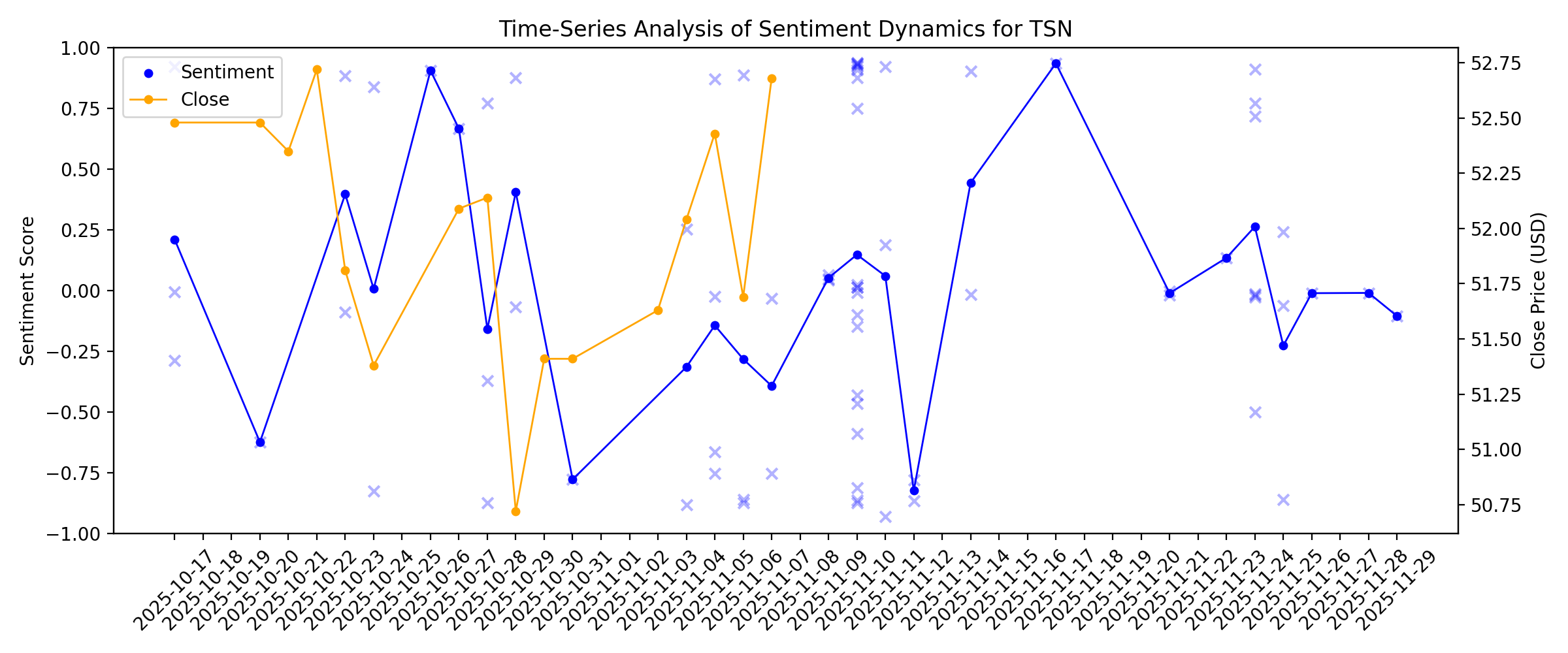

News sentiment analysis for TSN

Sentiment chart

2026-01-14

Stocks to Watch After December's CPI Report: CARS, CVNA, TSN

Description: Here are two stocks that are intriguing after December's CPI report and one that may need to be avoided for now.

2026-01-13

Can Tyson Foods' Chicken Segment Drive Consistent Profit Growth?

Description: TSN's chicken unit has delivered strong margin gains and profit growth in fiscal 2025, but sustaining momentum hinges on execution and cost discipline.

[Latest] Global Hybrid Meat Market Size/Share Worth USD 1,212.1 Billion by 2034 at a 9.4% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth Rate, Value, SWOT Analysis)

Description: [220+ Pages Latest Report] According to a market research study published by Custom Market Insights, the demand analysis of Global Hybrid Meat Market size & share revenue was valued at approximately USD 493.6 Billion in 2024 and is expected to reach USD 540 Billion in 2025 and is expected to reach around USD 1,212.1 Billion by 2034, at a CAGR of 9.4% between 2025 and 2034. The key market players listed in the report with their sales, revenues and strategies are Tyson Foods Inc., Cargill Incorpor

2026-01-12

Tyson Foods (TSN) Outpaces Stock Market Gains: What You Should Know

Description: In the most recent trading session, Tyson Foods (TSN) closed at $59.42, indicating a +2.4% shift from the previous trading day.

