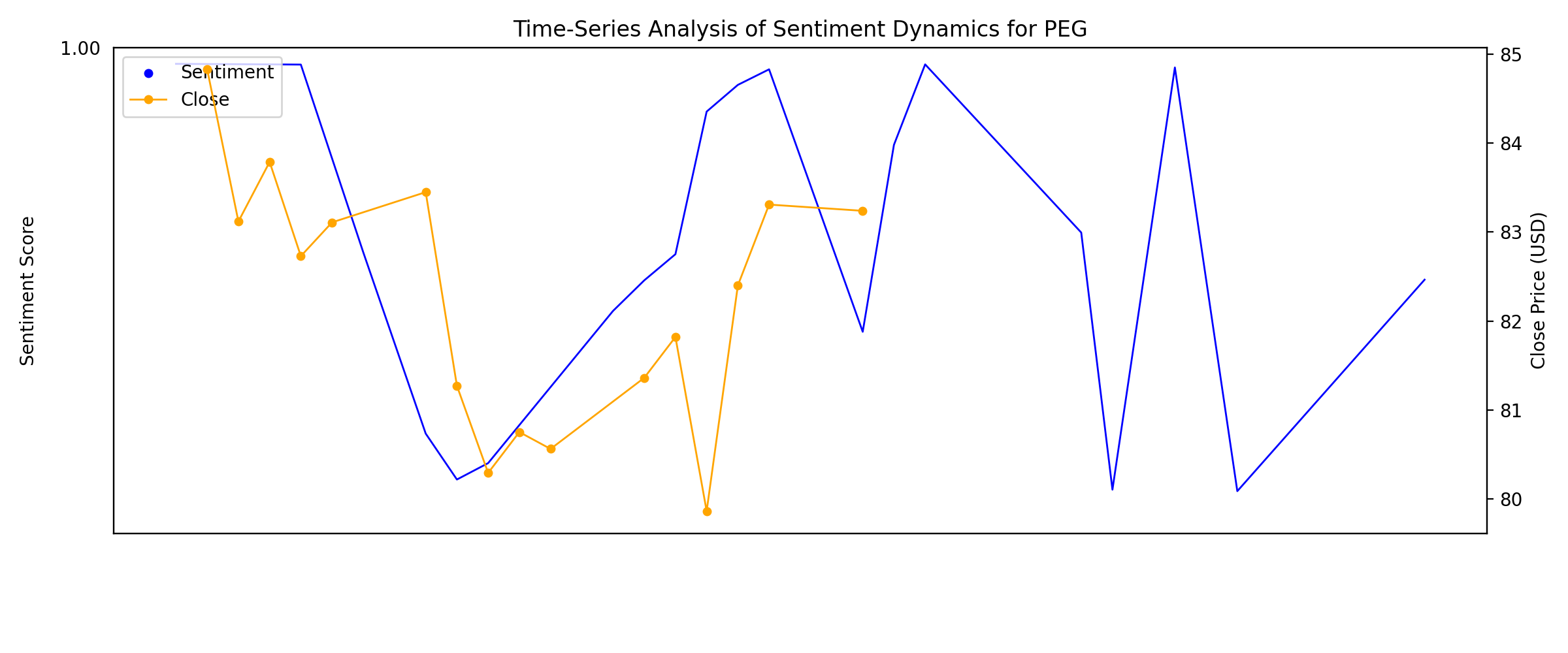

News sentiment analysis for PEG

Sentiment chart

2026-01-14

2026-01-13

2026-01-12

2026-01-11

2026-01-10

2026-01-09

2026-01-08

2026-01-07

2026-01-06

2026-01-05

Here's Why You Should Include PEG Stock in Your Portfolio Now

Description: Public Service Enterprise strengthens its appeal in the utility space with a solid ROE and steady dividend payments that continue to enhance shareholder value.

2026-01-04

Should You Be Impressed By Public Service Enterprise Group Incorporated's (NYSE:PEG) ROE?

Description: While some investors are already well versed in financial metrics (hat tip), this article is for those who would like...

