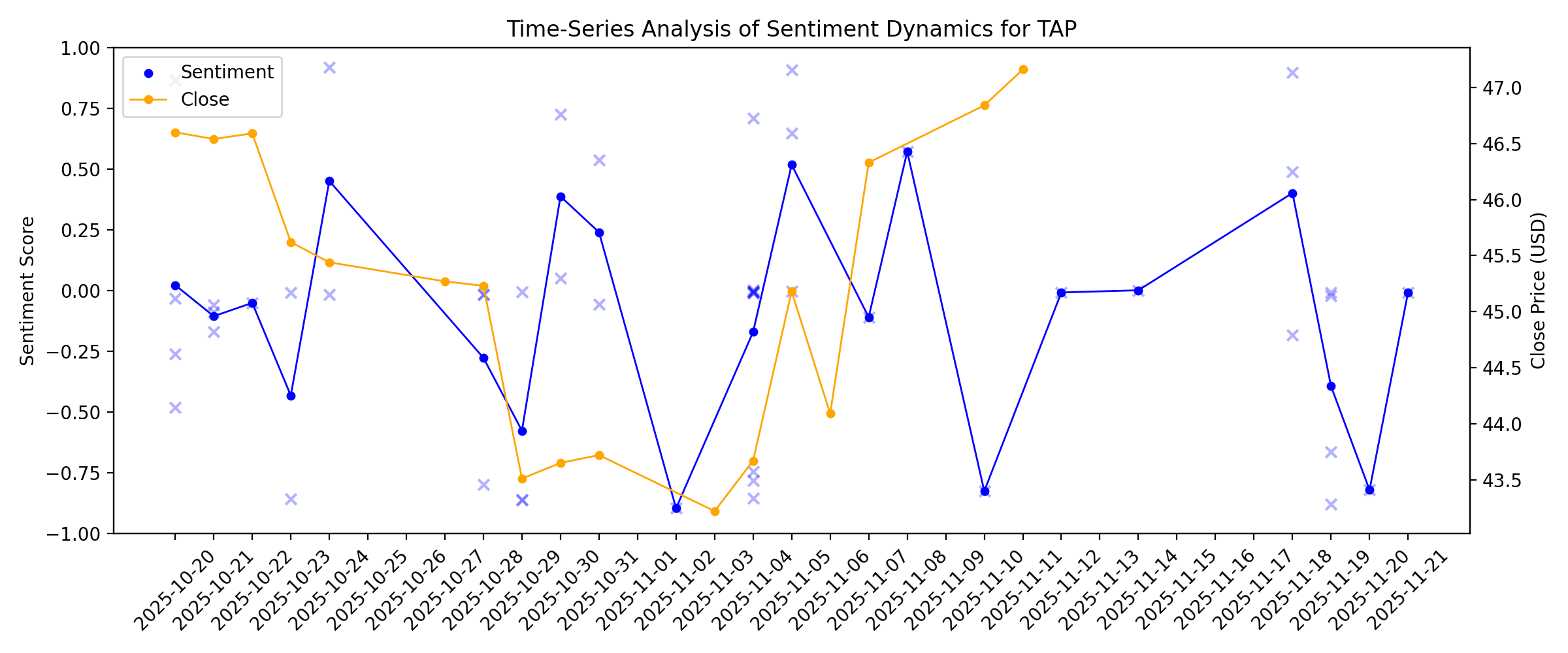

News sentiment analysis for TAP

Sentiment chart

2026-01-14

2026-01-13

One Beer Maker Bets on Vodka Tea Innovation as Its Rival Defends Legacy Brands

Description: Boston Beer (NYSE: SAM) and Molson Coors (NYSE: TAP) reported earnings revealing starkly different approaches to surviving the beer industry’s toughest stretch in years. Boston Beer posted Q3 revenue of $537.5 million, down 11.2% year-over-year, while expanding gross margin to 50.8%. Molson Coors generated $11.21 billion in trailing twelve-month revenue but carries negative TTM earnings ... One Beer Maker Bets on Vodka Tea Innovation as Its Rival Defends Legacy Brands

