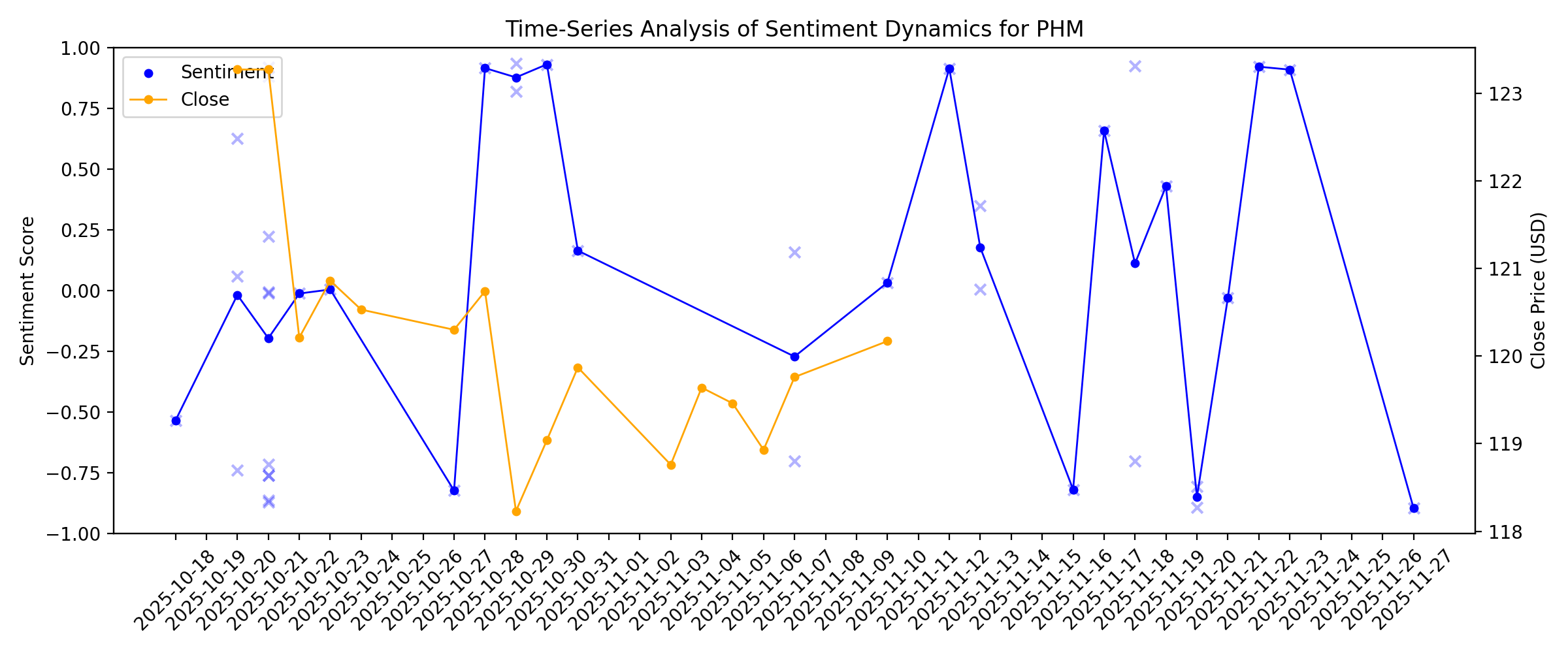

News sentiment analysis for PHM

Sentiment chart

2026-01-14

PulteGroup (PHM) Dips More Than Broader Market: What You Should Know

Description: PulteGroup (PHM) concluded the recent trading session at $130.67, signifying a -2.24% move from its prior day's close.

Wall Street Has a Positive Opinion on PulteGroup, Inc. (PHM)

Description: PulteGroup, Inc. (NYSE:PHM) is one of the Undervalued Cyclical Stocks to Invest In. Wall Street has a positive opinion on PulteGroup, Inc. (NYSE:PHM). Recently, on January 9, Michael Dahl from RBC Capital reiterated a Hold rating on the stock and lowered the price target slightly from $112 to $111. Earlier on January 7, Citizens reiterated […]

Homebuilder stocks slide, silver miners gain, crypto stocks rise

Description: Yahoo Finance Data and Markets Editor Jared Blikre joins Market Catalysts with Julie Hyman to take a closer look at some of the trending tickers on Yahoo Finance's platform on Wednesday. Homebuilder stocks (XHB) are in focus after Trump's Federal Housing Finance Agency Director Bill Pulte criticized share buybacks. Silver (SI=F) miners share in the precious metal's rise. Crypto stocks rise on bitcoin (BTC-USD) gains. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

D.R. Horton, Lennar, Other Home Builder Stocks Hit as Pulte Slams Buybacks

Description: Bill Pulte took aim at home builders’ stock buybacks, sending shares in D.R. Horton and Lennar lower.

