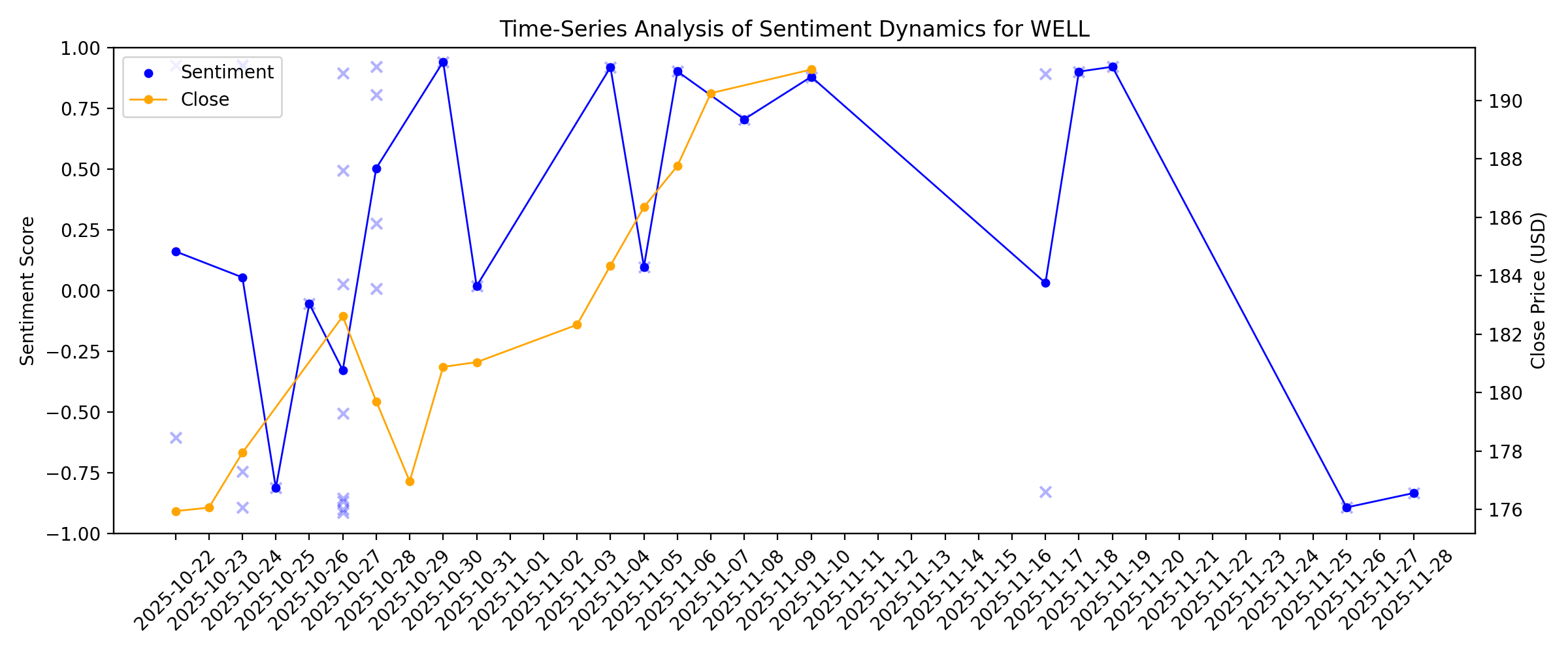

News sentiment analysis for WELL

Sentiment chart

2026-01-14

2026-01-13

What You Need To Know Ahead of Welltower’s Earnings Release

Description: Welltower is scheduled to release its fourth-quarter results soon, and analysts are projecting a double-digit rise in EPS.

2026-01-12

2026-01-11

2026-01-10

2026-01-09

2026-01-08

2026-01-07

Is It Too Late To Consider Welltower (WELL) After Its Strong Multi‑Year Rally?

Description: If you are wondering whether Welltower is still good value after its strong run, or if the price already reflects the story, this article walks through what the current share price might be implying. With the stock at US$185.65, Welltower has been flat over the last 7 days, down 7.6% over the last month, and roughly in line year to date. Its return over the last 1, 3 and 5 years sits at 49.4%, 177.5% and 232.5% respectively. Recent attention on senior housing and healthcare real estate, as...

2026-01-06

2026-01-05

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

2025-12-29

REITs Should Bounce Back in 2026. 3 Stocks to Consider Buying Now.

