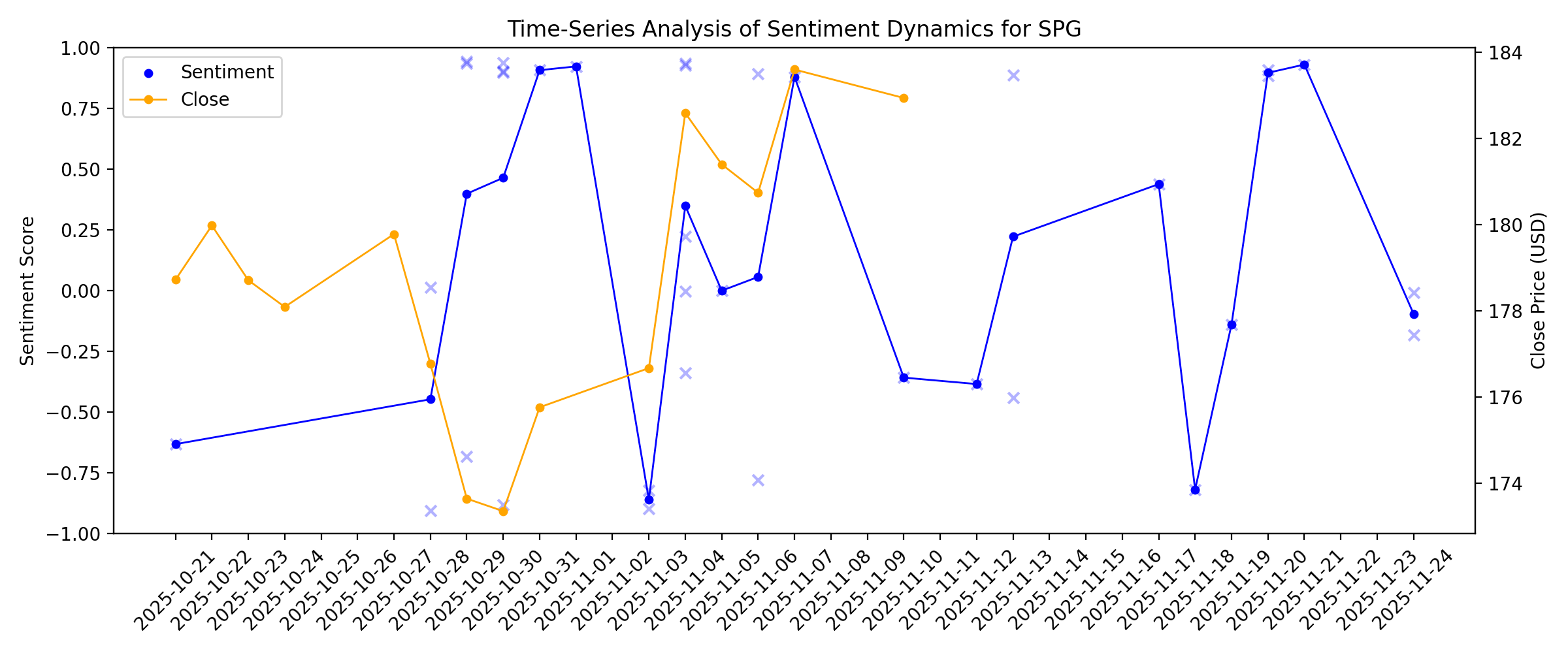

News sentiment analysis for SPG

Sentiment chart

2026-01-14

2026-01-13

Realty Income's Strategic Partnerships: Will it Boost Growth?

Description: O teams up with GIC in a $1.5B-plus JV targeting U.S. logistics build-to-suit projects and Mexico expansion to broaden funding and growth.

Simon Property Group: Cash-Leasing-Spread Compounding at Scale

Description: At a low-teens FFO multiple and mid-single-digit yield, sustained spreads support 6--8% FFO growth and a 9--12% total return without re-rating.