2026-01-13

Trump Administration Takes Aim at Home-Builder Stock Buybacks

Description: For some in the Trump administration, buybacks have become a dirty word. In an interview with The Wall Street Journal, President Trump’s Federal Housing Finance Agency director, Bill Pulte, questioned repurchases made by home builders when discussing the administration’s plans to lower housing costs. “They’re making, in some cases, more money than they’ve ever made, and they’re buying back stock like never before,” Pulte said.

2026-01-12

PulteGroup (PHM) Stock Jumps 7.3%: Will It Continue to Soar?

Description: PulteGroup (PHM) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term.

2026-01-11

US futures slip while Asian shares gain as Fed chair Powell faces legal threat

Description: U.S. futures slipped but markets in Asia advanced Monday after Federal Reserve Chair Jerome Powell said the Department of Justice had served the central bank with subpoenas. The threat of a criminal indictment over Powell’s testimony about the Fed’s building renovations is the latest escalation in President Donald Trump’s feud with the Fed. Trump has criticized the Fed’s $2.5 billion renovation of two office buildings as excessive. The future for the Nasdaq composite index slipped 0.8%.

Assessing PulteGroup (PHM) Valuation After Citizens Coverage Highlights Higher Margin Del Webb Growth

Description: Why Citizens’ New Coverage Moved PulteGroup Shares Citizens’ fresh Market Outperform rating on PulteGroup (PHM), combined with its focus on move-up and active adult buyers, sparked a 3.5% share price move and put the stock firmly back on investor watchlists. See our latest analysis for PulteGroup. That fresh coverage lands on top of a 1-year total shareholder return of 23.83% and a 3-year total shareholder return of 166.82%. The 11.03% year to date share price return suggests momentum has...

2026-01-10

2026-01-09

S&P 500, Dow Rally to New Peaks After Jobs Report; Wall Street Posts Weekly Gains

Description: The S&P 500 and the Dow Jones Industrial Average reached new all-time highs on Friday following a ke

S&P 500 Climbs in First Full Week of 2026, Hits New Highs

Description: The Standard & Poor's 500 index rose 1.6% this week to a fresh closing high in a broad climb led by

Equities Rise Intraday as Markets Weigh Jobs, Other Macro Data

Description: US benchmark equity indexes were higher intraday as traders parsed latest economic data, including a

Real Estate Stocks Jump on Trump’s Mortgage Bond Plan. Rates Hit 5.99%.

Description: Shares in real estate tech platforms and home builders rallied on Friday after President Donald Trump outlined a plan to buy mortgage bonds in a bid to make homeownership more affordable. Investors’ hopes for a rebound in the housing market just got a whole lot better. Mortgage lender Rocket Cos. rose 6.7%, putting the large mortgage originator on track for its highest close since 2021, according to Dow Jones Market Data.

2026-01-08

Why PulteGroup (PHM) Stock Is Trading Up Today

Description: Shares of homebuilding company PulteGroup (NYSE:PHM) jumped 3.5% in the morning session after Citizens initiated coverage on the stock with a Market Outperform rating and set a price target of $145.00.

Wall Street Bulls Look Optimistic About PulteGroup (PHM): Should You Buy?

Description: The average brokerage recommendation (ABR) for PulteGroup (PHM) is equivalent to a Buy. The overly optimistic recommendations of Wall Street analysts make the effectiveness of this highly sought-after metric questionable. So, is it worth buying the stock?

2026-01-07

Those who invested in PulteGroup (NYSE:PHM) five years ago are up 198%

Description: The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, if...

2026-01-06

PulteGroup, Inc. (PHM) Is a Trending Stock: Facts to Know Before Betting on It

Description: Recently, Zacks.com users have been paying close attention to PulteGroup (PHM). This makes it worthwhile to examine what the stock has in store.

