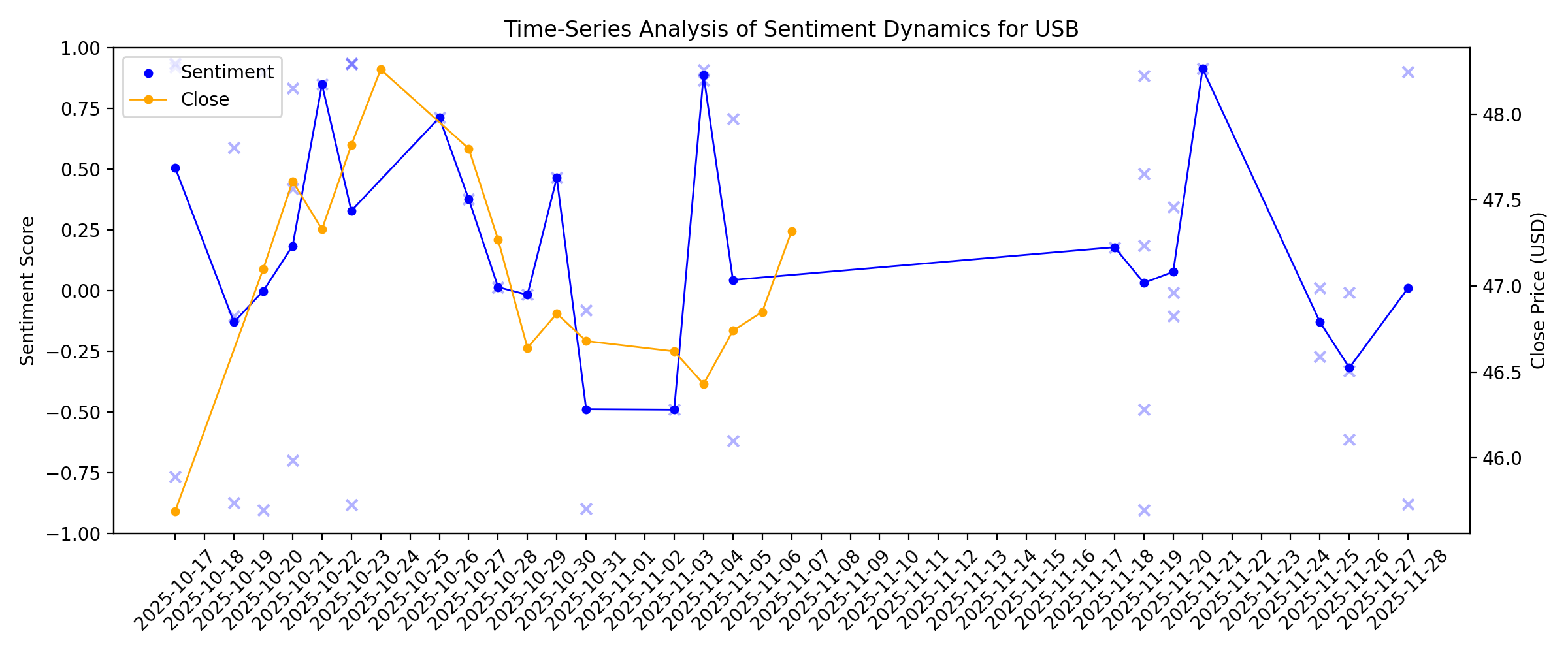

News sentiment analysis for USB

Sentiment chart

2026-01-14

Thursday Earnings Preview: Look to These Banking Giants for Key Consumer Insights

Description: Wednesday's earnings reports from some major banks are just the appetizer. On Thursday, the main course will be served up by Morgan Stanley, Goldman Sachs, PNC, and U.S. Bancorp.

Countdown to U.S. Bancorp (USB) Q4 Earnings: A Look at Estimates Beyond Revenue and EPS

Description: Beyond analysts' top-and-bottom-line estimates for U.S. Bancorp (USB), evaluate projections for some of its key metrics to gain a better insight into how the business might have performed for the quarter ended December 2025.

2026-01-13

US Bank to Buy BTIG for Up to $1 Billion in Trading Push

Description: Stephen Philipson, U.S. Bancorp Vice Chair and Head of Wealth, Corporate, Commercial, and Institutional Banking, discusses the firm's deal to buy BTIG. He tells Romaine Bostick on "The Close" that the acquisition is a natural step in U.S. Bancorp's evolution.