A Look At Molson Coors (TAP) Valuation As Sales Decline And Margins Face Ongoing Pressure

Description: Molson Coors Beverage (TAP) is back in focus after recent commentary underlined falling unit sales, shrinking returns, and pressured operating margins, even as the company leans harder into new products and brand collaborations. See our latest analysis for Molson Coors Beverage. At a share price of $48.85, Molson Coors has seen a 1 day share price return of 1.5% and a 7 day share price return of 5.48%. Its 1 year total shareholder return of 5.84% and 5 year total shareholder return of 6.83%...

2026-01-12

2026-01-11

2026-01-10

2026-01-09

Are ICE Raids Hurting Corona Sales? Constellation Brands Investors Are Wondering Aloud.

Description: Are immigration raids hurting Mexican beer sales? The question might sound both indelicate and frivolous at a time when Americans are hotly divided over the tactics of the Immigration and Customs Enforcement agency, or ICE. More than half of Constellation’s beer customers are Hispanic.

Molson Coors Beverage Company Announces 2025 Fourth Quarter and Full Year Earnings Date and Participation at the 2026 Consumer Analyst Group of New York (CAGNY) Conference

Description: GOLDEN, Colo. & MONTREAL, January 09, 2026--MOLSON COORS BEVERAGE COMPANY ANNOUNCES 2025 FOURTH QUARTER AND FULL YEAR EARNINGS DATE AND PARTICIPATION AT THE 2026 CAGNY CONFERENCE

2026-01-08

2026-01-07

2026-01-06

2026-01-05

Should Weak Sales, Margins, and Returns Require Action From Molson Coors Beverage (TAP) Investors?

Description: Molson Coors recently reported that unit sales have fallen for two consecutive years, alongside shrinking operating margins and a return on invested capital that is currently below zero. These pressures suggest the company may need to consider price reductions or other commercial adjustments, highlighting growing difficulty in turning past and current investments into profitable growth. We’ll now examine how these deteriorating margins and investment returns could alter Molson Coors’...

2026-01-04

2026-01-03

2026-01-02

Vice Stocks Enter ’26 With a Harsh Hangover

Description: It’s easy to see how investors in vice stocks could develop a severe case of the spins from 2025 since their performance was rarely in sync.

2026-01-01

2025-12-31

Is Volume Decline the Real Risk Behind Molson Coors' 2025 Outlook?

Description: TAP's 2025 outlook hinges on falling beer volumes, as pricing and cost controls cannot offset a structurally soft U.S. industry.

2025-12-30

2025-12-29

Jim Cramer Discusses Molson Coors (TAP) & Alcohol Industry

Description: We recently published 8 Stocks on Jim Cramer’s Radar. Molson Coors Beverage Company (NYSE:TAP) is one of the stocks on Jim Cramer’s radar. Molson Coors Beverage Company (NYSE:TAP) is an alcoholic beverage company. The shares are down by 18% year-to-date as the firm has struggled due to the broader weakness in the alcoholic beverage industry. […]

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

Stock Market Today, Dec. 23: Ambev Starts to Recover After Losing 4% This Month,

Description: On Dec. 23, 2025, Ambev posts gains after a major hedge fund’s 400% stake jump balances cautious ratings.

2025-12-22

Is Molson Coors Now a Value Opportunity After Portfolio Shift and Share Price Pullback?

Description: If you are wondering whether Molson Coors Beverage is quietly turning into a value opportunity, you are not alone. That is exactly what we are going to unpack here. The stock is up 3.4% over the past month but still down 16.6% year to date and 15.6% over the last year, which suggests the market has cooled on the name even though the 5 year return sits at 20.5%. Recent headlines have focused on Molson Coors sharpening its portfolio around core brands and premium extensions, alongside ongoing...

