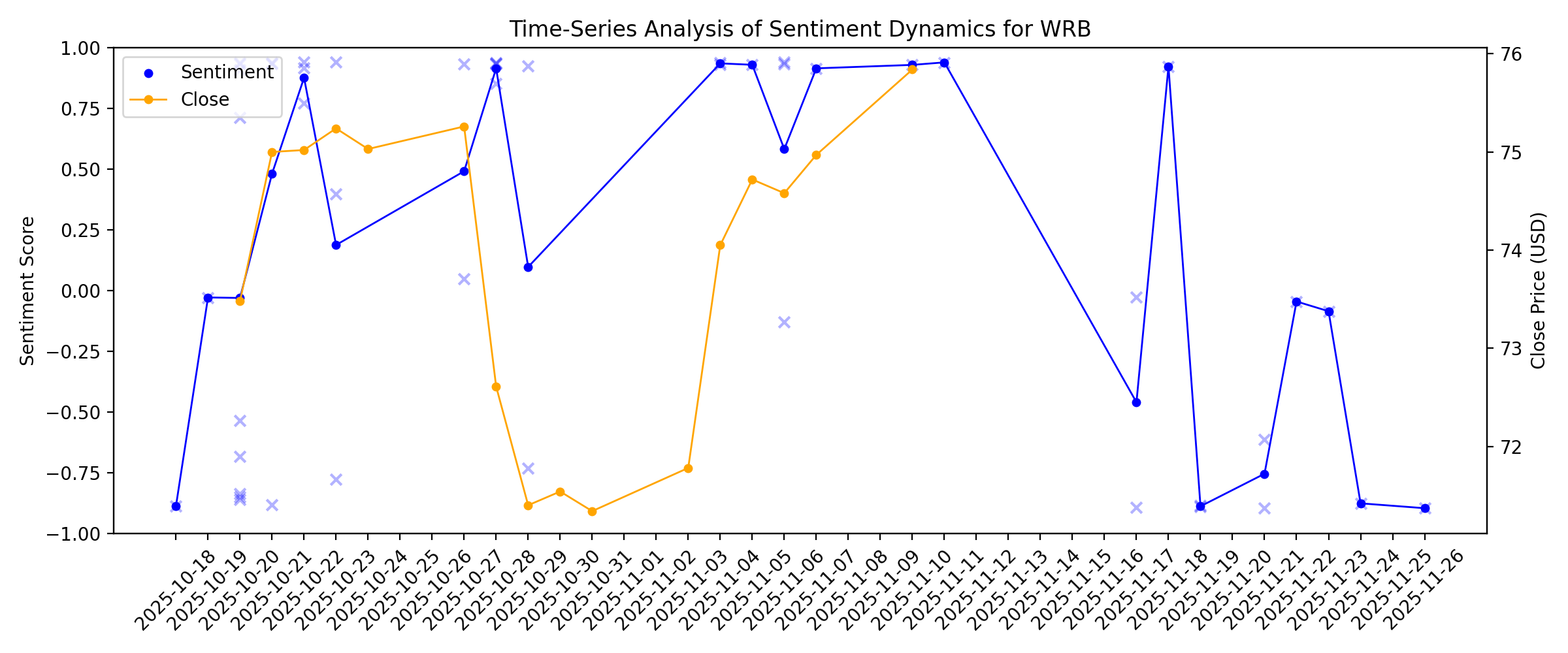

News sentiment analysis for WRB

Sentiment chart

2026-01-14

Warby Parker (WRBY) Soars 9.4% on Strong AI Glasses Demand

Description: We recently published 10 Stocks Leaving Wall Street in the Dust; 4 Hit Fresh Records. Warby Parker Inc. (NYSE:WRBY) was one of the top performers on Tuesday. Warby Parker bounced back by 9.44 percent on Tuesday to close at $29.09 apiece, as news of strong demand for artificial intelligence glasses spilled over to its stock. […]

2026-01-13

Mitsui Sumitomo Continues to Build WR Berkley Stake

Description: W.R. Berkley and Navan have just seen some huge insider purchases. have seen some huge insider purchases, and there were some other notable insider purchases as well.

