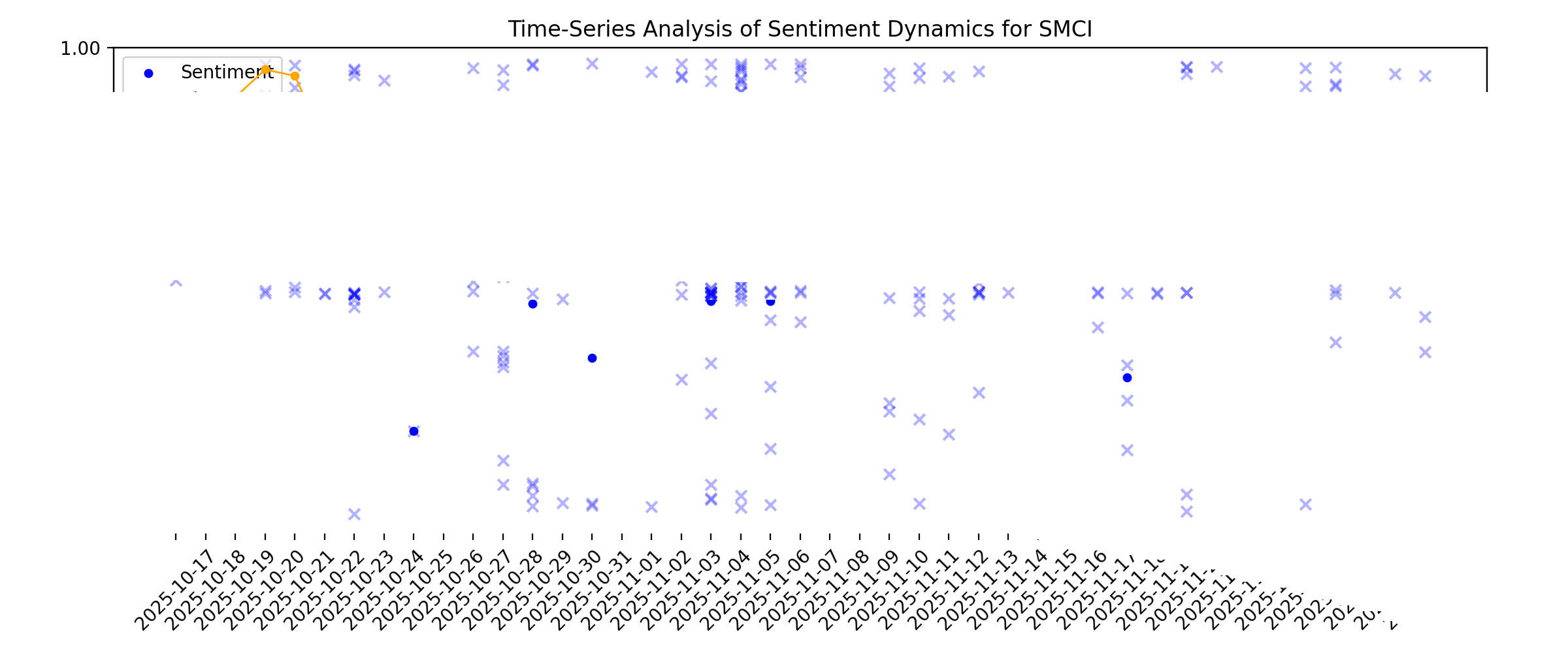

News sentiment analysis for SMCI

Sentiment chart

2026-01-14

Saitech Configures and Deploys Million-Dollar Liquid-Cooled Computing Solution for the U.S. Army

Description: Saitech Configures and Deploys Million-Dollar Liquid-Cooled Computing Solution for the U.S. Army

Super Micro Computer (SMCI) Announces Collaboration with Technology Partners

Description: Super Micro Computer, Inc. (NASDAQ:SMCI) is one of the Best Fundamental Stocks to Buy According to Analysts. On January 11, the company announced collaboration with technology partners for AI-powered intelligent in-store retail solutions, which have been designed to meet increasing customer expectations with scalability, improved productivity, and higher profitability. Through combining Super Micro Computer, Inc. […]

Insiders Favor These 3 High Growth Stocks For Potential Gains

Description: As the U.S. stock market navigates through a period marked by fluctuating bank earnings, inflation concerns, and record highs in precious metals, investors are keenly observing sectors that could offer potential growth amid these uncertainties. In such an environment, companies with high insider ownership often attract attention as they may indicate confidence from those who know the business best.

Supermicro Stock Slips 46% in 3 Months: Should You Buy, Sell, or Hold SMCI?

Description: Supermicro’s revenue growth story remains compelling, driven by secular demand for AI infrastructure. However, investors should be mindful of near-term margin compression.

Super Micro Computer Shares Slide After Goldman Sachs Downgrade

Description: Analyst flags margin pressure despite AI server demand and revenue growth.

Super Micro Stock Is Sliding. Wall Street Is Worried About Margins

Description: Super Micro Shares Fall After Goldman Starts Coverage With a Sell.

Stocks making big moves yesterday: Mobileye, AMD, Five9, UiPath, and Super Micro

Description: Check out the companies making headlines yesterday:

January 2026's Top Growth Stocks With Strong Insider Confidence

Description: As of January 2026, the U.S. markets are reaching new heights, with the S&P 500 and Dow Jones Industrial Average closing at record highs despite concerns about a DOJ probe into Fed Chair Powell. This resilient performance highlights the importance of identifying growth companies with strong insider ownership, as such stocks often reflect confidence from those closest to the company's operations and can be particularly appealing in a thriving market environment.

2026-01-13

Stock Market Today, Jan. 13: Super Micro Computer Drops on Analyst Downgrade and Margin Worries

Description: On Jan. 13, 2026, fresh analyst skepticism clashed with big AI infrastructure ambitions, putting Super Micro's profit outlook in focus.

Super Micro Computer (SMCI) Suffers a Larger Drop Than the General Market: Key Insights

Description: In the latest trading session, Super Micro Computer (SMCI) closed at $28.61, marking a -5.01% move from the previous day.

JPMorgan, Delta, Intel, AMD, Adobe, Moderna, Super Micro, and More Stock Market Movers

Description: Stocks fell Tuesday after the latest data from the Bureau of Labor Statistics showed inflation held steady in December as prices for goods and services rose 2.7%. JPMorgan Chase fell 4.2%. Earnings of $4.63 a share fell short of analysts’ calls for $4.85.

A Look At Super Micro Computer (SMCI) Valuation After Goldman Sachs Initiates Sell Rating

Description: Super Micro Computer (SMCI) is back in focus after Goldman Sachs initiated coverage with a Sell rating, flagging continued margin pressure and supplier concentration, even as the company maintains a leading position in AI servers. See our latest analysis for Super Micro Computer. The Goldman call comes after a tough spell for the share price, with a 90 day share price return of a 44.16% decline and a 30 day return of a 6.84% decline, even though the 3 year total shareholder return is about...

As Goldman Sachs Issues a Warning on Super Micro Computer Stock, Should You Risk Buying the Dip?

Description: Supermicro stock sinks as Goldman Sachs assumes coverage with a ‘Sell’ rating. Here’s why the investment firm recommends cutting exposure to SMCI shares in 2026.

Why Super Micro (SMCI) Stock Is Down Today

Description: Shares of server solutions provider Super Micro (NASDAQ:SMCI) fell 5.5% in the afternoon session after Goldman Sachs initiated coverage of the stock with a "Sell" rating and a $26 price target.

Nasdaq Turns Lower Amid Mag 7 Struggles

Description: So much for the Nasdaq Composite’s turnaround. The tech-heavy index was back down 0.4% on Tuesday after briefly turning positive. The S&P 500 was down 0.4%. The Dow sank 422 points, or 0.9%. Salesforce, down 6%, and Super Micro Computer, down 5.

Super Micro Computer Is an AI Winner. Sell the Stock Anyway, Goldman Sachs Says.

Description: Super Micro Computer stock is stuck in a rut, and Goldman Sachs doesn’t see it getting back on track in 2026. The firm maintained a Sell rating on Super Micro shares and slashed its price target to $26 from $34 in a research note Tuesday. The company has emerged as the pre-eminent supplier of artificial-intelligence servers to up-and-coming cloud providers, but it needs to find a way to expand its shrinking profit margin, Goldman said.

Trump calls Fed's Powell 'incompetent' or 'crooked,' SMCI falls

Description: Yahoo Finance Senior Reporter Brooke DiPalma tracks today's top moving stocks and biggest market stories in this Market Minute, including President Trump's comments calling Federal Reserve Chair Jerome Powell "incompetent or crooked," oil prices (CL=F, BZ=F) topping $60 per barrel, and Super Micro Computer (SMCI) stock falling after Goldman Sachs analysts initiated coverage with a Sell rating. Stay up to date on the latest market action, minute-by-minute, with Yahoo Finance's Market Minute.