Is U.S. Bancorp (USB) Pricing Reflect Its Excess Returns And Sector Headwinds?

Description: If you are wondering whether U.S. Bancorp is fairly priced or offering value right now, it helps to compare the share price with what the fundamentals suggest. The stock recently closed at US$54.39, with a 2% decline over the last 7 days, a 1.8% gain over the last 30 days, a 0.9% return year to date, and returns of 17.4% over 1 year, 32.6% over 3 years, and 39.2% over 5 years. Recent news coverage around U.S. Bancorp has focused on its standing in the U.S. banking sector. Commentary has...

Microsoft to pay more for power, US Bancorp's $1B deal for BTIG

Description: Market Catalysts Host Julie Hyman and Yahoo Finance Markets and Data Editor Jared Blikre track several of the day's top trending stock tickers, including Microsoft's (MSFT) goals to offset data center impact on US consumers' electricity bills, regional bank US Bancorp's (USB) reaching a $1 billion deal to acquire BTIG, and Tesla stock (TSLA) searching for direction in Tuesday's session after Wolfe Research analyst Emmanuel Rosner wrote that he remains "tactically constructive" on the EV maker. To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

U.S. Bancorp (USB) Earnings Expected to Grow: Should You Buy?

Description: U.S. Bancorp (USB) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

U.S. Bancorp to Buy BTIG for Up to $1 Billion

Description: U.S. Bancorp has struck a deal to buy BTIG, a financial-services firm specializing in investment banking, institutional sales and trading, research and prime brokerage, for up to $1 billion in cash and stock.

U.S. Bancorp to Acquire BTIG

Description: MINNEAPOLIS, January 13, 2026--U.S. Bancorp (NYSE: USB) announced today that it has entered into a definitive agreement to acquire BTIG, LLC, a financial services firm specializing in investment banking, institutional sales and trading, research and prime brokerage.

2026-01-12

2026-01-11

2026-01-10

How Diverging Analyst, Institutional, and Insider Moves Will Impact U.S. Bancorp (USB) Investors

Description: In recent days, U.S. Bancorp has attracted increased attention as multiple analysts reaffirmed or upgraded their views ahead of the bank’s fourth-quarter 2025 earnings release, while institutional investor Strategic Planning Group LLC significantly increased its shareholdings and insiders were net sellers over the past quarter. This mix of upbeat analyst views, institutional buying, and insider selling creates a complex signal about how different market participants are assessing U.S...

How The Story Around U.S. Bancorp (USB) Is Shifting After Earnings And New Street Targets

Description: Analysts have nudged their consensus price target on U.S. Bancorp stock from about US$57.50 to around US$60.84, reflecting refreshed models after recent earnings updates. Behind that shift sit only modest tweaks, including a slightly lower discount rate of roughly 7.68% and a small lift in the revenue growth assumption to about 8.62%, as research teams weigh stronger earnings inputs against more cautious ratings. Stay tuned to see how you can track these kinds of valuation shifts and keep up...

2026-01-09

2026-01-08

Huntington Bancshares Stock Sees IBD RS Rating Rise To 73

Description: A Relative Strength Rating upgrade for Huntington Bancshares shows improving technical performance. Will it continue?

2026-01-07

Will U.S. Bancorp (USB) Beat Estimates Again in Its Next Earnings Report?

Description: U.S. Bancorp (USB) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

2026-01-06

U.S. Bancorp Announces Fourth Quarter Earnings Conference Call Details

Description: MINNEAPOLIS, January 06, 2026--U.S. Bancorp Announces Fourth Quarter Earnings Conference Call Details

2026-01-05

U.S. Bancorp (USB) Stock Trades Up, Here Is Why

Description: Shares of financial services giant U.S. Bancorp (NYSE:USB) jumped 3.2% in the morning session after an analyst at Barclays raised the price target on the company's stock to $65 from $56.

A Look At U.S. Bancorp (USB) Valuation After Recent Share Price Momentum

Description: Event context for U.S. Bancorp U.S. Bancorp (USB) has drawn investor attention after recent share price moves, with the stock last closing at $53.93 and short term returns showing mixed performance over the past week, month, and past 3 months. See our latest analysis for U.S. Bancorp. While the 1 day share price move was positive, the stronger 90 day share price return of 13.54% alongside a 1 year total shareholder return of 15.55% suggests improving momentum after a quieter start to the...

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

What Falling Interest Rates Mean for KeyCorp's Net Interest Income

Description: Falling rates may pressure margins, but KEY expects net interest income to grow as funding costs ease and loan volumes rise.

