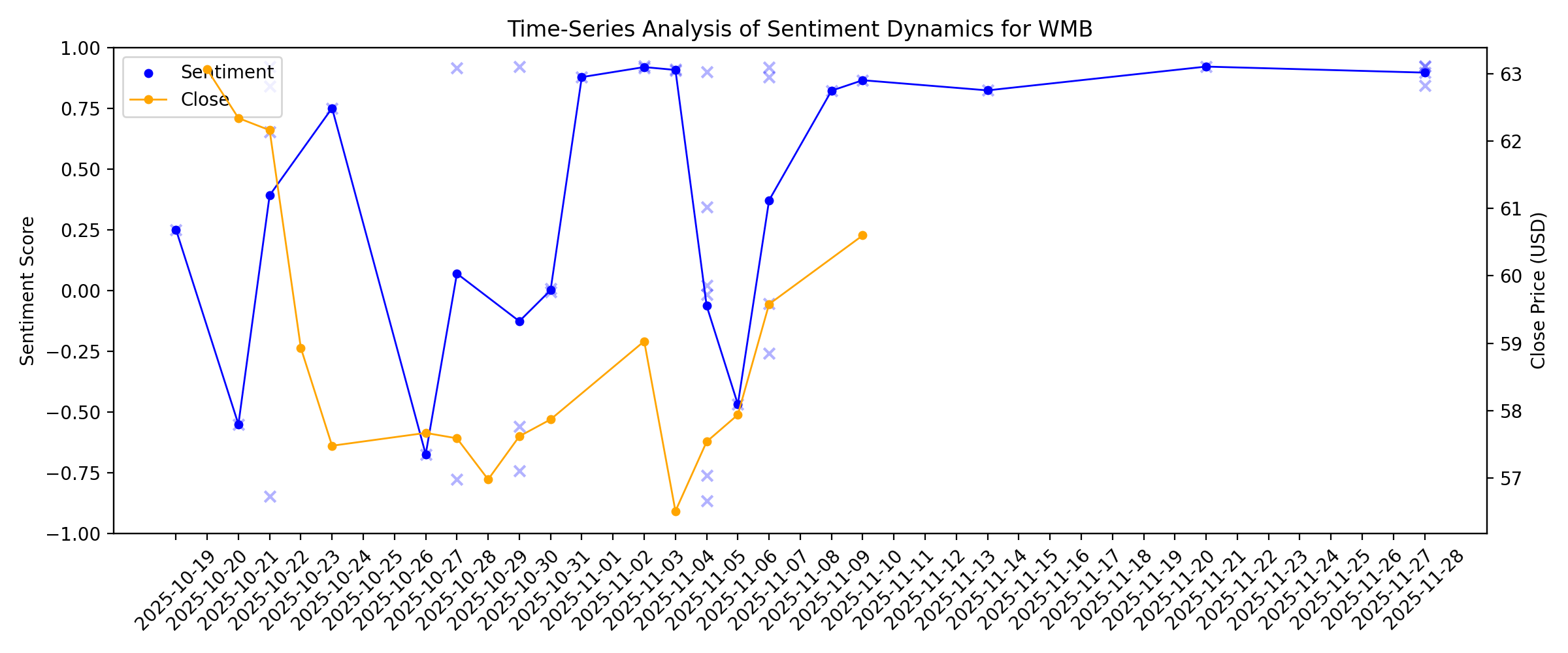

News sentiment analysis for WMB

Sentiment chart

2026-01-14

Is It Time To Reassess Williams Companies (WMB) After Strong Multi‑Year Share Gains?

Description: If you are wondering whether Williams Companies is reasonably priced at its current level, this article walks through what the numbers actually say about the stock's value. The shares most recently closed at US$60.49, with returns of 1.7% over the last 7 days, 1.3% over 30 days, a small year to date decline of 0.6%, and a 7.8% return over the past year, alongside very large gains over 3 and 5 years that are well above 7x over 5 years. Recent attention on Williams Companies has focused on its...

2026-01-13

How Lucrative is Enbridge's Dividend Yield Compared to the Industry?

Description: Enbridge's 5.9% dividend yield tops the midstream industry, backed by more than C$30B in secured projects and 31 straight years of dividend hikes.