Tyson Foods to Hold Annual Meeting of Shareholders

Description: SPRINGDALE, Ark., Jan. 12, 2026 (GLOBE NEWSWIRE) -- Tyson Foods, Inc. (NYSE: TSN) will hold its Annual Meeting of Shareholders on Thursday, February 5, 2026 at 11:00 a.m. Eastern time (10 a.m. Central time) at Tyson Foods, 2008 South Thompson Street, Springdale, Arkansas 72764. For shareholders attending in person, an admission ticket is required. Cameras, video and audio recording equipment, as well as large bags are not permitted. Please see our proxy statement, filed on December 17, 2025, for

2026-01-11

2026-01-10

2026-01-09

These 2 Consumer Staples Stocks Could Beat Earnings: Why They Should Be on Your Radar

Description: Finding stocks expected to beat quarterly earnings estimates becomes an easier task with our Zacks Earnings ESP.

2026-01-08

2026-01-07

Does Tyson Foods (TSN) Offer Value After Recent Share Price Weakness?

Description: If you are wondering whether Tyson Foods is priced attractively right now, this article walks through the numbers so you can judge the value for yourself. The stock last closed at US$56.20, with returns of 4.9% over the past year, a 3.2% decline year to date, and a 4.1% decline over the last week. Recent headlines around Tyson Foods have focused on its position as a major US meat producer, ongoing attention on input costs such as feed and energy, and how consumer demand for protein fits into...

Will Tyson (TSN) Beat Estimates Again in Its Next Earnings Report?

Description: Tyson (TSN) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

These 2 Consumer Staples Stocks Could Beat Earnings: Why They Should Be on Your Radar

Description: Investors looking for ways to find stocks that are set to beat quarterly earnings estimates should check out the Zacks Earnings ESP.

2026-01-06

Tyson agrees to $82.5M settlement in beef price-fixing lawsuit

Description: Meat giants have spent hundreds of millions of dollars to settle claims that they artificially raised prices for years.

2026-01-05

Tyson Foods (TSN) Stock Declines While Market Improves: Some Information for Investors

Description: Tyson Foods (TSN) closed the most recent trading day at $57.13, moving 1.57% from the previous trading session.

Tyson Foods Announces First Quarter Earnings Conference Call and Webcast

Description: SPRINGDALE, Ark., Jan. 05, 2026 (GLOBE NEWSWIRE) -- Tyson Foods, Inc. (NYSE: TSN) will release first quarter 2026 financial results on Monday, February 2, 2026. Management will host a conference call and webcast beginning at 9:00 a.m. Eastern Time (8:00 a.m. Central Time). A press release and supplemental materials will be issued before the market opens that morning. WebcastA link for the webcast of the conference call will be available on the Tyson Investor Relations website: https://ir.tyson.c

Tyson Foods’ Q1 FY2026 Earnings: What to Expect

Description: Before its Q1 FY2026 earnings release, here’s what analysts are expecting from this underperforming stock.

2026-01-04

Tyson (TSN) Price-Fixing Settlement: Taking Stock of the Company’s Valuation After the Legal Resolution

Description: Tyson Foods (TSN) just agreed to pay $55 million as part of an $87.5 million antitrust settlement over alleged beef price fixing, a move that closes one chapter but opens fresh questions for investors. See our latest analysis for Tyson Foods. The settlement lands as Tyson’s share price sits at $58.04, with a 90 day share price return of 7.18% suggesting improving sentiment even as lawsuits, shifting demand, and trade actions like China’s beef quotas keep risk perceptions in flux, and long...

2026-01-03

2026-01-02

2026-01-01

Tyson Foods (TSN) is Doing All It Can to Make Money, Says Jim Cramer

Description: We recently published 10 Stocks on Jim Cramer’s Radar. Tyson Foods Inc. (NYSE:TSN) is one of the stocks on Jim Cramer’s radar. Tyson Foods Inc. (NYSE:TSN) is one of the largest packaged food companies in America. Its shares are flat year-to-date, with media reports pinning the blame on several factors. These include a demand by President […]

2025-12-31

China Sets Beef Quotas in Hit to Brazil, Other Big Exporters

Description: China placed quotas on beef imports as it seeks to protect domestic farmers and producers, dealing a blow to Brazil and other major shippers including Australia and Argentina. Shipments exceeding the limits will be subject to a 55% duty, after authorities determined that rising imports had harmed China’s own industry. The trade measures, which follow an investigation launched in December 2024, are likely to restrict flows of beef into the world’s top importer, and could hurt producers and cattle farmers elsewhere.

2025-12-30

Why the Market Dipped But Tyson Foods (TSN) Gained Today

Description: In the closing of the recent trading day, Tyson Foods (TSN) stood at $59.18, denoting a +1.02% move from the preceding trading day.

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

Tyson Foods (TSN) Stock Falls Amid Market Uptick: What Investors Need to Know

Description: In the closing of the recent trading day, Tyson Foods (TSN) stood at $57.79, denoting a -1.45% move from the preceding trading day.

Small Nebraska Town Is Reeling From Exit of Meatpacking Giant Tyson

Description: Residents of Lexington are scrambling after the company announced plans to close its plant, the area’s biggest employer.

2025-12-22

2025-12-21

Does Tyson Offer Value After Cost Cutting Moves and a 36.8% DCF Discount?