The Zacks Analyst Blog Highlights Bank of America, Wells Fargo and U.S. Bancorp

Description: Bank of America stands out as rising consumer credit stress lifts focus on large U.S. banks with strong capital, liquidity and diversified revenue streams.

2025-12-30

What Falling Interest Rates Mean for Truist's Net Interest Income

Description: Falling rates and easing lending standards are set to support TFC's net interest income, with lower deposit costs driving gains.

US Consumer Credit Stress Rises: 3 Bank Stocks to Watch for Stability

Description: Rising US consumer credit stress is pressuring banks, but BAC, WFC and USB stand out with strong liquidity, improving asset quality and strategic moves.

2025-12-29

What Falling Rates Mean for M&T Bank's Net Interest Income?

Description: Can MTB leverage easing interest rates, lower funding costs, and balance sheet growth to lift NII and margins heading into 2026?

U.S. Bancorp Up Nearly 22% in 6 Months: Buy, Hold, or Sell the Stock?

Description: USB is up nearly 22% in six months, do strong revenue growth, liquidity, and digital investments make it a buy, hold, or sell now? Let us discuss.

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

3 Bank Stocks to Keep on Your Radar as They Reach New 52-Week Highs

Description: C, BAC and USB hit new 52-week highs as economic growth, rate cuts and bank strategies fuel investor optimism.

2025-12-23

2025-12-22

2025-12-21

2025-12-20

Is U.S. Bancorp Still Attractive After a 18% Yearly Rally in 2025?

Description: Wondering if U.S. Bancorp is still a smart buy at today’s price, or if most of the easy gains are already behind it? This breakdown will help you separate genuine value from wishful thinking. The stock has quietly climbed to around $54.16, with gains of 1.4% over the last week, 15.7% over the last month, and 18.1% over the past year, hinting that the market is steadily warming back up to the name. Recent headlines have focused on U.S. Bancorp tightening its balance sheet, sharpening its...

2025-12-19

Here's What to Expect From U.S. Bancorp's Next Earnings Report

Description: U.S. Bancorp is set to deliver its fourth-quarter results soon, and analysts project double-digit earnings growth.

2025-12-18

Are You Looking for a Top Momentum Pick? Why U.S. Bancorp (USB) is a Great Choice

Description: Does U.S. Bancorp (USB) have what it takes to be a top stock pick for momentum investors? Let's find out.

Ciena and Jack in the Box have been highlighted as Zacks Bull and Bear of the Day

Description: Ciena and Jack in the Box have been highlighted as Zacks Bull and Bear of the Day

US Financial 15 Split Corp. Preferred Dividend Declared

Description: TORONTO, Dec. 18, 2025 (GLOBE NEWSWIRE) -- US Financial 15 Split Corp ("US Financial 15") declares its monthly distribution of $0.07075 for each Preferred share, or 10.00% annually based on the previous month end net asset value. Distributions are payable January 9, 2026 to shareholders on record as at December 31, 2025. US Financial 15 invests in a portfolio consisting of 15 U.S. financial services companies as follows: American Express, Bank of America, Bank of New York Mellon Corp., Citigroup

U.S. Bancorp (USB): Assessing Valuation After Analyst Upgrades and New Digital Partnership Expansions

Description: U.S. Bancorp (USB) is back on investors radar as Wall Street warms to its steadier outlook and the bank leans into digital partnerships that could quietly reshape how it earns and keeps customers. See our latest analysis for U.S. Bancorp. Alongside these embedded finance and Coinstar moves, the stock has quietly rerated higher, with a roughly 17% 1 month share price return and an 18% 1 year total shareholder return suggesting momentum is rebuilding around U.S. Bancorp’s digital and dividend...

Did U.S. Bank’s Avvance and Coinstar Expansion Just Shift U.S. Bancorp’s (USB) Investment Narrative?

Description: In recent days, U.S. Bank has expanded its Avvance point-of-sale lending platform with three new integrated partners and broadened its Coinstar partnership, allowing clients to embed financing at checkout and deposit coins directly into checking accounts via more than 10,000 kiosks and over 100 branches across the U.S. This combination of embedded lending APIs for home improvement and elective medical services, alongside self-service coin deposits, highlights U.S. Bancorp’s push to deepen...

2025-12-17

2026 Can Be a Great Year for Banks: 3 Solid Stock Picks

Description: Rate cuts, easing credit stress and renewed deal activity could make 2026 a strong year for banks, with EWBC, USB and KEY standing out.

