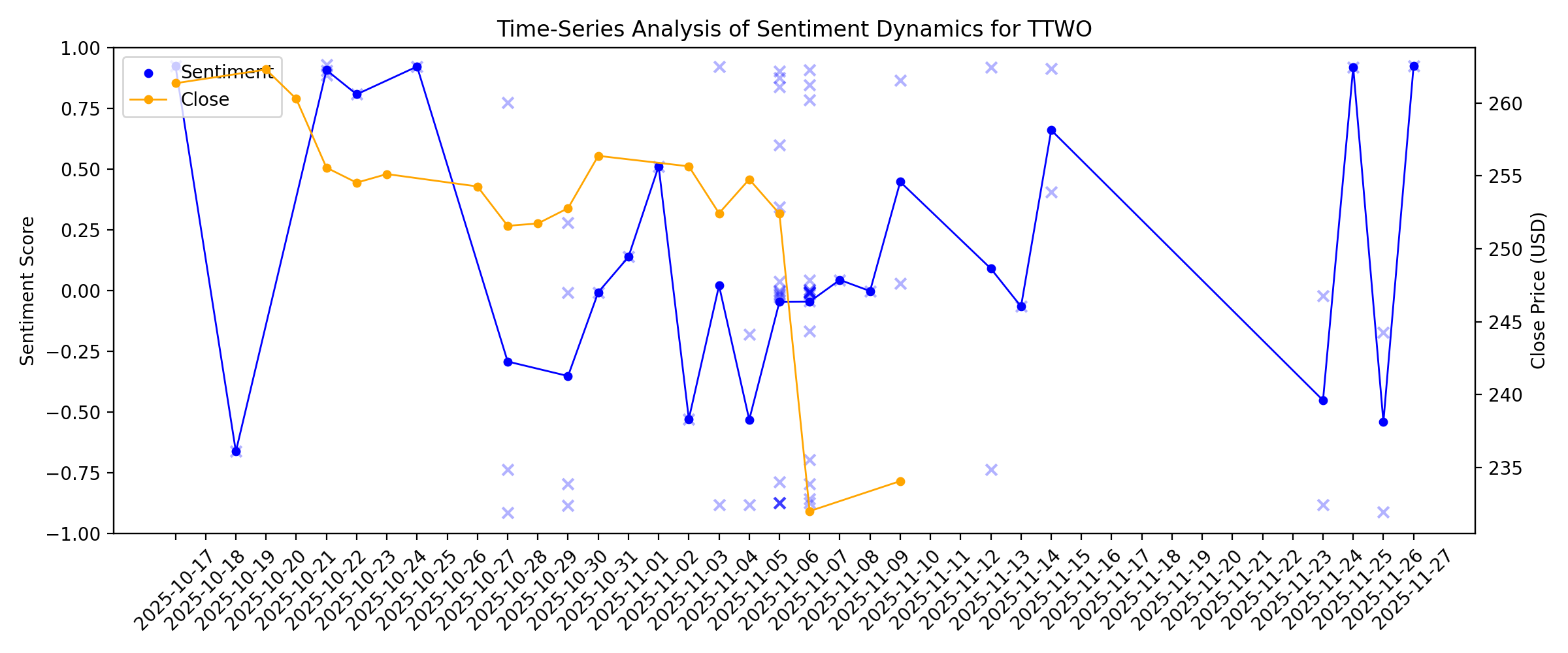

News sentiment analysis for TTWO

Sentiment chart

2026-01-14

2026-01-13

Jim Cramer on Take-Two: “Great Scarcity Value There”

Description: Take-Two Interactive Software, Inc. (NASDAQ:TTWO) is one of the stocks from different market sectors that Jim Cramer commented on. Cramer highlighted the stock’s performance in light of Electronic Arts going private. He said: “… Electronic Arts, that’s also got a takeover bid. It jumped almost 40% because it’s being taken private by a group of […]

Earnings Preview: What to Expect From Take-Two Interactive Software’s Report

Description: Take-Two Interactive Software is slated to report its fiscal third-quarter results next month, with Wall Street forecasting robust double-digit growth in profits.

2026-01-12

2026-01-11

2026-01-10

Did GTA VI Jitters and Short-Interest Shifts Just Reframe Take-Two Interactive's (TTWO) Risk Narrative?

Description: In recent days, Take-Two Interactive Software confirmed it will report third-quarter fiscal 2026 results on February 3, 2026, while investors weighed renewed rumors about possible Grand Theft Auto VI delays and shifting short interest. Alongside fresh analyst optimism around its blockbuster pipeline, the mix of GTA VI speculation and improving short interest has sharpened attention on how much future franchise execution matters for Take-Two’s outlook. We’ll now examine how renewed focus on...

Is It Too Late To Consider Take Two Interactive (TTWO) After 40% One Year Rally?

Description: If you are wondering whether Take-Two Interactive Software is richly priced or still offers value, this article walks through what the current share price might be implying. The stock recently closed at US$250.71, with returns of 1.9% over the past 30 days and 40.4% over the last year, while the year to date move sits at a 0.4% decline. Recent headlines have centered on Take-Two Interactive Software's major game franchises and its position in the broader gaming sector. The company often...

