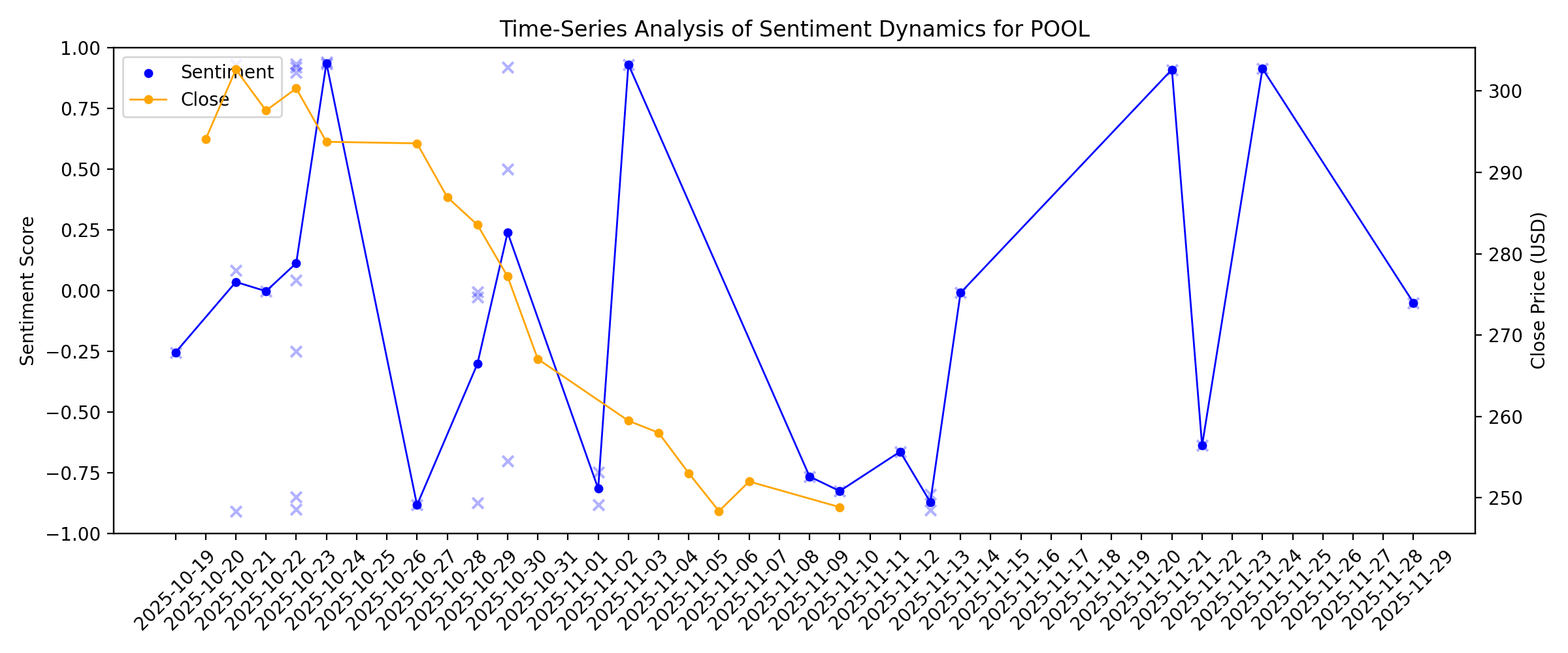

News sentiment analysis for POOL

Sentiment chart

2026-01-14

Are Consumer Discretionary Stocks Lagging Pool Corp. (POOL) This Year?

Description: Here is how Pool Corp. (POOL) and Revolve Group (RVLV) have performed compared to their sector so far this year.

2026-01-13

2026-01-12

Pool Corporation Announces the Retirement of Kenneth G. St. Romain and the Appointment of John B. Watwood

Description: COVINGTON, La., Jan. 12, 2026 (GLOBE NEWSWIRE) -- Pool Corporation (Nasdaq/GSM: POOL) announced today that Kenneth “Kenny” G. St. Romain, Senior Vice President, will retire from his position in 2026, and that John B. Watwood has joined the company as Executive Vice President. Mr. Watwood, reporting to Peter D. Arvan, President and CEO, will lead Pool Corporation’s swimming pool operations in North America, as well as oversee digital and technology initiatives. Mr. St. Romain will continue in his

2026-01-11

2026-01-10

2026-01-09

Are Options Traders Betting on a Big Move in Pool Stock?