2026-01-12

Is Natural Gas a Trade or a Trap After Hitting New Lows?

Description: WMB, LNG and CRK stand out as natural gas hits new lows, offering exposure to long-term growth amid short-term volatility.

2026-01-11

2026-01-10

2026-01-09

Prediction: Fidelity’s Energy ETF Goes Nuclear in 2026

Description: The Fidelity MSCI Energy Index ETF (NYSEARCA:FENY) started 2026 with a 2% gain in the first week. With $1.3 billion in assets and a 0.084% expense ratio, FENY offers pure-play exposure to U.S. energy companies, from oil majors like Exxon Mobil (NYSE:XOM) and Chevron (NYSE:CVX) to midstream giants like Williams Companies (NYSE:WMB). The fund’s 196% ... Prediction: Fidelity’s Energy ETF Goes Nuclear in 2026

Enbridge's Reliable Business Model Supports Attractive Dividend Growth

Description: ENB's fee-based midstream model drives stable earnings, billions in secured projects and a 5.94% yield, supporting projected dividend growth through 2026.

2026-01-08

2026-01-07

Should Williams’ $2.77 Billion Long-Dated Debt Deal Reshaping Its Balance Sheet Require Action From Williams (WMB) Investors?

Description: In early January 2026, Williams Companies completed a multi-tranche US$2.77 billion fixed-rate senior and subordinated unsecured notes offering across 2033, 2036, and 2056 maturities, with proceeds earmarked to refinance upcoming debt and for general corporate purposes. The mix of long-dated, callable debt and the decision to upsize existing 5.650% 2033 notes highlights Williams’ focus on extending its maturity profile while adding flexibility to support its large capital spending...

Williams Companies (WMB) Valuation Check After Recent Share Price Gain And Cooling Multi Year Momentum

Description: Williams Companies (WMB) has drawn fresh attention after recent trading left the stock with a 1 day return of about 1.5% and a past 3 months decline of roughly 4.3%. See our latest analysis for Williams Companies. The recent 1 day share price return of 1.5% at a share price of $60.39 comes against a softer trend over the past quarter, with a 90 day share price return of 4.3% and a year to date share price return of 0.8% decline. Longer term total shareholder returns of 10.8% over 1 year and...

2026-01-06

2 top stock picks within the energy sector for 2026

Description: The energy sector (XLE) is in focus after US President Trump oversaw the ousting of Venezuelan President Nicolás Maduro, opening up avenues for investment by energy giants to rebuild the country's oil infrastructure. Tortoise Capital Advisors senior portfolio manager and managing director Brian Kessens sits down with Market Domination Host Josh Lipton to share two of his top stock picks in the space: Williams Companies (WMB) and Energy Transfer (ET). To watch more expert insights and analysis on the latest market action, check out more Market Domination.

Passive Income Dividend Giants Dominate JP Morgan’s 2026 Energy Top Picks

Description: J.P. Morgan’s highest-yielding top pick energy stocks for 2026 have secular growth drivers, robust balance sheets, and exposure to transformative trends.

2026-01-05

Williams Prices $2.75 Billion of Senior Notes

Description: TULSA, Okla., January 06, 2026--Williams Prices $2.75 Billion of Senior Notes

Enbridge to Benefit From Rising Power Demand & Data Center Growth

Description: ENB is set to benefit as data center growth and rising power demand boost natural gas demand.

2026-01-04

2026-01-03

2026-01-02

Enterprise Products Well-Positioned to Withstand Inflation Pressures

Description: EPD secures predictable cash flow from inflation-protected contracts and projects like Athena and Mentone West 2, which will likely be operational by 2026-end.

ENB's Key Midstream Projects: A Catalyst for Incremental Cash Flows?

Description: Enbridge's more than C$30B in secured midstream projects could drive incremental cash flows and help sustain its long record of dividend growth.

2026-01-01

2025-12-31

TGS vs. WMB: Which Stock Is the Better Value Option?

Description: TGS vs. WMB: Which Stock Is the Better Value Option?

Enterprise Products Stays Resilient on Balance Sheet Strength

Description: EPD's diversified midstream assets, $3.6B liquidity and 4.7% borrowing cost support stable fee-based revenue and balance-sheet strength.

2025-12-30

Can Enterprise Products Weather the Ongoing Oil Price Softness?