Super Micro Computer Downgraded to Sell at Goldman on Margin Concerns

Description: Analyst sees limited profitability visibility despite AI server strength.

Top Growth Companies With Insider Ownership January 2026

Description: As the U.S. stock market navigates a period of cautious optimism following recent inflation data and mixed corporate earnings, investors are increasingly focused on identifying resilient growth opportunities. In this context, companies with high insider ownership often stand out as promising candidates, suggesting that those who know the business best have confidence in its future prospects.

Goldman Sachs assumes SMCI at Sell, warns margins face ‘further downside’

Description: Investing.com -- Goldman Sachs analyst Katherine Murphy has assumed coverage of Super Micro Computer with a Sell rating, citing ongoing margin pressure and limited visibility on profitability despite strong AI-server growth.

WDC Skyrockets 87% in 3 Months: Is the Stock Still a Buy in 2026?

Description: Western Digital jumps 86.5% in three months as AI-driven storage demand boosts margins and cash returns, leaving investors to weigh how much upside remains.

Here Are Tuesday’s Top Wall Street Analyst Research Calls: Adobe, AMD, Disney, Five Below, Intel, Reddit, KLA Corp, PayPal, Super Micro Computer and More

Description: Pre-Market Stock Futures: The futures are trending higher after the December consumer price index came in at 2.7%, which matched Wall Street expectations. The reversal in the futures comes after a wild Monday that saw stocks get hammered on the open, amid news of Department of Justice subpoenas sent to Federal Reserve Chairman Jay Powell ... Here Are Tuesday’s Top Wall Street Analyst Research Calls: Adobe, AMD, Disney, Five Below, Intel, Reddit, KLA Corp, PayPal, Super Micro Computer and More

Better Home & Finance Holding Among 3 High Growth Stocks With Strong Insider Confidence

Description: As the S&P 500 and Dow Jones Industrial Average reach new highs, investors are demonstrating resilience despite ongoing concerns, such as the DOJ probe into Fed Chair Powell. In this robust market environment, identifying growth companies with high insider ownership can be pivotal, as insider confidence often signals strong potential for future performance.

2026-01-12

January 2026's Top Insider-Owned Growth Stocks

Description: As the U.S. markets navigate a complex landscape marked by mixed stock index performances and unprecedented highs in gold and silver prices, investors are closely monitoring developments such as the DOJ's probe into Fed Chair Powell. Amid this backdrop, growth companies with high insider ownership can present compelling opportunities, as they often indicate strong confidence from those who know the business best.

SMCI Plunges 45% in 3 Months: Time to Buy, Sell or Hold the Stock?

Description: Super Micro Computer shares are down nearly 45% in three months, trading at a discounted P/E as margins compress, cash flow weakens, and AI expansion drives a Hold view.

Digi Power X Secures $20 Million NVIDIA B300 GPU Purchase from Supermicro to Power NeoCloudz(TM) GPU-as-a-Service Platform

Description: This news release constitutes a "designated news release" for the purposes of the Company's amended and restated prospectus supplement dated November 18, 2025, to its Canadian short form base shelf prospectus dated May 15, 2025. MIAMI, FL / ACCESS ...

Credo Technology Group Holding And 2 Insider Picks For Strong Growth

Description: As the U.S. stock market celebrates record highs with major indexes like the Dow and S&P 500 closing at unprecedented levels, investors are increasingly focused on identifying growth opportunities amid a robust economic backdrop. In this environment, companies with high insider ownership often attract attention as they may signal confidence from those closest to the business, potentially aligning well with current market optimism.

2026-01-11

Mizuho Reduces PT on Super Micro Computer (SMCI) Stock

Description: Super Micro Computer, Inc. (NASDAQ:SMCI) is one of the Oversold Fundamentally Strong Stocks to Buy Right Now. On January 9, Mizuho reduced the price target on the company’s stock to $31 from $45, while keeping a “Neutral” rating, as reported by The Fly. Notably, the firm adjusted targets in the semiconductors and semiconductor capital equipment group with respect to its […]

Supermicro Announces Intelligent In-Store Retail Solutions in Collaboration with a Broad Range of Industry Partners

Description: Retail's Big Show -- Super Micro Computer, Inc. (SMCI), a Total IT Solution Provider for AI/ML, HPC, Cloud, Storage, and 5G/Edge, today announced collaboration with technology partners for AI-powered intelligent in-store retail solutions designed to meet increasing customer expectations with scalability, improved productivity and increased profitability.

2026-01-10

2026-01-09

Top Growth Companies With Significant Insider Ownership

Description: As the U.S. stock market experiences a surge, with the S&P 500 reaching new all-time highs and major indexes poised for weekly gains, investors are keenly observing growth companies that combine robust performance with substantial insider ownership. In this thriving economic landscape, stocks with high insider ownership can be particularly appealing as they often indicate strong confidence from those who know the company best, aligning their interests with those of external shareholders.

SMCI to Enter Client, Edge and Consumer AI Markets: What's Next?

Description: Super Micro Computers plans to push beyond data centers with AI PCs, edge and consumer systems, targeting $36 billion in revenues by FY26 and new growth avenues.

Is Trending Stock Super Micro Computer, Inc. (SMCI) a Buy Now?

Description: Super Micro (SMCI) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Top Growth Companies With Insider Ownership In January 2026

Description: As of early 2026, the U.S. stock market is experiencing mixed movements, with the Dow Jones Industrial Average seeing gains while the Nasdaq has faced pressure from underperforming data-storage shares. Amidst this backdrop of fluctuating indices and sector-specific challenges, growth companies with high insider ownership often attract attention for their potential resilience and alignment between management and shareholder interests.

2026-01-08

January 2026's Top Growth Companies With Insider Confidence

Description: As the United States market navigates a mixed landscape with the Dow Jones Industrial Average reaching new highs while the Nasdaq faces pressure from data-storage shares, investors are keenly observing sectors that demonstrate resilience and growth potential. In this environment, companies with high insider ownership can signal strong confidence from those who know the business best, making them attractive considerations for growth-focused portfolios.

January 2026 Top Growth Stocks With Insider Influence

Description: As the U.S. stock market navigates a period of volatility with major indices like the S&P 500 and Dow Jones Industrial Average recently hitting all-time highs before pulling back, investors are keenly observing how geopolitical events and economic indicators shape future trends. In this environment, growth companies with high insider ownership can be particularly appealing as they often exhibit strong alignment between management and shareholder interests, potentially providing stability amid...

2026-01-07

Why Super Micro Computer Stock Fell In December

Description: The air is coming out of the stocks adjacent to the artificial intelligence (AI) buildout.

Top Insider-Owned Growth Companies To Watch In January 2026

Description: As the U.S. stock market experiences mixed movements with the Dow Jones and S&P 500 reaching fresh all-time highs, investors are keeping a close eye on geopolitical developments and economic indicators such as employment data. In this environment, growth companies with high insider ownership can be particularly appealing, as they often signal strong confidence from those who know the business best and may offer resilience amid market fluctuations.

January 2026's Top Growth Companies With Insider Stakes

Description: As the Dow Jones and S&P 500 reach new all-time highs, driven by a surge in data storage stocks amid an AI rally, investors are keenly observing the landscape for promising growth opportunities. In this buoyant market environment, companies with high insider ownership often attract attention due to their potential alignment of interests between management and shareholders, making them compelling candidates for those looking to capitalize on growth trends.

2026-01-06

Why Super Micro Computer (SMCI) Outpaced the Stock Market Today

Description: In the latest trading session, Super Micro Computer (SMCI) closed at $30.54, marking a +1.55% move from the previous day.

Super Micro Computer Announces Entry Into New Revolving Credit Facility

Description: SAN JOSE, Calif., January 06, 2026--Supermicro, Inc (Nasdaq: SMCI), a Total IT Solution Provider for AI, Cloud, Storage, and 5G/Edge, today announced it has entered into a definitive credit agreement providing for a senior revolving credit facility with JPMorgan Chase Bank, N.A., as administrative agent, and a syndicate of lenders.

Insiders Favor These 3 High Growth Stocks

Description: As the Dow Jones Industrial Average hits an all-time high for the second consecutive day, buoyed by recent geopolitical events, investors are closely watching how these developments impact market dynamics. In such a robust environment, stocks with strong growth potential and high insider ownership often attract attention as they suggest confidence from those closest to the company's operations.