2025-12-21

Molson Coors (TAP): Is the Recent Share Price Rebound Signalling a Value Opportunity?

Description: Molson Coors Beverage (TAP) has been grinding higher recently, with shares up about 6% over the past 3 months and roughly 3% this month, even as the year-to-date return remains negative. See our latest analysis for Molson Coors Beverage. That recent climb sits against a tougher backdrop, with the share price still down sharply on a year to date basis even as longer term total shareholder returns over three and five years remain modestly positive. This suggests momentum is only cautiously...

2025-12-20

2025-12-19

2025-12-18

2025-12-17

2025-12-16

Is Molson Coors Stock Underperforming the S&P 500?

Description: Molson Coors has underperformed the S&P 500 over the past year, and analysts are cautious about the stock’s prospects.

2025-12-15

2025-12-14

2025-12-13

2025-12-12

Can Molson Coors' Premium Bets Make Up for Sluggish Beer Demand?

Description: TAP leans on premium brands like Peroni to lift margins, but whether strong above-premium growth can offset broad beer softness remains uncertain.

2025-12-11

2025-12-10

2025-12-09

Molson Coors (TAP) Stock Trades Down, Here Is Why

Description: Shares of beer company Molson Coors (NYSE:TAP) fell 3% in the morning session after concerns grew over the impact of new weight-loss drugs on alcohol sales, a factor cited by Piper Sandler when the firm lowered its price target on the stock. The investment firm cut its price target to $50 from $52, citing recent developments in GLP-1 drugs and other regulatory factors. These types of drugs, often used for weight loss, were believed to be negatively impacting alcohol consumption. This view was pr

Wall Street Remains Cautious on Molson Coors Beverage Company (TAP)

Description: Molson Coors Beverage Company (NYSE:TAP) is among the Top 15 Lowest P/E Ratios of the S&P 500 in 2025. On November 21, Piper Sandler lowered its price target for the stock to $50 from $52, while keeping a Neutral rating. The firm said it was revising its price target, taking into account recent developments in […]

2025-12-08

Molson Coors (TAP) Stock Is Up, What You Need To Know

Description: Shares of beer company Molson Coors (NYSE:TAP) jumped 3.6% in the afternoon session after the company announced its Madrí Excepcional brand surpassed £1 billion in annual sales as the brand celebrated its fifth anniversary.

2025-12-07

Is Molson Coors Attractive After a 21.1% Slide and DCF Suggests Large Upside?

Description: Wondering if Molson Coors Beverage is starting to look like a bargain after a tough stretch in the market? This is exactly the kind of setup value focused investors like to dig into. The stock is down about 3.0% over the last week, 2.6% over the past month, and a steep 21.1% year to date, extending a 23.4% slide over the last year, even though the 5 year return is still slightly positive at 9.6%. Recently, the share price has been swayed by shifting sentiment around consumer spending and...

2025-12-06

How Recent Developments Are Reshaping The Molson Coors Beverage Investment Story

Description: Molson Coors Beverage’s fair value estimate has been nudged down to about $50.81 per share as analysts recalibrate expectations for revenue growth in a still-challenging beer category. While the discount rate is essentially unchanged at ~6.96%, the Street’s slightly lower revenue growth outlook of roughly 28.1% reflects a more cautious stance amid soft demand and limited near term catalysts. Stay tuned to see how you can track these evolving price targets and the shifting narrative around...

Assessing Molson Coors (TAP) Valuation After a 21% Year-to-Date Share Price Slide

Description: Molson Coors Beverage (TAP) has quietly slid this year, with the stock down about 21% year to date and roughly 23% over the past year. This has raised fresh questions about valuation. See our latest analysis for Molson Coors Beverage. What we are really seeing is a slow loss of momentum, with the latest share price of $45.13 sitting well below earlier highs and a 1 year total shareholder return that remains firmly negative. This hints that investors are still reassessing growth prospects and...

