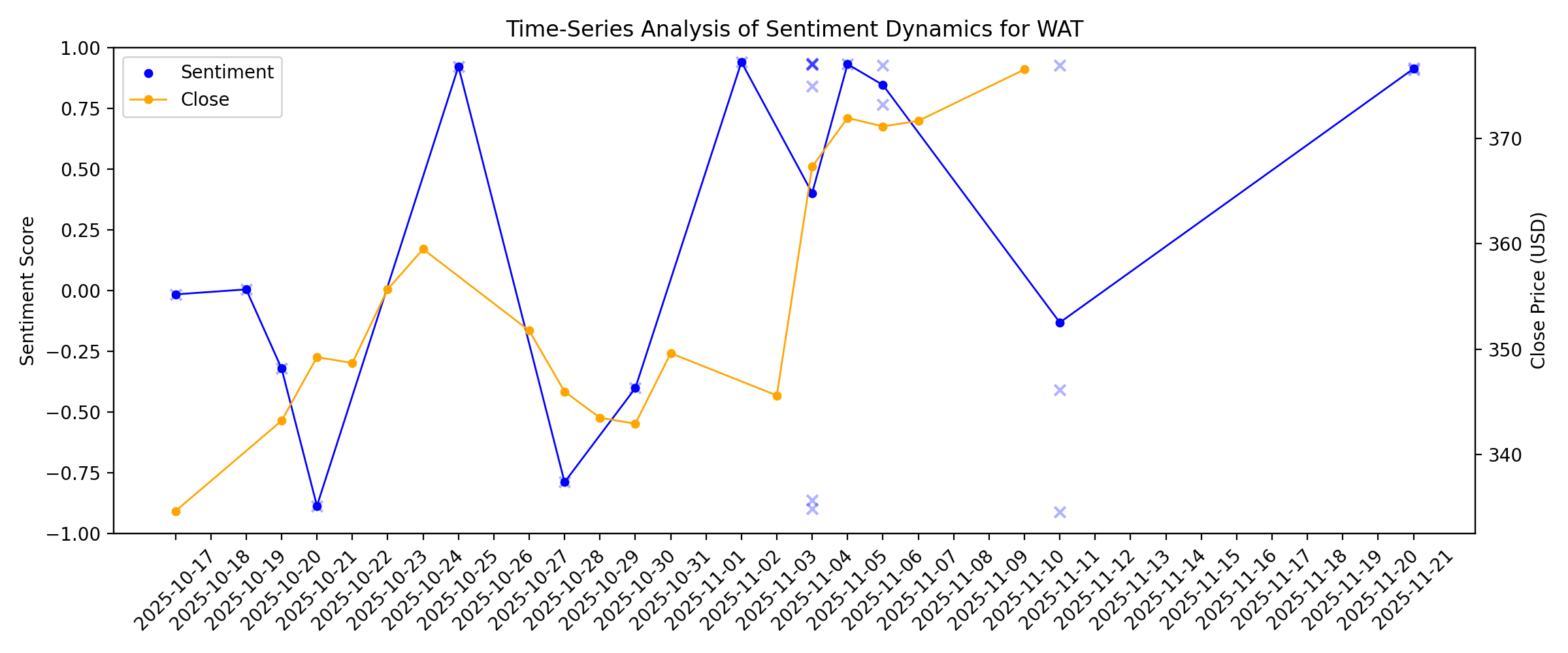

News sentiment analysis for WAT

Sentiment chart

2026-01-14

2026-01-13

Waters Corporation expands into biosciences and diagnostics

Description: The deal meaningfully expands Waters’ exposure to biologics, diagnostics, and regulated laboratory workflows while adding a substantial base of recurring revenue.

Are Options Traders Betting on a Big Move in WAT Stock?

Description: Investors need to pay close attention to Waters stock based on the movements in the options market lately.

2026-01-12

2026-01-11

2026-01-10

2026-01-09

2026-01-08

2026-01-07

2026-01-06

2026-01-05

Should Slower Core Growth And M&A Reliance Require Action From Waters (WAT) Investors?

