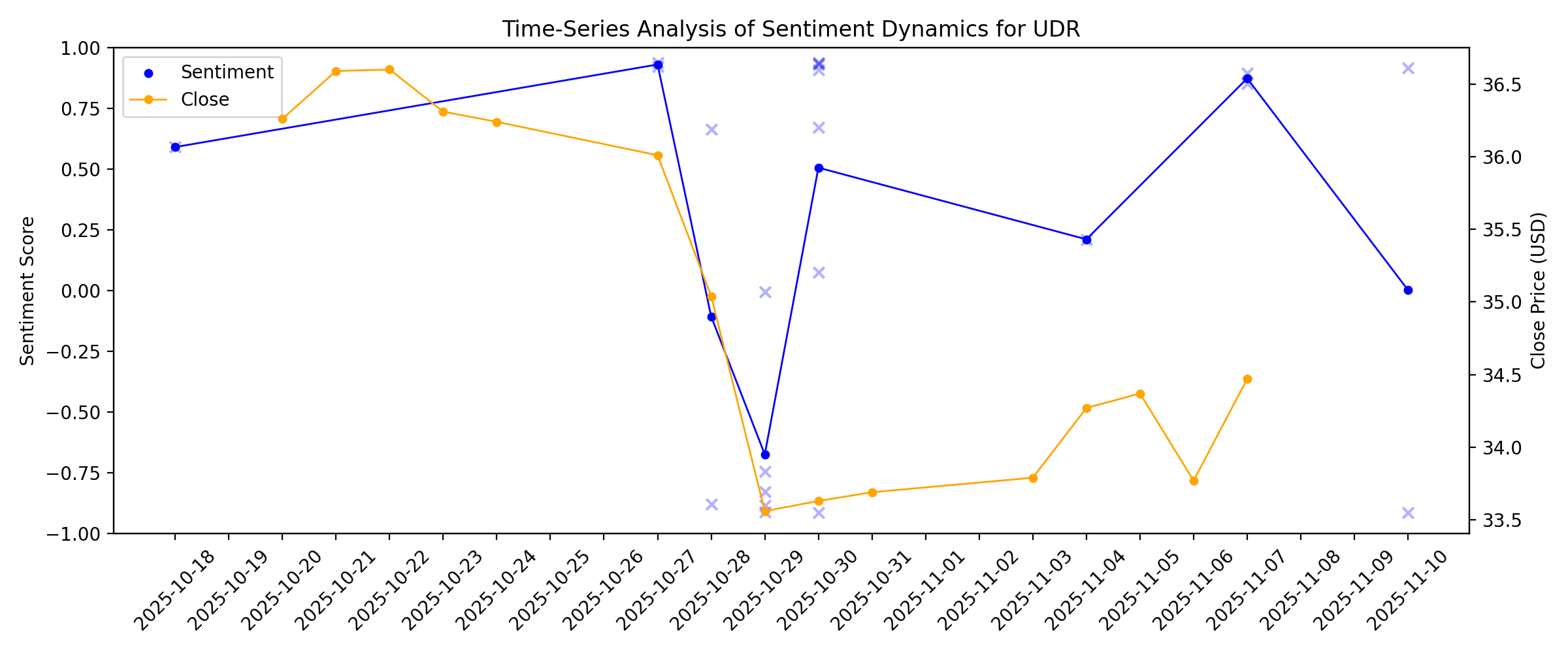

News sentiment analysis for UDR

Sentiment chart

2026-01-14

2026-01-13

2026-01-12

LaSalle completes $250M investment with Cortland

Description: The move came less than a month after the real estate investment manager increased its joint venture with UDR by $230 million.

2026-01-11

2026-01-10

2026-01-09

2026-01-08

UDR’s Quarterly Earnings Preview: What You Need to Know

Description: UDR is poised to release its fiscal fourth-quarter results shortly, with analysts anticipating modest, low single-digit growth in funds from operations.

2026-01-07

2026-01-06

2026-01-05

UDR, Inc. Appoints Ellen M. Goitia to Board of Directors

Description: DENVER, January 05, 2026--UDR, Inc. (the "Company") (NYSE: UDR), a leading multifamily real estate investment trust, announced today the appointment of Ellen M. Goitia to its Board of Directors, effective January 1, 2026. Ms. Goitia will serve as an independent director and has been appointed to the Nominating and Governance Committee and the Audit and Risk Management Committee. Her appointment was executed under the Board of Directors’ long-term succession plan with respect to director refreshm

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

3 Residential REITs to Consider for Steady Income in 2026

Description: U.S. rents and occupancy slip in November 2025. However, easing supply and solid demand could support residential REITs like ESS, UDR & CPT by 2026.

2025-12-22

2025-12-21

2025-12-20

2025-12-19

Did UDR’s (UDR) Expanded LaSalle JV and Steady Dividend Just Recast Its Capital Allocation Story?

