News sentiment analysis for TER

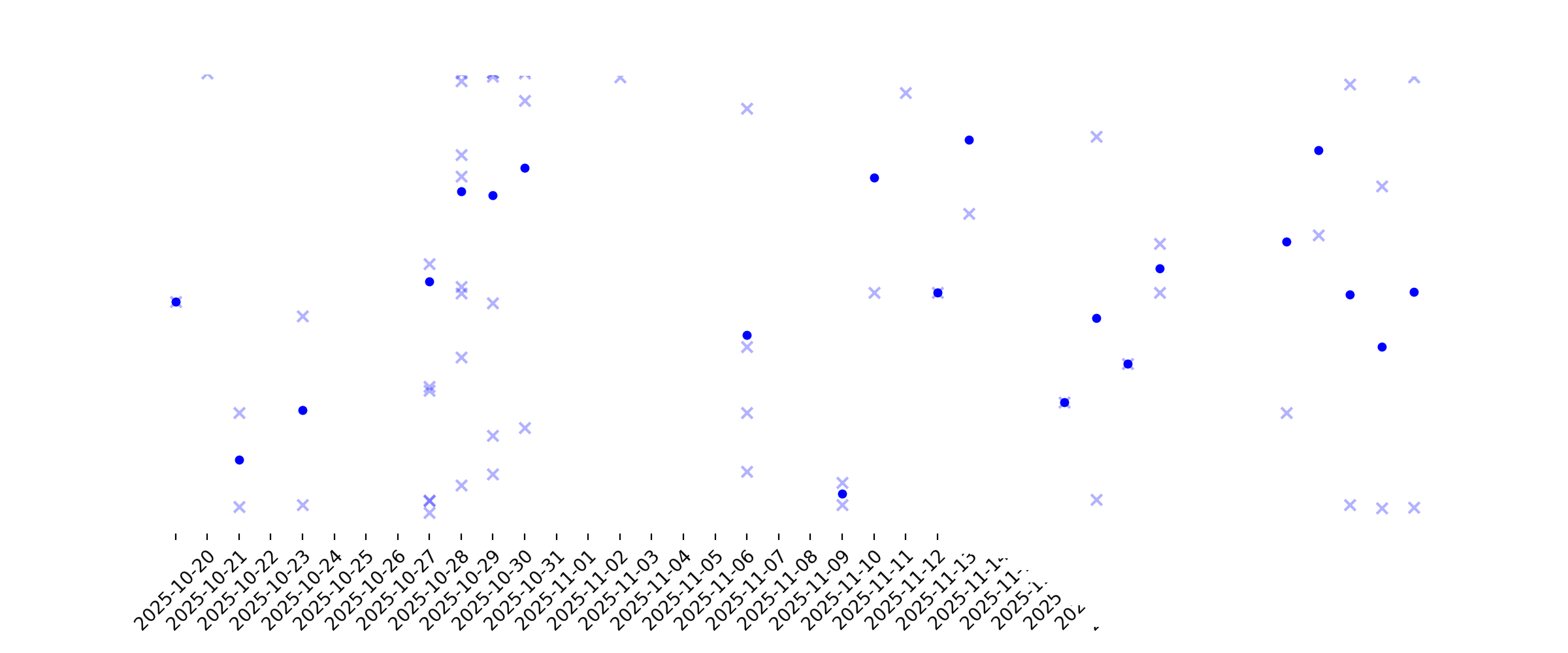

Sentiment chart

2026-01-14

2026-01-13

Teradyne to Announce Fourth Quarter and Full Year 2025 Results

Description: NORTH READING, Mass., January 13, 2026--Teradyne, Inc. (NASDAQ: TER) will release financial results for the fourth quarter and full year 2025 on Monday, February 2, 2026 at 5:00 p.m. Eastern Time (ET) or later.

LitePoint and MediaTek Join Forces to Accelerate a New Era of "Ultra-High Reliability" Wireless Connectivity

Description: SAN JOSE, Calif., January 13, 2026--LitePoint and MediaTek Join Forces to Accelerate a New Era of "Ultra-High Reliability" Wireless Connectivity

2026-01-12

2026-01-11

2026-01-10

2026-01-09

Assessing Teradyne (TER) Valuation As AI Test Demand And Robotics Optimism Build Ahead Of Earnings

Description: Teradyne (TER) is back in focus as investors watch for its upcoming quarterly earnings, with interest centered on AI driven test demand, the expanding Compute/Memory business, and improving Robotics profitability. See our latest analysis for Teradyne. Teradyne’s shares trade at US$216.31 after a 1 day share price decline of 2.77%, while a 90 day share price return of 63.77% and 1 year total shareholder return of 58.40% suggest momentum has been building as investors react to AI related test...

Teradyne Rises on AI Demand, Bullish Inflows

Description: Shares of Teradyne, Inc. (TER) gained 43.5% since last Big Money outlier inflow signal in June 2024.

Teradyne Stock Gains 58% in a Year: Should You Hold or Fold the Stock?

Description: TER stock is up nearly 58% in a year as AI-driven demand lifts semiconductor test and robotics, but premium valuation and competition cloud the outlook.

BofA Updates Semiconductor PTs, Framing 2026 as the Midpoint of the Decade-Long AI Infrastructure Shift

Description: Teradyne Inc. (NASDAQ:TER) is one of the hot tech stocks to invest in. On December 16, Bank of America raised the firm’s price target on Teradyne to $235 from $205 with a Buy rating on the shares. This sentiment came out as BofA broadly updated its price targets for the US semiconductor stocks, framing 2026 […]

Jim Cramer on Teradyne: “I Would Not Step Away From It”

Description: Teradyne, Inc. (NASDAQ:TER) is one of the stocks Jim Cramer shared his takes on. During the lightning round, a caller sought Cramer’s thoughts on the company, and he replied: “You know what… this is a tough one. The stock is capturing too much enthusiasm, but I’ve got to tell you, it is one hell of […]

2026-01-08

Teradyne (TER) Stock Slides as Market Rises: Facts to Know Before You Trade

Description: Teradyne (TER) closed the most recent trading day at $216.31, moving 2.77% from the previous trading session.