Description: Investors need to pay close attention to POOL stock based on the movements in the options market lately.

2026-01-08

2026-01-07

Is Pool (POOL) Price Weakness Creating A Valuation Opportunity For Investors

Description: If you are wondering whether Pool's current share price lines up with its underlying worth, you are not alone. This article is built to help you size that up clearly. The stock last closed at US$237.01, with returns of 3.6% over the past week, 0.0% over the last month, 3.2% year to date, and declines of 25.8% over 1 year, 27.9% over 3 years, and 32.8% over 5 years that may have shifted how the market views its risk and potential. Recent coverage around Pool has focused on how the share price...

Does Pool’s EPS Rebound And Dividend Flexibility Change The Bull Case For Pool (POOL)?

Description: In recent months, Pool Corporation, a major distributor of swimming pool supplies and maintenance products, has seen sales and earnings per share return to growth after an earlier slowdown tied to strained consumer budgets and softer North American demand. At the same time, strong cash flow and a conservative dividend payout ratio are drawing attention to Pool’s capacity to keep increasing shareholder returns even if earnings expansion remains modest. With Pool’s sales and earnings trends...

Zacks Industry Outlook Highlights Amer Sports, Pool, Acushnet, and Topgolf

Description: Amer Sports, Pool, Acushnet, and Topgolf have been highlighted in this Industry Outlook article.

2026-01-06

Here's My Top Dividend Stock to Buy in January

Description: This stock offers investors both a growing dividend and a compelling valuation.

4 Stocks to Buy as the Leisure & Recreation Industry Looks Promising

Description: The Leisure and Recreation Products industry is benefiting from strong fitness demand and booming golf trends. Moreover, stocks like AS, POOL, GOLF and MODG are likely to benefit from the trend.

2026-01-05

What to Watch With Pool Corp. Stock in 2026

Description: The company faces macroeconomic headwinds and sluggish sales growth that threaten a prolonged correction for the stock.

2026-01-04

2026-01-03

2026-01-02

2026-01-01

Shareholders in Pool (NASDAQ:POOL) are in the red if they invested five years ago

Description: In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market...

2025-12-31

2025-12-30

2025-12-29

2025-12-28

Pool Corp (POOL) Back in Focus as Analysts Revisit the Building Products Outlook

Description: Pool Corporation (NASDAQ:POOL) is included among the 15 Dividend Stocks with Low Payout Ratios and Strong Upside. On December 23, CFRA upgraded Pool Corporation (NASDAQ:POOL) to Buy from Hold and set a $304 price target. That followed a more cautious note a week earlier. On December 16, Stifel analyst W. Andrew Carter lowered his price […]

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

Coty downgraded, Spruce Biosciences initiated: Wall Street's top analyst calls

Description: Coty downgraded, Spruce Biosciences initiated: Wall Street's top analyst calls

Here Are Tuesday’s Top Wall Street Analyst Research Calls: AMETEK, Coty, Janus Henderson, Levi Strauss, Pool Corporation, Southern Copper, and More

Description: Pre-Market Stock Futures: The futures are trading flat after a solid start to the shortened Christmas holiday week. All of the major indices finished the day higher, but with the big event just 48 hours away, you can bet the trading volume will fall off a cliff. Wednesday will be a day for the junior ... Here Are Tuesday’s Top Wall Street Analyst Research Calls: AMETEK, Coty, Janus Henderson, Levi Strauss, Pool Corporation, Southern Copper, and More

2025-12-22

2025-12-21

2025-12-20

2025-12-19

2025-12-18

2025-12-17

2025-12-16

Should You Think About Buying Pool Corporation (NASDAQ:POOL) Now?

Description: Pool Corporation ( NASDAQ:POOL ), is not the largest company out there, but it received a lot of attention from a...

2025-12-15

How Is Pool's Stock Performance Compared to Other Industrial Stocks?

Description: Pool has significantly underperformed compared to other industrial stocks over the past year, yet analysts remain moderately optimistic about the stock’s prospects.