2026-01-12

2026-01-11

2026-01-10

A Look At Simon Property Group (SPG) Valuation After US$800 Million Debt Refinancing Move

Description: Simon Property Group (SPG) is back in focus after its operating partnership moved to issue US$800 million of 4.300% senior notes due 2031, with proceeds earmarked to retire debt maturing in 2026. See our latest analysis for Simon Property Group. At a share price of US$184.69, Simon Property Group has seen a 5.36% 90 day share price return, while its 1 year total shareholder return of 13.51% and very large 5 year total shareholder return suggest momentum has been building over time. The new...

What Catalysts Are Quietly Shifting The Narrative For Simon Property Group (SPG)?

Description: Simon Property Group’s fair value estimate has shifted only slightly, edging from about US$193.45 to roughly US$194.05 as recent Street research filters into updated REIT models following the latest Q3 reporting season. Behind this small move are modest tweaks to the discount rate and revenue growth assumptions, reflecting how analysts are balancing a generally supportive sector backdrop with a still cautious read on risk and timing. Read on to see how you can keep on top of these kinds of...

2026-01-09

Simon® Announces Date For Its Fourth Quarter 2025 Earnings Release And Conference Call

Description: Simon®, a real estate investment trust engaged in the ownership of premier shopping, dining, entertainment and mixed-use destinations, today announced details for its fourth quarter earnings release and conference call.

2026-01-08

The Overlooked Sector Paying 5%+ Yields That Wall Street Keeps Quiet About

Description: As much as the world likes to talk about REITs being a smart investment, they are still pretty overlooked, as they are not flashy enough for financial media and don’t generate the kind of volatility that keeps day traders interested. This quiet indifference is creating an opportunity for investors that should not be overlooked. While ... The Overlooked Sector Paying 5%+ Yields That Wall Street Keeps Quiet About

2026-01-07

2026-01-06

Simon Property Group Sells $800 Million of Senior Notes

Description: Simon®, a real estate investment trust engaged in the ownership of premier shopping, dining, entertainment and mixed-use destinations, announced today that its majority-owned operating partnership subsidiary, Simon Property Group, L.P. (the "Operating Partnership"), has agreed to sell $800 million aggregate principal amount of its 4.300% Notes due 2031.

2026-01-05

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

Vale and Azenta have been highlighted as Zacks Bull and Bear of the Day

Description: Vale stands out as Bull of the Day after a strong turnaround, rising production and a nearly 7% dividend push shares to new highs.

2025-12-30

Best REIT Stocks to Buy for Reliable Income Heading Into 2026

Description: Top REITs like PLD, SPG, and CUZ offer steady dividends and growth potential as 2026 approaches.

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

2025-12-21

2025-12-20

Simon Property Group (SPG): Is the Mall Giant Quietly Undervalued After Its Recent Share Price Gains?

Description: Simon Property Group (SPG) has quietly kept shareholders happy, with the stock up about 13% over the past year and roughly 84% in the past 3 years, even as malls continue to evolve. See our latest analysis for Simon Property Group. That steady backdrop, together with modest revenue and net income growth, has helped support the current share price of $184.93 and a healthy one year total shareholder return. This suggests that momentum is still quietly building around the story rather than...

2025-12-19

Has Simon Property Group’s Strong Multi Year Rally Already Priced In Future Growth?

Description: Wondering if Simon Property Group is still a smart buy after its huge run, or if you are late to the party? Here is a breakdown of what the current share price is really implying about potential future returns. The stock has climbed 1.7% over the last week, 2.7% over the past month, and is now up 6.7% year to date, adding to a 13.3% gain over 1 year and 84.6% and 186.2% over 3 and 5 years respectively. Behind those moves, investors have been watching how Simon navigates the long term shift...

2025-12-18

5 Reasons to Add Simon Property Stock to Your Portfolio

Description: SPG stands out as retail real estate rebounds, backed by premium assets, strong leasing momentum, strategic deals and rising dividends.

From Asset Sales to Acquisitions: How Is Federal Realty Repositioning?

Description: FRT's $170M property sales highlight a capital recycling push, funding growth, portfolio upgrades and selective acquisitions in high-demand retail markets.

