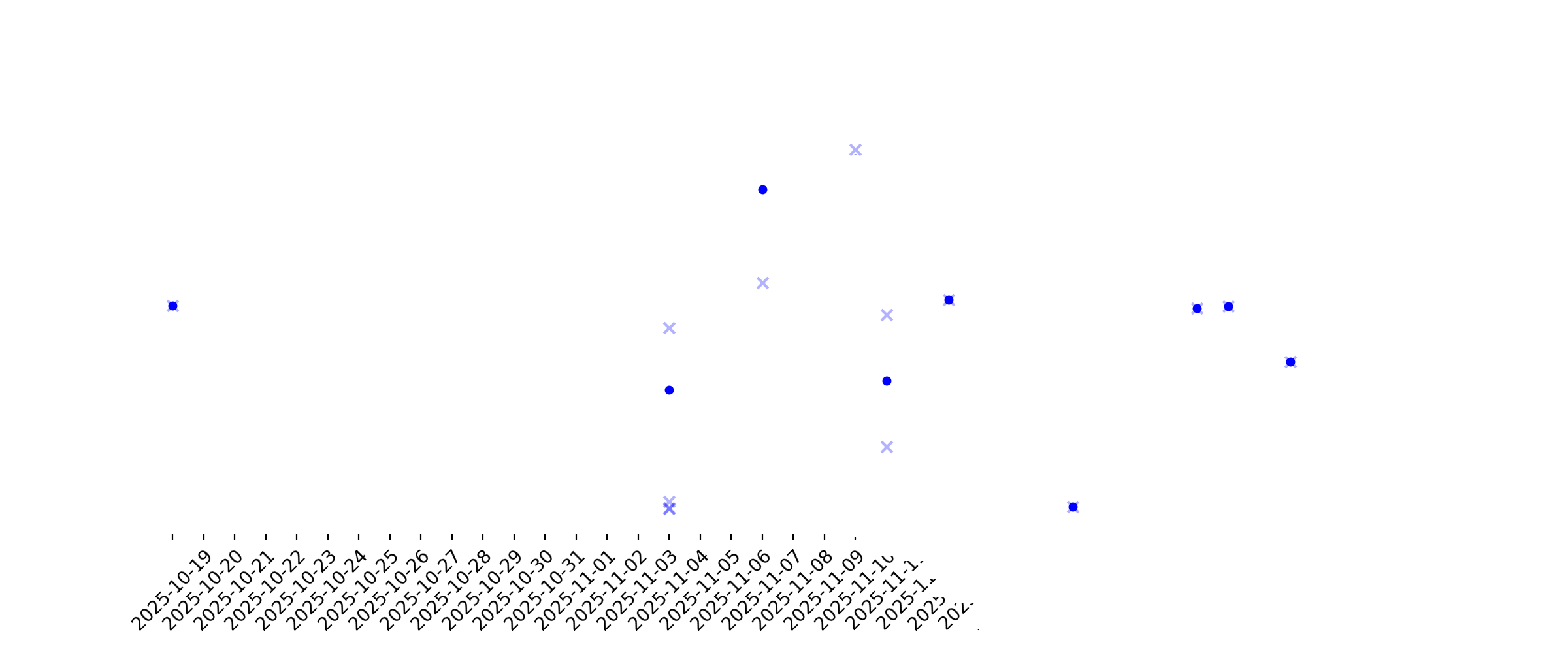

News sentiment analysis for PH

Sentiment chart

2026-01-14

2026-01-13

Will Parker-Hannifin (PH) Beat Estimates Again in Its Next Earnings Report?

Description: Parker-Hannifin (PH) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

2026-01-12

2026-01-11

Should You Be Adding Parker-Hannifin (NYSE:PH) To Your Watchlist Today?

Description: Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks...

2026-01-10

2026-01-09

2026-01-08

2026-01-07

Should You Think About Buying Parker-Hannifin Corporation (NYSE:PH) Now?

Description: Parker-Hannifin Corporation ( NYSE:PH ) received a lot of attention from a substantial price increase on the NYSE over...