Description: EPD's fee-based midstream model delivers stable revenues even as WTI crude trades below $60, shielding the company from oil price volatility.

2025-12-29

Natural Gas Outlook: Can Cold Weather Lift Prices in January 2026?

Description: Cold weather and steady LNG demand lift natural gas prices, putting WMB, LNG, and EE in focus for January 2026.

2025-12-28

2025-12-27

2025-12-26

2025-12-25

Does Williams Companies Still Offer Value After Strong Multi Year Share Price Gains?

Description: Wondering if Williams Companies at around $59 is still a smart buy or if most of the upside is gone? Here is a look at what the market might be pricing in and where the hidden value, or risk, could be lurking. The stock has edged up about 1.1% over the last week and is roughly flat over 30 days, but it is still up 6.4% year to date and 12.7% over the past year, with long term gains of 107.6% over three years and 281.5% over five years. Behind those moves, investors have been watching sector...

2025-12-24

2025-12-23

PSX, KMI Wrap Up Initial Open Season for Western Gateway Pipeline

Description: Phillips 66 and Kinder Morgan plan the Western Gateway Pipeline in response to strong demand, redirecting and upgrading existing lines to transport refined fuel from Texas to California.

Energy Transfer to Expand Transwestern Pipelines for Southwest Growth

Description: ET plans to widen Transwestern Desert Southwest pipes to 48 inches, lifting capacity to 2.3 Bcf/d to move Permian gas to Arizona and New Mexico.

2025-12-22

2025-12-21

2025-12-20

2025-12-19

2025-12-18

Why Enterprise Is Poised for Higher Discretionary Cash Flows in 2026

Description: EPD views 2026 as an inflection point as major projects wrap up, capex falls to $2-$2.5B and discretionary free cash flow rises.

2025-12-17

2025-12-16

Enterprise Products is Undervalued Now: Should You Bet on the Stock Now?

Description: EPD trades below peers on EV/EBITDA, but debt exposure and a lower yield suggest investors should not rush despite strong assets and cash flows.

2025-12-15

2025-12-14

2025-12-13

Reassessing Williams Companies (WMB) Valuation After a Recent Share Price Pullback

Description: Williams Companies (WMB) has quietly outperformed many energy peers over the past year, and with shares pulling back about 2% in the past week, investors are rechecking whether the recent dip improves the risk reward profile. See our latest analysis for Williams Companies. Despite the recent pullback in the share price to about $59.74 and a softer 7 day share price return, Williams still shows positive momentum, supported by rising earnings and a strong 1 year total shareholder return of...

2025-12-12

Here's Why Investors Should Keep an Eye on KMI, EPD, WMB Stocks

Description: Midstream players like Kinder Morgan, Enterprise Products and Williams offer predictable, fee-based cash flows, even as oil and gas prices fluctuate.

2025-12-11

Kinder Morgan Unveils Preliminary 2026 Guidance

Description: KMI projects 2026 gains with higher EBITDA, rising EPS and a dividend boost, underscoring its steady contract-backed midstream model.

EOG Resources Appoints John D. Chandler to Board of Directors

Description: EOG Resources, Inc. (EOG) today announced the appointment of John D. Chandler to its Board of Directors, effective December 10, 2025. Chandler served as Senior Vice President and Chief Financial Officer of The Williams Companies, Inc. (Williams), a publicly traded energy infrastructure provider focused on the gathering, processing, transportation and storage of natural gas, from 2017 until his retirement in 2022. Chandler also serves as a director of Matrix Services Company and LSB Industries, I

Here's Why Natural Gas Stocks are Well Poised to Gain: WMB, AR, CRK

Description: Rising EIA price forecasts and growing LNG demand are boosting prospects for natural gas players like WMB, AR and CRK.

2025-12-10

2025-12-09

3 Oil Pipeline Stocks With Solid Potential Amid Industry Strength

Description: Midstream players will secure additional cashflows from rising clean energy demand from data centers, which brightens the outlook for the Zacks Oil and Gas - Production and Pipelines industry. Some of the frontrunners in the industry are EPD, KMI and WMB.

2025-12-08

Inside Enterprise Products' Balance Sheet: Key Takeaways for Investors

Description: EPD's balance sheet shows lower debt exposure than peers, long-dated fixed-rate obligations, and a valuation below the industry average.