Simon Property (SPG) Upgraded to Buy: Here's Why

Description: Simon Property (SPG) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

2025-12-17

2025-12-16

W.P. Carey Announces Dividend Hike: Is the Increase Sustainable?

Description: WPC boosts its dividend 1.1% to $0.92 quarterly, lifting the annual payout to $3.68 and a 5.6% yield, as fundamentals support long-term sustainability.

2025-12-15

2025-12-14

2025-12-13

2025-12-12

2025-12-11

2025-12-10

2025-12-09

2025-12-08

2025-12-07

2025-12-06

2025-12-05

Here's Why it Is Wise to Retain SPG Stock in Your Portfolio Now

Description: SPG gains momentum as strong leasing, mixed-use projects and recent acquisitions fuel growth despite online and macro pressures.

2025-12-04

Simon Property Group (SPG): Valuation Check After Antitrust Lawsuit and New High-End Retail Acquisitions

Description: Simon Property Group (SPG) is juggling two very different headlines right now, with a fresh federal antitrust lawsuit on one side and new high end acquisitions like Phillips Place and Esplanade Aventura on the other. See our latest analysis for Simon Property Group. That mix of legal overhang and trophy acquisitions has not derailed sentiment much, with Simon Property Group’s share price at $183.32 and a solid 5.8% one year total shareholder return, reinforcing the strong 81.8% three year...

2025-12-03

/C O R R E C T I O N -- Electrify America, LLC/

Description: Electrify America, the largest open Hyper-Fast charging network in the U.S., and Simon®, a global leader in retail real estate, celebrate their ongoing collaboration to expand access to electric vehicle (EV) charging at Simon properties in convenient locations. Since Electrify America and Simon's first joint effort in 2018 at Gulfport Premium Outlets®, the companies have integrated EV charging with premier shopping, dining, and entertainment, giving customers the convenience of a single destinat

Electrify America and Simon® Collaboration Surpasses 500 Hyper-Fast Chargers

Description: Electrify America, the largest open Hyper-Fast charging network in the U.S., and Simon®, a global leader in retail real estate, celebrate their ongoing collaboration to expand access to electric vehicle (EV) charging at Simon properties in convenient locations. Since Electrify America and Simon's first joint effort in 2018 at Gulfport Premium Outlets®, the companies have integrated EV charging with premier shopping, dining, and entertainment, giving customers the convenience of a single destinat

2025-12-02

FRT Expands Its Portfolio With Village Pointe Buy: Can It Fuel Growth?

Description: FRT deepens its expansion push with the $153.3M acquisition of Omaha's Village Pointe, adding a high-traffic, premium open-air center to its portfolio.

Realty Income's $800M CityCenter Bet: Will Diversification Pay Off?

Description: O's $800M CityCenter move adds ARIA and Vdara exposure with a 7.4% return structure as the REIT pushes beyond its traditional footprint.

Why Analysts Say Simon Property Group’s Growth Story Is Shifting After Recent Positive Updates

Description: Simon Property Group's consensus analyst price target has risen slightly, moving from $192 to $193.45 amid recent market activity. This modest upward revision reflects mixed but generally constructive analyst sentiment following the company's latest earnings report. Stay tuned to learn how you can keep informed about further shifts in the evolving Simon Property Group narrative as new developments emerge. Analyst Price Targets don't always capture the full story. Head over to our Company...

Is Simon Property Group Fairly Priced After New Retail Partnership and Mixed-Use Expansion News?

Description: If you have ever wondered whether Simon Property Group is truly a value opportunity or just riding the waves of market optimism, you are in the right place for answers. While the stock price has stayed flat over the last week, Simon Property Group is up 5.3% over the past month, 6.7% year-to-date, and has surged by 168.9% across the past five years, hinting at both growth potential and evolving risk. Lately, the spotlight has been on Simon Property Group’s continued expansion efforts and...

