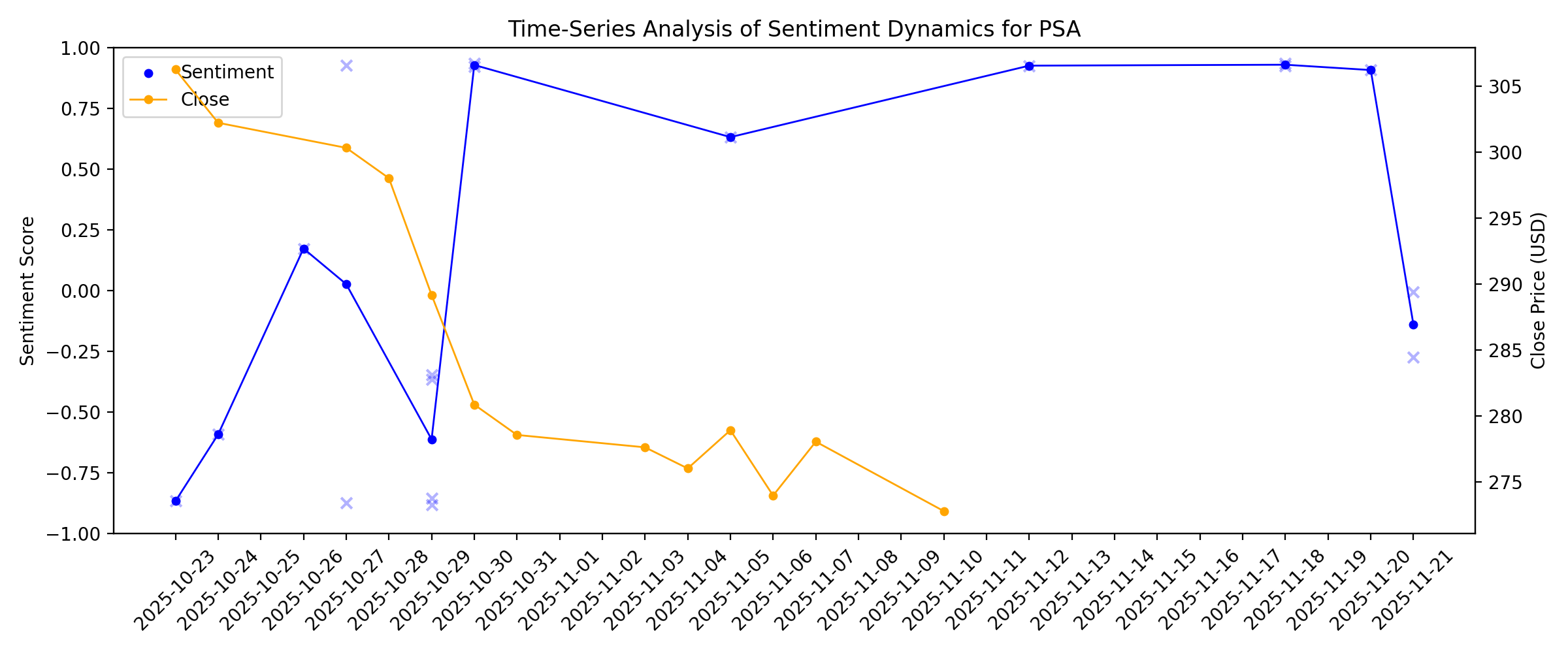

News sentiment analysis for PSA

Sentiment chart

2026-01-14

Is Public Storage (PSA) Pricing Reflect Its DCF And P/E Valuation Signals Today

Description: If you are looking at Public Storage and asking whether the current price lines up with its underlying value, this breakdown is designed for you. The share price last closed at US$279.83, with returns of 3.5% over the past 7 days, 1.8% over 30 days and 8.3% year to date, alongside a 0.6% return over 1 year, 8.5% over 3 years and 57.2% over 5 years. Recent attention on Public Storage has been supported by ongoing coverage of the self storage industry and investor interest in real estate names...

Public Storage Announces Tax Treatment of 2025 Dividends

Description: GLENDALE, Calif., January 14, 2026--Public Storage (NYSE:PSA) announced today the tax treatment of the Company’s 2025 dividends. For the tax year ended December 31, 2025, distributions for the PSA common stock and all the various series of preferred stock were classified as follows:

2026-01-13

OUT or PSA: Which Is the Better Value Stock Right Now?