Description: Earlier this week, LaSalle Investment Management said it closed a US$230 million expansion of its multifamily joint venture with UDR, lifting the vehicle to about US$850 million and adding four apartment communities totaling 974 homes in Portland, Orlando, and Richmond, with UDR retaining a 51% stake in the new assets. UDR’s Board also declared its 213th consecutive quarterly common dividend of US$0.43 per share for the fourth quarter of 2025, underscoring the REIT’s emphasis on recurring...

UDR Expands Joint Venture With LaSalle, Boosts Financial Flexibility

Description: UDR expands its LaSalle JV by $230M to $850M, adding 974 units and unlocking about $200M in cash to boost flexibility and long-term growth.

UDR (UDR) Valuation Check After $230 Million LaSalle Joint Venture Expansion and Portfolio Diversification

Description: The latest move from UDR (UDR) is a sizable one, with a $230 million expansion of its joint venture with LaSalle that adds 974 apartments across Portland, Orlando, and Richmond, and lifts the venture to roughly $850 million. See our latest analysis for UDR. Even with the LaSalle expansion and another steady quarterly dividend declaration, UDR's share price return is still negative over the year, while its multi year total shareholder return stays modestly positive. This suggests momentum has...

2025-12-18

How Shifting Wall Street Expectations Are Reshaping The Story Behind UDR’s Valuation

Description: UDR's latest valuation update nudges its fair value estimate slightly lower to about $40.43 per share from roughly $40.70, as analysts recalibrate expectations in light of softening apartment fundamentals and persistent capital allocation challenges for REITs. The model also reflects a modestly lower discount rate of around 7.35% versus 7.37% and a slight easing in anticipated revenue growth to roughly 2.45% from 2.46%. This captures a cautious but still constructive outlook as the sector...

UDR, Inc. Declares Quarterly Dividends

Description: DENVER, December 18, 2025--UDR, Inc. (NYSE: UDR), a leading multifamily real estate investment trust, today announced that its Board of Directors declared a regular quarterly dividend on its common stock for the fourth quarter of 2025 in the amount of $0.43 per share, payable in cash on February 2, 2026 to UDR common stock shareholders of record as of January 12, 2026. The February 2, 2026 dividend will be the 213th consecutive quarterly dividend paid by the Company on its common stock.

UDR, Inc. Announces $230 Million Joint Venture Expansion

Description: DENVER, December 18, 2025--UDR, Inc. (the "Company") (NYSE: UDR), a leading multifamily real estate investment trust, announced today that it has closed a $230 million expansion of its joint venture with LaSalle Investment Management (the "Partner"), increasing the size of the joint venture to approximately $850 million. Under the terms of the transaction, UDR will:

LaSalle Announces $230 Million Expansion of Joint Venture with UDR, Inc.

Description: LaSalle Investment Management ("LaSalle") announced today that it has closed on a $230 million expansion of its joint venture with UDR, Inc. (NYSE: UDR), a leading multifamily real estate investment trust. This transaction increases the total size of the joint venture to approximately $850 million.

2025-12-17

2025-12-16

2025-12-15

How Is UDR's Stock Performance Compared to Other Residential and Multisector Real Estate Stocks?

Description: While UDR has lagged behind its industry peers recently, analysts remain moderately optimistic about the stock’s prospects.

2025-12-14

2025-12-13

2025-12-12

2025-12-11

2025-12-10

2025-12-09

2025-12-08

2025-12-07

2025-12-06

2025-12-05

2025-12-04

2025-12-03

2025-12-02

2025-12-01

2025-11-30

2025-11-29

2025-11-28

2025-11-27

2025-11-26

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

2025-11-20

2025-11-19

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

2025-11-11

2025-11-10

Federal Realty Appoints Joseph D. Fisher to Board of Trustees

Description: Federal Realty Investment Trust (NYSE:FRT) today announced the appointment of Joseph D. Fisher to its Board of Trustees, effective January 1, 2026. Mr. Fisher will serve on the Board's Audit and Compensation and Human Capital Management Committees.

How Investors Are Reacting To UDR (UDR) Earnings Guidance Upgrade and Share Buyback Announcement

Description: UDR, Inc. recently reported its third-quarter 2025 results, highlighting year-over-year growth in revenue and net income, and announced it completed a share buyback of 951,000 shares for US$34.98 million between July and October 2025. The company also raised its full-year 2025 earnings guidance, signaling management's confidence following stronger-than-expected quarterly performance and operational progress. We'll explore how the upgraded full-year earnings outlook impacts UDR's investment...

2025-11-09

2025-11-08

2025-11-07

Camden's Q3 FFO Beat, Revenues Up Y/Y, '25 View Raised

Description: CPT's Q3 FFO beat is a result of higher lease rates and same-property revenues, though rising interest costs trim growth.

UDR, Inc. Stock Outlook: Is Wall Street Bullish or Bearish?

Description: UDR, Inc. has considerably underperformed the broader market over the past year, but analysts are cautiously optimistic about the stock’s prospects.

2025-11-06

2025-11-05

2025-11-04

UDR reports slowed leasing conditions in Q3

Description: The Colorado-based REIT cited new supply and economic challenges for a difficult leasing environment, particularly in the Sun Belt.

