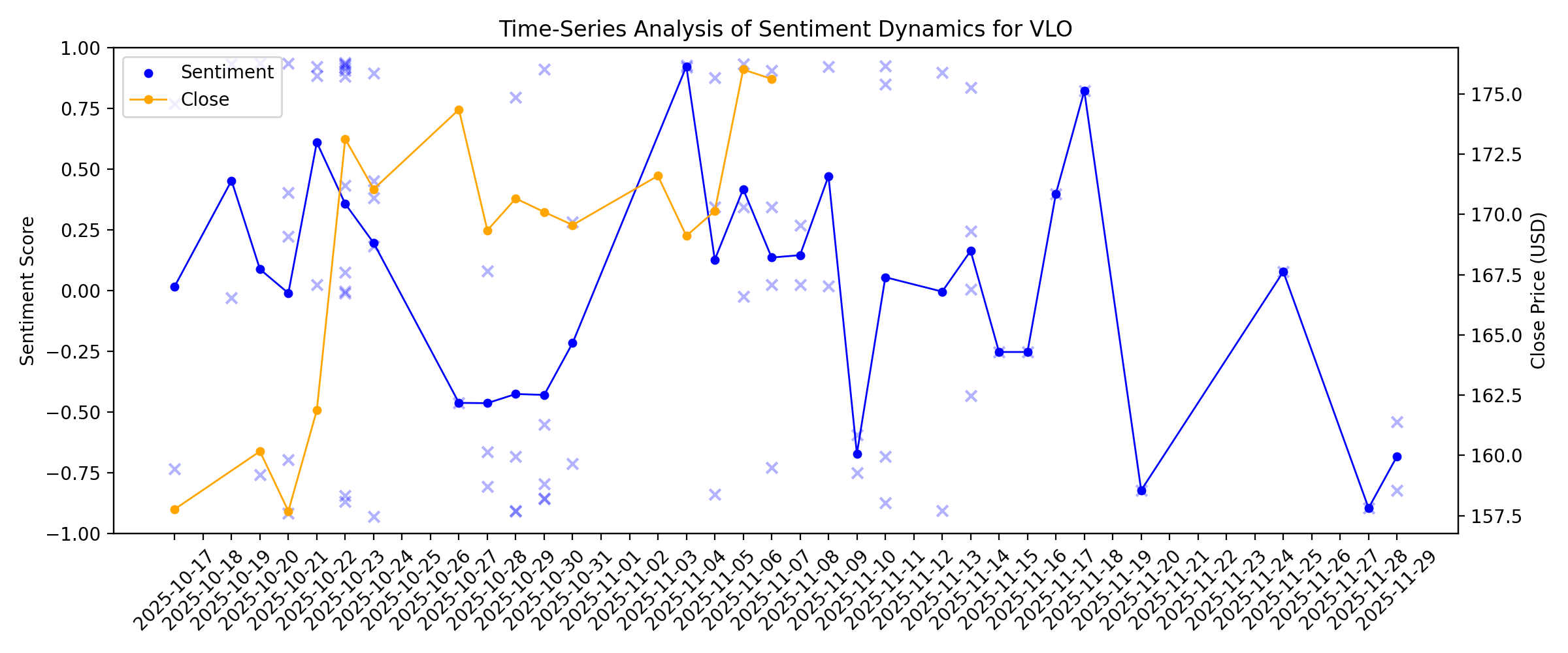

News sentiment analysis for VLO

Sentiment chart

2026-01-14

Exclusive-Chevron expected to receive expanded Venezuela license from US this week, sources say

Description: By Marianna Parraga and Jarrett Renshaw HOUSTON/WASHINGTON, Jan 14 (Reuters) - Chevron is expected to receive an expanded Venezuela license from the U.S. government this week that could allow for

Will the Refining Business Continue to be Favorable for Phillips 66?

Description: PSX could benefit as soft crude prices cut input costs, boosting refining margins even as broader energy markets face uncertainty.

2026-01-13

Venezuelan Oil and the Limits of U.S. Refining Capacity

Description: Venezuelan crude is attractive to complex U.S. refiners with coking capacity, but only a subset of Gulf and East Coast plants can fully process the heavy, high-sulfur oil.

Valero Energy (VLO) – Among the Best High Yield Crude Oil Stocks to Buy After Trump’s Blitz in Venezuela

Description: Valero Energy Corporation (NYSE:VLO) is included among the 10 High Yield Crude Oil Stocks to Buy After Trump’s Blitz in Venezuela. Valero Energy Corporation (NYSE:VLO) is the world’s premier independent petroleum refiner and a leading producer of low-carbon transportation fuels. Valero Energy Corporation (NYSE:VLO) soared to an all-time high on January 8 as investors recognized […]

Is Phillips 66 Poised to Gain From a Favorable Refining Backdrop?

Description: PSX's refining arm benefits from strong margins, with widening light-heavy spreads and cheaper heavy crude anticipated to support higher margins.

Can VLO Continue to Earn From Ongoing Softness in Oil Price?

Description: Valero stands to gain as crude prices stay soft, lifting refining margins, strengthening its balance sheet and supporting dividends and buybacks.

2026-01-12

Valero Energy (VLO) Stock Sinks As Market Gains: Here's Why

Description: The latest trading day saw Valero Energy (VLO) settling at $179.62, representing a -3.05% change from its previous close.

Chevron Bets on Venezuela Oil to Unlock Up to $700M in Cash Flow

Description: CVX is accelerating Venezuelan crude exports to ease storage bottlenecks and unlock up to $700 million in annual cash flow amid shifting geopolitics.

2026-01-11

2026-01-10

2026-01-09

Is It Time To Reassess Valero Energy (VLO) After Its Strong Multi‑Year Share Price Run?

Description: If you are wondering whether Valero Energy is priced attractively right now, it helps to step back and look at what the recent share performance might be telling you about expectations baked into the stock. The share price recently closed at US$185.28, with returns of 12.1% over the last week, 5.3% over the past month, 12.1% year to date and 50.3% over the last year, as well as 49.3% over three years and 281.3% over five years. This gives you a sense of how the market has treated the stock...

Does Valero (VLO) Closing Benicia Refine or Complicate Its Heavy-Crude Advantage Narrative?

Description: In early January 2026, Valero Energy moved to close its Benicia refinery while emphasizing plans to maintain fuel supply to Northern California via higher gasoline imports and support affected workers with relocation or outplacement options. At the same time, abrupt US action in Venezuela has cast a spotlight on Valero’s complex Gulf Coast refineries, which are configured to process heavy Venezuelan crude that many competitors cannot efficiently handle. We’ll now examine how Valero’s access...

Will Valero Energy (VLO) Beat Estimates Again in Its Next Earnings Report?

Description: Valero Energy (VLO) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

How to Boost Your Portfolio with Top Oils-Energy Stocks Set to Beat Earnings

Description: Finding stocks expected to beat quarterly earnings estimates becomes an easier task with our Zacks Earnings ESP.

Dow Jones Futures Rise Before Jobs Data, Trump Tariffs Ruling; Oklo, Revolution Medicines Soar

Description: The December jobs report and a possible Trump tariffs ruling loom. Oklo, Vistra, Revolution Medicines are early winners.

2026-01-08

Dow Jones Futures: Jobs Data, Trump Tariffs Ruling Loom After Small Caps Lead

Description: Small caps hit a new high Thursday as techs faltered. The December jobs report a possible Trump tariffs ruling loom Friday.

