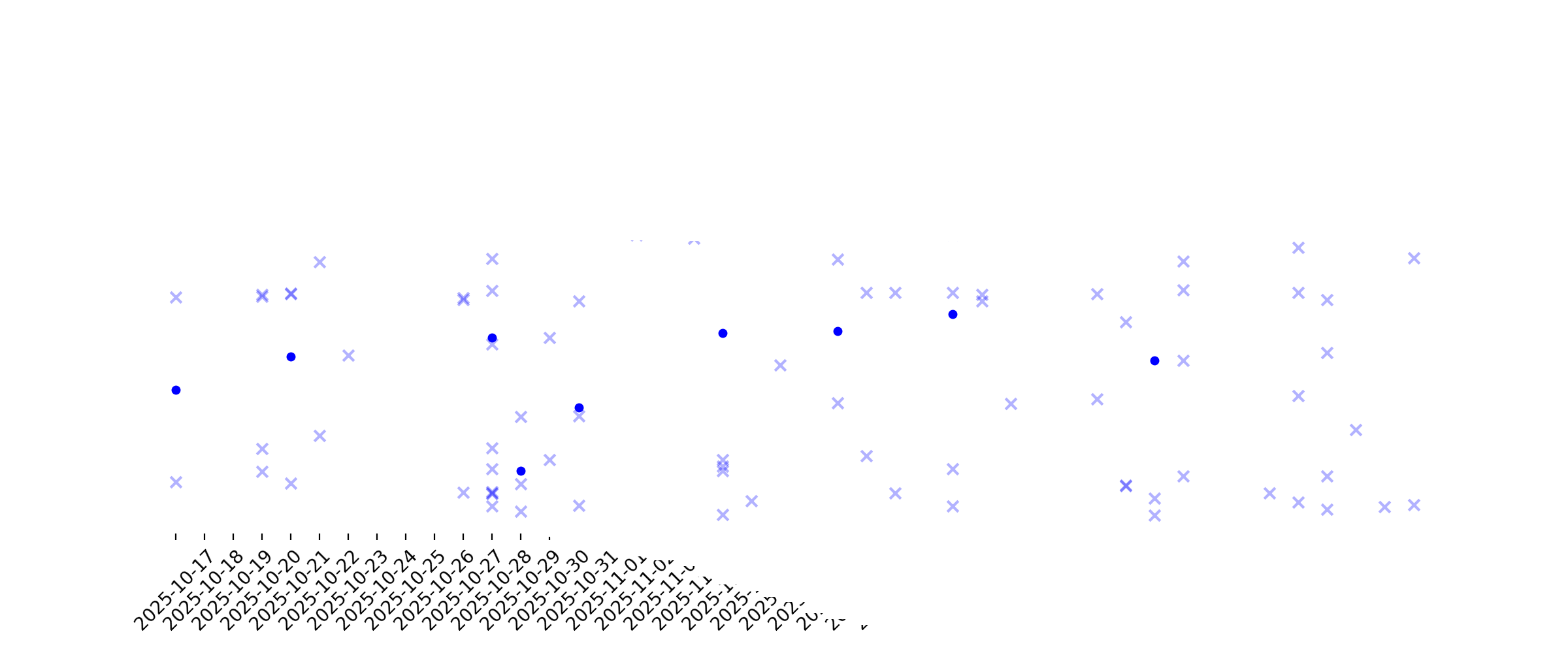

News sentiment analysis for PPL

Sentiment chart

2026-01-14

PPL (PPL) Gains As Market Dips: What You Should Know

Description: PPL (PPL) reached $35.53 at the closing of the latest trading day, reflecting a +1.57% change compared to its last close.

2026-01-13

2026-01-12

2026-01-11

2026-01-10

2026-01-09

2026-01-08

2026-01-07

PPL (PPL) Suffers a Larger Drop Than the General Market: Key Insights

Description: The latest trading day saw PPL (PPL) settling at $34.44, representing a -1.29% change from its previous close.