2026-01-05

2026-01-04

2026-01-03

2026-01-02

PulteGroup’s (NYSE:PHM) Q3 CY2025 Sales Beat Estimates

Description: Homebuilding company PulteGroup (NYSE:PHM) beat Wall Street’s revenue expectations in Q3 CY2025, but sales fell by 1.6% year on year to $4.4 billion. Its non-GAAP profit of $2.96 per share was 2.5% above analysts’ consensus estimates.

PulteGroup (PHM) Outpaces Stock Market Gains: What You Should Know

Description: PulteGroup (PHM) closed the most recent trading day at $119.07, moving +1.54% from the previous trading session.

2026-01-01

2025-12-31

2025-12-30

PulteGroup’s Quarterly Earnings Preview: What You Need to Know

Description: PulteGroup is expected to release its fourth-quarter earnings later next month, and consensus estimates point to a double-digit drop in profitability.

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

PulteGroup (PHM) Stock Sinks As Market Gains: What You Should Know

Description: In the latest trading session, PulteGroup (PHM) closed at $117.38, marking a -1.45% move from the previous day.

Investors Heavily Search PulteGroup, Inc. (PHM): Here is What You Need to Know

Description: PulteGroup (PHM) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

2025-12-22

2025-12-21

PulteGroup (PHM): Assessing Valuation After Recent Pullback and Strong Multi‑Year Shareholder Returns

Description: PulteGroup (PHM) has been drifting lower over the past week, even though the stock is still up solidly this year. That disconnect between recent weakness and longer term gains is catching investors attention. See our latest analysis for PulteGroup. That recent 7 day share price return of minus 5.29 percent looks more like a breather within a longer upswing, given the 11.24 percent year to date share price gain and a very strong 3 year total shareholder return of 167.79 percent. If PulteGroup...

2025-12-20

2025-12-19

2025-12-18

Del Webb Explore Breaks Ground on Model Homes at North River Ranch

Description: PARRISH, Fla., December 18, 2025--PulteGroup’s Del Webb Explore brand is excited to announce that construction is officially underway on model homes at Del Webb Explore North River Ranch, marking a major milestone for this innovative community in Manatee County. This is the first Del Webb Explore community in Florida, offering the signature Del Webb lifestyle without having to be 55 or older. Del Webb Explore North River Ranch is scheduled for a formal grand opening in May 2026.

2025-12-17

Why Installed Building Products (IBP) Shares Are Trading Lower Today

Description: Shares of building products installation services company Installed Building Products (NYSE:IBP) fell 2.4% in the afternoon session after peer Lennar (LEN) reported disappointing quarterly results and a soft outlook, dragging down the broader homebuilding sector.

2025-12-16

PulteGroup (PHM) Dips More Than Broader Market: What You Should Know

Description: PulteGroup (PHM) reached $124.39 at the closing of the latest trading day, reflecting a -1.68% change compared to its last close.

2025-12-15

Homebuilder sentiment rises, Exor rejects bid on Juventus stake

Description: Market Catalysts host Julie Hyman tracks several of the day's top trending stock tickers, including the rise in homebuilder sentiment in the month of December, Exor rejecting Tether Holdings offer for its 65% stake in the Juventus Football Club (JUV.F), and Goldman Sachs giving Teradyne (TER) a double upgrade. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

2025-12-14

2025-12-13

2025-12-12

Here is What to Know Beyond Why PulteGroup, Inc. (PHM) is a Trending Stock

Description: Recently, Zacks.com users have been paying close attention to PulteGroup (PHM). This makes it worthwhile to examine what the stock has in store.

2025-12-11

2025-12-10

Del Webb Announces Grand Opening of The Lake House, Amenity Center at Kensington Ridge

Description: DETROIT, December 10, 2025--Del Webb, the nation’s leading builder of active adult communities for those 55 and older, is proud to announce the grand opening of the highly anticipated clubhouse and amenity center, The Lake House, at Kensington Ridge by Del Webb. This 16,800-square-foot facility provides residents with a world-class, resort-style living experience.

2025-12-09

Is PulteGroup Still Attractive After Its Huge Multi Year Run And Recent Share Price Dip

Description: If you are wondering whether PulteGroup is still a smart buy after its big multi year run, you are not alone. This article is going to dig into what the current price really implies. The stock is up a massive 171.4% over three years and 203.4% over five years, but more recently it has slipped 5.6% in the last week while still sitting on a 14.3% gain year to date and 1.7% over the last year. Those swings have come as investors constantly reassess the housing backdrop, including shifting...

