paychex’s share price, including a 12.7% 3 month share price return, has pulled its 1 year total shareholder return close to 20% lower. This suggests sentiment is fading even as fundamentals keep improving. If this shift in sentiment has you...

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

2025-12-29

Arkansas Children's Receives Historic $50 Million Gift from Philanthropist B. Thomas Golisano

Description: Arkansas Children's announces a landmark $50 million gift from philanthropist, entrepreneur and child health advocate B. Thomas Golisano. This investment is the largest philanthropic gift in Arkansas Children's history and supports key strategic priorities for the health system, including its $371 million expansion. The 10-year systemwide growth plan includes program development, workforce recruitment and facility upgrades, designed to meet the escalating child health needs of the next generatio

2025-12-28

2025-12-27

“People Didn’t Like” Paychex (PAYX)’s Quarter

Description: We recently published 9 Stocks Jim Cramer Talked About. Paychex, Inc. (NASDAQ:PAYX) is one of the stocks on Jim Cramer talked about. Paychex, Inc. (NASDAQ:PAYX)’s shares are down 17% year-to-date and has seen several price target cuts recently. The firm reported its second-quarter earnings on December 19th and posted $1.56 billion in revenue to slightly […]

2025-12-26

2025-12-25

2025-12-24

2025-12-23

Jim Cramer Notes “Paychex Tends to Sell off on Earnings”

Description: Paychex, Inc. (NASDAQ:PAYX) is one of the stocks that was on Jim Cramer’s radar. Cramer noted the company’s earnings and analyst sentiment toward it. The Mad Money host stated: “If you want to get a real read on employment, I always like to check in with Paychex. That’s the payroll processor and outsourced human resources […]

2025-12-22

Paychex Faces Softer Revenue Trends, Paycor Reacceleration Risk, Morgan Stanley Says

Description: Paychex (PAYX) is seeing softer revenue per employee trends which are "often the first step towards

Paychex (PAYX) Reports Q2 Earnings: What Key Metrics Have to Say

Description: Although the revenue and EPS for Paychex (PAYX) give a sense of how its business performed in the quarter ended November 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

2025-12-21

Is Paychex Offering Value After an 18.9% Slide Amid HR Tech Competition?

Description: If you are wondering whether Paychex at around $112 a share is a bargain or a trap, you are not alone. This article is going to unpack what that price really implies. The stock has slipped about 2.7% over the last week and is down 18.9% year to date, but longer term holders are still sitting on gains of roughly 36.5% over five years. Recently, the market narrative around Paychex has been shaped by ongoing debates about the durability of small business employment, regulatory changes in...

2025-12-20

2025-12-19

Paychex Inc (PAYX) Q2 2026 Earnings Call Highlights: Strong Revenue Growth Amid Integration ...

Description: Paychex Inc (PAYX) reports an 18% revenue increase, driven by the Paycor acquisition, while navigating integration complexities and softer revenue per client.

Paychex Q2 Earnings & Revenues Surpass Estimates, Increase Y/Y

Description: PAYX beats on 2Q26 earnings and revenues. EPS grows 10.5% y/y and sales rise 18.3%, as management solutions led growth.

Paychex Lifts Earnings Guidance Mid-Point, Sees Revenue at Low End of Outlook

Description: Paychex (PAYX) on Friday raised the middle point of its full-year earnings guidance, but expects rev

Paychex's higher quarterly expenses overshadow annual earnings forecast raise

Description: Payroll services provider Paychex reported higher expenses for the second quarter on Friday, taking the shine off its raise in annual adjusted earnings growth forecast. Shares of the company were down 2.6% in early trading. They have fallen around 18% so far this year.

Paychex (PAYX) Q2 Earnings and Revenues Beat Estimates

Description: Paychex (PAYX) delivered earnings and revenue surprises of +1.61% and +0.22%, respectively, for the quarter ended November 2025. Do the numbers hold clues to what lies ahead for the stock?

Paychex (NASDAQ:PAYX) Reports Q4 CY2025 In Line With Expectations

Description: Human capital management company Paychex (NASDAQ:PAYX) met Wall Streets revenue expectations in Q4 CY2025, with sales up 18.3% year on year to $1.56 billion. Its non-GAAP profit of $1.26 per share was 2.4% above analysts’ consensus estimates.

Paychex: Fiscal Q2 Earnings Snapshot

Description: ROCHESTER, N.Y. (AP) — Paychex Inc. PAYX) on Friday reported fiscal second-quarter net income of $395.4 million. The Rochester, New York-based company said it had net income of $1.10 per share.