U.S. Bank Avvance Expands Embedded Financing Network with Three New Integrated Partners

Description: MINNEAPOLIS, December 17, 2025--U.S. Bank today announced the addition of three new integrated partners to its Avvance point-of-sale lending platform, further accelerating the growth of its API-driven embedded financing solutions. KabelSync, Strictly, and United Credit, have launched Avvance as an embedded payment option within their platforms, enabling merchants to offer flexible financing at the point of need.

2025-12-16

U.S. Bank and Coinstar Announce Expanded Partnership to Offer More Convenient Coin Deposit Options

Description: MINNEAPOLIS, December 16, 2025--U.S. Bank and Coinstar today announced an expansion of their partnership, giving U.S. Bank clients more ways to deposit coins directly into their checking accounts. Following a successful pilot at four branches, Coinstar’s Transfer to Account service is now available at more than 100 U.S. Bank branches and over 10,000 Coinstar kiosks in retail locations nationwide. The expanded service complements the bank’s 2,000 branches and robust digital capabilities to make e

2025-12-15

USB vs. NTRS: Which Stock Is the Better Value Option?

Description: USB vs. NTRS: Which Stock Is the Better Value Option?

2025-12-14

2025-12-13

2025-12-12

2025-12-11

Zacks Industry Outlook Highlights The Bank of New York Mellon and U.S. Bancorp

Description: BK and peers stand to gain as falling rates ease funding costs, lift loan demand and support expansion across major regional banks.

2025-12-10

U.S. Bank Decreases Prime Lending Rate to 6.75 Percent

Description: MINNEAPOLIS, December 10, 2025--U.S. Bank Decreases Prime Lending Rate to 6.75 Percent

KeyCorp Stock Gains 3% on Record 2025 Revenue Growth Projection

Description: KEY's shares climb 3% as it projects record 2025 revenues on a stronger fee income momentum, with disciplined expenses set to drive more durable growth.

2 Major Regional Banks to Buy as Industry Prospects Remain Favorable

Description: BNY Mellon and U.S. Bancorp are well-positioned for growth as the Zacks Major Regional Banks industry benefits from restructuring & acquisitions, digitization, modest loan demand and Fed policy shifts.

2025-12-09

U.S. Bancorp Announces Quarterly Dividends

Description: MINNEAPOLIS, December 09, 2025--U.S. Bancorp announces quarterly dividends

2025-12-08

2025-12-07

2025-12-06

2025-12-05

2025-12-04

Is It Too Late To Consider U.S. Bancorp After Its Strong 2025 Share Price Climb?

Description: If you are wondering whether U.S. Bancorp is still a solid value play at today’s price, or if most of the upside has already been taken, you are in the right place. The stock has quietly climbed to around $50.93, with returns of 4.0% over the last week, 9.2% over the last month, and 6.4% year to date, adding to a 37.6% gain over five years. Recent moves have come as investors reassess regional banks in light of shifting interest rate expectations and ongoing regulatory scrutiny. U.S. Bancorp...

2025-12-03

How Investors Are Reacting To U.S. Bancorp (USB) Profit Surge And Growing Fee Income Base

Description: In the past quarter, U.S. Bancorp reported an 18% jump in Q3 2025 net income to US$1.89 billion, driven by strong fee income growth across capital markets and trust and investment management services. An additional signal of confidence came as Mackenzie Financial Corp increased its U.S. Bancorp holdings by 13.3% in the second quarter, highlighting growing institutional interest in the bank’s fee-rich, diversified business model. We’ll now explore how this profit surge and expanding fee...

Assessing U.S. Bancorp (USB) Valuation After Its Recent Share Price Rebound

Description: U.S. Bancorp (USB) has been quietly grinding higher, with the stock up about 9% over the past month and roughly 4% in the past week, catching more investors’ attention. See our latest analysis for U.S. Bancorp. With the share price now at $50.93 and a solid 30 day share price return backing up a respectable multi year total shareholder return, it looks like momentum is rebuilding as investors reassess both earnings resilience and valuation for this regional banking leader. If U.S. Bancorp’s...

U.S. Bancorp to Speak at the Goldman Sachs U.S. Financial Services Conference

Description: MINNEAPOLIS, December 03, 2025--U.S. Bancorp to speak at the Goldman Sachs U.S. Financial Services Conference

2025-12-02

5 Banks That Outperform the S&P 500 in Volatile November

Description: Bank stocks like CFG, HBAN, USB, RF & FITB beat the S&P 500 index in volatile November as easing inflation and rate-cut hopes lift sentiment.