Super Micro Stock Rises as Nvidia's Vera Rubin Platform Enters Production

Description: Nvidia's Next AI Platform Is Boosting Super Micro Shares

Super Micro Expands Liquid-Cooling Capacity for Nvidia AI Platforms

Description: Move boosts production capacity and data-center efficiency for next-gen AI systems.

Supermicro Brings Enterprise-Class AI Performance to the Client, Edge, and Consumer Markets

Description: Super Micro Computer, Inc. (SMCI), a Total IT Solution Provider for AI/ML, HPC, Cloud, Storage, and 5G/Edge, will showcase its latest high-performance Super AI Station in Las Vegas, Nevada. Designed for AI developers, start-ups, and higher education and research professionals, Supermicro's new portfolio of products brings the latest innovation and performance to the desktop, edge, and consumer markets.

3 Growth Companies With Insider Ownership Up To 27%

Description: As the U.S. stock market experiences a surge, with major indexes reaching new heights following geopolitical developments, investors are increasingly focused on identifying growth opportunities amid this buoyant environment. In such a climate, companies with high insider ownership can present compelling prospects, as they often indicate strong confidence from those closest to the business in its potential for future success.

2026-01-05

Can These 2025 Stock Market Losers Turn It Around?

Description: We look back to look forward and predict whether three of 2025's biggest disappointments can turn it around in 2026.

Supermicro Announces Support for Upcoming NVIDIA Vera Rubin NVL72, HGX Rubin NVL8 and Expanded Rack-Scale Manufacturing Capacity for Liquid-Cooled AI Solutions

Description: Supermicro, Inc. (NASDAQ: SMCI), a total IT solution provider for AI, cloud, storage, and 5G/edge, today announced expansions in manufacturing capacity and liquid-cooling capabilities, in collaboration with NVIDIA, to enable first-to-market delivery of data center-scale solutions optimized for the NVIDIA Vera Rubin and Rubin platforms. Leveraging accelerated development and collaboration with NVIDIA, Supermicro is uniquely positioned to rapidly deploy the flagship NVIDIA Vera Rubin NVL72 and NVI

NVIDIA Kicks Off the Next Generation of AI With Rubin — Six New Chips, One Incredible AI Supercomputer

Description: Extreme Codesign Across NVIDIA Vera CPU, Rubin GPU, NVLink 6 Switch, ConnectX-9 SuperNIC, BlueField-4 DPU and Spectrum-6 Ethernet Switch Slashes Training Time and Inference Token Generation CostNews Summary: The Rubin platform harnesses extreme codesign across hardware and software to deliver up to 10x reduction in inference token cost and 4x reduction in number of GPUs to train MoE models, compared with the NVIDIA Blackwell platform.NVIDIA Spectrum-X Ethernet Photonics switch systems deliver 5x

3 Growth Companies With High Insider Ownership And Up To 49% Revenue Growth

Description: As the U.S. stock market experiences a surge, with major indices like the Dow Jones and S&P 500 climbing sharply following geopolitical developments, investors are increasingly focused on identifying growth opportunities amidst this volatility. In such an environment, companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business, aligning well with current market dynamics that favor robust revenue growth potential.

Vertiv Rallies 31% in a Year: Should You Buy the Stock?

Description: VRT rides on accelerating AI infrastructure demand as its expanding portfolio and strategic partnerships strengthen its position in data center markets.

AI buildout's next theme will be finding meaning in other sectors

Description: Major tech conference CES 2026 kicks off today with presentations from Nvidia (NVDA) CEO Jensen Huang and Advanced Micro Devices (AMD) CEO Lisa Su. As the first full trading week of the new year gets underway, what new tech themes should investors be watching for at this year's CES and beyond? Defiance ETFs CEO and CIO Sylvia Jablonski explains how she is watching how Big Tech's massive AI infrastructure CapEx spending and buildout could expand into other industries and sectors. To watch more expert insights and analysis on the latest market action, check out more Morning Brief.

Can Intel's Xeon 6900 Processors Drive Long-Term Growth?

Description: INTC boosts server CPU leadership as Xeon 6900 powers SMCI's 6U SuperBlade, delivering up to 128 cores, faster DDR5, and built-in AI acceleration.

AeroVironment And 2 Other Stocks That May Be Priced Below Estimated Value

Description: As the new year begins, major stock indexes in the United States have mostly risen, with the Dow Jones Industrial Average and S&P 500 snapping recent losing streaks, while the Nasdaq continues to face pressure. In this fluctuating market environment, identifying stocks that may be undervalued can offer potential opportunities for investors seeking value amid broader economic shifts.

Spotlighting 3 Prominent Growth Companies With Significant Insider Stakes

Description: As the new year kicks off with major stock indexes mostly rising, investors are keenly observing market trends and economic indicators that could influence their portfolios. In this climate, growth companies with high insider ownership often attract attention, as significant insider stakes can signal confidence in a company's long-term potential and align management's interests with those of shareholders.

2026-01-04

2026-01-03

Analysts Grow More Careful on Super Micro Computer (SMCI) Despite AI Demand

Description: Super Micro Computer, Inc. (NASDAQ:SMCI) is one of the Best AI Stocks to Buy under $50. This AI infrastructure stock issued its latest fiscal first quarter results for 2026 back in November. Its adjusted earnings per share came in at $0.35, falling short of Wall Street expectations of $0.40. Meanwhile, revenue totaled $5.02 billion, compared […]

2026-01-02

Super Micro Computer Just Launched a New AI Server. Should You Buy SMCI Stock Today?

Description: Supermicro stock inches higher as the company launches a new AI server. Attractive valuation and a strong backlog warrants owning SMCI shares in 2026.

Why Are Super Micro (SMCI) Shares Soaring Today

Description: Shares of server solutions provider Super Micro (NASDAQ:SMCI) jumped 5.7% in the afternoon session after the company unveiled a new high-density server designed for demanding AI and high-performance computing workloads.

Insider Picks For High Growth In January 2026

Description: As the U.S. markets kick off 2026 with a mixed start following a four-session skid to close out 2025, investors are keenly observing the broader economic landscape shaped by recent advances in AI and fluctuating interest rates. In such an environment, companies with high insider ownership can signal confidence from those who know the business best, making them appealing choices for growth-focused portfolios amidst these market conditions.

Exchange-Traded Funds, Equity Futures Higher Ahead of First Trading Day of 2026

Description: The broad market exchange-traded fund SPDR S&P 500 ETF Trust (SPY) was up 0.6%, and the actively tra

January 2026's Leading Growth Companies With Insider Influence

Description: As 2025 concludes, the U.S. stock market has shown impressive resilience with major indexes like the Nasdaq, S&P 500, and Dow Jones Industrial Average posting substantial gains despite a challenging final trading week. In this environment of robust growth and evolving economic policies, companies with high insider ownership can offer unique insights into their potential for success, as insiders often have a deeper understanding of their company's prospects and challenges.

2026-01-01

3 Insider-Owned Growth Stocks For Your Watchlist

Description: As 2025 comes to a close, the U.S. stock market has experienced a robust year with significant gains across major indices despite ending on a slightly downbeat note. In this environment, identifying growth companies with high insider ownership can be particularly appealing as insider confidence often signals potential for long-term success and alignment of interests with shareholders.

Top Growth Companies With High Insider Ownership In January 2026

Description: As the U.S. stock market wraps up 2025 with impressive double-digit gains despite a late-year dip, investors are increasingly focused on companies that not only demonstrate robust growth potential but also have significant insider ownership. In this environment, high insider ownership can be a positive indicator of confidence in a company's future prospects, aligning insiders' interests with those of shareholders and potentially offering added stability amidst market fluctuations.

2025-12-31

Supermicro Unveils High-Density, Liquid-Cooled and Air-Cooled 6U SuperBlade® Powered by Intel® Xeon® 6900 Series Processors for Maximum Performance and Efficiency

Description: Supermicro, Inc. (NASDAQ: SMCI), a Total IT Solution Provider for AI, Cloud, Storage, and 5G/Edge, is announcing the latest addition to its SuperBlade family with the SBI-622BA-1NE12-LCC, a high-density, direct liquid-cooled blade server powered by dual Intel Xeon 6900 series processors with up to 256 P-cores. This new SuperBlade solution delivers outstanding compute density, power efficiency, and performance. This new SuperBlade solution delivers outstanding compute density, power efficiency, a

Super Micro Computer (SMCI) Suffers a Larger Drop Than the General Market: Key Insights

Description: Super Micro Computer (SMCI) closed at $29.27 in the latest trading session, marking a -1.28% move from the prior day.

3 Stocks Set to Benefit as Elon Musk’s xAI Expands Its Huge Data Center

Description: Elon Musk’s xAI has purchased a third building to expand its massive data center complex near Memphis.

