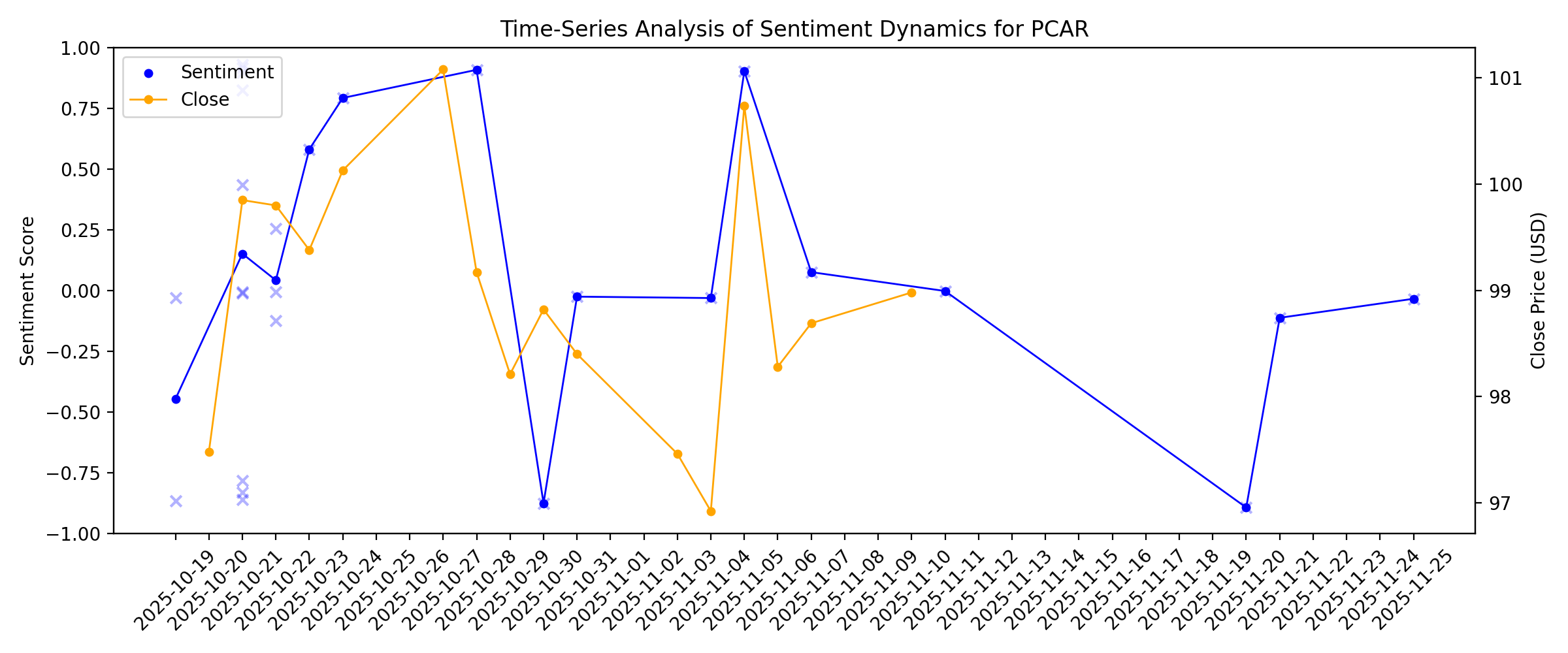

News sentiment analysis for PCAR

Sentiment chart

2026-01-14

2026-01-13

2026-01-12

2026-01-11

2026-01-10

2026-01-09

2026-01-08

Why Paccar (PCAR) Outpaced the Stock Market Today

Description: Paccar (PCAR) closed the most recent trading day at $118.2, moving +2.52% from the previous trading session.

Assessing PACCAR (PCAR) Valuation After Class 8 Order Surge Tariff Tailwinds And Insider Buying

Description: Why PACCAR’s recent order surge and insider buying matter now PACCAR (PCAR) is back on investor watchlists after a sharp rise in December Class 8 truck orders, expectations for tariff related margin benefits, strong Parts demand, and fresh insider buying from a company director. See our latest analysis for PACCAR. PACCAR’s recent news flow around surging Class 8 orders, margin tailwinds from tariff changes, and insider buying sits alongside a 90 day share price return of 21.09% and a 5 year...