2026-01-09

Are You a Momentum Investor? This 1 Stock Could Be the Perfect Pick

Description: The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Is Take-Two (TTWO) a Buy as Wall Street Analysts Look Optimistic?

Description: According to the average brokerage recommendation (ABR), one should invest in Take-Two (TTWO). It is debatable whether this highly sought-after metric is effective because Wall Street analysts' recommendations tend to be overly optimistic. Would it be worth investing in the stock?

2026-01-08

Take-Two Interactive (TTWO) Stock Falls Amid Market Uptick: What Investors Need to Know

Description: Take-Two Interactive (TTWO) reached $252.38 at the closing of the latest trading day, reflecting a -1.67% change compared to its last close.

2026-01-07

Here's Why Take-Two Interactive (TTWO) is a Strong Growth Stock

Description: The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

2026-01-06

Will Take-Two (TTWO) Beat Estimates Again in Its Next Earnings Report?

Description: Take-Two (TTWO) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

BYD vs. TTWO: Which Stock Is the Better Value Option?

Description: BYD vs. TTWO: Which Stock Is the Better Value Option?

Take-Two Interactive Software, Inc. to Report Third Quarter Fiscal Year 2026 Results on Tuesday, February 3, 2026

Description: NEW YORK, January 06, 2026--Take-Two Interactive Software, Inc. (NASDAQ: TTWO) today announced that it plans to report financial results for its third quarter of Fiscal Year 2026, ended December 31, 2025, after the market close on Tuesday, February 3, 2026. The Company plans to hold a conference call to discuss its results at 4:30 p.m. Eastern Time, which can be accessed by dialing (800) 715-9871 or (646) 307-1963 (conference ID: 9711440). A live, listen-only webcast and a replay of the call wil

A Look At Take-Two Interactive Software (TTWO) Valuation After A Strong 1 Year Shareholder Return

Description: Take-Two Interactive Software (TTWO) has attracted attention after a period where returns have differed sharply across timeframes, with the stock roughly flat over the past 3 months but showing a stronger 1 year total return profile. See our latest analysis for Take-Two Interactive Software. The recent 1 year total shareholder return of 41.57%, alongside a 3.80% 30 day share price return and latest share price of $257.31, suggests momentum has generally been building even if shorter term...

2026-01-05

What Analysts Think Is Shifting The Story For Take-Two Interactive Software (TTWO)

Description: Take Two Interactive Software's latest valuation update keeps the fair value estimate anchored near US$277.40, while slightly adjusting the discount rate to reflect a marginally lower assumed risk profile. The core revenue growth outlook remains essentially unchanged, as analysts weigh strong NBA 2K and mobile engagement against more cautious voices around near term GTA 6 expectations. Stay tuned to see how you can keep on top of these shifting narratives and what to watch for as sentiment...

2026-01-04

2026-01-03

2026 should be record year within the last decade of video games

Description: Are sales of video games and gaming hardware showing signs of slowing down? If so, what could this mean for games spending in 2026? Wedbush Securities managing director of strategic planning Michael Pachter sits down with Yahoo Finance markets and data editor Jared Blikre on Market Catalysts to share his forecast on video game sales for 2026, noting the release of Rockstar's long-awaited Grand Theft Auto VI. Also catch Michael Pachter's analysis on the bidding wars for Warner Bros. Discovery (WBD). To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

2026-01-02

Take-Two Interactive (TTWO) Stock Drops Despite Market Gains: Important Facts to Note

Description: Take-Two Interactive (TTWO) reached $251.6 at the closing of the latest trading day, reflecting a -1.73% change compared to its last close.

2026-01-01

2025-12-31

2025-12-30

RBLX vs TTWO: Which Gaming Stock Has the Stronger 2026 Setup?

Description: Roblox and Take-Two head into 2026 with sharply different models, pitting platform-driven growth against franchise-led earnings visibility.

2025-12-29

'Grand Theft Auto' Game Publisher Is A Steal, Analyst Says

Description: Investment firm Benchmark named video game publisher Take-Two Interactive Software as a "top idea" for 2026.

Take-Two Stock Has Been Hurt by GTA 6 Delays. Bet on a 2026 Hit, Analyst Says.

Description: The stock fell when the developer said last month that Grand Theft Auto VI would be released in November next year.

Here Are Monday’s Top Wall Street Analyst Research Calls: Doximity, KB Home, NVIDIA, Okta, On Holdings, Take-Two Interactive, Vail Resorts, and More

Description: Pre-Market Stock Futures: The futures are trading lower as we begin the final trading week of 2025, albeit a holiday-shortened one once again. The major indices all finished the session modestly lower on Friday, with the venerable S&P 500 taking early bows as it hit a fresh all-time high, joining the Dow Jones Industrial Average ... Here Are Monday’s Top Wall Street Analyst Research Calls: Doximity, KB Home, NVIDIA, Okta, On Holdings, Take-Two Interactive, Vail Resorts, and More

2025-12-28

2025-12-27

2025-12-26

Take-Two Interactive (TTWO) Increases Despite Market Slip: Here's What You Need to Know

Description: Take-Two Interactive (TTWO) closed at $256.09 in the latest trading session, marking a +1.78% move from the prior day.