2025-12-01

The Zacks Analyst Blog Highlights U.S Bancorp, KeyCorp and Columbia Banking System

Description: USB, KEY and COLB stand out as high-yield bank plays as easing-rate expectations and solid fundamentals create potential entry points.

How Is U.S. Bancorp's Stock Performance Compared to Other Regional Banks Stocks?

Description: Despite U.S. Bancorp's outperformance relative to its industry peers over the past year, Wall Street analysts maintain a cautiously optimistic outlook on the stock’s prospects.

2025-11-30

2025-11-29

2025-11-28

USB or BK: Which Is the Better Value Stock Right Now?

Description: USB vs. BK: Which Stock Is the Better Value Option?

3 Bank Stocks With Solid Dividend Yield to Keep an Eye On

Description: Bank stocks like USB, KEY and COLB offer robust dividend yields as investors hunt for stability and income in a shifting market landscape.

2025-11-27

2025-11-26

XLM Edges Higher 2.6% to $0.25 as U.S. Bank Tests Stablecoin Pilot

Description: Major banking institution selects XLM network for programmable digital currency pilot program

Goldman Sachs Spotlights Dividend Stocks Using AI – 5 Strong Buys Now

Description: Needless to say, over the last three years, the Artificial Intelligence explosion has been at the top of almost every investor’s mind. Many have become wealthy, as stocks like NVIDIA and other top tech names soared in a rally some feel is reminiscent of the late 1990s dot-com boom and bust. Between billions being spent ... Goldman Sachs Spotlights Dividend Stocks Using AI – 5 Strong Buys Now

How Recent Developments Are Rewriting the Story for US Bank

Description: U.S. Bancorp’s fair value estimate per share has been revised slightly downward, moving from $55.72 to $55.63, as recent equity research evaluates both improved operational results and emerging industry headwinds. Analysts point to heightened optimism based on higher revenue growth and solid fundamentals. However, they also remain mindful of potential valuation concerns and evolving market risks. For more on what is driving these adjustments and guidance on following future updates to the...

2025-11-25

3 Bank Stocks Walking a Fine Line

Description: Banks use their capital and expertise to help businesses grow while offering consumers essential financial products like mortgages and credit cards. Still, investors are uneasy as banks face challenges from credit quality concerns and potential regulatory changes. These doubts have certainly contributed to banking stocks’ recent underperformance - over the past six months, the industry’s 9.5% gain has fallen behind the S&P 500’s 13.1% rise.

U.S. Bancorp Quietly Joins the Stablecoin War--Why It Could Change Everything

Description: The Minneapolis bank is testing its own token on Stellar, joining Wall Street's deeper march into blockchain rails.

2025-11-24

2025-11-23

2025-11-22

2025-11-21

Truist Financial, U.S. Bancorp, and First Hawaiian Bank Shares Skyrocket, What You Need To Know

Description: A number of stocks jumped in the afternoon session after comments from a key Federal Reserve official boosted hopes for an interest rate cut. New York Federal Reserve President John Williams stated he sees “room for a further adjustment” in the near term, sparking a significant market rally. Following his remarks, the probability of the central bank cutting rates at its December meeting jumped from 39% to over 73%, according to the CME FedWatch tool. This positive sentiment provided relief to ma

2025-11-20

Wells Fargo, Robinhood Top New Rankings for Digital Wealth Management

Description: New J.D. Power rankings of customer satisfaction with financial websites and apps credits top performers with sleek and intuitive designs that didn’t pile on too many features.

Why US Bank, UBS, JPMorgan All Shut Down Their Robo Advisors

Description: Thin margins are one reason, but the shutdowns don’t necessarily spell the end of automated advice.

Is There an Opportunity in US Bancorp After Recent Share Price Dip?

Description: Curious if U.S. Bancorp stock might be undervalued, overpriced, or represent a smart long-term play? You are not alone. Digging into the real worth of this well-known bank is more important than ever. While U.S. Bancorp's share price recently dipped 2.3% in the last week and is down 0.6% over the past month, its three-year return stands at a substantial 22.6%. This highlights both short-term volatility and long-term growth possibilities. Recently, the stock has been in the spotlight as...

