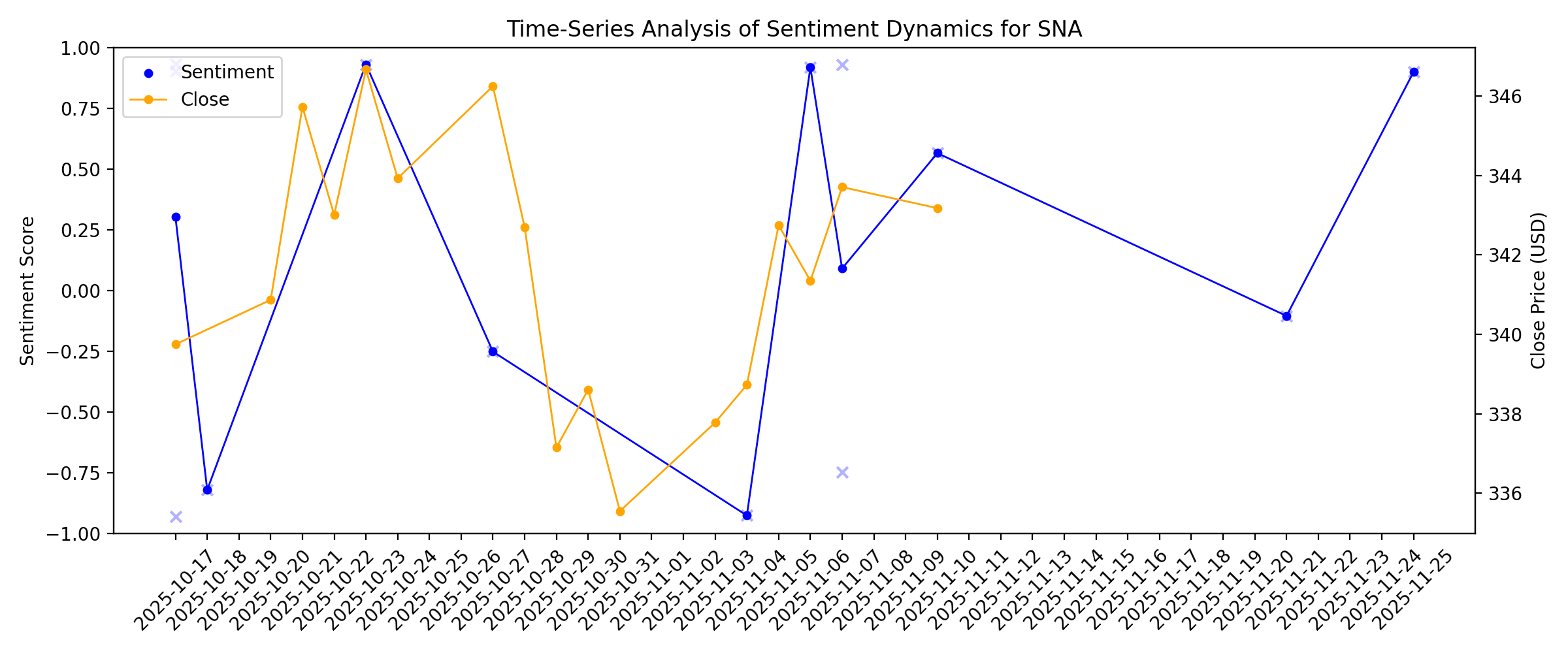

News sentiment analysis for SNA

Sentiment chart

2026-01-14

2026-01-13

2026-01-12

2026-01-11

2026-01-10

2026-01-09

What to Expect From Snap-on’s Q4 2025 Earnings Report

Description: Snap-on is poised to report its fourth-quarter results in the coming weeks, with analysts anticipating a marginal uptick in bottom-line performance.

2026-01-08

2026-01-07

Should Snap-on’s Quarterly Revenue and Margin Beat Require Action From Snap-on (SNA) Investors?

Description: In early January 2026, Snap-on reported quarterly results showing revenue rising 3.6% year on year, ahead of analyst expectations by 2.7%, alongside adjusted operating income that also surpassed forecasts. This performance suggests Snap-on’s mix of tools, equipment, and diagnostics may be converting into stronger operational efficiency and resilience than analysts had anticipated. We’ll now examine how this revenue and operating income outperformance could influence Snap-on’s previously...

Assessing Snap-on (SNA) Valuation After Recent Share Price Momentum

Description: Snap-on (SNA) has been drawing attention after recent trading, with the stock last closing at $357.73. For investors, its current share price invites closer inspection of returns, earnings and overall business performance. See our latest analysis for Snap-on. The recent 1-day share price return of 1.0% fits into a steady pattern, with a 90-day share price return of 5.45% and a 1-year total shareholder return of 9.48%, suggesting momentum has been gradually building around Snap-on. If...

2026-01-06

2026-01-05

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

Snap-on's Operational Agility, RCI Execution and Innovation Aid Growth

Description: SNA is leaning on RCI-driven efficiency, innovative tools and deeper repair-shop ties to fuel resilient growth across automotive and industrial markets.

2025-12-25

2025-12-24

2025-12-23

2025-12-22

Is Snap-on Incorporated's (NYSE:SNA) Stock's Recent Performance A Reflection Of Its Financial Health?

Description: Snap-on's (NYSE:SNA) stock is up by 3.1% over the past month. Given that the market rewards strong financials in the...

2025-12-21

2025-12-20

2025-12-19

2025-12-18

2025-12-17

2025-12-16

2025-12-15

Snap-on Stock: Is SNA Underperforming the Industrial Sector?