2026-01-06

PPL Corporation (NYSE:PPL) Has A ROE Of 7.6%

Description: Many investors are still learning about the various metrics that can be useful when analysing a stock. This article is...

2026-01-05

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

PPL vs. XEL: Which Utility Stock Looks Stronger for the Year Ahead?

Description: PPL and XEL ramp up clean energy and grid investments to meet surging power demand and drive long-term growth.

Is PPL (PPL) a Buy as Wall Street Analysts Look Optimistic?

Description: The average brokerage recommendation (ABR) for PPL (PPL) is equivalent to a Buy. The overly optimistic recommendations of Wall Street analysts make the effectiveness of this highly sought-after metric questionable. So, is it worth buying the stock?

2025-12-29

How Does Duke Energy's Regulated Utility Model Drive Stable Growth?

Description: DUK's regulated utility model helps it recover costs and earn stable returns on clean energy investments.

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

2025-12-21

PPL (PPL) Valuation Check as Storm Outages and Proposed Rate Hike Draw Investor Scrutiny

Description: PPL (PPL) is back in the spotlight after severe wind storms knocked out power to tens of thousands across central Pennsylvania, just as the utility pushes a sizable rate hike to fund grid upgrades. See our latest analysis for PPL. Despite the storm outages and headline risk around its proposed rate hike, PPL’s share price at $34.29 still sits on a solid footing, with a positive year to date share price return and a notably stronger multi year total shareholder return. This suggests momentum...

2025-12-20

Does Recent Strength in PPL Shares Still Leave Room for Upside in 2025?

Description: If you are wondering whether PPL is still a sensible buy at today’s price or if the easy money has already been made, you are not alone. The valuation story is more nuanced than the headline numbers suggest. The stock has delivered a 0.9% gain over the last week, is up 6.6% year to date and 9.2% over the past year, while longer term holders have seen roughly 28.7% and 54.6% total returns over 3 and 5 years, respectively. Those moves have come as investors refocus on regulated utilities with...

2025-12-19

PPL (PPL) Stock Slides as Market Rises: Facts to Know Before You Trade

Description: PPL (PPL) concluded the recent trading session at $34.29, signifying a -1.32% move from its prior day's close.

2025-12-18

2025-12-17

2025-12-16

PPL Stock Trades at Premium Value: Should You Buy, Hold or Sell?

Description: PPL trades at a premium P/E amid rising data center demand, dividend growth plans and a $20 billion investment outlook.

2025-12-15

2025-12-14

2025-12-13

2025-12-12

2025-12-11

2025-12-10

How Is PPL Corporation's Stock Performance Compared to Other Utilities Stocks?

Description: PPL Corporation has underperformed the Utilities industry over the past year, but analysts are cautiously optimistic about the stock’s prospects.

2025-12-09

PPL to Gain From Steady Investment in Clean Energy & Infrastructure

Description: PPL advances its long-term infrastructure and clean-energy investments as it targets major emission cuts and carbon neutrality by 2050.

2025-12-08

2025-12-07

PPL's (NYSE:PPL) Returns Have Hit A Wall

Description: If you're looking for a multi-bagger, there's a few things to keep an eye out for. Firstly, we'd want to identify a...

2025-12-06

2025-12-05

2025-12-04

2025-12-03

2025-12-02

2025-12-01

2025-11-30

2025-11-29

Accenture (ACN) Expands Palantir Capabilities With RANGR Data Acquisition and New AI Investments

Description: Accenture Plc. (NYSE:ACN) ranks among the best slow growth stocks to invest in. On November 20, Accenture Plc. (NYSE:ACN) acquired RANGR Data, a Palantir partner with extensive experience using a client-centric strategy to drive scaled transformation. The acquisition is expected to expand Accenture’s Palantir business in the US by adding 40 employees with experience in […]

2025-11-28

2025-11-27

PPL vs. AEE: Which Dividend-Paying Utility Looks More Attractive?