SE vs. TTWO: Which Gaming Stock Offers Better Growth Opportunity?

Description: Take-Two Interactive's deep franchise lineup, record bookings and strong pipeline give it an edge over Sea Limited's Free Fire-dependent rebound.

2025-12-25

2025-12-24

2025-12-23

2025-12-22

2025-12-21

Jim Cramer on Take-Two Interactive: “Strauss Zelnick Will Deliver”

Description: Take-Two Interactive Software, Inc. (NASDAQ:TTWO) is one of the stocks Jim Cramer shed light on. A caller asked if a successful launch of GTA VI could give the share price a boost. In response, Cramer said: “Absolutely. Absolutely. It’s the greatest entertainment franchise of all time. I think you can buy some here and buy […]

2025-12-20

2025-12-19

What Is Shifting the Take Two Narrative After Fresh GTA 6 and NBA 2K Optimism

Description: Take Two Interactive Software's fair value estimate has nudged up to about $277.40 from roughly $276.59, even as our assumed revenue growth rate eases slightly to around 15.08% from roughly 15.17%. This subtle shift reflects a tug of war between growing conviction in long term engagement and earnings power, especially around key franchises, and a marginally more conservative top line outlook amid heightened competitive and execution risks. Read on to see how these moving pieces are reshaping...

CHDN vs. TTWO: Which Stock Is the Better Value Option?

Description: CHDN vs. TTWO: Which Stock Is the Better Value Option?

2025-12-18

If GTA VI Delivers, Take-Two Could Hit $300 in 2026

Description: Take-Two Interactive (NASDAQ: TTWO) has delivered a solid 2025, with shares up approximately 36% from their 52-week low of $177.35 and trading near recent highs. The rally has been fueled by strong NBA 2K performance and mounting anticipation for Grand Theft Auto VI, launching November 2026. With the stock at $240.55, investors are asking whether ... If GTA VI Delivers, Take-Two Could Hit $300 in 2026

2025-12-17

Here's Why Take-Two Interactive (TTWO) is a Strong Growth Stock

Description: Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

2025-12-16

2025-12-15

Why the Market Dipped But Take-Two Interactive (TTWO) Gained Today

Description: Take-Two Interactive (TTWO) concluded the recent trading session at $244.56, signifying a +1.28% move from its prior day's close.

2025-12-14

2025-12-13

2025-12-12

A Look at Take-Two Interactive (TTWO) Valuation After a Strong Run and Recent Share Price Pullback

Description: Take-Two Interactive Software (TTWO) has been on a strong run this year, but the stock’s recent pullback has investors asking whether the market is simply catching its breath or flagging deeper concerns. See our latest analysis for Take-Two Interactive Software. At around $242.41 per share, Take-Two’s recent dip comes after a strong year to date share price return of about 32 percent, while a 3 year total shareholder return above 130 percent still signals powerful long term momentum. If this...

2025-12-11

Does Take-Two’s 134.7% Three Year Surge Still Leave Room for Further Returns?

Description: If you are wondering whether Take-Two Interactive Software is still a buy after its huge run, you are not alone. This article will walk through what the current price actually implies about future returns. The stock recently closed at $246.02, up 0.4% over the past week, 5.1% over the last month, and 34.4% year to date, while delivering 29.2% over 1 year and 134.7% over 3 years. Investors have been reacting to a steady drumbeat of franchise and pipeline headlines, ranging from ongoing...

Buy Stocks on the Dip? Here’s a Better Strategy.

Description: Many investors welcomed the market’s recent decline as an opportunity to buy the dip. That’s not the best strategy, argue two analysts.

2025-12-10

Buying Stocks on the Cheap Can Cost You More. Here’s a Better Strategy.

Description: Many investors welcomed the market’s recent decline as an opportunity to buy the dip. That’s not the best strategy, argue two analysts.

Amazon initiated, GE Vernova upgraded: Wall Street's top analyst calls

Description: Amazon initiated, GE Vernova upgraded: Wall Street's top analyst calls

What's the State of Take-Two Interactive Software With Its Blockbuster Hit Looming in 2026?

Description: The company is on the cusp of releasing arguably the most anticipated video game of all time.