Sector Update: Energy Stocks Gain Late Afternoon

Description: Energy stocks were higher late Thursday afternoon, with the NYSE Energy Sector Index rising 2.4% and

Chevron Is Loading Venezuela Oil Onto Tankers at the Fastest Pace in Months

Description: Chevron loaded 1.68 million barrels of Venezuelan oil onto ships during the first week of this month, the most for that period since May, according to vessel movements tracked by Bloomberg. Chevron’s accelerated tanker loadings come as Venezuelan crude-storage facilities near full capacity.

Sector Update: Energy Stocks Climb in Afternoon Trading

Description: Energy stocks were higher Thursday afternoon, with the NYSE Energy Sector Index rising 1.5% and the

Sector Update: Energy

Description: Energy stocks were higher Thursday afternoon, with the NYSE Energy Sector Index rising 1.5% and the

How Chevron's Expanded Venezuela Oil License Boosts Its Global Play

Description: CVX's expanded Venezuela license can revive exports, reshape U.S. oil strategy and give the company a rare edge amid ongoing sanctions uncertainty.

How Valero's Operational Flexibility Drives Profitability

Description: VLO's flexible refinery network enables the company shift product yields and process diverse crude grades, helping it capture higher margins in volatile markets.

Jim Cramer Says Refiners Like Valero as Potential Winners From Venezuelan Oil

Description: Valero Energy Corporation (NYSE:VLO) is one of the stocks Jim Cramer offered insights on. Cramer highlighted the company while discussing the opportunity for US refiners, as he stated: “The US refiners, especially Valero, may be a big beneficiary of that oil because they still have refineries that can handle what’s known as heavy crude. That’s […]

US Unveils Strategy on Venezuelan Oil, Spurring Rush for Access

Description: The US strategy — announced initially in a late-night social media post Tuesday from President Donald Trump and more details coming Wednesday from Energy Secretary Chris Wright — thrusts the federal government into direct involvement in the international oil market and promises to reinvigorate flows of Venezuelan crude to American refineries after years of sanctions. The return of Venezuelan barrels to US buyers could mark one of the most significant shifts in global energy markets in recent years. It has already sent Canadian crude prices plunging and weighed on benchmark oil futures.

Valero Energy (VLO) Jumps Following Trump’s Blitz in Venezuela

Description: The share price of Valero Energy Corporation (NYSE:VLO) surged by 8.13% between December 30, 2025, and January 6, 2026, putting it among the Energy Stocks that Gained the Most This Week. Valero Energy Corporation (NYSE:VLO) is the world’s premier independent petroleum refiner and a leading producer of low-carbon transportation fuels. Valero Energy Corporation (NYSE:VLO) received […]

2026-01-07

These Stocks Could Gain From Venezuela's Upheaval

Description: Shares of several energy sector companies surged after the U.S. capture of Venezuela's president. Here are the stocks positioned to benefit from a possible revival of the country's oil industry.

Venezuela Raid Doesn’t Assure a Win for Elliott Management’s Citgo Bid

Description: Elliott faces court and regulatory challenges before taking over Citgo, plus other refiners will compete with Citgo to refine Venezuelan crude.

Chevron in talks with US to expand Venezuela operating license - Reuters

Description: Investing.com -- Chevron Corp (NYSE:CVX) is negotiating with the U.S. government to expand its license for operations in Venezuela, aiming to increase crude exports to its refineries and other buyers, according to reporting from Reuters citing four sources familiar with the discussions.

Stock Market Today: Dow Slips Back Below 49K; Trump Takes On Defense Firms (Live Coverage)

Description: The Dow Jones index dipped in mixed trade Wednesday after surprise jobs data. Bitcoin stock Strategy jumped.

Ghost Tanker Seized And Trump's 50-Million-Barrel Venezuela Oil Claim. But What Are Oil Stocks Doing?

Description: Venezuela will give the U.S. between 30 and 50 million barrels of oil, according to President Donald Trump.

PSX Expands UK Footprint With Lindsey Refinery Asset Purchase

Description: Phillips 66 agrees to buy the Lindsey Oil Refinery assets in the U.K., planning to integrate key infrastructure into its Humber operations to enhance the U.K.'s energy security.

Top Midday Stories: Warner Bros. Board Urges Shareholders to Reject Revised Paramount Offer; China Asks Tech Companies to Halt Nvidia Chip Orders

Description: The Dow Jones Industrial Average was down, while the S&P 500 and Nasdaq Composite were up in late-mo

Chevron Stock Is Having a Volatile Week. Why It’s Moving Again Today.

Description: Chevron investors have been on high alert since the U.S. military operation in Venezuela over the weekend. The stock is in focus again Wednesday following a report that the oil giant is pairing up with private equity group Quantum Energy Partners to bid for Russian oil major Lukoil’s international assets, which are valued at $22 billion. The volatility came as the market digested the surprise U.S. military capture of Venezuela’s President Nicolás Maduro and President Donald Trump’s hopes for U.S. companies to get involved in fixing the country’s oil infrastructure.

Sector Update: Energy Stocks Advance Premarket Wednesday

Description: Energy stocks were advancing premarket Wednesday, with the State Street Energy Select Sector SPDR ET

Michael Burry Was Right About Valero Energy. Is He Right About an AI Bubble?

Description: Michael Burry has really been making headlines since he closed up shop over at Scion Asset Management with the belief that the broad stock market could be in for a rough couple of years. Undoubtedly, shutting down his hedge fund has also allowed him to be more vocal, with his Cassandra Unchained newsletter. With low ... Michael Burry Was Right About Valero Energy. Is He Right About an AI Bubble?

Exchange-Traded Funds Lower, Equity Futures Mixed Pre-Bell Wednesday Amid Economic Date Releases

Description: The broad market exchange-traded fund SPDR S&P 500 ETF Trust (SPY) was down 0.1% and the actively tr

Venezuela's Heavy Crude Potential: Can CVX, PSX & VLO Benefit?

Description: CVX, PSX and VLO may benefit as Trump signals the possibility of U.S. access to Venezuela's heavy crude, improving prospects for producers and complex refiners.

2026-01-06

Valero Energy (VLO) Stock Falls Amid Market Uptick: What Investors Need to Know

Description: In the closing of the recent trading day, Valero Energy (VLO) stood at $178.27, denoting a -1.27% move from the preceding trading day.

Dow Extends Rally, Closing Above 49000 for First Time

Description: Broad-based gains across healthcare and smaller technology stocks sent the Dow industrials and S&P 500 to new records.

These Stocks Moved the Most Today: Sandisk, Nvidia, AMD, Palantir, OneStream, SoFi, Microchip, and More

Description: Nvidia CEO Jensen Huang says the chip maker’s next big AI graphics processing unit, Vera Rubin, is in ‘full production.’

Strength Seen in Valero Energy (VLO): Can Its 9.2% Jump Turn into More Strength?

Description: Valero Energy (VLO) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term.

Oil Stocks Lose Steam As Trump Signals U.S. Could Subsidize Venezuela Infrastructure Rebuild

Description: Venezuela continues to dominate the headlines but oil stocks appeared to lose steam in Tuesday's stock market.

Should You Buy Valero Stock in January 2026? The Bull Case for Oil Stocks in the New Year.

Description: Valero stock is drawing renewed attention in early 2026 as refining margins stay firm and shifting crude flows quietly strengthen its competitive position.

Oil Eyes Supply Disruptions as Venezuela Rebuild Talk Falls Flat

Description: Oil inches higher as traders are more focused on short term effects of the Venezuela oil blockade than longer term supply additions.