Semtech, Photronics, Amkor, and Teradyne Shares Are Falling, What You Need To Know

Description: A number of stocks fell in the morning session after a broader market rotation out of the technology sector led to profit-taking following a recent rally.

Here’s What to Expect From Teradyne’s Next Earnings Report

Description: Teradyne is expected to release its fiscal fourth-quarter earnings soon, and analysts project a significant earnings increase.

2026-01-07

Teradyne (TER) Registers a Bigger Fall Than the Market: Important Facts to Note

Description: Teradyne (TER) reached $222.48 at the closing of the latest trading day, reflecting a -2.78% change compared to its last close.

Is Teradyne (TER) Pricing In Too Much Optimism After Its Strong Multi‑Year Share Run?

Description: If you are wondering whether Teradyne's current share price still offers value, this article will walk through what the numbers are saying about the stock right now. Teradyne shares last closed at US$228.84, with returns of 16.4% over 7 days, 14.0% over 30 days, 10.3% year to date, 65.6% over 1 year, 144.6% over 3 years and 70.3% over 5 years. These figures naturally raise questions about what is already priced in. Recent attention on Teradyne has been shaped by ongoing interest in...

2026-01-06

Qualcomm, Vishay Intertechnology, Power Integrations, Teradyne, and Entegris Shares Skyrocket, What You Need To Know

Description: A number of stocks jumped in the afternoon session after a broader market rally drove investor optimism in artificial intelligence and big tech stocks.

Universal Robots and Robotiq Showcase Next-Generation Palletizing Solution at CES 2026 in Collaboration with Siemens

Description: LAS VEGAS, January 06, 2026--Universal Robots, Siemens and Robotiq showcase robotic palletizing solution featuring new digital twin software at CES 2026 today

KLA Jumps 96% in a Year: Is There More Room for the Stock to Grow?

Description: KLAC surges 96% in a year, fueled by advanced packaging growth, AI demand and rising process control intensity.

Stocks Are Inching Higher

Description: The stock market was grinding higher in Tuesday morning trading. The Dow Jones Industrial Average rose 46 points, or 0.1%. The S&P 500 was up 0.2%. The Nasdaq Composite was up 0.2%. The yield on the 2-year Treasury note was up to 3.

LitePoint Accelerates Wi-Fi 8 Innovation with Qualcomm Technologies Through Advanced Testing

Description: SAN JOSE, Calif., January 06, 2026--LitePoint Accelerates Wi-Fi 8 Innovation with Qualcomm Technologies Through Advanced Testing

If You Invested $1000 in Teradyne a Decade Ago, This is How Much It'd Be Worth Now

Description: Why investing for the long run, especially if you buy certain popular stocks, could reap huge rewards.

2026-01-05

BofA says these are the best 7 AI chip stocks to own in 2026

Description: Investing.com -- Bank of America remains “constructive on AI-related semi, memory and semicap stocks despite expected volatility,” highlighting seven names it sees as best positioned for 2026.

2026-01-04

The Bull Case For Teradyne (TER) Could Change Following AI-Rally Spotlight On Softer Fundamentals - Learn Why

Description: In early January 2026, Teradyne reported that customers had delayed purchases over recent years, contributing to slightly lower revenue, weaker operating margins, and less profitable earnings per share. At the same time, a broad semiconductor rally powered by artificial intelligence optimism and cooler inflation pulled Teradyne into renewed investor focus despite these operational pressures. Now we’ll examine how AI-fueled sector enthusiasm, against softer recent fundamentals, reshapes...

2026-01-03

2026-01-02

Power Integrations, Teradyne, Entegris, IPG Photonics, and Magnachip Stocks Trade Up, What You Need To Know

Description: A number of stocks jumped in the afternoon session after a broad rally in the semiconductor sector kicked off the new year, driven by continued investor enthusiasm for artificial intelligence (AI).

2026-01-01

Here’s Why BofA Has a Buy Rating on Teradyne, Inc. (TER)

Description: Teradyne, Inc. (NASDAQ:TER) is one of the Unstoppable Technology Stocks to Buy. On December 16, Vivek Arya from Bank of America Securities reiterated a Buy rating on the stock and raised the price target from $205 to $235. On the same day, analyst C J Muse from Cantor Fitzgerald reiterated a Buy rating on Teradyne, […]

2025-12-31

Teradyne (TER) Declines More Than Market: Some Information for Investors

Description: Teradyne (TER) closed at $193.56 in the latest trading session, marking a -1.58% move from the prior day.

2025-12-30

Teradyne Rides on Accelerating AI Infrastructure Demand: What's Ahead?

Description: TER benefits from strong AI infrastructure demand, boosting semiconductor test and robotics sales while launching the new Titan HP system.

MG or TER: Which Is the Better Value Stock Right Now?

Description: MG vs. TER: Which Stock Is the Better Value Option?

Wall Street Analysts Think Teradyne (TER) Is a Good Investment: Is It?

Description: The average brokerage recommendation (ABR) for Teradyne (TER) is equivalent to a Buy. The overly optimistic recommendations of Wall Street analysts make the effectiveness of this highly sought-after metric questionable. So, is it worth buying the stock?