Is PulteGroup Stock Underperforming the Dow?

Description: Despite PulteGroup’s recent underperformance relative to the Dow, analysts remain moderately optimistic about the stock’s prospects.

2025-12-08

PulteGroup (PHM) Dips More Than Broader Market: What You Should Know

Description: PulteGroup (PHM) closed the most recent trading day at $124.88, moving 1.66% from the previous trading session.

2025-12-07

2025-12-06

2025-12-05

Here's What Investors Must Know Ahead of Toll Brothers' Q4 Earnings

Description: TOL faces a soft housing backdrop in Q4, but pricing strength and luxury demand may help offset volume pressure as margins and backlog remain key watchpoints.

Wall Street Analysts Think PulteGroup (PHM) Is a Good Investment: Is It?

Description: Based on the average brokerage recommendation (ABR), PulteGroup (PHM) should be added to one's portfolio. Wall Street analysts' overly optimistic recommendations cast doubt on the effectiveness of this highly sought-after metric. So, is the stock worth buying?

PulteGroup (PHM): Reassessing Valuation After Another Earnings Beat Despite Softer Forward Estimates

Description: PulteGroup (PHM) just delivered another earnings beat, extending a streak of upside surprises that has investors taking a fresh look at the stock despite expectations for lower revenue and earnings this year. See our latest analysis for PulteGroup. The latest earnings beat comes as PulteGroup’s 1 month share price return of 6.9% contrasts with a softer 90 day share price return of minus 9.0%, while its 3 year total shareholder return of 195.4% continues to signal powerful long term...

Zacks Industry Outlook Highlights PulteGroup, Green Brick Partners and Century Communities

Description: PulteGroup, Green Brick Partners and Century Communities stay in focus as homebuilders navigate strained affordability and rising costs.

2025-12-04

This Home Builder’s Earnings Were So Bad It Hammered All Housing Stocks

Description: New Jersey-based home builder Hovnanian Enterprises had a bad quarter that caused its shares to plunge by double-digits—and dragged down other housing stocks. Shares fell 23% on Thursday, and concerns about its report spilled over to other home builder stocks as well. D.R. Horton fell by 2.6%, Lennar dropped 4.8%, PulteGroup lost 1.9%, Toll Brothers slipped 1.2%, and KB Home tumbled 2.5%.

Top Analyst Reports for HSBC, Abbott & Shell

Description: HSBC's Asia pivot, Abbott's device momentum and Shell's resilient Q3 results headline today's standout analyst reports.

3 Homebuilders in Focus Despite Challenging Market Backdrop

Description: Although higher mortgage rates and land/labor costs pose risks, better operating leverage and marketing strategies are likely to drive homebuilders like PHM, GRBK and CCS.

Homebuilders look at another tough year as weak demand, rising supply hurt margins

Description: Investing.com -- 2026 will likely be another difficult year for US homebuilders as weak demand drivers, rising supply and expensive valuations will keep pressure on earnings after the sector lagged the S&P 500 in 2025.JPMorgan analysts have a cautious stance on the group downgrading Lennar and Century Communities, though they upgraded Toll Brothers.

PulteGroup Reveals Home Design Trends for 2026

Description: ATLANTA, December 04, 2025--Design trends are lasting longer. What's popular today remains relevant tomorrow, and that endurance reflects something bigger. Homebuyers are stepping away from constant consumption and turnover and making purchasing decisions that last throughout every phase of life. The home design industry is responding, and PulteGroup Inc. (NYSE: PHM), the nation’s third-largest homebuilder, is watching it unfold across hundreds of projects nationwide.

PulteGroup’s Fourth Quarter 2025 Earnings Release and Webcast Conference Call Scheduled for January 29, 2026

Description: ATLANTA, December 04, 2025--PulteGroup, Inc. (NYSE: PHM) today announced that it will release its fourth quarter 2025 financial results before the market opens on Thursday, January 29, 2026. The Company will hold a conference call to discuss its fourth quarter results that same day at 8:30 a.m. (ET).

2025-12-03

2025-12-02

High Growth Tech Stocks In Europe With Promising Potential

Description: The European market has recently shown positive momentum, with the pan-European STOXX Europe 600 Index climbing 2.35% and major indices in Germany, Italy, France, and the UK all posting gains. In this environment of cautious optimism where eurozone inflation remains near target levels and business sentiment shows mixed signals, identifying high-growth tech stocks requires a focus on companies that demonstrate robust innovation potential and resilience to economic fluctuations.