Description: AEE edges past PPL with stronger earnings growth, ROE, and capex plans, despite trading at a premium valuation.

2025-11-26

2025-11-25

Brokers Suggest Investing in PPL (PPL): Read This Before Placing a Bet

Description: The average brokerage recommendation (ABR) for PPL (PPL) is equivalent to a Buy. The overly optimistic recommendations of Wall Street analysts make the effectiveness of this highly sought-after metric questionable. So, is it worth buying the stock?

2025-11-24

2025-11-23

2025-11-22

Accenture (ACN): Evaluating Valuation Following New Digital Transformation Partnerships with PPL Corporation and Essity

Description: Accenture (ACN) is gaining attention after revealing new collaborations with PPL Corporation and Essity. This showcases its efforts to deliver advanced cloud, AI, and financial management solutions. These moves highlight the firm's growing impact on digital transformation. See our latest analysis for Accenture. Momentum around Accenture has been mixed, with shares jumping 4.6% in the past day following news of fresh industry partnerships but still reflecting a 27.8% decline year-to-date. Its...

2025-11-21

PPL to Pay Quarterly Stock Dividend Jan 2, 2026

Description: PPL Corporation (NYSE: PPL) declared a quarterly common stock dividend on Friday, Nov. 21, 2025, of $0.2725 per share, payable Jan. 2, 2026 to shareowners of record as of Dec.10, 2025.

2025-11-20

What Catalysts Are Shaping the Evolving Story for PPL Investors?

Description: PPL stock has recently seen analysts adjust their price target, reflecting evolving views on sector dynamics and company performance. Updates include a modest increase in the discount rate and a slight reduction in projected revenue growth. This is counterbalanced by persistent optimism toward long-term catalysts such as data center expansion and nuclear energy. Stay tuned to discover how these shifting factors shape the ongoing narrative and to learn how to keep informed about future...

PPL Underperforms Its Industry in Six Months: How to Play the Stock?

Description: PPL stands to benefit from surging data center demand and major grid upgrades, but its premium valuation and softer returns are concerns.

2025-11-19

PPL Capital Funding, Inc. announces pricing of $1 billion of 3.000% Exchangeable Senior Notes

Description: PPL Capital Funding, Inc. ("PPL Capital Funding"), a wholly-owned subsidiary of PPL Corporation (NYSE: PPL), announced today the pricing of $1 billion aggregate principal amount of its 3.000% Exchangeable Senior Notes due 2030 (the "notes") in a private placement (the "offering") to persons reasonably believed to be qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the "Securities Act"). PPL Capital Funding also granted the initial purchasers of t

PPL Capital Funding, Inc. announces proposed private placement of $1 billion of Exchangeable Senior Notes

Description: PPL Capital Funding, Inc. ("PPL Capital Funding"), a wholly-owned subsidiary of PPL Corporation (NYSE: PPL), announced today that it intends to offer, subject to market conditions and other factors, $1 billion aggregate principal amount of its Exchangeable Senior Notes due 2030 (the "notes") in a private placement (the "offering") to persons reasonably believed to be qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the "Securities Act"). PPL Capi

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

2025-11-11

PPL (PPL): Reassessing Valuation After Raised Guidance and Strong Earnings Boost Growth Outlook

Description: PPL (PPL) shares were in focus after the company released new 2025 earnings guidance and reported stronger results for the recent quarter. Investors are watching these moves because they highlight PPL’s improving performance and future outlook. See our latest analysis for PPL. Investors have taken notice of PPL’s recent earnings and sharp 2025 guidance, which came after financial results showing stronger sales and profits across the board. That momentum is reflected in a year-to-date share...

Accenture and Apptio Team Up with PPL to Unlock Deeper Technology Spending Insights

Description: NEW YORK, November 11, 2025--Accenture and Apptio are working with PPL Corporation to transform how the company prioritizes and manages technology spending.