2026-01-07

PACCAR (PCAR) Is Up 5.3% After Surging Class 8 Orders And Insider Buying - Has The Bull Case Changed?

Description: In December, PACCAR reported that North American Class 8 truck orders climbed to 42,200 units, a very large month‑over‑month increase and 21% above the prior year, while Director Brice Hill bought 1,569 shares on January 6 according to an SEC filing. The combination of pre-buying ahead of EPA 2027 regulations, deferred fleet replacements, and insider share accumulation highlights how both customers and management are acting on PACCAR’s current end-market strength. Next, we’ll examine how...

Paccar (PCAR) Falls More Steeply Than Broader Market: What Investors Need to Know

Description: Paccar (PCAR) concluded the recent trading session at $115.3, signifying a -1.52% move from its prior day's close.

Here's How Much You'd Have If You Invested $1000 in Paccar a Decade Ago

Description: Why investing for the long run, especially if you buy certain popular stocks, could reap huge rewards.

Strength Seen in Paccar (PCAR): Can Its 3.7% Jump Turn into More Strength?

Description: Paccar (PCAR) witnessed a jump in share price last session on above-average trading volume. The latest trend in earnings estimate revisions for the stock suggests that there could be more strength down the road.

2026-01-06

2026-01-05

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

Paccar (PCAR) Declines More Than Market: Some Information for Investors

Description: Paccar (PCAR) concluded the recent trading session at $109.51, signifying a -1.31% move from its prior day's close.

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

Earnings Preview: What to Expect From PACCAR’s Report

Description: PACCAR is scheduled to report its fourth-quarter results next month, with analysts forecasting a sharp double-digit decline in earnings.

2025-12-23

2025-12-22

Paccar (PCAR) Beats Stock Market Upswing: What Investors Need to Know

Description: Paccar (PCAR) closed at $112.81 in the latest trading session, marking a +1.11% move from the prior day.

2025-12-21

Assessing PACCAR (PCAR) Valuation After Its Strong Multi‑Year Share Price Performance

Description: PACCAR (PCAR) has been quietly rewarding patient investors, with the stock up roughly 15% over the past 3 months and nearly doubling over 3 years. This performance has prompted a closer look at what is driving that strength. See our latest analysis for PACCAR. Zooming out, PACCAR’s recent 30 day share price return around the mid single digits adds to a strong three year total shareholder return. This suggests momentum is still building as investors grow more comfortable with its earnings...

2025-12-20

Does PACCAR Still Offer Value After 15.6% Monthly Gain And Strong Five Year Rally?

Description: Wondering if PACCAR at around $111 a share still offers good value or if most of the upside has already been priced in? This breakdown will walk through what the numbers are really saying about the stock. The share price is flat over the last week, but a 15.6% gain over the past month and 134.1% over five years shows investors have been steadily rewarding PACCAR, hinting at both growth potential and a shift in how the market views its risk profile. Those moves come as PACCAR continues to...

2025-12-19

S&P 500 Stocks Upgraded: AI Data Center Power Plays And Truck Makers

Description: A pair of AI data center backup power plays and suppliers of heavy trucks and parts earned upgrades.

Circle Internet initiated, Lyft downgraded: Wall Street's top analyst calls

Description: Circle Internet initiated, Lyft downgraded: Wall Street's top analyst calls

Here Are Friday’s Top Wall Street Analyst Research Calls: Birkenstock, Coreweave, Lockheed Martin, Lyft, Paccar, Stryker, Synaptics, and More

Description: Pre-Market Stock Futures: Futures are trading higher on Friday as we prepare for the holiday-shortened week leading up to Christmas, following a solid risk-on Thursday. The Consumer Price Index print for November lit a fire under stocks as it came in much lower than expected at 2.7%. However, many on Wall Street were quick to ... Here Are Friday’s Top Wall Street Analyst Research Calls: Birkenstock, Coreweave, Lockheed Martin, Lyft, Paccar, Stryker, Synaptics, and More

2025-12-18

2025-12-17

2025-12-16

2025-12-15

2025-12-14

Will Leadership Shuffle And Special Dividend Shift PACCAR's (PCAR) Capital Allocation Narrative?