Citi Maintains Neutral Outlook on Simon Property Group (SPG)

Description: Simon Property Group, Inc. (NYSE:SPG) is one of the best dividend stocks in the real estate sector. On November 26, Citi maintained a Neutral rating on Simon Property Group while lifting the price target from $170 to $185. In another corporate update, dated November 18, Simon Property Group announced the acquisition of Phillips Place in […]

2025-12-01

2025-11-30

2025-11-29

2025-11-28

2025-11-27

2025-11-26

2025-11-25

2025-11-24

Holidays Start @TheMall™

Description: The holidays are here—and Simon's 220+ Simon Malls® and Simon Premium Outlets® across the country are ready to help shoppers make it their most joyful one yet. Shoppers will discover hundreds of new stores, restaurants and entertainment destinations, plus unforgettable experiences with family and friends and the debut of Simon+™, a new loyalty program that rewards members throughout the holidays and beyond.

Barclays cuts Klépierre, Gecina to EW and Icade to UW on sector weakness

Description: Investing.com -- Barclays downgraded Klépierre and Gecina to “equal weight” and cut Icade to “underweight” as the brokerage warned that political instability and weakening office fundamentals in France could continue to pressure the real estate sector into 2026, in a note dated Monday.

2025-11-23

2025-11-22

2025-11-21

SP Group AS (OCSE:SPG) Q3 2025 Earnings Call Highlights: Navigating Challenges with Strategic ...

Description: Despite a dip in sales, SP Group AS (OCSE:SPG) remains optimistic with a robust order book and strategic expansions in key sectors.

2025-11-20

Simon Property Group (SPG): Assessing Valuation After a Flat Trading Session

Description: Simon Property Group (SPG) tracked a flat day in the market, holding at $180.07 per share. While there was no major event driving movement, investors may be weighing its recent returns and overall profitability trends. See our latest analysis for Simon Property Group. Simon Property Group’s 1-year total shareholder return of just under 4% masks some longer-run strength, with three- and five-year total returns at an impressive 77% and 170%. The recent modest share price gains suggest momentum...

Simon Property Acquires Philips Place in Charlotte to Boost Growth

Description: SPG expands in Charlotte with its acquisition of Phillips Place, aiming to elevate the open-air retail center through new offerings and continued investment.

2025-11-19

It Might Be Time to Buy Stocks Again. Even Tech.

Description: Investors must be patient and embrace diversification as they position themselves for a tech-stock rebound after this month’s slide. But they don‘t need an all-clear sign from Nvidia after the chip company’s earnings to wade back in. There are plenty of good opportunities in the market, even in some of the beaten-up tech and artificial intelligence names.

2025-11-18

Simon® Acquires Phillips Place in Charlotte

Description: Simon®, a real estate investment trust engaged in the ownership of premier shopping, dining, entertainment and mixed-use destinations, today announced that it has acquired Phillips Place™ in the heart of the SouthPark neighborhood of Charlotte, North Carolina.

2025-11-17

LEAP, SIMON & SHOPIFY COLLABORATE TO ACCELERATE BOMBAS EXPANSION INTO PHYSICAL RETAIL WITH NEW TEXAS STORE

Description: Leap, the leading platform for modern physical retail, today announced the opening of Bombas' third-ever retail store in Austin, following successful openings in South Florida and New York City last month. This expansion leverages Leap's retail platform that integrates with Shopify and utilizes Simon® premium retail locations, enabling Bombas to establish physical retail spaces in key markets while minimizing traditional barriers that have long stood between brands and premium physical retail.

2025-11-16

2025-11-15

2025-11-14

2025-11-13

How Investors May Respond To Simon Property Group (SPG) Earnings Beat and Dividend Hike Amid Expansion

Description: Simon Property Group recently announced strong third quarter 2025 results, including year-over-year revenue and net income growth, alongside a quarterly common stock dividend increase to US$2.20 per share and updated earnings guidance for the full year. The company's focus on expanding experiential mixed-use destinations, as shown by the unveiling of the Sagefield luxury lifestyle project, highlights its efforts to diversify income streams and adapt to evolving consumer preferences. We'll...