2025-11-10

2025-11-09

2025-11-08

2025-11-07

Wall Street Bulls Look Optimistic About PPL (PPL): Should You Buy?

Description: The average brokerage recommendation (ABR) for PPL (PPL) is equivalent to a Buy. The overly optimistic recommendations of Wall Street analysts make the effectiveness of this highly sought-after metric questionable. So, is it worth buying the stock?

2025-11-06

PPL (PPL) Reports Q3 Earnings: What Key Metrics Have to Say

Description: The headline numbers for PPL (PPL) give insight into how the company performed in the quarter ended September 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Are Wall Street Analysts Bullish on PPL Corporation Stock?

Description: Although PPL Corporation has underperformed the broader market over the past year, Wall Street analysts maintain a moderately optimistic outlook about the stock’s prospects.

2025-11-05

PPL (PPL) Net Margin Rises to 11.2%, Highlighting Ongoing Profitability Debate

Description: PPL (PPL) reported a 17.5% increase in earnings for the latest year, though this pace came in below its average of 20.9% annual growth over the past five years. Looking forward, PPL is expected to deliver 12% earnings growth and 5% revenue growth per year, both tracking below broader US market averages. Net profit margins improved to 11.2% from 10.2% last year. Investors have seen shares trade at $36.37, reflecting a premium compared to the company's estimated fair value and sector...

PPL Corp (PPL) Q3 2025 Earnings Call Highlights: Strong Earnings and Strategic Investments ...

Description: PPL Corp (PPL) reports robust Q3 earnings and outlines ambitious infrastructure investments to drive future growth.

PPL Beats Q3 Earnings & Revenues Estimates, Narrows EPS Guidance

Description: PPL posts solid third-quarter results with earnings and revenue beats, boosted by stronger sales and segment gains, while tightening its 2025 EPS outlook

PPL (PPL) Surpasses Q3 Earnings and Revenue Estimates

Description: PPL (PPL) delivered earnings and revenue surprises of +4.35% and +3.08%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

PPL: Q3 Earnings Snapshot

Description: PPL) on Wednesday reported third-quarter net income of $318 million. On a per-share basis, the Allentown, Pennsylvania-based company said it had net income of 43 cents. Earnings, adjusted for non-recurring costs and costs related to mergers and acquisitions, were 48 cents per share.

Stocks Fall Pre-Bell as Investors Await ADP Employment Report, Fresh Corporate Earnings

Description: The main US stock measures were tracking in the red in Wednesday's premarket activity as traders awa

PPL Corporation reports third-quarter 2025 results; narrows earnings forecast and reaffirms growth targets

Description: PPL Corporation (NYSE: PPL) today announced third-quarter 2025 reported earnings (GAAP) of $318 million, or $0.43 per share, compared with third-quarter 2024 reported earnings of $214 million, or $0.29 per share.

2025-11-04

PPL to Report Q3 Earnings: What's in Store for the Stock this Season?

Description: PPL's third-quarter results hinge on data center demand, cost cuts and grid upgrades, but its premium valuation may temper investor enthusiasm.

PPL (PPL) Q3 Earnings Preview: What You Should Know Beyond the Headline Estimates

Description: Looking beyond Wall Street's top-and-bottom-line estimate forecasts for PPL (PPL), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended September 2025.

2025-11-03

2025-11-02

How Kentucky Project Approvals at PPL (PPL) Have Changed Its Investment Story

Description: In recent days, PPL Corporation received approval from Kentucky regulators for the construction of two new natural gas combined-cycle units and environmental facility upgrades, supporting long-term electricity demand and grid reliability in the region. This regulatory approval aligns with PPL’s plans to deploy up to US$20 billion for grid modernization and expansion through 2028, highlighting the company’s efforts to meet surging demand from data center growth and broader...

2025-11-01

2025-10-31

2025-10-30

PPL vs. Duke Energy: Which Utility Stock Offers Better Value for Now?