Description: PACCAR Inc recently announced leadership changes effective January 1, 2026, promoting Kevin D. Baney to President and John N. Rich to Executive Vice President and Chief Technology Officer, while refining responsibilities across its truck, parts, technology, and support businesses. Alongside these management moves, PACCAR’s Board declared an extra US$1.40 per share special cash dividend and reaffirmed a regular US$0.33 quarterly dividend, underscoring its current approach to returning cash to...

2025-12-13

2025-12-12

Here's Why Paccar (PCAR) Fell More Than Broader Market

Description: Paccar (PCAR) closed the most recent trading day at $111.56, moving 1.09% from the previous trading session.

2025-12-11

2025-12-10

Are Options Traders Betting on a Big Move in Paccar Stock?

Description: Investors need to pay close attention to PCAR stock based on the movements in the options market lately.

2025-12-09

PACCAR Announces Extra Cash Dividend

Description: BELLEVUE, Wash., December 09, 2025--PACCAR Inc’s Board of Directors today declared an extra cash dividend of one dollar and forty cents ($1.40) per share, payable on January 7, 2026, to stockholders of record at the close of business on December 19, 2025.

2025-12-08

2025-12-07

PACCAR (PCAR): Assessing Valuation After Parts Division Records Boost Sentiment And Long-Term Growth Investments

Description: PACCAR (PCAR) has caught investors attention again as its Parts division posts record revenue and stronger margins, helping the stock climb about 12% over the past 3 months despite a slightly negative 1 year return. See our latest analysis for PACCAR. That rebound is not just noise, with a roughly 12% 90 day share price return and an 85% three year total shareholder return. This hints that the market still sees PACCAR as a structural winner in trucking and aftermarket services. If PACCAR's...

2025-12-06

Driverless 18-wheelers may reach your street sooner than you think

Description: Opening Bid Unfiltered is available on Apple Podcasts, Spotify, YouTube, or wherever you get your podcasts. The driverless car race is well underway. While Waymo is seen as having a leadership position, Tesla (TSLA) CEO Elon Musk is aiming for robotaxi debuts likely in 2026. Thus far, the race to bring autonomous trucks to life to address driver shortages is a bit more open. Aurora Innovation (AUR) is seen as the leader at this juncture and is backed by Uber (UBER), boasting key partnerships with Paccar (PCAR), Nvidia (NVDA), and Volvo (VOLCAR-B.ST). The company has successfully debuted driverless commercial trucks on select routes in Texas, with plans to expand to more routes in 2026. Yahoo Finance Executive Editor Brian Sozzi talks on the Opening Bid Unfiltered podcast with Aurora Innovation co-founder and Chris Urmson. Urmson led Google's (GOOG) driverless technology unit for several years, which ultimately became Waymo. He shares his vision for Aurora Innovation, the 2026 product roadmap, and why autonomous technology is needed for commercial trucks. Listen on your favorite podcast platform or watch on our website for full episodes of Opening Bid Unfiltered. Yahoo Finance's Opening Bid Unfiltered is produced by Langston Sessoms.

2025-12-05

2025-12-04

Rivian Automotive (RIVN) Up 13.7% Since Last Earnings Report: Can It Continue?

Description: Rivian Automotive (RIVN) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-12-03

Paccar (PCAR) Beats Stock Market Upswing: What Investors Need to Know

Description: Paccar (PCAR) reached $108.54 at the closing of the latest trading day, reflecting a +2.5% change compared to its last close.

2025-12-02

Is PACCAR Stock Outperforming the Dow?

Description: As PACCAR has outpaced the Dow recently, analysts remain moderately optimistic about the stock’s prospects.

Is There Now an Opportunity in PACCAR After Five-Year Gains of 116%?

Description: Wondering if now is the right time to buy PACCAR? You are not alone. Plenty of investors are trying to figure out if the current price truly represents good value. After a 5.7% gain over the last month and an impressive 116.4% return over five years, PACCAR’s stock has not escaped recent volatility, dipping 0.9% last week and holding near flat year-to-date. Industry headlines point to ongoing shifts in the truck manufacturing sector, including supply chain normalization and increased demand...

2025-12-01

The Best Dividend Stocks for 2026: Strategist

Description: Wolfe Research screened for companies with high dividend growth and high free-cash-flow yield. Here’s what they found.