Why U.S. Natural Gas Prices Are Surging to Three-Year Highs

Description: CTRA, LNG, and WMB could benefit as U.S. natural gas futures soar past $5 on cold weather and record exports.

2025-12-07

2025-12-06

2025-12-05

2025-12-04

2025-12-03

Why Is The Williams Companies (WMB) Up 6.6% Since Last Earnings Report?

Description: The Williams Companies (WMB) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-12-02

How Is Williams Companies’ Stock Performance Compared to Other Oil & Gas Stocks?

Description: Williams Companies has outpaced its industry peers over the past year and analysts are fairly upbeat about its future prospects.

2025-12-01

2025-11-30

2025-11-29

2025-11-28

Williams Companies (WMB): Evaluating Whether This Energy Stock Remains Undervalued After Recent Momentum

Description: Williams Companies (WMB) has been drawing attention in recent weeks as investors continue to track its performance within the energy infrastructure sector. The stock’s returns over the past month have put it in focus for those evaluating steady names in natural gas and midstream operations. See our latest analysis for Williams Companies. Momentum around Williams Companies has steadily built this year, fueled by its role in essential energy infrastructure and solid execution despite broader...

The Bull Case For Williams Companies (WMB) Could Change Following Key Regulatory Wins for Major Northeast Projects

Description: Williams Companies recently announced it has secured key regulatory approvals for its Northeast Supply Enhancement project from New Jersey and New York authorities, and is also advancing development of the Constitution Pipeline in upstate New York, both intended to bolster natural gas supply and energy reliability in the region. This progress is expected to spur more than US$1 billion in new investment, generate thousands of regional jobs, and offer long-term energy benefits to users in the...

Williams Companies Rises on Infrastructure Buzz: What Recent Momentum Means for Investors

Description: Wondering if Williams Companies stock is a hidden bargain or fully priced? If you are curious about whether there is real value under the hood, you are in the right place. The stock has seen solid momentum lately, rising 1.0% in the last week and showing a 5.7% gain for the past month. This is in addition to a notable 245.9% return over the last five years. Recent headlines around major infrastructure investments and commitments to natural gas transportation have fueled renewed attention on...

Williams Companies (WMB) Gains Regulatory Approvals for NESE Project, TD Cowen Retains Buy Rating

Description: The Williams Companies, Inc. (NYSE:WMB) ranks among the 9 hot energy stocks to buy. On November 7, The Williams Companies, Inc. (NYSE:WMB) announced that it had obtained important regulatory licenses from New Jersey and New York environmental authorities for its Northeast Supply Enhancement (NESE) project. The NESE project aims to boost energy stability in New […]

2025-11-27

2025-11-26

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

Give Oil a Miss, Focus on Natural Gas Stocks: WMB, AR, CRK

Description: Williams, Antero and Comstock stand to benefit as EIA forecasts rising gas prices and cleaner-fuel demand outshines softer oil markets.

2025-11-20

2025-11-19

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

Why Risk-Averse Investors Should Keep an Eye on WMB, KMI, EPD

Description: WMB, KMI & EPD's midstream model offers predictable cash flows, making it a standout for risk-averse investors amid volatile energy markets.

2025-11-13

2025-11-12

2025-11-11

2025-11-10

Natural Gas Prices Warm Up 5% Amid Early Winter Forecasts

Description: WMB, LNG, and EE emerge as key stocks as early winter forecasts, LNG exports, and steady demand fuel a third straight weekly rally.

2025-11-09

Is Williams (WMB) Gaining an Edge With Northeast Supply Enhancement Pipeline Approval?

Description: Earlier this month, Williams Companies secured essential regulatory permits from New York and New Jersey for its Northeast Supply Enhancement pipeline, unlocking a critical phase in the project’s advancement. This milestone is expected to facilitate over US$1 billion in regional infrastructure investment while paving the way for lower emissions and greater energy reliability in New York City. With regulatory barriers now cleared for a major infrastructure expansion, we'll explore how this...

2025-11-08

2025-11-07

New York Approves a Controversial Pipeline. Energy Politics Are Changing.

Description: The project is an expansion of a natural-gas pipeline network that stretches from Texas to New York, carrying 15% of the nation’s natural gas.