2025-12-01

PulteGroup, Inc. (PHM) is Attracting Investor Attention: Here is What You Should Know

Description: Recently, Zacks.com users have been paying close attention to PulteGroup (PHM). This makes it worthwhile to examine what the stock has in store.

PulteGroup to Attend the 2025 Goldman Sachs Industrials and Materials Conference

Description: ATLANTA, December 01, 2025--In conjunction with its upcoming attendance at the 2025 Goldman Sachs Industrials on Thursday December 4, 2025, PulteGroup, Inc. (NYSE: PHM) has posted a new investor presentation to its website. PulteGroup’s new and completely updated presentation provides a detailed review of the Company’s investment thesis, operating platform, business strategies and competitive advantages.

2025-11-30

2025-11-29

2025-11-28

2025-11-27

Why Is Meritage (MTH) Up 10.2% Since Last Earnings Report?

Description: Meritage (MTH) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-11-26

2025-11-25

2025-11-24

2025-11-23

PulteGroup's (NYSE:PHM) Shareholders Will Receive A Bigger Dividend Than Last Year

Description: PulteGroup, Inc. ( NYSE:PHM ) will increase its dividend from last year's comparable payment on the 6th of January to...

2025-11-22

Is PulteGroup’s Valuation Fair After Year-to-Date Gains and News on Community Launches?

Description: Wondering if PulteGroup is a bargain or just riding the wave? This is the perfect place to find out if the price tag matches what the company is really worth. The stock has had a mild lift of 1.6% over the past week and is basically flat for the last 30 days. Looking back further, it is up an impressive 11.8% year-to-date, even after a 6.6% dip over the past year. Much of this volatility can be traced to shifting expectations in the housing market and recent news around mortgage rates and...

2025-11-21

Homebuilders rise on rate cut odds, VinFast posts wider Q3 loss

Description: Market Catalysts host Julie Hyman tracks several of the day's top trending stock tickers, including the share gains for homebuilders PulteGroup (PHM), D.R. Horton (DHI), and KB Home (KBH); Elastic (ESTC) stock sliding lower after reporting slowing cloud business growth; and Vietnamese EV manufacturer VinFast Auto (VFS) publishing a wider-than-expected loss for its third quarter. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

2025-11-20

Housing Chief Bill Pulte Becomes a Potential Liability for Donald Trump

Description: When Pulte was picked to take the helm of the Federal Housing Finance Agency, which regulates mortgage giants Fannie Mae and Freddie Mac, the Trump transition team considered the posting more of a backwater, according to people familiar with the process. Trump’s advisers during the transition viewed the FHFA as less important than other postings dealing with higher-priority issues such as immigration and tariffs, said the people, who spoke on condition of anonymity to describe private deliberations. Pulte was tapped for the FHFA job after being passed over for top posts at the Department of Housing and Urban Development, the people said.

Why Is PulteGroup (PHM) Down 5.4% Since Last Earnings Report?

Description: PulteGroup (PHM) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-11-19

PulteGroup Increases Quarterly Cash Dividend by 18% to $0.26 Per Share

Description: ATLANTA, November 19, 2025--PulteGroup, Inc. (NYSE: PHM) announced today that its Board of Directors has voted to increase the Company’s quarterly dividend by 18% to $0.26 per common share. The increase will be effective with the Company’s next scheduled dividend, which is payable January 6, 2026, to shareholders of record at the close of business on December 16, 2025.

2025-11-18

PulteGroup to Boost Footprint by Debuting in the Cincinnati Market

Description: PHM to expand into Cincinnati, aiming to build on Midwest demand strength despite a weak housing market.

PulteGroup, Inc. (PHM) is Attracting Investor Attention: Here is What You Should Know

Description: Recently, Zacks.com users have been paying close attention to PulteGroup (PHM). This makes it worthwhile to examine what the stock has in store.

2025-11-17

PulteGroup Initiates Strategic Expansion into Cincinnati Market

Description: ATLANTA, November 17, 2025--Building on its longstanding success in the cities of Cleveland and Columbus, PulteGroup, Inc. (NYSE: PHM), the nation's third largest homebuilder, announces its plans to enter the Cincinnati market.

