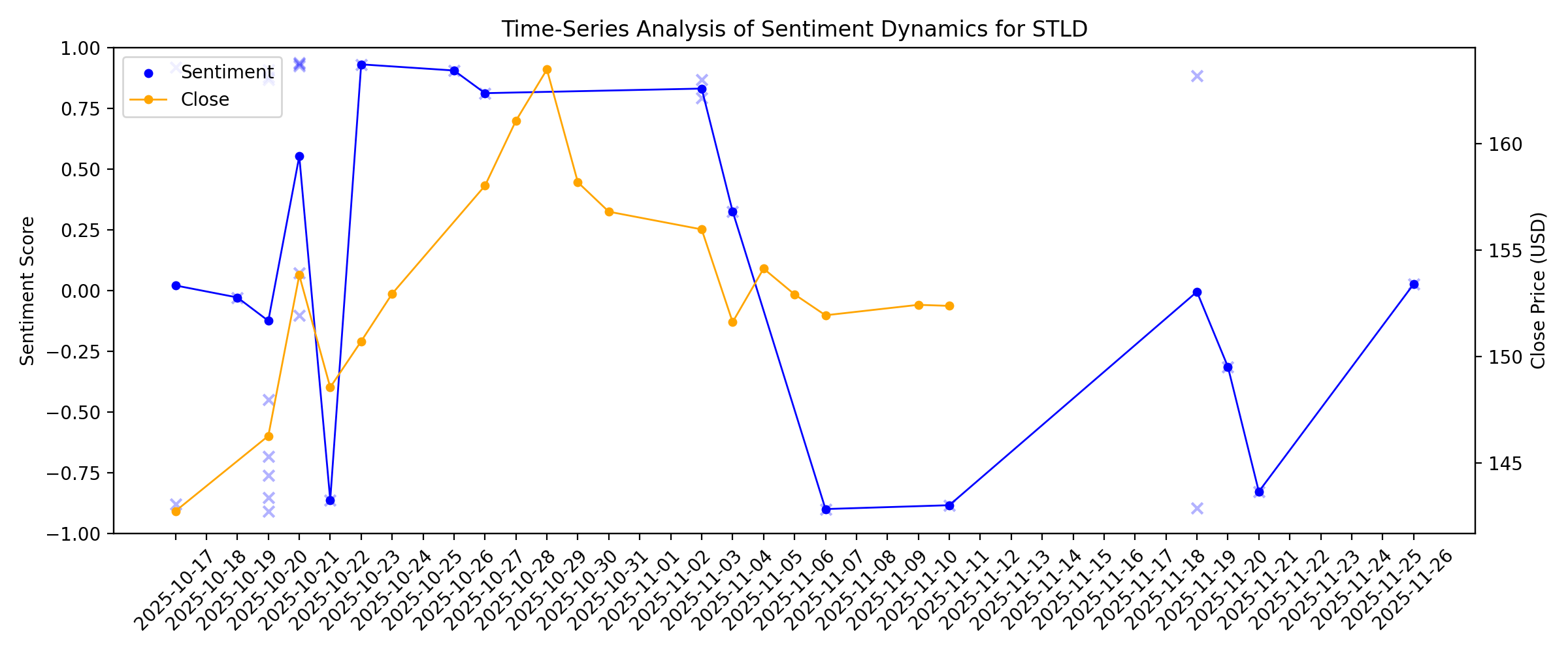

News sentiment analysis for STLD

Sentiment chart

2026-01-14

2026-01-13

2026-01-12

Steel Dynamics Announces Fourth Quarter and Full Year 2025 Earnings Conference Call and Webcast

Description: Steel Dynamics, Inc. (NASDAQ/GS: STLD), one of the largest domestic steel producers and metals recyclers in North America, today announced it intends to release Fourth Quarter and Full Year 2025 financial results before the market opens on Monday, January 26, 2026. The teleconference is scheduled to begin at 11:00 a.m. Eastern Standard Time that same day and will be hosted by Mark D. Millett, Chairman and Chief Executive Officer, Theresa E. Wagler, Executive Vice President and Chief Financial Of

2026-01-11

2026-01-10

2026-01-09

2026-01-08

2026-01-07

Steel Dynamics Stock Looks Poised for Strong Q1 Gains

Description: The security is still trading near recent record highs

BlueScope Rejects Steel Dynamics, SGH Takeover Bid

Description: BlueScope argued that the $8.8 billion takeover bid didn’t reflect the value expected to be realized through current initiatives, growth investments and land monetization.

