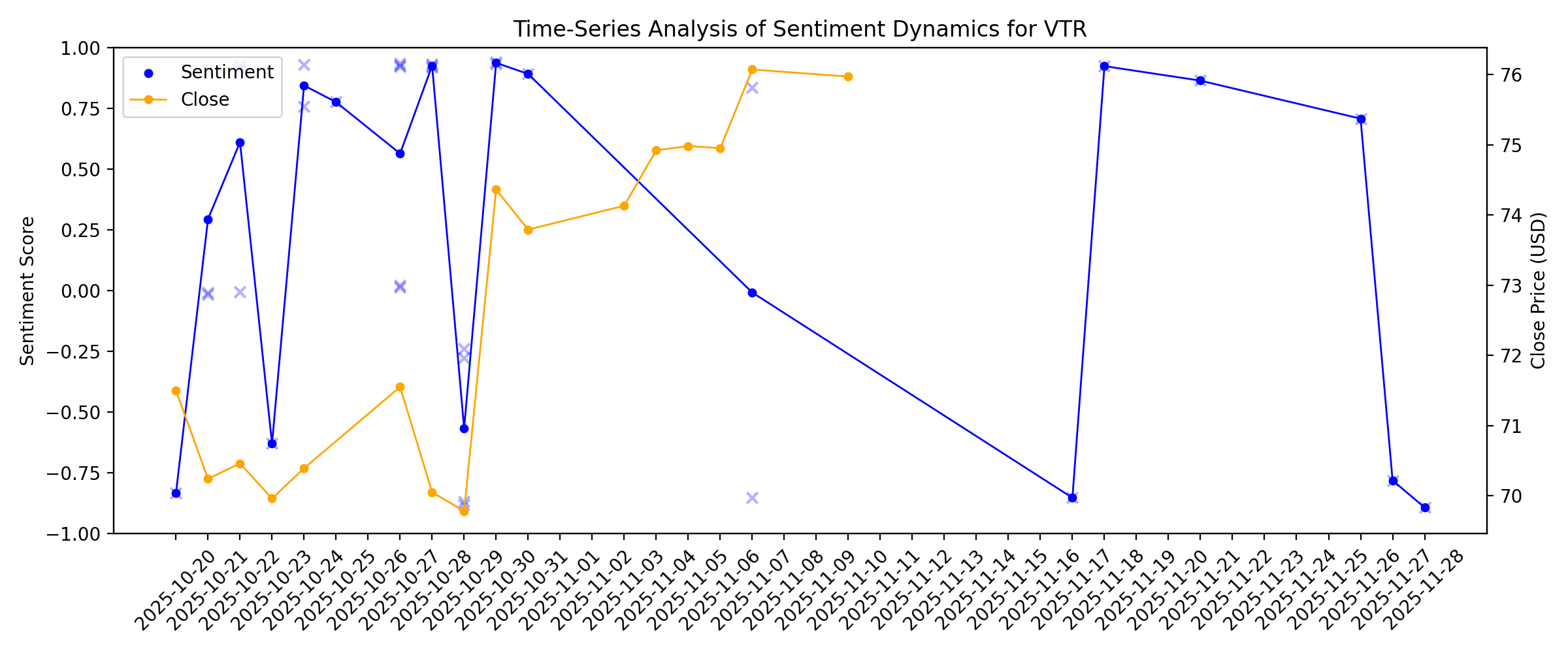

News sentiment analysis for VTR

Sentiment chart

2026-01-14

Ventas Announces Fourth Quarter 2025 Earnings Release Date and Conference Call

Description: CHICAGO, January 14, 2026--Ventas, Inc. (NYSE: VTR) will issue its fourth quarter 2025 earnings release after the close of trading on the New York Stock Exchange on Thursday, February 5, 2026. A conference call to discuss those earnings will be held on Friday, February 6, 2026 at 10:00 a.m. Eastern Time (9:00 a.m. Central Time).

Ventas' Quarterly Earnings Preview: What You Need to Know

Description: Ventas is scheduled to announce its fiscal fourth-quarter earnings soon, and analysts project a high single-digit FFO growth.

4 Strong Buy Passive Income Dividend Stocks Goldman Sachs Loves in January

Description: These four Goldman Sachs Buy-rated dividend stocks for quality names that offer outstanding total return potential and solid upside.

2026-01-13

2026-01-12

2026-01-11

2026-01-10

2026-01-09

2026-01-08

2026-01-07

2026-01-06

2026-01-05

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

Ventas Stock Rallies 24.5% in Six Months: Will the Trend Last?