2025-12-29

2025-12-28

2025-12-27

6 under-the-radar stocks to play the AI boom in 2026: BofA

Description: While Nvidia and Broadcom dominate, Bank of America's Vivek Arya says some specialized small- and mid-caps are essential for the next $1 trillion chip surge

Have $2,000? 3 Top Robotics Stocks to Buy and Hold for at Least a Decade

Description: These top robotics stocks are compelling for different reasons.

2025-12-26

2025-12-25

Teradyne (TER): Assessing Valuation After Strong Multi-Period Share Price Gains

Description: Recent Performance Signals Growing Investor Interest Teradyne (TER) has been quietly rewarding patient investors, with the stock up about 7% over the past week and nearly 20% in the past month, significantly outpacing the broader semiconductor space. See our latest analysis for Teradyne. That short term strength is not happening in isolation, with Teradyne delivering a year to date share price return of about 57 percent and a three year total shareholder return of roughly 139 percent. This...

2025-12-24

Teradyne's UltraFLEXplus Gains Traction: A Sign for More Upside?

Description: TER's UltraFLEXplus is gaining adoption as AI and data center demand lift Semiconductor Test revenue and support a strong Q4 outlook.

2025-12-23

Quantum Enablers Poised for 40% Plus Growth in 2026: INTC, AVGO & TER

Description: INTC, AVGO and TER stand out as quantum enablers, already generating revenues and projected to deliver 40%+ earnings growth in 2026.

2025-12-22

TER vs. AMD: Which AI Component Supplier Stock Is the Better Buy?

Description: Teradyne's AI-driven test systems and stronger earnings surprises give TER an edge over Advanced Micro Devices in the fast-growing AI semiconductor supply chain.

2025-12-21

2025-12-20

2025-12-19

How Teradyne’s New Detroit-Area Robotics Hub Could Shape Teradyne (TER) Investors’ Automation Thesis

Description: In December 2025, Teradyne Robotics announced it will open a new U.S. Operations Hub in Wixom, Michigan in 2026 to manufacture Universal Robots cobots, support potential MiR AMRs production, and provide regional training, service, and demo capabilities for North American customers. This expansion deepens Teradyne’s roots in the Detroit manufacturing corridor, aiming to address reshoring, workforce shortages, and productivity demands with AI-enabled collaborative and mobile robotics. We’ll...

FormFactor, Amkor, and Teradyne Stocks Trade Up, What You Need To Know

Description: A number of stocks jumped in the afternoon session after investor optimism around artificial intelligence fueled broad market gains.

Zacks Industry Outlook Highlights Teradyne, Flex and Bel Fuse

Description: Teradyne, Flex and Bel Fuse have been highlighted in this Industry Outlook article.

2025-12-18

Teradyne (TER) Beats Stock Market Upswing: What Investors Need to Know

Description: Teradyne (TER) closed the most recent trading day at $190.45, moving +2.83% from the previous trading session.

Seagate Technology, onsemi, Semtech, Nova, and Teradyne Shares Are Soaring, What You Need To Know

Description: A number of stocks jumped in the afternoon session after the semiconductor sector rallied as a bullish revenue forecast from memory-chip maker Micron Technology helped reignite investor enthusiasm for the AI-driven market.

3 Electronics Stocks to Buy From a Prospering Industry

Description: Electronics stocks like TER, FLEX and BELFB are expected to benefit from investments in infrastructure and expanded capacity despite macroeconomic headwinds.

2025-12-17

2025-12-16

Has Teradyne’s AI Test Boom Pushed Its Stock Price Too Far in 2025?

Description: If you are wondering whether Teradyne is still a smart buy after its big run up, or if the easy money has already been made, this breakdown will help you think through whether the current price actually makes sense. The stock has cooled slightly over the last week, down 2.6%, but that follows a strong 14.5% gain over 30 days and a 53.8% return year to date, building on a 52.8% 1-year and 124.6% 3-year performance. Behind those moves, investors have been focused on Teradyne's positioning in...

Nvidia and Broadcom Are Wall Street's Top Chip Picks for 2026

Description: Analog Chips Face Headwinds, AI Chips Still Hot

Costco downgraded, Dollar General upgraded: Wall Street’s top analyst calls

Description: The most talked about and market moving research calls around Wall Street are now in one place. Here are today’s research calls that investors need to know, as compiled by The Fly.Claim 50% Off TipRanks Premium and Invest with Confidence Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential Top 5 Upgrades: JPMorgan upgrad

2025-12-15

Quantum Computing Enablers to Win in 2026: AMD, ORCL & More

Description: Quantum's real 2026 winners may be enablers, not builders, as AMD, Oracle and others target early revenues from hybrid systems and security.

Texas Instruments Stock Slips. It Caught a Rare Downgrade From Goldman Sachs.

Description: Texas Instruments is the world’s largest player in analog semiconductors, but its stock may get left behind even as the industry rallies, analysts at Goldman Sachs said. The investment bank issued a rare double downgrade for Texas Instruments shares Monday, dropping its rating for the stock all the way to Sell from Buy in a research note. Texas Instruments shares slipped 0.5% to $178.50 on Monday.

Homebuilder sentiment rises, Exor rejects bid on Juventus stake

Description: Market Catalysts host Julie Hyman tracks several of the day's top trending stock tickers, including the rise in homebuilder sentiment in the month of December, Exor rejecting Tether Holdings offer for its 65% stake in the Juventus Football Club (JUV.F), and Goldman Sachs giving Teradyne (TER) a double upgrade. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

Costco downgraded, Dollar General upgraded: Wall Street's top analyst calls

Description: Costco downgraded, Dollar General upgraded: Wall Street's top analyst calls

2025-12-14

2025-12-13

What Analysts Think Is Changing the Teradyne Story on AI and Automation Growth

Description: Teradyne's fair value estimate has been nudged higher from $184.69 to $192.38 per share as analysts recalibrate models to reflect stronger AI driven test demand and improving Industrial Automation trends through 2026 and beyond. Underlying assumptions now bake in slightly faster revenue growth of 17.01%, supported by rising confidence in multi year orders from leading foundries and OSAT partners. Investors can monitor these evolving expectations to better understand how the Teradyne narrative...

