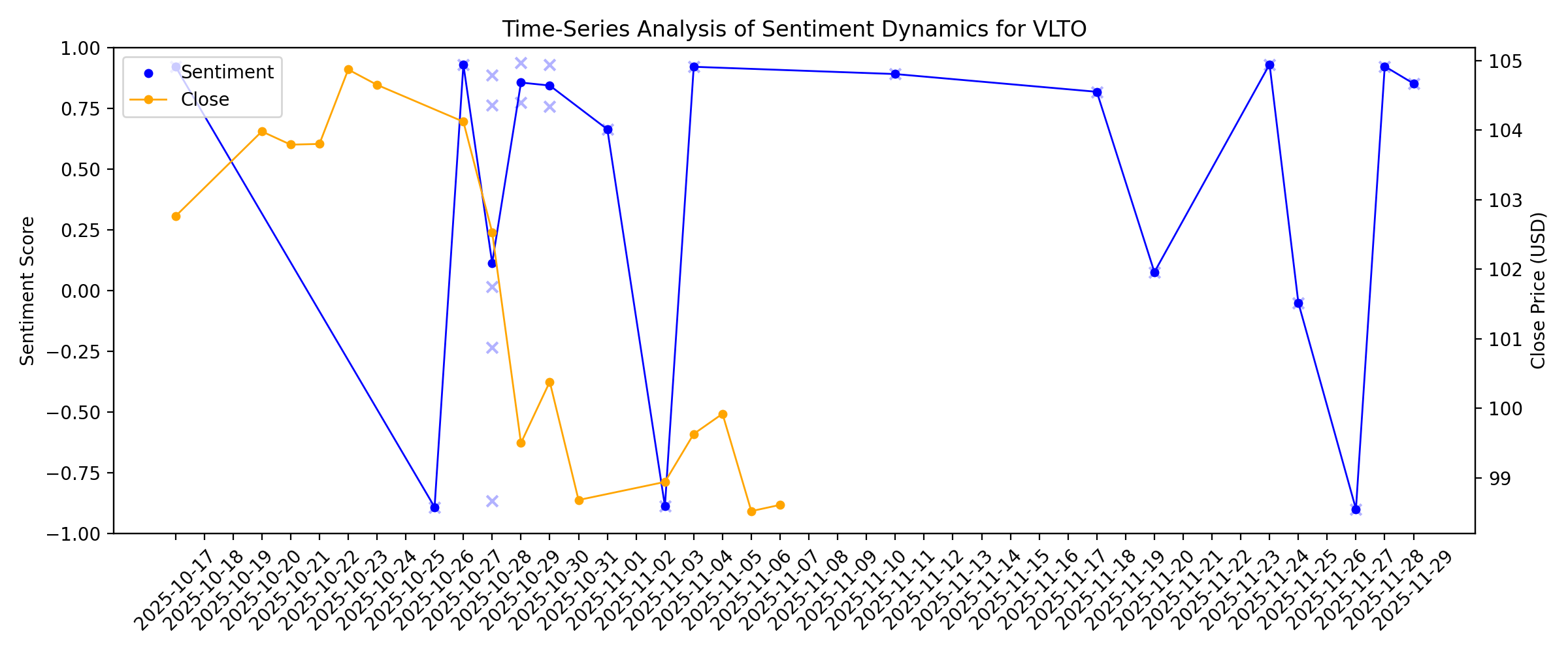

News sentiment analysis for VLTO

Sentiment chart

2026-01-14

Veralto Schedules Fourth Quarter 2025 Earnings Call

Description: Veralto Corporation (NYSE: VLTO), a global leader in essential water and product quality solutions dedicated to Safeguarding the World's Most Vital Resources™, announced that it will webcast its fourth quarter 2025 earnings conference call on Wednesday, February 4, 2026, beginning at 8:30 a.m. ET.

2026-01-13

2026-01-12

Here's What to Expect From Veralto’s Next Earnings Report

Description: Analysts expect Veralto to deliver steady Q4 2025 growth, even as the stock has struggled to keep pace with the broader market.

2026-01-11

2026-01-10

Assessing Veralto (VLTO) Valuation After Recent Share Price Momentum

Description: Veralto (VLTO) has been drawing attention after recent share price gains, with the stock up about 1% over the past day and roughly 4% over the past month as investors reassess its profile. See our latest analysis for Veralto. At a share price of $102.73, Veralto’s recent 7 day share price return of 4.29% and year to date share price return of 4.29% suggest momentum has picked up again, while the 1 year total shareholder return of 3.10% points to a more measured longer term outcome. If...