2025-12-05

2025-12-04

Molson Coors Beverage Company (TAP): A Bull Case Theory

Description: We came across a bullish thesis on Molson Coors Beverage Company on Cundill Deep Value’s Substack by FRAGMENTS. In this article, we will summarize the bulls’ thesis on TAP. Molson Coors Beverage Company’s share was trading at $46.91 as of December 1st. TAP’s trailing and forward P/E were 9.11 and 8.12 respectively according to Yahoo Finance. Molson Coors (TAP) represents the […]

Molson Coors (TAP) Up 2.4% Since Last Earnings Report: Can It Continue?

Description: Molson Coors (TAP) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-12-03

2025-12-02

Coors Plans to Spend More on Non-Alcoholic Beer As Drinking Habits Continue to Change. 'We Believe We Can Win Here'

Description: Molson-Coors Beverage Co. (NYSE:TAP) is planning on acquiring more non-alcoholic beer brands in an effort to appeal to the public's changing drinking habits, according to company executives. "While beer is our roots and at the core of our business, you can also expect us to step up our focus on beyond beer because we believe we can win here," CEO Rahul Goyal said on Molson-Coors's Q3 earnings call earlier this month. "Not only does it help to premiumize our business, but it also creates value fo

2025-12-01

2025-11-30

2025-11-29

2025-11-28

2025-11-27

2025-11-26

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

Does Molson Coors Offer Value After 19% Stock Slide and Brand Reshaping Moves?

Description: Wondering whether Molson Coors Beverage is a hidden value play or just treading water? Let's dive into what the numbers are actually saying. Despite some short-term bumps, the stock dipped by 0.7% over the last week and is down 1.0% this month. It has also seen a larger 19.4% slide year-to-date and a 21.0% decline over the last 12 months. Recent headlines spotlight the company's ongoing efforts to reshape its brand portfolio and capitalize on shifting consumer tastes. This is all happening...

2025-11-20

Molson Coors Beverage Company Announces Regular Quarterly Dividend

Description: GOLDEN, Colo. & MONTREAL, November 20, 2025--Molson Coors Beverage Company Announces Regular Quarterly Dividend

2025-11-19

DoorDash, Home Depot, Molson Coors: Top Analyst Calls

Description: Yahoo Finance senior reporter Brooke DiPalma keeps track of several Wall Street analyst calls on top trending stocks, including calls around shares of DoorDash (DASH), Home Depot (HD), and Molson Coors (TAP). To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

DoorDash, Baidu upgraded: Wall Street's top analyst calls

Description: DoorDash, Baidu upgraded: Wall Street's top analyst calls

Here Are Wednesday’s Top Wall Street Analyst Research Calls: DoorDash, Freeport-McMoRan, GitLab, Home Depot, Medtronic, Molson-Coors, and More

Description: Pre-Market Stock Futures: Futures are trading higher this morning, as all the major indices once again closed lower on Tuesday, marking the fourth straight day of losses. The Dow Jones Industrials closed down 1.07% at 46,091, while the S&P 500 was last seen at 6617, down 0.83%. The NASDAQ, which has been hit the hardest ... Here Are Wednesday’s Top Wall Street Analyst Research Calls: DoorDash, Freeport-McMoRan, GitLab, Home Depot, Medtronic, Molson-Coors, and More

The Zacks Analyst Blog Highlights Molson Coors, Chefs' Warehouse, Ambev and PepsiCo

Description: Molson Coors ramps marketing and leans on core and economy brands as beer consumption softens and competitive pressure intensifies.

2025-11-18

Will Constellation Brands' Emphasis on Core Labels Drive Growth Ahead?

Description: STZ leans into premiumization, innovation and strong beer momentum to capture shifting consumer tastes and fuel growth.

Beer Business Softness Deepens: Can Molson Coors Reignite Core Brands?

Description: TAP ramps up marketing, local execution and economy-brand focus as beer softness deepens, aiming to revive its core lineup.