2025-11-19

U.S. Bancorp (USB): Exploring Valuation After Launching Innovative Split Card for Equal Payment Purchases

Description: U.S. Bancorp (USB) has introduced the U.S. Bank Split Card, a new credit card that automatically divides every purchase into equal monthly payments, without interest or an annual fee. This move is generating plenty of discussion among investors and consumers alike. See our latest analysis for U.S. Bancorp. Investor excitement around the Split Card comes as U.S. Bancorp wraps up a year of subtle shifts. Its recent total shareholder return landed at -4.8% for the past twelve months, though the...

New U.S. Bank Split™ Card Launch Might Change the Case for Investing in U.S. Bancorp (USB)

Description: On November 5, 2025, U.S. Bank announced the launch of the U.S. Bank Split™ World Mastercard®, a new credit card with automatic, no-fee, no-interest installment payments for all purchases and flexible extension plans for larger transactions. This product offers a differentiated approach to pay-over-time solutions by combining consumer credit-building, transparency, and broad Mastercard acceptance with full digital integration through U.S. Bank’s platforms. Next, we’ll consider how U.S...

Will U.S. Bancorp's AI-Focused Strategy Boost Profitability?

Description: Can USB's AI-powered cash forecasting, embedded payments upgrades, and digital partnerships meaningfully boost profitability? Let's check out.

U.S. Bank, AAA - The Auto Club Group Drive Credit Card Partnership Into New Chapter

Description: MINNEAPOLIS, November 19, 2025--U.S. Bank and The Auto Club Group (ACG) announce the extension of their co-branded credit card partnership, which provides AAA members in select states with an opportunity to deepen their relationship with AAA while rewarding themselves for everyday credit card purchases.

US Financial 15 Split Corp. Preferred Dividend Declared

Description: TORONTO, Nov. 19, 2025 (GLOBE NEWSWIRE) -- US Financial 15 Split Corp ("US Financial 15") declares its monthly distribution of $0.06983 for each Preferred share, or 10.00% annually based on the previous month end net asset value. Distributions are payable December 10, 2025 to shareholders on record as at November 28, 2025. US Financial 15 invests in a portfolio consisting of 15 U.S. financial services companies as follows: American Express, Bank of America, Bank of New York Mellon Corp., Citigro

2025-11-18

U.S. Bank launches AI-driven cash forecasting tool

Description: MINNEAPOLIS, November 18, 2025--U.S. Bank today introduced a cash forecasting tool with Kyriba to help businesses gain real-time visibility and control over their cash and liquidity positions. U.S. Bank Liquidity Manager, powered by Kyriba’s liquidity performance platform, leverages traditional methods and advanced AI to deliver cash forecasting, scenario planning, and operational efficiency for both mid-sized and large firms.

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

2025-11-11

2025-11-10

2025-11-09

2025-11-08

2025-11-07

2025-11-06

2025-11-05

U.S. Bank Launches Split™ World Mastercard®

Description: MINNEAPOLIS, November 05, 2025--Today, U.S. Bank [NYSE: USB] announced a new kind of credit card that enables automatic no-fee, no interest equal monthly payments on all purchases: the U.S. Bank Split™ World Mastercard®.

Is U.S. Bancorp (USB) Undervalued? A Fresh Look at Valuation After Annual Growth Update

Description: U.S. Bancorp (USB) has recently reported an annual revenue increase of 7% and net income growth of 6%. Investors are watching the stock after these updates, as shares have shown mixed movement over the past month. See our latest analysis for U.S. Bancorp. USB’s share price has slipped over the past month, but it is still up 4.5% over the last quarter and boasts a 1-year total shareholder return of almost 2%. That longer-term track record, including a robust 3-year total return above 21%,...

2025-11-04

TD Cowen Raises PT on U.S. Bancorp (USB) Stock

Description: U.S. Bancorp (NYSE:USB) is one of the Best Monopoly Stocks to Buy Now. On October 20, TD Cowen lifted the price target on the company’s stock to $60 from $59, while keeping a “Buy” rating on the company’s stock, as reported by The Fly. Notably, the firm updated the model after Q3 2025 results, where the company posted […]

U.S. Bancorp Stock: Analyst Estimates & Ratings

Description: While U.S. Bancorp has lagged the broader market recently, analysts still see room for improvement and maintain a reasonably bullish outlook on the stock.

2025-11-03

U.S. Bank Launches Edward Jones Co-Branded Products, Expanding Reach to Millions of New Customers

Description: MINNEAPOLIS, November 03, 2025--U.S. Bank today announced that its co-branded checking and credit card products, Edward Jones® Everyday Solutions Powered by U.S. Bank®, are now available to Edward Jones clients through its network of more than 20,000 financial advisors.