SPG Launches Simon+ Loyalty Program for Shoppers to Get Rewards

Description: Simon Property rolls out Simon+, a loyalty program that offers cash back and curated rewards for purchases across in-store and online.

2025-11-12

Simon® Debuts Simon+™: A New Loyalty Program Connecting Retailers and Shoppers

Description: Simon®, a real estate investment trust engaged in the ownership of premier shopping, dining, entertainment and mixed-use destinations, today announced the launch of Simon+™, a new loyalty program that rewards members with cash back, points and perks for shopping nationwide at Simon Malls ® and Premium Outlets® and online at ShopSimon.com™ or the ShopSimon app.

2025-11-11

2025-11-10

Digital Turbine and The Trade Dek have been highlighted as Zacks Bull and Bear of the Day

Description: Digital Turbine and The Trade Dek have been highlighted as Zacks Bull and Bear of the Day

2025-11-09

2025-11-08

2025-11-07

Europe Leads Realty Income's Investment Surge: What Comes Next?

Description: O's growing European footprint, higher yields and strong deal pipeline power its 2025 investment outlook.

2025-11-06

Jim Cramer Calls Simon Property Group’s Stock a Bargain

Description: Simon Property Group, Inc. (NYSE:SPG) is one of the latest stocks on Jim Cramer’s radar. Cramer called the stock a bargain, as he stated: “Now, on the conference call, management kept their prepared remarks brief, seemingly happy to let the excellent numbers speak for themselves. I like that when people do that… With the excellent […]

Shopping Mall Giant Simon Property Group Offers Stable Financials, Dividend Hikes

Description: Strong yields and stable financials make Simon Property Group a top dividend stock for income-focused investors as shares near a buy zone.

2025-11-05

Simon Property Group (SPG): Net Margin Decline Challenges Prevailing Bull Case Ahead of Earnings Season

Description: Simon Property Group (SPG) has delivered a 9.7% annual earnings growth rate over the past five years, but recent results show a pause in momentum. The current net profit margin is 36.4%, down from 41.4% last year, and forward forecasts point to 3.4% annual earnings growth and 1.8% revenue growth. Both of these rates trail the projected pace of the broader US market. While earnings remain high quality and relative value is attractive, margin compression and below-market growth expectations...

2025-11-04

Is Simon Property Group’s Recent Stock Dip a Valuation Opportunity for 2025?

Description: If you have ever wondered whether Simon Property Group is a hidden gem or just fairly priced, you are not alone. We are about to break it down for you. The stock has climbed 7.7% over the past year and boasts an impressive 78.3% jump over three years. It recently dipped 1.7% in the last week and is down 4.6% for the month. Recent news around Simon Property Group has focused on continued momentum in consumer foot traffic at shopping centers and high-profile property repositionings. Both...

Simon Property Q3 FFO Beats Estimates on Higher Revenues & Occupancy

Description: SPG's Q3 FFO tops estimates as rising rents, occupancy gains and a key acquisition fuel stronger guidance.

Simon® to Bring Sagefield™, A Curated Blend of Bespoke Retail, Culinary Artistry, and Design Excellence, to South Nashville

Description: Simon®, a real estate investment trust engaged in the ownership of premier shopping, dining, entertainment and mixed-use destinations, today unveiled plans to create SagefieldTM, a thoughtfully distinctive luxury lifestyle destination.

How Recent Developments Are Shaping the Story for Simon Property Group

Description: Simon Property Group’s consensus analyst price target has been revised upward, now standing at $188.40 per share compared to $186.45 previously. This slight gain reflects mixed sentiment in new analyst research, balancing recent company performance against evolving risks. Read on to learn how these shifting expectations might impact the stock’s narrative and discover how to stay informed as opinions continue to evolve. Analyst Price Targets don't always capture the full story. Head over to...

Simon Property Group Inc (SPG) Q3 2025 Earnings Call Highlights: Strong FFO Growth and ...

Description: Simon Property Group Inc (SPG) reports robust financial results with increased FFO, strategic acquisitions, and a dividend hike, despite challenges in Las Vegas and tariff concerns.