Description: VTR shares rise 24.5% in six months, far outperforming the industry, as strong SHOP growth and balance sheet gains lift sentiment.

2025-12-21

2025-12-20

2025-12-19

2025-12-18

Is It Too Late to Consider Ventas After a 36% Rally in 2025?

Description: If you are wondering whether Ventas is still a smart buy after its big run, or if the easy money has already been made, you are not alone in asking whether the current price actually reflects its long term value. Ventas has quietly turned into a strong performer, with the stock up 36.1% year to date and 38.4% over the last year. This caps off an impressive 95.4% gain over three years and 91.7% over five years, even after a recent flat 30 day stretch and a modest 1.5% rise in the last...

2025-12-17

2025-12-16

The Longevity Shift: Healthcare REITs to Benefit From Global Aging

Description: WELL, VTR, CTRE and OHI are tapping the longevity economy as aging populations drive rising demand for senior housing, skilled nursing and long-term care real estate.

2025-12-15

2025-12-14

2025-12-13

2025-12-12

2025-12-11

Key Reasons to Add Ventas Stock to Your Portfolio Right Now

Description: VTR gains momentum as its healthcare real estate portfolio, research investments and solid balance sheet point to further growth potential.

Is Ventas Stock Outperforming the S&P 500?

Description: Ventas has outshone the broader S&P 500 Index over the past year, yet Wall Street analysts maintain a highly bullish outlook on the stock’s prospects.

2025-12-10

Ventas Declares Quarterly Dividend of $0.48 Per Common Share

Description: CHICAGO, December 10, 2025--Ventas, Inc. (NYSE: VTR) today announced that its Board of Directors has declared a quarterly dividend of $0.48 per common share. The dividend will be payable in cash on January 15, 2026, to stockholders of record as of the close of business on December 31, 2025.

2025-12-09

2025-12-08

2025-12-07

2025-12-06

2025-12-05

Ventas to Participate in Investor Meetings at Nareit’s REITworld 2025 Annual Conference

Description: CHICAGO, December 05, 2025--Ventas, Inc. (NYSE: VTR) ("Ventas" or the "Company") announced today that management will participate in investor meetings at Nareit’s REITworld 2025 Annual Conference (the "Nareit Conference") on December 8-9, 2025.

2025-12-04

2025-12-03

Why Is SBA Communications (SBAC) Down 4.7% Since Last Earnings Report?

Description: SBA Communications (SBAC) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-12-02

Ventas Announces Pricing of Senior Notes Offering

Description: CHICAGO, December 02, 2025--Ventas, Inc. (NYSE: VTR) ("Ventas" or the "Company") announced today that its wholly owned subsidiary, Ventas Realty, Limited Partnership ("Ventas Realty"), has priced an underwritten public offering of $500.0 million aggregate principal amount of 5.000% Senior Notes due 2036 (the "Notes") at an issue price equal to 99.510% of the principal amount of the Notes. The Notes will be senior unsecured obligations of Ventas Realty and will be fully and unconditionally guaran

How Investors May Respond To Ventas (VTR) Raising Senior Housing Investment Targets After Strong Q3 Results

Description: In the third quarter of 2025, Ventas reported normalized FFO per share of US$0.88, surpassing analyst estimates and increasing 10% year over year; the company also raised its normalized FFO guidance and investment volume target for senior housing to US$2.5 billion. An important insight is that Ventas’ positive performance was anchored by strong same-store cash NOI growth in its senior housing and outpatient medical portfolios, even as triple-net leased properties saw a slight decrease. We'll...

Wells Fargo is Bullish on this Real Estate Dividend Stock

Description: Ventas, Inc. (NYSE:VTR) is one of the best dividend stocks in the real estate sector. On November 25, John Kilichowski from Wells Fargo issued a Buy rating on Ventas. The analyst assigned a price target of $88 for the stock. Separately, the company reported its Q3 2025 financials on October 29. Year-to-date at the end […]

2025-12-01

2025-11-30

2025-11-29

2025-11-28

Why Is Ventas (VTR) Up 7.7% Since Last Earnings Report?

Description: Ventas (VTR) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-11-27

Are You Looking for a Top Momentum Pick? Why Ventas (VTR) is a Great Choice

Description: Does Ventas (VTR) have what it takes to be a top stock pick for momentum investors? Let's find out.

