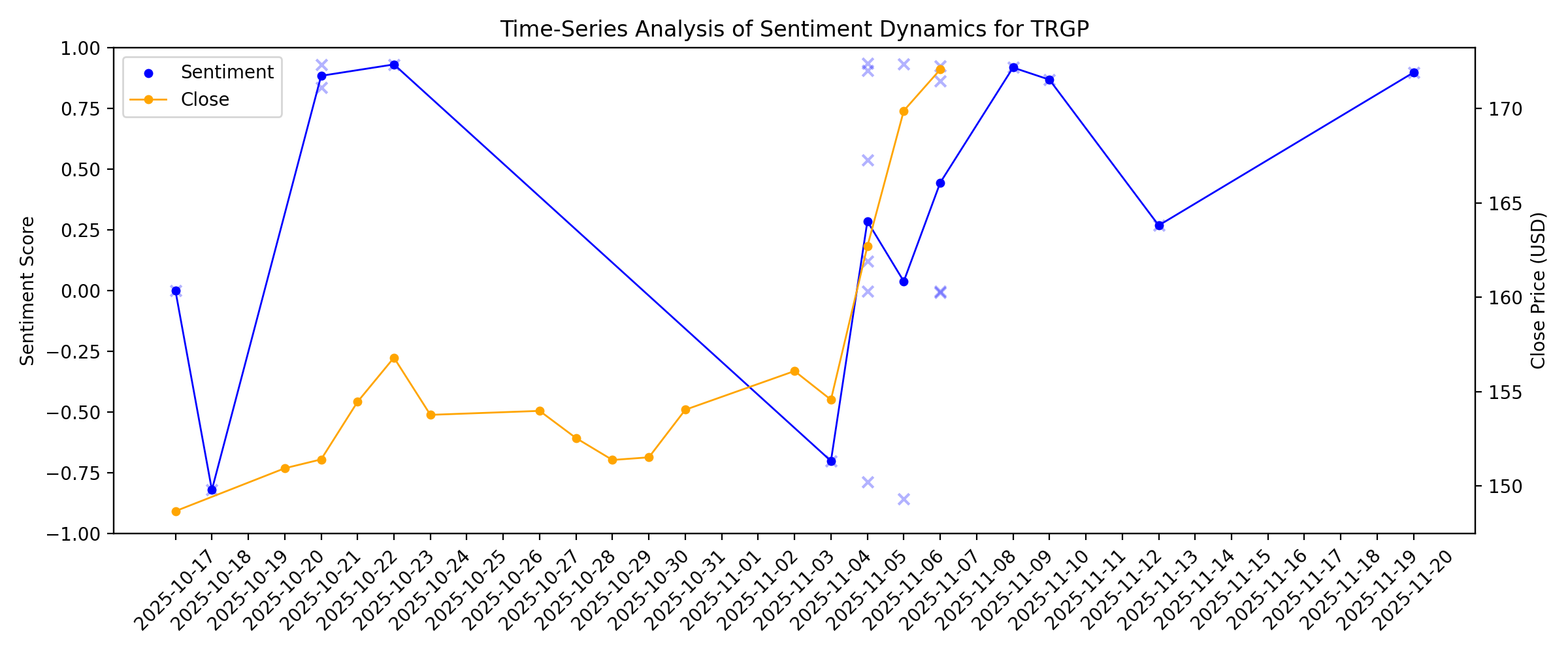

News sentiment analysis for TRGP

Sentiment chart

2026-01-14

Here’s Why Oakmark Select Fund Backs Targa Resources (TRGP)

Description: Oakmark Funds, advised by Harris Associates, released its “Oakmark Select Fund” fourth-quarter 2025 investor letter. Oakmark Select Fund is a non-diversified fund that aims to deliver capital appreciation by investing in mid and large-cap US companies. A copy of the letter can be downloaded here. In the quarter, the fund (investor class) outperformed the S&P 500 Index, […]

2026-01-13

2026-01-12

2026-01-11

2026-01-10

2026-01-09

2026-01-08

2026-01-07

2026-01-06

Targa Resources Corp. Completes Acquisition of Stakeholder Midstream

Description: HOUSTON, Jan. 06, 2026 (GLOBE NEWSWIRE) -- Targa Resources Corp. (NYSE: TRGP) (“Targa” or the “Company”) announced today that it has closed the previously announced acquisition of Stakeholder Midstream, LLC for $1.25 billion in cash. The acquisition has an effective date of January 1, 2026. About Targa Resources Corp. Targa Resources Corp. is a leading provider of midstream services and is one of the largest independent infrastructure companies in North America. The Company owns, operates, acqui

The Venezuela News Lifted Some Oil Stocks. The Losers May Be Better Bets.