2026-01-12

2026-01-11

2026-01-10

2026-01-09

How Recent Analyst Shifts Are Rewriting The Story For W. R. Berkley (WRB)

Description: W. R. Berkley has just seen its fair value estimate nudged from US$74.20 to US$73.06, a small adjustment that still reflects a market wrestling with mixed research views and questions about how earnings might hold up into 2026 and 2027. The discount rate assumption sits effectively unchanged at about 6.96%, while revenue is now modelled for a 0.68% decline compared with a 0.63% decline previously, echoing concerns around softer sales trends and a more cautious stance from some analysts. As...

ACGL Outperforms Industry, Trades Near 52-Week High: Time to Hold?

Description: Arch Capital is poised to gain from new business opportunities, rate increases, solid premium growth and effective capital deployment.

2026-01-08

W. R. Berkley Corporation Increases Share Repurchase Authorization

Description: GREENWICH, Conn., January 08, 2026--W. R. Berkley Corporation (NYSE: WRB) announced today that its Board of Directors has increased the Company's share repurchase authorization to 25 million shares of common stock. The Company’s focus continues to be on delivering value to shareholders through building book value as well as returning excess capital to shareholders through a variety of available methods. Repurchases may be made by the Company from time to time at prevailing prices in the open mar

2026-01-07

Billionaires Start 2026 With Huge Insider Buys

Description: Under Armour, W.R. Berkley, and Gabelli Healthcare & WellnessRx Trust have seen some huge insider purchases, and there were some other notable insider purchases as well.

2026-01-06

W. R. Berkley Corporation to Announce Fourth Quarter and Full Year 2025 Earnings on January 26, 2026

Description: GREENWICH, Conn., January 06, 2026--W. R. Berkley Corporation (NYSE: WRB) will release its fourth quarter and full year 2025 earnings after the market closes on Monday, January 26, 2026. A copy of the earnings release will be available on the Company’s website at www.berkley.com.

2026-01-05

A Look At W. R. Berkley (WRB) Valuation After Recent 90 Day Share Price Pullback

Description: Recent return profile and business scale W. R. Berkley (WRB) has seen mixed share-price moves recently, with a 1 day return of 1.08% and a 7 day return of 2.02%, while the past 3 months show a 10.81% decline. Over longer horizons, the stock shows a 1 year total return of 24.46%, a 3 year total return of 54.29% and a 5 year total return of 164.92%. The last close was US$69.36. The company reports annual revenue of US$14.65b and net income of US$1.91b, reflecting a sizeable footprint across its...

2026-01-04

2026-01-03

2026-01-02

RLI Stock Moves Above 50 Day SMA: Buy, Sell or Stay Invested?

Description: RLI climbs above its 50-day SMA as strong underwriting, product diversity and dividends support long-term appeal.

W. R. Berkley Corporation Announces Executive Appointments

Description: GREENWICH, Conn., January 02, 2026--W. R. Berkley Corporation (NYSE: WRB) today announced that Lee Iannarone has been named executive vice president. He is succeeded by Stephen Kennedy, who has been named senior vice president and general counsel. The appointments are effective immediately.

2026-01-01

2025-12-31

2025-12-30

CHAMP Titles Raises $55 Million In Largest Funding Round To Date

Description: CLEVELAND, December 30, 2025--CHAMP Titles, Inc. ("CHAMP"), the nation’s leading provider of digital solutions to motor vehicle agencies, announced today that it has raised $55 million in new financing, surpassing all previous rounds and marking the company’s largest raise to date. The round was led by W. R. Berkley Corporation, Point72 Ventures, and ORIX Corporation USA, with participation from other existing investors as well. CHAMP’s total funding now exceeds $100 million, reflecting strong a

The Biggest IPO of the Year Prompts Huge Insider Buy

Description: Kodiak Sciences, Medline, and W.R. Berkley have seen some huge insider purchases, and there were some other notable insider purchases as well..

2025-12-29

W. R. Berkley Corporation Names Erin Rotz President of Berkley Fire & Marine

Description: GREENWICH, Conn., December 29, 2025--W. R. Berkley Corporation (NYSE: WRB) today announced the appointment of Erin Rotz as president of Berkley Fire & Marine. The appointment is effective immediately.