2025-12-12

Why Teradyne (TER) Dipped More Than Broader Market Today

Description: The latest trading day saw Teradyne (TER) settling at $193.37, representing a -5.2% change from its previous close.

MG or TER: Which Is the Better Value Stock Right Now?

Description: MG vs. TER: Which Stock Is the Better Value Option?

2025-12-11

TER Gains From Strong Semiconductor Test Segment: More Upside Ahead?

Description: Teradyne rides on surging AI test demand as its Semiconductor Test segment jumps, with memory test revenue more than doubling in the quarter.

2025-12-10

Here's How Much a $1000 Investment in Teradyne Made 10 Years Ago Would Be Worth Today

Description: Investing in certain stocks can pay off in the long run, especially if you hold on for a decade or more.

Is Teradyne Stock Outperforming the Nasdaq?

Description: Teradyne has significantly outperformed the Nasdaq over the past year, and analysts are moderately optimistic about the stock’s prospects.

2025-12-09

Teradyne (TER) Valuation Check After New U.S. Robotics Hub Announcement

Description: Teradyne (TER) is back in the spotlight after its robotics division unveiled plans for a new U.S. Operations Hub in Wixom, Michigan, tying the stock more tightly to America’s reindustrialization and automation story. See our latest analysis for Teradyne. That robotics expansion is landing at a time when sentiment has already swung hard in Teradyne’s favor, with a 69.73% 3 month share price return and a 71.61% 1 year total shareholder return pointing to building momentum rather than a late...

The next 3 phases of the AI cycle to come in 2026

Description: US stocks (^DJI, ^IXIC, ^GSPC) closed Tuesday's trading session mixed ahead of the Federal Reserve's next interest rate decision on Wednesday. Some Wall Street experts are forecasting the economic setup for 2026 to be a healthy environment for equities. Allspring Global Investments Senior Portfolio Manager Bryant VanCronkhite highlights several of the market drivers that could materialize in 2026, defining the three phases he sees the AI landscape evolving through. To watch more expert insights and analysis on the latest market action, check out more Market Domination Overtime.

Teradyne Surges 129% in Six Months: Is the Stock Worth a Buy?

Description: TER's booming AI test demand and new high-speed systems spotlight the company's accelerating growth trajectory.

Teradyne Will Expand Its Global Robotics Presence with New US Operations Hub in Metro Detroit, Michigan

Description: NORTH READING, Mass., December 09, 2025--Teradyne Robotics announces new US Operations Hub in Metro Detroit producing Universal Robots, creating more than 200 new jobs over the coming years.

2025-12-08

2025-12-07

2025-12-06

2025-12-05

Teradyne (TER) Is Considered a Good Investment by Brokers: Is That True?

Description: The average brokerage recommendation (ABR) for Teradyne (TER) is equivalent to a Buy. The overly optimistic recommendations of Wall Street analysts make the effectiveness of this highly sought-after metric questionable. So, is it worth buying the stock?

Zacks Investment Ideas feature highlights: Tesla, Honeywell International, Teradyne, UiPath, Ondas and Unusual Machines

Description: Tesla leads a roster of robotics-focused stocks investors are watching as the Trump administration pushes AI-driven productivity growth.

2025-12-04

Teradyne (TER) Is Up 8.8% After Stifel’s AI Test Upgrade - What's Changed

Description: In late November 2025, Teradyne gained attention after Stifel upgraded its rating, citing the company’s underappreciated position in AI-focused semiconductor testing and networking. The upgrade highlighted a shift in Teradyne’s revenue mix toward AI GPU and ASIC test solutions, reinforcing its role in enabling advanced compute systems. We’ll now explore how Stifel’s AI-driven upgrade may influence Teradyne’s investment narrative built around semiconductor test complexity and robotics...

Stifel Says This 1 ‘Picks and Shovels’ AI Stock Is a Buy for Massive Growth in 2026

Description: Teradyne’s valuation looks full, but Stifel’s upgrade, growing ties to TSMC and potentially Nvidia’s Blackwell chips, and double‑digit earnings growth estimates suggest the AI infrastructure cycle could still push the stock higher over the next year.

2025-12-03

Why Tesla (TSLA) Stock Is Climbing Today

Description: Tesla Surges 1% as Trump Administration Pushes Robotics Revolution

Tesla stock rises after Trump administration signals robotics push

Description: Investing.com -- Tesla (NASDAQ:TSLA) stock rose 1% Wednesday following reports that the Trump administration is planning to accelerate development of the robotics industry, potentially benefiting companies in the automation sector.

2025-12-02

Why Is Teradyne (TER) Stock Rocketing Higher Today

Description: Shares of semiconductor testing company Teradyne (NASDAQ:TER) jumped 6.4% in the afternoon session after Stifel upgraded the chip testing equipment maker to a "Buy" from a "Hold" rating and raised its price target. Analyst Brian Chin increased the price target to $225 from $162, noting stronger long-term growth prospects. The firm highlighted what it called an underappreciated position for the company in AI networking. The upgrade was based on a belief that a “narrative shift, revenue shift, and

Teradyne upgraded, Circle Internet initiated: Wall Street's top analyst calls

Description: Teradyne upgraded, Circle Internet initiated: Wall Street's top analyst calls

Stifel sees a buying opportunity in this AI networking stock

Description: Investing.com -- Stifel upgraded an AI networking name to Buy from Hold in a note on Tuesday, arguing that a “narrative shift, revenue shift, and optionality in AI compute [are] too important to ignore.”