2026-01-06

Buy 5 High-Flying Old Economy Stocks of 2025 for Solid Near-Term Gains

Description: Old-economy stocks WFC, MTZ, CW, LDOS and PH have surged over 30% in the past month, turning the AI rally into a broad-based opportunity.

2026-01-05

2026-01-04

2026-01-03

Parker-Hannifin Insiders Sold US$18m Of Shares Suggesting Hesitancy

Description: The fact that multiple Parker-Hannifin Corporation ( NYSE:PH ) insiders offloaded a considerable amount of shares over...

2026-01-02

Solid Demand in Defense Aerospace Drives Howmet: Can the Momentum Last?

Description: HWM is riding strong defense aerospace demand, as rising engine spares orders and military funding fuel solid revenue momentum.

What to Expect From Parker-Hannifin's Q2 2026 Earnings Report

Description: Parker-Hannifin will release its second-quarter earnings soon, and analysts anticipate a single-digit bottom-line growth.

2026-01-01

2025-12-31

2025-12-30

RBC Bearings Gains From Business Strength Amid Persisting Headwinds

Description: RBC benefits from aerospace and defense strength, VACCO acquisition synergies and a solid backlog, even as rising costs and softer end markets pose risks.

Here's Why It is Worth Investing in Powell Industries Stock Now

Description: POWL is benefiting from strong utility demand, a growing backlog and strategic investments, supported by solid liquidity and a debt-free balance sheet.

Can Parker-Hannifin Sustain Growth as Aerospace Demand Surges?

Description: PH is seeing accelerating aerospace momentum, with strong OEM and aftermarket demand supporting upbeat fiscal 2026 growth guidance.

2025-12-29

2025-12-28

2025-12-27

2025-12-26

Top Analyst Reports for Advanced Micro Devices, Goldman Sachs and Lam Research

Description: AMD, LRCX and GS headline Zacks Research Daily, which spotlights 16 analyst-picked stocks selected from roughly 70 reports.

RBC Bearings' Aerospace & Defense Growth Picks Up: A Sign of More Upside?

Description: RBC is seeing accelerating aerospace and defense growth, fueled by strong OEM demand, a rising backlog and robust defense orders.

2025-12-25

2025-12-24

2025-12-23

2025-12-22

Does Parker Hannifin’s 41% 2025 Surge Still Make Sense Given Growth Expectations?

Description: If you are wondering whether Parker Hannifin still makes sense at its current price after its massive run, or if you may be late to the party, this breakdown will help you consider whether the current price makes long term sense. The stock has barely paused this year, climbing 40.8% year to date and 38.6% over the last 12 months, on top of an increase of 215.9% over three years and 254.0% over five years. Behind those moves, investors have been responding to Parker Hannifin’s growing role in...

Cluster of Upbeat Analyst Calls Might Change The Case For Investing In Parker-Hannifin (PH)

Description: In recent weeks, multiple research firms, including Truist Securities, Goldman Sachs, Citigroup, Barclays, and Stifel, have reiterated positive views on Parker-Hannifin while updating their forward-looking assessments of the stock. This broad wave of reaffirmed optimism from major institutions highlights how closely the market is watching Parker-Hannifin’s execution on growth, margin resilience, and exposure to longer-cycle aerospace and electrification trends. Next, we’ll examine how this...

Here's Why It is Worth Investing in Nordson Stock Right Now

Description: NDSN is benefiting from end-market recovery, acquisition synergies and strong capital returns, making the stock attractive for long-term investors.

2025-12-21

2025-12-20

2025-12-19

2025-12-18

If You Invested $1000 in Parker-Hannifin a Decade Ago, This is How Much It'd Be Worth Now

Description: Investing in certain stocks can pay off in the long run, especially if you hold on for a decade or more.