Sector Update: Energy Stocks Gain Late Afternoon

Description: Energy stocks rose late Friday afternoon, with the NYSE Energy Sector Index climbing 1.7% and the En

New York’s Hochul Approves Permit for Controversial Gas Pipeline

Description: New York state on Friday approved a crucial permit for a natural gas pipeline project proposed by energy company Williams. The controversial project, known as the Northeast Supply Enhancement pipeline, would transport natural gas from Pennsylvania through New Jersey and serve customers in Brooklyn, Queens, and Long Island. New York Governor Kathy Hochul’s administration greenlit the pipeline despite opposition from environmental groups and elected officials who said it would lock in greenhouse gas emissions and further tether New Yorkers to fossil fuels.

Williams Secures Key Permits for Northeast Supply Enhancement Project

Description: TULSA, Okla., November 07, 2025--Williams Secures Key Permits on Northeast Supply Enhancement Project

2025-11-06

The Williams Companies, Inc. (NYSE:WMB) Third-Quarter Results Just Came Out: Here's What Analysts Are Forecasting For Next Year

Description: The Williams Companies, Inc. ( NYSE:WMB ) came out with its third-quarter results last week, and we wanted to see how...

2025-11-05

Williams’ Transco Prices Private Debt Issuance

Description: TULSA, Okla., November 05, 2025--Transcontinental Gas Pipe Line Company, LLC ("Transco"), a wholly owned subsidiary of Williams (NYSE: WMB), announced that it has priced its previously announced offering of senior notes.

Williams’ Transco Initiates Private Debt Issuance

Description: TULSA, Okla., November 05, 2025--Transcontinental Gas Pipe Line Company, LLC ("Transco"), a wholly owned subsidiary of Williams (NYSE: WMB), announced today that it is offering senior notes to certain institutional investors. The notes will be offered pursuant to certain exemptions from registration under the Securities Act of 1933, as amended (the "Securities Act").

Williams Q3 Earnings and Revenues Miss Estimates, Expenses Down Y/Y

Description: WMB expects 2025 growth capital expenditures to be between $3.95 billion and $4.25 billion, with a leverage ratio estimated at a midpoint of 3.7x.

Williams Companies Stock Outlook: Is Wall Street Bullish or Bearish?

Description: Williams Companies has underperformed the broader market over the past year, but analysts are cautiously optimistic about the stock’s prospects.

These 3 Beaten-Down Energy Stocks Could Have Further to Fall

Description: Weak oil prices are the least of their problems.

Williams Companies (WMB): Evaluating Valuation Following Strong Q3 Growth and Expansion Announcements

Description: Williams Companies (WMB) grabbed investors’ attention after posting its third-quarter earnings, which highlighted strong revenue growth, record adjusted EBITDA, and continued expansion of its natural gas operations and storage assets through acquisitions. See our latest analysis for Williams Companies. Williams Companies’ share price slipped 4.3% after earnings, largely reflecting cautious sentiment around rising costs and regulatory headwinds. However, its solid third-quarter results and...

2025-11-04

Williams Companies Inc (WMB) Q3 2025 Earnings Call Highlights: Strong EBITDA Growth and ...

Description: Williams Companies Inc (WMB) reports a 13% increase in adjusted EBITDA and outlines strategic initiatives to drive continued growth and innovation.

Examining Williams’ Valuation After Recent -8.5% Price Drop and Expansion Headlines

Description: Ever wondered whether Williams Companies stock is a hidden bargain or riding too high? Let's roll up our sleeves and dig into what the numbers and market trends are signaling. The stock has seen some impressive long-term growth with a 100.1% return over three years and 294.1% over five years. Even though it dipped -8.5% in the past month, it has been up 5.6% year-to-date. Recent headlines have put Williams Companies in the spotlight, from industry-wide movements in energy infrastructure to...

2025-11-03

Williams Posts Solid EBITDA Growth Despite Higher Costs

Description: U.S. pipeline operator delivers double-digit operating gains as Transco and Gulf volumes rise, reaffirming 2025 guidance.