Has Phillips 66 Stock Run Ahead of its Underlying Fundamentals?

Description: PSX looks pricey on EV/EBITDA, but soft oil prices and growing midstream exposure could justify the premium.

Markets Shrug Off Shift in Venezuelan Oil Industry’s Prospects

Description: Venezuela’s 303 billion barrels worth of oil reserves are estimated to be about a fifth of the world’s total.

Stock Index Futures Muted as Rally Stalls, U.S. Economic Data Awaited

Description: March S&P 500 E-Mini futures (ESH26) are down -0.06%, and March Nasdaq 100 E-Mini futures (NQH26) are up +0.07% this morning, taking a breather after the AI-driven rally seen in the first trading days of 2026.

US Stock Market Today: S&P 500 Futures Dip As Manufacturing Softens And Yields Ease

Description: The Morning Bull - US Market Morning Update Tuesday, Jan, 6 2026 US stock futures are slightly lower this morning, with E-mini S&P 500 contracts down about 0.1%, as investors weigh signs of weaker US factories against softer signals from the bond market. The ISM Manufacturing PMI fell to 47.9 in December, a reading below 50 that points to shrinking factory activity and raises questions about demand for industrial goods, machinery and materials. At the same time, US Treasury yields have dipped...

2026-01-05

Chevron Highlights Stocks to Consider if Venezuela's Oil Industry is Revived

Description: The energy sector is catching investors' attention as we begin 2026, with crude oil prices spiking following the capture and extradition of Venezuelan President Nicolas Maduro to the United States

Markets Risk-On with Venezuela News, Deregulation

Description: The Dow reached the close at 48,977 -- a record-high level. The blue-chip index gained +594 points on the day.

Chevron, Halliburton, Other Energy Shares Gain on Venezuela Windfall Hopes

Description: There isn’t an easy path for U.S. companies to fulfill President Trump’s promise of overhauling Venezuela's energy infrastructure and reviving its key industry. But many oil-company shares are riding high nonetheless: Oil majors: Chevron (CVX): The one U.

Energy & Utilities Roundup: Market Talk

Description: Find insight on oil futures, Venezuela’s oil production and more in the latest Market Talks covering Energy and Utilities.

Dow Closes at New Peak as Oil Jumps Following US Military Action Against Venezuela

Description: The Dow Jones Industrial Average notched a fresh record high on Monday, with energy stocks leading t

Heard on the Street Recap: Gunboat Rally

Description: Energy and defense stocks rose after the U.S. ouster of Venezuela's president, Nicolás Maduro. Chevron, the last remaining U.S. oil major in Venezuela, gained, as did ConocoPhillips and Exxon Mobil. The prospect of greater geopolitical tensions lifted global defense stocks.

US Equities Markets End Higher Monday as Oil Stocks Surge on Venezuela Turmoil

Description: US equity indexes closed higher Monday after oil-related stocks and crude prices climbed as Venezuel

These Stocks Moved the Most Today: Chevron, Valero Energy, Comcast, Tesla, CoreWeave, IBM, Coinbase, and More

Description: Chevron, the last oil major still operating in Venezuela, surges following the U.S. capture of President Nicolás Maduro.

These Oil Stocks Take Off As Trump Says U.S. Oil Companies 'Very Much Involved' In Venezuela Transition

Description: Chevron and other U.S. oil stocks soared in Monday's stock market. U.S. oil prices increased less than 1%.

Why Big Oil has a long road ahead in Venezuela, the 'fallen angel of global crude markets'

Description: The US oil industry faces a long road ahead in Venezuela, with multiple headwinds in a potential rebuild of the country's oil industry.

Equities, Oil Prices Rise Intraday After US Captures Venezuelan President

Description: US benchmark equity indexes and oil prices rose after midday Monday as markets assessed the impact o

Stocks Jump After U.S. Captures Venezuela’s Maduro

Description: MARKETS MAIN Energy and defense stocks rose after the U.S. ousted Venezuela’s president, Nicolás Maduro, and President Trump pledged American drillers would revive the country’s crude production. The moves helped boost indexes, as did surges in growth stocks such as Tesla, Amazon and Palantir.

Is Phillips 66's Midstream Push Building More Resilient Business?

Description: PSX benefits as WTI trades below $59, while fee-based midstream revenues and growing focus on midstream and chemicals help shield the cash flows from crude volatility.

Top Midday Stories: Oil Stocks Rise After US Attack on Venezuela; QXO Receives $1.2 Billion Investment From Apollo-Affiliated Funds

Description: All three major US stock indexes rose in late-morning trading Monday as investors weighed the US att

Chevron, Exxon and SLB Stocks Are Surging but Oil Prices Are Hardly Moving. What’s Up.

Description: Oil stocks were soaring early Monday even as crude prices were only up around 1% following the surprise U.S. operation to capture Venezuelan President Nicolás Maduro.

Venezuela oil: Energy giants likely to invest in infrastructure

Description: Oil prices (CL=F, BZ=F) are rising Monday morning following President Trump's ousting of Venezuelan President Nicolás Maduro over the weekend. Energy giants are already looking to invest billions of dollars into reviving Venezuela's oil market and rebuilding its oil infrastructure. Hedgeye Risk Management energy analyst Fernando Valle lists the operators and refiners, like Chevron (CVX) and Exxon Mobil (XOM), who would have so much to gain from this opportunity. China — one of Venezuela's biggest trade allies for oil — has condemned the invasion. To watch more expert insights and analysis on the latest market action, check out more Opening Bid.

Chevron Lead Energy Stocks Rally Amid Venezuela Oil Hopes

Description: Exxon and Conoco Post Modest Gains Amid Venezuela Uncertainty

U.S. Oil Stocks Surge Following Trump’s Blitz in Venezuela

Description: U.S. oil stocks are surging as President Trump opens Venezuela’s oil industry to American investment following the capture of Nicolas Maduro.

Valero Energy (VLO) Valuation Check After Venezuelan Political Shock And Potential Oil Policy Shift

Description: Valero Energy (VLO) is back in focus after U.S. President Donald Trump said Venezuelan President Nicolás Maduro was captured, with investors weighing how a potential policy shift on Venezuelan crude could influence refinery economics. See our latest analysis for Valero Energy. The latest moves around Venezuelan oil come after a mixed spell for the stock, with a 30 day share price return of a 5.07% decline but a 1 year total shareholder return of 39.63% and 5 year total shareholder return of...

Trump's Maduro ousting: Oil prices tick higher, oil stocks rally

Description: Oil prices (CL=F, BZ=F) are up only slightly after US President Trump ousted Venezuelan President Nicolás Maduro. Oil companies, like Chevron (CVX), SLB Limited (SLB), and Halliburton (HAL), are rallying on the news. Yahoo Finance Breaking News Reporter Jake Conley joins Morning Brief to discuss the moves in the oil market and energy companies. To watch more expert insights and analysis on the latest market action, check out more Morning Brief.

2026-01-04

2026-01-03

The Oil Sector’s Biggest Winners and Losers From Venezuela Regime Change

Description: The capture of Venezuelan President Nicolás Maduro has reopened a question the oil market has largely sidelined for years: What changes if Venezuela’s oil industry begins to normalize under U.S. influence? In comments today, President Donald Trump says the sanctions on Venezuelan oil remain in place, but he also said that the U.S. intends to be “very involved” in Venezuela’s oil sector, which he says requires billions of dollars fix the “badly broken” oil infrastructure. While Venezuela currently produces just 1% of global supply, the Wood Mackenzie estimate of $15–20 billion to add 500,000 barrels per day highlights the capital intensity of its extra-heavy crude.