Here Are Wednesday’s Top Wall Street Analyst Research Calls: AbbVie, Amazon.com, Biogen, EchoStar, Ferrari, GE Vernova, PepsiCo, Take-Two Interactive, and More

Description: Pre-Market Stock Futures: Futures are trading modestly lower as the big day has finally arrived: the Federal Reserve will wrap up its last meeting of 2025, and the odds still heavily favor a 25-basis-point rate hike. The worry hanging over traders is that many fear a “hawkish rate cut.” Where they do cut 25 basis ... Here Are Wednesday’s Top Wall Street Analyst Research Calls: AbbVie, Amazon.com, Biogen, EchoStar, Ferrari, GE Vernova, PepsiCo, Take-Two Interactive, and More

2025-12-09

How Strong In-Game Spending and GTA VI Delay Could Impact Take-Two Interactive Software (TTWO) Investors

Description: In recent days, Take-Two Interactive Software reported strong earnings marked by solid revenue growth, improved operating cash flow, and robust bookings driven by in-game spending. At the same time, investor focus has intensified on how the delayed but highly anticipated Grand Theft Auto VI release could reshape the company’s longer-term earnings profile. Next, we’ll examine how this momentum in recurrent in-game spending could influence Take-Two’s existing investment narrative and future...

What to Know Before Buying Take-Two Stock

Description: This top video game producer is poised for explosive growth.

Brokers Suggest Investing in Take-Two (TTWO): Read This Before Placing a Bet

Description: Based on the average brokerage recommendation (ABR), Take-Two (TTWO) should be added to one's portfolio. Wall Street analysts' overly optimistic recommendations cast doubt on the effectiveness of this highly sought-after metric. So, is the stock worth buying?

Is Take-Two Interactive Software Stock Outperforming the Dow?

Description: Take-Two Interactive Software has delivered stronger returns than the Dow Jones Industrial Average over the past year, and Wall Street remains highly optimistic about the stock’s future trajectory.

2025-12-08

Here's How Much a $1000 Investment in Take-Two Interactive Made 10 Years Ago Would Be Worth Today

Description: Why investing for the long run, especially if you buy certain popular stocks, could reap huge rewards.

2025-12-07

2025-12-06

2025-12-05

Has Take-Two (TTWO) Stock Been Good for Investors?

Description: This top game producer has a solid lineup of hit franchises that continue to shine.

2025-12-04

Three Stocks Estimated To Be Trading Below Their Intrinsic Value In December 2025

Description: As the Dow Jones and S&P 500 approach record highs, investors are closely watching market movements amidst expectations of a potential interest rate cut by the Federal Reserve. In this environment, identifying stocks that may be trading below their intrinsic value can offer opportunities for those seeking to capitalize on market inefficiencies.

2025-12-03

2025-12-02

2025-12-01

Why Take-Two Interactive (TTWO) is a Top Growth Stock for the Long-Term

Description: The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Here Are Monday’s Top Wall Street Analyst Research Calls: Archer Aviation, Beta Technologies, Carvana, Chevron, MPLX, Toast, Zscaler and More

Description: Pre-Market Stock Futures: Futures are trading lower on Monday as traders and investors return from the Thanksgiving holiday, preparing to start the final trading month of 2025, which has been another outstanding year for investors and the stock market, with the potential for a third year of double-digit gains for the S&P 500 despite a ... Here Are Monday’s Top Wall Street Analyst Research Calls: Archer Aviation, Beta Technologies, Carvana, Chevron, MPLX, Toast, Zscaler and More

2025-11-30

2025-11-29

2025-11-28

2025-11-27

Take-Two Interactive (TTWO): Exploring Valuation as Shares Hold Steady and Analyst Targets Diverge

Description: Take-Two Interactive Software (TTWO) has held steady in recent trading, with shares recently seeing only minor movements over the past week and month. Investors may be watching for fresh signals on company momentum or catalysts ahead. See our latest analysis for Take-Two Interactive Software. With shares up more than 33% year-to-date and a 1-year total shareholder return of 31%, Take-Two Interactive Software has shown clear momentum. The company also reports an impressive three-year total...

2025-11-26

Roblox Isn’t Playing Games. Why the Stock Could Jump 50%.

Description: The videogame platform is looking more and more like the next YouTube. Investors are missing the opportunity.

Zacks.com featured highlights include Take-Two Interactive, Globus, Rockwell Automation, Canadian and VICI

Description: Take-Two Interactive, Globus, Rockwell Automation, Canadian and VICI have been highlighted in this Screen of The Week article.

2025-11-25

5 Stocks With Strong Sales Growth to Bet on Amid Volatile Markets

Description: Stocks like TTWO, GMED, ROK, CNQ and VICI stand out with strong sales growth expectations despite market uncertainty.

2025-11-24

WorldWinner Appoints Nir Efrat as Chief Executive Officer

Description: WorldWinner, a leading real-money skill-gaming company and operator of both WorldWinner and FanDuel Faceoff (in partnership with FanDuel), today announced that Nir Efrat has been appointed Chief Executive Officer, effective immediately.

3 Unprofitable Stocks with Questionable Fundamentals

Description: Unprofitable companies face headwinds as they struggle to keep operating expenses under control. Some may be investing heavily, but the majority fail to convert spending into sustainable growth.

2025-11-23

2025-11-22

2025-11-21

2025-11-20

2025-11-19

2025-11-18

2025-11-17

2025-11-16

2025-11-15

Does Take-Two’s 28% 2025 Rally Reflect Real Value or Just Gaming Hype?