Description: Recent commentary indicates that Waters Corporation’s core business has underperformed over the past two years, with organic revenue growth trailing healthcare peers and returns on capital weakening, raising questions about the strength of its existing profit pools. An important implication is that Waters may increasingly lean on acquisitions to supplement its slower-growing core operations, potentially reshaping how it allocates capital and pursues long-term growth opportunities. We’ll now...

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

Waters Corporation to Present at the 44th Annual J.P. Morgan Healthcare Conference on Monday, January 12, 2026

Description: Waters Corporation (NYSE:WAT) announced that Udit Batra, Ph.D., Waters President and Chief Executive Officer, will present at the 44th Annual J.P. Morgan Healthcare Conference on Monday, January 12th, 2026 at 2:15 PM Pacific Time (5:15 PM Eastern Time).

2025-12-22

2025-12-21

2025-12-20

2025-12-19

2025-12-18

2025-12-17

Waters (WAT): Revisiting Valuation After Steady Multi‑Year Share Price Gains

Description: Waters (WAT) has quietly delivered steady long term gains, with shares up around 23% over the past 3 months and more than 50% over five years, despite recent short term softness. See our latest analysis for Waters. At around $377 per share, Waters has given investors a solid 23.09% 90 day share price return. Its 5 year total shareholder return above 50% points to steady, enduring momentum rather than a short lived spike. If Waters has you thinking about quality compounders in healthcare, it...

2025-12-16

2025-12-15

2025-12-14

Street Calls of the Week

Description: Investing.com -- Here is your Pro Recap of the top takeaways from Wall Street analysts for the past week.

2025-12-13

2025-12-12

2025-12-11

Is Waters Corporation Stock Outperforming the Nasdaq?

Description: As Waters Corporation has considerably outperformed the Nasdaq recently, analysts remain moderately optimistic about the stock’s prospects.

Morgan Stanley Highlights Positive Outlook for Becton, Dickinson (BDX) and the MedTech Sector

Description: Becton, Dickinson and Company (NYSE:BDX) is included among the 15 Best Stocks to Buy for the Long Term. On December 2, Morgan Stanley analyst Patrick Wood lifted the firm’s price target on Becton, Dickinson and Company (NYSE:BDX) to $210 from $197 and maintained an Overweight rating on the shares. The analyst noted that the company’s […]

2025-12-10

2025-12-09

2025-12-08

Top ASX Dividend Stocks To Consider In December 2025

Description: As the Australian market navigates a cautious landscape, with telecoms leading amidst broader sector declines and rate pause expectations from the RBA, investors are keenly observing how these dynamics might influence dividend stocks. In such an environment, selecting robust dividend stocks involves looking for companies with strong fundamentals and consistent payout histories to potentially weather economic fluctuations.

2025-12-07

2025-12-06

2025-12-05

2025-12-04

Why Is Waters (WAT) Up 6.9% Since Last Earnings Report?

Description: Waters (WAT) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

Jim Cramer on Waters Corporation: “I Think It Should Be Loved on Wall Street

Description: Waters Corporation (NYSE:WAT) is one of the stocks Jim Cramer recently discussed. Cramer discussed the company’s upcoming merger with Becton, Dickinson’s biosciences and diagnostics business. He remarked: “Finally, please don’t forget about one that was always my personal favorite, never owned it for the trust, Waters Corporation, one of the quieter companies in this space […]

2025-12-03

2025-12-02

A Look At The Intrinsic Value Of Waters Corporation (NYSE:WAT)

Description: Key Insights The projected fair value for Waters is US$361 based on 2 Stage Free Cash Flow to Equity With US$398 share...

2025-12-01

2025-11-30

2025-11-29

2025-11-28

2025-11-27

2025-11-26

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

Mettler-Toledo, Agilent, Waters Corporation, Merck, and Regeneron Shares Skyrocket, What You Need To Know

Description: A number of stocks jumped in the afternoon session after comments from a key Federal Reserve official bolstered hopes for an interest rate cut. New York Federal Reserve President John Williams stated he sees “room for a further adjustment” in the near term, sparking a significant market rally. Following his remarks, the probability of the central bank cutting rates at its December meeting jumped from 39% to over 73%, according to the CME FedWatch tool. This positive sentiment provided relief to

Waters Corporation Stock: Is Wall Street Bullish or Bearish?

