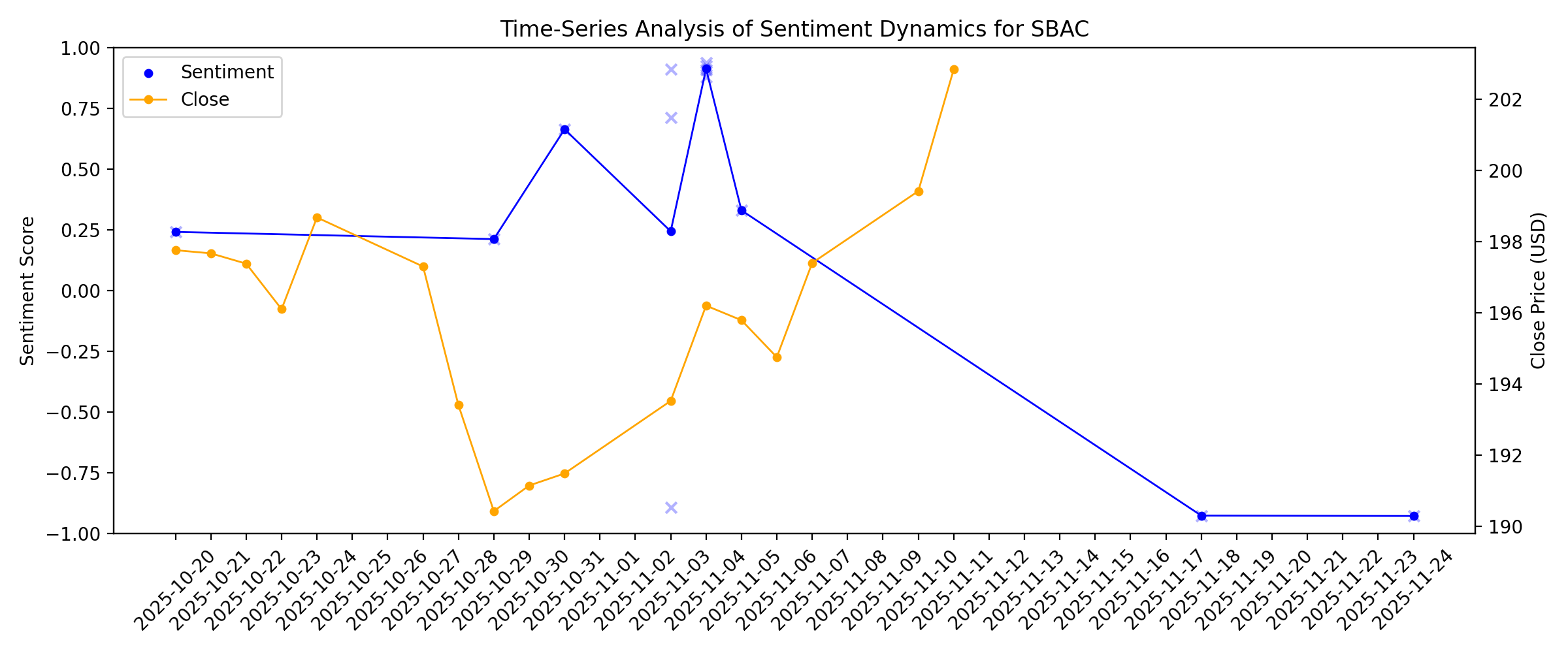

News sentiment analysis for SBAC

Sentiment chart

2026-01-14

2026-01-13

SBA Communications price target lowered to $240 from $245 at JPMorgan

Description: JPMorgan analyst Richard Choe lowered the firm’s price target on SBA Communications (SBAC) to $240 from $245 and keeps a Neutral rating on the shares. The firm reduced new leasing estimates for the tower companies ahead of earnings to reflect a more conservative approach due to the potential impact from EchoStar. A “modest” industry outlook is outweighed by the EchoStar/Dish overhang, but deals could be a positive catalyst for the tower stocks, the analyst tells investors in a research note.Clai

2026-01-12

2026-01-11

2026-01-10

2026-01-09

2026-01-08

2026-01-07

2026-01-06

2026-01-05

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

SBA Communications (SBAC) Upgraded to Buy: What Does It Mean for the Stock?

Description: SBA Communications (SBAC) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #2 (Buy).