2025-11-30

2025-11-29

2025-11-28

2025-11-27

2025-11-26

2025-11-25

3 Nasdaq 100 Stocks with Questionable Fundamentals

Description: While the Nasdaq 100 (^NDX) is filled with cutting-edge technology and consumer companies, not all are on solid footing. Some are dealing with declining demand, high costs, or regulatory pressures that could limit future upside.

2025-11-24

2025-11-23

2025-11-22

2025-11-21

3 Nasdaq 100 Stocks We Keep Off Our Radar

Description: The Nasdaq 100 (^NDX) is known for housing some of the most innovative and fastest-growing companies in the market. But not every stock in the index is a winner - some are struggling with slowing growth, increasing competition, or unsustainable valuations.

2025-11-20

Why Is Paccar (PCAR) Down 3.3% Since Last Earnings Report?

Description: Paccar (PCAR) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-11-19

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

2025-11-11

PACCAR (PCAR): Assessing Valuation Potential After Recent Share Price Fluctuations

Description: PACCAR (PCAR) shares have had a mixed run lately, with the stock seeing a small decline over the past day but gaining around 5% over the past month. Investors are keeping an eye on recent price shifts and considering how they compare to the broader trends. See our latest analysis for PACCAR. While PACCAR’s 1-year total shareholder return is down 12.6%, the three- and five-year figures show strong long-term gains. This suggests that recent volatility might be more of a pause than a reversal...

2025-11-10

2025-11-09

2025-11-08

2025-11-07

Paccar envisions ‘competitive leg up’ from Section 232 tariffs

Description: CEO Preston Feight says domestic production could pay off as new trade rules take effect Nov. 1.

2025-11-06

2025-11-05

PACCAR Stock Outlook: Is Wall Street Bullish or Bearish?

Description: PACCAR has significantly underperformed the broader market over the past year, yet analysts are cautiously optimistic about the stock’s prospects.

2025-11-04

2 Cash-Heavy Stocks with Exciting Potential and 1 We Brush Off

Description: A surplus of cash can mean financial stability, but it can also indicate a reluctance (or inability) to invest in growth. Some of these companies also face challenges like stagnating revenue, declining market share, or limited scalability.

2025-11-03

2025-11-02

2025-11-01

2025-10-31

TFI operating income drops amid US woes

Description: Challenges with the carrier’s OEM and federal government customers come from tariff policy and the congressional funding-based shutdown.

2025-10-30

GM or PCAR: Which Is the Better Value Stock Right Now?

Description: GM vs. PCAR: Which Stock Is the Better Value Option?

2025-10-29

2025-10-28

5 Must-Read Analyst Questions From PACCAR’s Q3 Earnings Call

Description: PACCAR’s third quarter results were met with a positive market response, despite a year-over-year revenue decline. Management credited ongoing performance in its core truck brands—Peterbilt, Kenworth, and DAF—as well as resilient growth in its PACCAR Parts and Financial Services businesses. CEO Preston Feight highlighted the company’s ability to navigate “dynamic market conditions,” with PACCAR Parts posting record quarterly revenue and healthy margins, and Financial Services delivering double-d

2025-10-27

2025-10-26

2025-10-25

2025-10-24

Why Analysts See PACCAR’s Story Shifting as Tariffs and Valuation Drive New Optimism

Description: PACCAR’s consensus analyst price target has recently been revised upward from $103.50 to $107.00, highlighting growing optimism about the company’s fair value. This change comes amid mixed analyst sentiment that balances constructive drivers, such as tariff relief and improved market share prospects, with ongoing sector uncertainties. Stay tuned to discover how these evolving dynamics could shape PACCAR’s outlook and how investors can monitor the continuing shifts in its narrative. What Wall...

2025-10-23

Quebec layoffs at U.S. truck plant days before tariff spur calls for urgent action

Description: Union is calling on Ottawa to hone its industrial strategy and prioritize buying from domestic manufacturers

2025-10-22

PACCAR Q3 Earnings Match Expectations, Capex Outlook Revised

Description: PCAR's third-quarter earnings are in line with estimates as weaker truck sales weigh on results; capex and R&D forecasts trimmed.

Core Scientific upgraded, HP downgraded: Wall Street's top analyst calls

Description: Core Scientific upgraded, HP downgraded: Wall Street's top analyst calls

PCAR Q3 Deep Dive: Tariffs Peak, Margins Compress, and Section 232 Sparks Competitive Shift

Description: Trucking company PACCAR (NASDAQ:PCAR) reported Q3 CY2025 results topping the market’s revenue expectations, but sales fell by 19% year on year to $6.67 billion. Its GAAP profit of $1.12 per share was 2.7% below analysts’ consensus estimates.

