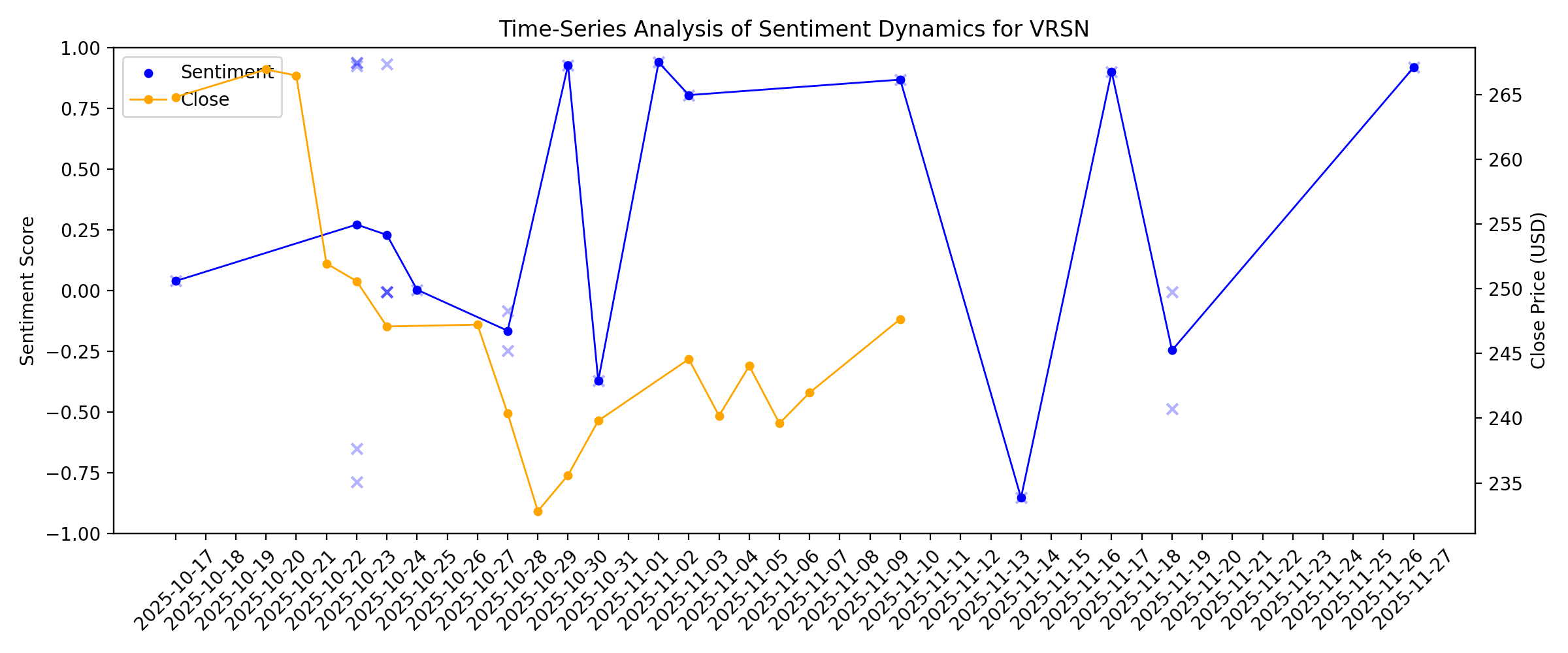

News sentiment analysis for VRSN

Sentiment chart

2026-01-14

Do Options Traders Know Something About VeriSign Stock We Don't?

Description: Investors need to pay close attention to VRSN stock based on the movements in the options market lately.

2026-01-13

Looking At The Narrative For VeriSign VRSN As Domain Trends And Buybacks Evolve

Description: Why the VeriSign Price Target Shifted Only Slightly The small move in VeriSign's fair value estimate, from US$295.50 to US$295.75, reflects an updated view that folds in recent research without meaningfully changing the core thesis around its .com franchise and domain trends. The modest adjustment to the discount rate, from 9.23% to 9.19%, incorporates a bit more comfort around cash flow visibility while keeping long term revenue growth assumptions effectively unchanged. As you read on, you...

2026-01-12

Is VeriSign (VRSN) Pricing Look Stretched After Recent 1-Year Share Gain?