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

Sector Update: Energy Stocks Rise Late Afternoon

Description: Energy stocks were higher late Tuesday afternoon, with the NYSE Energy Sector Index and the State St

Sector Update: Energy Stocks Advance Tuesday Afternoon

Description: Energy stocks were higher Tuesday afternoon, with the NYSE Energy Sector Index rising 0.8% and the S

PSEG Long Island Contract Extension Approved by N.Y. State Comptroller

Description: Public Service Enterprise Group (PSEG) announced today that the New York State comptroller has given final approval of the extension of the operations services agreement with the Long Island Power Authority (LIPA).

2025-12-29

The Power of Partnership: How PSEG's Art-Inspired Infrastructure Projects Help Brighten Local Neighborhoods

Description: NORTHAMPTON, MA / ACCESS Newswire / December 29, 2025 /Originally published on PSEG ENERGIZE! We value the strong partnerships we have forged with communities across our service territory, working collaboratively to build energy infrastructure that ...

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

Holiday Lights and Community Programs: PSEG Supports the Essex County Turtle Back Zoo

Description: NORTHAMPTON, MA / ACCESS Newswire / December 22, 2025 / For more than 30 years, we've been a proud supporter of Essex County Turtle Back Zoo. This year, our employees and their families rolled up their sleeves for the annual Turtle Back Zoo Day of ...

2025-12-21

2025-12-20

2025-12-19

Reduce. Reuse. Recycle. Reinvest in PSEG's Communities

Description: NORTHAMPTON, MA / ACCESS Newswire / December 19, 2025 /Originally published on PSEG ENERGIZE! We believe that doing what's right means caring for both the environment and the communities we serve. We continuously work to reduce waste, repurpose materials ...

Assessing Public Service Enterprise Group (PEG) Valuation After Recent Share Price Cooling

Description: Public Service Enterprise Group (PEG) has quietly drifted lower this year, even as its long term total return remains solid. That disconnect is what makes the current setup interesting for patient, income focused investors. See our latest analysis for Public Service Enterprise Group. Over the past few months the share price has cooled off slightly, even with the latest close at $80.66. However, that comes after a very strong multi year run where total shareholder returns have been impressive,...

Why The Narrative Around Public Service Enterprise Group Is Shifting After Recent Analyst and Contract Updates

Description: Public Service Enterprise Group's latest valuation update trims the fair value estimate slightly from about $90.61 to $89.50 per share, as analysts factor in a blend of long term electrification tailwinds and near term regulatory and political noise. Behind this small move, assumptions have shifted toward a marginally higher discount rate, around 6.96% versus 6.78%, alongside a stronger top line outlook with revenue growth lifted from roughly 3.53% to 4.30%. Stay tuned to see how you can...

2025-12-18

2025-12-17

PSE&G Ranked #1 for Residential Electric in the East among Large Utilities in J.D. Power 2025 Customer Satisfaction Study for 4th Consecutive Year

Description: Public Service Electric & Gas, New Jersey's largest utility, has once again been recognized as the highest-ranked utility in customer satisfaction among large electric utilities in the East Region, according to the J.D. Power 2025 Electric Utility Residential Customer Satisfaction Study℠. This marks the fourth consecutive year PSE&G has earned the top position.

PSEG - Stronger Together: Partnering With New Jersey Communities for a Brighter Tomorrow

Description: NORTHAMPTON, MA / ACCESS Newswire / December 17, 2025 /Originally published on PSEG ENERGIZE! Every day, the PSEG Foundation supports communities across New Jersey. Through the Neighborhood Partners Program, the Foundation is supporting efforts that ...

2025-12-16

2025-12-15

PSEG - J.D. Power 2025 Business Electric East Large Segment Customer Satisfaction Rankings: We're #1 & #2

Description: PSEG Long Island and PSE&G earn the top rankings for customer satisfaction in the East Large Segment of the J.D. Power 2025 Electric Utility Business Customer Satisfaction Study NEWARK, NJ / ACCESS Newswire / December 15, 2025 /Originally published ...