Description: OUT vs. PSA: Which Stock Is the Better Value Option?

Raymond James Analysts’ Best Picks Could Explode Again in 2026: 4 Red-Hot Dividend Stocks

Description: The Raymond James Best Picks list for 2026 is strong, and we identified four quality stocks for growth and income investors that offer solid dividends and strong upside potential.

2026-01-12

2026-01-11

2026-01-10

2026-01-09

2026-01-08

2026-01-07

2026-01-06

Key Reasons to Add Public Storage Stock to Your Portfolio Now

Description: PSA's strong brand, recession-resistant model, tech-driven efficiencies and $3.76B in acquisitions position it well for steady long-term growth.

2026-01-05

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

2025-12-21

2025-12-20

2025-12-19

2025-12-18

2025-12-17

2025-12-16

2025-12-15

2025-12-14

2025-12-13

2025-12-12

2025-12-11

Public Storage (PSA): Revisiting Valuation After Recent Share Price Weakness

Description: Public Storage (PSA) has quietly slipped over the past month, with the stock down about 4% and roughly 13% lower over the past year, prompting a closer look at its long term REIT story. See our latest analysis for Public Storage. That slide fits a wider pattern, with the 30 day share price return of minus 3.69% and year to date share price return of minus 9.76% pointing to fading momentum even as the five year total shareholder return of 41.08% still reflects a solid long run outcome. If...

2025-12-10

Is Softer New-Lease Rents Amid Expansion Changing the Investment Case for Public Storage (PSA)?

Description: In recent weeks, Public Storage reported lower average contract rent per square foot for new tenants while expanding its portfolio with 88 acquired or contracted facilities in 2025, adding 6.1 million net rentable square feet. At the same time, sector commentary points to early signs of a self-storage recovery, with market rents turning positive and occupancy trends improving after a period of pressure. We’ll now explore how this combination of early sector stabilisation and Public...

Does Public Storage’s 2025 Valuation Reflect Its Recent Share Price Slide?

Description: If you have been wondering whether Public Storage is a bargain or a value trap at current levels, you are not alone. This breakdown aims to give you a clear, no jargon answer. The stock is down about 3.8% over the last week, 1.9% over the last month, and roughly 9.8% year to date, even though the 5 year return still sits at a solid 45.2%. These moves are playing out against a backdrop of shifting expectations for interest rates and ongoing debate about demand for self storage as households...

2025-12-09

2025-12-08

Is the worst over for storage REITs? RBC sees pricing turning positive

Description: Investing.com -- Storage landlords are showing early signs of stabilisation after years of pricing pressure, with RBC Capital Markets arguing that “most things are in place for a storage recovery.”

2025-12-07

Brookfield, GIC Agree $4.5 Billion Deal for Australia’s National Storage

Description: The consortium entered into a takeover agreement for the largest self-storage provider in Australia and New Zealand after almost two weeks of exclusive due diligence.

2025-12-06

2025-12-05

CoreWeave initiated, Unity upgraded: Wall Street's top analyst calls

Description: CoreWeave initiated, Unity upgraded: Wall Street's top analyst calls

2025-12-04

2025-12-03

Is Public Storage Stock Underperforming the S&P 500?

Description: Although Public Storage stock has underperformed the S&P 500 over the past year, analysts remain moderately bullish about its prospects.

2025-12-02

2025-12-01

2025-11-30

2025-11-29

2025-11-28

2025-11-27

2025-11-26

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

Public Storage (PSA): Evaluating Potential Value After Recent Share Price Decline

Description: Public Storage (PSA) shares dipped slightly over the past week, continuing a gradual trend that has left the stock down 14% over the past month. Investors may be weighing short-term pressures against the company’s longer-term performance. See our latest analysis for Public Storage. Public Storage’s latest 30-day share price return of -13.89% reflects a clear loss of momentum, following a string of mild setbacks throughout the year. While the 1-year total shareholder return sits at -17.76%,...

Equinix Hosts Merck KGaA's HPC at its Data Center in Germany

Description: EQIX hosts Merck KGaA's new liquid-cooled high-performance computer in Germany, blending private and public cloud to boost scalable, efficient scientific computing.

2025-11-20

Is Wall Street Bullish or Bearish on Public Storage Stock?

Description: Public Storage has underperformed the broader market over the past year, but analysts are moderately optimistic about the stock’s prospects.