2026-01-02

Valero Energy (VLO) Beats Stock Market Upswing: What Investors Need to Know

Description: In the latest trading session, Valero Energy (VLO) closed at $165.31, marking a +1.55% move from the previous day.

Will the Oil Price Environment Aid PSX's Refining Operations?

Description: With WTI below $60 a barrel, Phillips 66 could benefit as a leading refiner buying cheaper crude, with soft oil prices expected to persist.

Is the Current Oil Price Favorable for VLO's Refining Operations?

Description: WTI crude below $60 could lift Valero Energy's margins, as the refiner buys cheaper oil and turns it into gasoline and distillates as inventories rise.

2026-01-01

2025-12-31

Resilient Demand and Strategic Upgrades Drive XOM's Refining Success

Description: ExxonMobil's refining arm gains as cheaper crude, tight product supply and strategic refinery upgrades enable it to remain competitive.

Why Oil Stocks Are Worth a Bet in 2026

Description: Energy shares rose in 2025 despite lower crude prices, a sign of potential strength in the year ahead.

Earnings Preview: What To Expect From Valero Energy's Report

Description: Valero Energy is scheduled to report its fourth-quarter results next month, and analysts expect a triple-digit earnings surge.

2025-12-30

Is Par Pacific Holdings Positioned for a Strong Finish to 2025?

Description: PARR benefits from strong refining margins, with management pointing to a supportive Q4 outlook amid favorable supply-demand dynamics.

2025-12-29

New Strong Buy Stocks for December 29th

Description: MH, M, VLO, BG and SAIC have been added to the Zacks Rank #1 (Strong Buy) List on December 29th, 2025.

2025-12-28

2025-12-27

2025-12-26

3 Energy Growth Stocks to Buy Now for the Road Into 2026

Description: CVE, FTI and VLO are three energy stocks with buy ranks and strong growth characteristics for investors to consider for 2026.

2025-12-25

2025-12-24

Is Valero Energy (VLO) Stock Undervalued Right Now?

Description: Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

3 Energy Stocks Investors Should Invest in Before 2025 is Over

Description: PSX, VLO and OII stand out heading into 2026, as refining strength, low crude costs and resilient oilfield service demand offset softer oil prices.

2025-12-23

How Investors Are Reacting To Valero Energy (VLO) Conflicting Analyst Downgrades And Bullish Options Signals

Description: In recent weeks, Valero Energy has faced contrasting signals as major banks downgraded the stock on valuation and refining-margin concerns while options data pointed to more positive institutional sentiment. This tug-of-war between cautious analyst views and an increasingly constructive options backdrop is reshaping how investors interpret Valero’s position in a weak energy sector. We’ll now examine how rising institutional bullishness in the options market may influence Valero Energy’s...

Top Research Reports for Mastercard, GE Aerospace & Micron Technology

Description: Mastercard leads today's top research as analysts spotlight solid revenue growth, digital payment tailwinds, and rising costs to watch.

Best Momentum Stocks to Buy for Dec. 23

Description: VLO, SU and IAG made it to the Zacks Rank #1 (Strong Buy) momentum stocks list on Dec. 23, 2025

Are Oils-Energy Stocks Lagging Suncor Energy (SU) This Year?

Description: Here is how Suncor Energy (SU) and Valero Energy (VLO) have performed compared to their sector so far this year.

Wall Street Analysts See Valero Energy (VLO) as a Buy: Should You Invest?

Description: Based on the average brokerage recommendation (ABR), Valero Energy (VLO) should be added to one's portfolio. Wall Street analysts' overly optimistic recommendations cast doubt on the effectiveness of this highly sought-after metric. So, is the stock worth buying?

3 Oil Refining Stocks That Gained More Than 30% in 2025

Description: VLO, PARR and DINO soared over 30% in 2025. Tight supply and strong execution could keep them worth watching into 2026.

Best Income Stocks to Buy for Dec. 23

Description: JXN, VLO and SU made it to the Zacks Rank #1 (Strong Buy) income stocks list on Dec. 23, 2025.

Best Value Stocks to Buy for Dec.23

Description: JXN, SU and VLO made it to the Zacks Rank #1 (Strong Buy) value stocks list on Dec. 23, 2025

2025-12-22

Valero (VLO) Stock Just Triggered a Rare Quant Signal the Options Market Is Missing

Description: VLO stock is showing an unusual probability profile beneath recent weakness. A closer look at derivatives activity reveals why upside may be underestimated.

Darling Ingredients Announces Sale of Approximately $50 million in Production Tax Credits

Description: IRVING, Texas, December 22, 2025--Darling Ingredients Inc. (NYSE: DAR) today announced the sale of approximately $50 million of production tax credits to a corporate buyer. These credits were generated under the Inflation Reduction Act (IRA) by the company’s Diamond Green Diesel joint venture.

2025-12-21

2025-12-20

2025-12-19

Valero Energy (VLO): Taking a Fresh Look at Valuation After a Recent Share Price Pullback

Description: Valero Energy (VLO) has been drifting after a strong run this year, and that pause is exactly why it deserves another look, especially with refining margins and fuel demand quietly reshaping expectations. See our latest analysis for Valero Energy. After rallying hard earlier this year, Valero’s share price has cooled off with a 1 month share price return of minus 9 point 8 percent. However, its year to date share price return of 32 point 1 percent and 1 year total shareholder return of 41...

2025-12-18

Is Trending Stock Valero Energy Corporation (VLO) a Buy Now?

Description: Valero Energy (VLO) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

2025-12-17

Should Investors Bet on Overvalued Par Pacific Stock Right Now?

Description: PARR trades above industry EV/EBITDA, but soft oil prices, refining strength and recent gains may justify the premium for investors.

2025-12-16

Valero Energy (VLO) Declines More Than Market: Some Information for Investors

Description: Valero Energy (VLO) reached $162.82 at the closing of the latest trading day, reflecting a -3.03% change compared to its last close.

Phillips 66 Unveils $2.4 Billion Capital Spending Plan for 2026

Description: PSX outlines a $2.4B capital budget for 2026, increasing spending from 2025 and channeling most funds into midstream and refining growth projects.

2025-12-15

Top Research Reports for Microsoft, Novartis & RTX

Description: Microsoft, Novartis and RTX headline Zacks' top research picks, spotlighting cloud, pharma innovation and defense demand shaping market leaders.

2025-12-14

2025-12-13

Should Investors Rethink Valero After Its 2025 Rally and Elevated Earnings Multiple?

Description: Wondering if Valero Energy is still a smart buy after its massive run, or if most of the upside is already priced in? Let us unpack what the market might be missing in the valuation. Even after a 268.7% gain over 5 years and a strong 36.7% year-to-date climb, the stock has cooled off recently, slipping 3.4% over the last week and 5.2% over the past month. It still sits near $168.3 and is up 34.4% over the last year. Recent moves in Valero’s share price have been shaped by shifting...