3 Insider-Favored Growth Companies To Consider

Description: As 2025 comes to a close, major U.S. stock indexes have experienced a mix of record highs and recent declines, with the Dow Jones Industrial Average, Nasdaq, and S&P 500 all showing significant annual gains despite ending the year on a downward trend. In this fluctuating market environment, growth companies with high insider ownership can offer appealing prospects for investors seeking alignment between company leadership and shareholder interests.

GraniteShares Announces Weekly Distributions for its YieldBOOST ETFs: COYY, TSYY, NVYY, XBTY, AMYY, TQQY, AZYY, YSPY, MTYY, PLYY, HOYY, SMYY, BBYY, FBYY, IOYY, MAAY, NUGY, SEMY, QBY, RGYY, HMYY and RTYY

Description: New York, Dec. 31, 2025 (GLOBE NEWSWIRE) -- GraniteShares today announced the weekly distributions for its GraniteShares YieldBOOST ETFs: COYY, TSYY, NVYY, XBTY, AMYY, TQQY, AZYY, YSPY, MTYY, PLYY, HOYY, SMYY, BBYY, FBYY, IOYY, MAAY, NUGY, SEMY, QBY, RGYY, HMYY and RTYY as shown in the table below. ETF TickerETF NameDistribution FrequencyDistribution per ShareDistribution Rate1,330-Day SEC Yield2ROC4Ex-Date & Record Date5,6Payment Date7RTYYGraniteShares YieldBOOST RIOT ETFWeekly$0.53282149.19%n/

3 Growth Companies With Insider Ownership Up To 17%

Description: As the U.S. markets experience a slight downturn with major indexes closing lower for the third consecutive session, investors are increasingly focusing on companies that demonstrate resilience and potential for growth. In these uncertain times, firms with high insider ownership can be particularly appealing, as they often indicate strong confidence from those who know the business best.

Is Universal Technical Institute Stock a Buy After Needham Raised Its Stake Over $7 Million?

Description: The education specialist ended its 2025 fiscal year with strong revenue growth.

2025-12-30

Super Micro Stock Had a Wild 2025. What to Expect in 2026.

Description: Coming into Tuesday, shares of the server maker, once a darling of the artificial-intelligence trade, had fallen 1.3% this year. Super Micro’s performance also pales in comparison to how other tech companies have done this year. Shares surged more than 45% in February, when Super Micro narrowly avoided delisting from the Nasdaq Stock Market capping months of speculation that a failure to file its financial results on time might cost the company its spot in the exchange.

Porch Group And 2 Other Growth Stocks Insiders Are Confident In

Description: In the current U.S. market landscape, major stock indexes are experiencing mixed performance following two consecutive sessions of losses, with investors keeping a close eye on technology giants and precious metals making notable rebounds. In such an environment, stocks with high insider ownership can be appealing as they often signal strong confidence from those closest to the company's operations and future prospects.

U.S. International Trade Commission Votes to Institute Investigation into Samsung

Description: IRVINE, CA / ACCESS Newswire / December 30, 2025 / Netlist, Inc. (OTCQB:NLST) today announced that the United States International Trade Commission (ITC) has voted to institute an investigation into Samsung and two of its customers, Google and Super ...

Super Micro Computer (NASDAQ:SMCI) Hasn't Managed To Accelerate Its Returns

Description: If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. One common...

3 Growth Stocks With High Insider Confidence

Description: As the United States stock market experiences a mixed start to the holiday-shortened week, with major indexes closing lower and precious metals retreating from record highs, investors are keenly observing companies that demonstrate resilience and strong insider confidence. In such fluctuating market conditions, growth stocks with high insider ownership can be particularly appealing as they often signal that those closest to the company have faith in its long-term potential.

2025-12-29

3 Promising Growth Companies With Insider Ownership Up To 14%

Description: As the U.S. stock market experiences a slight pullback following a recent winning streak, investors are closely watching for potential opportunities amid fluctuating indices and retreating precious metals prices. In this context, growth companies with significant insider ownership can be particularly appealing, as they often signal confidence from those who know the business best and may offer resilience during market volatility.

Super Micro Computer, Inc. (SMCI) is Attracting Investor Attention: Here is What You Should Know

Description: Zacks.com users have recently been watching Super Micro (SMCI) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Should You Buy SMCI Stock Ahead of 2026?

Description: SMCI Shares Are Volatile Again. What the AI Server Story Looks Like in 2026

3 Growth Companies With Insider Ownership Up To 18%

Description: As the major U.S. stock indexes log weekly gains amid a holiday-shortened trading week, investors are increasingly focusing on growth companies that demonstrate strong insider ownership. In the current market environment, where stability and confidence are key, companies with significant insider stakes can signal alignment between management and shareholders' interests, potentially making them attractive options for those seeking long-term growth opportunities.

2025-12-28

2025-12-27

2025-12-26

Insiders Favor American Resources And Two Other Leading Growth Stocks

Description: As the U.S. stock market closes a holiday-shortened week on a high note, with the S&P 500 hitting fresh all-time highs and major indexes poised for weekly gains, investors are increasingly turning their attention to growth companies with substantial insider ownership. In such an environment, stocks favored by insiders can offer insights into potential opportunities as these individuals often have unique perspectives on their company's future prospects.

Insider Confidence In December 2025's Leading Growth Companies

Description: As the U.S. stock market continues to reach new heights, with the S&P 500 setting an all-time high and major indices logging consecutive gains, investors are increasingly attracted to companies that demonstrate robust growth potential and strong insider confidence. In this thriving environment, stocks with high insider ownership often signal a deep commitment from those who know the company best, suggesting alignment with shareholder interests and potential resilience in times of market...

2025-12-25

December 2025's Top Insider-Owned Growth Stocks

Description: As the U.S. stock market continues to hit new highs, with the S&P 500 setting an all-time record and major indices posting consistent gains, investors are keenly observing growth opportunities. In this thriving environment, companies with high insider ownership often attract attention due to the potential alignment of interests between management and shareholders, making them compelling considerations for those seeking robust growth prospects.

High Growth Companies With Strong Insider Confidence December 2025

Description: As the U.S. stock market celebrates record highs with the S&P 500 and Dow Jones Industrial Average setting new closing records, investors are increasingly focusing on companies that demonstrate both growth potential and strong insider confidence. In this buoyant market environment, stocks with high insider ownership can be particularly appealing as they often signal management's belief in the company's future prospects, aligning their interests closely with those of shareholders.

2025-12-24

Super Micro Computer Stock Tumbles, But Investors are Piling into Its Call Options - Time to Buy SMCI?

Description: Super Micro Computer delivered disappointing quarterly results on Nov. 4. SMCI stock has tanked, as investors lost faith in this AI server company. However, large, unusual call options activity in SMCI may indicate that it could be time to buy.

3 High Growth Companies Insiders Are Eager To Own

Description: As the U.S. stock market continues its upward trajectory, with major indices like the S&P 500 hitting all-time highs, investors are increasingly looking for opportunities in high-growth companies that insiders are eager to own. In this environment, companies with substantial insider ownership can be particularly attractive, as they often signal confidence in the company's future prospects and alignment of interests between management and shareholders.

SMCI's Rack-Scale AI Strategy: Is it the Next Growth Engine?

Description: Super Micro Computer is scaling rack-scale AI to 6,000 racks a month, betting rising demand offsets near-term margin pressure from custom platform upgrades.

3 Growth Companies With Insider Ownership Up To 27%

Description: As the U.S. stock market reaches new heights, with the S&P 500 closing at a record high following robust economic growth, investors are increasingly focused on identifying promising opportunities in this buoyant environment. In such conditions, stocks of growth companies with significant insider ownership can be particularly appealing, as they often indicate strong confidence from those most familiar with the company's potential and strategic direction.

2025-12-23

3 Growth Companies With Insider Ownership Up To 37%

Description: As the U.S. market experiences a fourth consecutive session of gains, buoyed by better-than-expected GDP data and a strong tech sector performance, investors are increasingly focusing on growth companies with significant insider ownership. In this context, stocks with high levels of insider investment can be particularly appealing as they often indicate confidence in the company's future prospects amidst an evolving economic landscape.

Super Micro Jumps as AI Server Demand Explodes -- Nebius Struggles to Keep Pace

Description: AI Stock Surge: Super Micro Outpaces Competitors in Server Race

Spotlighting 3 Growth Companies With Strong Insider Ownership

Description: As the U.S. stock market continues its upward momentum, with major indexes like the S&P 500 and Dow Jones Industrial Average nearing record highs, investors are increasingly focused on growth opportunities in sectors such as technology. In this environment of advancing tech shares and record-setting precious metals, companies with strong insider ownership can be particularly appealing, as they often signal confidence from those closest to the business and may align well with investor...