Molson Coors to shut Franciscan Well brewery in Ireland

Description: The US giant said it plans to stop producing the Franciscan Well brands "early in the new year".

2025-11-17

2025-11-16

2025-11-15

2025-11-14

Molson Coors (TAP): Assessing Valuation After Q3 Earnings Miss, Sales Decline, and Outlook Cut

Description: Molson Coors Beverage (TAP) just reported third-quarter earnings, and the numbers fell short of expectations. Sales and revenue both declined year over year, while the company also booked a large goodwill impairment. See our latest analysis for Molson Coors Beverage. Molson Coors’ latest earnings disappointment and guidance cut come after a year in which the stock has struggled to gain traction, as risk sentiment has clearly faded. Despite a brief pop of nearly 2% after Q3 results, the...

2025-11-13

2025-11-12

Molson Coors Stock: Analyst Estimates & Ratings

Description: Molson Coors has considerably underperformed the broader market over the past year, and analysts are cautious about the stock’s prospects.

2025-11-11

2025-11-10

Viant Technology Announces Third Quarter 2025 Financial Results

Description: IRVINE, Calif., November 10, 2025--Viant Technology Inc. (Nasdaq: DSP), a leader in AI-powered programmatic advertising, today reported financial results for its third quarter ended September 30, 2025.

2025-11-09

2025-11-08

Cheers! Beer and Liquor Stocks on Sale With High Yields to 7.25%

Description: Two of the world's largest beer and liquor companies pay dividends at rates exceeding 4%, and both offer some of the best entry points in years.

2025-11-07

Results: Molson Coors Beverage Company Delivered A Surprise Loss And Now Analysts Have New Forecasts

Description: Molson Coors Beverage Company ( NYSE:TAP ) came out with its third-quarter results last week, and we wanted to see how...

2025-11-06

2025-11-05

Molson Coors' Low Valuation Reflects Cyclical, Structural Headwinds, Morgan Stanley Says

Description: Molson Coors Beverage (TAP) posted a modest Q3 miss and faces cyclical and structural headwinds alre

Viant Named the Ad Platform Partner for Molson Coors

Description: IRVINE, Calif., November 05, 2025--Viant today announced a multi-year partnership designating Viant as the Advertising Platform for Molson Coors Beverage Company, beginning in 2026.

Molson Coors (TAP): Losses Narrow 17.4% Annually, Profitability Targeted Within Three Years

Description: Molson Coors Beverage (TAP) is currently unprofitable, but is expected to deliver a 65.59% annual earnings growth and reach profitability within the next three years. Revenue is forecast to grow at 0.6% per year, trailing the US market's pace of 10.5%. Losses have shrunk by an average of 17.4% annually over the past five years. Market watchers see TAP as a potential turnaround, with discounted valuation and future growth prospects balanced by ongoing concerns about its financial strength and...

2025-11-04

How Impairment-Driven Losses and Lowered Sales Guidance at Molson Coors (TAP) Has Changed Its Investment Story

Description: Molson Coors Beverage Company recently reported a third-quarter net loss of US$2.93 billion, driven by substantial goodwill and intangible asset impairments, and issued revised 2025 guidance anticipating net sales to decline by 3% to 4% on a constant currency basis, likely at the lower end of this range. This marks a sharp turnaround from the prior year's results and suggests mounting challenges for the company, despite ongoing share repurchases and its role as a leading North American...

Molson Coors Beverage Co (TAP) Q3 2025 Earnings Call Highlights: Navigating Challenges with ...

Description: Despite a decline in net sales and earnings, Molson Coors Beverage Co (TAP) focuses on brand strength and strategic growth opportunities.

Molson Coors Leans on Affordable Beers as Industry Weakness Persists

Description: The company swung to a loss in the recent quarter, as changing consumer preferences and macroeconomic pressures weighed on the beer industry.

Molson Coors Stock Dips on Q3 Earnings & Sales Miss, Soft 2025 View

Description: TAP shares slip after third-quarter 2025 earnings and sales miss estimates, with the brewer guiding for a softer 2025 outlook.

