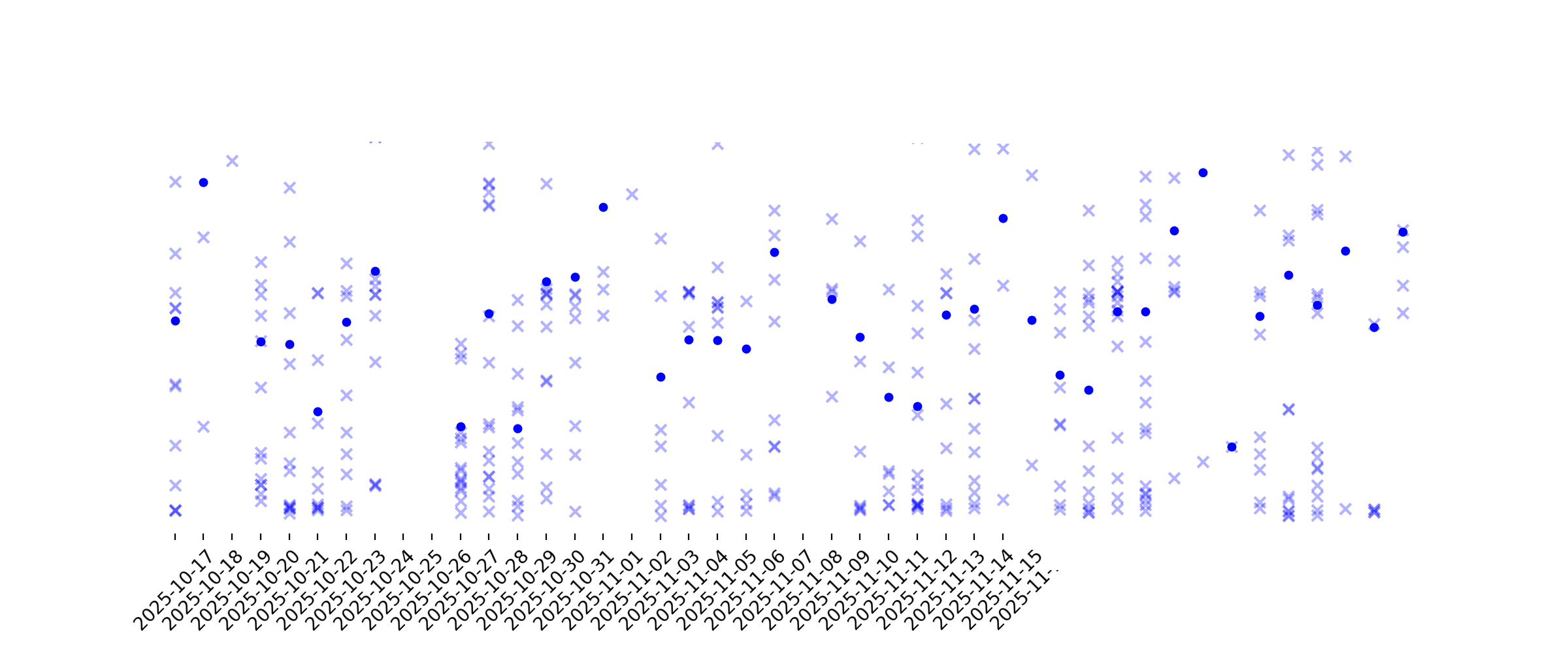

News sentiment analysis for REG

Sentiment chart

2026-01-14

2026-01-13

Regency Centers Corporation’s Q4 2025 Earnings: What to Expect

Description: Regency Centers is set to report its Q4 earnings early next month. Here’s what analysts are expecting.

2026-01-12

2026-01-11

2026-01-10

2026-01-09

2026-01-08

2026-01-07

2026-01-06

Regency Centers Invites You to Join Its Fourth Quarter 2025 Earnings Conference Call

Description: JACKSONVILLE, Fla., Jan. 06, 2026 (GLOBE NEWSWIRE) -- Regency Centers Corporation (“Regency Centers” or the “Company”) (NASDAQ: REG) will announce its fourth quarter 2025 earnings results on Thursday, February 5, 2026, after the market closes. The Company’s earnings release and supplemental information package will be posted on the Investor Relations section of the Company’s website – investors.regencycenters.com. The Company will host an earnings conference call on Friday, February 6, 2026, at

2026-01-05

2026-01-04

2026-01-03

2026-01-02

Is it Wise to Hold Regency Centers Stock in Your Portfolio Now?

Description: REG's grocery-anchored portfolio, strong leasing spreads and acquisitions support growth, but rising e-commerce and debt pressures cloud the outlook.