2025-12-01

2025-11-30

2025-11-29

2025-11-28

How the Story Around Teradyne Is Shifting After Analyst Upgrades and AI Momentum

Description: Teradyne’s fair value estimate was recently increased from $172.63 to $184.69, as analysts revised their outlook on the company’s future growth potential. This upward adjustment follows a modest improvement in projected revenue expansion and reflects renewed optimism tied to AI-driven demand in the semiconductor sector. Stay tuned to discover how you can track these ongoing narrative shifts and stay ahead of the latest updates impacting Teradyne’s story. Analyst Price Targets don't always...

Why Is KLA (KLAC) Down 4.6% Since Last Earnings Report?

Description: KLA (KLAC) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-11-27

Serve Robotics vs Teradyne: Which Robotics Stock Is a Buy For 2026?

Description: Will TER's AI-fueled profits outshine SERV's bold growth bets as both robotics stocks head into a pivotal 2026?

Why Is Teradyne (TER) Up 3.1% Since Last Earnings Report?

Description: Teradyne (TER) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-11-26

XXEC Investment Advisors Sells 17,000 Badger Meter Shares Worth $4.4 Million

Description: Badger Meter delivers flow measurement and analytics solutions for water utilities and industrial clients worldwide. Sales grew 13% in the third quarter.

MG or TER: Which Is the Better Value Stock Right Now?

Description: MG vs. TER: Which Stock Is the Better Value Option?

2025-11-25

Billionaire Steve Cohen loads up on top AI stock, calms bubble fears

Description: Everyone's been chiming in on the AI bubble, but you wouldn’t spot any worrisome signs from Point72’s Q3 buying spree. Guided by billionaire hedge fund manager Steve Cohen, the hedge fund doubled down on AI hardware and infrastructure during the quarter, growing positions in Advanced Micro ...

Teradyne (TER): Valuation Insight After AI-Fueled Tech Rally Spurs Share Price Gains

Description: Teradyne (TER) shares recently climbed after a wave of investor enthusiasm swept across tech stocks, spurred by fresh optimism around artificial intelligence. Even with ongoing market swings, the company’s semiconductor and robotics focus continues to draw positive attention. See our latest analysis for Teradyne. After some choppy weeks, Teradyne’s 15% share price jump over the past month stands out, with momentum fueled by surging AI optimism and tech sector tailwinds. Long-term investors...

2025-11-24

Impinj, FormFactor, Amkor, Teradyne, and Applied Materials Shares Skyrocket, What You Need To Know

Description: A number of stocks jumped in the afternoon session after renewed enthusiasm for Alphabet reinvigorated the artificial intelligence trade, propelling a market rebound heading into the Thanksgiving holiday. The Nasdaq index jumped 2.6% and the S&P 500 gained 1.6%, driven by a 5% rally in Alphabet following the announcement of its upgraded Gemini 3 AI model. This optimism spilled over into the broader tech sector, lifting shares of Broadcom, Micron, and Palantir significantly. The rally built on mo

If You Invested $1000 in Teradyne a Decade Ago, This is How Much It'd Be Worth Now

Description: Why investing for the long run, especially if you buy certain popular stocks, could reap huge rewards.

2025-11-23

2025-11-22

2025-11-21

2025-11-20

Teradyne, Microchip Technology, and Qualcomm Shares Are Falling, What You Need To Know

Description: A number of stocks fell in the afternoon session after markets faded the Nvidia rally in the morning session, as investors remained uncertain about future rate cuts.

Cathie Wood Targets New Tech Winners, Dumps AMD in Major Shuffle

Description: ARK Invest Shakes Up Portfolio: Massive Bullish Buy Amid AMD Sell-Off

2025-11-19

Cathie Wood makes $7.9 million swing into former pandemic-darling stock

Description: Cathie Wood entered the Nov. 18 session with a clear idea of what she was looking to own, and popular metaverse stock Roblox (RBLX) was at the top of that list. ARK Invest scooped up 78,096 shares worth about $7.9 million, her largest trade of the day and her most aggressive bet on Roblox in ...

2025-11-18

Viam Partners with Universal Robots on Industrial Automation Systems

Description: Viam, the modern software engineering platform for robotics, today announced a new partnership with Universal Robots, the leading collaborative robot company. Universal Robots' UR Series collaborative robots (cobots) will be a flagship hardware partner as Viam expands its industrial robotic solutions.

Wall Street Analysts See Teradyne (TER) as a Buy: Should You Invest?

Description: According to the average brokerage recommendation (ABR), one should invest in Teradyne (TER). It is debatable whether this highly sought-after metric is effective because Wall Street analysts' recommendations tend to be overly optimistic. Would it be worth investing in the stock?

2025-11-17

Leverage Shares by Themes expands its single stock Leveraged ETF lineup with NU, NET, OKTA, TER, NEM, CMG, ABNB, SPOT and SBUX

Description: GREENWICH, Conn., Nov. 17, 2025 (GLOBE NEWSWIRE) -- Leverage Shares by Themes is thrilled to unveil nine new single stock leveraged ETFs, available for trading starting November 17, 2025. These products are designed to empower investors to amplify returns (up and down) and actively engage with the performance of influential companies. The new ETFs are tailored to target a 200% exposure to the daily performance of their underlying stocks, offering sophisticated traders and the retail investor eff

2025-11-16

2025-11-15

2025-11-14

Is Teradyne's (TER) Upbeat Guidance Revealing a Shift in Its AI Testing Advantage?