2025-12-12

REX: 21 Profitable Quarters in a Row and Expansion Momentum Ahead — Quarterly Update Report

Description: Download the Complete Report Here By Brandon Hornback REX American Resources Corp. (NYSE: REX) continued its long-running winning of streak, making it 21 straight profitable quarters. Ethanol volumes edged higher and operational discipline helped offset softer pricing, reinforcing REX’s position as one of the sector’s most reliable performers. Growth investments remain firmly on track: The […]

2025-12-11

Sector Update: Energy Stocks Softer Late Afternoon

Description: Energy stocks were lower late Thursday afternoon, with the NYSE Energy Sector Index down 0.4% and th

Sector Update: Energy Stocks Decline Thursday Afternoon

Description: Energy stocks were lower Thursday afternoon, with the NYSE Energy Sector Index down 0.2% and the Sta

Here Are Thursday’s Top Wall Street Analyst Research Calls: American Eagle Outfitters, Ferrari, Intuitive Surgical, Roku, PayPal, Synopsis, Visa, and More

Description: Pre-Market Stock Futures: Futures are trading lower after a big rate-cut rally on Wednesday was sideswiped by Oracle’s disappointing earnings after the bell yesterday. The Federal Reserve’s 25-basis-point rate cut, as expected, put the benchmark rate at 3.50%-3.75%. The third consecutive cut lowered rates to their lowest level since late 2022, to help support a ... Here Are Thursday’s Top Wall Street Analyst Research Calls: American Eagle Outfitters, Ferrari, Intuitive Surgical, Roku, PayPal, Sy

2025-12-10

2025-12-09

Valero Energy (VLO) Ascends While Market Falls: Some Facts to Note

Description: Valero Energy (VLO) concluded the recent trading session at $175.32, signifying a +1.01% move from its prior day's close.

Why Casey's Q2 Earnings Beat Isn't Enough To Lift The Stock

Description: Casey's General Stores reported fiscal Q2 earnings late Tuesday as gasoline prices hover around $3.00 per gallon.

PSX Stock Climbs 1.5% After Latest Retail Business Divestment

Description: Phillips 66 shares rise after a major retail divestment brings $1.6B in proceeds and supports its shift toward more profitable assets.

2025-12-08

Gasoline Prices Are The Lowest In Four Years And This Gas Station Chain Reports Earnings

Description: Casey's General Stores reports fiscal Q2 earnings and its all about gasoline prices and gas sales at the pump.

2025-12-07

2025-12-06

How Valero’s Refining Margin Rebound and Capital Returns Strategy Will Impact Valero Energy (VLO) Investors

Description: Valero Energy recently reported stronger-than-expected Q3 2025 results, with refining margins rebounding sharply and refinery throughput utilization reaching 97%, underscoring the company’s robust operational performance across its global network of refineries, ethanol plants, and renewable diesel facilities. At the same time, solid free cash flow and a healthy balance sheet are supporting ongoing dividends and aggressive share repurchases, even as some analysts now see more limited upside...

2025-12-05

Is Par Pacific's Refining Business More Resilient & Competitive?

Description: PARR's diverse crude sourcing and heavy-oil cost edge fuel its refining strength and standout stock performance.

Valero Energy Corporation to Release Fourth Quarter and Full Year 2025 Earnings Results on January 29, 2026

Description: SAN ANTONIO, December 05, 2025--Valero Energy Corporation (NYSE: VLO) will release its financial and operational results for the fourth quarter and full year 2025 on Thursday, January 29, 2026, before the market opens. Management will host a conference call at 10:00 a.m. ET to discuss the results.

Newsom Sparks Rebellion in Bay Area Town Over Gasoline Imports

Description: Valero Energy Corp. plans to shut its refinery in Benicia in April, part of a wave of refinery closures across California as the state shifts away from fossil fuels. Newsom is counting on increased imports to ensure gas prices don’t soar, and his administration is exploring the Valero site — which is connected to a marine port — as a potential storage hub, said Benicia Mayor Steve Young.

Anabi acquires 12 c-stores in California

Description: The deal includes nine Cox Family Stores near the San Francisco Bay area and three in the Lake Tahoe region.

2025-12-04

Darling Ingredients Announces Agreement to Sell Approximately $60 Million in Production Tax Credits

Description: IRVING, Texas, December 04, 2025--Darling Ingredients Inc. (NYSE: DAR) today announced an agreement to sell approximately $60 million of production tax credits to a corporate buyer. These credits were generated under the Inflation Reduction Act (IRA) by the company’s Diamond Green Diesel joint venture. The proceeds of the sale are scheduled to be received by Dec. 31, 2025, upon satisfaction of certain funding conditions.

Valero Energy (VLO): Reassessing Valuation After Strong Q3 2025 Earnings Beat and Refining Margin Rebound

Description: Valero Energy (VLO) just posted stronger than expected Q3 2025 results, with a rebound in refining margins and high utilization that pushed revenue above forecasts and helped the stock extend its recent rally. See our latest analysis for Valero Energy. The stock has cooled slightly since that earnings pop, but with a roughly 14% 90 day share price return and a 5 year total shareholder return above 260%, momentum still looks firmly constructive rather than exhausted. If Valero’s run has you...

Valero Energy Corporation (VLO) is Attracting Investor Attention: Here is What You Should Know

Description: Recently, Zacks.com users have been paying close attention to Valero Energy (VLO). This makes it worthwhile to examine what the stock has in store.

2025-12-03

Is the Current Oil Price Favorable for Par Pacific's Refining Business?

Description: Soft crude prices could boost PARR's refining margins as lower feedstock costs align with EIA's outlook for continued inventory builds.

2025-12-02

How Is Valero Energy's Stock Performance Compared to Other Energy Stocks?

Description: Despite Valero Energy’s strong performance relative to its industry peers over the past year, Wall Street analysts maintain a cautiously optimistic outlook on the stock’s prospects.

2025-12-01

2025-11-30

5 High Yielding Goldman Sachs Conviction List Picks Deliver Safe Passive Income

Description: Founded in 1869, Goldman Sachs is the world’s second-largest investment bank by revenue and is ranked 55th on the Fortune 500 list of the largest United States corporations by total revenue. The Wall Street white-glove giant offers financing, advisory services, risk distribution, and hedging for the firm’s institutional and corporate clients. We review the firm’s ... 5 High Yielding Goldman Sachs Conviction List Picks Deliver Safe Passive Income

2025-11-29

Taiwan Semiconductor, Gold And Silver Play Lead 5 Stocks Near Buy Points

Description: Taiwan Semiconductor, the chip fabricator with the A-1 AI client list, including Nvidia and Alphabet, leads this weekend watchlist of five stocks near buy points. Gold and silver streaming company Wheaton Precious Metals, oil refining giant Valero Energy, AI cooling play Comfort Systems and industrial lighting and control systems supplier Acuity also are on the list. FIX and WPM have a 99 IBD Composite Rating out of a possible 99, according to IBD Stock Checkup.

An Intrinsic Calculation For Valero Energy Corporation (NYSE:VLO) Suggests It's 45% Undervalued

Description: Key Insights Valero Energy's estimated fair value is US$321 based on 2 Stage Free Cash Flow to Equity Valero Energy is...

2025-11-28

Phillips 66 (PSX) Down 1.5% Since Last Earnings Report: Can It Rebound?

Description: Phillips 66 (PSX) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-11-27

2025-11-26

2025-11-25

Oil Prices Near Four-Year Lows. Goldman Sachs Sees Opportunity.

Description: Oil prices fell Tuesday and analysts project prices to keep coming down in the coming years. Refining stocks are holding up.