Description: As would-be home buyers know, real estate is all about interest rates. That could set the sector up for gains.

2025-12-28

2025-12-27

2025-12-26

WELL vs. MPW: Which Healthcare REIT Stock is the Better Buy Now?

Description: Welltower's senior housing and outpatient medical focus highlights growth potential, setting it apart from hospital-heavy peers in a shifting healthcare REIT landscape.

2025-12-25

2025-12-24

2025-12-23

2025-12-22

WSR Rewards Investors With 5.6% Dividend Hike: Is it Sustainable?

Description: Whitestone boosts its quarterly dividend by 5.6% to 14.25 cents, lifting its annual yield to 4.19% and adds a $50M buyback.

2026 Looks Like An Inflection Point For Schwab’s US REIT To Launch Higher | SCHH

Description: The Schwab U.S. REIT ETF (NYSEARCA:SCHH) has spent the last year treading water, down roughly 2% while investors waited for interest rates to cooperate. With the 10-year Treasury hovering around 4.2% in mid-December and the Federal Reserve signaling a gradual path toward lower rates in 2026, SCHH sits at the inflection point where real estate ... 2026 Looks Like An Inflection Point For Schwab’s US REIT To Launch Higher | SCHH

2025-12-21

ServiceNow & Welltower: Why this strategist is watching the stocks

Description: Tematica Research Chief Investment Officer Chris Versace shares his perspective on two stocks: ServiceNow (NOW) amid its talks to acquire Armis for upwards of $7 billion, and real estate investment trust — or REIT — Welltower, Inc. (WELL). Also catch Chris Versace explain how significant AI usage will be alongside mass adoption by industries and hyperscalers in 2026. To watch more expert insights and analysis on the latest market action, check out more Market Domination.

2025-12-20

2026 Could Be Explosive For The SPDR Dow Jones REIT, And It’s 4% Dividend

Description: The SPDR Dow Jones REIT ETF (NYSEARCA:RWR) occupies an unusual space in the REIT universe. With just $1.7 billion in assets, it’s small enough to fly under the radar, yet its 24-year track record and roughly 4% dividend yield have kept it quietly relevant. The ETF recently trades around $99, up 3% year-to-date through mid-December, ... 2026 Could Be Explosive For The SPDR Dow Jones REIT, And It’s 4% Dividend

2025-12-19

Resolution Capital Initiates Position in Healthcare Realty Trust After a Year of REIT Pressure

Description: After a tough stretch for REITs, Resolution Capital’s entry into Healthcare Realty Trust highlights a view that valuation and cash flow matter more than near-term rate debates

2025-12-18

2025-12-17

Did Surging Revenue and Senior Housing Demand Just Shift Welltower's (WELL) Investment Narrative?

Description: In recent weeks, Welltower Inc., a major senior housing and healthcare real estate owner, reported revenue growth of more than 30% year over year, reflecting stronger residential fees, services, and rental income in a sector supported by aging baby boomers. Analysts have responded with continued positive ratings while highlighting that long-term demand for senior housing, projected to grow steadily through 2033, could be a key support for Welltower’s expanding portfolio. We’ll now examine...

2025-12-16

The Longevity Shift: Healthcare REITs to Benefit From Global Aging

Description: WELL, VTR, CTRE and OHI are tapping the longevity economy as aging populations drive rising demand for senior housing, skilled nursing and long-term care real estate.

In a Volatile Market, Investors Should Consider These 3 REITs

Description: These investments combine high yields and low volatility.

2025-12-15

Welltower Stock Rallies 48.1% YTD: Will It Continue to Gain?

Description: WELL shares have risen 48% year to date as strong senior housing demand, outpatient growth, and portfolio restructuring drive cash flows and investor optimism.

2025-12-14

2025-12-13

2025-12-12

Host Hotels Announces Special Dividend: Time to Buy the Stock?

Description: HST boosts investment appeal with a 15 cents per share special dividend atop its regular payout, lifting the total 2025 dividend annualized yield of 5.24%.

2025-12-11

Assessing Welltower After a 53% Surge and Lofty Earnings Multiple in 2025

Description: If you have been wondering whether Welltower is still worth buying after its big run, you are not alone. That is exactly the question this breakdown aims to tackle. The stock has cooled slightly with a 5.4% dip over the last week and a flat 30-day return, but it is still up 53.2% year to date, 51.2% over 1 year, and more than tripled over 3 and 5 years. Behind those gains, investors have been reacting to Welltower's expanding senior housing footprint, new partnerships with leading operators,...