BlueScope Steel rejects $8.8B takeover bid from Steel Dynamics, SGH

Description: This is the fourth attempt from the U.S. metals recycler and producer since late 2024 to acquire the Australia-based firm’s North America businesses.

Is It Time To Reassess Steel Dynamics (STLD) After A 3.5x Five Year Return?

Description: If you are wondering whether Steel Dynamics at around US$172.74 is still offering value or starting to look stretched, you are not alone. The stock has returned 1.0% over the last week and 4.6% over the last month, with a 1.9% decline year to date set against a 46.3% gain over the past year and a 69.0% return over three years. These moves sit alongside a very large 5 year return of roughly 3.5x. This keeps Steel Dynamics on the radar of many investors and that kind of long term performance...

2026-01-06

Stocks to Watch Tuesday: AIG, Vistra, Microchip, Under Armour

Description: ↗️ Vistra (VST): The power-generation company plans to buy Cogentrix Energy in a roughly $4 billion deal that will include natural-gas generation facilities. Shares rallied 4.1% on Tuesday. 🔎 Under Armour (UAA, UA): Fairfax Financial has a 22% stake in the struggling sportswear company, a securities filing showed.

Bluescope Steel receives $8.8bn takeover bid from SGH and Steel Dynamics

Description: BlueScope is reviewing the non-binding cash offer, which includes further due diligence.

4 Steel Producer Stocks In Focus as Industry Gains on Price Recovery

Description: The rebound in steel prices and firm demand in construction and automotive should help Steel Producers industry players MT, STLD, CMC and SID to gain.

2026-01-05

Steel Dynamics, SGH Bid $8.8 Billion to Acquire BlueScope Steel

Description: Steel Dynamics intensified efforts to buy the North Star steel mill in Ohio, partnering on an US$8.8 billion bid to acquire its Australian owner in the latest example of tariffs reshaping a once-struggling sector. Indiana-based Steel Dynamics has made three unsuccessful bids for North Star and other assets owned by BlueScope Steel beginning in late 2024. On Monday, Steel Dynamics said it teamed up with Australian conglomerate SGH last month to make a fourth attempt to buy the business.

Steel Dynamics (STLD) Stock Drops Despite Market Gains: Important Facts to Note

Description: The latest trading day saw Steel Dynamics (STLD) settling at $171.83, representing a -2.4% change from its previous close.

Steel Dynamics and SGH Submit a NBIO to Acquire BlueScope Steel

Description: Steel Dynamics (STLD), together with SGH, said late Monday it has submitted a non-binding indicative

SGH and Steel Dynamics confirm the submission of a NBIO to acquire BlueScope Steel Ltd

Description: SGH and Steel Dynamics confirm the submission of a NBIO to acquire BlueScope Steel Ltd

2026-01-04

Steel Dynamics (STLD): Is the Recent Share Price Surge Fully Reflecting Its Valuation?

Description: Steel Dynamics (STLD) has quietly rewarded patient investors, with the stock up roughly 24% over the past 3 months and about 58% over the past year, far outpacing many industrial peers. See our latest analysis for Steel Dynamics. At a share price of $176.06, Steel Dynamics has built steady momentum, with a solid 90 day share price return and strong one year total shareholder return suggesting investors are warming to its growth prospects and earnings resilience. If Steel Dynamics' recent run...

Steel Dynamics (NASDAQ:STLD) shareholders have earned a 37% CAGR over the last five years

Description: For many, the main point of investing in the stock market is to achieve spectacular returns. While not every stock...

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

Steel Dynamics (STLD) Sees a More Significant Dip Than Broader Market: Some Facts to Know

Description: Steel Dynamics (STLD) closed the most recent trading day at $171.03, moving 1.07% from the previous trading session.

2025-12-29

2025-12-28

Jim Cramer on Nucor: “I Always Knew That Was a Good One”

Description: Nucor Corporation (NYSE:NUE) is one of the stocks Jim Cramer discussed along with macroeconomic conditions. Cramer said he should have “pushed hard” on the company stock, as he commented: “Regular metals, generally up with the help of tariffs, but a lot of crops and chemical stocks are very bad. That explains why we’ve seen a […]

2025-12-27

2025-12-26

Steel Dynamics' Q4 2025 Earnings: What to Expect

Description: Steel Dynamics will release its fourth-quarter earnings next month, and analysts anticipate a double-digit bottom-line growth.