2025-12-28

2025-12-27

2025-12-26

PLMR Stock Outperforms Industry: What Should Investors Do Now?

Description: Palomar Holdings rides on a fee-based PLMR-FRONT platform, premium growth, rising investment income and risk transfer strategy.

CINF Outperforms Industry, Trades Near 52-Week High: Time to Hold?

Description: Cincinnati Financial stock gains from new business-written premiums, an agent-focused business model, improved interest income, and effective capital deployment.

2025-12-25

2025-12-24

What to Expect From W. R. Berkley’s Next Quarterly Earnings Report

Description: W. R. Berkley is all set to release its fiscal fourth-quarter earnings soon, and analysts project a marginal earnings drop.

2025-12-23

2025-12-22

2025-12-21

2025-12-20

2025-12-19

2025-12-18

2025-12-17

2025-12-16

2025-12-15

2025-12-14

Assessing W. R. Berkley’s valuation after its latest 1 per share special dividend announcement

Description: W. R. Berkley (WRB) just caught investors’ attention with a fresh 1 dollar per share special dividend, capping 2025 special payouts at 1.50 dollars and underscoring management confidence in the insurer’s cash generation. See our latest analysis for W. R. Berkley. The new special dividend lands as W. R. Berkley’s share price hovers around 69.33 dollars after a choppy few months. A solid year to date share price return and strong multi year total shareholder returns suggest momentum is cooling,...

2025-12-13

2025-12-12

CB Stock Near 52-Week High, Outperforms Industry: Time to Hold?

Description: Chubb Limited fuels growth with global middle-market expansion, strategic M&A, strong premiums, and a solid capital position despite catastrophe risk.

2025-12-11

Is W. R. Berkley Stock Underperforming the Nasdaq?

Description: WRB continues to lag the Nasdaq’s stronger gains, yet analysts maintain a measured stance on its longer-term prospects.

2025-12-10

2025-12-09

R. Berkley Corporation (WRB): A Bull Case Theory

Description: We came across a bullish thesis on W. R. Berkley Corporation on Pacific Northwest Edge’s Substack by David. In this article, we will summarize the bulls’ thesis on WRB. W. R. Berkley Corporation’s share was trading at $72.98 as of December 1st. WRB’s trailing and forward P/E were 15.33 and 15.36 respectively according to Yahoo Finance. W.R. Berkley Corp. […]

2025-12-08

Mitsui Sumitomo acquires 12.5% stake in W. R. Berkley

Description: This move follows the Japanese company’s agreements with the Berkley Family, which includes a company and trusts owned by Berkley family members.

2025-12-07

WR Berkley (WRB) Falls 14% on Profit-Taking, Investors Digest Mitsui Stake Acquisition

Description: We recently published December Disappointments: 10 Big Names Troubled Early. WR Berkley Corp. (NYSE:WRB) is one of the worst performers of last week. WR Berkley fell by 14.12 percent in the past five trading days of the month as investors resorted to profit-taking following the week prior’s surge, while in a wait-and-see mode for more […]

2025-12-06

Assessing W. R. Berkley After 14.1% Pullback and Specialty Insurance Expansion in 2025

Description: If you are wondering whether W. R. Berkley is attractively priced after its recent run, you are not alone. This article is designed to unpack what the current share price really implies. The stock has pulled back sharply in the short term, down 14.1% over the last week and 10.7% over the last month. Yet it is still up 15.0% year to date and 157.4% over five years, which hints that the recent drop might say more about market sentiment than long term fundamentals. Recent headlines have...

2025-12-05

W. R. Berkley Corporation Declares Special and Regular Quarterly Cash Dividends

Description: GREENWICH, Conn., December 05, 2025--W. R. Berkley Corporation (NYSE: WRB) announced today that its Board of Directors declared a special cash dividend on its common stock of $1.00 per share to be paid on December 29, 2025 to stockholders of record at the close of business on December 15, 2025. Together with the 50 cents per share special dividend that was paid on June 30, 2025, this will bring special cash dividends paid during 2025 to $1.50 per share.