2026-01-09

2026-01-08

2026-01-07

Here's Why You Should Retain FactSet Stock in Your Portfolio Now

Description: FDS rides on a solid three-month run as AI-ready data launches, AWS integration and steady capital returns support growth despite rising costs.

2026-01-06

2026-01-05

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

Reasons Why Investors Can Consider Buying ADP Stock Now

Description: Automatic Data Processing accelerates growth via DataCloud, Q1 FY26 mid-single-digit gains and 25.5% margins, plus smart deals and a 51st straight dividend hike.

2025-12-29

Here's Why You Should Retain IQV Stock in Your Portfolio Now

Description: IQVIA Holdings shares jump 25.5% in three months as AWS partnership, growing R&DS backlog and buybacks lift its earnings outlook.

2025-12-28

2025-12-27

2025-12-26

Here's Why You Should Retain WCN Stock in Your Portfolio Now

Description: Waste Connections has outpaced a falling industry, fueled by a steady EPS growth outlook, active acquisitions adding revenues and a rising dividend signal.

2025-12-25

Veralto (VLTO) Dividend Hike: Evaluating the Stock’s Valuation After an 18% Payout Increase

Description: Veralto (VLTO) just gave income focused investors something new to chew on, as its board approved an 18% hike to the quarterly dividend, lifting the payout to $0.13 per share starting in early 2026. See our latest analysis for Veralto. That confidence is being tested against a mixed backdrop, with the latest share price at $102.29, a modestly positive year to date share price return of 1.69%, but a slightly negative 1 year total shareholder return of 0.73%. This suggests momentum is still...

2025-12-24

Is OppFi (OPFI) Stock Outpacing Its Business Services Peers This Year?

Description: Here is how OppFi Inc. (OPFI) and Veralto (VLTO) have performed compared to their sector so far this year.

2025-12-23

2025-12-22

2025-12-21

2025-12-20

2025-12-19

2025-12-18

2025-12-17

2025-12-16

Veralto Announces Increase in Quarterly Dividend

Description: Veralto (NYSE: VLTO), a global leader in essential water and product quality solutions dedicated to Safeguarding the World's Most Vital Resources™, announced today that its board of directors has approved an 18% increase to its quarterly cash dividend, and accordingly approved a quarterly cash dividend of $0.13 per share of its common stock, payable on January 30, 2026 to holders of record as of the close of business on December 31, 2025.

2025-12-15

2025-12-14

2025-12-13

2025-12-12

Reasons Why Investors Can Consider Buying Veralto Stock Now

Description: VLTO's fast-growing water and product quality segments, boosted by TraceGains and rising demand trends, underpin its strengthening growth outlook.

2025-12-11

Has the Market Mispriced Veralto After Its Recent Share Price Slide?

Description: For investors wondering whether Veralto at around $97.75 is a quietly mispriced opportunity or a value trap in the making, this breakdown is designed to give you a clear, no-nonsense view of where it really stands. The stock has drifted lower recently, with returns of -5.0% over the last week, -0.1% over the last month, and -2.8% year to date, adding to a -7.2% slide over the past year that has some investors questioning whether sentiment has moved beyond what fundamentals might...

2025-12-10

Jefferies upgrades Pentair, John Bean and Middleby among multi industrials

Description: Investing.com -- Jefferies outlined a 2026 roadmap for multi industrial stocks built around growth in power and data centers, margin expansion through internal productivity efforts, and a turn in the capital spending cycle after two years of weak volumes. The brokerage upgraded Pentair, John Bean Technologies and Middleby to Buy, while cutting Emerson Electric and Veralto to Hold.

Is Veralto Corporation Stock Underperforming the S&P 500?

Description: Veralto Corporation stock has lagged behind the S&P 500 over the past year, while analysts remain moderately bullish about its prospects.

Amazon initiated, GE Vernova upgraded: Wall Street's top analyst calls

Description: Amazon initiated, GE Vernova upgraded: Wall Street's top analyst calls

Here Are Wednesday’s Top Wall Street Analyst Research Calls: AbbVie, Amazon.com, Biogen, EchoStar, Ferrari, GE Vernova, PepsiCo, Take-Two Interactive, and More

Description: Pre-Market Stock Futures: Futures are trading modestly lower as the big day has finally arrived: the Federal Reserve will wrap up its last meeting of 2025, and the odds still heavily favor a 25-basis-point rate hike. The worry hanging over traders is that many fear a “hawkish rate cut.” Where they do cut 25 basis ... Here Are Wednesday’s Top Wall Street Analyst Research Calls: AbbVie, Amazon.com, Biogen, EchoStar, Ferrari, GE Vernova, PepsiCo, Take-Two Interactive, and More

2025-12-09

2025-12-08

2025-12-07

2025-12-06

2025-12-05

2025-12-04

Here's Why You Should Retain Equifax Stock in Your Portfolio Now

Description: EFX's stock slump contrasts with rising revenues and earnings forecasts as new AI tools and acquisitions reshape its credit and verification capabilities.