2025-11-02

2025-11-01

2025-10-31

U.S. Bancorp to Speak at the BancAnalysts Association of Boston Conference

Description: MINNEAPOLIS, October 31, 2025--U.S. Bancorp to speak at the BancAnalysts Association of Boston Conference

With 82% ownership of the shares, U.S. Bancorp (NYSE:USB) is heavily dominated by institutional owners

Description: Key Insights Given the large stake in the stock by institutions, U.S. Bancorp's stock price might be vulnerable to...

2025-10-30

U.S. Bank: Freight market contracts in Q3 as capacity tightens

Description: MINNEAPOLIS, October 30, 2025--The U.S. truck freight market reversed its brief Q2 improvement in the third quarter of 2025, with national shipment volumes contracting 2.9%, according to the latest U.S. Bank Freight Payment Index. Meanwhile, shipper spending managed to increase for second consecutive quarter.

2025-10-29

U.S. Bank Decreases Prime Lending Rate to 7.00 Percent

Description: MINNEAPOLIS, October 29, 2025--U.S. Bank Decreases Prime Lending Rate to 7.00 Percent

2025-10-28

Berkshire’s Charlie Munger Long Chaired This Legal Publisher. Its Stock Looks Cheap.

Description: Daily Journal stock could pique the interest of value investors after hitting an air pocket recently.

2025-10-27

U.S. Bank rolls out new SinglePoint experience to businesses

Description: MINNEAPOLIS, October 27, 2025--U.S. Bank is rolling out the next generation of SinglePoint, its market leading, highly intuitive and efficient treasury management platform. Designed for businesses of all sizes, the enhanced SinglePoint makes it easy for clients to manage their liquidity, cash flow and financial risk with greater insight and efficiency. SinglePoint is part of U.S. Bank’s award-winning suite of digital connectivity and open-banking solutions.

2025-10-26

Why Analysts See a Shifting Story for U.S. Bancorp Amid Fresh Optimism and Valuation Caution

Description: U.S. Bancorp’s stock has seen a slight increase in its consensus analyst price target, moving from $54.95 to $55.67. This upward revision reflects a blend of optimism about the bank’s stronger operating trends, as well as ongoing caution regarding valuation and long-term growth. Stay tuned to discover how investors and analysts identify key shifts like these, and how you can stay ahead of evolving narratives in the financial markets. What Wall Street Has Been Saying Analyst reports on U.S...

2025-10-25

2025-10-24

2025-10-23

US Bancorp's Credibility Improving With Management Focused on Building Investor Trust, Deutsche Bank Says

Description: US Bancorp's (USB) credibility is improving after two good quarters, with management focused on buil

Here's Why U.S. Bancorp (USB) is a Strong Value Stock

Description: Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

5 Insightful Analyst Questions From U.S. Bancorp’s Q3 Earnings Call

Description: U.S. Bancorp’s third quarter was characterized by broad-based strength in fee-generating businesses and steady improvement in credit quality. Management highlighted that fee income grew across payments, institutional, and consumer segments, while strategic investments in process automation contributed to improved operating leverage. CEO Gunjan Kedia credited the company’s performance to a diversified balance sheet and ongoing risk management, stating, “Our highly diversified balance sheet and fo

2025-10-22

Citigroup's 2025 Revenues to Cross $84B: What's Driving the Momentum?

Description: C is set to exceed $84B in 2025 revenues as CEO Jane Fraser's transformation plan fuels growth, efficiency and strategic expansion.

2025-10-21

TD Cowen Raises U.S. Bancorp (USB) Price Target, Cites Strong Revenue and Fee Growth

Description: U.S. Bancorp (NYSE:USB) is included among the 11 High-Yield Dividend Stocks for Steady Cash Flow. U.S. Bancorp (NYSE:USB) ranks among the leading financial institutions in the United States. Headquartered in Minneapolis, the company operates primarily through its subsidiary, U.S. Bank, which provides a wide range of services, including personal and commercial banking, wealth management, and […]

U.S. Bank Avvance Launches Customized Embedded Financing Offering

Description: MINNEAPOLIS, October 21, 2025--Financial institutions and fintechs are now able to offer their customers simple, flexible embedded financing options that are tailored to their brand and experience thanks to the new U.S. Bank Avvance developer portal experience.