2025-12-17

Parker-Hannifin price target raised to $1,000 from $900 at Goldman Sachs

Description: Goldman Sachs raised the firm’s price target on Parker-Hannifin (PH) to $1,000 from $900 and keeps a Buy rating on the shares. Parker-Hannifin has evolved into an industrial compounder through strong execution and accretive capital deployment, with one-third of end-market exposure in the more resilient aerospace segment and the remainder positioned to benefit from increased mega-project activity, the analyst tells investors in a research note. North American industrial orders have been positive

Parker-Hannifin (PH): Assessing Valuation After a Multi-Year Share Price Surge

Description: Parker-Hannifin (PH) has quietly turned into one of the market's stronger industrial compounders, with the stock up around 18% over the past 3 months and more than 30% over the past year. See our latest analysis for Parker-Hannifin. That recent strength builds on a powerful trend, with the share price now at $874.49 and a 1 year total shareholder return of 32.59%, alongside a standout 3 year total shareholder return of 216.38% that signals sustained momentum rather than a short burst of...

2025-12-16

2025-12-15

2025-12-14

2025-12-13

2025-12-12

2025-12-11

Nordson's Earnings Surpass Estimates in Q4, Revenues Miss

Description: NDSN tops earnings forecasts as Medical and Fluid Solutions strength lifts margins, though Q4 revenues fall short of expectations.

Zacks Industry Outlook Highlights Parker-Hannifin, Flowserve, Watts Water and Helios

Description: PH and peers push through sector softness with cost controls, innovation and solid end-market demand supporting select industrial names.

2025-12-10

4 Industrial Manufacturing Stocks to Buy Despite Industry Headwinds

Description: Persistent weakness in the manufacturing sector weighs on the Zacks Manufacturing - General Industrial industry's near-term prospects. PH, FLS, WTS and HLIO are a few stocks investors may consider buying.

2025-12-09

2025-12-08

2025-12-07

2025-12-06

2025-12-05

What Parker-Hannifin (PH)'s Aerospace Surge and Higher-Margin Shift Means For Shareholders

Description: Parker-Hannifin recently reported quarterly results that exceeded analyst expectations, with strong organic growth led by its aerospace and defense businesses and improving performance in North American industrial operations. The company’s progress on its Win Strategy 3.0, combined with recent acquisitions in filtration and electrified motion control, is reshaping its mix toward higher-margin, longer-cycle revenue streams. With aerospace and defense now a key growth engine, we’ll examine how...

2025-12-04

Here Are Thursday’s Top Wall Street Analyst Research Calls: AutoZone, BXP, Fiserv, Meta Platforms, PayPal, Salesforce, Toast and More

Description: Pre-Market Stock Futures: The futures are trading modestly higher on Thursday after a rollercoaster session on Wednesday, as stocks fell after the open on weak ADP data showing private-sector employment shed 32,000 jobs in November, the largest in 2-1/2 years. That didn’t last long, as bonds rallied on hopes of a rate cut next week ... Here Are Thursday’s Top Wall Street Analyst Research Calls: AutoZone, BXP, Fiserv, Meta Platforms, PayPal, Salesforce, Toast and More

2025-12-03

Here's Why You Should Consider Investing in Parker-Hannifin Now

Description: PH advances on strong aerospace demand, strategic acquisitions and consistent shareholder returns.

2025-12-02

Here's How Much a $1000 Investment in Parker-Hannifin Made 10 Years Ago Would Be Worth Today

Description: Investing in certain stocks can pay off in the long run, especially if you hold on for a decade or more.

2025-12-01

Does the Parker-Hannifin Rally Signal Room for Growth in 2025?

Description: Wondering if Parker-Hannifin stock is a smart buy right now? You are not alone, as investors increasingly want to know whether the current price reflects real value. The stock has surged 10.8% over the last month and is up an impressive 36.0% year-to-date. This highlights strong momentum that could signal shifting market sentiment or promising growth prospects. This recent rally comes as investors respond to Parker-Hannifin’s strategic moves in industrial automation and its expansion through...

Top Analyst Reports for Palantir, Philip Morris & TotalEnergies

Description: Palantir surges as its AI platforms and defense projects lift momentum, while analyst reports track shifts across tobacco, energy and microcaps.

Why Investors Should Retain A. O. Smith Stock in Portfolio Now

Description: AOS rides strong North American heater demand and strategic acquisitions, though China weakness and rising costs pose challenges.

Parker-Hannifin's Aerospace Strength Holds Firm: More Upside Ahead?