Molson Coors Sees More Beer Drinkers on a Budget

Description: Molson Coors plans to lean more on affordable brands such as Miller High Life and Keystone Light as beer drinkers contend with an uncertain economy. The maker of Miller Lite and Blue Moon has experienced a particular decline in purchases from low-income and Hispanic consumers in the U.

Molson Coors (TAP) Reports Q3 Earnings: What Key Metrics Have to Say

Description: While the top- and bottom-line numbers for Molson Coors (TAP) give a sense of how the business performed in the quarter ended September 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Molson Coors books hefty impairment charges, Q3 sales down

Description: The US giant recorded impairments on its Americas unit and on two other sets of assets.

Molson Coors Brewing (TAP) Q3 Earnings and Revenues Lag Estimates

Description: Molson Coors (TAP) delivered earnings and revenue surprises of -2.91% and -1.67%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Molson Coors (NYSE:TAP) Misses Q3 Revenue Estimates

Description: Beer company Molson Coors (NYSE:TAP) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 2.3% year on year to $2.97 billion. Its GAAP loss of $14.79 per share decreased from $0.96 in the same quarter last year.

Molson Coors Beverage Company Reports 2025 Third Quarter Results

Description: GOLDEN, Colo. & MONTRÉAL, November 04, 2025--Molson Coors Beverage Company Reports 2025 Third Quarter Results

2025-11-03

2025-11-02

Earnings To Watch: Molson Coors (TAP) Reports Q3 Results Tomorrow

Description: Beer company Molson Coors (NYSE:TAP) will be announcing earnings results this Tuesday before market open. Here’s what to look for.

2025-11-01

2025-10-31

5 ‘Sin Stocks’ Are Offering High-Yield Dividend Treats With No Tricks

Description: Five companies pay dependable, high-yield dividends and look like great ideas for growth, even as income investors worry about a possible big sell-off.

3 Stocks Under $50 with Warning Signs

Description: Stocks in the $10-50 range offer a sweet spot between affordability and stability as they’re typically more established than penny stocks. But their headline prices don’t guarantee quality, and investors should exercise caution as some have shaky business models.

2025-10-30

Molson Coors Faces 'Challenging' Quarter as Beer Demand Softens, UBS Says

Description: Molson Coors Beverage's (TAP) Q3 results are expected to reflect a "challenging" quarter as beer dem

Molson Coors Q3 Earnings Preview: What's in Store for the Stock?

Description: TAP faces softer beer demand and surging aluminum costs in Q3, though innovation and premiumization may ease the hit.

2025-10-29

1 million-square-foot data center proposed for 141 acres in Trenton

Description: Oct. 29—A California-based real estate company has purchased 141 acres of land in the city of Trenton for a planned 1 million-square-foot data center. The company, Prologis, and the City of Trenton closed on the sale the week of Oct. 13, according to Mattie Sorrentino, Prologis' vice president of communications. The land was sold to Prologis by the City of Trenton. All of the 141 acres lies ...

Is Molson Coors (TAP) Undervalued? A Fresh Look at the Latest Valuation Narrative

Description: Molson Coors Beverage (TAP) shares have moved only slightly over the past week, but the longer-term performance tells a different story. The stock is down 8% over the past 3 months and 16% in the past year. See our latest analysis for Molson Coors Beverage. After a challenging year, momentum for Molson Coors Beverage still appears to be fading. Issues from earlier in the year continue to weigh on sentiment, with the stock’s one-year total shareholder return now at -16.2%. The stock has...

MGP (MGPI) Q3 Earnings and Revenues Beat Estimates

Description: MGP (MGPI) delivered earnings and revenue surprises of +37.10% and +2.42%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

2025-10-28

Tens of Thousands of White-Collar Jobs Are Disappearing as AI Starts to Bite

Description: Layoffs at companies ranging from Amazon to Target are sending young and experienced workers alike into an unwelcoming market.