Description: Teradyne recently declared a quarterly cash dividend of US$0.12 per share, payable on December 17, 2025, to shareholders of record as of November 24, 2025, and reported quarterly results that exceeded analyst expectations while raising its revenue and EPS outlook for the upcoming quarter. This combination of strong financial performance, increased guidance, and analyst support is contributing to a more optimistic outlook for Teradyne’s core markets, especially AI chip testing. We’ll now...

Top Robotics Stocks to Add to Your Portfolio for Impressive Returns

Description: Robotics is poised for robust long-term growth. Consider NVDA, TRMD and TER for potential market dominance across sectors.

2025-11-13

Amkor, Teradyne, Penguin Solutions, Magnachip, and Lam Research Stocks Trade Down, What You Need To Know

Description: A number of stocks fell in the afternoon session after markets continued to retreat, as investors re-evaluated the high valuations of stocks that benefited from the artificial intelligence boom.

2025-11-12

Nvidia Ownership Hits Record Levels -- Could NVDA Climb More Higher?

Description: Nvidia Leads Chip Stock Ownership Despite Peer Gains, Says BofA

2025-11-11

Marvell Technology, Himax, Teradyne, Penguin Solutions, and Vishay Intertechnology Shares Are Falling, What You Need To Know

Description: A number of stocks fell in the afternoon session after negative news from a data center company and a significant sale of Nvidia shares by a major investor fueled a broader sell-off.

Teradyne (TER): Is the Stock Overvalued After Strong Q3 Earnings and Upgraded Guidance?

Description: Teradyne (TER) shares caught attention after the company’s third-quarter results came in stronger than expected. Revenue and earnings topped forecasts, and management raised its outlook for the December quarter. See our latest analysis for Teradyne. Momentum has been steadily building for Teradyne, and the bullish mood around its recent earnings beat and guidance upgrade is unmistakable. In the last month alone, the company delivered a remarkable 39% share price return, and its total...

2025-11-10

Teradyne Declares Quarterly Cash Dividend

Description: NORTH READING, Mass., November 10, 2025--Teradyne, Inc. (NASDAQ:TER) today announced a quarterly cash dividend of $0.12 per share, payable on December 17, 2025, to shareholders of record as of the close of business on November 24, 2025.

MG vs. TER: Which Stock Is the Better Value Option?

Description: MG vs. TER: Which Stock Is the Better Value Option?

2025-11-09

2025-11-08

2025-11-07

Best Momentum Stocks to Buy for Nov. 7

Description: TER, HSBC and TCBK made it to the Zacks Rank #1 (Strong Buy) momentum stocks list on Nov. 7, 2025.

Is Wall Street Bullish or Bearish on Teradyne Stock?

Description: Teradyne stock has outperformed the broader market over the past year, and analysts are moderately bullish about its prospects.

Here's How Much a $1000 Investment in Teradyne Made 10 Years Ago Would Be Worth Today

Description: Why investing for the long run, especially if you buy certain popular stocks, could reap huge rewards.

New Strong Buy Stocks for Nov. 7: BMRC, HSBC and More

Description: HSBC, PRAA, STNE, TER and BMRC have been added to the Zacks Rank #1 (Strong Buy) List on Nov. 7, 2025.

2025-11-06

2025-11-05

2025-11-04

5 Revealing Analyst Questions From Teradyne’s Q3 Earnings Call

Description: Teradyne’s third quarter was marked by strong AI-driven demand in semiconductor testing, which management cited as the primary catalyst for both revenue and non-GAAP earnings outperformance. CEO Gregory Smith attributed the sequential growth to “huge investments in cloud AI build-out,” particularly for compute, networking, memory, and power devices. Additionally, the company highlighted robust results in its memory test business, with shipments supporting high-bandwidth memory (HBM) and DRAM app

2025-11-03

Does Teradyne’s 75% Rally Reflect Real Value After Its Robotics Push?

Description: Ever wonder if Teradyne is truly worth its current price, or if the recent buzz is just hype? You're in the right place for a breakdown that goes beyond the surface. Shares have surged, up 24.8% over the past month and an impressive 75.1% in the last year. This has sparked plenty of conversation about what is fueling this run. Recent headlines have centered on the company's strategic investments in automation and robotics, drawing attention from both Wall Street and tech industry insiders...

2025-11-02

2025-11-01

2025-10-31

S&P 500 Advances Weekly Amid Gains in Information Technology, Consumer Discretionary

Description: The Standard & Poor's 500 index rose more than 0.7% this week, led by the information technology and

This Top Computer and Technology Stock is a #1 (Strong Buy): Why It Should Be on Your Radar

Description: Finding strong, market-beating stocks with a positive earnings outlook becomes easier with the Zacks Rank.

Why Teradyne Stock Is Skyrocketing This Week

Description: The company's strong quarterly performance is merely one factor helping this AI stock to rise.

3 Hyped Up Stocks We Steer Clear Of

Description: Exciting developments are taking place for the stocks in this article. They’ve all surged ahead of the broader market over the last month as catalysts such as new products and positive media coverage have propelled their returns.

2025-10-30

Can Strong Semiconductor Test Segment Push Teradyne Stock Higher?

Description: TER's strong AI-fueled Semiconductor Test growth lifts third-quarter 2025 results and outlook, despite headwinds from weak robotics demand and higher costs.