Description: If you are wondering whether VeriSign's share price lines up with its underlying value, starting with a clear look at valuation can help you frame that question. VeriSign's stock last closed at US$248.66, with returns of 3.9% over 7 days, 2.8% over 30 days, 3.4% year to date, and 19.7% over 1 year, as well as 17.3% over 3 years and 28.5% over 5 years. These returns sit against a backdrop of ongoing attention on VeriSign's role in internet infrastructure and its position in the US software...

Assessing VeriSign (VRSN) Valuation After Recent Mixed Share Price Performance

Description: VeriSign stock snapshot after recent performance shifts VeriSign (VRSN) has drawn attention after a mixed set of recent returns, with the share price up over the past week and month, but showing a decline over the past 3 months. See our latest analysis for VeriSign. At a recent share price of $248.94, VeriSign’s 7 day share price return of 4.05% contrasts with its 6.06% decline over 90 days. However, the 1 year total shareholder return of 19.83% suggests momentum has been improving over a...

VeriSign Earnings Preview: What to Expect

Description: VeriSign will release its fourth-quarter earnings next month, and analysts anticipate a double-digit bottom-line growth.

2026-01-11

2026-01-10

2026-01-09

2026-01-08

2026-01-07

2026-01-06

2026-01-05

2026-01-04

2026-01-03

2026-01-02

Verisign to Report Fourth Quarter and Full Year 2025 Financial Results

Description: RESTON, Va., January 02, 2026--VeriSign, Inc. (NASDAQ: VRSN), a global provider of critical internet infrastructure and domain name registry services, today announced that its live earnings teleconference for the fourth quarter and full year 2025 will take place on Thursday, Feb. 5, 2026, at 4:30 p.m. (EST). The earnings news release will be distributed to the wire services at approximately 4:05 p.m. (EST) that day and will also be available directly from the company’s website at https://investo

2026-01-01

2025-12-31

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

Buffett’s $24 Billion Selling Spree: The 6 Stocks Berkshire Hathaway Dumped

Description: Investors began to notice that Warren Buffett began being more conservative with the stock market three years ago, and that streak has continued even as the S&P 500 hit new peaks and beyond. He sold Apple (NASDAQ:AAPL), Bank of America (NYSE:BAC), VeriSign (NASDAQ:VRSN), DaVita (NYSE:DVA), D.R. Horton (NYSE:DHI), and Nucor (NYSE:NUE) as of Q3 2025. ... Buffett’s $24 Billion Selling Spree: The 6 Stocks Berkshire Hathaway Dumped

Managed Domain Name System (DNS) Industry Trends and Strategic Profiles (2025-2030) Featuring Akamai Technologies, Alibaba Cloud, Cloudflare, IBM NS1 Connect, No-IP, Verisign and More

Description: Market opportunities include the rising demand for secure and high-performing DNS solutions driven by digital expansion, cloud adoption, and increasing cyber threats. Innovations like AI-driven traffic routing and blockchain enhance DNS security, while regulations encourage investment in scalable solutions. Managed Domain Name System (DNS) Market Managed Domain Name System (DNS) Market Dublin, Dec. 23, 2025 (GLOBE NEWSWIRE) -- The "Managed Domain Name System (DNS) - Global Strategic Business Rep

2025-12-22

2025-12-21

2025-12-20

2025-12-19

2025-12-18

2025-12-17

2025-12-16

2025-12-15

2025-12-14

Has VeriSign’s Recent Dip Opened a Window After Strong 2024 Gains?

Description: If you are wondering whether VeriSign at around $242 a share still looks attractive or if most of the upside has already been realized, this breakdown will walk through what the market might be missing in the current price. The stock has dipped about 3.0% over the last week and 4.3% over the last month, but is still up 18.0% year to date and 23.7% over the past year. This pattern suggests that recent weakness might just be a pause within a longer uptrend. Recent headlines have focused on...

2025-12-13

2025-12-12

How Is VeriSign’s Stock Performance Compared to Other Software Stocks?

Description: VeriSign has outpaced the broader software industry over the past year, and analysts maintain a fairly upbeat view of its forward prospects.