2025-12-25

2025-12-24

Steel Dynamics (STLD) Stock Dips While Market Gains: Key Facts

Description: In the latest trading session, Steel Dynamics (STLD) closed at $175.38, marking a -1.03% move from the previous day.

2025-12-23

2025-12-22

2025-12-21

2025-12-20

2025-12-19

Steel Dynamics Projects Sequentially Lower Q4 Earnings on Seasonality

Description: STLD guides Q4 EPS at $1.65-$1.69, up year over year but down sequentially as seasonal demand, outages and lower steel prices pressure profits.

2025-12-18

Has Steel Dynamics Run Too Far After a 54% Surge or Is Value Still Left?

Description: Wondering if Steel Dynamics is still good value after such a big run? This breakdown will help you decide whether the stock still deserves a spot on your buy list. The share price has climbed 54.3% year to date and 52.2% over the last year, with a strong 11.7% gain in the past month despite a flat 7 day move of around 0.2%. Recent headlines have focused on resilient US steel demand, ongoing infrastructure and manufacturing investment, and continued enthusiasm for reshoring, all of which...

2025-12-17

Steel Dynamics (STLD) Rises As Market Takes a Dip: Key Facts

Description: Steel Dynamics (STLD) concluded the recent trading session at $172.74, signifying a +2.13% move from its prior day's close.

Steel Dynamics (STLD): Assessing Valuation After Strong 3-Month Share Price Gains

Description: Steel Dynamics (STLD) has quietly rewarded patient investors, with the stock up about 9% over the past month and roughly 24% in the past 3 months, outpacing many industrial peers. See our latest analysis for Steel Dynamics. Zooming out, Steel Dynamics is trading around $169.13 with strong momentum, as its solid year to date share price return and robust multi year total shareholder returns underline growing confidence in its earnings resilience and long term demand backdrop. If Steel Dynamics...

Nucor Stock Is Down. Steel Prices Are Up, but There’s a Problem.

Description: Higher steel prices have been a boon to American steel companies. Now, higher costs, such as for scrap steel, are starting to bite. Benchmark steel prices have been fine, at about $900 per ton, up $100 since the end of the third quarter and up about $200 compared with a year ago.

Nucor, Steel Dynamics Warn of Profit Shortfalls

Description: Steelmakers Nucor and Steel Dynamics warned that their fourth-quarter earnings would fall well short of Wall Street’s expectations.

Steel Dynamics Provides Fourth Quarter 2025 Earnings Guidance

Description: Steel Dynamics, Inc. (NASDAQ/GS: STLD) today provided fourth quarter 2025 earnings guidance in the range of $1.65 to $1.69 per diluted share. Comparatively, the company's sequential third quarter 2025 earnings were $2.74 per diluted share, and prior year fourth quarter earnings were $1.36 per diluted share.

2025-12-16

2025-12-15

2025-12-14

2025-12-13

2025-12-12

2025-12-11

Steel Dynamics (STLD) Rises Higher Than Market: Key Facts

Description: In the most recent trading session, Steel Dynamics (STLD) closed at $173.01, indicating a +1.04% shift from the previous trading day.

4 Steel Stocks That Have Gained More Than 40% YTD Amid Price Recovery

Description: CMC, MT, NUE and STLD have surged over 40% YTD as steel prices recover and demand rebounds in key end markets.

Is Steel Dynamics’ Q3 Earnings Beat And Analyst Optimism Altering The Investment Case For STLD?

Description: Steel Dynamics recently reported stronger-than-expected third-quarter results, with net sales and earnings both rising year over year and exceeding analyst forecasts. This performance, alongside continued analyst confidence and insider share activity, has reinforced the market’s focus on the company’s earnings momentum and operational execution. Against this backdrop of third-quarter outperformance, we’ll explore how stronger earnings and analyst optimism may influence Steel Dynamics’...

2025-12-10

Is Steel Dynamics Stock Outperforming the Dow?

Description: As Steel Dynamics has outperformed the Dow recently, analysts remain moderately optimistic about the stock’s prospects.