2025-12-14

2025-12-13

2025-12-12

2025-12-11

2025-12-10

Public Service Enterprise Group (PEG) – Among the Best Energy Stocks for a Retirement Portfolio

Description: Public Service Enterprise Group Incorporated (NYSE:PEG) is included among the 11 Energy Stocks to Buy for a Retirement Portfolio. Public Service Enterprise Group Incorporated (NYSE:PEG) is a predominantly regulated energy company that engages in the provision of electric and gas services. On November 20, Morgan Stanley lowered its price target on Public Service Enterprise Group […]

2025-12-09

Is Public Service Enterprise Group Fairly Priced After Its Recent Share Price Pullback?

Description: If you have been wondering whether Public Service Enterprise Group is quietly turning into a bargain or just fairly priced for a steady utility, you are exactly the kind of investor this breakdown is for. The stock has slipped recently, down about 3.5% over the last week, 5.5% over the past month, and 7.5% year to date, even though it is still up a strong 42.6% over three years and 63.7% over five. Those softer short term moves come against a backdrop of ongoing investment in regulated...

2025-12-08

PSE&G and PSEG Foundation Launch $1.5 Million Community Relief Initiative To Support Those in Need

Description: NORTHAMPTON, MA / ACCESS Newswire / December 8, 2025 / PSEG Community to receive assistance with food, housing and other services through more than 25 non-profit organizations Today, PSE&G and the PSEG Foundation announced $1.5 million in grants to ...

PSE&G and the PSEG Foundation Launch $1.5 Million Community Relief Initiative to Provide Support in Times of Need

Description: PSE&G and the PSEG Foundation, committed to building thriving communities, today announced $1.5 million in grants to over 25 local organizations that provide critical assistance to households facing economic hardship. The initiative is unveiled alongside PSE&G and the PSEG Foundation's inaugural nonprofit partner conference on December 9thwhich will bring together more than 135 community leaders to strengthen collaboration and share practical insights that advance local impact. We are deeply com

2025-12-07

2025-12-06

2025-12-05

Is Public Service Enterprise Stock Underperforming the S&P 500?

Description: While Public Service Enterprise has lagged behind the S&P 500 Index over the past year, analysts are moderately optimistic about the stock’s prospects.

2025-12-04

2025-12-03

Why Is PSEG (PEG) Down 1.4% Since Last Earnings Report?

Description: PSEG (PEG) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-12-02

2025-12-01

2025-11-30

2025-11-29

2025-11-28

Public Service Enterprise Group (PEG): Evaluating Valuation After Recent Share Price Momentum

Description: Public Service Enterprise Group (PEG) shares have traded steadily over the past week, with a slight increase of about 3% month-to-date. Investors are watching to see if this quiet period sets the stage for larger moves. See our latest analysis for Public Service Enterprise Group. Public Service Enterprise Group’s share price has picked up some momentum recently, with a 4% gain over the past month following a period of relative calm. Despite this uptick, the 1-year total shareholder return...

Return Trends At Public Service Enterprise Group (NYSE:PEG) Aren't Appealing

Description: If you're looking for a multi-bagger, there's a few things to keep an eye out for. Ideally, a business will show two...

2025-11-27

2025-11-26

2025-11-25

2025-11-24

2025-11-23

2025-11-22

Public Service Enterprise Group (PEG) Declares Dividend of $0.63 per Share

Description: Public Service Enterprise Group Incorporated (NYSE:PEG) is included among the 14 Best Utility Dividend Stocks to Buy Now. Public Service Enterprise Group Incorporated (NYSE:PEG) is a predominantly regulated energy company that engages in the provision of electric and gas services. With a dividend history of 118 consecutive years, Public Service Enterprise Group Incorporated (NYSE:PEG) is known […]

2025-11-21

2025-11-20

PSEG Gains Momentum Through Smart Investments and Clean Energy Plans

Description: PEG is poised to benefit from clean energy expansion and heavy infrastructure spending, even as solvency pressures remain.

2025-11-19

2025-11-18

PSEG Declares Regular Quarterly Dividend for the Fourth Quarter of 2025

Description: The Board of Directors of Public Service Enterprise Group (NYSE: PEG) today declared a $0.63 per share dividend on the outstanding common stock of the company for the fourth quarter of 2025.