Description: Analysts remain upbeat on Snap-on, even though the stock has struggled to keep pace with the broader sector’s gains.

2025-12-14

2025-12-13

2025-12-12

2025-12-11

2025-12-10

2025-12-09

2025-12-08

2025-12-07

2025-12-06

2025-12-05

2025-12-04

Will SNA's Operational Agility, RCI Plan & Innovations Fuel Growth?

Description: Snap-on's growth strategy, innovation push and expanding product lineup signal resilient operations and potential progress ahead.

2025-12-03

2025-12-02

2025-12-01

Is There An Opportunity With Snap-on Incorporated's (NYSE:SNA) 23% Undervaluation?

Description: Key Insights Snap-on's estimated fair value is US$444 based on 2 Stage Free Cash Flow to Equity Current share price of...

2025-11-30

2025-11-29

2025-11-28

2025-11-27

2025-11-26

2025-11-25

Snap-on Stock: Analyst Estimates & Ratings

Description: Although Snap-on has considerably underperformed the broader market over the past 52 weeks, Wall Street analysts maintain a moderately optimistic outlook about the stock’s prospects.

2025-11-24

2025-11-23

2025-11-22

2025-11-21

3 Industrials Stocks with Questionable Fundamentals

Description: Whether you see them or not, industrials businesses play a crucial part in our daily activities. Sure, they are at the whim of macroeconomic factors that influence capital spending (like interest rates), but the industry has held its ground over the past six months as its 11.2% return was almost identical to the S&P 500.

2025-11-20

2025-11-19

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

2025-11-11

2025-11-10

Snap-on (NYSE:SNA) Is Increasing Its Dividend To $2.44

Description: Snap-on Incorporated ( NYSE:SNA ) has announced that it will be increasing its periodic dividend on the 10th of...

2025-11-09

2025-11-08

2025-11-07

How Investors Are Reacting To Snap-on (SNA) 14 Percent Dividend Increase After 16th Straight Hike

Description: On November 6, 2025, Snap-on Incorporated announced that its board raised the quarterly dividend by 14% to US$2.44 per share, marking the 16th consecutive annual increase and payable on December 10 to shareholders of record as of November 21. This significant dividend hike follows strong third-quarter earnings and signals management’s continued confidence in Snap-on’s financial position and operating strength, despite recent revenue and earnings challenges. With the 14% dividend increase...

Investors in Snap-on (NYSE:SNA) have seen impressive returns of 132% over the past five years

Description: The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, you...

2025-11-06

Snap-on Raises Dividend 14%

Description: KENOSHA, Wis., November 06, 2025--Snap-on announced today that its Board of Directors raised its quarterly common stock dividend by 14% to $2.44 per share.

2025-11-05

2025-11-04

Snap-on to Present at Baird 2025 Global Industrial Conference

Description: KENOSHA, Wis., November 04, 2025--Snap-on is scheduled to present at the Baird 2025 Global Industrial Conference on Wednesday, November 12, 2025 at approximately 10:40 AM Eastern.

2025-11-03

2025-11-02

2025-11-01

2025-10-31

2025-10-30

2025-10-29

2025-10-28

2025-10-27

1 Unpopular Stock That Should Get More Attention and 2 We Find Risky

Description: When Wall Street turns bearish on a stock, it’s worth paying attention. These calls stand out because analysts rarely issue grim ratings on companies for fear their firms will lose out in other business lines such as M&A advisory.

2025-10-26

2025-10-25

2025-10-24

2025-10-23

The Top 5 Analyst Questions From Snap-on’s Q3 Earnings Call

Description: Snap-on delivered third-quarter results that surpassed Wall Street’s expectations, leading to a positive market reaction. Management attributed the performance to robust demand in its repair systems and information segment, which benefited from increased activity with both OEM dealerships and independent repair shops. CEO Nick Pinchuk highlighted ongoing momentum, citing the company’s ability to adapt to challenging macro conditions through its diversified manufacturing base and a strategic focu

2025-10-22

2025-10-21

2025-10-20

2025-10-19

2025-10-18

Snap-on (SNA): Neutral Revenue Outlook and Projected Margin Expansion Ahead of Upcoming Earnings

Description: Snap-on (SNA) recently announced its latest earnings update, though concrete figures for revenue, EPS, or profit margins were not disclosed in the available filings and data. Historic comparative numbers and trends are missing, making it challenging to assess the direction of growth for investors this quarter. With no clear trends or new risk disclosures on hand, all eyes are on the broader context as shareholders look for signals in future updates. See our full analysis for Snap-on. Up next,...

2025-10-17

How Investors May Respond To Snap-on (SNA) Q3 Earnings Beat and Repair Systems Segment Growth

Description: On October 16, 2025, Snap-on Incorporated reported third-quarter earnings that surpassed analyst profit estimates, with sales reaching US$1.19 billion and net income of US$265.4 million. A standout factor was the strong performance in Snap-on's Repair Systems & Information segment, reflecting robust demand from both OEM dealerships and independent repair shops. We'll explore how Snap-on's improved operating margins and segment growth could impact its investment narrative moving forward. AI...

Company News for Oct 17, 2025

Description: Companies In The News Are: MMC, JBHT, EPAC, SNA.

SNA Q3 Deep Dive: Diagnostics and Repair Systems Lead Amid Macro Uncertainty

Description: Professional tools and equipment manufacturer Snap-on (NYSE:SNA) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 3.6% year on year to $1.29 billion. Its non-GAAP profit of $4.71 per share was 1.2% above analysts’ consensus estimates.