Description: Wondering if Take-Two Interactive Software's stock is genuinely good value or just riding the hype cycle? You are not alone, and today we'll break down what really matters for investors. The stock's had an energetic run recently, climbing 1.3% in the past week. However, it's cooled off in the last month with a 10.1% drop. Still, the year-to-date jump is a remarkable 28.4%. Recent moves come on the heels of industry-wide M&A chatter and the rollout of anticipated new game titles, both of...

2 Growth Stocks Down 10% to 64% to Buy in November

Description: These companies remain on track to deliver excellent returns over the long term.

2025-11-14

Take-Two's Latest GTA Delay Could Amplify Demand for Long-Awaited Game, Analysts Say

Description: Take-Two Interactive Software's (TTWO) recent decision to again delay the release of "Grand Theft Au

2025-11-13

Wall Street Bulls Look Optimistic About Take-Two (TTWO): Should You Buy?

Description: Based on the average brokerage recommendation (ABR), Take-Two (TTWO) should be added to one's portfolio. Wall Street analysts' overly optimistic recommendations cast doubt on the effectiveness of this highly sought-after metric. So, is the stock worth buying?

The 5 Most Interesting Analyst Questions From Take-Two’s Q3 Earnings Call

Description: Take-Two’s third quarter results were met with a negative market reaction, despite surpassing Wall Street’s revenue expectations. Management attributed the quarter’s top-line growth to strong performance across its mobile portfolio—particularly titles like Toon Blast and Color Block Jam—as well as the launch of NBA 2K26, which saw record in-game spending. CEO Strauss Zelnick highlighted that the company’s focus on engaging players and optimizing live services drove a 20% increase in recurrent co

2025-11-12

2025-11-11

2025-11-10

After Plunging 7.9% in 4 Weeks, Here's Why the Trend Might Reverse for Take-Two (TTWO)

Description: Take-Two (TTWO) has become technically an oversold stock now, which implies exhaustion of the heavy selling pressure on it. This, combined with strong agreement among Wall Street analysts in revising earnings estimates higher, indicates a potential trend reversal for the stock in the near term.

US Stock Market Today: S&P 500 Futures Climb as Shutdown Fears Ease

Description: The Morning Bull - US Market Morning Update Monday, Nov, 10 2025 US stock futures are climbing this morning as investors digest some rare good news from Washington. The government shutdown, on track to be the longest ever, looks set to wrap up soon after the Senate approved a funding deal through the end of January. For everyday investors, that means less worry about missed paychecks or market disruptions from political gridlock. Meanwhile, new data shows Americans borrowed $13.09 billion...

2025-11-09

Earnings Beat: Take-Two Interactive Software, Inc. (NASDAQ:TTWO) Just Beat Analyst Forecasts, And Analysts Have Been Lifting Their Forecasts

Description: Take-Two Interactive Software, Inc. ( NASDAQ:TTWO ) shareholders are probably feeling a little disappointed, since its...

2025-11-08

Take-Two Interactive Software (TTWO): Valuation Perspectives After GTA VI Delay and Earnings Beat

Description: Take-Two Interactive Software (TTWO) caught investors’ attention after announcing another delay for Grand Theft Auto VI, with the new target now set for a November 2026 launch. This news came even as the company posted strong quarterly earnings. See our latest analysis for Take-Two Interactive Software. Despite raising its full-year outlook and beating earnings expectations, Take-Two’s latest delay for Grand Theft Auto VI rattled investors and sent its share price down over 8% in a day...

2025-11-07

Nasdaq Logs Worst Week Since March Amid Tech Valuation Worries

Description: The Nasdaq Composite fell for a second straight session on Friday to log its worst week since the en

S&P 500 Posts Weekly Loss, Breaking Win Streak Amid Drop in Consumer Sentiment

Description: The Standard & Poor's 500 index fell 1.6% this week, led by the technology sector, as consumer senti

S&P 500 Gains and Losses Today: Take-Two Stock Falls; Expedia Soars on Resilient Travel Demand

Description: A video game maker faced pressure on Friday, Nov. 7, 2025, after delaying the release of a highly anticipated title, while strong quarterly results helped lift shares of a travel booking company.

US Equity Markets Close Mixed Amid Schumer's Proposal, Drop in Consumer Sentiment

Description: US equity indexes closed mixed on Friday after Senate Minority Leader Chuck Schumer shared a new pla

These Stocks Moved the Most Today: Tesla, Expedia, Take-Two, Block, Affirm, Sunrun, Globus Medical, JFrog, and More

Description: Tesla declines after the electric-vehicle maker's shareholders approve a massive pay package for CEO Elon Musk.

Take-Two Just Delayed GTA 6... Again. Is TTWO Stock About to Break Its Key 200-Day Moving Average?

Description: Take-Two stock sinks as the company announces yet another delay in launching GTA VI. But Wall Street remains bullish on TTWO shares after robust Q2 earnings.