Paychex Reports Second Quarter Results

Description: ROCHESTER, N.Y., December 19, 2025--Paychex, Inc. (Nasdaq: PAYX) (the "Company," "Paychex," "we," "our," or "us"), an industry-leading human capital management ("HCM") company, today reported results for the fiscal quarter ended November 30, 2025 (the "second quarter") of the fiscal year ending May 31, 2026 ("fiscal 2026"). Results compared with the same period last year were as follows:

Stocks Mostly Up Pre-Bell as Traders Digest Latest Inflation Data

Description: The benchmark US stock measures were mostly pointing higher before the opening bell on Friday as tra

Should You Buy the 3 Highest-Paying Dividend Stocks on the Nasdaq?

Description: See if any of these high-yield stocks are worth buying.

2025-12-18

Carnival earnings, home sales, consumer sentiment: What to Watch

Description: Market Domination Overtime host Josh Lipton previews several of the biggest stories to come tomorrow, Friday, December 19, including earnings results from Conagra Brands (CAG) and cruise operator Carnival Corporation (CCL), existing home sales data, and the latest reading on consumer sentiment for the month of December. To watch more expert insights and analysis on the latest market action, check out more Market Domination Overtime.

If AI Financial Automation Happens (It Is) Then These Four Companies Win

Description: Artificial intelligence is rapidly transforming financial operations, and several companies are racing to automate accounts payable, receivable, and expense management for small and mid-sized businesses. We looked at four stocks to see who benefits most from AI-powered financial automation. The Players in AI Financial Automation Bill.com (NYSE:BILL) provides cloud-based financial automation for SMBs, processing approximately ... If AI Financial Automation Happens (It Is) Then These Four Companie

Bridgeline Digital, Inc. (BLIN) Reports Q4 Loss, Lags Revenue Estimates

Description: Bridgeline Digital (BLIN) delivered earnings and revenue surprises of +50.00% and -0.23%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Top 3 Dividend Stocks To Consider For Your Portfolio

Description: In the wake of recent inflation data that came in cooler than expected, major U.S. stock indexes like the Dow Jones and S&P 500 have rebounded, snapping a four-session losing streak and reflecting renewed investor optimism. Amidst this backdrop of market recovery, dividend stocks continue to attract attention for their potential to provide steady income streams, making them an appealing consideration for investors looking to balance growth with stability in their portfolios.

What to Expect From Paychex's Q2 2026 Earnings Report

Description: Paychex is all set to release its fiscal second-quarter earnings tomorrow, and analysts project a single-digit earnings growth

Paychex price target lowered to $126 from $137 at Stifel

Description: Stifel analyst David Grossman lowered the firm’s price target on Paychex (PAYX) to $126 from $137 and keeps a Hold rating on the shares ahead of fiscal Q2 EPS due on December 19. The firm expects a largely in-line quarter and guidance, adding that it estimates 5%-plus second half growth is needed to achieve the low-end of the company’s FY26 organic revenue guidance.Claim 50% Off TipRanks Premium and Invest with Confidence Unlock hedge-fund level data and powerful investing tools designed to help

2025-12-17

Paychex Gears Up to Report Q2 Earnings: What's in Store?

Description: PAYX prepares to report 2Q26 results, with revenues expected to jump 18% y/y, driven by Management Solutions growth and added Paycor contributions.

2025-12-16

Does Paychex’s AI-First Pivot and Margin Pressure Reshape Its Acquisition Story for PAYX?

Description: Earlier this month, Paychex reported US$1.54 billion in quarterly revenue, up 16.8% year on year, but slightly missed EBITDA expectations as management acknowledged margin pressure even while highlighting a strong start to fiscal 2026. Alongside the earnings update, Paychex detailed an AI-first push across Paychex Flex, Paycor, and SurePayroll and reiterated its intention to keep pursuing M&A after integrating Paycor, underscoring a focus on technology-led growth and portfolio expansion over...