2025-12-29

Here’s Why SBA Communications (SBAC) Has Promising Organic Growth Prospects

Description: TCW funds, an investment management company, released its “TCW Global Real Estate Fund” third-quarter 2025 investor letter. A copy of the letter can be downloaded here. The fund (I Share) returned +2.37% in the quarter compared to +4.50% for the S&P Global REIT Index. The overweight allocation in Diversified Real Estate Activities had a favorable […]

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

2025-12-21

2025-12-20

2025-12-19

2025-12-18

4 Reasons Why You Should Add SBAC Stock to Your Portfolio Now

Description: SBAC is positioned to benefit from carrier capex, long-term tower leases and portfolio expansion, even as shares dipped 4% over three months.

2025-12-17

2025-12-16

2025-12-15

2025-12-14

2025-12-13

2025-12-12

2025-12-11

SBA Communications (SBAC): Has the Recent Share Price Slide Opened a Valuation Opportunity?

Description: SBA Communications (SBAC) has been sliding over the past month, with the stock down about 7% and roughly 11% lower over the past year, prompting fresh questions about its valuation. See our latest analysis for SBA Communications. That slide fits a longer cooling trend for SBA Communications, with the share price down meaningfully over the past year and multi year total shareholder returns also negative. This suggests momentum has faded even as modest revenue and earnings growth continues. If...

2025-12-10

Rush Island Decided It Had Enough Fun With Six Flags Stock

Description: Six Flags recently made significant executive changes, hoping for a turnaround.

Is SBA Communications Stock Underperforming the S&P 500?

Description: While SBA Communications has underperformed the S&P 500 recently, analysts remain moderately optimistic about the stock’s prospects.

2025-12-09

2025-12-08

2025-12-07

2025-12-06

2025-12-05

2025-12-04

Is it Wise to Retain SBA Communications Stock in Your Portfolio Now?

Description: SBAC leans on long-term tower leases and global portfolio expansion to tap rising mobile data demand. However, customer concentration and high debt levels pose risk.

2025-12-03

Why Is SBA Communications (SBAC) Down 4.7% Since Last Earnings Report?

Description: SBA Communications (SBAC) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-12-02

How Recent Developments Are Rewriting the Story for SBA Communications

Description: Shares of SBA Communications recently experienced a minor adjustment in their price target, with fair value estimates moving from $235.71 to $235.29 per share. At the same time, the discount rate increased slightly, signaling greater perceived risk or required return. As market signals shift, it is important to stay informed about what drives these changes and how investors can track evolving sentiment moving forward. Stay updated as the Fair Value for SBA Communications shifts by adding it...

Barclays is Positive on SBA Communications Corporation (SBAC)

Description: SBA Communications Corporation (NASDAQ:SBAC) is one of the best dividend stocks in the real estate sector. On November 17, Barclays analyst Brendan Lynch reiterated a Buy call on SBAC along with a target price of $219. In a different business update, dated November 3, SBAC released its financial results for the third quarter of 2025. […]

2025-12-01

American Tower, Crown Castle downgraded as EchoStar disputes cloud tower leasing

Description: Investing.com -- Barclays downgraded American Tower and Crown Castle to Equal Weight, saying the tower companies face rising uncertainty over their ability to collect rent tied to EchoStar, which could push 2026 growth lower and limit prospects for a near term re-rating. Brokerage kept its Overweight on SBA Communications, which it said has less exposure to the dispute.

2025-11-30

2025-11-29

2025-11-28

2025-11-27

2025-11-26

2025-11-25

2025-11-24

SBA Communications Corporation to Speak at the UBS Global Media and Communications Conference

Description: BOCA RATON, Fla., November 24, 2025--SBA Communications Corporation (NASDAQ: SBAC) ("SBA") announces that Marc Montagner, Chief Financial Officer, is scheduled to speak at the UBS Global Media and Communications Conference, Tuesday, December 9, 2025, at 2:15 PM (ET). The conference will be at the UBS Office on 11 Madison Avenue in New York. The audio presentation for SBA can be accessed by visiting www.sbasite.com.

2025-11-23

2025-11-22

2025-11-21

2025-11-20

2025-11-19

2025-11-18

SBA Communications Corporation to Speak at the BofA Securities 2025 Leveraged Finance Conference

Description: BOCA RATON, Fla., November 18, 2025--SBA Communications Corporation (NASDAQ: SBAC) ("SBA") announces that Marc Montagner, Chief Financial Officer, is scheduled to speak at the BofA Securities 2025 Leveraged Finance Conference, Tuesday, December 2, 2025 at 10:50 AM (ET). The conference will be at The Boca Raton in Boca Raton, Florida. The audio presentation for SBA can be accessed by visiting www.sbasite.com.