Description: Waters Corporation has lagged the broader market over the past year, yet analysts still see a steady path forward, maintaining a moderately upbeat outlook on the company’s long-term prospects.

2025-11-20

2025-11-19

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

2025-11-11

Why Waters (WAT) Is Up 5.1% After Raising 2025 Sales and Earnings Guidance

Description: Waters Corporation recently reported its third quarter results for 2025, showing revenue of US$799.89 million and net income of US$148.92 million, while also raising both its fourth quarter and full-year sales and earnings guidance. This announcement combined stronger year-to-date financial performance with increased management confidence, as reflected by the updated earnings outlook for the remainder of 2025. Given the upward revision of full-year guidance and ongoing revenue growth, we'll...

Waters Corporation to Present at the Jefferies Global Healthcare Conference in London

Description: Waters Corporation (NYSE:WAT) announced that Udit Batra, Ph.D., Waters President and Chief Executive Officer, will participate in a fireside chat at the Jefferies Global Healthcare Conference in London on Tuesday, November 18th, 2025, at 2:30 PM Greenwich Mean Time (9:30 AM Eastern Time).

Waters Boosts Lab Productivity and Sample Throughput with Launch of its Charged Aerosol Detector Designed for Empower Software

Description: Waters Corporation (NYSE:WAT) today announced the launch of its Charged Aerosol Detector (CAD) specifically designed for use with Waters Empower Software, the world's most trusted chromatography data system (CDS). Waters is the global market leader in chromatography software solutions for regulatory filings, as Empower Software is used to submit data for approximately 80% of novel drugs to regulatory authorities.2

2025-11-10

2025-11-09

2025-11-08

2025-11-07

2025-11-06

Becton Dickinson tops Q4 profit forecast, guides above consensus for 2026

Description: Investing.com -- Becton Dickinson posted fourth-quarter earnings that came in slightly above expectations and offered guidance that also beat forecasts.

Waters (WAT) Revenue Growth Outpaces Market Yet Margins Compress, Testing Bullish Narratives

Description: Waters (WAT) posted annual revenue growth of 14.5% and earnings per share are forecast to expand by 15.2% per year, just below the US market average. Over the past year, earnings ticked up 4.3%, and net profit margins landed at 20.9%, a slight dip from 21.4% a year ago. Investors are weighing ongoing profit and revenue growth against a share price that trades above fair value, as margins have compressed slightly. See our full analysis for Waters. The next section takes these results and puts...

2025-11-05

Waters Q3 Earnings Surpass Estimates, Revenue Increase Y/Y

Description: WAT posts strong Q3 results with 16% earnings growth and higher sales, lifting its full-year outlook for 2025.

2025-11-04

Waters Corp (WAT) Q3 2025 Earnings Call Highlights: Strong Revenue Growth and Raised Guidance

Description: Waters Corp (WAT) reports an 8% revenue increase and raises full-year guidance, driven by robust instrument and recurring sales growth.

Why Is Waters Corporation (WAT) Stock Soaring Today

Description: Shares of scientific instruments company Waters Corporation (NYSE:WAT) jumped 8.2% in the morning session after it reported mixed third-quarter 2025 results where a strong revenue performance outweighed a miss on profitability. The company announced sales of $799.9 million, up 8% year on year and beating Wall Street estimates by 2.4%. This top-line strength was driven by an 8% increase in organic revenue, which also surpassed expectations. However, the quarter was not without its challenges. Wat

Waters Corporation (WAT) Slipped Following the Acquisition Announcement

Description: Baron Funds, an investment management company, released its “Baron Health Care Fund” third-quarter 2025 investor letter. A copy of the letter can be downloaded here. The fund rose 5.39% (Institutional Shares) in the quarter, compared to a 5.05% gain for the Russell 3000 Health Care Index (benchmark) and an 8.18% gain for the Russell 3000 […]