Metals & Mining outlook: Nucor remains top pick at Jefferies, CMC upgraded to Buy

Description: Investing.com -- The U.S. steel sector is heading into 2026 on firmer ground, a Jefferies analyst says, with rising free cash flow expected as prices stabilize, imports fall, and capital spending eases.

2025-12-09

2025-12-08

2025-12-07

2025-12-06

2025-12-05

2025-12-04

Steel Dynamics (STLD) Stock Drops Despite Market Gains: Important Facts to Note

Description: Steel Dynamics (STLD) reached $168.11 at the closing of the latest trading day, reflecting a -1.98% change compared to its last close.

2025-12-03

Steel Dynamics (STLD) Gains as BofA Updates Coverage for North American Metals Stocks

Description: Steel Dynamics, Inc. (NASDAQ:STLD) is included among the 15 Dividend Stocks that Outperform the S&P 500. On November 24, Bank of America raised its price target on Steel Dynamics, Inc. (NASDAQ:STLD) to $185 from $155 while maintaining a Buy rating. The firm noted it is updating its price forecasts for North American metals and mining […]

2025-12-02

Steel Dynamics Secures Complete Ownership of New Process Steel

Description: STLD's full buyout of New Process Steel aims to boost its value-added manufacturing strength and deepen a key customer partnership.

2025-12-01

Steel Dynamics Completes Acquisition of the Remaining 55% Ownership Interest in New Process Steel

Description: Steel Dynamics, Inc. (NASDAQ/GS: STLD) today announced its completion of the acquisition of the remaining 55% equity interest in New Process Steel, L.P. ("New Process Steel" or "New Process"). New Process Steel is a metals solutions and distribution supply-chain management company headquartered in Houston, Texas, with a focus toward growing its value-added manufacturing applications.

2025-11-30

2025-11-29

2025-11-28

2025-11-27

2025-11-26

UBS Downgrades Steel Dynamics (STLD) to Neutral Despite Higher $165 Price Target

Description: Steel Dynamics, Inc. (NASDAQ:STLD) is included among the 15 Best Stocks to Buy for Medium Term. On November 4, UBS analyst Andrew Jones downgraded Steel Dynamics, Inc. (NASDAQ:STLD) to Neutral from Buy while raising the price target to $165 from $158, as reported by The Fly. The downgrade was driven by valuation, as the stock […]

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

Steel Dynamics Announces Completion of Notes Offering and Redemption Call for its 5.000% Notes Due 2026

Description: Steel Dynamics, Inc. (NASDAQ/GS: STLD) announced today that it has consummated the sale of $650 million aggregate principal amount of 4.000% Notes due 2028 (the "2028 Notes") as well as reopened and consummated the sale of an additional $150 million aggregate principal amount of 5.250% Notes due 2035 (the "Additional 2035 Notes" and, together with the 2028 Notes, the "Notes"). The Additional 2035 Notes were issued at a price of 101.443% of their principal amount, an implied yield of 5.053%. The

2025-11-20

Cleveland-Cliffs Stock Sees RS Rating Firms Up

Description: On Thursday, Cleveland-Cliffs stock got a positive adjustment to its Relative Strength (RS) Rating, from 78 to 82. Looking For The Best Stocks To Buy And Watch? Start Here This unique rating measures technical performance by showing how a stock's price movement over the last 52 weeks measures up against that of other stocks on the major indexes.

2025-11-19

What Recent Analyst Updates Mean for Steel Dynamics and Its Evolving Story

Description: Steel Dynamics shares have seen their fair value estimate inch up from $166.58 to $167.42 in response to mixed signals from Wall Street analysts. This modest price target boost comes as experts digest the company's resilience amid industry headwinds, balancing both optimistic and cautious outlooks. Stay tuned to discover how you can monitor these ongoing shifts in sentiment and stay ahead as the story evolves. Analyst Price Targets don't always capture the full story. Head over to our Company...

Why Is Steel Dynamics (STLD) Up 0.5% Since Last Earnings Report?

Description: Steel Dynamics (STLD) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

2025-11-11

Steel Dynamics Announces Leadership Appointment

Description: Steel Dynamics, Inc. (NASDAQ/GS: STLD) today announced the appointment of Matt Bell as the company's head of its metals recycling platform effective today.