Reassessing Welltower (WELL) Valuation After Strong FFO Growth and Improving Senior Housing Demand

Description: Fresh reports on Welltower (WELL) highlight strong momentum in its core healthcare real estate business, as double digit gains in FFO and same store NOI, powered by improving senior housing demand, draw investors back to the stock. See our latest analysis for Welltower. That earnings momentum has not gone unnoticed, with the share price now at $191.07 and a powerful year to date share price return of 53.20%, supported by a standout five year total shareholder return of 228.39%. This signals...

2025-12-10

Zacks Industry Outlook Highlights Welltower, Prologis and Digital Realty Trust

Description: Improving demand, easing rate pressures and tech-driven property needs put Welltower, Prologis and Digital Realty in a stronger REIT spotlight.

2025-12-09

Top 3 Equity REITs Worth Buying as Industry Outlook Improves

Description: Welltower, Prologis and Digital Realty are set to gain from rising demand in healthcare, logistics and AI-ready data centers.

2025-12-08

2025-12-07

2025-12-06

2025-12-05

2025-12-04

2025-12-03

Morgan Stanley Notes Strong Supply-Demand Fundamentals in Senior Housing for Welltower (WELL)

Description: Welltower Inc. (NYSE:WELL) is included among the 15 Dividend Stocks that Outperform the S&P 500. On November 20, Morgan Stanley raised its price target on Welltower Inc. (NYSE:WELL) to $200 from $170 while maintaining an Overweight rating. The analyst cited strong third-quarter results and favorable supply-demand dynamics in senior housing, noting increased confidence in the […]

4 Reasons to Add Welltower Stock to Your Portfolio Right Now

Description: A rise in the senior citizen population and healthcare expenses, restructuring efforts and a healthy balance sheet are likely to support WELL.

2025-12-02

What Welltower (WELL)'s Double-Digit Revenue Growth Means for Shareholders

Description: In the past week, Welltower reported quarterly results highlighting a 36.4% year-over-year increase in residential fees and services revenues, alongside a 30.6% rise in total revenues, surpassing analyst expectations. Despite these stronger-than-expected financials, the company's shares experienced a pullback following the report, potentially reflecting investor reactions to earlier gains or profit-taking. To understand the impact of this recent revenue surge, we will now explore what it...

Wells Fargo Has a Bullish Outlook on Welltower (WELL)

Description: Welltower Inc. (NYSE:WELL) is one of the best dividend stocks in the real estate sector. On November 25, analyst John Kilichowski from Wells Fargo assigned a Buy recommendation on Welltower, along with a $218 price target. Separately, on October 27, the company reported that at the conclusion of Q3 2025, its net debt to enterprise […]

2025-12-01

Morgan Stanley’s Confidence Rises in American Healthcare REIT (AHR) Following Senior Housing Review

Description: American Healthcare REIT, Inc. (NYSE:AHR) is included among the 14 Best Up and Coming Dividend Stocks to Buy. On November 20, Morgan Stanley increased its price target on American Healthcare REIT, Inc. (NYSE:AHR) to $55 from $52, keeping an Overweight rating, according to a report by The Fly. After reviewing the company’s third-quarter numbers and […]

2025-11-30

Welltower Stock: Is WELL Outperforming the Real Estate Sector?

Description: Welltower has significantly outperformed the broader real estate sector over the past year, and analysts remain strongly bullish on the stock’s prospects.

2025-11-29

2025-11-28

3 Top REIT Dividend Stocks to Buy Right Now With $1,000 for Passive Income

Description: Don't overlook these REITs the next time you go stock shopping.

2025-11-27

2025-11-26

Why Is Welltower (WELL) Up 13.9% Since Last Earnings Report?

Description: Welltower (WELL) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

2025-11-20

2025-11-19

Evaluating Welltower (WELL): Does Recent Momentum Reflect Fair Value?

Description: Welltower (WELL) has been trading actively this month, with the stock showing steady gains of nearly 11% over the past month. Investors are watching to see how the company maintains momentum as ongoing sector developments unfold. See our latest analysis for Welltower. Welltower’s recent 10.8% 1-month share price return is part of a broader surge, as momentum has picked up impressively this year. Investors have enjoyed a 57.9% share price gain since January, while the total shareholder return...