2025-12-14

2025-12-13

2025-12-12

2025-12-11

2025-12-10

2025-12-09

2025-12-08

2025-12-07

2025-12-06

2025-12-05

Pool Corporation (POOL): A Bull Case Theory

Description: We came across a bullish thesis on Pool Corporation on StockOpine’s Newsletter’s Substack by StockOpine. In this article, we will summarize the bulls’ thesis on POOL. Pool Corporation’s share was trading at $243.37 as of December 1st. POOL’s trailing and forward P/E were 22.19 and 20.75 respectively according to Yahoo Finance. Pool Corporation (POOL) reported Q3 2025 results that […]

2025-12-04

2025-12-03

2025-12-02

2025-12-01

2025-11-30

A Fresh Look at Pool Corp (POOL) Valuation Following Recent Share Price Weakness

Description: Pool (POOL) shares have recently faced a challenging stretch, moving lower over the past month and three months. The company’s performance has drawn attention from investors who are looking to understand what is driving the stock’s recent trend. See our latest analysis for Pool. Pool’s share price has lost momentum, with a 1-month share price return of -12.12%, extending to -26.82% year-to-date. Looking at the bigger picture, the total shareholder return over the last year sits at -34.34%...

Should You Revisit Pool Corp After a 27% Slide in 2025?

Description: Wondering if now is the right time to jump into Pool stock, or if the recent price action has opened up a buying opportunity? Let’s break down what’s really happening beneath the surface. After a modest 1.5% gain in the past week, Pool has still shed 12.1% in the last 30 days and remains down 26.8% year-to-date. This has led many investors to question if the worst is over or if more volatility lies ahead. Recent headlines covering the broader consumer discretionary sector, including shifting...

2025-11-29

Has Buffett's Recent Buy of POOL Stock Been Good for Investors?

Description: This recent addition to Buffett's portfolio has been underperforming. How has it done over the long term?

2025-11-28

2025-11-27

2025-11-26

2025-11-25

2025-11-24

Do Wall Street Analysts Like Pool Corporation Stock?

Description: Pool Corporation has underperformed the broader market over the past year, but analysts are moderately optimistic about the stock’s prospects.

2025-11-23

2025-11-22

What to Know Before Buying Pool Corp. Stock

Description: The recent Berkshire buy is trading for much lower than Buffett paid.

2025-11-21

Stitch Fix, Delta, Pool, Marriott, and Frontdoor Stocks Trade Up, What You Need To Know

Description: A number of stocks jumped in the afternoon session after comments from a key Federal Reserve official bolstered hopes for an interest rate cut. New York Federal Reserve President John Williams stated he sees “room for a further adjustment” in the near term, sparking a significant market rally. Following his remarks, the probability of the central bank cutting rates at its December meeting jumped from 39% to over 73%, according to the CME FedWatch tool. This positive sentiment provided relief to

2025-11-20

2025-11-19

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

Is There an Opportunity in Pool After a 26% Drop in 2025?

Description: Wondering if now is the right time to buy Pool stock? You are not alone, as plenty of investors are asking where the value lies after recent price swings. Pool’s shares have pulled back notably, dropping 16.8% over the past month and declining 26.1% since the start of the year. This hints at shifting market sentiment and heightened volatility. Several headlines have weighed on the stock price lately, including broader concerns around consumer discretionary spending and interest rate...

2025-11-13

Warren Buffett Has Been a Net Seller for 3 Years, but He’s Buying These 3 Stocks

Description: Warren Buffett has taken a highly conservative approach to the stock market in recent years. However, he has bought Chevron (NYSE:CVX), UnitedHealth Group (NYSE:UNH) and Pool Corp (NASDAQ:POOL) in the most recent quarter. He has been selling stocks for three straight years in a row, or 12 consecutive quarters. This does not mean that he’s selling ... Warren Buffett Has Been a Net Seller for 3 Years, but He’s Buying These 3 Stocks

Could This Bear Market Buy Help You Become a Millionaire?

Description: Berkshire Hathaway owns this company, and you might want to own it, too, but only buy it if you think long term.

2025-11-12

A Once-in-a-Decade Opportunity: 1 Magnificent Dividend Stock Down 56% to Buy Right Now

Description: Even Warren Buffett's Berkshire Hathaway hasn't been able to resist buying the stock.

2025-11-11

2025-11-10

Why Is Wall Street So Bearish on Pool Corp? There's 1 Key Reason.

Description: Warren Buffett has been buying up this consumer stock hand over fist, but the market keeps sticking to the sidelines.