2025-11-26

Sinceri Senior Living Announces Strategic Expansion & Continued Growth Across Key Markets

Description: VANCOUVER, WASHINGTON / ACCESS Newswire / November 26, 2025 / Sinceri Senior Living is pleased to announce the continued expansion of its national foot, print through the transition and management of additional senior living communities across multiple ...

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

Ventas (VTR): Assessing Valuation Following Recent 14% Monthly Share Price Gain

Description: Ventas (VTR) has attracted attention lately, posting steady gains over the past month. With shares climbing 14% in that period, investors are starting to take a closer look at what is driving the momentum. See our latest analysis for Ventas. Ventas’s strong 13.6% share price gain over the past month has built on already impressive momentum, with the stock now up more than 37% year-to-date. While short-term moves can capture headlines, the real story is Ventas’s 27.8% total shareholder return...

2025-11-20

2025-11-19

2025-11-18

Ventas Stock Rallies 16.2% in Three Months: Will It Continue to Gain?

Description: VTR's expanding SHOP footprint, rising cash NOI and active capital recycling underscore its growth momentum.

2025-11-17

Ventas Announces Planned Retirement of Peter J. Bulgarelli, EVP, Outpatient Medical & Research and CEO of Lillibridge Healthcare Services

Description: CHICAGO, November 17, 2025--Ventas, Inc. (NYSE: VTR) ("Ventas" or the "Company") today announced that Peter J. Bulgarelli, Executive Vice President, Outpatient Medical & Research and Chief Executive Officer of Lillibridge Healthcare Services, has informed the Company of his intention to retire on May 1, 2026. Ventas will commence a search process to identify a successor.

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

2025-11-11

2025-11-10

2025-11-09

2025-11-08

2025-11-07

Here's How You Can Earn $100 In Passive Income By Investing In Ventas Stock

Description: Ventas Inc. (NYSE:VTR) is a real estate investment trust that owns and manages a diverse portfolio of healthcare and senior housing properties, including senior living communities, outpatient medical buildings, research centers, and hospitals across ...

Ventas Stock: Analyst Estimates & Ratings

Description: Senior housing giant Ventas has significantly outpaced the broader market over the past year, and analysts remain strongly bullish on the stock’s prospects.

2025-11-06

2025-11-05

2025-11-04

2025-11-03

2025-11-02

2025-11-01

2025-10-31

Ventas (VTR) Profit Margins Turn Positive, Challenging Bearish Narratives on Growth Outlook

Description: Ventas (VTR) has swung to profitability, with earnings now forecast to grow by 24.24% annually and revenue expected to rise 11.1% each year over the next three years, both topping broader US market averages. This turnaround follows a challenging five-year stretch where earnings declined 21.8% per year and a recent one-off $75 million loss weighed on results, but the company’s net profit margin is now positive. While key risks remain, including less sustainable dividends and the impact of...

2025-10-30

Ventas Inc (VTR) Q3 2025 Earnings Call Highlights: Strong Growth in Senior Housing and Improved ...

Description: Ventas Inc (VTR) reports a 10% increase in normalized FFO per share and raises 2025 guidance amid robust performance in its senior housing portfolio.

Ventas Q3 FFO and Revenues Beat Estimates, Same-Store Cash NOI Rises

Description: VTR posts strong Q3 results with higher FFO and revenues, fueled by gains in senior housing and outpatient medical portfolios.

2025-10-29

Ventas (VTR) Reports Q3 Earnings: What Key Metrics Have to Say

Description: The headline numbers for Ventas (VTR) give insight into how the company performed in the quarter ended September 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Ventas (VTR) Q3 FFO and Revenues Top Estimates

Description: Ventas (VTR) delivered FFO and revenue surprises of +1.15% and +3.86%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Ventas: Q3 Earnings Snapshot

Description: The results topped Wall Street expectations. The Chicago-based real estate investment trust said it had funds from operations of $406.2 million, or 88 cents per share, in the period. The average estimate of five analysts surveyed by Zacks Investment Research was for funds from operations of 87 cents per share.

Ventas Reports 2025 Third Quarter Results

Description: CHICAGO, October 29, 2025--Ventas, Inc. (NYSE: VTR) ("Ventas" or the "Company") today reported results for the third quarter ended September 30, 2025.

2025-10-28

Federal Realty to Report Q3 Earnings: What to Expect From the Stock?

Description: FRT is poised for third-quarter growth as demand for premium retail assets and mixed-use developments boosts revenues.