2025-11-18

This Safe-and-Steady Dividend Stock Just Hit New All-Time Highs

Description: Welltower (WELL) is a $135 billion REIT focused on senior housing, healthcare, and outpatient facilities. Shares have strong technical momentum and are trading at a new all-time high. WELL stock is up 45% in the past year and over 50% in the year to date. Analyst sentiment is mostly positive,...

2025-11-17

Are You Looking for a Top Momentum Pick? Why Welltower (WELL) is a Great Choice

Description: Does Welltower (WELL) have what it takes to be a top stock pick for momentum investors? Let's find out.

Welltower Stock Rises 19.3% in 3 Months: Will It Continue to Gain?

Description: WELL's stock momentum is fueled by strong SHO demand, major U.K. acquisitions and ample liquidity amid aging demographics.

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

2025-11-11

2025-11-10

Are Wall Street Analysts Predicting Welltower Stock Will Climb or Sink?

Description: As Welltower has outperformed relative to the broader market over the past year, Wall Street analysts remain strongly optimistic about the stock’s prospects.

2025-11-09

2025-11-08

Why Welltower (WELL) Is Up 5.1% After Senior Housing Surge and Equity Offering Moves

Description: In the past week, Welltower Inc. completed a multi-billion dollar follow-on equity offering, made several key executive hires, and reported third-quarter 2025 earnings results showing higher revenues but lower net income year-over-year. Analyst coverage has focused on Welltower's sharpened pivot toward senior housing, with numerous upgrades and Buy reiterations reflecting confidence in the company's expanded investment and operational focus in this segment. We'll examine how Welltower’s...

2025-11-07

2025-11-06

Welltower Inc. (WELL) is a Buy on Senior Housing Focus and Strong Financial Performance: BMO Capital

Description: Welltower Inc. (NYSE:WELL) is one of the must-buy US stocks to buy now. On October 28, BMO Capital Markets analyst Juan Sanabria reiterated a Buy rating on Welltower Inc. (NYSE:WELL) stock and a $200 price target. The positive stance is in response to the company’s strong financial performance and strategic initiatives. The company delivered solid […]

2025-11-05

Top Research Reports for Tesla, BlackRock & Welltower

Description: Tesla sets delivery records but braces for weaker Q4 as tax credits expire and competition heats up.

2025-11-04

3 Reasons Growth Investors Will Love Welltower (WELL)

Description: Welltower (WELL) possesses solid growth attributes, which could help it handily outperform the market.

2025-11-03

2025-11-02

2025-11-01

2025-10-31

Medical Properties Q2 NFFO Misses Estimates, Revenues Rise Y/Y

Description: MPW's Q3 results show higher revenues but lower NFFO per share as interest expenses weigh on performance.

2025-10-30

Ventas Q3 FFO and Revenues Beat Estimates, Same-Store Cash NOI Rises

Description: VTR posts strong Q3 results with higher FFO and revenues, fueled by gains in senior housing and outpatient medical portfolios.

2025-10-29

2025-10-28

Welltower (WELL) Margin Miss Challenges High-Growth Narrative Despite Strong Forecasts

Description: Welltower (WELL) reported a net profit margin of 9.7%, down from 12.1% the previous year, and posted earnings growth of 4.9% over the past year, trailing its 5-year average annual growth rate of 9.4%. Looking ahead, revenue is forecast to grow at 14.5% per year and earnings at 24.4% per year, both outpacing US market averages. Despite recent margin compression and a premium price-to-earnings ratio of 128x, investor focus is now turning to whether this outlook justifies the stock’s above-fair...

Welltower's Q3 FFO & Revenues Beat Estimates, Same Store NOI Rises

Description: WELL's Q3 FFO outshines estimates, driven by a rise in revenues. Same Store NOI improves year over year.