US Equity Indexes Rise as Fed's Preferred Inflation Gauge Slips, Michigan Price Pressures Growth Outlook Declines

Description: US equity indexes rose in midday trading on Friday as the Federal Reserve's preferred measure for un

W. R. Berkley Corporation Has Been Informed That Mitsui Sumitomo Insurance Co. Has Acquired Beneficial Ownership of At Least 12.5% of the Company’s Shares Pursuant to Previously Announced Agreements with the Berkley Family

Description: GREENWICH, Conn., December 05, 2025--W. R. Berkley Corporation (NYSE: WRB) (the "Company") today announced that the Company has been informed by representatives of Mitsui Sumitomo Insurance Co., Ltd. ("MSI"), a leading Japanese property and casualty insurance carrier, that MSI has acquired beneficial ownership of at least 12.5% of the Company’s outstanding common stock (the "Common Stock") pursuant to MSI’s previously announced agreements with a company owned by members of the Berkley family and

2025-12-04

2025-12-03

2025-12-02

2025-12-01

2025-11-30

2025-11-29

2025-11-28

2025-11-27

2025-11-26

Why Is Arch Capital (ACGL) Up 10.5% Since Last Earnings Report?

Description: Arch Capital (ACGL) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-11-25

2025-11-24

Some Insurers Don’t Want to Cover AI’s Errors

Description: As businesses hustle to incorporate artificial intelligence in everything they do, their insurances want to part of it.

2025-11-23

AI is too risky to insure, say people whose job is insuring risk

Description: Major insurers including AIG, Great American, and WR Berkley are asking U.S. regulators for permission to exclude AI-related liabilities from corporate policies. One underwriter describes the AI models’ outputs to the FT as "too much of a black box."

2025-11-22

How the Narrative Around W. R. Berkley Is Shifting After Recent Analyst Updates

Description: W. R. Berkley shares have come under renewed analyst scrutiny following a minor decrease in the consensus price target, which edged down from $74.47 to $74.20. This adjustment reflects a combination of optimism regarding sector stability and caution driven by evolving industry challenges. Read on to discover how the evolving landscape is shaping analyst perspectives and how you can stay informed as the narrative continues to shift. Stay updated as the Fair Value for W. R. Berkley shifts by...

2025-11-21

Why Is First American Financial (FAF) Down 1.3% Since Last Earnings Report?

Description: First American Financial (FAF) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2 Mid-Cap Stocks with Impressive Fundamentals and 1 Facing Challenges

Description: Many investors pay attention to mid-cap stocks because they have established business models and expansive market opportunities. However, their paths to becoming $100 billion corporations are ripe with competition, ranging from giants with vast resources to agile upstarts eager to disrupt the status quo.

2025-11-20

2025-11-19

ALL or WRB: Which Is the Better Value Stock Right Now?

Description: ALL vs. WRB: Which Stock Is the Better Value Option?

W.R. Berkley (WRB) Up 3.3% Since Last Earnings Report: Can It Continue?

Description: W.R. Berkley (WRB) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

2025-11-18

W. R. Berkley (WRB): Exploring Valuation After a Recent Series of Steady Share Price Gains

Description: W. R. Berkley (WRB) stock has drawn attention after seeing steady gains through the past month, rising about 5%. Investors are likely weighing the company's recent results and overall industry trends as they consider its valuation. See our latest analysis for W. R. Berkley. W. R. Berkley’s latest 1-day share price return of 0.52% adds to a streak of steady gains, with the stock now up 33.6% year-to-date. This growing momentum builds on a strong track record, as the company’s 1-year total...

2025-11-17

W. R. Berkley Corporation Names Hale Johnston President of Berkley Net

Description: GREENWICH, Conn., November 17, 2025--W. R. Berkley Corporation (NYSE: WRB) today announced the appointment of Hale Johnston as president of Berkley Net, a Berkley company. The appointment is effective immediately. He succeeds Brian Douglas, who joined Berkley Net in 2006 and served as its president since 2018. Mr. Douglas will remain a key member of the W. R. Berkley Corporation team.