DataLane Secures $27M to Deliver Identity Graph of 20M Local Businesses

Description: NEW YORK, December 16, 2025--DataLane, the identity graph for local businesses, today announced a $22.5 million Series A led by Amplify Partners with participation from Harry Stebbings, founder of 20VC, Basis Set, Mischief, and others. DataLane is building the first highly accurate identity platform for every local business in America — a LinkedIn for the offline economy — so companies like DoorDash, Square, Paychex, and Motorola can find, verify, and reach real business owners with unmatched pr

2025-12-15

Jim Cramer Highlights Paychex’s Role in Managing Payouts

Description: Paychex, Inc. (NASDAQ:PAYX) is one of the stocks on Jim Cramer’s game plan this week. Cramer finished his game plan with the stock, as he commented: “Finally, Friday, we have a bunch of good reads on a slew of different industries… Paychex handles the payouts of millions of individuals who work at small and medium-sized […]

Paychex Identifies Top Regulatory Trends to Watch in 2026

Description: ROCHESTER, N.Y., December 15, 2025--Paychex, Inc. (Nasdaq: PAYX), an industry-leading human capital management (HCM) company, released its annual list of top regulatory and compliance trends to watch in 2026. The list is intended to keep business leaders informed about the regulatory changes most likely to impact them in the coming year and why. This year’s trends span retirement, taxes, artificial intelligence (AI) laws, and employment law.

US Equity Investors to Focus on Labor, Inflation Data This Week Alongside Micron Technology's Results

Description: US equity investors will focus on labor market and inflation data while tuning in to the Federal Res

2025-12-14

Trump's Fed pick comes into focus, economic data backlog clears: What to watch this week

Description: With the December Fed meeting in the rear view, investor attention will turn toward Fed chair nomination drama and the potential for a Santa rally (or not)

2025-12-13

2025-12-12

2025-12-11

Broadcom Inc. (AVGO) Beats Q4 Earnings and Revenue Estimates

Description: Broadcom Inc. (AVGO) delivered earnings and revenue surprises of +4.28% and +2.94%, respectively, for the quarter ended October 2025. Do the numbers hold clues to what lies ahead for the stock?

Paychex Pays 3.65% and Added $4.2 Billion in Debt but the Dividend Looks Safe

Description: Paychex (Nasdaq: PAYX) pays a quarterly dividend of $1.08 per share, yielding 3.65%. The company has raised its dividend for 14 consecutive years, with the most recent 10.2% increase in February 2025. The question for income investors: can Paychex sustain this dividend after taking on $4.2 billion in new debt to acquire Paycor? Metric Value ... Paychex Pays 3.65% and Added $4.2 Billion in Debt but the Dividend Looks Safe

2025-12-10

2025-12-09

Braze, Inc. (BRZE) Q3 Earnings Meet Estimates

Description: Braze (BRZE) delivered earnings and revenue surprises of 0.00% and +3.69%, respectively, for the quarter ended October 2025. Do the numbers hold clues to what lies ahead for the stock?

2025-12-08

Paychex Unveils Intelligent AI Solutions to Revolutionize Workforce Management

Description: ROCHESTER, N.Y., December 08, 2025--Paychex, Inc. (Nasdaq: PAYX), an industry-leading human capital management (HCM) company, announced today a suite of AI-driven innovations to transform the HCM experience, evolving from user-directed to AI-powered with expertise infused at every touch point. Through AI-driven solutions that anticipate needs, automate tasks, and deliver precise, actionable insights, Paychex is simplifying complex HR processes, improving business outcomes, and driving greater ef

2025-12-07

Paychex (PAYX): Revisiting Valuation After a 19% Share Price Pullback Despite Steady Earnings Growth

Description: Paychex (PAYX) has quietly lagged the market this year, with the stock down about 19% over the past year even as revenue and net income continue to grow at mid single digit to low double digit rates. See our latest analysis for Paychex. That slide has reset expectations a bit, with the 90 day share price return of negative 17.3 percent dragging the one year total shareholder return to roughly negative 19 percent, even though the five year total shareholder return is still comfortably...

Reassessing Paychex After 2025 Slump And New HR Partnerships

Description: Wondering if Paychex is actually a bargain after its recent slump, or just fairly priced for a steady dividend payer? This breakdown will walk you through what the numbers are really saying about the stock. Despite trading around $112.06, the shares are roughly flat over the last month, up just 0.3% in the past week, but still down 19.1% year to date and over the last 12 months, which has many investors reassessing both the risk and upside from here. Recent headlines have focused on Paychex...

2025-12-06

2025-12-05

Paychex Q2 Expected In-Line as H2 Acceleration Looms, RBC Says

Description: Paychex (PAYX) is tracking toward an in-line fiscal Q2 and appears positioned for a stronger second

Paychex Schedules Second Quarter Fiscal 2026 Earnings Conference Call on December 19, 2025

Description: ROCHESTER, N.Y., December 05, 2025--Paychex, Inc. (Nasdaq: PAYX), an industry-leading human capital management ("HCM") company, will release financial results for its fiscal 2026 second quarter ended November 30, 2025 on Friday, December 19, 2025, before the financial markets open.