2025-11-03

2025-11-02

2025-11-01

2025-10-31

2025-10-30

UDR Inc (UDR) Q3 2025 Earnings Call Highlights: Strong Occupancy and Raised Guidance Amid ...

Description: UDR Inc (UDR) reports robust occupancy and raises full-year guidance, despite facing economic headwinds and decelerating lease growth.

UDR (UDR): $25.3M One-Off Gain Raises Earnings Quality Questions as Margins Slip

Description: UDR (UDR) posted a net profit margin of 7.4%, coming in just below last year’s 7.9% and reflecting the impact of a $25.3 million one-off gain in the latest 12 months. Looking ahead, the company’s earnings are forecast to grow by 8.27% annually, while revenue is projected to rise by 3.5% per year. This lags behind the broader US market rate of 10.3%. Investors will be weighing these figures alongside UDR’s attractive dividend and discounted valuation. However, they must consider flagged risks,...

UDR (UDR) Q3 2025 Earnings Call Transcript

Description: Presenting on the call with me today are Chief Operating Officer, Mike Lacey, and Chief Financial Officer, Dave Bragg. Senior officers Andrew Kanter and Chris Van Anz will also be available during the Q&A portion of the call.

Essex Property Q3 Core FFO Beats Estimates, '25 View Raised

Description: ESS posts Q3 core FFO above estimates and lifts its 2025 outlook, driven by steady revenues and NOI gains despite cost pressures.

UDR's Q3 FFOA Beats Estimates, Revenues & Same-Store NOI Grow

Description: UDR posts higher Q3 FFOA and raises full-year guidance, fueled by rent growth and resilient same-store NOI performance.

Invitation Homes' Q3 FFO In Line, Revenues Beat, Rents Improve Y/Y

Description: Invitation Homes posts steady Q3 core FFO of 47 cents per share as higher rents offset lower occupancy, prompting a slight full-year outlook raise.

Mid-America Apartment's Q3 FFO & Revenues Lag Estimates, Rent Declines

Description: MAA's Q3 results highlight a slight FFO miss and softer same-store revenues, but low resident turnover and active development plans support stability.

2025-10-29

UDR (UDR) Q3 Earnings: Taking a Look at Key Metrics Versus Estimates

Description: While the top- and bottom-line numbers for UDR (UDR) give a sense of how the business performed in the quarter ended September 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

UDR (UDR) Surpasses Q3 FFO Estimates

Description: UDR (UDR) delivered FFO and revenue surprises of +3.17% and -0.10%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

UDR: Q3 Earnings Snapshot

Description: The Highlands Ranch, Colorado-based real estate investment trust said it had funds from operations of $232.3 million, or 65 cents per share, in the period. The average estimate of eight analysts surveyed by Zacks Investment Research was for funds from operations of 63 cents per share. Funds from operations is a closely watched measure in the REIT industry.

UDR, Inc. Announces Third Quarter 2025 Results and Updates Full-Year 2025 Guidance Ranges

Description: DENVER, October 29, 2025--UDR, Inc. (the "Company") (NYSE: UDR), announced today its third quarter 2025 results. Net Income, Funds from Operations ("FFO"), and FFO as Adjusted ("FFOA") per diluted share for the quarter ended September 30, 2025, are detailed below.

UDR (UDR): Exploring Valuation After Recent Share Price Declines

Description: UDR (UDR) shares slipped following the latest data release, which showed the company’s stock declining roughly 3% over the past week and 6% over the past month. Investors are keeping an eye on how these moves could influence its valuation. See our latest analysis for UDR. UDR’s 2024 hasn’t been smooth sailing. Shares have lost momentum, with a share price return of -17.6% year-to-date and a 1-year total shareholder return of -16.1%. The pullback reflects shifting investor sentiment, even as...

2025-10-28

Equity Residential (EQR) Meets Q3 FFO Estimates

Description: Equity Residential (EQR) delivered FFO and revenue surprises of 0.00% and +0.13%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

France Welcomes Reserve Bill to Purchase 2% of Bitcoin Supply

Description: France has introduced a bill to accumulate 2% of Bitcoin’s BTC $112 215 24h volatility: 1.7% Market cap: $2.24 T Vol. 24h: $68.09 B fixed supply in a bid to become the first country to establish a BTC Strategic Reserve in Europe. This marks a strategic move in the region ...

2025-10-27

Essex Property to Report Q3 Earnings: Here's What to Expect

Description: ESS' Q3 results are likely to show higher revenues and core FFO, aided by its West Coast strength despite market headwinds.

UDR Set to Report Q3 Earnings: What's in Store for the Stock?

Description: UDR's diversified portfolio and tech upgrades are set to lift Q3 performance, though rising rental supply may have tempered gains.

2025-10-26

2025-10-25

2025-10-24

2025-10-23

2025-10-22

2025-10-21

2025-10-20

2025-10-19

2025-10-18

3 High-Yield Dividend Stocks to Buy With $1,000 and Hold Forever

Description: If you are looking for reliable income in today's lofty market, this trio should provide you with the sustainable yields you seek.