2025-11-09

Think You Know Pool Corp.? Here's 1 Little-Known Fact You Can't Overlook.

Description: After joining Berkshire Hathaway's portfolio, Pool Corp. has drawn a lot of attention, and here's why that makes total sense.

2025-11-08

2025-11-07

2025-11-06

2025-11-05

2025-11-04

2025-11-03

Could Pool’s (POOL) Steady Capital Returns Reflect a Shifting Approach to Long-Term Growth?

Description: In October 2025, Pool Corporation reported third-quarter earnings with sales of US$1.45 billion and confirmed a quarterly dividend of US$1.25 per share, alongside a continued share repurchase program and reaffirmed flat full-year revenue guidance. The company's resilience was highlighted by growth in sales of maintenance and renovation equipment and steady earnings despite broader market headwinds, signaling operational strength and investor confidence. We'll explore how Pool's confirmed...

2025-11-02

Billionaire Warren Buffett's Latest Stock Buy Is Now on Sale for Less Than He Paid. Is It Still Worth It?

Description: You could pick up shares today and pay less than Buffett did! The big question is, should you?

3 Warren Buffett Stocks to Buy Hand Over Fist in November

Description: Warren Buffett's Berkshire Hathaway owns dozens of stocks, but these are the three you should pounce on.

2025-11-01

2025-10-31

2025-10-30

Landstar Enhances Its Board of Directors, Appoints Barr Blanton and Melanie Housey Hart

Description: JACKSONVILLE, Fla., Oct. 30, 2025 (GLOBE NEWSWIRE) -- Landstar System, Inc. (NASDAQ: LSTR), a technology-enabled, asset-light provider of integrated freight transportation solutions, delivering safe, specialized transportation services, announced today the addition of Barr Blanton and Melanie Housey Hart to its Board of Directors. Barr Blanton, 42, is a recognized leader in technology advisory and business transformation. He currently serves as chief executive officer and a member of the board o

5 Dividend Stocks to Hold for the Next 10 Years

Description: These consumer-facing businesses have the brand power to continue growing their dividends and your portfolio for the foreseeable future.

5 Must-Read Analyst Questions From Pool’s Q3 Earnings Call

Description: Pool’s third quarter results reflected stable performance in a challenging environment, with management attributing sales growth to consistent maintenance demand and early signs of stabilization in new pool construction and remodel activity. CEO Peter Arvan highlighted that growth in building materials and increased adoption of digital tools like POOL360 supported gross margin expansion. Management pointed out that chemical sales were impacted by deflation in certain products, but overall volume

2025-10-29

Evaluating Pool Corp (POOL): Is Recent Modest Growth Already Reflected in the Current Valuation?

Description: Pool (POOL) just released its third quarter results, and investors are paying close attention. The headline numbers show a slight uptick in revenue and net income for the quarter; however, year-to-date trends continue to signal challenges for the company’s core operations. See our latest analysis for Pool. Following the earnings update, Pool’s share price has reflected the shifting sentiment. Year-to-date, the share price return is down 13.8%, and the one-year total shareholder return sits...

YETI or POOL: Which Is the Better Value Stock Right Now?

Description: YETI vs. POOL: Which Stock Is the Better Value Option?

3 Cash-Producing Stocks We Steer Clear Of

Description: While strong cash flow is a key indicator of stability, it doesn’t always translate to superior returns. Some cash-heavy businesses struggle with inefficient spending, slowing demand, or weak competitive positioning.

2025-10-28

2025-10-27

My 2 Favorite Warren Buffett Stocks to Buy Right Now

Description: Warren Buffett owns these two stocks, and you might want to, too, but each one has a very different story to tell.

2025-10-26

2025-10-25

2025-10-24

Pool Corp Q3 Earnings & Revenues Surpass Estimates, Rise Y/Y

Description: POOL's Q3 earnings and revenues beat estimates, driven by steady maintenance demand and digital expansion momentum.

POOL Q3 Deep Dive: Margin Expansion and Technology Investment Amid Cautious Consumer Demand

Description: Swimming pool distributor Pool (NASDAQ:POOL) met Wall Street’s revenue expectations in Q3 CY2025, with sales up 1.3% year on year to $1.45 billion. Its GAAP profit of $3.40 per share was in line with analysts’ consensus estimates.