Description: U.S. shale producers took hits on Monday. Snapping up shares could pay off, but there are clear risks.

2026-01-05

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

Investors in Targa Resources (NYSE:TRGP) have seen fantastic returns of 638% over the past five years

Description: For many, the main point of investing in the stock market is to achieve spectacular returns. And we've seen some truly...

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

2025-12-21

2025-12-20

2025-12-19

2025-12-18

2025-12-17

2025-12-16

2025-12-15

2025-12-14

2025-12-13

2025-12-12

2025-12-11

2025-12-10

2025-12-09

Is Targa Resources Stock Outperforming the Dow?

Description: Targa Resources has notably outperformed the Dow Jones Industrial Average in recent months, and analysts remain optimistic about the stock’s prospects.

2025-12-08

2025-12-07

2025-12-06

2025-12-05

2025-12-04

Is Targa Resources Still Attractive After Its Surge and Strong Long Term Returns?

Description: Wondering if Targa Resources at around $175 a share is still a smart buy, or if most of the upside is already priced in? Here is a closer look at what the recent moves and fundamentals might be indicating about value. Over the very short term, the stock has climbed about 1.5% in the last week and 12.6% over the past month, even though it is down roughly 4.0% year to date and 8.1% over the last 12 months. Looking at a longer horizon, the 3 year and 5 year returns of 174.2% and 646.7%...

2025-12-03

Sector Update: Energy Stocks Gain Late Afternoon

Description: Energy stocks advanced late Wednesday afternoon, with the NYSE Energy Sector Index rising 1.7% and t

Sector Update: Energy Stocks Gain in Afternoon Trading

Description: Energy stocks advanced Wednesday afternoon with the NYSE Energy Sector Index gaining 1.8% and the En

RBC Capital Maintains Outperform Rating on Targa Resources (TRGP) After Q3 Beat

Description: Targa Resources Corp. (NYSE:TRGP) ranks among the best energy stocks with huge upside potential. On November 18, RBC Capital lifted its price target for Targa Resources Corp. (NYSE:TRGP) to $213 from $208, while maintaining an Outperform rating following the company’s third-quarter 2025 results. The firm observed that Targa Resources Corp. (NYSE:TRGP) displayed robust quarterly performance […]

2025-12-02

The Most Boring Oil Month in Years Sets the Stage for a High-Stakes December

Description: After a month where every geopolitical bet fizzled, the oil market enters December searching for its next catalyst.

Targa Resources to acquire Stakeholder Midstream in $1.25bn deal

Description: Stakeholder Midstream offers natural gas gathering, treating and processing services, as well as crude oil gathering and storage services in the Permian Basin.

2025-12-01

Targa Resources (TRGP): Exploring Valuation as Investors Reassess Midstream Momentum

Description: Targa Resources (TRGP) stock has been moving steadily, drawing attention as investors weigh the company’s latest performance against broader energy sector trends. Over the past month, shares have climbed 15%, signaling renewed interest in the pipeline operator. See our latest analysis for Targa Resources. Targa Resources has seen its momentum build throughout the year, with a recent 1-month share price return of 14.7%, suggesting renewed optimism. However, taking a broader view, the past...

Sector Update: Energy Stocks Rise Late Afternoon

Description: Energy stocks were higher late Monday afternoon, with the NYSE Energy Sector Index up 0.7% and the E

Sector Update: Energy Stocks Rise Monday Afternoon

Description: Energy stocks were higher Monday afternoon, with the NYSE Energy Sector Index up 0.7% and the Energy

Targa Resources to Acquire Stakeholder Midstream in $1.25 Billion Deal

Description: Targa Resources (TRGP) will acquire midstream oil and gas company Stakeholder Midstream in an all-ca

Sector Update: Energy Stocks Edge Higher Premarket Monday

Description: Energy stocks were edging higher premarket Monday, with The Energy Select Sector SPDR Fund (XLE) adv

Targa Resources to Acquire Stakeholder Midstream for $1.25 Billion

Description: Targa Resources agreed to acquire Stakeholder Midstream, which provides natural gas gathering and processing services in the Permian Basin, for $1.25 billion in cash.

Targa Resources Corp. to Acquire Permian Basin Gathering & Processing System for $1.25 Billion

Description: $1.25 billion purchase price represents ~6 times 2026 estimated unlevered adjusted free cash flowUnderpinned by long-term acreage dedications of ~170,000 acres and attractive fee-based contractsStable volume profile with significant additional economic drilling opportunitiesFurther enhances Targa’s leading sour gas treating capabilities and expands Targa’s gathering and processing (G&P) footprint in the Permian BasinIncreases scale and cash flow with minimal impact to pro forma leverage HOUSTON,

2025-11-30

Is Targa Resources Corp.'s (NYSE:TRGP) ROE Of 64% Impressive?