2025-11-17

On Utility Scam Awareness Day, PSEG Long Island Urges Customers to 'Slow Down. Verify. Stop the Scam.'

Description: Scammers are leveraging the stresses of the holiday season against households and businesses on Long Island and in the Rockaways, impersonating PSEG Long Island and area utilities and demanding immediate payment to prevent a shutoff. On Utility Scam Awareness Day, Nov. 19, PSEG Long Island urges customers to get wise to scammers' tactics and do the right thing if confronted with a demand for payment and a threat of imminent shutoff: "Slow Down. Verify. Stop the Scam."

PSE&G Wins Three Prestigious Awards for System Resiliency, Reliability and Customer Service

Description: PSEG NewsRoom NEWARK, NJ / ACCESS Newswire / November 17, 2025 / PSE&G is the winner of the 2025 ReliabilityOne® Awards for the following: National Award for Outstanding System Resiliency National Award for Outstanding Customer Engagement for the ...

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

PSEG Long Island Tops the J.D. Power 2025 Business Customer Satisfaction Study in the East Large Segment

Description: PSEG Long Island has been ranked the highest in customer satisfaction among business customers in the East Large Segment, according to the J.D. Power 2025 Electric Utility Business Customer Satisfaction StudySM. The honor caps off an 11-year rise from the bottom of the survey rankings when PSEG Long Island took over operation of the electric grid.

2025-11-11

Public Service Enterprise Group (PEG): Evaluating Valuation After Modest Share Price Rebound

Description: Public Service Enterprise Group (PEG) has caught some investor attention recently, partly due to shifting returns over the past month and year. Shares have edged up 3% in the last month but remain down 2% over the past year. See our latest analysis for Public Service Enterprise Group. Despite a modest rebound in recent weeks, Public Service Enterprise Group’s short-term share price return remains underwhelming compared to its history. However, a long-term perspective highlights a robust total...

Is Wall Street Bullish or Bearish on Public Service Enterprise Group Stock?

Description: Public Service Enterprise has underperformed the broader market over the past year, but analysts are cautiously optimistic about the stock’s prospects.

2025-11-10

Top Research Reports for Accenture, Sanofi & Dell Technologies

Description: Accenture, Sanofi, and Dell Technologies stand out in today's top analyst research picks, each navigating growth and market pressures in distinct ways.

2025-11-09

2025-11-08

2025-11-07

PEG Q3 Earnings Surpass Estimates, Revenues Increase Y/Y

Description: PSEG posts a solid Q3 with earnings and revenues beating estimates, driven by stronger operating income and narrowed 2025 guidance.

2025-11-06

Sector Update: Energy Stocks Rise Late Afternoon

Description: Energy stocks rose late Thursday afternoon with the NYSE Energy Sector Index gaining 0.6% and the En

PSEG could offer lower rates to New Jersey’s incoming governor: equity analysts

Description: Public Service Enterprise Group is ready to work with the new administration to keep rates down and find ways to add power supplies in the state, PSEG’s CEO Ralph LaRossa said.

2025-11-05

Is Now the Right Moment to Reevaluate Public Service Enterprise Group Amid Clean Energy Initiatives?

Description: Ever wondered if Public Service Enterprise Group is truly a value opportunity or just another utility stock flying under the radar? Let's dive in and see if now could be the right moment to take a closer look. While Public Service Enterprise Group’s share price is up just 0.7% in the past week and has barely budged over the past year, long-term investors have enjoyed a 56.6% gain over three years and 59.4% over five years. This hints at periods of quiet but substantial momentum. Behind those...

2025-11-04

Electricity Prices Are on the Ballot This Election. Watch Utilities.

Description: Elections could shed light on whether rising electricity prices will be a major liability for Republicans. Some races could also determine the fortunes of utilities.

PSEG (PEG) Margin Expansion Reinforces Bullish Narratives Despite Valuation Premium

Description: Public Service Enterprise Group (PEG) reported earnings growth of 19.9% year-over-year, surpassing its strong five-year average of 14.5%. Net profit margins improved to 17.8% from 16.1% last year, with forecasts pointing to continued, albeit more moderate, growth ahead. For investors, the key takeaway is a solid history of profit and revenue gains, set against a backdrop of slower projected growth compared to the wider US market and a share price that sits above estimated fair value. See our...