Welltower Positioning for Sustained Growth With Portfolio Shift, UBS Says

Description: Welltower (WELL) is positioning its portfolio for "sustained elevated" growth by divesting 68% of it

Remedy Medical Properties and Kayne Anderson Acquire a Portfolio of Outpatient Medical Assets from Welltower

Description: Remedy Medical Properties ("Remedy") and Kayne Anderson Real Estate, together the nation's largest private owner of healthcare real estate, today announced the acquisition of a portfolio of outpatient medical (OM) assets from Welltower. The portfolio comprises approximately 18 million square feet across 296 properties in 34 states, and this acquisition establishes the Remedy and Kayne Anderson Real Estate partnership as the nation's largest owner of outpatient medical buildings, with more than 5

2025-10-27

Compared to Estimates, Welltower (WELL) Q3 Earnings: A Look at Key Metrics

Description: The headline numbers for Welltower (WELL) give insight into how the company performed in the quarter ended September 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Welltower (WELL) Surpasses Q3 FFO and Revenue Estimates

Description: Welltower (WELL) delivered FFO and revenue surprises of +3.08% and +1.36%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Welltower reports Q3 earnings, raises FFO guidance and lowers net income guidance

Description: Investing.com -- Welltower Inc (NYSE:WELL) reported third quarter normalized funds from operations (FFO) of $1.34 per share, representing a 20.7% increase from the same period last year, despite missing analyst expectations on earnings per share. The healthcare real estate investment trust’s shares dipped 0.7% in after-hours trading Monday.

Welltower: Q3 Earnings Snapshot

Description: The real estate investment trust, based in Toledo, Ohio, said it had funds from operations of $919.2 million, or $1.34 per share, in the period. The average estimate of five analysts surveyed by Zacks Investment Research was for funds from operations of $1.30 per share. Funds from operations is a closely watched measure in the REIT industry.

Welltower Issues Business Update

Description: Welltower® Inc. (NYSE: WELL) has issued the following business update which can be found at:

Welltower Announces a Transformative New Era to Maximize Long-Term Shareholder Returns

Description: Welltower Announces a Transformative New Era to Maximize Long-Term Shareholder Returns

Welltower Announces $23 Billion of Transactions and Intensified Focus on Seniors Housing to Amplify Long-Term Growth Profile

Description: Welltower Announces $23 Billion of Transactions and Intensified Focus on Seniors Housing to Amplify Long-Term Growth Profile

Welltower Reports Third Quarter 2025 Results

Description: Welltower Inc. (NYSE:WELL) today announced results for the quarter ended September 30, 2025.

2025-10-26

Big Tech earnings, a crucial Fed meeting, and a Trump-Xi sit-down: What to watch this week

Description: The market enters the fourth full week of the government shutdown with international trade and domestic rates in focus.

2025-10-25

How To Put $100 In Your Retirement Fund Each Month With Welltower Stock

Description: Welltower Inc. (NYSE:WELL) is a real estate investment trust that invests in healthcare and seniors housing infrastructure, including properties for seniors housing, post-acute care, and outpatient medical services. It will report its Q3 2025 earnings ...

2025-10-24

Big Tech earnings, Fed meeting, Trump & Xi meet: What to Watch

Description: Market Domination Overtime host Josh Lipton previews several of the biggest stories to come next week, including earnings results from Magnificent Seven companies Microsoft (MSFT), Amazon (AMZN), Apple (AAPL), Alphabet (GOOG, GOOGL), and Meta Platforms (META); Federal Reserve officials convening for their October FOMC meeting; and President Trump is meeting Chinese President Xi Jinping in South Korea as the government shutdown nears its fifth week. To watch more expert insights and analysis on the latest market action, check out more Market Domination Overtime.

Fed Rate Move, Apple Earnings, Trump-Xi Meeting: What to Watch Next Week

Description: Investors next week will tune into big-tech earnings and the first Federal Reserve meeting since the U.S. government shutdown began. Later in the week, President Trump is due to meet with Chinese leader Xi Jinping as trade tensions between the two economic giants simmer.

Healthpeak Q3 FFO Beats Estimates, Same-Store NOI Rises Y/Y

Description: DOC's third-quarter results reflect the continued strong performance of its high-quality outpatient medical and CCRC portfolios.

Digital Realty's Q3 Core FFO & Revenues Top Estimates, '25 View Raised

Description: DLR posts strong Q3 results and lifts its 2025 FFO outlook on robust leasing and rising enterprise demand.

2025-10-23

2025-10-22

Welltower Gears Up to Report Q3 Earnings: What's in the Cards?

Description: WELL's Q3 results are likely to shine on the increasing aging population and its healthcare expenditure, though high interest expenses could weigh on gains.

Welltower (WELL) Q3 Earnings Preview: What You Should Know Beyond the Headline Estimates

Description: Beyond analysts' top-and-bottom-line estimates for Welltower (WELL), evaluate projections for some of its key metrics to gain a better insight into how the business might have performed for the quarter ended September 2025.