2025-11-10

2025-11-09

2025-11-08

2025-11-07

Steel Dynamics Announces Fourth Quarter 2025 Cash Dividend

Description: Steel Dynamics, Inc. (NASDAQ/GS: STLD) today announced that the company's board of directors declared a fourth quarter 2025 cash dividend of $0.50 per common share. The dividend is payable to shareholders of record at the close of business on December 31, 2025 and is payable on or about January 9, 2026.

2025-11-06

2025-11-05

2025-11-04

UBS downgrades Steel Dynamics as valuation catches up to growth

Description: Investing.com -- UBS downgraded Steel Dynamics Inc to Neutral from Buy, saying the stock’s 22% rally since August has left limited upside despite steady fundamentals and strong cash generation potential. The brokerage raised its price target 4% to $165.

2025-11-03

Is There Now an Opportunity in Steel Dynamics After Surge in US Steel Prices?

Description: If you have ever wondered whether Steel Dynamics is trading for less than it is actually worth, you are in the right place. Let’s break down what the numbers and latest trends really mean for investors. The stock has had quite a run so far this year, up 40.1% year-to-date and gaining 8.1% in the last month, though it dipped slightly by 0.8% this past week. This shows both strength and some market caution. Sharp rises in US steel prices and positive analyst outlooks have put Steel Dynamics in...

How Recent Developments Are Rewriting the Story for Steel Dynamics

Description: Steel Dynamics has seen its Fair Value Estimate rise from $153.83 to $166.58 per share, marking an 8 percent increase in the projected price target. This adjustment reflects an evolving outlook on the company as analysts balance optimism about supportive policies and improved domestic demand with ongoing sector challenges. Stay tuned to follow how expert perspectives continue to shape the narrative and what it means for those monitoring Steel Dynamics’ outlook. Analyst Price Targets don't...

2025-11-02

2025-11-01

2025-10-31

2025-10-30

2025-10-29

2025-10-28

2025-10-27

Steel Dynamics Launches Lower-Embodied-Carbon Steel Products BIOEDGE™ and EDGE™

Description: Steel Dynamics, Inc. (NASDAQ/GS: STLD) today announced lower-embodied-carbon steel product offerings, BIOEDGE™ and EDGE™, to support customers in achieving their greenhouse gas emissions reduction and sustainability initiatives.

2025-10-26

Steel Dynamics (STLD) Delivers Strong Q3, Eyes Aluminum Ramp and Biocarbon Growth

Description: Steel Dynamics, Inc. (NASDAQ:STLD) is one of the top steel stocks to buy amid US tariffs. On October 20, Steel Dynamics (NASDAQ:STLD) reported robust third-quarter results with $4.8 billion in net sales, $404 million in net income ($2.74 EPS), and adjusted EBITDA of $664 million. The company achieved record steel shipments of 3.6 million tons, […]

2025-10-25

2025-10-24

2025-10-23

Materials Stocks, Copper Jump After Freeport-McMoRan Earnings. Charts Point to More Upside Ahead.

Description: Materials stocks and copper are in focus today, with Freeport-McMoRan trading higher after delivering better-than-expected quarterly results. The which holds Freeport-McMoRan as its fourth-largest position, is up close to 2% since the open. Copper prices have been climbing steadily after the late-July tariff-driven selloff and are now consolidating in a bull flag pattern near the key $5.00 level.

2025-10-22

Is the Options Market Predicting a Spike in Steel Dynamics Stock?

Description: Investors need to pay close attention to STLD stock based on the movements in the options market lately.

2025-10-21

Steel Dynamics (STLD): Net Profit Margins Fall Short, Challenging Bullish Narratives on Earnings Outlook

Description: Steel Dynamics (STLD) reported a 2.4% annual decline in earnings over the past five years, with net profit margins decreasing to 6.4% this year from 9.8% previously. Despite the recent slip, future prospects appear brighter, as earnings are forecast to jump 26.9% a year while the share price of $153.82 remains below the estimated fair value of $289.56. With only two minor risk flags noted and a valuation that compares favorably to industry peers, investors are eyeing the company’s strong...