2025-12-22

Better Artificial Intelligence Stock: Nebius vs. Super Micro Computer

Description: Which of these high-growth AI stocks has a brighter future?

ChatGPT Super Micro Computer Stock Will Close At This Price In The Next 60 Days

Description: Analysts are saying that Super Micro Computer could hit $176 by 2030. Bullish on SMCI? Invest in Super Micro Computer on SoFi with no commissions. If it's your first time signing up for SoFi, you'll receive up to $1,000 in stock when you first fund ...

Discover 3 Elite Growth Stocks With Significant Insider Ownership

Description: As the U.S. stock market begins a holiday-shortened week with gains across major indexes, driven by advancements in tech shares and record highs in gold and silver, investors are keenly observing the shifts and opportunities within this vibrant economic landscape. In such an environment, growth companies with significant insider ownership can offer unique insights into potential long-term value creation, as insiders often have strong confidence in their firm's prospects.

Li Auto And 2 More Growth Companies With Strong Insider Confidence

Description: As the U.S. stock market experiences a resurgence, with major indexes like the S&P 500 and Nasdaq posting weekly gains amid a tech rally, investor confidence appears to be on the rise. In such an environment, growth companies with high insider ownership can signal strong internal belief in their long-term potential, making them attractive considerations for those looking to align with management's vision.

2025-12-21

2025-12-20

2025-12-19

3 Growth Companies With High Insider Ownership Seeing Earnings Growth Up To 68%

Description: As the U.S. stock market experiences a surge, particularly in tech shares, investors are closely monitoring growth companies with high insider ownership as potential opportunities amidst this renewed risk appetite. In such an environment, stocks that combine robust earnings growth with significant insider stakes can offer insights into management confidence and alignment with shareholder interests.

Top Growth Companies With Strong Insider Ownership December 2025

Description: As the U.S. stock market faces a downturn with major indexes like the S&P 500 and Dow Jones Industrial Average posting consecutive losses, investors are increasingly cautious about tech stocks amid concerns of an AI bubble. In such volatile times, companies with strong insider ownership often attract attention as they may indicate confidence from those who know the business best.

The top 10 trending tickers of 2025 on Yahoo Finance

Description: Nvidia (NVDA), Tesla (TSLA), and Palantir (PLTR) are some of the top-viewed ticker pages on Yahoo Finance in 2025. Yahoo Finance Markets and Data Editor Jared Blikre, who also hosts Yahoo Finance's Stocks in Translation podcast, examines the 10 most popular ticker pages on Yahoo Finance, with AI names dominating the list, with the exception of bitcoin (BTC-USD). Catch more Stocks in Translation, with new episodes every Tuesday and Thursday. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

2025-12-18

3 Growth Stocks With Strong Insider Confidence

Description: As the U.S. stock market rebounds with major indexes like the Dow Jones and S&P 500 poised to break losing streaks thanks to cooler-than-expected inflation data, investor sentiment is cautiously optimistic. In such a climate, growth stocks with high insider ownership can be particularly appealing, as they often signal strong confidence from those closest to the company's operations and future prospects.

Insider Confidence Drives Growth In December 2025

Description: As the U.S. market navigates a complex landscape marked by rising unemployment and mixed performances across major indices, investor attention is increasingly drawn to companies where insider confidence remains robust. In this environment, high insider ownership can be a compelling indicator of potential growth, suggesting that those who know the company best are committed to its future success.

2025-12-17

3 Growth Companies With High Insider Ownership And 13% Revenue Growth

Description: As the U.S. stock market experiences a pullback with major indices like the S&P 500 and Dow Jones facing consecutive losses, investors are increasingly cautious amid concerns over an AI bubble and tepid labor data. In such uncertain times, growth companies with high insider ownership can offer a compelling option as they often align management's interests with those of shareholders, potentially leading to sustained revenue growth despite broader market challenges.

Nasdaq Slides. Why AI Stocks Are Falling Again.

Description: The Nasdaq Composite took a plunge on Wednesday amid a flurry of selling among artificial intelligence and Big Tech stocks. The Dow fell 110 points, or 0.2%, dragged down by Caterpillar and Nvidia. Utility stocks tied to the AI trade like Constellation Energy and Vistra were down more than 5%.

Western Digital Surges 195% in 6 Months: What Should Investors Do Now?

Description: WDC shares surge nearly 200% in six months, driven by AI-led data-center demand for high-capacity HDDs, stronger margins, and rising capital returns.

AI GPU Platforms Drive 75% of SMCI's Revenues: More Upside Ahead?

Description: Super Micro Computer's AI GPU platforms drive more than 75% of Q1 FY26 revenues as new NVIDIA Blackwell liquid-cooled systems ramp for volume shipments.

AI Chips Update - AlphaTON Capital Expands AI Capabilities With NVIDIA B300 Integration

Description: AlphaTON Capital has announced the acquisition of its first NVIDIA B300 GPUs, integrated into Supermicro's advanced HGX systems, through a partnership with Atlantic AI. This deployment aims to enhance the Cocoon AI Network by leveraging advanced compute power, thereby offering enterprise-level artificial intelligence capabilities with military-grade privacy protection to users worldwide. The NVIDIA B300 chips, renowned for their high-performance processing suitable for complex AI tasks, mark...

Three Insider-Favored Growth Companies To Watch

Description: As the U.S. stock market grapples with pressures on AI stocks and anticipates key economic data releases, investors are keenly observing how these factors influence broader market trends. In such a volatile environment, growth companies with high insider ownership often stand out as they suggest confidence from those closest to the business, making them intriguing prospects for investors seeking stability amid uncertainty.

2025-12-16

3 Growth Companies With High Insider Ownership And Earnings Growth Up To 110%

Description: In a period marked by the retreat of major stock indexes following unexpected unemployment data, investors are closely examining growth companies with high insider ownership as potential opportunities. In today's market, where economic indicators can sway investor sentiment, stocks with strong earnings growth and significant insider stakes may offer unique insights into company confidence and long-term potential.

Super Micro Computer, Inc. (SMCI) is Attracting Investor Attention: Here is What You Should Know

Description: Recently, Zacks.com users have been paying close attention to Super Micro (SMCI). This makes it worthwhile to examine what the stock has in store.

Cloud AI Today - EdgeMode Boosts AI Efficiency with Green Data Center Partnership

Description: EdgeMode Inc. has entered into a strategic collaboration with Supermicro and Krambu to enhance the deployment of AI-focused data centers, utilizing advanced compute infrastructure and sustainable technologies. This collaboration aims to integrate high-performance server and GPU solutions with sustainable design techniques like liquid cooling and waste-heat recovery. The partnership underscores a commitment to developing efficient AI infrastructure with potential benefits extending beyond data...

Super Micro Computer's (NASDAQ:SMCI) earnings growth rate lags the 60% CAGR delivered to shareholders

Description: The last three months have been tough on Super Micro Computer, Inc. ( NASDAQ:SMCI ) shareholders, who have seen the...

Spotlighting Bridgewater Bancshares And 2 Other Growth Stocks With Strong Insider Ownership

Description: As the U.S. stock market navigates a challenging landscape marked by AI bubble concerns and fluctuating major indexes, investors are keenly observing key economic indicators like employment data and retail sales to gauge future trends. In this environment, growth companies with strong insider ownership can offer a unique appeal, as high insider stakes often signal confidence in the company's long-term prospects despite broader market volatility.

2025-12-15

Highlighting December 2025's Growth Leaders With Insider Ownership

Description: As the United States stock market grapples with concerns over an AI bubble, technology shares have been under pressure, causing declines in major indices like the Nasdaq and Dow Jones Industrial Average. In such a volatile environment, companies with strong growth potential and high insider ownership can offer investors a sense of stability and alignment of interests between management and shareholders.

Super Micro Stock Falls Amid Rising Competition in AI Servers

Description: Super Micro Faces Near-Term Hurdles but AI Growth Offers Potential Upside

EdgeMode Announces Strategic Collaboration with Supermicro and Krambu to Advance Sustainable, High-Performance AI Data Centers

Description: FORT LAUDERDALE, Fla., Dec. 15, 2025 (GLOBE NEWSWIRE) -- EdgeMode (OTC: EDGM), a global Energy and AI data center infrastructure company, today announced it has entered into a Memorandum of Understanding (MOU) with Supermicro, a global leader in high-performance and energy-efficient server technologies, and Krambu Inc., an advanced data-center infrastructure company specializing in liquid cooling, industrial symbiosis, and sustainable design. The collaboration establishes a strategic framework t

AvePoint Leads These 3 High Growth Stocks Backed By Insiders

Description: As the United States market grapples with volatility, particularly in the tech sector due to AI bubble concerns, investors are increasingly seeking stability through high insider ownership in growth companies. In this environment, stocks like AvePoint stand out as they offer a unique blend of growth potential and insider confidence, which can be appealing amidst broader market uncertainties.