2025-12-04

DocuSign (DOCU) Q3 Earnings and Revenues Beat Estimates

Description: DocuSign (DOCU) delivered earnings and revenue surprises of +9.78% and +1.52%, respectively, for the quarter ended October 2025. Do the numbers hold clues to what lies ahead for the stock?

2025-12-03

Is Paychex Stock Underperforming the Dow?

Description: As Paychex has notably underperformed the Dow recently, analysts remain cautious about the stock’s prospects.

Is Paychex, Inc.'s (NASDAQ:PAYX) ROE Of 41% Impressive?

Description: One of the best investments we can make is in our own knowledge and skill set. With that in mind, this article will...

2025-12-02

U.S. Small Business Employment Sees Modest Uptick in November

Description: ROCHESTER, N.Y., December 02, 2025--According to the latest Paychex Small Business Employment Watch, which is based on the payroll data of Paychex’s customers with fewer than 50 employees, the small business employment growth rate edged higher in November. The report's Small Business Jobs Index rose to 99.38, up 0.11 percentage points from October, while hourly earnings growth increased marginally to 2.66%, demonstrating consistency across the small business sector.

2025-12-01

2025-11-30

2025-11-29

2025-11-28

2025-11-27

2025-11-26

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

Paychex and Asana Shares Are Soaring, What You Need To Know

Description: A number of stocks jumped in the afternoon session after comments from a key Federal Reserve official bolstered hopes for an interest rate cut.

2025-11-20

2025-11-19

Paychex Introduces AI-Driven Participant Event Notifications for Financial Advisors

Description: ROCHESTER, N.Y., November 19, 2025--Paychex, Inc. (Nasdaq: PAYX), an industry-leading human capital management (HCM) company, today introduced Participant Event Notifications, an AI-powered wealth management solution for financial advisors. This pioneering new advisor plan management tool leverages both payroll and plan level data to alert advisors through real-time notifications within the Paychex Flex® Advisor Console when retirement plan participants reach key data milestones and have work or

2025-11-18

Top Dividend Stocks To Consider In November 2025

Description: As the U.S. stock market experiences significant fluctuations, with major indexes closing sharply lower and tech stocks facing volatility, investors are increasingly looking for stability in their portfolios. In such an environment, dividend stocks can offer a reliable income stream and potential for long-term growth, making them an attractive consideration amidst current market uncertainties.

2025-11-17

2025-11-16

2025-11-15

Should You Rethink Paychex After Its 19% Decline in 2025?

Description: Wondering if Paychex is a hidden bargain or trading above its worth? You are not alone, as plenty of investors are keeping an eye out for standout value among HR and payroll service providers. The stock has experienced some turbulence, holding steady over the last week but sliding 12.1% in the past month and down 19.1% year to date. This highlights both shifting growth expectations and changing risk perception. Recent headlines have featured industry-wide commentary on economic headwinds and...

2025-11-14

2025-11-13

2025-11-12

Paychex Honored as an HCM Technology and GenAI Leader

Description: ROCHESTER, N.Y., November 12, 2025--Paychex, Inc. (Nasdaq: PAYX), an industry-leading human capital management (HCM) company, announced today its Paychex Flex® and Paycor platforms were both recognized as a "Leader" by global analyst and research firm, NelsonHall, in the firm’s 2025 "HCM Technology and GenAI" Vendor Evaluation and Assessment Tool (NEAT). The NEAT enables buyers to assess the capabilities of HCM vendors across a range of criteria and business situations to identify the best-perfo

2025-11-11

2025-11-10

2025-11-09

2025-11-08

Does Paychex’s (PAYX) Analyst Upgrade Reveal New Momentum in Its Resilience Strategy?

Description: Earlier this week, Paychex was upgraded by analysts as its valuation became more appealing following a 20% price drop, with focus on resilience, client retention, and robust margins amid continuing macroeconomic and hybrid work challenges. New analyst commentary also highlighted Paychex’s ability to pursue growth through acquisitions such as Paycor, supported by favorable trends like recent Federal Reserve rate cuts and ongoing demand for human capital management technology. We'll explore...