Description: Both PPL and DUK stocks have massive long-term capital expenditure to expand their infrastructure and add more clean projects in their portfolio.

Alliant Energy (LNT) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Description: Alliant Energy (LNT) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

LG&E and KU receive approval on plans to meet Kentucky's growing energy needs

Description: Louisville Gas and Electric Company and Kentucky Utilities Company received approval October 28 from the Kentucky Public Service Commission (KPSC) to add new generation that will support LG&E and KU's ability to continue serving customers safely and reliably, while keeping pace with Kentucky's record-breaking economic development needs.

2025-10-29

NorthWestern (NWE) Q3 Earnings and Revenues Surpass Estimates

Description: NorthWestern (NWE) delivered earnings and revenue surprises of +5.33% and +1.59%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

PPL (PPL) Stock Moves -1.16%: What You Should Know

Description: PPL (PPL) reached $36.48 at the closing of the latest trading day, reflecting a -1.16% change compared to its last close.

PPL (PPL) Earnings Expected to Grow: Should You Buy?

Description: PPL (PPL) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2025-10-28

2025-10-27

2025-10-26

2025-10-25

PPL (PPL): Valuation in Focus as Pennsylvania Regulators Launch Formal Review of Planned Rate Hike

Description: The Pennsylvania Public Utility Commission has put PPL (PPL)’s proposed annual revenue increase under review, pausing the company’s planned rate hike for nearly 1.5 million customers while a formal investigation unfolds. See our latest analysis for PPL. Shares of PPL have experienced a steady climb this year, with a 16.1% share price gain year-to-date and a robust 18.9% total shareholder return over the past twelve months. The recent regulatory developments, alongside upcoming earnings and...

2025-10-24

What You Need to Know Ahead of PPL Corporation's Earnings Release

Description: PPL Corporation is expected to announce its fiscal third-quarter earnings next month, and analysts project a high single-digit earnings growth.

2025-10-23

PPL (PPL) Stock Declines While Market Improves: Some Information for Investors

Description: The latest trading day saw PPL (PPL) settling at $37.36, representing a -1.03% change from its previous close.

2025-10-22

Wall Street Analysts Think PPL (PPL) Is a Good Investment: Is It?

Description: Based on the average brokerage recommendation (ABR), PPL (PPL) should be added to one's portfolio. Wall Street analysts' overly optimistic recommendations cast doubt on the effectiveness of this highly sought-after metric. So, is the stock worth buying?

2025-10-21

PPL Corporation (PPL): A Bull Case Theory

Description: We came across a bullish thesis on PPL Corporation on Beat the TSX (BTSX-20)’s Substack by Beat the TSX-27 Strategy. In this article, we will summarize the bulls’ thesis on PPL. PPL Corporation’s share was trading at $37.08 as of September 29th. PPL’s trailing and forward P/E were 27.61 and 18.87 respectively according to Yahoo Finance. Pembina […]

2025-10-20

LG&E and KU reach agreement with key stakeholders on rate requests that strengthen reliability and improve service for customers

Description: Louisville Gas and Electric Company and Kentucky Utilities Company have reached an agreement with the majority of the intervening parties to their requests to adjust base rates that support necessary, ongoing system enhancements and hardening projects to defend against the impacts of more frequent and severe storms, implement new technologies, meet increased energy needs and improve customers' service.

2025-10-19

2025-10-18

2025-10-17

Is PPL’s Strong 2025 Rally Justified After Recent Cash Flow Turnaround?

Description: If you have been watching PPL stock or even just dabbling in the utilities sector, you have probably noticed its steady march upward. With a closing price of $37.44, PPL is up 0.6% in the last week and has notched a robust 5.1% gain over the past month. Over the long run, it has delivered a 16.3% gain year-to-date and an impressive 18.3% return over the past year. Even stepping back further, the stock has delivered 61.5% in the last three years and 59.3% over five years. The kind of...