Description: If you are wondering whether Tyson Foods is quietly turning into a value opportunity while attention is focused on flashier names, this article will walk you through whether the current price really makes sense. The stock has dipped 2.4% over the last week, but is still up 8.9% over the past month and modestly positive over 1 year. This suggests sentiment is shifting as investors reassess its long term prospects. Recent headlines have focused on Tyson's ongoing cost cutting efforts and...

2025-12-20

Tyson Foods (TSN): Assessing Valuation After a Recent Share Price Grind Higher

Description: Tyson Foods (TSN) has been quietly grinding higher, with the stock up about 9 % over the past month and 4 % over the past year, drawing fresh attention from value focused investors. See our latest analysis for Tyson Foods. That steady 30 day share price return of roughly 9 % has helped Tyson creep higher even as sentiment has been choppy, with the latest $58.47 share price sitting on top of a modest but improving 1 year total shareholder return. If Tyson’s slow and steady grind appeals to...

2025-12-19

More US Beef Plants May Close as Cattle Herds Keep Shrinking

Description: Cattle placed in US feedlots, where animals are fed until ready to be slaughtered, dropped 11% from a year ago to a record low for November, according to a US Department of Agriculture report Friday. It’s also setting the slate for more expensive American steaks for longer, complicating President Donald Trump’s efforts to bring down record beef prices. Tyson Foods Inc., the country’s biggest meatpacker, underscored the difficulties for the industry last month as it announced it would close a Nebraska beef plant and reduce operations to one shift at a facility in Texas roughly 450 miles from the Mexican border.

Jim Cramer on Cal-Maine: “This One Is a Wild Trader”

Description: Cal-Maine Foods, Inc. (NASDAQ:CALM) is one of the stocks Jim Cramer was asked about. A caller sought Cramer’s thoughts on the stock, and he said: “No, no… This one is a wild trader. It has never interested me. I even like Tyson Foods more than Cal-Maine Foods, and that’s saying something. Don’t forget, Walmart’s the […]

2025-12-18

2025-12-17

2025-12-16

Tyson Foods (TSN) Registers a Bigger Fall Than the Market: Important Facts to Note

Description: In the latest trading session, Tyson Foods (TSN) closed at $58.19, marking a -2.25% move from the previous day.

2025-12-15

2025-12-14

2025-12-13

2025-12-12

JBS to Close California Plant as Meat Processors Feel Pressure

Description: Meatpacking giant JBS is closing a small processing plant in California that cuts and packages meat products for supermarkets. The closure will cut about 370 jobs and comes less than a month after rival Tyson Foods closed one of its larger beef slaughter plants in Nebraska, laying off 3,200 people. JBS, the largest beef processor in the U.S., said the Riverside, Calif., plant doesn’t slaughter any cattle and handles different types of meat.

Tyson Foods (TSN) Is Up 6.1% After Shuttering Nebraska Beef Plant And Cutting Amarillo Shift

Description: In November 2025, Tyson Foods announced it would shut down its Lexington, Nebraska beef facility and cut to a single shift in Amarillo, Texas, while reallocating volumes to other plants to better match a domestic cattle herd at its lowest level in 75 years. This restructuring highlights how Tyson is reshaping its beef footprint to protect efficiency and margins, even as cattle supplies remain historically tight. We’ll now examine how this capacity realignment in beef processing affects Tyson...

Zacks Industry Outlook Highlights Tyson Foods, Pilgrim's Pride and Beyond Meat

Description: TSN and peers navigate strong protein demand, premiumization trends and supply-driven cost pressures reshaping the meat industry.

2025-12-11

Tyson Foods (TSN) Stock Trades Up, Here Is Why

Description: Shares of meat company Tyson Foods (NYSE:TSN) jumped 3.1% in the afternoon session after investors reacted positively to the company's recent move to streamline its beef operations for better long-term efficiency.

3 Meat Stocks to Watch as Strong Protein Demand Drives the Industry

Description: Tyson Foods, Pilgrim's Pride and Beyond Meat gain from strong protein demand and innovation, even as tight supplies and rising costs weigh on the industry.

Tyson Foods Stock: Is TSN Underperforming the Consumer Staples Sector?

Description: Analysts remain cautiously reserved on Tyson as its recent performance shows mixed results compared with the broader Consumer Staples sector.

2025-12-10

3 AgTech & Food Innovation Stocks Well-Placed for the Long Haul

Description: Tyson Foods, Beyond Meat and GrowGeneration emerge as strong AgTech plays as innovation reshapes protein, ingredients and cultivation tech.

2025-12-09

2025-12-08

2025-12-07

Trump Tasks Top Advisers With Finding Way to Lower Soaring Beef Prices

Description: The Trump administration is prodding ranchers and meatpackers to do something about soaring beef prices, while looking at increasing imports from Mexico and South America.

2025-12-06

2025-12-05

Is Tyson Foods Offering Value After Recent DCF Discount and PE Multiple Reassessment?