2026-01-01

2025-12-31

PECO or REG: Which Is the Better Value Stock Right Now?

Description: PECO vs. REG: Which Stock Is the Better Value Option?

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

Regency Centers (REG) Rating Adjusted in JPMorgan’s 2026 Outlook

Description: Regency Centers Corporation (NASDAQ:REG) is included among the Best Stocks for a Dividend Achievers List. On December 18, JPMorgan analyst Michael Mueller downgraded Regency Centers Corporation (NASDAQ:REG) to Neutral from Overweight. The price target moved down to $76 from $81. Mueller framed the move as tactical. He called it “simply a ‘stock call’ as we […]

2025-12-22

2025-12-21

2025-12-20

2025-12-19

2025-12-18

Is There Still Value in Regency Centers After Strong 3 and 5 Year Gains?

Description: Wondering if Regency Centers at around $67.71 is quietly setting up a value opportunity, or if the easy money has already been made? This breakdown is designed to help you decide without getting lost in REIT jargon. The stock has slipped a bit in the short term, down 0.1% over the last week and 2.6% over the past month, but long term holders are still sitting on gains of 23.0% over 3 years and 82.2% over 5 years, despite being down 6.2% year to date and 2.6% over the last year. Recently,...

2025-12-17

2025-12-16

Regency Centers Elects Mark J. Parrell to Board of Directors

Description: JACKSONVILLE, Fla., Dec. 16, 2025 (GLOBE NEWSWIRE) -- Regency Centers Corporation (“Regency Centers” or “Regency”) (Nasdaq: REG) today announced the election of Mark J. Parrell to its Board of Directors (the “Board”), effective January 1, 2026. With the addition of Mr. Parrell as an independent director, Regency will expand the size of its Board to twelve directors. “We are delighted to welcome Mark to our Board,” said Martin E. “Hap” Stein, Jr., Executive Chair of Regency Centers. “His proven l

Regency Centers Stock: Is REG Underperforming the Real Estate Sector?

Description: Regency Centers has underperformed compared to the broader real estate sector over the past year, yet analysts remain bullish on the stock’s prospects.

2025-12-15

2025-12-14

2025-12-13

2025-12-12

JP Morgan Has 5 Sizzling December Analyst Focus List High-Yield Dividend Picks

Description: Five high-yield stock picks from the J.P. Morgan December Analyst Focus List make sense for growth and income investors looking for the top ideas.

2025-12-11

2025-12-10

Key Reasons to Add Regency Centers Stock to Your Portfolio Now

Description: REG's grocery-anchored centers, solid rent growth and active expansions underscore its stability and long-term growth potential.

2025-12-09

2025-12-08

2025-12-07

2025-12-06

2025-12-05

2025-12-04

2025-12-03

2025-12-02

2025-12-01

2025-11-30

2025-11-29

Regency Centers (REG): Evaluating Valuation Perspectives After Recent Share Price Momentum

Description: Regency Centers (REG) has caught investor attention lately as its stock performance diverges from broader market trends. Investors are taking a close look at recent returns, company results, and what they might signal about future value. See our latest analysis for Regency Centers. Regency Centers has seen its share price edge up 2.6% over the past month, with momentum picking up slightly after a modest start to the year. While the 1-year total shareholder return stands at -2.2%, the...

2025-11-28

Why Is Equinix (EQIX) Down 9.9% Since Last Earnings Report?

Description: Equinix (EQIX) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

Is it Wise to Hold Regency Centers Stock in Your Portfolio?

Description: REG thrives on grocery-anchored strength, acquisitions and dividends but faces e-commerce threats, high debt and market concentration.

2025-11-27

PECO or REG: Which Is the Better Value Stock Right Now?

Description: PECO vs. REG: Which Stock Is the Better Value Option?

2025-11-26

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

2025-11-20

2025-11-19

2025-11-18

How Regency Centers, Independent Bank, And Peoples Bancorp Can Put Cash In Your Pocket

Description: Companies with a long history of paying dividends and consistently hiking them remain appealing to income-focused investors. Regency Centers, Independent Bank, and Peoples Bancorp have rewarded shareholders for years and recently announced dividend ...

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

A Look at Regency Centers (REG) Valuation Following Upbeat Q3 Results, Dividend Hike, and Raised 2025 Guidance

Description: Regency Centers (REG) just posted its third-quarter results, showing year-over-year increases in both same-property Net Operating Income and Funds From Operations. The company also raised its 2025 guidance and announced a higher dividend. See our latest analysis for Regency Centers. Regency Centers’ upbeat quarter and increased dividend have caught investor attention, but the stock recently dipped, down 3.1% right after earnings, highlighting how positive momentum does not always translate...