Molson Coors Beverage Company (TAP) Announces its Restructuring Plan

Description: Molson Coors Beverage Company (NYSE:TAP) is one of the Best 52-Week Low Mid Cap Stocks to Buy Now. On October 20, Molson Coors Beverage Company (NYSE:TAP) announced its corporate restructuring plan to create a more agile American Company and position it for future growth. As part of this plan, the company aims to cut around […]

Earnings Preview: Molson Coors Brewing (TAP) Q3 Earnings Expected to Decline

Description: Molson Coors (TAP) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2025-10-27

2025-10-26

2025-10-25

2025-10-24

S&P 500 Posts Weekly Gain, Jumps to Record High Amid Earnings Beats, Softer-Than-Expected Inflation

Description: The Standard & Poor's 500 index rose 1.9% this week to a new closing high as September consumer pric

Looking at the Narrative for Molson Coors as Analyst Sentiment Shifts Amid New Developments

Description: Molson Coors Beverage stock recently saw its consensus analyst price target move down from $53.48 to $53.33. This small adjustment reflects evolving analyst sentiment, balanced between renewed caution and emerging optimism amid shifting market dynamics. Stay tuned to discover how you can track future updates as the narrative around Molson Coors continues to develop. What Wall Street Has Been Saying Analyst commentary on Molson Coors Beverage stock in recent months has reflected a balanced yet...

2025-10-23

Boston Beer (SAM) Tops Q3 Earnings Estimates

Description: Boston Beer (SAM) delivered earnings and revenue surprises of +12.43% and -0.81%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Molson Coors' Q3 2025 Earnings: What to Expect

Description: Molson Coors is expected to announce its fiscal third-quarter earnings next month, and analysts project a single-digit earnings drop.

2025-10-22

Molson Coors to cut hundreds of jobs in restructuring plan

Description: Molson Coors will eliminate 400 positions representing 9% of its Americas salaried workforce as part of a transformation strategy to accelerate growth.

2025-10-21

Molson Coors layoffs to include Canadian workers, but job cuts 'not driven by tariffs'

Description: The beer company plans to eliminate approximately 400 salaried positions across the Americas by the end of December

Molson Coors jobs to go as new CEO eyes “bolder decisions”

Description: The brewer said it expects to eliminate roughly 400 roles across the Americas business by the end of the year.

Is Molson Coors a Hidden Opportunity After Recent Alternative Beverage Investments and Price Drop?

Description: Thinking about what to do with Molson Coors Beverage is a bit like standing at a crossroads with a cold beverage in hand. It can be tempting to stick with what you know, but there is always curiosity about what might be just around the corner. After sliding nearly 19% year-to-date and dipping 14% over the past year, the stock’s recent moves have left many investors scratching their heads. Yet, if you zoom out, there is a very different picture: over the past five years, Molson Coors is up...

2025-10-20

Molson Coors Sacking 400 and Set To Take Related Charges As Restructures Americas Business Unit

Description: Molson Coors Beverage Company (TPX-A.TO and TPX-B.TO) announced Monday a corporate restructuring pla

Molson Coors to Cut 9% of Americas Workforce

Description: Molson Coors will eliminate about 400 salaried positions, or 9%, from its Americas business. The restructuring will allow the maker of Miller Lite and Blue Moon to focus on growth areas and invest in new products, the company said Monday.

Molson Coors to Cut 9% of Americas Workforce in Restructuring

Description: Molson Coors said it will eliminate around 400 salaried positions across its Americas business, representing about 9% of the unit’s workforce.

Molson Coors Beverage Company Announces Corporate Restructuring of Americas Business Unit

Description: CHICAGO, October 20, 2025--Molson Coors Beverage Company ("Molson Coors" or "the company") (NYSE: TAP, TAP.A) today announced a corporate restructuring plan, designed to create a leaner, more agile Americas organization while advancing its ability to reinvest in the business and position the company for future growth.