Williams Delivers Strong Third-Quarter 2025 Results

Description: TULSA, Okla., November 03, 2025--Williams Reports Strong Third Quarter 2025 Financial Results

2025-11-02

2025-11-01

Why The Narrative Around Williams Companies Is Evolving With Recent Analyst Upgrades and Industry Growth

Description: The consensus analyst price target for Williams Companies stock has inched upward, rising from $66.85 to $67.22 per share based on the latest research coverage. This modest increase comes as analysts strike a broadly optimistic tone. They underscore prospects for continued share price growth given anticipated long-term expansion and strong sector positioning. Stay tuned to find out how you can track ongoing updates to the Williams Companies investment narrative as market dynamics evolve. Stay...

2025-10-31

MPLX to Report Q3 Earnings: Here's What Investors Should Know

Description: MPLX's Q3 results are expected to face pressure over reduced volumes, likely due to sluggish production growth in key basins.

Vertiv and Lennar Corporation have been highlighted as Zacks Bull and Bear of the Day

Description: Zacks names Vertiv Holdings as its Bull of the Day for its dominant AI infrastructure, while homebuilder Lennar earns the Bear of the Day tag amid slowing demand and falling margins.

2025-10-30

Pembina Pipeline (PBA) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Description: Pembina Pipeline (PBA) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Curious about The Williams Companies (WMB) Q3 Performance? Explore Wall Street Estimates for Key Metrics

Description: Looking beyond Wall Street's top-and-bottom-line estimate forecasts for The Williams Companies (WMB), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended September 2025.

3 Energy Stocks Poised to Outshine Earnings Estimates in Q3

Description: Comstock, Williams and Marathon Petroleum are positioned to deliver upbeat Q3 earnings amid a favorable energy price backdrop.

2025-10-29

2025-10-28

Williams to Report Q3 Earnings: What Surprise Awaits Investors?

Description: WMB gears up to release Q3 earnings with upbeat forecasts driven by strong Transco growth despite cost pressures ahead.

Williams Announces Quarterly Cash Dividend

Description: TULSA, Okla., October 28, 2025--Williams announces quarterly cash dividend

2025-10-27

Williams Companies, Inc. (The) (WMB) Reports Next Week: Wall Street Expects Earnings Growth

Description: The Williams Companies (WMB) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2025-10-26

2025-10-25

2025-10-24

Does Williams (WMB) See Expanding LNG Infrastructure as the Key to Long-Term Growth?

Description: Woodside Energy recently announced that Williams Companies will invest in the US$17.5 billion Louisiana LNG project, while Williams also agreed to acquire a substantial stake and operational role in Driftwood Pipeline LLC and sell a minority interest in South Mansfield upstream to JERA. These transactions reinforce Williams Companies’ ambition to expand its integrated natural gas infrastructure footprint amid accelerating US and global LNG demand and highlight its continued emphasis on...

2025-10-23

2025-10-22

Woodside Energy Would Like at Least One More Partner for Louisiana LNG

Description: Woodside Energy signaled a major investment by U.S.-based Williams Cos. in Louisiana LNG likely won’t be its last sale of equity in the $17.5 billion project.

Williams Accelerates Wellhead to Water Strategy with Upstream Asset Divestiture and Strategic LNG Partnership

Description: TULSA, Okla., October 22, 2025--Williams (NYSE: WMB) announced today a series of transactions that strengthens the company’s wellhead to water strategy.

Meet the Little-Known Dividend Growth Stock That Has Skyrocketed 80% Higher Since 2022

Description: Williams has been a very reliable dividend stock.

Williams Companies’ Quarterly Earnings Preview: What You Need to Know

Description: Williams Companies is gearing up to unveil its third-quarter results in the upcoming weeks, and analysts expect a solid double-digit surge in earnings.

2025-10-21

These 2 Oils-Energy Stocks Could Beat Earnings: Why They Should Be on Your Radar

Description: Finding stocks expected to beat quarterly earnings estimates becomes an easier task with our Zacks Earnings ESP.

2025-10-20

2025-10-19

The Williams Companies, Inc. (WMB) Plots $3.1B Investment to Bolster Power Generation

Description: The Williams Companies, Inc. (NYSE:WMB) is one of the most profitable energy stocks to buy right now. On October 1, the company announced plans to invest $3.1 billion to enhance its power generation capacity. The transaction is expected to close in the first half of 2027. The push is part of the energy giant’s bid […]