2025-11-16

Why The 22% Return On Capital At PulteGroup (NYSE:PHM) Should Have Your Attention

Description: There are a few key trends to look for if we want to identify the next multi-bagger. One common approach is to try and...

2025-11-15

2025-11-14

2025-11-13

PulteGroup Stock Could Bounce Off Bullish Trendline

Description: The security has pulled back from this year's peak near $142

Del Webb Announces Grand Opening of New Greater Palm Springs Community, Desert Retreat

Description: PALM SPRINGS, Calif., November 13, 2025--Del Webb, the nation’s leading builder of active-adult communities for those 55 and older, today announced the grand opening of its newest community, Del Webb Desert Retreat. A Grand Opening event will take place on Saturday, November 15th from 10 AM to 2 PM. Located in the highly sought-after city of Indio, CA, Desert Retreat continues Del Webb's long and successful history in the region, offering an exclusive, resort-style living experience defined by s

2025-11-12

What Are Wall Street Analysts' Target Price for PulteGroup Stock?

Description: Although PulteGroup has underperformed the broader market over the past year, Wall Street analysts maintain a moderately optimistic outlook on the stock’s prospects.

2025-11-11

2025-11-10

PulteGroup Celebrates Veterans Day with More Than Words: Building Homes and Careers for Those Who Served

Description: ATLANTA, November 10, 2025--PulteGroup honors America’s wounded veterans and transitioning service members with action. The nation’s third-largest homebuilder has delivered over 100 mortgage-free homes to veterans with service-connected injuries, employs approximately 250 veterans across the company, and maintains a thriving internal business resource group dedicated to supporting those who served.

2025-11-09

2025-11-08

2025-11-07

More Homes Equal Lower Prices. Bill Pulte Wants Builders to Step on the Gas.

Description: “The builders have got to start building,” Federal Housing Finance Agency director Bill Pulte said at a Friday conference.

PulteGroup, Inc. (PHM) Is a Trending Stock: Facts to Know Before Betting on It

Description: Recently, Zacks.com users have been paying close attention to PulteGroup (PHM). This makes it worthwhile to examine what the stock has in store.

2025-11-06

2025-11-05

2025-11-04

2025-11-03

2025-11-02

2025-11-01

2025-10-31

How Lower Q3 Earnings and Aggressive Buybacks at PulteGroup (PHM) Are Shaping Its Investment Narrative

Description: PulteGroup recently announced its third quarter and nine-month 2025 results, reporting third-quarter revenue of US$4.40 billion and net income of US$585.83 million, both lower than the prior year, alongside an update that it repurchased 2,434,829 shares for US$300 million during the quarter. This continued share buyback activity brings total repurchases since 2013 to 199 million shares, or more than 70% of shares outstanding, highlighting a significant commitment to returning capital to...

2025-10-30

EMCOR Q3 Earnings Miss Estimates, RPOs Increase Y/Y, Stock Up

Description: EME posts higher third-quarter 2025 revenues and earnings year over year despite missing estimates, with record RPOs driving a 2.4% stock gain.

2025-10-29

Masco Misses Q3 Earnings & Sales Estimates, Slashes '25 EPS Outlook

Description: Can MAS overcome its Q3 setback and revive growth after weak architectural sales and a trimmed 2025 EPS outlook?

Otis Worldwide Q3 Earnings & Net Sales Beat Estimates, Stock Up

Description: OTIS posts strong third-quarter results with earnings and sales beating estimates, fueled by solid growth in its Service segment.

2025-10-28

D.R. Horton Stock Tumbles on Q4 Earnings Miss, Revenues Down Y/Y

Description: Can DHI regain its growth traction as housing demand softens and margins face pressure despite strong liquidity?

2025-10-27

Investors Heavily Search PulteGroup, Inc. (PHM): Here is What You Need to Know

Description: PulteGroup (PHM) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

2025-10-26

2025-10-25

2025-10-24

2025-10-23

United Rentals' Q3 Earnings Miss Estimates, Revenues Up Y/Y

Description: URI posts record third-quarter revenues and adjusted EBITDA on solid construction demand, but earnings fall short of estimates.

2025-10-22

PulteGroup (PHM) Profit Margin Drops to 14.9%, Challenging Bullish Narratives on Earnings Stability

Description: PulteGroup (PHM) posted a net profit margin of 14.9%, down from 16.6% last year, signaling a notable contraction in margins. Over the last five years, annual earnings growth averaged an impressive 14%, but recent results mark a reversal as earnings growth turned negative. Looking ahead, consensus forecasts call for earnings to decline by 6.2% annually over the next three years, with revenue expected to edge lower by 0.09% per year. See our full analysis for PulteGroup. The next section puts...