Description: If you are wondering whether Tyson Foods is quietly turning into a value opportunity while many investors chase the latest market darlings, this article will walk you through whether the current share price makes sense. The stock has slipped 3.1% over the last week but is still up 7.9% over the past month. This suggests sentiment has improved recently even though it remains down year to date and over the past year. Recent headlines have focused on Tyson streamlining its operations and...

2025-12-04

2025-12-03

2025-12-02

2025-12-01

2025-11-30

2025-11-29

Jim Cramer Says “It’s Not Clear That the Beef Tariffs Helped Tyson”

Description: Tyson Foods, Inc. (NYSE:TSN) is one of the stocks Jim Cramer recently talked about. Cramer noted that he likes the company’s stock at these levels, as he commented: “How about the other turkey play, Tyson Foods? Well, I come out pretty strangely on this one. While Tyson’s been trading sideways for years, it’s held up […]

2025-11-28

Global beef production set to decline again in 2026 – Rabobank

Description: Among the major producing regions, Brazil, the US and Canada are all expected to see lower beef production.

2025-11-27

2025-11-26

Is Tyson Foods (TSN) Recalibrating Its Beef Operations to Strengthen Long-Term Profitability?

Description: Earlier this week, Tyson Foods announced the closure of its Lexington, Nebraska beef processing facility and a shift reduction at its Amarillo, Texas plant as part of efforts to adapt to historically low U.S. cattle supplies and beef segment losses. This decision marks one of the largest recent reductions in U.S. beef processing capacity, with thousands of employees impacted and a nationwide beef industry facing significant structural challenges. We will examine how Tyson's decision to close...

2025-11-25

Meatpacker Stocks Rise on Hope of More Cattle

Description: Meatpackers are losing millions of dollars processing beef amid record high prices, but there are signs ranchers are preparing to grow their herd sizes.

3 Cash-Producing Stocks Walking a Fine Line

Description: Generating cash is essential for any business, but not all cash-rich companies are great investments. Some produce plenty of cash but fail to allocate it effectively, leading to missed opportunities.

Where's the Beef?

Description: There are a number of moving parts to the cattle markets these days.

2025-11-24

Tyson Foods To Shut Down Major Beef Plant In Nebraska Weeks After Trump Launched Probe On Meatpackers

Description: Tyson Foods Inc. (NYSE:TSN) has announced the closure of its beef plant in Lexington, Nebraska, to “position” itself for long-term success. Historic Cattle Lows Force Tyson Cuts The meat processing giant’s decision to close the Nebraska plant was ...

Stocks to Watch Monday Recap: Alphabet, Alibaba, Tesla, US Foods

Description: ↗️ Alibaba (HK:9988, BABA): The Chinese e-commerce leader said its Qwen artificial-intelligence app drew more than 10 million downloads in the first week after relaunching. Shares jumped more than 4% in New York and Hong Kong.

Tyson Foods to close major beef plant, scale back operations as cattle supplies decline

Description: Tyson Foods will close its Nebraska beef plant affecting 3,200 workers and scale back Texas operations as cattle shortages force major industry restructuring.

Tyson Closes a Beef Plant, and Meat Companies’ Stocks Rise

Description: Shares of meatpackers JBS and Tyson Foods jumped Monday after Tyson said late last week it was closing one of its largest beef plants and slashing production at another. Beef processors have been losing hundreds of millions of dollars over the past two years, with shrinking cattle herds driving livestock prices higher. Tyson said Friday it plans to close its Lexington, Neb., plant, which can kill about 5,000 cattle a day, while separately moving its Amarillo, Texas, plant, which can kill 6,000 cattle a day, from two shifts to one.

Meat Snacks Market Competitive Landscape Report 2025: Recent Developments, Company Strategies, Sustainability Benchmarking, Product Launches, Key Persons, and Revenue Forecasts

Description: The global meat snacks market is projected to grow from $9.56 billion in 2024 to $16.57 billion by 2033, at a CAGR of 6.30%. This growth is driven by increasing demand for convenient, high-protein snacks, flavor innovations, and clean-label offerings. Notable companies contributing to this growth include Nestlé, Hormel Foods, Conagra Brands, and Jack Link's. New product launches by Tyson Foods and Danish Crown highlight the industry’s focus on protein-rich and healthier options. Emerging economi

Processed Meat Market Competitive Landscape Report 2025: Recent Developments, Strategies, Sustainability Benchmarking, Product Analysis, Key Persons and Revenue

Description: The global processed meat market is forecasted to grow from USD 432.5 billion in 2024 to USD 664.2 billion in 2033 at a CAGR of 4.88%. Key drivers include demand for high-protein diets, food processing innovations, and changing consumer trends. Processed meats, like sausages and bacon, are popular for their convenience and flavor. Notably, health concerns are driving a shift towards healthier options. Leading companies like Hormel Foods, Tyson Foods, and Nestlé are expanding globally. Sustainabi

Tyson Foods to close US beef plant after year of losses

Description: The meatpacker will also convert its beef facility in Amarillo, Texas, to a single, "full-capacity" shift.