Jim Cramer Says “Danaher’s Been Acting Much Better”

Description: Danaher Corporation (NYSE:DHR) is one of the stocks Jim Cramer recently discussed. Cramer noted that he still likes the stock for the Charitable Trust, as he said: “Now, first, there’s tried and true, but lately trying Danaher, DHR, a conglomerate that became more focused on life sciences diagnostics when it spun off its water and […]

2025-12-03

2025-12-02

2025-12-01

2025-11-30

2025-11-29

Share Buyback and In-Situ Deal Might Change the Case for Investing in Veralto (VLTO)

Description: Veralto Corporation recently announced a US$750 million share repurchase program authorized with no expiration date and agreed to acquire In-Situ, an environmental water measurement specialist, for approximately US$422 million, with the deal expected to close in early 2026. The combination of a substantial buyback plan and acquisition aims to strengthen Veralto’s capital allocation approach and expand its presence in high-growth water analytics markets. We’ll examine how Veralto’s newly...

2025-11-28

Here's Why Investors Should Retain TransUnion Stock for Now

Description: TRU's stock gains momentum as new tech solutions, partnerships and steady dividends highlight its expanding role across credit and marketing ecosystems.

2025-11-27

Why Is Veralto (VLTO) Up 1.8% Since Last Earnings Report?

Description: Veralto (VLTO) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-11-26

2025-11-25

Veralto Announces Agreement to Acquire In-Situ and Establishes $750 Million Share Repurchase Program

Description: Veralto (NYSE: VLTO) (the "Company"), a global leader in essential water and product quality solutions dedicated to Safeguarding the World's Most Vital Resources™, announced that it has entered into a definitive agreement to acquire In-Situ for $435 million, subject to customary closing adjustments. The purchase price, after considering estimated tax benefits, is approximately $422 million. The transaction is expected to close in the first quarter of 2026, subject to customary closing conditions

2025-11-24

Veralto (VLTO) Upgraded to Buy: Here's What You Should Know

Description: Veralto (VLTO) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #2 (Buy).

2025-11-23

2025-11-22

2025-11-21

2025-11-20

Veralto (VLTO): Evaluating Current Valuation as Share Price Momentum Cools

Description: Veralto (VLTO) has seen some movement in its stock price over the past month, with shares closing at $98.26. Investors may be evaluating recent performance as the company navigates shifts in the broader commercial services sector. See our latest analysis for Veralto. Veralto’s share price has been under a bit of pressure lately, with a 30-day share price return of -5.5% and a year-to-date return of -2.3%. This signals that momentum has cooled compared to earlier optimism. Over the last year,...

2025-11-19

2025-11-18

Is Wall Street Bullish or Bearish on Veralto Stock?

Description: While Veralto has lagged behind the broader market over the past year, Wall Street analysts maintain a moderately optimistic outlook about the stock’s prospects.

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

2025-11-11

Buy 5 Business Services Sector Stocks to Boost Your Portfolio Stability

Description: These five Business Services stocks, XYL, TRI, ULS, OMC and VLTO, offer growth and stability amid strong sector fundamentals.

2025-11-10

2025-11-09

2025-11-08

2025-11-07

2025-11-06

2025-11-05

2025-11-04

5 Insightful Analyst Questions From Veralto’s Q3 Earnings Call

Description: Veralto’s third quarter results reflected steady execution across its core Water Quality and Product Quality and Innovation (PQI) segments, with management attributing growth to new customer wins and increased market penetration. CEO Jennifer Honeycutt highlighted the company’s ability to navigate a dynamic macro environment, noting that demand was broad-based across geographies and end markets. Management credited pricing actions, particularly in response to tariffs, and continued operational i

2025-11-03

Veralto Appoints Kim Chainey as Chief Legal Officer

Description: Veralto (NYSE: VLTO), a global leader in essential water and product quality solutions dedicated to Safeguarding the World's Most Vital Resources™, announced the appointment of Kimberly Y. (Kim) Chainey as Senior Vice President and Chief Legal Officer, effective December 1, 2025. She will report to Veralto President and Chief Executive Officer, Jennifer L. Honeycutt.

2025-11-02

2025-11-01

Veralto Corporation (NYSE:VLTO) Third-Quarter Results Just Came Out: Here's What Analysts Are Forecasting For Next Year

Description: Last week, you might have seen that Veralto Corporation ( NYSE:VLTO ) released its third-quarter result to the market...