2025-11-24

2025-11-23

2025-11-22

2025-11-21

2025-11-20

Valero Energy Corporation (VLO) Is a Trending Stock: Facts to Know Before Betting on It

Description: Valero Energy (VLO) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

2025-11-19

2025-11-18

How Recent Developments Are Rewriting the Story for Valero Energy

Description: Valero Energy has seen its consensus analyst price target increase slightly, moving from $180.78 to $182.22 per share. This modest revision comes amid new research and analyst coverage. These updates reflect optimism about the company’s business model and operational strengths, even as analysts consider evolving market factors. Stay tuned to discover ways to stay informed about ongoing changes in the market narrative for Valero stock. Stay updated as the Fair Value for Valero Energy shifts by...

2025-11-17

Can Energy’s Strength Continue Into Year End? What the Charts Say About 3 Stocks.

Description: Exploration stocks have also done well, with the up 8% over the same stretch. Doug Busch is the senior technical analyst at Barron’s Investor Circle glossary of technical terms is updated regularly with new entries.

2025-11-16

Dow Jones Futures Rise, Google Jumps; All Eyes On Nvidia Earnings

Description: After a roller-coaster market week and tough time for AI plays, investors will keep a close eye on Nvidia earnings.

2025-11-15

Dow Jones Futures: Will Nvidia Revive Or Ruin Rocky Market? What To Do Now.

Description: After a roller-coaster market week and tough time for AI plays, investors will keep a close eye on Nvidia earnings.

2025-11-14

Dow Jones Futures: Market Eyes Nvidia After Wild Week. 5 Stocks Near Buy Points.

Description: Dow Jones futures will open Sunday evening, along with S&P 500 futures and Nasdaq futures. All eyes will be on Nvidia (NVDA) earnings this week. The stock market saw some wild swings this past week, with the Dow Jones hitting a record high while the S&P 500 and Nasdaq briefly undercut their 50-day lines. Thanks to another Friday bounce off...

IBD Stock Of The Day: Buy Points In Play As Oil Refinery Margins Fatten

Description: The Findlay, Ohio-based oil refiner is IBD's Stock of the Day for Friday. Marathon, like most oil refineries, is helped by the growing difference between crude oil prices, which are going down, and gas prices, which have stayed flat. The difference between inputs and the refined products companies like Marathon sell is referred to in the oil business as the "crack spread."

Eli Lilly Leads Three Stocks Near Buy Points

Description: The stock market continued its sell-off Friday, but a few stocks ascended in buy zones and hovered near new highs. Eli Lilly, for one, hit an all-time high. Another is Valero, which has edged into a buy zone above an entry at 178.43, according to IBD MarketSurge.

Investors in Valero Energy (NYSE:VLO) have seen fantastic returns of 309% over the past five years

Description: When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose...

2025-11-13

Goldman Sachs Says US Stocks Could Lag for 10 Years: 5 Strong Buy Value Dividend Ideas

Description: Here are five Goldman Sachs stock picks that conservative growth and income investors should consider moving to for what could be a volatile 2026.

Archrock Beats Q3 Earnings & Revenue Estimates, Both Up Y/Y

Description: AROC expects contract operations revenues to range from $1.27 billion to $1.28 billion, supported by a healthy adjusted gross margin of 71-71.5%.

2025-11-12

2025-11-11

Dow Jones Leader Goldman Sachs, Intuitive Stock In Or Near Buy Zones

Description: Dow Jones financial giant Goldman Sachs, along with Intuitive Surgical and Valero Energy, are in or near buy zones in today's stock market.

Pembina Pipeline Q3 Earnings & Revenues Miss Estimates, Both Down Y/Y

Description: PBA expects 2025 adjusted EBITDA in the range of C$4.25 billion to C$4.35 billion compared with the previous guidance of C$4.23 billion to C$4.43 billion.

Delek US Q3 Earnings & Revenues Beat Estimates, Adjusted EBITDA Up Y/Y

Description: DK expects total crude throughput in the range of 252,000-284,000 bpd and total throughput in the band of 271,000-303,000 bpd for the fourth quarter of 2025.

Valero Energy Stock: Analyst Estimates & Ratings

Description: Although Valero Energy has outperformed the broader market over the past year, analysts maintain a measured but positive stance on the stock, signaling steady confidence in its outlook.

2025-11-10

TC Energy Q3 Earnings Match Estimates, Revenues Beat, Both Fall Y/Y

Description: TRP anticipates its 2025 comparable EBITDA to be between C$10.8 billion and C$11 billion, with net Capex to be between C$5.5 billion and C$6 billion.

Northern Q3 Earnings Beat Estimates, Revenues Miss, Both Down Y/Y

Description: NOG expects total production of 132,500-134,000 barrels of oil equivalent per day, with oil production in the range of 75,000-76,500 barrels per day for 2025.

2025-11-09

Dow Jones Futures Rise As Government Shutdown Deal Advances; Nvidia In Buy Area

Description: The Senate has a deal to end the government shutdown. The stock market fell last week but bulls fought back Friday.

Is There Now an Opportunity in Valero After 42.6% Share Price Surge in 2025?

Description: If you have ever wondered whether Valero Energy is a value play or just another hot stock, you are in exactly the right place. Valero’s stock price has surged recently, gaining 3.6% in the last week, 11.1% over the past month, and 42.6% year-to-date. This points to major momentum and shifting market sentiment. This rally follows a wave of industry headlines, such as increased demand for refined fuels pushing margins higher and new policy developments around energy exports. The broader energy...

2025-11-08

Dow Jones Futures: Bulls Fight Back At Key Level; Opportunity Or Head Fake?

Description: The stock market ended a bad week with bulls making a stand Friday at a critical level. Nvidia leads stocks in buy zones.

Eli Lilly And These AI Plays Lead 5 Stocks Near Buy Points

Description: Eli Lilly, the weight-loss drug heavyweight, joins AI stocks CrowdStrike Holdings and Semtech on this weekend's watchlist of five stocks near buy points. CrowdStrike is a leader in the emerging area of AI-driven security, while Semtech's data-center chips facilitate high performance with low power consumption. Lilly has a 99 IBD Composite Rating out of a possible 99, according to IBD Stock Checkup.

2025-11-07

Dow Jones Futures: What To Do As Stock Market Bulls Fight Back; Nvidia Holds Buy Point

Description: The stock market ended a bad week with bulls making a stand Friday at a critical level. Nvidia leads stocks in buy zones.

Stock Of The Day Pokes Buy Point As Margins Grow Amid These Global Events

Description: Valero Energy is aiming for a 52-week high this week as it pokes at a buy point. The oil refinery operator and ethanol supplier is the IBD Stock of the Day. The stock surged 7% on Oct. 23, its best day since April, after Valero beat third-quarter profit and sales expectations.

Dow Jones Futures Fall As Stock Market, Palantir Break Key Levels; Tesla Shareholders OK Elon Musk Pay

Description: Dow Jones futures: The stock market indexes and Palantir undercut key levels. Tesla shareholders voted in favor of the Elon Musk pay deal.

USA Compression Q3 Earnings Beat Estimates, Revenues Rise Y/Y

Description: USAC expects adjusted EBITDA of $610-$620 million and distributable cash flow between $370 million and $380 million for 2025.

2025-11-06

Dow Jones Futures: Stock Market, Palantir Break Key Levels; Tesla Shareholders OK Elon Musk Pay

Description: Dow Jones futures: The stock market indexes and Palantir undercut key levels. Tesla shareholders voted in favor of the Elon Musk pay deal.