Sector Update: Tech Stocks Fall Late Afternoon

Description: Tech stocks fell late Friday afternoon with the Technology Select Sector SPDR Fund (XLK) declining 0

Take-Two Stock Nosedives -- GTA 6 Delay Sparks Investor Panic

Description: Take-Two Tanks as Rockstar Postpones GTA 6 to 2026

Equities Fall Intraday Amid Continued Tech Weakness, Souring Consumer Sentiment

Description: US benchmark equity indexes were lower intraday amid continued weakness in technology shares, while

Top Stock Movers Now: Tesla, Expedia, Take-Two, Block, and More

Description: Major U.S. equities indexes lost ground Friday afternoon, led by the tech sector amid lingering worries about an AI bubble and after a string of weaker-than-expected earnings reports.

Peloton's upbeat outlook, Comcast's Sky & ITV talks

Description: Yahoo Finance's John Hyland takes a closer look at some of the top stories on Wall Street as part of Friday's Market Minute, including Take-Two (TTWO) delaying Grand Theft Auto VI, Peloton's (PTON) strong outlook, and Comcast's (CMCSA) TV business. Stay up to date on the latest market action, minute-by-minute, with Yahoo Finance's Market Minute.

Why Take-Two (TTWO) Stock Is Down Today

Description: Shares of video game publisher Take Two (NASDAQ:TTWO) fell 9.2% in the afternoon session after the company announced that the release of its highly anticipated game, “Grand Theft Auto VI,” was delayed again.

Take-Two Has 'Several' Profit Growth Drivers Despite Grand Theft Auto VI Setback, Wedbush Says

Description: Take-Two Interactive Software (TTWO) has "several" opportunities for profit growth even as the video

Another Delay in the Release of 'GTA 6' Is Pulling Down Take-Two's Stock Today

Description: Shares of Take-Two Interactive fell Friday following last night's news that the company will postpone the release of one of the industry's highest-profile games.

Take-Two delays GTA 6, Wendy's & MP Materials earnings

Description: There are a number of stocks on the move on Friday, Nov. 7. Take-Two Interactive (TTWO) shares are moving lower after announcing another release delay for "Grand Theft Auto VI." Wendy's (WEN) and MP Materials (MP) are both seeing their stocks trade slightly higher in early trading after issuing quarterly reports. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

Take-Two's GTA 6 delay: Markets are punishing 'disappointment'

Description: Take-Two (TTWO) stock is under pressure after the video game company announced it is delaying the release of the highly anticipated Grand Theft Auto (GTA) VI. PNC Asset Management Group chief investment strategist Yung-Yu Ma examines the stock price reaction to the delay. To watch more expert insights and analysis on the latest market action, check out more Opening Bid.

Take-Two Stock Falls on Latest Grand Theft Auto Delay

Description: Take-Two announced that Grand Theft Auto VI would now be released in November 2026, six months later than expected.

Take-Two's Q2 Loss Narrows Year Over Year, Revenue Outlook Raised

Description: TTWO's fiscal second quarter soars with 33% bookings growth to $1.96B, raises FY26 guidance as NBA 2K26, Borderlands 4 excel.

Here's Why Take-Two Interactive (TTWO) is a Strong Growth Stock

Description: Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

TTWO Q3 Deep Dive: Mobile Momentum and Franchise Launches Shape Outlook

Description: Video game publisher Take Two (NASDAQ:TTWO) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 20.3% year on year to $1.77 billion. On top of that, next quarter’s revenue guidance ($1.60 billion at the midpoint) was surprisingly good and 6.7% above what analysts were expecting. Its GAAP loss of $0.72 per share was 15.3% below analysts’ consensus estimates.

2025-11-06

Dow Jones Futures: Stock Market, Palantir Break Key Levels; Tesla Shareholders OK Elon Musk Pay

Description: Dow Jones futures: The stock market indexes and Palantir undercut key levels. Tesla shareholders voted in favor of the Elon Musk pay deal.

Take-Two (TTWO) Q2 Earnings: How Key Metrics Compare to Wall Street Estimates

Description: Although the revenue and EPS for Take-Two (TTWO) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

‘Grand Theft Auto VI’ Is Postponed Again — to November 2026

Description: Shares of Take-Two fell about 7% in extended trading after the delay was announced, overshadowing quarterly results that topped Wall Street estimates. “It’s always painful when we move a date,” Chief Executive Officer Strauss Zelnick said on a call with investors. The company told Bloomberg that the fired employees were leaking confidential information.

Take-Two Interactive (TTWO) Q2 Earnings and Revenues Beat Estimates

Description: Take-Two (TTWO) delivered earnings and revenue surprises of +60.44% and +12.93%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Take-Two Delays ‘Grand Theft Auto VI’ Again

Description: The delay of the next iteration of one of its most popular franchises pulled the videogame developer’s stock down in after-hours trading, despite an increased full-year financial view.

Take-Two falls in afterhours as further delay to GTA VI offsets guidance hike

Description: Investing.com--Take-Two raised its annual guidance Thursday, but reported mixed fiscal second-quarter results after posting a surprise loss and pushed back the release of the next edition of Grand Theft Auto to November next year.