Teradyne Seeing 'Big' Upside, Gaining Share Across Applications, UBS Says

Description: Teradyne's (TER) future looks "very bright," with the company seeing big upside from custom ASIC pro

Teradyne Set for Multi-Year Growth Acceleration on AI, Robotics Demand, BofA Says

Description: Teradyne's (TER) long-term growth outlook has strengthened as the company enters a multi-year accele

Teradyne (TER) Hits New All-Time High on Strong Revenues, Better-Than-Expected Growth Estimates

Description: We recently published 10 Stocks Defying Wall Street Slump; 8 Hit Fresh Highs. Teradyne, Inc. (NASDAQ:TER) is one of the best-performing stocks on Thursday. Teradyne jumped to a new all-time high on Wednesday, as investors cheered a strong revenue performance and a higher growth outlook that beat Wall Street estimates. At intra-day trading, Teradyne, Inc. […]

BofA double-upgrades Teradyne on multiple growth drivers from AI chips to robotics

Description: Investing.com -- Bank of America double-upgraded Teradyne Inc to Buy from Underperform, saying the chip-testing company is entering a multi-year growth phase powered by rising semiconductor complexity and new opportunities in robotics.

Here are Thursday’s Top Wall Street Analyst Research Calls: Coinbase Global, Meta Platforms, Boeing, Cisco Systems, and More

Description: Pre-Market Futures: Futures are trading lower on Thursday as we get ready for a spooky Friday. The major indices started the day hitting new all-time highs on Wednesday, but sank in the afternoon after Fed Chairman Powell suggested that a December rate cut is not a given and that data between now and the December ... Here are Thursday’s Top Wall Street Analyst Research Calls: Coinbase Global, Meta Platforms, Boeing, Cisco Systems, and More

Should You Invest in Teradyne (TER) Based on Bullish Wall Street Views?

Description: The average brokerage recommendation (ABR) for Teradyne (TER) is equivalent to a Buy. The overly optimistic recommendations of Wall Street analysts make the effectiveness of this highly sought-after metric questionable. So, is it worth buying the stock?

Teradyne, Inc. (TER) Hit a 52 Week High, Can the Run Continue?

Description: Teradyne (TER) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.

2025-10-29

Teradyne (TER): Margin Decline Raises Bar for High-Growth Narrative at Premium Valuation

Description: Teradyne (TER) reported a 15.5% net profit margin for the recent period, down from 18.7% the year before, with earnings having declined 15.2% annually over the last five years and negative growth most recently. Despite the profit slowdown, expectations for the future remain high, as analysts forecast earnings to grow 24.2% and revenue to climb 13.4% per year over the next three years. These projections are expected to outpace broader US market averages. See our full analysis for...

US Equity Markets End Mixed After Fed Chair Raises Doubts Over December Rate Cut

Description: US equity indexes closed mixed on Wednesday after comments by Federal Reserve Chair Jerome Powell ra

S&P 500 Gains and Losses Today: Index Wavers as Fed Lowers Rates, Powell Warns December Cut Not Guaranteed

Description: Strong earnings and guidance helped boost an electronic test equipment provider and a data storage specialist on Wednesday, Oct. 29, 2025, while soft results weighed on a fintech firm.

Sector Update: Tech Stocks Gain Late Afternoon

Description: Tech stocks rose late Wednesday afternoon with the Technology Select Sector SPDR Fund (XLK) gaining

Here's Why AI Demand Sent Teradyne Stock Up 20% Today

Description: Semiconductor companies continue to invest in developing solutions to support AI-led growth.

Teradyne Stock Spikes 20% on Earnings. How AI Is Lifting Shares.

Description: FEATURE Shares of Teradyne rose sharply Wednesday after the maker of test systems for semiconductors and robotics beat quarterly earnings expectations and issued a blockbuster outlook. The company posted adjusted earnings of 85 cents a share for the third quarter, ahead of Wall Street’s call for 79 cents.

Teradyne Q3 Earnings Beat Estimates, Revenues Increase Y/Y, Shares Up

Description: TER tops Q3 earnings and revenue estimates despite a year-over-year dip in earnings and margin pressure.

Why Teradyne (TER) Stock Is Up Today

Description: Shares of semiconductor testing company Teradyne (NASDAQ:TER) jumped 19.7% in the afternoon session after the company reported better-than-expected third-quarter results and provided a robust forecast for the fourth quarter, signaling strong demand for its chip-testing equipment.

TER Q3 Deep Dive: AI Demand Drives Upside, New CFO Announced

Description: Semiconductor testing company Teradyne (NASDAQ:TER) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 4.3% year on year to $769.2 million. On top of that, next quarter’s revenue guidance ($960 million at the midpoint) was surprisingly good and 17.1% above what analysts were expecting. Its non-GAAP profit of $0.85 per share was 7.4% above analysts’ consensus estimates.

Teradyne (TER) is a Great Momentum Stock: Should You Buy?

Description: Does Teradyne (TER) have what it takes to be a top stock pick for momentum investors? Let's find out.

Etsy's CEO shakeup, Kraft Heinz warns about US sales environment

Description: Market Catalysts host Julie Hyman tracks several of the day's top trending stock tickers, including Etsy (ETSY) announcing a CEO shakeup, Kraft Heinz (KHC) lowering its sales outlook and its CEO Carlos Abrams-Rivera issuing a warning around the US consumer environment, and Teradyne (TER) stock gaining on its latest earnings results and revenue growth. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

2025-10-28

Teradyne (TER) Reports Q3 Earnings: What Key Metrics Have to Say

Description: The headline numbers for Teradyne (TER) give insight into how the company performed in the quarter ended September 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Teradyne (TER) Beats Q3 Earnings and Revenue Estimates

Description: Teradyne (TER) delivered earnings and revenue surprises of +8.97% and +3.32%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Teradyne forecasts quarterly revenue above estimates, names new CFO

Description: Teradyne on Tuesday forecast fourth-quarter revenue above Wall Street expectations, banking on robust demand for its chip-testing equipment, and named a new chief financial officer. Shares of the company surged more than 21% in extended trading, after it also surpassed estimates for third-quarter revenue. Teradyne said Michelle Turner, former CFO at defense contractor L3Harris Technologies, has been appointed as its finance chief effective November 3.