2025-11-23

Tyson Foods (TSN): Assessing Valuation Following Beef Business Restructuring and Facility Closures

Description: Tyson Foods (TSN) is making significant changes to its beef business, announcing the closure of its Lexington, Nebraska facility and a shift reduction in Amarillo, Texas. These moves are part of a broader plan to streamline operations and improve long-term efficiency. See our latest analysis for Tyson Foods. Tyson Foods has made headlines with a flurry of recent moves, from facility closures and workforce changes to announcing a modest sales outlook for 2026 and affirming a small dividend...

2025-11-22

2025-11-21

Tyson to Close One of the Biggest Beef-Processing Plants in the U.S.

Description: The largest meat supplier in the U.S. has lost more than $425 million on beef this year, despite near record-high prices.

Tyson Foods to close Nebraska plant as it faces $600 million loss in beef business

Description: Tyson's announcement to close a Nebraska plant comes as beef prices surge in cost.

2025-11-20

2025-11-19

2025-11-18

2025-11-17

5 Must-Read Analyst Questions From Tyson Foods’s Q3 Earnings Call

Description: Tyson Foods’ third quarter results drew a positive market reaction, reflecting investor optimism despite sales missing Wall Street estimates. Management attributed the quarter’s performance to operational improvements and momentum in its Chicken and Prepared Foods businesses, alongside disciplined cost management. CEO Donnie King highlighted that the Chicken segment benefitted from “higher volumes, better operational execution and lower feed costs,” while Prepared Foods captured market share thr

2025-11-16

2025-11-15

2025-11-14

The Score: Tyson, Robinhood, Walmart, Paramount Skydance and More Stocks That Defined the Week

Description: Chicken sales are helping offset Tyson’s beef losses as the American cattle shortage takes a bite out of Tyson’s profits. The meatpacking giant on Monday said its beef prices rose 17% in the latest quarter, while beef sales volumes fell 8% amid the lowest U.S. cattle supply since the 1950s. As price tags rise on beef and pork products, consumers are flocking to chicken nuggets and wings, helping lift Tyson’s chicken sales.

JBS Boosts Ground Beef, Wagyu Steak Production to Stem Beef Losses

Description: Meatpackers like JBS and Tyson Foods are being squeezed by the lowest U.S. cattle supply since the 1950s. It is driving their beef costs to record levels, and leading to hundreds of millions of dollars in losses as a result.

2025-11-13

2025-11-12

“The Cows Aren’t Doing It!” For Tyson Foods, (TSN) Says Jim Cramer

Description: We recently published 12 Fresh Stocks Jim Cramer Discussed Along With His Latest Thoughts On Quantum Computing. Tyson Foods, Inc. (NYSE:TSN) is one of the stocks Jim Cramer recently discussed. Tyson Foods, Inc. (NYSE:TSN) is one of the largest meat companies in America. The firm reported its earnings for the fourth fiscal quarter and full […]

Tyson Foods (NYSE:TSN) Is Due To Pay A Dividend Of $0.50

Description: The board of Tyson Foods, Inc. ( NYSE:TSN ) has announced that it will pay a dividend on the 15th of December, with...

2025-11-11

Company News for Nov 11, 2025

Description: Companies in The News Are: TSN, VG, AAL, HUM

Tyson Foods points to further pressure on beef volumes from “tight” supply

Description: Higher beef prices are expected to benefit Tyson Foods’ chicken sales in the new financial year.

TSN Q3 Deep Dive: Chicken Momentum Offsets Beef Headwinds as Tyson Navigates Tight Protein Markets

Description: Meat company Tyson Foods (NYSE:TSN) missed Wall Street’s revenue expectations in Q3 CY2025 as sales rose 2.2% year on year to $13.86 billion. Its non-GAAP profit of $1.15 per share was 37.8% above analysts’ consensus estimates.

2025-11-10

Earnings live: CoreWeave revenue boosted by AI boom, Paramount stock jumps, Occidental Petroleum falls

Description: The third quarter earnings season has been mostly positive, with most of the reports in the rearview mirror.

Stocks to Watch Monday: Paramount, Barrick Mining, Pfizer, Tyson Foods

Description: ↗️ TSMC (TSM, TW:2330): The contract chip maker's sales rose last month at the slowest pace since February 2024, but remained in double-digits. Its American depositary receipts were up 3.1%, part of a broader rebound in technology stocks.

Tyson Foods Inc (TSN) Q4 2025 Earnings Call Highlights: Strong Growth in Chicken and Prepared ...

Description: Tyson Foods Inc (TSN) reports robust sales and earnings growth, driven by strategic execution and market expansion despite challenges in the beef segment.

Sector Update: Consumer Stocks Mixed Late Afternoon

Description: Consumer stocks were mixed late Monday afternoon, with the Consumer Staples Select Sector SPDR Fund

Trump Accused Meat Suppliers of Fixing Beef Prices. What Tyson’s Earnings Show.

Description: Tyson Foods the largest meat supplier in the U.S., posted mixed results in its fiscal fourth quarter. While its chicken business boomed, beef is still a soft spot. Last week, Donald Trump accused meatpackers of colluding to push beef prices higher.