Take-Two delays GTA 6, Affirm & Opendoor report earnings

Description: Yahoo Finance anchor Josh Lipton examines some of the stocks on the move in Thursday's after-hours trading, including Take-Two (TTWO), Affirm (AFRM), and Opendoor (OPEN). To watch more expert insights and analysis on the latest market action, check out more Asking for a Trend.

Take-Two Earnings Slam Dunk Overshadowed By 'GTA 6' Delay

Description: Take-Two Interactive Software trounced estimates for its fiscal Q2 but announced a six-month delay for its “Grand Theft Auto 6” game.

Take-Two Stock Falls on Latest Grand Theft Auto Delay

Description: Take-Two announced that Grand Theft Auto VI would now be released in November 2026, six months later than expected.

Take-Two: Fiscal Q2 Earnings Snapshot

Description: The New York-based company said it had a loss of 73 cents per share. Earnings, adjusted for non-recurring costs and stock option expense, came to $1.46 per share. The results surpassed Wall Street expectations.

Take-Two (NASDAQ:TTWO) Surprises With Q3 Sales But Stock Drops

Description: Video game publisher Take Two (NASDAQ:TTWO) announced better-than-expected revenue in Q3 CY2025, with sales up 20.3% year on year to $1.77 billion. On top of that, next quarter’s revenue guidance ($1.60 billion at the midpoint) was surprisingly good and 6.7% above what analysts were expecting. Its GAAP loss of $0.73 per share was 17.1% below analysts’ consensus estimates.

Take-Two Interactive Software Fiscal Q2 Loss Narrows, Revenue Rises; Fiscal 2026 Guidance Adjusted

Description: Take-Two Interactive Software (TTWO) reported a fiscal Q2 loss late Thursday of $0.73 per diluted sh

Take-Two Interactive Software, Inc. Reports Results for Fiscal Second Quarter 2026

Description: NEW YORK, November 06, 2025--Take-Two Interactive Software, Inc. (NASDAQ:TTWO) today reported results for the second quarter of its fiscal year 2026, ended September 30, 2025. For further information, please see the second quarter fiscal 2026 results slide deck posted to the Company’s investor relations website at take2games.com/ir.

Equities Fall Intraday as Report Shows Surge in Job Cuts

Description: US benchmark equity indexes were lower intraday as a report showed a surge in job cut announcements

Stocks Mostly Up Pre-Bell as Traders Assess Supreme Court Hearing on Trump Tariffs

Description: US equity markets were mostly pointing higher before Thursday's opening bell as investors assess the

How Recent Developments Are Shaping the Take-Two Interactive Investment Story

Description: Take-Two Interactive Software's stock narrative has shifted recently, as the consensus analyst price target moved up slightly from $270.34 to $274.49. This modest increase points to growing optimism around the company’s trajectory, supported by strong engagement in key franchises and an improving top-line outlook. Stay tuned to discover how you can keep current with the evolving perspective on Take-Two’s future performance. Analyst Price Targets don't always capture the full story. Head over...

2025-11-05

Tesla shareholder vote, Fed talk, mortgage rates: What to Watch

Description: Asking for a Trend host Josh Lipton takes a look at the top stories for investors to watch on Thursday, Nov. 6. Tesla (TSLA) is having its shareholder meeting, where investors will decide whether to award Tesla CEO Elon Musk with a $1 trillion pay package. AstraZeneca (AZN), ConocoPhilips (COP), and Warner Bros. Discovery (WBD) post earnings results in the morning. Airbnb (ABNB), Take-Two (TTWO), and Affirm (AFRM) will report in the afternoon. There will be lots of commentary from Federal Reserve officials, including from Cleveland Fed President Beth Hammack and Fed Governor Christopher Waller. Weekly mortgage rates data from Freddie Mac (FMCC) will also be released. To watch more expert insights and analysis on the latest market action, check out more Asking for a Trend.

Take-Two Earnings On Deck With GTA VI In Focus

Description: Investors eye updates as profits surge and release delays drag

2025-11-04

Take-Two (TTWO) To Report Earnings Tomorrow: Here Is What To Expect

Description: Video game publisher Take Two (NASDAQ:TTWO) will be reporting earnings this Thursday afternoon. Here’s what to expect.

Take-Two to Report Q2 Earnings: What's in the Cards for the Stock?

Description: TTWO is poised for strong fiscal Q2 results with blockbuster game launches like NBA 2K26 and Borderlands, which are expected to drive bookings growth.

2025-11-03

NBA TAKE-TWO MEDIA UNVEILS NEW NBA 2K LEAGUE

Description: NBA Take-Two Media (NBAT2), the next chapter in the long-standing partnership between the National Basketball Association (NBA) and Take-Two Interactive Software (NASDAQ: TTWO), today announced the arrival of the newly re-launched NBA 2K League (2KL). The new 2KL is an innovative entertainment property where competition meets culture, bringing everyone from fans to NBA players and creators together to play, compete, and build community—no matter their NBA® 2K skill level.