Paychex (PAYX): Evaluating Value After Analyst Upgrade and Recent Share Price Decline

Description: Paychex (PAYX) was just upgraded from hold to buy after its share price dropped by around 20% over the past few months. Analysts point to improved valuation, steady client retention, and recent strategic growth as reasons for renewed interest. See our latest analysis for Paychex. Paychex’s share price has lost nearly 20% this year, reflecting shifting market sentiment and perhaps some renewed caution about business service leaders, even as the company posts steady growth and client retention...

2025-11-07

BILL Holdings Tops Q1 Earnings Estimates on Core Strength & Higher TPV

Description: BILL's Q1 earnings and revenues beat forecasts as strong transaction growth and rising payment volumes drive momentum.

2025-11-06

Why One Economist Calls This the ‘Stupidest Chart in the World’

Description: A popular chart online compares the S&P 500’s big gain since the launch of ChatGPT to the decline in job openings.

BILL Reports First Quarter Fiscal Year 2026 Financial Results

Description: SAN JOSE, Calif., November 06, 2025--BILL (NYSE: BILL), the intelligent finance platform trusted by half a million businesses to manage, move and maximize their money, today announced financial results for the first fiscal quarter ended September 30, 2025.

2025-11-05

2025-11-04

U.S. Small Business Employment Growth Remains Consistent as Weekly Hours Worked Reach Near-Decade High

Description: ROCHESTER, N.Y., November 04, 2025--According to the latest Paychex Small Business Employment Watch, which is based on the payroll data of Paychex’s customers with fewer than 50 employees, small business employment levels remained consistent in October. The report’s Small Business Jobs Index has moved less than one percentage point over the last year, indicating continued moderation in small business hiring. While hourly earnings growth for U.S. small business workers slowed marginally to 2.58%,

2025-11-03

2025-11-02

2025-11-01

2025-10-31

2025-10-30

2025-10-29

2025-10-28

Xactly Appoints Chief Marketing Officer and Chief Human Resources Officer To Fuel Next Phase of Growth

Description: Tiffany Sieve joins as CMO and Megan Barbier as CHRO to Accelerate Brand Expansion and People Strategy SAN JOSE, CA / ACCESS Newswire / October 28, 2025 /Xactly, a global leader in intelligent revenue solutions, today announced the appointments of ...

2025-10-27

2025-10-26

2025-10-25

Paychex (PAYX): Assessing Valuation After Recent Share Price Dip

Description: Paychex (PAYX) remains in focus as investors assess the company’s returns in a shifting market environment. The stock has seen a dip over the past month, which has prompted questions about its current valuation. See our latest analysis for Paychex. Despite slipping 2.9% over the past month and recently trading at $124.6, Paychex’s share price has actually drifted lower for most of this year. This mirrors fading market momentum in business services stocks. Still, its five-year total...

Jim Cramer on Automatic Data Processing: “It is an Excellent Company”

Description: Automatic Data Processing, Inc. (NASDAQ:ADP) is one of the stocks Jim Cramer was recently asked about. A caller mentioned that it has been difficult to own the stock over the last few months and asked if they should sell or hold it. In response, Cramer said: “You know, I’ll tell you, it’s funny you said […]

2025-10-24

2 Large-Cap Stocks to Keep an Eye On and 1 We Avoid

Description: Large-cap stocks have the power to shape entire industries thanks to their size and widespread influence. With such vast footprints, however, finding new areas for growth is much harder than for smaller, more agile players.

2025-10-23

2025-10-22

Paychex, Inc. (PAYX): A Bull Case Theory

Description: We came across a bullish thesis on Paychex, Inc. on Compounding Dividends’s Substack by TJ Terwilliger. In this article, we will summarize the bulls’ thesis on PAYX. Paychex, Inc.’s share was trading at $124.37 as of October 6th. PAYX’s trailing and forward P/E were 27.67 and 22.78 respectively according to Yahoo Finance. Paychex, Inc. (PAYX) is a […]

2025-10-21

2025-10-20

1 Profitable Stock with Promising Prospects and 2 We Find Risky

Description: Not all profitable companies are built to last - some rely on outdated models or unsustainable advantages. Just because a business is in the green today doesn’t mean it will thrive tomorrow.

2025-10-19

2025-10-18

High Margins, Low Upside: Paychex, Inc. (PAYX) Gets a Hold

Description: Paychex, Inc. (NASDAQ:PAYX) is among the most profitable software stocks to invest in. On October 6, 2025, Stephens analyst Charles Nabhan began coverage on Paychex, Inc. (NASDAQ:PAYX) with a new Hold rating, citing a blend of reasons, including the stock’s premium valuation. The analyst views this valuation as restricting potential upside, even though it is […]