Description: PH rides strong aerospace demand, with double-digit segment growth and upbeat organic sales expectations.

Is Parker-Hannifin Stock Outperforming the S&P 500?

Description: Parker-Hannifin has outperformed the S&P 500 over the past year, and analysts are highly optimistic about the stock’s prospects.

2025-11-30

2025-11-29

2025-11-28

IDEX Stock Exhibits Strong Prospects Despite Persisting Headwinds

Description: IEX gains from strong FMT and HST momentum, strategic acquisitions and enhanced shareholder returns despite FSDP softness.

2025-11-27

Is Kion Group (KIGRY) Stock Outpacing Its Industrial Products Peers This Year?

Description: Here is how Kion Group (KIGRY) and Parker-Hannifin (PH) have performed compared to their sector so far this year.

2025-11-26

2025-11-25

GE Aerospace to Pump in $53M to Upgrade West Jefferson Facility

Description: GE is investing $53M to expand its West Jefferson site, boosting production capacity of engine components output and adding more than 40 jobs.

2025-11-24

2025-11-23

2025-11-22

A Fresh Look at Parker-Hannifin (PH) Valuation After Recent Share Price Momentum

Description: Parker-Hannifin (PH) has been drawing attention lately as investors take a closer look at its performance over the past month, with shares rising 9% and showing continued momentum over the past three months. See our latest analysis for Parker-Hannifin. After a standout 8.75% share price return this past month, Parker-Hannifin’s year-to-date jump of 33% signals momentum is truly building. Notably, its robust 19.9% total shareholder return over the past year puts recent gains in context and...

2025-11-21

Illinois Tool Gains From Business Strength Amid Persisting Headwinds

Description: ITW sees momentum in key segments and margin gains from enterprise initiatives even as certain markets soften, setting up a mixed but closely watched 2025.

2025-11-20

Cimpress Exhibits Strong Prospects Despite Persisting Headwinds

Description: CMPR benefits from rising demand across key segments, even as escalating costs and margin pressure pose ongoing challenges.

Parker-Hannifin (PH) Upgraded to Buy: What Does It Mean for the Stock?

Description: Parker-Hannifin (PH) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #2 (Buy).

2025-11-19

2025-11-18

Parker-Hannifin Stock: Is Wall Street Bullish or Bearish?

Description: Due to Parker-Hannifin’s outperformance relative to the broader market over the past year, Wall Street analysts maintain a strongly optimistic outlook on the stock’s prospects.

2025-11-17

2025-11-16

2025-11-15

Parker-Hannifin’s (PH) a “Standout Stock,” Says Jim Cramer

Description: We recently published 11 Stocks Jim Cramer Talked About. Parker-Hannifin Corporation (NYSE:PH) is one of the stocks Jim Cramer recently discussed. Parker-Hannifin Corporation (NYSE:PH) is one of the largest industrial equipment companies in the world. The firm’s products include motion control systems, hydraulics and avionics systems, and other associated items. Parker-Hannifin Corporation (NYSE:PH) made a […]

2025-11-14

Should You Rethink Parker-Hannifin After Its 14% Surge and Automation Focus?

Description: Wondering whether Parker-Hannifin is truly worth its price tag or if there's untapped value hiding beneath the surface? You're not alone, and this is exactly what we're here to unpack. In just the past month, the stock has jumped 14.3%, pushing its year-to-date gains to 33.7% and adding to an impressive three-year return of 187.1%. Much of this recent momentum has been fueled by optimism around shifts in industrial automation and sustainability, as well as Parker-Hannifin's ambitious moves...

2025-11-13

Parker-Hannifin price target raised to $960 from $930 at Baird

Description: Baird analyst Mircea Dobre raised the firm’s price target on Parker-Hannifin (PH) to $960 from $930 and keeps an Outperform rating on the shares. The firm updated its model following the announcement of its filtration acquisition which Baird said they like. Published first on TheFly – the ultimate source for real-time, market-moving breaking financial news. Try Now>> See the top stocks recommended by analysts >> Read More on PH: Parker-Hannifin price target raised to $1,000 from $960 at Susqueha

Century Aluminum's Earnings and Revenues Lag Estimates in Q3

Description: CENX posts quarterly earnings miss despite higher sales, as weaker shipments and mix weigh on performance.