A Fresh Look at Ventas (VTR) Valuation After Notable Institutional Moves and Senior Housing Tailwinds

Description: Ventas (VTR) is gaining fresh attention from institutional investors as Diamond Hill Mid Cap Strategy initiated a new position. The move is rooted in strong demographic trends, tight senior housing supply, and opportunities arising from strategic acquisitions. See our latest analysis for Ventas. Ventas has seen its share price climb steadily this year, with a 23.45% gain year-to-date hinting at building momentum, even as the broader market's attention remains focused elsewhere. Despite some...

VICI Properties to Report Q3 Earnings: What to Expect From the Stock?

Description: VICI's Q3 performance is set to benefit from stable lease revenues, portfolio diversification and steady growth across key income streams.

2025-10-27

Invitation Homes to Report Q3 Earnings: What to Expect From the Stock?

Description: INVH's Q3 results are likely to reflect strong demand for single-family rentals and tech-driven margin gains amid supply pressures.

What's in the Offing for Ventas Stock This Earnings Season?

Description: While VTR's Q3 earnings are likely to have benefited from SHOP operating trends and a well-diversified tenant base, high interest expenses may have hurt it.

UDR Set to Report Q3 Earnings: What's in Store for the Stock?

Description: UDR's diversified portfolio and tech upgrades are set to lift Q3 performance, though rising rental supply may have tempered gains.

PSA Set to Report Q3 Earnings: What to Expect From the Stock?

Description: Public Storage's Q3 growth is expected to stem from technology-driven efficiencies and economies of scale, boosting revenues and FFO.

Extra Space Storage to Report Q3 Earnings: What to Expect?

Description: EXR's Q3 report may show solid revenue growth, but rising competition and discounting could pressure its margins and FFO.

2025-10-26

2025-10-25

Does Institutional Interest and Tech Recognition Signal a Strategic Shift for Ventas (VTR)?

Description: In recent days, Ventas Inc has attracted increased attention with new institutional investment from Diamond Hill Mid Cap Strategy and ongoing positive analyst commentary highlighting its strong position in senior housing and healthcare real estate. Company officer Debra A. Cafaro also disclosed the sale of 219,520 shares for US$15.66 million on October 20, 2025, in line with standard insider reporting requirements. An interesting development is the recognition Ventas is gaining for using...

2025-10-24

Healthpeak Q3 FFO Beats Estimates, Same-Store NOI Rises Y/Y

Description: DOC's third-quarter results reflect the continued strong performance of its high-quality outpatient medical and CCRC portfolios.

American Tower to Report Q3 Earnings: What to Expect From the Stock?

Description: AMT's Q3 revenues are likely to have risen on 5G rollout, cloud growth and macro-tower investments, though AFFO per share may have slightly dipped.

2025-10-23

Is Ventas (VTR) The Best REIT Dividend Stock to Buy for Non-AI Trade?

Description: We recently published Top 10 Trending Stocks Everyone’s Watching in Q4. Ventas Inc (NYSE:VTR) is one of the trending stocks everyone’s watching. Morningstar’s Dave Sekera said in a recent program on Schwab Network that investors are not paying attention to non-AI stocks as their focus remains on growth. The analyst warned that incessant focus on […]

2025-10-22

Welltower Gears Up to Report Q3 Earnings: What's in the Cards?

Description: WELL's Q3 results are likely to shine on the increasing aging population and its healthcare expenditure, though high interest expenses could weigh on gains.

BXP to Post Q3 Earnings: What to Expect From the Stock?

Description: BXP's focus on high-quality and life science office conversions is likely to have lifted Q3 leasing, while debt and higher interest costs may weigh on results.

Alexandria to Post Q3 Earnings: What to Expect From the Stock?

Description: ARE's Q3 results may show lower revenues and FFO as occupancy pressures weigh on performance.

2025-10-21

What's in the Cards for Healthpeak Properties This Earnings Season?

Description: DOC's Q3 earnings are likely to be hurt by lower revenues and higher interest expenses amid an aging population.

What's in Store for Crown Castle Stock This Earnings Season?

Description: Customer concentration and high interest expenses are likely to impact CCI's Q3 results despite its unmatched portfolio of wireless communication infrastructure assets.

Digital Realty to Post Q3 Earnings: What to Expect From the Stock?

Description: DLR's vast data center network and AI-focused growth are set to drive a 6.4% revenue gain in Q3 2025.

2025-10-20

Ventas (VTR) Could Be a Great Choice

Description: Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Ventas (VTR) have what it takes? Let's find out.