A Look at U.S. Bancorp’s Valuation Following Positive Q3 Results and Renewed Investor Optimism

Description: U.S. Bancorp reported third quarter results that came in ahead of expectations, with increased net income and net interest income helping drive record net revenue. The company’s performance reflects both operational momentum and renewed confidence in regional banks. See our latest analysis for U.S. Bancorp. After a year shaped by both legal challenges and bold digital initiatives, U.S. Bancorp’s stock has shown steady resilience. While the year-to-date share price return is slightly negative,...

2025-10-20

Enterprise Financial Services, Banc of California, U.S. Bancorp, Texas Capital Bank, and Seacoast Banking Shares Skyrocket, What You Need To Know

Description: A number of stocks jumped in the afternoon session after investor fears over a potential credit crisis eased, following reassuring commentary from regional banks. After a volatile previous week sparked by news of stress from some U.S. regional banks, sentiment shifted. These events now appear to be isolated, according to market analysis. The recovery was evident as the KBW Nasdaq Regional Banking Index rose, regaining some of its recent losses. Adding to the positive momentum, several regional b

US Financial 15 Split Corp. Preferred Dividend Declared

Description: TORONTO, Oct. 20, 2025 (GLOBE NEWSWIRE) -- US Financial 15 Split Corp ("US Financial 15") declares its monthly distribution of $0.07083 for each Preferred share, or 10.00% annually based on the previous month end net asset value. Distributions are payable November 10, 2025 to shareholders on record as at October 31, 2025. US Financial 15 invests in a portfolio consisting of 15 U.S. financial services companies as follows: American Express, Bank of America, Bank of New York Mellon Corp., Citigrou

2025-10-19

They Managed 'Dozens Of Credit Cards Responsibly'—Until They Didn't. Now They Owe $177,000 And Can't Find A Way Out. Here's What Happened

Description: A financially overwhelmed Redditor who once had a perfect credit score and juggled multiple credit cards responsibly is now facing more than $177,000 in debt and thinking about bankruptcy. Debt Spiral With No End In Sight In a recent post on r/CRedit, ...

Business People: City & County Credit Union announces top executive transition

Description: FINANCIAL SERVICES City & County Credit Union, St. Paul, announced the planned retirement of President and CEO Patrick Pierce in April 2026. Pierce has been with the organization since 2001. Thomas Coulter, executive vice president of operations, has been chosen to succeed Pierce. … U.S. Bancorp, the Minneapolis-based parent company of U.S. Bank, announced the hire of Christopher Paulison as ...

What Does U.S. Bancorp’s Prime Rate Cut Mean for Its Stock Valuation in 2025?

Description: If you are eyeing U.S. Bancorp and wondering whether now is the moment to buy, hold, or simply watch from the sidelines, you are not alone. The bank’s recent stock price action has left both optimists and skeptics with reasons to pay attention. Over the past week, shares ticked up by 0.9%, a modest rebound after shedding 7.9% in the last month. Year-to-date and one-year returns show slight declines of -4.5% and -2.9%, respectively. If you zoom out to the longer term, the picture brightens,...

2025-10-18

2025-10-17

How regional bank earnings helped put bank stocks back on track

Description: Big Banks kicked off the third quarter earnings cycle earlier this week, followed by other banking names like Bank of New York Mellon (BK), Charles Schwab (SCHW), and US Bancorp (USB). Meanwhile, Friday's batch of bank earnings from regional names like Truist (TFC), Fifth Third (FITB), Huntington (HBAN), Ally Financial (ALLY), and more helped ease Wall Street's credit fears that had sparked on Thursday. Yahoo Finance Senior Reporter David Hollerith joins Market Domination Overtime host Josh Lipton to outline the details. To watch more expert insights and analysis on the latest market action, check out more Market Domination Overtime.

TFC Q3 Earnings Beat as Fee Income Rises, Provisions Fall, Stock Gains

Description: Truist Financial posts a Q3 earnings beat as rising fee income, higher loans and lower provisions lift results despite expense pressures.

Earnings live: American Express beats estimates, EssilorLuxottica stock surges as focus turns to regional bank earnings

Description: Third quarter earnings season is just beginning, and analysts expect S&P 500 companies grew their profits by 8% during the quarter.

USB Q3 Deep Dive: Payments, Fee Growth, and Deposit Strategy Drive Solid Performance

Description: Financial services giant U.S. Bancorp (NYSE:USB) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 6.8% year on year to $7.3 billion. Its non-GAAP profit of $1.22 per share was 9% above analysts’ consensus estimates.