2025-12-11

2025-12-10

2025-12-09

2025-12-08

2025-12-07

2025-12-06

2025-12-05

2025-12-04

VeriSign, Inc. (VRSN): A Bear Case Theory

Description: We came across a bearish thesis on VeriSign, Inc. on X.com by MinusCherry. In this article, we will summarize the bulls’ thesis on VRSN. VeriSign, Inc.’s share was trading at $253.67 as of December 2nd. VRSN’s trailing and forward P/E were 29.26 and 25.77 respectively according to Yahoo Finance. VeriSign, Inc., together with its subsidiaries, provides internet infrastructure […]

2025-12-03

2025-12-02

2025-12-01

2025-11-30

2025-11-29

2025-11-28

2025-11-27

VeriSign (VRSN) Q3 2025 Earnings Call Transcript

Description: VeriSign delivered both growth in a domain name base and solid financial performance during the third quarter. At the end of September, the domain name base for .com and .net totaled 171.9 million domain names, up 1.4% year-over-year. During the quarter, we returned $72 million through dividends and $215 million through share repurchases for a total return to shareholders of $287 million.

2025-11-26

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

2025-11-20

2025-11-19

How Increased Focus on Domain Security Impacts VeriSign’s Valuation in 2025

Description: Wondering if VeriSign is a hidden value play or priced for perfection? Let’s dive into what the numbers and recent trends suggest for curious investors like you. The stock has been on quite a ride, dropping 1.9% in the last week and 7.9% over the past month. It still boasts a strong 19.8% year-to-date gain and an impressive 36.7% return over the last year. Recent headlines have highlighted increased attention on domain security and the long-term importance of internet infrastructure...

VeriSign Stock: Analyst Estimates & Ratings

Description: Are Wall Street analysts bullish or bearish on VeriSign’s stock?

2025-11-18

2025-11-17

These Stocks Are Moving the Most Today: Alphabet, Apple, Dell, HPE, Nvidia, XPeng, Tesla, Quantum Computing, and More

Description: Alphabet rose after Berkshire Hathaway disclosed that it bought $4.3 billion worth of shares in the third quarter.

2025-11-16

2025-11-15

2025-11-14

There's A Lot To Like About VeriSign's (NASDAQ:VRSN) Upcoming US$0.77 Dividend

Description: Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be...

2025-11-13

2025-11-12

2025-11-11

2025-11-10

Why VeriSign Pulled Back in October

Description: VeriSign pulled back after a strong run to start 2025.

2025-11-09

2025-11-08

2025-11-07

2025-11-06

2025-11-05

2025-11-04

2025-11-03

Shopify Q3 Earnings On Desk: What To Expect From Upcoming Quarter

Description: Wall Street Expects Another Big Beat: Shopify Earnings Could Spark A Breakout Rally

2025-11-02

VeriSign's Strong Q3 Results and Dividends Might Change The Case For Investing In VRSN

Description: VeriSign reported third quarter earnings with sales of US$419.1 million and net income of US$212.8 million, surpassing results from the prior year, and declared a quarterly dividend of US$0.77 per share payable in late November 2025. The company continued its substantial share repurchase activity and saw improvement in new domain registrations and renewal rates, indicating strengthened demand for its core domain name services. With third quarter revenue and net income exceeding expectations,...

2025-11-01

2025-10-31

1 S&P 500 Stock for Long-Term Investors and 2 Facing Challenges

Description: The S&P 500 (^GSPC) is often seen as a benchmark for strong businesses, but that doesn’t mean every stock is worth owning. Some companies face significant challenges, whether it’s stagnating growth, heavy debt, or disruptive new competitors.

2025-10-30

5 Must-Read Analyst Questions From VeriSign’s Q3 Earnings Call

Description: VeriSign’s third quarter was marked by continued growth in its core domain name business and positive market reaction, with revenue and earnings per share both surpassing Wall Street’s expectations. Management attributed this performance to the success of revamped marketing programs and stronger registrar engagement, particularly in the U.S. and EMEA regions. CEO Jim Bidzos emphasized improvements in both new domain registrations and renewal rates, stating the company’s adjustments to its channe

2025-10-29

2025-10-28

Warner Bros. Discovery upgraded, F5 downgraded: Wall Street's top analyst calls

Description: Warner Bros. Discovery upgraded, F5 downgraded: Wall Street's top analyst calls

1 Mid-Cap Stock to Consider Right Now and 2 We Ignore

Description: Mid-cap stocks often strike the right balance between having proven business models and market opportunities that can support $100 billion corporations. However, they face intense competition from scaled industry giants and can be disrupted by new innovative players vying for a slice of the pie.