Description: Many investors are still learning about the various metrics that can be useful when analysing a stock. This article is...

2025-11-29

2025-11-28

2025-11-27

2025-11-26

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

2025-11-20

Biggest Gas Pipeline Buildout Since 2008 Propels Trump Energy Push

Description: As many as 12 projects to install new pipelines or expand existing ones are on pace to be completed next year in Texas, Louisiana and Oklahoma, increasing the region’s capacity to ship gas by 13%, according to data compiled by Bloomberg from US Energy Information Administration estimates. It will mark the biggest one-year expansion for Gulf Coast pipelines since the height of the shale-gas boom in 2008.

2025-11-19

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

Are Wall Street Analysts Bullish on Targa Resources Stock?

Description: Although Targa Resources has been underperforming the broader market, analysts remain bullish about its prospects.

2025-11-12

2025-11-11

2025-11-10

Targa Resources (TRGP) Jumps Following Q3 Report

Description: The share price of Targa Resources Corp. (NYSE:TRGP) surged by 11.7% between October 31 and November 7, 2025, putting it among the Energy Stocks that Gained the Most This Week. Targa Resources Corp. (NYSE:TRGP) is a leading provider of midstream services and one of the largest independent infrastructure companies in North America. Targa Resources Corp. […]

2025-11-09

Revenue Miss: Targa Resources Corp. Fell 9.0% Short Of Analyst Revenue Estimates And Analysts Have Been Revising Their Models

Description: It's been a pretty great week for Targa Resources Corp. ( NYSE:TRGP ) shareholders, with its shares surging 12% to...

2025-11-08

2025-11-07

Targa Resources (TRGP) Is Up 11.7% After Strong Q3 Earnings and Dividend Hike Plans – Has The Bull Case Changed?

Description: Targa Resources Corp. recently reported strong third-quarter 2025 earnings, with revenue reaching US$4.15 billion and net income of US$478.4 million, alongside new buybacks and plans to recommend a significant dividend increase for 2026. These updates reflect strengthened cash flow and a shareholder-focused approach, highlighted by a completed share repurchase totaling over US$600 million since August 2024. We’ll explore how Targa’s robust earnings and planned dividend hike add momentum to...

McDonald’s Stock Challenged By a Tougher Economy, Analyst Says. Plus, Marriott, Snowflake, and More.

Description: Targa Resources reported a solid third-quarter beat driven by volume growth in the gathering & processing segment and also plans to come in at the high end of the previous fiscal-2025 adjusted Ebitda guidance. It also bought back about $156 million of stock during the quarter and announced a 25% dividend increase for 2026; we thus expect investors to view this update positively. Bio-Techne reported below-expected financial results for its first-quarter 2026 (September), including revenue of $286.6 million, down 1% year over year, and flat adjusted earnings of $0.42 versus $0.42 for first-quarter 2025.

S&P 500 Posts Weekly Loss, Breaking Win Streak Amid Drop in Consumer Sentiment

Description: The Standard & Poor's 500 index fell 1.6% this week, led by the technology sector, as consumer senti

Targa Resources price target raised to $196 from $185 at BMO Capital

Description: BMO Capital analyst Ameet Thakkar raised the firm’s price target on Targa Resources (TRGP) to $196 from $185 and keeps an Outperform rating on the shares. The company’s Q3 results demonstrate its resilience to lower rig counts and oil prices, the analyst tells investors in a research note. Comments expecting FY26 double-digit volumetric growth and confidence in FY27 may also help improve investor sentiment despite crude/NGL pricing, the firm added. Published first on TheFly – the ultimate source

2025-11-06

Targa Resources Corp. Prices $1.75 Billion Offering of Senior Notes

Description: HOUSTON, Nov. 06, 2025 (GLOBE NEWSWIRE) -- Targa Resources Corp. (“Targa” or the “Company”) (NYSE: TRGP) announced today the pricing of an underwritten public offering (the “Offering”) of $750 million aggregate principal amount of its 4.350% Senior Notes due 2029 and $1.0 billion aggregate principal amount of its 5.400% Senior Notes due 2036 at a price to the public of 99.938% and 99.920% of their face value, respectively. The Offering is expected to close on November 12, 2025, subject to the sa

Targa Resources (TRGP) Profit Margin Improves, Challenging Valuation Concerns With Slower Growth Ahead

Description: Targa Resources (TRGP) posted 43.2% earnings growth over the last year, a pace below its five-year average of 62.5% per year. Net profit margins improved to 8.9% from 6.5%, while earnings are set to grow at 10% per year, which trails both the US market average of 16% and the company's own historical growth. With the stock trading at a 23x P/E, higher than industry and peer averages, investors will be weighing a track record of expanding profit margins and quality earnings against a slower...