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

2025-11-11

2025-11-10

2025-11-09

2025-11-08

2025-11-07

2025-11-06

2025-11-05

SBA Communications (SBAC) Profit Margin Beat Challenges Cautious Narratives on Valuation and Risk

Description: SBA Communications (SBAC) reported a net profit margin of 30.7%, up from 25.8% last year. One-year earnings growth was 25%, which is below its five-year average of 34.2%. Shares recently traded at $196.20, below the analyst fair value estimate of $224.42. Its Price-To-Earnings Ratio of 24.4x is also below both peer and industry averages. Investors are likely encouraged by the sustained margin improvement and disciplined valuation, but a mixed outlook for growth and notable financial risks...

2025-11-04

How Analyst Views on SBA Communications Are Shifting Amid Guidance Updates and Sector Uncertainty

Description: Recent analyst adjustments have nudged SBA Communications' Fair Value estimate higher, moving from $239.41 to $241.18 per share, as evolving industry trends and company performance feed into updated price targets. The changes reflect a tension between bullish optimism, which highlights strong operational results and rising guidance, and cautious views regarding shifting customer contracts and sector uncertainties. Stay tuned to see how investors can keep up with these ongoing developments...

SBA Communications (SBAC) Earnings Call Transcript

Description: Brendan Cavanagh: Thank you, Mark. The agreement enhances operational efficiencies for both companies, and the length of the agreement provides both companies with stability and more certainty for the future.

SBA Communications' Q3 AFFO Beats Estimates, Revenues Grow Y/Y

Description: SBAC posts solid Q3 revenue growth and beats AFFO estimates, driven by strong site-leasing and development activity.

SBA Communications Corp (SBAC) Q3 2025 Earnings Call Highlights: Record Revenue Growth and ...

Description: SBA Communications Corp (SBAC) reports robust financial performance with significant revenue growth, strategic acquisitions, and a promising long-term agreement with Verizon.

2025-11-03

SBA Communications tops third-quarter estimates, raises 2025 revenue forecast

Description: SBA Communications beat third-quarter estimates and raised its annual revenue forecast on Monday, helped by steady demand for its site leasing services from mobile network operators. The company is benefiting from increasing investments by mobile network operators to expand 5G and network capacity, driven by resilient consumer demand for connectivity, signaling steady site leasing activity for SBA. The company owns and operates wireless communications infrastructure, including tower structures, rooftops and other structures.

SBA Communications: Q3 Earnings Snapshot

Description: SBAC) on Monday reported a key measure of profitability in its third quarter. The results beat Wall Street expectations. The real estate investment trust, based in Boca Raton, Florida, said it had funds from operations of $354.9 million, or $3.30 per share, in the period.

SBA Communications Corporation Reports Third Quarter 2025 Results; Updates Full Year 2025 Outlook; and Declares Quarterly Cash Dividend

Description: BOCA RATON, Fla., November 03, 2025--SBA Communications Corporation (Nasdaq: SBAC) ("SBA" or the "Company") today reported results for the quarter ended September 30, 2025.

2025-11-02

2025-11-01

2025-10-31

SBA Communications (SBAC) Slid on Slower 5G Deployment

Description: Diamond Hill Capital, an investment management company, released its “Select Fund” third-quarter 2025 investor letter. A copy of the letter can be downloaded here. Markets continued their YTD rally in the third quarter, with the Russell 3000 Index surging 8%. At the same time, the portfolio underperformed the Russell 3000 Index, returning 4.98%. To get […]

2025-10-30

2025-10-29

SBA Communications to Report Q3 Earnings: What to Expect?

Description: SBAC's Q3 results may show higher revenues year over year, but elevated sprint churn is likely to have weighed on AFFO per share.

2025-10-28

2025-10-27

2025-10-26

2025-10-25

2025-10-24

2025-10-23

2025-10-22

2025-10-21

2025-10-20

Is it Wise to Retain SBA Communications Stock in Your Portfolio Now?

Description: SBAC's strong tower portfolio, long-term leases and expansion moves fuel growth. However, customer concentration and high debt levels pose risks.