2025-10-27

2025-10-26

2025-10-25

VeriSign (VRSN) Margin Decline Undermines Bullish Narratives as Valuation Remains a Focus

Description: VeriSign (VRSN) reported revenue growth forecasts of 4.7% per year, with earnings expected to rise by 5.8% annually, both notably trailing the broader US market averages of 10% and 15.5%, respectively. Over the past five years, earnings grew at 2.8% per year, and the company’s net profit margin slipped to 49.9% from last year’s 55.7%, signaling some margin compression. Against this backdrop of modest growth, investors face the tradeoff between a relatively lower price-to-earnings ratio and...

2025-10-24

VeriSign (VRSN) Stock Trades Down, Here Is Why

Description: Shares of internet infrastructure company VeriSign (NASDAQ:VRSN) fell 2.5% in the afternoon session after the company's third-quarter earnings beat was overshadowed by an underwhelming growth outlook and declining profitability. VeriSign reported revenue of $419.1 million, up 7.3% year-over-year, and earnings per share of $2.27, both narrowly topping analyst expectations. Despite these beats, the market reacted negatively to underlying trends. The company’s operating margin contracted to 67.8% f

Top Midday Decliners

Description: Deckers Outdoor (DECK) dropped 12% after the footwear designer and distributor's full-year guidance

VeriSign (VRSN): Examining Valuation After Recent Share Price Dip

Description: VeriSign (VRSN) shares have been trading quietly this week, drifting slightly lower in recent sessions. Looking back over the past month, the stock is down about 13%, prompting investors to revisit the company’s overall performance. See our latest analysis for VeriSign. VeriSign’s recent drift lower comes after a string of strong long-term gains. The stock still posts a 22.2% year-to-date share price return and an impressive 36.1% total shareholder return over the last year. While near-term...

VRSN Q3 Deep Dive: Marketing Programs Drive Domain Growth, AI Trends Shape Outlook

Description: Internet infrastructure company VeriSign (NASDAQ:VRSN) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 7.3% year on year to $419.1 million. Its GAAP profit of $2.27 per share was 1.3% above analysts’ consensus estimates.

2025-10-23

VeriSign Inc (VRSN) Q3 2025 Earnings Call Highlights: Strong Revenue Growth and Improved ...

Description: VeriSign Inc (VRSN) reports a 7.3% increase in revenue and a higher domain renewal rate, while addressing challenges in operating expenses and regional growth.

DNIB.com Reports Internet Has 378.5 Million Domain Name Registrations at the End of the Third Quarter of 2025

Description: RESTON, Va., October 23, 2025--VeriSign, Inc. (NASDAQ: VRSN), a global provider of critical internet infrastructure and domain name registry services, today announced that, according to the latest Domain Name Industry Brief Quarterly Report from DNIB.com, the third quarter of 2025 closed with 378.5 million domain name registrations across all top-level domains (TLDs), an increase of 6.8 million domain name registrations, or 1.8% compared to the second quarter of 2025. Domain name registrations a

VeriSign (NASDAQ:VRSN) Exceeds Q3 Expectations

Description: Internet infrastructure company VeriSign (NASDAQ:VRSN) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 7.3% year on year to $419.1 million. Its GAAP profit of $2.27 per share was 1.3% above analysts’ consensus estimates.

VeriSign: Q3 Earnings Snapshot

Description: RESTON, Va. AP) — VeriSign Inc. VRSN) on Thursday reported profit of $212.8 million in its third quarter.

Verisign Reports Third Quarter 2025 Results

Description: RESTON, Va., October 23, 2025--VeriSign, Inc. (NASDAQ: VRSN), a global provider of critical internet infrastructure and domain name registry services, today reported financial results for the third quarter of 2025.

2025-10-22

2025-10-21

2025-10-20

2025-10-19

2025-10-18

2025-10-17

1 Software Stock to Keep an Eye On and 2 We Find Risky

Description: From commerce to culture, software is digitizing every aspect of our lives. The undeniable tailwinds fueling SaaS companies have led to lofty valuation multiples historically, but rich prices also make re-ratings harder and place a ceiling on returns - over the past six months, the industry’s 19.9% gain has lagged the S&P 500 by 6 percentage points.