2025-10-21

How Should Investors View PACCAR After Its 5% Rally and Latest Valuation Signals?

Description: If you are staring at PACCAR's stock price and wondering whether now is the right time to take action, you are not alone. PACCAR has had its share of ups and downs lately, and smart investors are taking another look to see what the road ahead could hold. In the last week, shares jumped 5.0%, making up for some sluggishness over the past year, which has seen the stock dip just under 1%. That, however, comes after an impressive ride over the past three and five years, with shares up 85.3% and...

PACCAR Inc (PCAR) Q3 2025 Earnings Call Highlights: Record Parts Revenue and Strategic ...

Description: PACCAR Inc (PCAR) reports robust financial performance with record parts revenue and strategic expansions, despite facing tariff-related margin pressures.

PACCAR (PCAR): Net Profit Margin Falls to 9.9%, Testing Bullish Growth Narratives

Description: PACCAR (PCAR) posted robust earnings over the past five years, growing EPS by 24.2% annually, while current net profit margins stand at 9.9% compared to 14.1% a year ago. Looking forward, the company's earnings are forecast to rise 18.13% each year, ahead of the US market's 15.5% pace. Revenue growth is projected at 8.4% per year, which is slower than the market but still healthy. Despite the recent slip in margins, investors are weighing sustained profit growth potential and favorable...

PACCAR (PCAR) Valuation in Focus After Latest 3% Share Price Rebound

Description: PACCAR (PCAR) shares edged higher today, with the stock gaining almost 3% following its latest trading session. Investors seem to be watching closely because the stock’s recent performance has diverged from longer-term trends. See our latest analysis for PACCAR. PACCAR’s shares have seen a bump today, yet overall momentum has faded compared to last year’s pace. The stock’s latest 1-day share price return of 2.95% stands out against a year-to-date decline of 5.74%. Its 1-year total shareholder...

Paccar (PCAR) Q3 Earnings: How Key Metrics Compare to Wall Street Estimates

Description: Although the revenue and EPS for Paccar (PCAR) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Paccar (PCAR) Q3 Earnings Match Estimates

Description: Paccar (PCAR) delivered earnings and revenue surprises of 0.00% and +1.53%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

PACCAR (NASDAQ:PCAR) Surprises With Q3 Sales

Description: Trucking company PACCAR (NASDAQ:PCAR) reported Q3 CY2025 results exceeding the market’s revenue expectations, but sales fell by 19.1% year on year to $6.67 billion. Its GAAP profit of $1.12 per share was 2.6% below analysts’ consensus estimates.

Paccar: Q3 Earnings Snapshot

Description: BELLEVUE, Wash. AP) — Paccar Inc. PCAR) on Tuesday reported third-quarter net income of $590 million.

PACCAR (NASDAQ:PCAR) Reports Sales Below Analyst Estimates In Q3 Earnings

Description: Trucking company PACCAR (NASDAQ:PCAR) fell short of the market’s revenue expectations in Q3 CY2025, with sales falling 25.9% year on year to $6.11 billion. Its GAAP profit of $1.12 per share was 2.6% below analysts’ consensus estimates.

PACCAR Achieves Good Quarterly Revenues and Profits

Description: BELLEVUE, Wash., October 21, 2025--"PACCAR delivered good revenues and net income in the third quarter of 2025. Peterbilt, Kenworth and DAF’s excellent trucks contributed to the good results," said Preston Feight, chief executive officer. "PACCAR Parts and PACCAR Financial Services continued to deliver excellent performance and strong profits. I am very proud of our employees and dealers who delivered outstanding trucks and transportation solutions to our customers."

2025-10-20

2025-10-19

PACCAR (PCAR) Reports Earnings Tomorrow: What To Expect

Description: Trucking company PACCAR (NASDAQ:PCAR) will be reporting earnings this Tuesday morning. Here’s what to expect.

Tesla, Netflix set to report earnings as US-China trade fight turns 'unsustainable': What to watch this week

Description: As investors enters shutdown week three, a US-China trade war, credit gesticulation, and an incoming oil glut are weighing on the market.