2025-11-19

2025-11-18

HIW's $223M Bet on 6Hundred at Legacy Union: Time to Buy the Stock?

Description: Highwoods' $223M move to acquire 6Hundred at Legacy Union boosts its Charlotte footprint and adds long-term cash-flow upside.

Medical Properties Rewards Investors With 12.5% Dividend Hike

Description: MPW raises its dividend payout by 12.5%. Its ability to generate decent cash flows and a solid balance sheet position is likely to support the latest hike.

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

Four Corners Rewards Investors With a 3.2% Dividend Increase

Description: FCPT raises its dividend payout by 3.2%. Its ability to generate decent cash flows and solid balance sheet position are likely to support the latest hike.

2025-11-11

2025-11-10

2025-11-09

2025-11-08

2025-11-07

2025-11-06

2025-11-05

How the Narrative Around Public Storage Is Shifting After Recent Analyst and Company Updates

Description: Public Storage’s stock recently saw its consensus analyst price target inch upward from $322.74 to $326.16. This change highlights a modestly more optimistic view of the company’s fair value. The adjustment follows new research that considers both the benefits of tighter industry supply in self-storage and the challenges created by housing market uncertainty. Stay tuned to discover how to track these evolving perspectives and stay informed on future updates for Public Storage stock. Stay...

2025-11-04

2025-11-03

2025-11-02

2025-11-01

2025-10-31

2025-10-30

Public Storage PSA Q3 2025 Earnings Transcript

Description: Joseph D. Russell: Thank you, Ryan, and thank you all for joining us today. Public Storage's third quarter results reflect differentiated strategies that continue to drive our outperformance. In addition to encouraging industry trends, including operational stabilization, lower competition from new supply, and increasing acquisition activity, we are raising our 2025 outlook for the second consecutive quarter based on outperformance in same-store and non-same-store NOI growth, acquisition volume, and core FFO growth per share.

Public Storage's Q3 FFO & Revenues Beat Estimates, '25 View Raised

Description: PSA posts higher Q3 FFO and revenues, fueled by rent gains and acquisitions, and lifts its 2025 outlook on stabilizing operations.

2025-10-29

Public Storage (PSA) Q3 Earnings: Taking a Look at Key Metrics Versus Estimates

Description: The headline numbers for Public Storage (PSA) give insight into how the company performed in the quarter ended September 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Public Storage (PSA) Q3 FFO and Revenues Top Estimates

Description: Public Storage (PSA) delivered FFO and revenue surprises of +1.65% and +1.22%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Public Storage: Q3 Earnings Snapshot

Description: The real estate investment trust, based in Glendale, California, said it had funds from operations of $758.7 million, or $4.31 per share, in the period. The average estimate of eight analysts surveyed by Zacks Investment Research was for funds from operations of $4.24 per share. Funds from operations is a closely watched measure in the REIT industry.

Public Storage Reports Results for the Three and Nine Months Ended September 30, 2025

Description: GLENDALE, Calif., October 29, 2025--Public Storage (NYSE:PSA) announced today operating results for the three and nine months ended September 30, 2025.

2025-10-28

2025-10-27

PSA Set to Report Q3 Earnings: What to Expect From the Stock?

Description: Public Storage's Q3 growth is expected to stem from technology-driven efficiencies and economies of scale, boosting revenues and FFO.

Easterly Government Properties (DEA) Meets Q3 FFO Estimates

Description: Easterly Government Properties (DEA) delivered FFO and revenue surprises of 0.00% and +0.88%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

2025-10-26

Public Storage (PSA): Exploring Current Valuation After Recent Share Price Movement

Description: Public Storage (PSA) has been quietly moving in recent trading, with shares dropping slightly over the past week while making up some ground for the month. The company’s yearly data paints a mixed but intriguing picture for investors tracking the real estate sector. See our latest analysis for Public Storage. Public Storage’s recent share price slip comes after a modest rally in recent weeks. While momentum has been mixed, the company’s long-term total shareholder return remains healthy, up...

2025-10-25

2025-10-24

Countdown to Public Storage (PSA) Q3 Earnings: Wall Street Forecasts for Key Metrics

Description: Beyond analysts' top-and-bottom-line estimates for Public Storage (PSA), evaluate projections for some of its key metrics to gain a better insight into how the business might have performed for the quarter ended September 2025.

2025-10-23

OUT vs. PSA: Which Stock Is the Better Value Option?

Description: OUT vs. PSA: Which Stock Is the Better Value Option?