2025-10-31

2025-10-30

Veralto (VLTO) Earnings Growth Accelerates, Challenging Cautious Narratives on Profit Momentum

Description: Veralto (VLTO) posted earnings growth of 13% in the latest year, marking an acceleration from its 2.2% annual pace over the past five years. Net profit margins widened to 16.7%, up from last year’s 15.7%. With shares trading at $99.5 and below the estimated fair value of $132.38, the market seems to be weighing strong earnings quality and consistent profit growth against outlooks for more moderate future expansion. See our full analysis for Veralto. Now it is time to see how these results...

First Close of Emerald Global Water Fund II Reaches EUR 60 Million

Description: Emerald Announces €60Million First Close of Global Water Fund II Water Team at Emerald Technology Ventures Helge Daebel (center), Partner and Head of Emerald’s Water Practice with water tech specialists Kelven Lam, Clayton MacDougald and Michal Natora. ZÜRICH, Oct. 30, 2025 (GLOBE NEWSWIRE) -- Emerald Technology Ventures, a globally recognized venture capital firm with two decades of water-sector leadership, announced the first close of its Global Water Fund II at €60 million, marking a signific

2025-10-29

VLTO Q3 Deep Dive: Tariff Mitigation, Data Center Growth, and Margin Trends

Description: Water analytics and treatment company Veralto (NYSE:VLTO) met Wall Streets revenue expectations in Q3 CY2025, with sales up 6.8% year on year to $1.40 billion. On the other hand, next quarter’s revenue guidance of $1.38 billion was less impressive, coming in 1.4% below analysts’ estimates. Its non-GAAP profit of $0.99 per share was 4.6% above analysts’ consensus estimates.

Veralto Q3 Earnings & Revenues Beat Estimates, Increase Y/Y

Description: VLTO posts strong Q3 results with double-digit EPS growth, solid Water Quality sales and a raised 2025 outlook.

2025-10-28

Veralto (NYSE:VLTO) Reports Q3 In Line With Expectations

Description: Water analytics and treatment company Veralto (NYSE:VLTO) met Wall Street’s revenue expectations in Q3 CY2025, with sales up 6.8% year on year to $1.40 billion. On the other hand, next quarter’s revenue guidance of $1.38 billion was less impressive, coming in 1.4% below analysts’ estimates. Its non-GAAP profit of $0.99 per share was 4.6% above analysts’ consensus estimates.

Veralto (VLTO) Q3 Earnings and Revenues Beat Estimates

Description: Veralto (VLTO) delivered earnings and revenue surprises of +4.21% and +0.58%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Veralto: Q3 Earnings Snapshot

Description: The results topped Wall Street expectations. The average estimate of four analysts surveyed by Zacks Investment Research was for earnings of 95 cents per share. The water and product quality services provider posted revenue of $1.4 billion in the period, which matched Street forecasts.

Veralto Reports Third Quarter 2025 Results

Description: Veralto (NYSE: VLTO) (the "Company"), a global leader in essential water and product quality solutions dedicated to Safeguarding the World's Most Vital Resources™, announced results for the third quarter ended October 3, 2025.

Veralto (VLTO): Assessing Valuation Following Latest Performance Update

Description: Veralto (VLTO) shares edged lower following their latest performance update. Investors are weighing the company’s recent trends in revenue and net income growth as they look for signals about its future direction in this competitive sector. See our latest analysis for Veralto. With Veralto’s share price sitting at $104.12, the stock’s year-to-date gain of 3.5% has outpaced its total shareholder return of just 0.55% over the past year. This suggests that while momentum has softened lately,...

2025-10-27

Veralto Gears Up to Report Q3 Earnings: Here's What You Should Know

Description: VLTO is likely to post solid Q3 results, fueled by robust U.S. demand and steady growth in its Water Quality segment.

2025-10-26

Veralto (VLTO) Q3 Earnings Report Preview: What To Look For

Description: Water analytics and treatment company Veralto (NYSE:VLTO) will be reporting results this Tuesday afternoon. Here’s what investors should know.

2025-10-25

2025-10-24

2025-10-23

2025-10-22

2025-10-21

2025-10-20

2025-10-19

2025-10-18

2025-10-17

3 Industrials Stocks That Concern Us

Description: Whether you see them or not, industrials businesses play a crucial part in our daily activities. They are also bound to benefit from a friendlier regulatory environment with the Trump administration, and this excitement has led to a six-month gain of 38.5% for the sector - higher than the S&P 500’s 25.9% return.