The 5 Most Interesting Analyst Questions From Parker-Hannifin’s Q3 Earnings Call

Description: Parker-Hannifin’s third quarter performance drew a significant positive market reaction, reflecting broad-based momentum across its business segments. Key drivers included strong organic growth, with the company highlighting a return to positive territory in its North America industrial operations and continued strength in aerospace and defense. CEO Jennifer Parmentier emphasized the contribution from both commercial and aftermarket aerospace, as well as improved productivity and favorable mix i

2025-11-12

What TransDigm Earnings Say About a Booming Aerospace Sector

Description: Wednesday, TransDigm reported fiscal fourth-quarter adjusted EPS of $10.82 from sales of $2.4 billion. Wall Street was looking for EPS of $10.08 and sales of $2.4 billion.

Parker-Hannifin Shows How to Compound. Wall Street Is Pleased.

Description: Price targets for shares are rising after the company’s purchase of Filtration Group for $9.3 billion.

Reasons Why You Should Avoid Betting on Ingersoll Rand Right Now

Description: IR struggles with rising costs, mounting debt and currency headwinds, pressuring profitability and investor sentiment.

2025-11-11

Dow Hit New High as Shutdown Nears End; Nasdaq Falls as Nvidia Slides

Description: The Dow Jones Industrial Average hit an all-time high Tuesday as the US government shutdown appeared

Parker Hannifin Hits Record High After Acquisition, As This Often Overlooked Industry Gets Another Boost

Description: Parker Hannifin shares climbed to an all-time high Tuesday after the company announced it agreed to acquire privately held Filtration Group for $9.25 billion. The deal adds to Parker's industrial offerings and creates one of the largest global industrial filtration businesses. Parker Hannifin plans to fold the business into its industrial and aerospace products segment.

Is Kion Group (KIGRY) Outperforming Other Industrial Products Stocks This Year?

Description: Here is how Kion Group (KIGRY) and Parker-Hannifin (PH) have performed compared to their sector so far this year.

Parker-Hannifin to Buy Filtration Group for $9.25 Billion

Description: Parker-Hannifin has agreed to buy Filtration Group for $9.25 billion, adding a major filtration-technologies manufacturer to its industrial portfolio.

Strong Results Drove Parker-Hannifin (PH) Higher in Q3

Description: Madison Investments, an investment advisor, released its “Madison Large Cap Fund” third-quarter 2025 investor letter. A copy of the letter can be downloaded here. The fund decreased 2.2% in the third quarter compared to an 8.1% gain for the S&P 500 Index. The current market focus on short-term profits led the fund to underperform the […]

Parker to Acquire Filtration Group Corporation, Significantly Expanding Filtration Offering and Aftermarket Business

Description: Adds complementary and proprietary filtration technologies for critical applications Expands presence in Life Sciences, HVAC/R, and In-Plant and Industrial market verticals $2 billion in expected CY2025 sales, creating one of the largest global industrial filtration businesses 85% aftermarket sales increases Parker Filtration aftermarket sales by 500 bps$220M cost synergies leveraging the power of The Win Strategy™ Expected to be accretive to organic growth, synergized EBITDA margin, adjusted EP

2025-11-10

2025-11-09

2025-11-08

2025-11-07

Parker-Hannifin (PH): Assessing Valuation After Record Earnings and Upgraded Fiscal Year Outlook

Description: Parker-Hannifin (PH) grabbed attention after announcing record quarterly results, with sales and profits surpassing expectations. The company also increased its fiscal year guidance, which signals confidence in sustained growth momentum across several key segments. See our latest analysis for Parker-Hannifin. Parker-Hannifin’s share price surged 7.75% in a single day following its upbeat results and raised outlook. This capped off a year-to-date share price return of 32.5%. This momentum...