2025-11-03

Public Service Enterprise Group Inc (PEG) Q3 2025 Earnings Call Highlights: Strong Financial ...

Description: Public Service Enterprise Group Inc (PEG) reports increased earnings and narrows guidance, while addressing challenges in the energy market.

PSEG (PEG) Q3 2025 Earnings Call Transcript

Description: Ralph A. LaRossa: Public Service Enterprise Group Incorporated reported a solid third and year-to-date operating and financial results reflecting the expected positive impact of the new rates from the October 2024 distribution rate case settlement that benefited the full third quarter. This program is focused on replacing and modernizing New Jersey energy infrastructure meeting load growth and expanding energy efficiency programs that lower energy demand and customer bills. During the quarter, Public Service Enterprise Group Incorporated nuclear supplied the grid with 7.9 terawatt hours of reliable carbon-free baseload energy while providing Public Service Enterprise Group Incorporated with the financial flexibility to fund our regulated investment.

PSEG: Q3 Earnings Snapshot

Description: NEWARK, N.J. (AP) — Public Service Enterprise Group Inc. PEG) on Monday reported third-quarter profit of $622 million. The Newark, New Jersey-based company said it had profit of $1.24 per share.

PSEG ANNOUNCES THIRD QUARTER 2025 RESULTS

Description: Public Service Enterprise Group (NYSE: PEG) reported the following results for the third quarter and nine months ended September 30, 2025:

2025-11-02

Even though Public Service Enterprise Group (NYSE:PEG) has lost US$1.3b market cap in last 7 days, shareholders are still up 54% over 3 years

Description: Public Service Enterprise Group Incorporated ( NYSE:PEG ) shareholders might be concerned after seeing the share price...

2025-11-01

2025-10-31

2025-10-30

2025-10-29

PSEG (PEG) Q3 Earnings on the Horizon: Analysts' Insights on Key Performance Measures

Description: Evaluate the expected performance of PSEG (PEG) for the quarter ended September 2025, looking beyond the conventional Wall Street top-and-bottom-line estimates and examining some of its key metrics for better insight.

2025-10-28

Exelon (EXC) Earnings Expected to Grow: Should You Buy?

Description: Exelon (EXC) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2025-10-27

With Winter Heating Season Nearing, PSEG Long Island Hosts Community Events to Help Customers Struggling with Bills

Description: As winter heating season approaches, PSEG Long Island is holding three community events to help customers apply for state and federal programs that exist to help those struggling with utility bills. There are also many ways they can lower their bills by using energy wisely.

PSEG (PEG) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Description: PSEG (PEG) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2025-10-26

2025-10-25

Public Service Enterprise Group (PEG) – Price Target Raised at Morgan Stanley

Description: Public Service Enterprise Group Incorporated (NYSE:PEG) is included among the 12 Best Utility Stocks to Buy for Dividends. Public Service Enterprise Group Incorporated (NYSE:PEG) is a predominantly regulated energy company that engages in the provision of electric and gas services. On October 22, Morgan Stanley raised its price target on Public Service Enterprise Group Incorporated […]

2025-10-24

2025-10-23

All You Need to Know About PSEG (PEG) Rating Upgrade to Buy

Description: PSEG (PEG) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

2025-10-22

2025-10-21

2025-10-20

2025-10-19

Public Service Enterprise Group (PEG): Evaluating Valuation as Q3 Earnings and Nuclear Growth Catalysts Draw Investor Focus

Description: Public Service Enterprise Group (PEG) is in the spotlight as it prepares to announce third-quarter earnings, with expectations of profit growth from last year. Investors are also watching recent analyst attention as well as the company's nuclear energy initiatives. See our latest analysis for Public Service Enterprise Group. Public Service Enterprise Group has enjoyed a burst of momentum lately, as last week’s 5.1% share price return outpaced its modest year-to-date dip. While the stock’s...