2025-12-14

Here’s What Blackwell Portfolio Expansion Means for Super Micro Computer (SMCI)

Description: Super Micro Computer Inc. (NASDAQ:SMCI) is one of the 10 Data Center Cooling Companies to Invest In. On December 9, the company expanded its NVIDIA Blackwell Portfolio by introducing new 4U and 2-OU (OCP) liquid-cooled NVIDIA HGX B300 systems. These products are designed to deliver power efficiency and exceptional GPU density for the AI factory […]

2025-12-13

2025-12-12

Super Micro (SMCI) Stock Trades Down, Here Is Why

Description: Shares of server solutions provider Super Micro (NASDAQ:SMCI) fell 4% in the afternoon session after investors rotated out of AI-linked high-flyers following underwhelming earnings updates from Oracle and Broadcom as the core thesis shifted from "growth at any cost" to "prove the returns."

Insiders Favor These 3 Prominent Growth Companies

Description: As the U.S. stock market experiences fluctuations, with the Dow Jones reaching new highs before pulling back and tech stocks facing pressure due to AI bubble concerns, investors are keenly observing insider activity as a potential indicator of confidence in growth companies. In this context, high insider ownership can be seen as a vote of confidence from those closest to the business, suggesting that these insiders believe in their company's long-term prospects despite current market volatility.

VRT vs. SMCI: Which Data Center Infrastructure Stock Is a Better Buy?

Description: Vertiv gains momentum as AI-driven data center demand boosts orders and backlog, widening its edge over Super Micro Computer.

Krystal Biotech And 2 Other Growth Stocks Insiders Are Betting On

Description: As the U.S. stock market experiences a surge following the Federal Reserve's decision to cut interest rates, investors are closely watching growth companies with high insider ownership. In this environment, stocks like Krystal Biotech and others where insiders have significant stakes can be particularly attractive, as they often signal confidence in the company's potential amidst evolving economic conditions.

2025-12-11

Azio AI Advances Sovereign AI Infrastructure Strategy, Supporting Philippines' National Investment Fund Modernization and Positioning for Long-Term Public-Sector Growth

Description: Azio AI, the artificial intelligence compute and GPU infrastructure subsidiary of Azio, today announced its active participation in early-stage technical and infrastructure discussions supporting the Philippines' national initiative to modernize and restructure its sovereign investment platform, including the Maharlika Investment Fund (MIF) and Maharlika Investment Corporation (MIC).

Oracle Stock Hasn’t Dropped Like This Since the Dot-Com Bust. What’s Driving the Selloff.

Description: Financial guidance that came in short of estimates and increased spending on artificial-intelligence infrastructure look to be worrying investors. Adjusted earnings per share were $2.26, well ahead of Wall Street’s consensus estimate of $1.64, up from $1.47 last year. The big beat was largely driven by the company’s sale of its interest in the Ampere chip company to SoftBank for $2.7 billion, boosting pretax earnings by 91 cents a diluted share.

High Insider Ownership Fuels Growth Stocks In December 2025

Description: As the Dow Jones Industrial Average reaches new heights, contrasting with declines in the Nasdaq and S&P 500 due to tech sector pressures, investors are keenly observing market dynamics shaped by interest rate cuts and evolving economic indicators. In this fluctuating environment, stocks with high insider ownership often attract attention for their potential alignment of interests between company leaders and shareholders, a factor that can be particularly appealing amid broader market...

SMCI Declines 9% in a Year: Should You Hold or Fold the Stock?

Description: Super Micro Computer's shares slide as expansion strains margins and cash flow, even as AI server demand and new platforms fuel long-term growth ambitions.

3 High Growth Companies With Strong Insider Ownership

Description: As the U.S. stock market experiences a surge following the Federal Reserve's recent interest rate cut, investors are keenly observing how these changes might impact growth companies and their potential for future expansion. In such a dynamic environment, high insider ownership can be an indicator of confidence in a company's prospects, making it an attractive feature for those seeking to identify promising growth opportunities.

2025-12-10

3 Growth Companies With High Insider Ownership Achieving 29% Revenue Growth

Description: As major stock indexes in the United States show mixed performance ahead of the Federal Reserve's anticipated interest rate decision, investors are closely monitoring how these changes might impact various sectors. In this environment, growth companies with high insider ownership can be particularly appealing as they often signal strong confidence from those who know the business best, and achieving notable revenue growth can further highlight their potential resilience and adaptability.

AZIO AI Appoints Chris Young as Chief Executive Officer to Lead Global Expansion of AI Compute Infrastructure and Sovereign Data-Center Deployment

Description: AZIO AI Appoints Chris Young as Chief Executive Officer to Lead Global Expansion of AI Compute Infrastructure and Sovereign Data-Center Deployment

High Insider Ownership Fuels Growth Stocks In December 2025

Description: As the U.S. markets navigate a mixed landscape ahead of a crucial Federal Reserve decision on interest rates, investor optimism remains buoyant despite concerns over economic policies and potential stock bubbles. In this environment, growth companies with high insider ownership often attract attention due to their perceived alignment of interests between management and shareholders, offering a compelling narrative for those seeking resilient investment opportunities in uncertain times.

2025-12-09

Supermicro Expands NVIDIA Blackwell Portfolio with New 4U and 2-OU (OCP) Liquid-Cooled NVIDIA HGX B300 Solutions Ready for High-Volume Shipment

Description: Super Micro Computer, Inc. (SMCI), a Total IT Solution Provider for AI, Cloud, Storage, and 5G/Edge, today announced the expansion of its NVIDIA Blackwell architecture portfolio with the introduction and shipment availability of new 4U and 2-OU (OCP) liquid-cooled NVIDIA HGX B300 systems. These latest additions are a key part of Supermicro's Data Center Building Block Solutions (DCBBS) that deliver unprecedented GPU density and power efficiency for hyperscale data centers and AI factory deployme

Insider Confidence In High Growth Stocks December 2025

Description: As the U.S. stock market experiences a slight uptick with major indices like the Dow Jones, S&P 500, and Nasdaq showing modest gains amidst anticipation of a Federal Reserve rate cut, investors are keenly observing economic indicators such as job openings and interest rates. In this environment, growth companies with high insider ownership can be particularly appealing as they often signal strong internal confidence in their future potential and align well with investor interests during times...

Cornelis and Supermicro Collaborate to Overcome Power and Network Bottlenecks for Next-Generation AI/HPC Infrastructure

Description: WAYNE, Pa., December 09, 2025--As enterprise data centers struggle to run increasingly complex AI training and scientific simulation workloads within tight power and cooling limits, Cornelis and Supermicro have validated a new high-performance infrastructure solution designed to deliver more computing power using less energy. Supermicro’s liquid-cooled FlexTwin™ server platforms are now fully validated with Cornelis’ CN5000 high-speed networking, giving organizations a practical way to scale AI

Zscaler And 2 Other Growth Stocks Insiders Are Betting On

Description: As the U.S. stock markets experience a pullback with major indices like the S&P 500 slipping after nearing record highs, investors are keenly watching the Federal Reserve's upcoming decision on interest rates. In such uncertain times, growth companies with high insider ownership can be appealing as they often signal confidence from those closest to the business.

2025-12-08

Where Will Super Micro Computer Stock Be in 5 Years?

Description: This computing hardware company is much less exciting than it used to be.

3 Growth Companies With High Insider Ownership And 25% Return On Equity

Description: As the U.S. stock market experiences fluctuations with major indices like the Dow Jones and S&P 500 pulling back amid anticipation of the Federal Reserve's interest rate decision, investors are increasingly focused on companies that demonstrate strong financial metrics and insider confidence. In this environment, growth companies with high insider ownership and a robust return on equity can offer compelling opportunities for those looking to navigate market volatility effectively.

Inside Alert: Super Micro (SMCI) Director Cashes Out $1.6 Million in Shares

Description: Super Micro Shares See Director Exit -- $1.6M Stake Sold in Form 4 Filing

3 Growth Companies With High Insider Ownership And Earnings Up To 105%

Description: As U.S. markets respond positively to encouraging inflation data, hopes for a Federal Reserve rate cut have buoyed investor sentiment, pushing major indices like the Nasdaq and S&P 500 closer to record highs. In this environment of cautious optimism, growth companies with high insider ownership can be particularly appealing as they often align management's interests with those of shareholders, potentially driving robust performance even amidst market fluctuations.

The Zacks Analyst Blog Highlights Dell Technologies, Hewlett-Packard, Cisco Systems and Super Micro Computers

Description: DELL rides surging demand for AI servers and a record backlog, even as competition from CSCO, HPE and SMCI intensifies.