Tyson Foods' Q4 Earnings Top Estimates, Sales Grow on Pricing

Description: TSN posts a strong Q4 with higher earnings and sales driven by pricing gains, showcasing the strength of its diversified protein portfolio.

Tyson Foods Squeezed by Surging Beef Costs

Description: Tyson Foods expects high beef prices to persist into next year as the nation’s cattle shortage continues to squeeze the meatpacking industry’s profits. Arkansas-based Tyson, a bellwether for the American meat industry, said its beef prices rose 17% during its most recent quarter, while beef sales volumes fell 8%. The lowest U.S. cattle supply since the 1950s is driving costs to record levels for meatpackers.

Tyson Foods Logs Surprise Fourth-Quarter Profit Growth Despite Revenue Miss

Description: Tyson Foods' (TSN) fiscal fourth-quarter profit unexpectedly rose year-over-year even as sales grew

Government Shutdown Possibly Coming to an End

Description: Government Shutdown Possibly Coming to an End.

Eli Lilly inks new AI deal, Tyson tops Q4 earnings estimates

Description: Market Catalysts host Julie Hyman tracks several of the day's top trending stock tickers, including Plug Power (PLUG) suspending its loan-guarantee initiative amid liquidity challenges, Eli Lilly's (LLY) new AI deal with Insilico Medicine, and Tyson Foods (TSN) topping fourth quarter adjusted earnings estimates. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

Pre-Markets Up as Government Shutdown Looks to End

Description: We don't officially see the government opened this morning, but a major impediment from the minority party is being removed.

Are Options Traders Betting on a Big Move in Tyson Foods Stock?

Description: Investors need to pay close attention to TSN stock based on the movements in the options market lately.

Compared to Estimates, Tyson (TSN) Q4 Earnings: A Look at Key Metrics

Description: Although the revenue and EPS for Tyson (TSN) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Tyson Foods (TSN) Beats Q4 Earnings Estimates

Description: Tyson (TSN) delivered earnings and revenue surprises of +35.29% and -0.35%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Tyson forecasts another year of sales growth

Description: The US meat titan expects its net sales to rise 2-4% in its new financial year, which started on 28 September.

Tyson Foods beats Q4 earnings estimates, shares rise on profit growth

Description: Investing.com -- Tyson Foods, Inc. (NYSE:TSN) reported better-than-expected fourth-quarter earnings on Monday, as the food giant achieved growth in sales, adjusted operating income, and adjusted earnings per share. The company’s shares rose 2% premarket following the results.

Tyson Foods (NYSE:TSN) Misses Q3 Revenue Estimates

Description: Meat company Tyson Foods (NYSE:TSN) fell short of the markets revenue expectations in Q3 CY2025 as sales rose 2.2% year on year to $13.86 billion. Its non-GAAP profit of $1.15 per share was 37.8% above analysts’ consensus estimates.

Tyson: Fiscal Q4 Earnings Snapshot

Description: SPRINGDALE, Ark. AP) — Tyson Foods Inc. TSN) on Monday reported fiscal fourth-quarter profit of $47 million.

Tyson Foods Reports Fourth Quarter And Fiscal 2025 Results

Description: Achieves Year-Over-Year Growth in Sales, Adjusted Operating Income and Adjusted EPSSPRINGDALE, Ark., Nov. 10, 2025 (GLOBE NEWSWIRE) -- Tyson Foods, Inc. (NYSE: TSN), one of the world’s largest food companies and a recognized leader in protein with leading brands including Tyson, Jimmy Dean, Hillshire Farm, Ball Park, Wright, Aidells, ibp and State Fair, reported the following results: (in millions, except per share data)Fourth Quarter Twelve Months Ended 2025 2024 2025 2024Sales$13,860 $13,565 $

Stocks Gain Pre-Bell as Senate Moves One Step Further to End Government Shutdown

Description: The benchmark US stock measures were pointing higher before the opening bell Monday, after the Senat

2025-11-09

How DOJ Probe Into Alleged Price Fixing at Tyson Foods (TSN) Has Changed Its Investment Story

Description: Earlier this month, Tyson Foods came under scrutiny after President Trump called for a Department of Justice investigation into price fixing and collusion allegations in the meatpacking sector, focusing on accusations related to artificially inflated beef prices. This heightened regulatory focus has added a layer of uncertainty to Tyson Foods' outlook, raising questions among industry observers about potential legal and operational impacts. We'll look at how increased regulatory scrutiny...

Is Tyson Foods Attractive After Recent Industry Moves and a 9.4% Decline in 2025?

Description: Curious if Tyson Foods is a value play or a value trap? You are not alone, especially with so much buzz around where the stock might go next. Shares have ticked up 2.5% over the last week and are slightly higher over the past month at 1.1%. However, the year-to-date return is still down by 9.4%. Recent headlines have spotlighted Tyson Foods’ strategic moves in the protein market and its initiatives to manage rising input costs. This has drawn new attention to the company this month. Upbeat...

Tyson Foods (TSN) Valuation: Are Recent Gains a Signal or a Short-Lived Shift?