Marathon Q3 Earnings Miss Estimates, Revenues Beat, Expenses Down Y/Y

Description: MPC, Findlay, OH-based oil and gas refining and marketing company, expects refining operating costs to average $5.80 per barrel in the fourth quarter of 2025.

Valero Energy (VLO): Exploring the Stock’s Valuation After Recent Momentum

Description: Valero Energy (VLO) shares have seen steady movement over the past month, with the stock rising a little over 4%. Investors watching the refining sector are curious how these recent gains compare to the company's longer history of solid total returns. See our latest analysis for Valero Energy. Valero Energy’s momentum appears to be building, with a 28% share price return over the past three months and a 38% return year-to-date, both much stronger than the 4% gain in the past month. Over the...

2025-11-05

Suncor Energy Q3 Earnings & Revenues Beat Estimates, Both Down Y/Y

Description: SU beats Q3 estimates with record production and refining, partly offset by lower upstream price realizations.

Williams Q3 Earnings and Revenues Miss Estimates, Expenses Down Y/Y

Description: WMB expects 2025 growth capital expenditures to be between $3.95 billion and $4.25 billion, with a leverage ratio estimated at a midpoint of 3.7x.

Coterra Q3 Earnings Miss Estimates, Revenues Beat, Expenses Rise Y/Y

Description: CTRA expects total production of 772-782 MBoepd, natural gas output of 2,925-2,965 MMcfpd and oil volumes in the range of 159-161 MBopd for 2025

2025-11-04

Murphy USA Q3 Earnings Top Estimates as Merchandise Shines

Description: MUSA tops Q3 earnings estimates as strong merchandise performance offsets weaker fuel sales and revenue shortfall.

Is Valero Energy Corporation's (NYSE:VLO) Recent Stock Performance Influenced By Its Fundamentals In Any Way?

Description: Valero Energy (NYSE:VLO) has had a great run on the share market with its stock up by a significant 25% over the last...

2025-11-03

2025-11-02

2025-11-01

2025-10-31

Chevron Q3 Earnings Beat Estimates as Production Hits Record

Description: CVX pays $3.4 billion in dividends and buys back $2.6 billion worth of its shares during the third quarter.

Some May Be Optimistic About Valero Energy's (NYSE:VLO) Earnings

Description: Valero Energy Corporation's ( NYSE:VLO ) recent soft profit numbers didn't appear to worry shareholders, as the stock...

2025-10-30

ProPetro Holding's Q3 Loss Narrower Than Expected, Sales Beat

Description: PUMP projects full-year capital expenditures for 2025 to be between $270 million and $290 million.

Magnolia Oil & Gas Q3 Earnings Match Estimates, Revenues Beat

Description: MGY expects fourth-quarter 2025 D&C capital spending of about $110 million, bringing full-year capex close to the midpoint of its $430-$470 million guidance.

Here's Why Valero Energy (VLO) is a Strong Value Stock

Description: Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Valero Energy Corporation (VLO) is Attracting Investor Attention: Here is What You Should Know

Description: Valero Energy (VLO) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Why Investors Need to Take Advantage of These 2 Oils-Energy Stocks Now

Description: Finding stocks expected to beat quarterly earnings estimates becomes an easier task with our Zacks Earnings ESP.

2025-10-29

Sector Update: Energy Stocks Rise Wednesday Afternoon

Description: Energy stocks advanced Wednesday afternoon with the NYSE Energy Sector Index and the Energy Select S

With 87% ownership in Valero Energy Corporation (NYSE:VLO), institutional investors have a lot riding on the business

Description: Key Insights Significantly high institutional ownership implies Valero Energy's stock price is sensitive to their...

Valero Energy Corporation Announces CFO Transition

Description: SAN ANTONIO, October 29, 2025--Valero Energy Corporation (NYSE: VLO, "Valero") announced today that Homer Bhullar, who has served as Valero’s Vice President-Investor Relations and Finance since April 29, 2021, has been appointed by Valero’s Board of Directors to serve as Senior Vice President and Chief Financial Officer, effective January 1, 2026. Mr. Bhullar will succeed Jason Fraser, who will remain as Executive Vice President and Chief Financial Officer until his retirement from the position

Valero Energy Corporation Declares Regular Cash Dividend on Common Stock

Description: SAN ANTONIO, October 29, 2025--The Board of Directors of Valero Energy Corporation (NYSE: VLO, "Valero") has declared a regular quarterly cash dividend of $1.13 per share on its common stock. The dividend will be payable on December 18, 2025, to shareholders of record as of the close of business on November 20, 2025.

2025-10-28

Jim Cramer Says “I Think Meta Has a Terrific Quarter”

Description: Meta Platforms, Inc. (NASDAQ:META) is one of the stocks on Jim Cramer’s radar recently. A caller’s top five holdings were Meta, Microsoft, Walmart, Valero, and AbbVie, and they asked if their portfolio is diversified or not. In response, Cramer said: “Okay, so Valero, the margins are really good right now with oil versus gasoline. So […]

Here's Why Valero Energy (VLO) is a Strong Momentum Stock

Description: The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Here’s the RS Large Cap Value Strategy’s Views on Valero Energy Corporation (VLO)

Description: RS Investments, an investment management company, released its “RS Large Cap Value Strategy” third-quarter 2025 investor letter. A copy of the letter can be downloaded here. The strategy underperformed the benchmark, Russell 1000 Value Index, in the quarter, returning 4.47% net vs 5.33% for the Index. Adverse stock selection in the Consumer Discretionary and Consumer […]

2025-10-27

Oceaneering Q3 Earnings Beat Estimates, Revenues Increase Y/Y

Description: OII expects 2025 adjusted EBITDA to be between $391 million and $401 million and is maintaining its full-year free cash flow guidance of $110 million to $130 million.

2025-10-26

2025-10-25

2025-10-24

Valero To Shut Benicia Refinery After Failed State Talks

Description: Energy giant says it will import fuel to serve California

PBF Energy Stock Earns 91 Relative Strength Rating

Description: PBF Energy stock saw a positive improvement to its Relative Strength (RS) Rating on Friday, with an increase from 84 to 91. Here Are 3 Keys For Successful Stock Investing IBD's proprietary RS Rating tracks technical performance by using a 1 (worst) to 99 (best) score that identifies how a stock's price performance over the trailing 52 weeks matches up against the rest of the market.

Company News for Oct 24, 2025

Description: Companies in The News Are: HON, TSLA, VLO, LVS

PTEN Q3 Earnings Loss Narrower Than Expected, Sales Beat

Description: Patterson-UTI Energy expects $85 million in adjusted gross profit from Completion Services and a rig count similar to that of the third quarter in Drilling Services for the fourth quarter.

Dow Jones Futures: Intel, AI Play Jump After Bullish Tesla Move; Trade Talks, CPI In Focus

Description: Futures rise with Intel and AI play Comfort Systems big earnings winners. Trump cuts off Canada trade negotiations with China talks set to start. CPI inflation due.

2025-10-23

Dow Jones Futures: Intel, AI Play Jump Late After Tesla Makes Bullish Move

Description: The stock market neared highs in a quietly bullish session. Tesla reversed higher while CrowdStrike and Snowflake broke out. Intel and Comfort Systems jumped late on earnings.

Valero Energy (VLO) One-Off $1.1B Loss Undermines Earnings Quality, Spotlighting Margin Debate

Description: Valero Energy (VLO) posted a 0.6% net profit margin for the twelve months ending September 30, 2025, down from last year’s 4.4%, as a one-off $1.1 billion loss weighed on the bottom line. Despite this margin pressure, analysts expect the company’s earnings to grow at a 15.8% annual rate over the next three years, while revenue is forecast to decline a modest 0.6% per year. Investors are watching closely, as Valero’s stock trades below estimated fair value but looks expensive relative to...