2025-11-12

2025-11-11

BofA lists 16 stock opportunities away from AI

Description: Investing.com -- Bank of America analysts said investor enthusiasm around artificial intelligence has left a range of attractively valued companies overlooked, identifying 16 “non-AI” opportunities that combine solid earnings momentum with discounted valuations.

2025-11-10

REG- A Diversified Shopping Center REIT with a Solid Yield

Description: Regency Centers Corp. (REG) is an owner, operator, and developer of shopping centers located in suburban areas with strong demographics. Major markets are in geographic areas located in states throughout the Northeast, Mid-Atlantic, Southeast, and the Midwest, highlights Martin Fridson, editor of Forbes/Fridson Income Securities Investor.

2025-11-09

2025-11-08

2025-11-07

2025-11-06

2025-11-05

2025-11-04

If Crypto and Gold Crash, 4 JP Morgan Top Dividend Picks Are Safe Havens

Description: These four top conservative stock picks from J.P. Morgan make sense for growth and income investors looking for the top safe-haven dividend-paying ideas.

2025-11-03

2025-11-02

2025-11-01

2025-10-31

2025-10-30

Regency Centers Corp (REG) Q3 2025 Earnings Call Highlights: Strong Growth and Strategic ...

Description: Regency Centers Corp (REG) reports robust NOI growth, raises full-year earnings outlook, and navigates competitive market dynamics.

2025-10-29

Regency Centers (REG): Net Margin Dip Challenges Bullish Narratives on Premium Valuation

Description: Regency Centers (REG) posted steady but moderate growth in its latest earnings update, with annual earnings expected to rise 8.6% per year and revenue forecast for 2.6% annual growth. Both figures trail the broader US market averages of 15.6% and 10.2%, respectively. Net profit margins notched 25.3%, reflecting a slight dip from last year's 26.2%, and recent annual earnings growth came in at 2%, well below the five-year average pace of 13.5%. For investors, the spotlight is now on the...

Did Strong Q3 Results and a Dividend Hike Just Shift Regency Centers' (REG) Investment Narrative?

Description: Regency Centers Corporation recently announced its third quarter 2025 results, reporting year-over-year increases in revenue, net income, and Same Property Net Operating Income, alongside a raised full-year earnings guidance and a more than 7% dividend increase on its common stock. The board also declared quarterly dividends for its Series A and Series B preferred stock, while the company initiated over US$170 million in new development and redevelopment projects and expanded its property...

Regency Centers Q3 FFO Meet Estimates, Same-Property NOI Rises

Description: REG posts steady Q3 results, with FFO matching estimates and revenues beating estimates, backed by strong leasing and same-property NOI growth.

A Look at Regency Centers (REG) Valuation After Raised Outlook and Higher Dividend

Description: Regency Centers (REG) delivered third quarter results that showed year-over-year growth in both revenue and net income. The company raised its outlook for the full year and announced a higher dividend for shareholders. These moves suggest management sees momentum continuing. See our latest analysis for Regency Centers. Regency Centers’ share price has hovered around $71 in recent weeks, showing little dramatic movement. The one-year total shareholder return stands at 2.7%, while longer-term...

2025-10-28

Regency Centers (REG) Matches Q3 FFO Estimates

Description: Regency Centers (REG) delivered FFO and revenue surprises of 0.00% and +0.60%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Regency Centers: Q3 Earnings Snapshot

Description: The results matched Wall Street expectations. The Jacksonville, Florida-based real estate investment trust said it had funds from operations of $213.5 million, or $1.15 per share, in the period. The average estimate of six analysts surveyed by Zacks Investment Research was for funds from operations of $1.15 per share.

Regency Centers Reports Third Quarter 2025 Results and Increases Common Stock Dividend

Description: JACKSONVILLE, Fla., Oct. 28, 2025 (GLOBE NEWSWIRE) -- Regency Centers Corporation (“Regency Centers,” “Regency” or the “Company”) (Nasdaq: REG) today reported financial and operating results for the quarterly period ended September 30, 2025, and provided updated 2025 earnings guidance. For the three months ended September 30, 2025 and 2024, Net Income Attributable to Common Shareholders was $0.58 and $0.54, respectively, per diluted share. Third Quarter 2025 Highlights Reported Nareit FFO of $1.

2025-10-27

2025-10-26

2025-10-25

2025-10-24

2025-10-23

2025-10-22

Regency Centers to Post Q3 Earnings: What's in Store for the Stock?

Description: REG is set to post Q3 results, with expected gains in revenues and FFO per share despite higher e-commerce adoption and interest expenses.