Description: Tyson Foods (TSN) shares have seen moderate gains recently, rising a little under 2% in the past week. Investors are taking notice as the company’s stock performance continues to shift amid evolving market dynamics. See our latest analysis for Tyson Foods. Over the past year, Tyson Foods’ share price has dipped, reflected in a one-year total shareholder return of -8.6%. Short-term momentum appears mixed as recent gains have only partially offset losses earlier in the year. This up-and-down...

2025-11-08

2025-11-07

Trump Calls for Antitrust Probe Over Rising Beef Prices

Description: The president accused meatpacking companies of driving up beef prices and the Justice Department has launched an investigation.

When Will the Shutdown End? What to Watch in the Next Week

Description: All eyes will be on any move toward ending the record-long government shutdown. Meanwhile, investors will dig into more earnings from companies including Disney and Paramount Skydance. Here's what to watch: Monday, Nov.

2025-11-06

Tyson Foods (TSN) Registers a Bigger Fall Than the Market: Important Facts to Note

Description: Tyson Foods (TSN) closed the most recent trading day at $51.69, moving 1.41% from the previous trading session.

Monster Beverage (MNST) Surpasses Q3 Earnings and Revenue Estimates

Description: Monster Beverage (MNST) delivered earnings and revenue surprises of +16.67% and +4.10%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Is Trending Stock Tyson Foods, Inc. (TSN) a Buy Now?

Description: Tyson (TSN) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

2025-11-05

Looking For Yields: Exxon Mobil, Getty Realty, And Tyson Foods Are Consistent Moneymakers

Description: Companies with a long history of paying dividends and consistently hiking them remain appealing to income-focused investors. Exxon Mobil, Getty Realty, and Tyson Foods have rewarded shareholders for years and recently announced dividend increases. ...

1 of Wall Street’s Favorite Stock with Solid Fundamentals and 2 We Avoid

Description: Wall Street is overwhelmingly bullish on the stocks in this article, with price targets suggesting significant upside potential. However, it’s worth remembering that analysts rarely issue sell ratings, partly because their firms often seek other business from the same companies they cover.

Countdown to Tyson (TSN) Q4 Earnings: A Look at Estimates Beyond Revenue and EPS

Description: Evaluate the expected performance of Tyson (TSN) for the quarter ended September 2025, looking beyond the conventional Wall Street top-and-bottom-line estimates and examining some of its key metrics for better insight.

Tyson Foods Stock: Analyst Estimates & Ratings

Description: As Tyson Foods has considerably underperformed the S&P 500 Index over the past year, Wall Street analysts maintain a cautious outlook about the stock’s prospects.

2025-11-04

Former Cisco Systems COO Maria Martinez Joins Alkira's Advisory Board

Description: Alkira®, the leader in Network Infrastructure as a Service (NIaaS), today announced the appointment of Maria N. Martinez to its advisory board.

Rapid Food Safety Testing Global Market Forecast Report 2025-2030: Opportunities in AI-Driven Predictive Analytics, Government Modernisation Programs, and Rising Consumer Focus on Food Safety

Description: The global rapid food safety testing market, valued at $19.66 billion in 2025, is forecast to grow at a CAGR of 9.7%, reaching $31.22 billion by 2030. Increasing demand for convenience foods, subject to contamination risks, drives this growth. Key testing methods like PCR, ELISA, and chromatography ensure safety compliance. Notable companies, such as Nestlé and Tyson Foods, lead in testing adoption. The immunoassay-based testing, key for detecting contaminants, holds a significant market share.

2025-11-03

2025-11-02

2025-11-01

2025-10-31

Why This Arkansas-Based Company Could Be a Buy for Value Investors (Tyson Foods)

Description: Tyson Foods is a commodity business that is currently out of favor, but that will eventually change if history is any guide.

2025-10-30

2025-10-29

Tyson Foods (TSN) Stock Moves -2.72%: What You Should Know

Description: Tyson Foods (TSN) closed at $50.72 in the latest trading session, marking a -2.72% move from the prior day.

Looking at the Narrative for Tyson Foods as Analyst Views and Product Moves Shift the Story

Description: Tyson Foods shares have recently seen their fair value estimate revised slightly downward, shifting from $62.42 to $61.75 per share. This subtle adjustment comes in light of mixed analyst sentiment, as they balance the company's growth potential with ongoing operational challenges. Read on to discover how investors can track these evolving perspectives as the narrative around Tyson Foods continues to develop. What Wall Street Has Been Saying Analyst commentary on Tyson Foods in recent months...

2025-10-28

How Tyson Foods, First Merchants, And Fidelity National Financial Can Put Cash In Your Pocket

Description: Companies with a long history of paying dividends and consistently hiking them remain appealing to income-focused investors. Tyson Foods, First Merchants, and Fidelity National Financial have rewarded shareholders for years and recently announced ...

Tyson Foods Earnings Preview: What to Expect

Description: What should investors expect from Tyson Foods’ upcoming Q4 earnings?