2025-11-03

Simon® Reports Third Quarter 2025 Results

Description: Simon®, a real estate investment trust engaged in the ownership of premier shopping, dining, entertainment and mixed-use destinations, today reported results for the quarter ended September 30, 2025.

Simon® Acquires Remaining Interest in Taubman Realty Group

Description: Simon®, a real estate investment trust engaged in the ownership of premier shopping, dining, entertainment and mixed-use destinations, today announced that it has closed on the acquisition of the remaining 12% interest in The Taubman Realty Group Limited Partnership ("TRG") which it did not own in exchange for 5.06 million limited partnership units in Simon Property Group L.P.

2025-11-02

2025-11-01

Simon Property Group (SPG): Assessing Valuation After Dividend Hike and Upbeat Growth Expectations

Description: Simon Property Group (SPG) just announced a 4.9% increase to its quarterly dividend. Investor attention is turning to upcoming third-quarter earnings, with expectations of higher funds from operations. Strong leasing demand and high occupancy are fueling this optimism. See our latest analysis for Simon Property Group. Shares of Simon Property Group have traded with some volatility lately, but momentum is still building, supported by upbeat earnings expectations and strong leasing trends...

2025-10-31

The Zacks Analyst Blog Highlights Simon Property, Realty Income and The Macerich

Description: Simon Property, Realty Income, and Macerich could deliver upside this earnings season as retail REIT fundamentals stabilize.

2025-10-30

Kimco's Q3 FFO & Revenues Beat Estimates, Dividend Raised

Description: KIM posts solid Q3 results, with higher FFO per share and revenues, boosted by rising rents and occupancy and lifts its dividend and 2025 FFO per share outlook.

3 Retail REITs to Watch for Potential Upside This Earnings Season

Description: Simon Property, Realty Income and Macerich may surprise investors this earnings season with solid fundamentals and resilient portfolios.

Kimco Realty (KIM) Tops Q3 FFO and Revenue Estimates

Description: Kimco Realty (KIM) delivered FFO and revenue surprises of +2.33% and +2.21%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Should Simon Property Group's (SPG) Higher Occupancy and Upbeat Outlook Prompt Investor Action?

Description: Simon Property Group recently reported a 96% occupancy rate, year-over-year revenue growth of 4.84%, and higher base rents, further supporting increased funds from operations (FFO) guidance and sustained dividend growth. A unique driver has been Simon's evolution of its mall portfolio into multi-purpose destinations, helping to attract robust leasing activity and positioning the company to benefit as economic conditions change. We'll explore how Simon's strong leasing performance and...

2025-10-29

Here's What to Expect From Simon Property This Earnings Season

Description: SPG's Q3 results may show higher revenues and FFO, backed by strong retail demand and mixed-use developments.

Regency Centers Q3 FFO Meet Estimates, Same-Property NOI Rises

Description: REG posts steady Q3 results, with FFO matching estimates and revenues beating estimates, backed by strong leasing and same-property NOI growth.

Curious about Simon Property (SPG) Q3 Performance? Explore Wall Street Estimates for Key Metrics

Description: Beyond analysts' top-and-bottom-line estimates for Simon Property (SPG), evaluate projections for some of its key metrics to gain a better insight into how the business might have performed for the quarter ended September 2025.

2025-10-28

Smead Value Fund's Strategic Moves: UnitedHealth Group Inc. Takes Center Stage

Description: Analyzing Smead Value Fund (Trades, Portfolio)'s Third Quarter 2025 N-PORT Filing

What's in the Cards for Kimco Realty Stock in Q3 Earnings?

Description: While a healthy retail real estate market and focus on developing mixed-use assets are likely to aid KIM's Q3 earnings, high interest expenses may have hurt it.

2025-10-27

2025-10-26

2025-10-25

2025-10-24

2025-10-23

2025-10-22

2025-10-21

How to Find Strong Finance Stocks Slated for Positive Earnings Surprises

Description: Why investors should use the Zacks Earnings ESP tool to help find stocks that are poised to top quarterly earnings estimates.