2025-10-21

Mortgage Rates Are Slipping. Why That’s Not Sparking Housing Demand.

Description: Mortgage rates are headed lower, but that might not matter for would-be home buyers. Mortgage News Daily on Tuesday pegged the 30-year fixed mortgage rate at 6.17%, the lowest since the mid-September drop in the run-up to that month’s Federal Reserve meeting. Homebuying sentiment in September, the most recent month available, remained relatively low, with 73% of respondents telling Fannie Mae it was a bad time to buy.

PulteGroup Inc (PHM) Q3 2025 Earnings Call Highlights: Navigating Market Challenges with ...

Description: PulteGroup Inc (PHM) reports strong financial performance despite a challenging sales environment, with strategic focus on market dynamics and operational efficiency.

PulteGroup’s Earnings Are Mixed. Lower Mortgage Rates Aren’t Driving Demand Right Now.

Description: The builder’s third-quarter earnings came in at $2.96 a share on revenue of $4.4 billion, beating expectations.

PulteGroup's Q3 Earnings & Revenues Beat, Net New Orders Down Y/Y

Description: Can PHM's earnings beat and pricing gains outweigh housing market softness and declining new home orders?

PulteGroup (PHM) Reports Q3 Earnings: What Key Metrics Have to Say

Description: Although the revenue and EPS for PulteGroup (PHM) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

PulteGroup (PHM) Is Considered a Good Investment by Brokers: Is That True?

Description: The average brokerage recommendation (ABR) for PulteGroup (PHM) is equivalent to a Buy. The overly optimistic recommendations of Wall Street analysts make the effectiveness of this highly sought-after metric questionable. So, is it worth buying the stock?

PulteGroup Profit Falls as Housing Market Remains Stalled

Description: PulteGroup recorded a lower third-quarter profit as affordability concerns continued to put off home buyers.

PulteGroup (PHM) Surpasses Q3 Earnings and Revenue Estimates

Description: PulteGroup (PHM) delivered earnings and revenue surprises of +3.50% and +2.45%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

PulteGroup: Q3 Earnings Snapshot

Description: ATLANTA (AP) — PulteGroup Inc. PHM) on Tuesday reported third-quarter profit of $585.8 million. On a per-share basis, the Atlanta-based company said it had net income of $2.96.

PulteGroup Reports Third Quarter 2025 Financial Results

Description: ATLANTA, October 21, 2025--PulteGroup, Inc. (NYSE: PHM) announced today financial results for its third quarter ended September 30, 2025. For the quarter, the Company reported net income of $586 million, or $2.96 per share. In the prior year period, the Company reported net income of $698 million, or $3.35 per share.

2025-10-20

Lack of Housing Data Is Keeping Investors in the Dark. PulteGroup Earnings Will Provide Answers.

Description: Investors awaiting PulteGroup’s earnings should keep their eye on the builder’s new orders and home sale gross margin.

PulteGroup to Report Q3 Earnings: What's in Store for This Homebuilder?

Description: PHM gears up to report Q3 results as affordability hurdles, mortgage rates and margin pressure weigh on expectations.

PulteGroup (PHM): Exploring Valuation as Recent Momentum Draws Investor Attention

Description: PulteGroup (PHM) shares have edged higher over the past week, giving investors something to watch after several months of mixed performance. The stock’s recent moves come as the homebuilder navigates shifting market trends and changing industry dynamics. See our latest analysis for PulteGroup. PulteGroup’s share price has delivered a 15.6% gain year-to-date, building on positive momentum despite a slight pullback in recent weeks. While the past year’s total shareholder return is down about...

2025-10-19

2025-10-18

Federal leverage over Fannie, Freddie could shape Trump’s housing push

Description: Investing.com -- U.S. President Donald Trump called for government-backed mortgage giants Fannie Mae and Freddie Mac to “get Big Homebuilders going” over which analysts are gauging how much influence Washington could actually wield over builders struggling with high costs and soft demand.The Federal Housing Finance Agency (FHFA) oversees Fannie and Freddie, which could become a key pressure point, according to Barclays analysts. FHFA Director Bill Pulte, who has echoed Trump’s call for more cons