2025-11-02

How Analyst Upgrades and Labor Disputes at Take-Two Interactive (TTWO) Are Shaping Its Investment Outlook

Description: In the past week, Take-Two Interactive was rated a strong buy by Zacks following significant upward revisions in earnings estimates, with recent quarterly results outperforming analyst expectations in both revenue and earnings per share. The company also faced controversy after layoffs at Rockstar Games led to union suppression allegations, which Take-Two denied, citing employee misconduct instead. While positive analyst sentiment and earnings expectations boosted investor interest, the...

2025-11-01

Video Game CEO Says Regenerative AI Will 'Increase Employment,' Despite Job Losses In The Industry

Description: Regenerative AI will create more jobs in the video game industry, Take-Two (NASDAQ:TTWO) CEO Strauss Zelnick said recently, despite the fact that thousands of animators and other behind-the-scenes workers have lost their jobs due to the technology. “It will not reduce employment, it will increase employment,” Zelnick said during a talk on Oct. 17 at The Paley Center for Media, according to media reports.. “Technology always increases productivity, which in turn increases GDP, which in turn incre

2025-10-31

Charter Earnings Miss Estimates in Q3, Revenues Decline Y/Y

Description: CHTR posts a 5.4% y/y drop in Q3 EPS and a 0.9% fall in revenues due to weak video and ad sales.

2025-10-30

Comcast's Q3 Earnings Surpass Estimates, Revenues Decrease Y/Y

Description: CMCSA beats Q3 earnings and revenue estimates despite lower Y/Y revenue due to last year's Paris Olympics boost.

Electronic Arts Q2 Earnings and Revenues Decline Year Over Year

Description: EA's Q2 earnings tumble 43.7% with $1.84B in revenues, as live services drop and margins contract.

Take-Two Interactive (TTWO) Earnings Expected to Grow: Should You Buy?

Description: Take-Two (TTWO) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Take-Two Interactive Software, Inc. (TTWO) is Attracting Investor Attention: Here is What You Should Know

Description: Zacks.com users have recently been watching Take-Two (TTWO) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

2025-10-29

2025-10-28

Take-Two Interactive (TTWO) Stock Dips While Market Gains: Key Facts

Description: The latest trading day saw Take-Two Interactive (TTWO) settling at $251.54, representing a -1.07% change from its previous close.

Is It Worth Investing in Take-Two (TTWO) Based on Wall Street's Bullish Views?

Description: Based on the average brokerage recommendation (ABR), Take-Two (TTWO) should be added to one's portfolio. Wall Street analysts' overly optimistic recommendations cast doubt on the effectiveness of this highly sought-after metric. So, is the stock worth buying?

Best Buy (BBY)’s “Been Sneaking Up,” Says Jim Cramer

Description: We recently published 10 Latest Stocks Jim Cramer Talked About. Best Buy Co., Inc. (NYSE:BBY) is one of the stocks Jim Cramer recently discussed. Cramer discussed Best Buy Co., Inc. (NYSE:BBY) late during the show and tied it in with Intel’s latest earnings report. During the earnings, Intel CFO David Zinsner had outlined that Intel […]

2025-10-27

2025-10-26

2025-10-25

Take-Two Interactive (TTWO): Examining Valuation Following Recent Share Price Momentum

Description: Take-Two Interactive Software (TTWO) has caught the attention of investors this week following a subtle uptick in its stock price. Shares climbed slightly, sparking curiosity about what could be driving renewed interest in the video game publisher. See our latest analysis for Take-Two Interactive Software. Momentum seems to be building for Take-Two, with the share price climbing over 4% in the past month and now up nearly 40% year-to-date. Over the last year, investors have enjoyed a total...

2025-10-24

2025-10-23

1 Surging Stock for Long-Term Investors and 2 That Underwhelm

Description: The stocks in this article are all trading near their 52-week highs. This strength often reflects positive developments such as new product launches, favorable industry trends, or improved financial performance.

2025-10-22

Take-Two Interactive (TTWO) Falls More Steeply Than Broader Market: What Investors Need to Know

Description: Take-Two Interactive (TTWO) closed the most recent trading day at $255.56, moving 1.81% from the previous trading session.

Electronic Arts, NFL Partnership Expands to Extend Reach of Offerings

Description: EA said its partnership with the NFL is expanding in an effort to boost the videogame maker’s Madden NFL franchise and college-football offerings.

Take-Two Interactive Software's Quarterly Earnings Preview: What You Need to Know

Description: Take-Two Interactive Software is expected to unveil its fiscal second-quarter earnings next month, and analysts project a strong double-digit profit growth.

2025-10-21

2025-10-20

2025-10-19

Estimating The Fair Value Of Take-Two Interactive Software, Inc. (NASDAQ:TTWO)

Description: Key Insights The projected fair value for Take-Two Interactive Software is US$265 based on 2 Stage Free Cash Flow to...

2025-10-18

2025-10-17

2 Reasons to Like TTWO (and 1 Not So Much)

Description: Take-Two trades at $257.07 per share and has stayed right on track with the overall market, gaining 20.8% over the last six months. At the same time, the S&P 500 has returned 25.5%.