Why Parker-Hannifin (PH) Is Up 7.7% After Record Sales and Raised Full-Year Guidance

Description: Parker-Hannifin Corporation recently reported record first-quarter results, with sales rising to US$5.08 billion and net income increasing to US$808 million, both exceeding analyst expectations. Management's decision to raise full-year guidance and highlight margin expansion underscores growing confidence in the aerospace business and successful integration of acquisitions like Curtis Instruments. We'll now examine how Parker-Hannifin's record-breaking quarterly profits and elevated guidance...

Company News for Nov 7, 2025

Description: Companies In The News Are: CMI, PLNT, PH, AZN.

PH Q3 Deep Dive: Aerospace, Aftermarket, and International Demand Boost Guidance

Description: Industrial machinery company Parker-Hannifin (NYSE:PH) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 3.7% year on year to $5.08 billion. Its non-GAAP profit of $7.22 per share was 9% above analysts’ consensus estimates.

2025-11-06

Parker Hannifin Corp (PH) Q1 2026 Earnings Call Highlights: Record Sales and Raised Guidance ...

Description: Parker Hannifin Corp (PH) reports record Q1 sales of $5.1 billion, raises fiscal year guidance, and navigates sector-specific challenges.

Parker-Hannifin Q1 Earnings Beat, Aerospace Systems Sales Up Y/Y

Description: PH posts strong Q1 with higher earnings, solid Aerospace growth, and raises its fiscal 2026 outlook.

Why Is Parker-Hannifin (PH) Stock Rocketing Higher Today

Description: Shares of industrial machinery company Parker-Hannifin (NYSE:PH) jumped 7.6% in the morning session after the company reported third-quarter results that surpassed Wall Street expectations and raised its full-year financial outlook. The motion and control technologies leader announced sales of $5.08 billion, which were above analyst forecasts. Organic sales, which strip out acquisitions and currency fluctuations, grew by 5% year on year. The company's adjusted earnings per share came in at $7.22

Parker-Hannifin (PH) Q1 Earnings: How Key Metrics Compare to Wall Street Estimates

Description: The headline numbers for Parker-Hannifin (PH) give insight into how the company performed in the quarter ended September 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Parker-Hannifin (PH) Surpasses Q1 Earnings and Revenue Estimates

Description: Parker-Hannifin (PH) delivered earnings and revenue surprises of +8.25% and +2.93%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Parker-Hannifin (NYSE:PH) Exceeds Q3 Expectations, Stock Soars

Description: Industrial machinery company Parker-Hannifin (NYSE:PH) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 3.7% year on year to $5.08 billion. Its non-GAAP profit of $7.22 per share was 9% above analysts’ consensus estimates.

Parker-Hannifin: Fiscal Q1 Earnings Snapshot

Description: The results exceeded Wall Street expectations. The average estimate of eight analysts surveyed by Zacks Investment Research was for earnings of $6.67 per share. The maker of motion and control products posted revenue of $5.08 billion in the period, also exceeding Street forecasts.

Parker Reports Fiscal 2026 First Quarter Results

Description: Organic Sales and Margin Expansion Drive EPS Growth, FY26 Outlook IncreasedCLEVELAND, Nov. 06, 2025 (GLOBE NEWSWIRE) -- Parker Hannifin Corporation (NYSE: PH), the global leader in motion and control technologies, today reported results for the quarter ended September 30, 2025, that included the following highlights (compared with the prior year period): Fiscal 2026 First Quarter Highlights: Sales were a record $5.1 billion; organic sales growth was 5%Net income was $808 million, an increase of

2025-11-05

2025-11-04

Parker-Hannifin (PH) Reports Q3: Everything You Need To Know Ahead Of Earnings

Description: Industrial machinery company Parker-Hannifin (NYSE:PH) will be reporting earnings this Thursday before the bell. Here’s what to expect.

What to Note Ahead of Parker-Hannifin's Q1 Earnings Release?

Description: PH readies its fiscal Q1 2026 report with strong aerospace demand and margin discipline offsetting softness in industrial markets.

2025-11-03

2025-11-02

There's A Lot To Like About Parker-Hannifin's (NYSE:PH) Upcoming US$1.80 Dividend

Description: Readers hoping to buy Parker-Hannifin Corporation ( NYSE:PH ) for its dividend will need to make their move shortly, as...