2025-10-23

Pool Corp (POOL) Margin Declines Challenge Bullish Narratives Despite High-Quality Earnings

Description: Pool (POOL) posted a net profit margin of 7.7%, down from 8.5% a year ago, and has faced a 2.8% annual decline in earnings over the past five years, with negative earnings growth in the most recent year. Looking ahead, analysts expect earnings to increase 6.5% per year and revenue to grow at 4% annually. Both figures lag broader US market averages. Shares currently change hands at $300.31 and trade at 27.4x earnings, a premium to industry peers. With high earnings quality and an appealing...

Pool Corp (POOL) Q3 2025 Earnings Call Highlights: Steady Growth Amid Market Challenges

Description: Pool Corp reports a 1% increase in net sales and a 4% rise in EPS, while navigating market fluctuations and investing in technology for future growth.

Pool Corp. (POOL) Surpasses Q3 Earnings and Revenue Estimates

Description: Pool Corp. (POOL) delivered earnings and revenue surprises of +0.30% and +0.14%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Could Buying Pool Corp. Today Set You Up for Life?

Description: Warren Buffett doesn't buy stocks on a whim, which is why you might be interested in Berkshire Hathaway's investment in Pool Corp.

Pool (NASDAQ:POOL) Reports Q3 In Line With Expectations

Description: Swimming pool distributor Pool (NASDAQ:POOL) met Wall Street’s revenue expectations in Q3 CY2025, with sales up 1.3% year on year to $1.45 billion. Its GAAP profit of $3.40 per share was in line with analysts’ consensus estimates.

Pool Corp.: Q3 Earnings Snapshot

Description: POOL on Thursday reported third-quarter profit of $126.5 million. On a per-share basis, the Covington, Louisiana-based company said it had net income of $3.40. Earnings, adjusted for pretax gains, came to $3.39 per share.

Pool Corporation Reports Third Quarter Results

Description: Q3 2025 Highlights Net sales increased 1% from Q3 2024 to $1.5 billion, following growth in Q2 2025Gross margin of 29.6% expanded 50 bps from Q3 2024Diluted EPS increased 4% from Q3 2024 to $3.40Confirms annual earnings guidance range of $10.81-$11.31 per diluted share, including year-to-date ASU 2016-09 tax benefit of $0.11 COVINGTON, La., Oct. 23, 2025 (GLOBE NEWSWIRE) -- Pool Corporation (Nasdaq/GSM:POOL) today reported results for the third quarter of 2025 and confirmed its annual earnings g

2025-10-22

Evaluating Pool’s Stock Performance as Consumer Spending Uncertainty Weighs on Outlook

Description: If you have been watching Pool’s stock price chart with a bit of confusion lately, you are not alone. Over the short term, Pool has gained 2.4% in the past week, but zooming out tells a less sunny story. The thirty-day period shows a nearly 5% drop, and the year-to-date slide now sits at 9.1%. Looking farther back, the past year has been tough, with a decline of 12.4%. The five-year total underscores the challenge with a drop of nearly 13%. However, examining the three-year horizon reveals...

2025-10-21

Pool (POOL) Q3 Earnings Report Preview: What To Look For

Description: Swimming pool distributor Pool (NASDAQ:POOL) will be announcing earnings results this Thursday before the bell. Here’s what to look for.

Pool Corporation To Celebrate 30 Years On Nasdaq By Ringing The Opening Bell

Description: COVINGTON, La., Oct. 21, 2025 (GLOBE NEWSWIRE) -- Pool Corporation (Nasdaq: POOL), the world’s largest wholesale distributor of swimming pool supplies, equipment and related leisure products and a member of the S&P 500 Index, will celebrate its 30th anniversary as a publicly listed company by ringing the opening bell at the Nasdaq MarketSite later this month. “I am incredibly proud to celebrate Pool Corporation’s 30th anniversary by having my leadership team join me to ring Nasdaq’s opening bell

Pool Corp Gears Up to Report Q3 Earnings: Things to Keep in Mind

Description: POOL's Q3 results are likely to reflect steady gains from strong maintenance sales, franchise growth and expanding digital platforms despite macro headwinds.

2025-10-20

2025-10-19

Is This Louisiana-Based Company a Growth Opportunity for Investors?

Description: This company generates revenue even when the economy is unfavorable.