Waters (WAT) Tops Q3 Earnings and Revenue Estimates

Description: Waters (WAT) delivered earnings and revenue surprises of +5.92% and +2.59%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Waters Corporation (NYSE:WAT) Beats Q3 Sales Expectations

Description: Scientific instruments company Waters Corporation (NYSE:WAT) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 8% year on year to $799.9 million. The company expects next quarter’s revenue to be around $926.8 million, close to analysts’ estimates. Its GAAP profit of $2.50 per share was 14.7% below analysts’ consensus estimates.

Waters: Q3 Earnings Snapshot

Description: The results topped Wall Street expectations. The average estimate of six analysts surveyed by Zacks Investment Research was for earnings of $3.21 per share. The maker of products used in drug discovery and development posted revenue of $799.9 million in the period, also topping Street forecasts.

Waters Corporation (NYSE: WAT) Reports Third Quarter 2025 Financial Results

Description: Waters Corporation (NYSE: WAT), today announced its financial results for the third quarter of 2025.

2025-11-03

2025-11-02

Waters (WAT): Exploring Valuation After Recent Share Price Momentum and Business Developments

Description: Waters (WAT) stock has shown some interesting price movement over the past month, up nearly 6% even as long-term returns remain mixed. Investors may be weighing recent business results and overall sector sentiment at current levels. See our latest analysis for Waters. Waters’ share price has bounced back impressively in the last month with a 6.5% gain, though its 1-year total shareholder return remains negative. Momentum is picking up after a 22% share price rise over the past 90 days, which...

2025-11-01

2025-10-31

2025-10-30

Globus Medical (GMED) Expected to Beat Earnings Estimates: What to Know Ahead of Q3 Release

Description: Globus Medical (GMED) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2025-10-29

2025-10-28

Waters (WAT) Reports Next Week: Wall Street Expects Earnings Growth

Description: Waters (WAT) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2025-10-27

2025-10-26

2025-10-25

What You Need to Know Ahead of Waters Corporation's Earnings Release

Description: Waters Corporation is all set to unveil its fiscal third-quarter earnings next month, and analysts project a high single-digit earnings growth.

2025-10-24

2025-10-23

2025-10-22

2025-10-21

Solventum Appoints Heather Knight as Chief Commercial Officer

Description: Solventum (NYSE: SOLV) announced today the appointment of Heather Knight as Chief Commercial Officer, effective November 10, 2025. In this newly created role, Ms. Knight will oversee global commercial and R&D operations across Solventum's MedSurg, Dental Solutions and Health Information Systems segments, and will report directly to CEO Bryan Hanson.

2025-10-20

Did Xevo CDMS Launch Just Shift Waters' (WAT) Investment Narrative in Next-Gen Therapeutics?

Description: Earlier this month, Waters Corporation launched the Xevo Charge Detection Mass Spectrometer (CDMS), offering direct, individual-particle mass measurement of mega-mass biomolecules critical to next-generation therapeutics and structural biology. This innovation enables scientists to analyze complex biomolecules, such as viral vectors and mRNA therapeutics, using up to 100-fold less sample volume and delivering results in under ten minutes, addressing major industry challenges in advanced...

2025-10-19

Waters Surges 10% After New Pharma Collaboration Has the Market Priced in Future Growth?

Description: Trying to decide what to do with Waters stock? You're not alone. Whether you’ve already got a stake or are looking for an open lane, recent moves in the share price have sparked plenty of conversation. After a lukewarm year so far, with the stock down 9.1% year to date, Waters just pulled off a strong 10.2% rally over the past month, following a more modest 1.1% gain last week. That kind of reversal always catches the eye, especially for a company that has managed to post an 18.6% return over...

2025-10-18

2025-10-17

3 S&P 500 Stocks We’re Skeptical Of

Description: While the S&P 500 (^GSPC) includes industry leaders, not every stock in the index is a winner. Some companies are past their prime, weighed down by poor execution, weak financials, or structural headwinds.