2 S&P 500 Stocks with Exciting Potential and 1 We Turn Down

Description: The S&P 500 (^GSPC) is often seen as a benchmark for strong businesses, but that doesn’t mean every stock is worth owning. Some companies face significant challenges, whether it’s stagnating growth, heavy debt, or disruptive new competitors.

2025-10-27

North America Frozen Food Market Forecast Report 2025: A $145.34 Billion Market by 2033 Featuring Unilever, Nestle, General Mills, Nomad, Tyson, Conagra, Wawona Foods, Bellisio, McCain, Kraft Heinz

Description: North America's frozen food market is set to grow from $103.45 billion in 2024 to $145.34 billion by 2033, with a CAGR of 3.85%. Key drivers include the demand for convenience, extended shelf life, and innovative product offerings. The market includes categories like frozen fruits, meats, seafood, ready meals, and snacks, distributed via groceries, hypermarkets, and online channels. The U.S. leads the market due to its robust retail infrastructure, with Canada seeing a rise in health-conscious p

2025-10-26

Tyson Foods (TSN): Valuation Insights as New Product Launches and Raised Earnings Estimates Drive Interest

Description: Tyson Foods (NYSE:TSN) has caught fresh attention after rolling out a new line of Hillshire Farm frozen snacks and seeing revised upward earnings estimates. These moves are sparking renewed discussion about the company's evolving outlook. See our latest analysis for Tyson Foods. After a challenging start to the year, Tyson Foods' 1-year total shareholder return sits at -9.4%, reflecting ongoing supply chain headwinds and market uncertainty. However, a stronger operational performance and new...

2025-10-25

2025-10-24

Tyson Foods, Inc. (TSN) is Attracting Investor Attention: Here is What You Should Know

Description: Tyson (TSN) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

United States Diabetic Food Market Trends and Company Analysis Report 2025-2033 Featuring Nestle, Unilever, Kellogg Co, Conagra Brands, Tyson Foods, The Hershey Co, and Hain Celestial

Description: The United States diabetic food market is projected to reach US$ 7.35 billion by 2033, growing from US$ 4.4 billion in 2024 at a CAGR of 5.85%. This growth is fueled by rising health consciousness, increased diabetes prevalence, and demand for low-calorie, low-sugar options. Consumer interest in blood glucose management is driving expansion, as is the innovation in snacks, drinks, and meal solutions. Retail and e-commerce channels enhance accessibility, while challenges include high product cost

2025-10-23

Tyson Foods (TSN) Stock Dips While Market Gains: Key Facts

Description: Tyson Foods (TSN) closed at $51.81 in the latest trading session, marking a -1.73% move from the prior day.

Beyond Meat Stock Falls. Is the Meme-Fueled Rally Over?

Description: The company said Tuesday it was expanding its distribution at over 2,000 Walmart locations in the U.S., and on Thursday announced that upscale grocer Erewhon would carry the latest versions of its Beyond Burger and Beyond Beef products. Beyond Meat shares traded below a dollar for the first time on Oct. 13, then shot up to an intraday high of $7.69 earlier this week. Beyond Meat was the first pure-play maker of plant-based alternative meat to go public.

2025-10-22

2025-10-21

2025-10-20

Hillshire Farm® Brings Flaky Stuffed Croissants and Ciabatta Deli Sandwiches to the Frozen Aisle

Description: SPRINGDALE, Ark., Oct. 20, 2025 (GLOBE NEWSWIRE) -- Hillshire Farm is calling™! For the first time ever, consumers can find the brand they know and love in the freezer aisle. As part of Tyson Foods’ expanding portfolio, Hillshire Farm is bringing savory snacks to the freezer with the debut of Stuffed Croissants and Ciabatta Deli Sandwiches. From flaky, real-butter croissants to rustic ciabatta bread, the new culinary-inspired handhelds pair the Hillshire Farm lunch meats that consumers already r

2025-10-19

2025-10-18

2025-10-17

The Bull Case for Tyson Foods (TSN) Could Change Following Revenue Beat and Multi-Protein Portfolio Momentum

Description: Earlier this month, Tyson Foods reported a strong second quarter, with revenue surpassing analyst expectations by 2.9% and achieving 3.6% year-on-year growth, driven by the company's multi-protein, multi-channel portfolio. This performance highlights Tyson Foods' ability to outperform its peers in the perishable food sector, underlining the benefits of its diversified operational approach amid ongoing market fluctuations. We'll examine how Tyson Foods' robust multi-protein portfolio and...

Is Tyson Foods a Bargain After Latest Cost-Cutting Moves in 2025?

Description: Thinking about what to do with Tyson Foods stock? You’re definitely not alone. Whether you’re a long-term investor weighing your next move or someone just getting familiar with the company, Tyson is one of those names that pops up on value radars for a reason. The stock most recently closed at $52.16, and while it’s seen a modest climb of 1.1% over the past week, it’s still down 4.0% over the past month and has fallen 10.3% year-to-date. Zooming out a bit, the one-year and three-year returns...

1 Safe-and-Steady Stock Worth Your Attention and 2 We Turn Down

Description: Low-volatility stocks may offer stability, but that often comes at the cost of slower growth and the upside potential of more dynamic companies.