2025-11-05

Targa Resources (TRGP) Q3 2025 Earnings Call Transcript

Description: To accommodate this continued volume growth from our customers, in September, we announced several new growth projects, including our Speedway NGL transportation expansion, the YETI gas processing plant in Texas and the Permian Delaware, and Buffalo Run, an expansion of our Permian natural gas pipeline system. And today, we announced our next gas processing plant, Copperhead, in New Mexico and the Permian Delaware.

Targa Resources Corp (TRGP) Q3 2025 Earnings Call Highlights: Record Volumes and Strategic ...

Description: Targa Resources Corp (TRGP) reports a robust quarter with record adjusted EBITDA and announces a significant dividend increase, despite facing operational challenges.

Targa Resources (TRGP) Reports Q3 Earnings: What Key Metrics Have to Say

Description: Although the revenue and EPS for Targa Resources (TRGP) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Top Stock Movers Now: Seagate Technology, McDonald's, Trex, Pinterest, and More

Description: Tech stocks rebounded from Tuesday's losses to help boost the major U.S. equities indexes Wednesday afternoon.

Targa Resources Corp. Reports Record Third Quarter 2025 Results and Announces Expectation for a 25% Increase to its 2026 Common Dividend

Description: HOUSTON, Nov. 05, 2025 (GLOBE NEWSWIRE) -- Targa Resources Corp. (NYSE: TRGP) (“TRGP,” the “Company” or “Targa”) today reported third quarter 2025 results. Third quarter 2025 net income attributable to Targa Resources Corp. was $478.4 million compared to $387.4 million for the third quarter of 2024. The Company reported adjusted earnings before interest, income taxes, depreciation and amortization, and other non-cash items (“adjusted EBITDA”)(1) of $1,274.8 million for the third quarter of 2025

Targa Resources (TRGP): Exploring Valuation Opportunities After Recent Share Price Pullback

Description: Targa Resources (TRGP) shares have pulled back over the past month, dipping about 5% even as the company continues to show steady annual revenue and net income growth. Investors are monitoring how these trends might influence future performance. See our latest analysis for Targa Resources. Targa Resources' share price has drifted lower this year, with a 1-month share price return of -4.8% and a year-to-date decline of 15.6%. While recent momentum has faded, longer-term investors have still...

2025-11-04

Unlocking Q3 Potential of Targa Resources (TRGP): Exploring Wall Street Estimates for Key Metrics

Description: Evaluate the expected performance of Targa Resources (TRGP) for the quarter ended September 2025, looking beyond the conventional Wall Street top-and-bottom-line estimates and examining some of its key metrics for better insight.

2025-11-03

2025-11-02

2025-11-01

2025-10-31

2025-10-30

2025-10-29

2025-10-28

2025-10-27

2025-10-26

2025-10-25

2025-10-24

2025-10-23

Marathon Petroleum Stock Earns 82 RS Rating

Description: Marathon Petroleum shows rising price performance, earning an upgrade to its IBD Relative Strength Rating from 76 to 82.

2025-10-22

2025-10-21

Targa Resources (TRGP) Upgraded to Buy: Here's Why

Description: Targa Resources (TRGP) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

JPMorgan Lifts PT on Targa Resources (TRGP) Stock

Description: Targa Resources Corp. (NYSE:TRGP) is one of the Best Beaten Down Stocks to Buy According to Hedge Funds. On October 7, JPMorgan analyst Jeremy Tonet lifted the price target on the company’s stock to $215 from $214, while keeping an “Overweight” rating as part of the Q3 earnings preview. As per the firm, Targa Resources Corp. (NYSE:TRGP)’s […]

2025-10-20

2025-10-19

2025-10-18

Is Targa Resources Corp. (NYSE:TRGP) Trading At A 44% Discount?

Description: Key Insights Using the 2 Stage Free Cash Flow to Equity, Targa Resources fair value estimate is US$264 Targa Resources...

2025-10-17

Targa Resources’ Q3 2025 Earnings: What to Expect

Description: Targa Resources is gearing up to drop its third-quarter numbers soon, and analysts are betting on a solid double-digit leap in EPS for the quarter.