1 Reason Super Micro Computer Could Be a Multimillionaire-Maker Stock

Description: Can the server company's management finally get its business forecasts correct this year?

2025-12-07

2025-12-06

2025-12-05

Super Micro Computer, Inc. (SMCI): A Bull Case Theory

Description: We came across a bullish thesis on Super Micro Computer, Inc. on Deep Value Returns’s Substack. In this article, we will summarize the bulls’ thesis on SMCI. Super Micro Computer, Inc.’s share was trading at $33.41 as of December 1st. SMCI’s trailing and forward P/E were 26.65 and 17.92 respectively according to Yahoo Finance. SuperMicro (SMCI) recently preannounced its […]

3 Growth Companies With High Insider Ownership And 95% Earnings Growth

Description: As U.S. stock indexes edge higher following key inflation data, investors are closely monitoring the Federal Reserve's upcoming policy decisions, which could impact market dynamics. In this environment, growth companies with significant insider ownership can be particularly appealing due to their potential for strong alignment between management and shareholder interests.

Super Micro Computer, Inc. (SMCI) Is a Trending Stock: Facts to Know Before Betting on It

Description: Zacks.com users have recently been watching Super Micro (SMCI) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Insider-Owned Growth Leaders To Watch In December 2025

Description: As the U.S. stock market navigates a mixed performance with major indices like the Dow and S&P 500 nearing record highs, investors are closely monitoring economic indicators such as upcoming inflation data that could influence Federal Reserve decisions on interest rates. In this environment of cautious optimism, growth companies with high insider ownership stand out as intriguing opportunities, offering potential resilience and alignment of interests between company insiders and shareholders.

2025-12-04

3 Growth Companies Insiders Are Betting On

Description: As the Dow Jones and S&P 500 approach record highs, investors are closely monitoring insider activities in growth companies, especially given the current economic indicators suggesting potential interest rate cuts by the Federal Reserve. In this environment, stocks with high insider ownership can be appealing as they often signal confidence from those most familiar with a company's prospects.

Why Is Super Micro (SMCI) Down 19.9% Since Last Earnings Report?

Description: Super Micro (SMCI) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

3 Growth Companies With Insider Ownership Up To 35%

Description: As the major U.S. stock indexes, including the Dow Jones Industrial Average, continue to close higher amid investor optimism despite a decline in private employment, market attention turns to growth companies with significant insider ownership. In today's environment, where economic indicators are mixed and interest rate decisions loom large, stocks with high insider ownership can be appealing as they often signal confidence from those closest to the company's operations and future prospects.

2025-12-03

High Insider Ownership Growth Companies To Watch In December 2025

Description: As the U.S. stock market continues to show resilience, with major indexes like the Dow Jones and S&P 500 experiencing gains despite mixed economic signals such as a decline in private payrolls, investors are increasingly looking towards companies with solid growth potential and strong insider ownership. In this environment, stocks where insiders hold significant stakes can be particularly appealing, as they often indicate confidence in the company's future prospects and alignment of interests...

Update: Digi Power Loses 6.6% on AI Infrastructure Update

Description: (Updates shares.) Digi Power X (DGX.V) on Wednesday provided an update on the execution of its AI

3 Growth Companies With High Insider Ownership Seeing 30% Revenue Growth

Description: As the U.S. markets rebound with tech and crypto-related stocks leading the charge, investors are keenly observing growth companies that demonstrate robust insider ownership and impressive revenue trajectories. In this environment, firms showcasing significant insider stakes alongside strong revenue growth often signal confidence in their business models and potential resilience amid fluctuating market conditions.

Super Micro Computer Stock: Is SMCI Underperforming the Technology Sector?

Description: Super Micro Computer has notably underperformed the technology sector over the past year, and analysts remain cautious about the stock’s prospects.

2025-12-02

Vertiv Surges 57% in the Past 6 Months: Is the Stock Worth Buying?

Description: VRT's six-month surge, booming AI-driven orders, and rapid portfolio expansion set the stage for a strong 2025 outlook.

3 Growth Companies With High Insider Ownership And Earnings Growth Up To 122%

Description: As the U.S. stock market experiences a slight uptick following a break in its five-session winning streak, investors are paying close attention to sectors like technology and cryptocurrency, which have shown notable rebounds. In this environment, growth companies with high insider ownership can present intriguing opportunities due to their potential for strong alignment between management and shareholder interests.

Netlist says USPTO, DOJ file public interest comment in ITC action

Description: Netlist (NLST) announced the United States Patent and Trademark Office and the United States Department of Justice have filed a joint public interest comment in connection with Netlist’s complaint before the United States International Trade Commission against Samsung (SSNLF), Google (GOOGL) and Super Micro (SMCI). Netlist is seeking exclusion and cease and desist orders against the Respondents, which would direct U.S. Customs and Border Protection to stop Samsung memory products that infringe N

3 Stocks Estimated To Be Trading Below Their Intrinsic Value In December 2025

Description: As December 2025 begins, the U.S. stock market faces a pullback with major indices like the Dow Jones, S&P 500, and Nasdaq closing lower amid a risk-off sentiment affecting big tech and crypto-tied shares. In such an environment, identifying stocks that are potentially trading below their intrinsic value can offer investors opportunities to capitalize on mispricings in the market.

Astera Labs And 2 Other Top Growth Companies With Significant Insider Stakes

Description: As the U.S. stock market navigates a challenging start to December, with major indices like the Dow Jones and Nasdaq experiencing declines amid risk-off sentiment, investors are increasingly focused on companies where insiders hold significant stakes. In such volatile times, growth companies with high insider ownership can offer a measure of confidence, as these insiders often have a vested interest in steering their firms toward long-term success.

2025-12-01

Top Growth Stocks With Strong Insider Backing December 2025

Description: As December begins, U.S. stock indexes have slipped amid a risk-off sentiment, with notable declines in big tech and cryptocurrency-tied shares. In this environment of cautious investor behavior, growth companies with high insider ownership can offer a reassuring signal of confidence and alignment between management and shareholders.

If This AI Theme Really Deteriorates, These Are the 3 Stocks to Short

Description: I recently penned an intriguing piece on Palantir (NASDAQ:PLTR), and my bear case behind this top mega-cap tech stock right now. Rest assured, that’s one of the picks I’m including in this list of top short opportunities in the market, for those who are skeptical of the AI buildout and the amount of spending underway ... If This AI Theme Really Deteriorates, These Are the 3 Stocks to Short

USPTO and USDOJ File Public Interest Comment in Netlist' U.S. International Trade Commission Action Against Samsung

Description: IRVINE, CA / ACCESS Newswire / December 1, 2025 / Netlist, Inc. (OTCQB:NLST) today announced the United States Patent and Trademark Office (USPTO) and the United States Department of Justice (USDOJ) have filed a joint public interest comment in connection ...

3 High-Growth Companies With Insider Ownership Up To 33%

Description: As the U.S. stock market wrapped up a robust week with major indexes posting their best performance since June, the Nasdaq's seven-month winning streak came to an end, highlighting the volatility and shifting dynamics within different sectors. In such an environment, growth companies with significant insider ownership can be particularly appealing as they often indicate strong confidence from those who know the company best.

2025-11-30

2025-11-29

2025-11-28

Top Growth Companies With Strong Insider Ownership November 2025

Description: As the U.S. stock market experiences a robust week, buoyed by gains across major indices like the Dow Jones and Nasdaq despite recent technical disruptions, investors are keenly observing growth trends and insider activities. In such an environment, companies with high insider ownership often attract attention for their potential alignment of interests between management and shareholders, making them intriguing candidates for those looking to understand growth dynamics in today's market.

These Were the S&P 500’s Best and Worst Stocks in November

Description: Lithium miner Albemarle came out on top, while Super Micro Computer led the list of worst performers.

Top Growth Companies With Strong Insider Confidence November 2025

Description: As the U.S. stock market experiences a robust upswing, with major indexes on track for their best week since June, investor confidence is buoyed by strong performances across various sectors. In this favorable climate, growth companies with high insider ownership are particularly noteworthy as they often signal strong internal confidence and alignment between management and shareholders.

2025-11-27

Super Micro Computer, Inc. (NASDAQ:SMCI) Stock Has Shown Weakness Lately But Financials Look Strong: Should Prospective Shareholders Make The Leap?

Description: Super Micro Computer (NASDAQ:SMCI) has had a rough month with its share price down 36%. However, a closer look at its...

SMCI Aims for $36B in FY26 Revenues: Is the Growth Target Realistic?

Description: Super Micro Computer targets $36B in FY26 revenues despite a quarterly dip, betting on AI demand and its modular data center strategy to drive growth.