2025-11-01

2025-10-31

2025-10-30

Parker to Announce Fiscal 2026 First Quarter Earnings on November 6; Conference Call and Webcast Scheduled for 11 a.m. Eastern

Description: CLEVELAND, Oct. 30, 2025 (GLOBE NEWSWIRE) -- Parker Hannifin Corporation (NYSE: PH), the global leader in motion and control technologies, today announced that it will release its fiscal 2026 first quarter earnings before the market opens on Thursday, November 6, 2025, followed by a conference call at 11:00 a.m., Eastern time. During the call, the company will discuss fiscal 2026 first quarter results and respond to questions from institutional investors and security analysts. The conference cal

Parker-Hannifin (PH) Reports Next Week: Wall Street Expects Earnings Growth

Description: Parker-Hannifin (PH) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2025-10-29

Generac Holdings (GNRC) Q3 Earnings and Revenues Lag Estimates

Description: Generac Holdings (GNRC) delivered earnings and revenue surprises of -18.67% and -7.44%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Is Parker-Hannifin’s Valuation Justified After Expansion into Smart Automation Technologies?

Description: Trying to figure out what to do with your Parker-Hannifin shares or whether it is time to get in? You are not alone. With this industrial giant closing recently at $767.01 and showing impressive gains, up 1.2% in the past week, 2.2% over the last month, and a stellar 21.8% so far this year, there is no shortage of investors watching closely. The stock has soared a remarkable 263.2% over the last five years, reflecting not only confidence in the company’s strategy but also a market...

2025-10-28

MEMSCAP and Parker Hannifin Enter Into a Development Agreement for Fluidic Applications

Description: GRENOBLE, France, October 28, 2025--Regulatory News: MEMSCAP (Euronext Paris: MEMS), leading provider of high-accuracy, high-stability pressure sensor solutions for the aerospace and medical markets using MEMS technology (Micro Electro Mechanical Systems), today announces the signature of a development contract with Parker Hannifin Corporation (NYSE: PH), through one of its fluidic divisions.

2025-10-27

2025-10-26

2025-10-25

2025-10-24

3 S&P 500 Stocks We’re Skeptical Of

Description: The S&P 500 (^GSPC) is home to the biggest and most well-known companies in the market, making it a go-to index for investors seeking stability. But not all large-cap stocks are created equal - some are struggling with slowing growth, declining margins, or increased competition.

2025-10-23

2025-10-22

Parker Declares Quarterly Cash Dividend

Description: CLEVELAND, Oct. 22, 2025 (GLOBE NEWSWIRE) -- Parker Hannifin Corporation (NYSE: PH), the global leader in motion and control technologies, today announced that its Board of Directors has declared a regular quarterly cash dividend of $1.80 per share of common stock to shareholders of record as of November 7, 2025. The dividend is payable December 5, 2025. This is the company's 302nd consecutive quarterly dividend. Parker has increased its annual dividends per share paid to shareholders for 69 con

Parker Hannifin Is Up More Than 20% Since our Recommendation. The Stock Is Still Cheap.

Description: From the sleek designs of military jets to the pleasing swoop of an airplane’s wing, humans have always found flight fascinating. The stock has risen more than 20% since Barron’s highlighted it in the summer of 2024. Parker Hannifin shares aren’t likely to take investors on a bumpy ride.

2025-10-21

2025-10-20

Can Parker Hannifin's (PH) Dividend Streak Shape Its Reputation for Lasting Shareholder Value?

Description: Parker Hannifin recently announced it will webcast its Annual Meeting of Shareholders on October 22, 2025, with access provided through the company's investor website for one year. The company also holds one of the longest annual dividend increase streaks in the S&P 500, marking 69 consecutive fiscal years of growth. With analysts maintaining positive outlooks for Parker-Hannifin, we'll explore how this renewed confidence could influence its investment narrative. These 11 companies survived...

2025-10-19

2025-10-18

2025-10-17

IBD's Most Sustainable Companies Across Industry Categories

Description: Sustainable stocks are ready for a clean energy future and can deliver solid returns in all types of market environments. Here are the winners.