Valero Earnings Show Why Refiners Are Energy’s Big Winners This Year

Description: Energy Select Sector SPDR Fund, weighted toward oil majors, has risen just 3.2% this year while the VanEck Oil Refiners ETF is up 40%.

Valero Energy Corp (VLO) Q3 2025 Earnings Call Highlights: Record Profits and Strategic ...

Description: Valero Energy Corp (VLO) reports a significant increase in net income and strong shareholder returns, while navigating operational and market challenges.

Sector Update: Energy Stocks Gain Late Afternoon

Description: Energy stocks advanced late Thursday afternoon with the NYSE Energy Sector Index rising 2% and the E

Sector Update: Energy Stocks Gain Thursday Afternoon

Description: Energy stocks were higher Thursday afternoon, with the NYSE Energy Sector Index rising 1.8% and the

Valero Energy Q3 Earnings Beat Estimates on Higher Refining Margins

Description: VLO posts a strong Q3 earnings beat as higher refining and ethanol margins offset weaker renewable diesel sales.

Oil Prices Rally 5% On Trump; Two Oil Plays Makes Bullish Earnings Moves

Description: U.S. oil prices soared more than 5%, hitting two-week highs early Thursday on Trump administration moves. West Texas Intermediate crude oil futures jumped Thursday after the U.S. announced sanctions on key Russian oil companies. President Donald Trump also said he would put pressure on major buyers and plans to discuss Russian oil imports with China President Xi Jinping next week.

Exchange-Traded Funds, Equity Futures Lower Pre-Bell Thursday Amid Oil Surge, Trade Tensions

Description: The broad market exchange-traded fund SPDR S&P 500 ETF Trust (SPY) was down 0.1% and the actively tr

Valero Energy (VLO) Tops Q3 Earnings and Revenue Estimates

Description: Valero Energy (VLO) delivered earnings and revenue surprises of +24.07% and +8.05%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Valero Energy: Q3 Earnings Snapshot

Description: SAN ANTONIO (AP) — Valero Energy Corp. VLO) on Thursday reported third-quarter profit of $1.1 billion. On a per-share basis, the San Antonio-based company said it had net income of $3.53.

Valero Energy Reports Third Quarter 2025 Results

Description: SAN ANTONIO, October 23, 2025--Valero Energy Corporation (NYSE: VLO, "Valero") today reported net income attributable to Valero stockholders of $1.1 billion, or $3.53 per share, for the third quarter of 2025, compared to net income of $364 million, or $1.14 per share, for the third quarter of 2024. Excluding the adjustments shown in the accompanying earnings release tables, adjusted net income attributable to Valero stockholders was $1.1 billion, or $3.66 per share, for the third quarter of 2025

2025-10-22

Does Valero’s Recent 3% Dip Signal Opportunity for Investors in 2025?

Description: If you are sitting on the fence about Valero Energy, you are definitely not alone. The stock has drawn plenty of attention lately, bouncing through some near-term turbulence yet still carrying an impressive longer-term track record. In just the past week, shares have slipped 2.8%, and zooming out to the past month, the stock has shed 3%. Take a step back, though, and the story shifts. Valero is still boasting a 28% return since the start of the year and a massive 400.2% gain over the past...

Valero Energy’s Expanded Credit Facility Could Be a Game Changer for VLO

Description: On October 16, 2025, Valero Energy amended and restated its existing revolving credit agreement, extending the maturity to October 2030 and increasing the credit facility size up to US$5.5 billion, with interest and fees tied to company credit ratings. This extended access to significant liquidity highlights Valero’s commitment to maintaining financial flexibility for operations and investments, even as market uncertainties persist. We'll now examine how Valero’s extended credit facility may...

Why The Narrative Around Valero Is Shifting Amid Analyst Upgrades and Sector Uncertainty

Description: Valero Energy's consensus analyst price target has recently nudged higher, rising from $169 to nearly $175.63 per share. This shift comes as market observers weigh both the company's resilient performance and evolving industry conditions. Stay tuned to see how you can keep track of these narrative shifts as analyst perspectives continue to evolve. What Wall Street Has Been Saying Recent analyst activity surrounding Valero Energy reflects a predominantly positive but nuanced outlook, with...

2025-10-21

Earnings live: GM stock soars, Netflix sinks as third quarter results pour in

Description: Third quarter earnings season is ramping up, and analysts expect S&P 500 companies grew their profits by 8% during the quarter.

Is Suncor Energy (SU) Stock Outpacing Its Oils-Energy Peers This Year?

Description: Here is how Suncor Energy (SU) and Valero Energy (VLO) have performed compared to their sector so far this year.

Exploring Analyst Estimates for Valero Energy (VLO) Q3 Earnings, Beyond Revenue and EPS

Description: Evaluate the expected performance of Valero Energy (VLO) for the quarter ended September 2025, looking beyond the conventional Wall Street top-and-bottom-line estimates and examining some of its key metrics for better insight.

Will These 4 Energy Stocks Surpass Q3 Earnings Estimates?

Description: Here is a look at what to expect from energy stocks FTI, VLO, BKR, and XPRO ahead of their quarterly earnings reports, which are set to be released Oct. 23.

Wells Fargo Suggests 2 Energy Stocks to Buy in a Challenging Market

Description: There are headwinds in store for the oil industry, but a new report from Wells Fargo suggests that there are still plenty of sound options for investors. The bank sees demand as slowing, although not turning fully negative, and refining as an area of strength. The outline is simple enough: supply is sufficient, and end-product fuels should attract investor attention. Summing up this outlook, Wells Fargo analyst Sam Margolin writes, “We pick stocks based on return of capital trends, which have hi

2025-10-20

Earnings live: Cleveland-Cliffs stock soars, Zions Bancorp rises with results from GM, Netflix on deck

Description: Third quarter earnings season is ramping up, and analysts expect S&P 500 companies grew their profits by 8% during the quarter.

Draft: Valero Energy Corporation - Who pays almost 70 times Earnings for this?

Description: Why the oil sector is unlikely to grow in the future

2025-10-19

Tesla, Netflix set to report earnings as US-China trade fight turns 'unsustainable': What to watch this week

Description: As investors enters shutdown week three, a US-China trade war, credit gesticulation, and an incoming oil glut are weighing on the market.

Valero Energy (VLO): Evaluating Valuation After Strong Multi-Year Shareholder Returns and Industry Shifts

Description: Valero Energy (VLO) shares have been relatively steady lately, even as energy markets show mixed signals. Investors are watching how the company’s financial track record translates in a market shaped by evolving supply and demand dynamics. See our latest analysis for Valero Energy. Valero’s share price has held up well so far in 2024, climbing 28.1% year-to-date as energy demand trends and supply uncertainty continue to fuel investor interest. While momentum has cooled in recent weeks, the...

2025-10-18

2025-10-17

VLO Poised to Report Q3 Earnings: Here's What You Need to Know

Description: Valero gears up for Q3 results with earnings estimated to rise 158% year over year, even as revenues are projected to decline nearly 10%.

Valero Energy Corporation (VLO) Is a Trending Stock: Facts to Know Before Betting on It

Description: Recently, Zacks.com users have been paying close attention to Valero Energy (VLO). This makes it worthwhile to examine what the stock has in store.