3 Insider-Loved Growth Stocks To Watch Now

Description: As the U.S. stock market enjoys a robust upswing, with major indexes on track for their best week since June, investors are increasingly interested in growth companies where insiders hold significant ownership stakes. Such insider commitment can often signal strong confidence in a company's future prospects, making these stocks particularly appealing during times of market optimism.

2025-11-26

Top Growth Companies With Strong Insider Ownership For November 2025

Description: As the U.S. stock market experiences a significant upswing, with major indexes like the Nasdaq and S&P 500 posting notable gains, investors are keenly observing growth companies that exhibit strong insider ownership. In such a buoyant market environment, stocks where company insiders hold substantial stakes can be appealing as they often signal confidence in the company's future prospects and alignment of interests with shareholders.

If You Invested $10K In Super Micro Computer Stock 10 Years Ago, How Much Would You Have Now?

Description: Super Micro Computer Inc. (NASDAQ:SMCI) is a global leader in high-performance, high-efficiency server and storage solutions, specializing in application-optimized and energy-efficient systems for AI, cloud, and data centers. It is set to report its ...

Insider-Owned Growth Leaders To Watch In November 2025

Description: As the United States stock markets experience a notable upswing, with major indices like the Dow surging by over 650 points, investors are keenly observing potential opportunities in growth companies. In such a buoyant market environment, stocks with high insider ownership can be particularly appealing as they often signal confidence from those closest to the company's operations and future prospects.

2025-11-25

AI Trade Splinters as Google Challenges Nvidia’s Dominance

Description: Investors are sending two leaders of the AI trade in opposite directions. Alphabet took another step toward $4 trillion in market value on Tuesday, rising more than 1% to extend a monthslong rally fueled by enthusiasm for the Google parent’s AI tools, cloud computing and chip business. Nvidia shares slid 2.6%, dragging the world’s biggest company by market capitalization further below a $5 trillion valuation reached just weeks ago.

Why NVDIA, AMD and Super Micro Computer Are Down Big Today

Description: On a day when the tech sector is doing its best to prop up market sentiment, some of its biggest names are lagging behind. Nvidia (Nasdaq: NVDA), Advanced Micro Devices (Nasdaq: AMD) and Super Micro Computer (Nasdaq: SMCI) are all under pressure as competition intensifies in the white-hot AI revolution. It may still be early ... Why NVDIA, AMD and Super Micro Computer Are Down Big Today

Dell bets on rising AI server demand to forecast higher growth

Description: (Reuters) -Dell forecast fourth-quarter revenue and profit above Wall Street estimates on Tuesday, as increasing investments in data centers to support artificial intelligence boost demand for its servers, sending its shares up 4% in extended trading. The company also announced the permanent appointment of David Kennedy as its finance chief. Dell, which raised its annual revenue and profit expectations, offers AI-optimized severs equipped with Nvidia's powerful chips.

3 Growth Companies With Up To 36% Insider Ownership

Description: As the U.S. stock market experiences a mix of gains and losses, with indices like the Dow Jones and S&P 500 showing resilience despite some sector-specific downturns, investors are keenly observing growth companies that demonstrate strong potential amid fluctuating economic indicators. In this environment, insider ownership can be a compelling factor for investors seeking confidence in a company's future prospects, as it often signals alignment between company insiders and shareholders'...

The Stock Market Is Struggling. Blame Nvidia, Crypto Stocks.

Description: The S&P 500 struggled at the open on Tuesday, but the majority of stocks in the index were rising. With the market benchmark down 0.6%, more than 350 stocks in the index were set to close higher. The Invesco S&P 500 Equal Weight ETF, which weighs every stock in the index the same, was up 0.2%.

Super Micro Leaps Higher With Tech Stocks as Alphabet Sets Off AI Shockwave

Description: Super Micro Jumps Again as Alphabet's AI Momentum Lifts Chip and Server Names

November 2025's Top Growth Companies With Significant Insider Stakes

Description: As the U.S. markets kick off a holiday-shortened week with significant gains, buoyed by optimism over potential Federal Reserve rate cuts, investors are eyeing growth opportunities amid the broader economic landscape. In this environment, companies that demonstrate robust growth potential coupled with high insider ownership can be particularly appealing, as they may indicate strong confidence from those closest to the business.

2025-11-24

Why Super Micro (SMCI) Stock Is Trading Up Today

Description: Shares of server solutions provider Super Micro (NASDAQ:SMCI) jumped 2.8% in the afternoon session after renewed enthusiasm for Alphabet reinvigorated the artificial intelligence trade, propelling a market rebound heading into the Thanksgiving holiday. The Nasdaq index jumped 2.6% and the S&P 500 gained 1.6%, driven by a 5% rally in Alphabet following the announcement of its upgraded Gemini 3 AI model. This optimism spilled over into the broader tech sector, lifting shares of Broadcom, Micron, a

Insider-Favored Growth Stocks To Watch In November 2025

Description: As the U.S. stock market kicks off a holiday-shortened week with notable gains across major indexes, investors are increasingly optimistic about a potential interest rate cut by the Federal Reserve in December. Amid this backdrop, growth companies with high insider ownership are garnering attention as they often signal strong confidence from those closest to the business, making them intriguing options for those looking to navigate current market conditions.

Investors Heavily Search Super Micro Computer, Inc. (SMCI): Here is What You Need to Know

Description: Zacks.com users have recently been watching Super Micro (SMCI) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Top Growth Companies With Strong Insider Ownership In November 2025

Description: In the midst of a volatile November 2025, where major U.S. stock indexes have experienced significant swings and tech stocks face scrutiny, investors are keenly observing companies with robust fundamentals. Amidst this backdrop, growth companies with high insider ownership stand out as potentially resilient options due to their alignment of interests between management and shareholders.

2025-11-23

2025-11-22

2025-11-21

3 Growth Companies With High Insider Ownership Expecting 46% Profit Growth

Description: In a week marked by significant volatility in the U.S. stock market, with major indices like the S&P 500 and Nasdaq poised for their biggest weekly losses since April, investors are closely watching Federal Reserve signals that may indicate an upcoming rate cut. Amid these turbulent times, growth companies with high insider ownership can present intriguing opportunities as they often reflect strong internal confidence and alignment of interests between management and shareholders.

AMD Rides on Accelerating Data Center Growth: A Sign of More Upside?

Description: AMD's soaring Data Center sales, fueled by EPYC processors and Instinct GPUs, highlight robust demand and strong growth expectations into late 2025.

3 Growth Companies With High Insider Ownership Expecting Up To 67% Earnings Growth

Description: In the midst of recent volatility, where major U.S. stock indexes have experienced significant shifts, investors are keenly observing companies that demonstrate resilience and potential for growth. Amidst this backdrop, stocks with high insider ownership often attract attention as they can signal confidence from those closest to the company’s operations and future prospects.

2025-11-20

TTM Technologies, Super Micro, IonQ, Flex, and Arlo Technologies Shares Plummet, What You Need To Know

Description: A number of stocks fell in the afternoon session after markets faded the Nvidia rally in the morning session, as investors remained uncertain about future rate cuts.

These Stocks Moved the Most Today: Nvidia, Exact Sciences, Walmart, AMD, Alphabet, Palo Alto Networks, and More

Description: Nvidia turns lower as strong earnings fail to assuage concerns over an artificial-intelligence bubble.

Super Micro Computer Shares Rise After Launch of New AMD-Powered AI Server

Description: Supermicro gains after expanding its AI hardware portfolio.

3 Growth Companies With Insider Ownership Ranging From 13% To 25%

Description: In the current U.S. market, major stock indexes like the Dow Jones, S&P 500, and Nasdaq have shown resilience by advancing modestly after Nvidia's impressive results boosted tech stocks and Walmart's strong performance lifted its outlook. Amid these movements, investors are increasingly interested in growth companies with significant insider ownership as this can indicate confidence from those who understand the business best.

Why Is Super Micro Computer Stock Rising Today

Description: Supermicro Jumps After Rolling Out High-Octane AMD AI Servers

Supermicro Announces Participation in Upcoming Investor Events

Description: SAN JOSE, Calif., November 20, 2025--Super Micro Computer, Inc. (Nasdaq: SMCI) ("Supermicro" or the "Company"), a Total IT Solution Provider for AI, Cloud, Storage, and 5G/Edge, today announced its participation in the upcoming investor conferences:

GraniteShares Announces Weekly Distributions for its YieldBOOST ETFs: COYY, TSYY, NVYY, XBTY, AMYY, TQQY, AZYY, YSPY, MTYY, PLYY, HOYY, SMYY, BBYY, FBYY, IOYY, MAAY, NUGY and SEMY