Teradyne Sees Big Fourth-Quarter Revenue Jump on AI-Related Demand

Description: The company expects fourth-quarter revenue to jump 27%, a big pickup from the third quarter as AI-related test demand boost sales across its business.

Teradyne (NASDAQ:TER) Delivers Strong Q3 Numbers, Stock Jumps 18.8%

Description: Semiconductor testing company Teradyne (NASDAQ:TER) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 4.3% year on year to $769.2 million. On top of that, next quarter’s revenue guidance ($960 million at the midpoint) was surprisingly good and 17.1% above what analysts were expecting. Its non-GAAP profit of $0.85 per share was 7.4% above analysts’ consensus estimates.

Teradyne Announces Chief Financial Officer Transition

Description: NORTH READING, Mass., October 28, 2025--Teradyne, Inc. (NASDAQ: TER), a leading provider of automated test equipment and advanced robotics, today announced that Michelle Turner has been appointed its Chief Financial Officer effective November 3, 2025 replacing Sanjay Mehta, who has served as Teradyne’s CFO since 2019. Mr. Mehta will stay on as an executive advisor to help support capacity expansion driven by a demand in Semiconductor Test. Mr. Mehta plans to retire in 2026.

Teradyne: Q3 Earnings Snapshot

Description: TER) on Tuesday reported third-quarter profit of $119.6 million. On a per-share basis, the North Reading, Massachusetts-based company said it had profit of 75 cents. Earnings, adjusted for one-time gains and costs, came to 85 cents per share.

Teradyne Reports Third Quarter 2025 Results

Description: NORTH READING, Mass., October 28, 2025--Teradyne, Inc. (NASDAQ: TER):

Live: Complete Teradyne’s Q3 Earnings Coverage

Description: Teradyne (NASDAQ: TER) reports fiscal Q3 2025 results tonight with investors watching for confirmation that the AI-driven test recovery is broadening beyond semiconductors. The company beat expectations in Q2 with EPS of $0.57 vs. $0.54 est. and revenue of $651.8 million, driven by strength in AI compute system-on-chip (SOC) testing and better utilization across Semi ... Live: Complete Teradyne’s Q3 Earnings Coverage

Teradyne (TER): Evaluating Valuation After Recent Strong Share Price Gains

Description: Teradyne (TER) shares have been moving steadily over the past month, gaining roughly 9% as the company continues to post solid financial growth. Investors appear interested in its annual revenue and net income gains. See our latest analysis for Teradyne. Teradyne’s share price momentum has really gained steam, with a 9% rise over the past month and an impressive 63% gain over the last 90 days. The company’s strong financial results have supported a total shareholder return of 33% in the past...

2025-10-27

How Teradyne’s (TER) Push Into Robotics Is Shaping Its Investment Story

Description: Teradyne recently reported a modest 0.9% year-over-year revenue increase for the quarter ended September 30, 2025, with earnings per share in line with its guidance and analyst expectations predicting ongoing growth in automated test and robotics solutions. This comes as the company’s expansion into robotics and automation, bolstered by acquisitions of Universal Robots and Mobile Industrial Robots, is being closely watched as a potential catalyst for future diversification and growth despite...

2025-10-26

2025-10-25

2025-10-24

MKSI vs. TER: Which Stock Is the Better Value Option?

Description: MKSI vs. TER: Which Stock Is the Better Value Option?

1 Cash-Heavy Stock on Our Watchlist and 2 We Avoid

Description: Companies with more cash than debt can be financially resilient, but that doesn’t mean they’re all strong investments. Some lack leverage because they struggle to grow or generate consistent profits, making them unattractive borrowers.

2025-10-23

TER Gears Up to Report Q3 Earnings: What's in Store for the Stock?

Description: Teradyne's Q3 results may showcase AI compute strength and UltraFLEXplus demand, offset by weakness in the robotics end-market.

How Recent AI Wins and Analyst Upgrades Are Reshaping Teradyne’s Growth Story

Description: Teradyne's outlook has been bolstered by a notable increase in its Fair Value Estimate, rising from $124.69 to $139.38. This change is driven by renewed analyst confidence amid strengthening sector demand. At the same time, a marginal decrease in the Discount Rate reflects a slight decline in perceived risk around the company's prospects. As the narrative surrounding Teradyne continues to evolve with new catalysts and shifting analyst perspectives, stay tuned to see how these developments...

2025-10-22

Teradyne, Inc. (TER): A Bull Case Theory

Description: We came across a bullish thesis on Teradyne, Inc. on Make Money, Make Time’s Substack by Oliver | MMMT Wealth. In this article, we will summarize the bulls’ thesis on TER. Teradyne, Inc.’s share was trading at $139.30 as of October 16th. TER’s trailing and forward P/E were 50.18 and 29.07 respectively according to Yahoo Finance. TER Holdings (TER) […]

Here's How Much You'd Have If You Invested $1000 in Teradyne a Decade Ago

Description: Why investing for the long run, especially if you buy certain popular stocks, could reap huge rewards.

2025-10-21

Teradyne (TER) Stock Moves 2.97%: What You Should Know

Description: Teradyne (TER) closed at $143.33 in the latest trading session, marking a +2.97% move from the prior day.

2025-10-20

3 Profitable Stocks Walking a Fine Line

Description: Even if a company is profitable, it doesn’t always mean it’s a great investment. Some struggle to maintain growth, face looming threats, or fail to reinvest wisely, limiting their future potential.