Strong Q3 Earnings and Share Buybacks Might Change the Case for Investing in Steel Dynamics (STLD)

Description: Steel Dynamics reported third-quarter 2025 earnings, posting sales of US$4.83 billion and net income of US$403.69 million, both above analyst expectations and higher than the prior year’s results for the same period. The company also completed US$210 million in share repurchases during the quarter, reflecting management’s continued focus on shareholder returns alongside operational improvements and growth initiatives in low-carbon production. With record steel shipments underpinning...

Steel Dynamics Inc (STLD) Q3 2025 Earnings Call Highlights: Record Steel Shipments and ...

Description: Steel Dynamics Inc (STLD) reports strong financial performance with record shipments and strategic advancements despite market challenges.

Just two U.S. makers of critical railroad material left after plant closure

Description: Cleveland-Cliffs will close its idle Steelton, Pa., facility permanently, leaving just two U.S. producers of steel rail for track. The post Just two U.S. makers of critical railroad material left after plant closure appeared first on FreightWaves.

STLD's Q3 Earnings Beat Estimates on Record Steel Shipments

Description: Steel Dynamics posts a Q3 earnings beat with higher sales, stronger steel shipments and margin improvement driven by solid operations.

2025-10-20

Compared to Estimates, Steel Dynamics (STLD) Q3 Earnings: A Look at Key Metrics

Description: The headline numbers for Steel Dynamics (STLD) give insight into how the company performed in the quarter ended September 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Steel Dynamics (STLD) Tops Q3 Earnings and Revenue Estimates

Description: Steel Dynamics (STLD) delivered earnings and revenue surprises of +3.01% and +2.93%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Steel Dynamics: Q3 Earnings Snapshot

Description: FORT WAYNE, Ind. AP) — Steel Dynamics Inc. STLD) on Monday reported third-quarter earnings of $403.7 million.

Steel Dynamics Reports Third Quarter 2025 Results

Description: Steel Dynamics Reports Third Quarter 2025 Results

Cleveland-Cliffs Rides Trump Tariffs To Transformative Deal; CLF Stock Surges

Description: Cleveland-Cliffs credited Trump tariffs for a new pact with a "major global steel producer."

Wall Street Set to Open Higher Monday as Investors Look Ahead to a Week of Earnings Reports

Description: US stocks look set to open higher in Monday's trading session ahead of a raft of earnings coming out

Stocks Rise Pre-Bell as Traders Await Earnings, Key Inflation Data; AWS-Linked Internet Outage Impacts Major Websites

Description: The benchmark US stock measures were tracking in the green before the opening bell Monday as investo

Looking at the Narrative for Steel Dynamics as Analyst Views Evolve with New Tariffs and Demand Shifts

Description: The consensus analyst price target for Steel Dynamics has recently increased slightly, rising from $151.50 to $153.83 per share. This change reflects a cautious but incrementally optimistic view, with near-term support from resilient U.S. steel prices and the anticipated positive effects of tariff adjustments. Stay tuned to discover how you can keep up with ongoing updates as the company's outlook continues to evolve. What Wall Street Has Been Saying Analyst commentary on Steel Dynamics...

2025-10-19

Tesla, Netflix set to report earnings as US-China trade fight turns 'unsustainable': What to watch this week

Description: As investors enters shutdown week three, a US-China trade war, credit gesticulation, and an incoming oil glut are weighing on the market.

2025-10-18

2025-10-17

Tesla earnings, September CPI report: What to Watch Next Week

Description: Market Domination Overtime host Josh Lipton previews several of the biggest stories to come next week, including the US Bureau of Labor Statistics (BLS) preparing to release September's Consumer Price Index (CPI) report, now rescheduled to come out next Friday, October 24, amid the ongoing government shutdown; as well as corporate earnings results from companies like EV maker Tesla (TSLA), Coca-Cola (KO), Ford (F), and Intel (INTC). To watch more expert insights and analysis on the latest market action, check out more Market Domination Overtime.

How To Earn $500 A Month From Steel Dynamics Stock Ahead Of Q3 Earnings

Description: Steel Dynamics, Inc. (NASDAQ:STLD) will release earnings results for the third quarter, after the closing bell on Monday, Oct. 20. Analysts expect the company to report quarterly earnings at $2.63 per share, up from $2.05 per share in the year-ago period. Steel Dynamics is likely to post quarterly revenue of $4.76 billion. Last year, it earned $4.34 billion, according to data from Benzinga Pro. With the recent buzz around Steel Dynamics, some investors may be eyeing potential gains from the comp