W. R. Berkley Stock Outlook: Is Wall Street Bullish or Bearish?

Description: W. R. Berkley has outperformed the broader market over the past year, but analysts are cautious about the stock’s prospects.

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

2025-11-11

WRB Stock Near 52-Week High: A Signal for Investors to Hold Tight?

Description: W.R. Berkley stock gains from higher premiums, lower claims frequency in certain lines of business, effective capital deployment and sufficient liquidity.

2025-11-10

TRV Outperforms Industry, Trades at Premium: Should You Buy the Stock?

Description: Travelers' momentum in renewal rate improvements, steady earnings growth, strong returns, and upbeat analyst sentiment are likely to sustain its earnings growth.

2025-11-09

2025-11-08

2025-11-07

PGR vs. WRB: Which P&C Insurance Stock is a Smarter Investment?

Description: Progressive's higher ROE and stronger growth outlook give it a slight edge over W.R. Berkley in the expanding P&C insurance market.

2025-11-06

How Recent Analyst Shifts Are Reshaping the Story for W. R. Berkley

Description: W. R. Berkley’s consensus analyst price target has slipped slightly, shifting from $74.80 to $74.47. This modest change reflects a recent blend of optimism because of sector stability, as well as caution resulting from execution challenges and mixed earnings. Stay tuned to discover how you can stay informed on these evolving analyst perspectives and what they could mean for investors going forward. Stay updated as the Fair Value for W. R. Berkley shifts by adding it to your watchlist or...

MetLife Q3 Earnings Beat Estimates on Lower Costs, Asia Unit Strength

Description: MET beats Q3 EPS estimates and rose 21% year over year as strong Asia results, attributable to higher volumes, and lower expenses offset Latin America tax hit.

American Financial Q3 Earnings Beat on Higher Underwriting Show

Description: AFG's Q3 results reflect increased average renewal pricing, lower catastrophe losses, and improved net investment income, offset by lower premiums.

2025-11-05

Berkshire Hathaway Q3 Earnings Beat, Revenues Miss, Both Rise Y/Y

Description: Berkshire Hathaway posts a 33.8% surge in Q3 operating earnings, driven by strong insurance and retail gains despite a slight revenue miss.

2025-11-04

EverQuote Q3 Earnings & Revenues Top, Automotive Revenues Rise Y/Y

Description: EverQuote's strong Q3 beat on earnings and revenues is powered by double-digit growth in the Automotive and Home insurance segments.

CNA Financial Q3 Earnings Beat Estimates on Solid Underwriting

Description: CNA's Q3 results reflect improved investment income, increased renewal premium change, and higher underwriting income, partly offset by escalating expenses.

2025-11-03

2025-11-02

2025-11-01

2025-10-31

2025-10-30

2025-10-29

RNR Q3 Earnings Beat on Lower Expenses, Strong Underwriting Results

Description: RenaissanceRe's Q3 earnings surge 53% YoY, fueled by reduced net claims and claim expenses and improved underwriting income in the Property unit, partly offset by a decline in gross premiums written.

2 Profitable Stocks to Target This Week and 1 We Question

Description: Not all profitable companies are built to last - some rely on outdated models or unsustainable advantages. Just because a business is in the green today doesn’t mean it will thrive tomorrow.

2025-10-28

Arch Capital Q3 Earnings Beat, Revenues Miss Estimates

Description: Arch Capital's strong underwriting and investment gains drive Q3 earnings beat, even as revenues narrowly miss estimates.

Cincinnati Financial Q3 Earnings and Revenues Top, Premiums Rise Y/Y

Description: Cincinnati Financial's Q3 profit doubles as strong premium growth, pricing gains and higher investment income lift results.

Brown & Brown Q3 Earnings & Revenues Beat Estimates, Dividend Raised

Description: BRO's Q3 results reflect increased organic revenues, higher commission and fees, and expanded EBITDAC margin, offset by higher expenses.

Principal Financial Q3 Earnings & Revenues Lag Estimates, Dividend Up

Description: PFG's Q3 results reflect solid performance across most of the segments, offset by higher expenses.

2025-10-27

W. R. Berkley (WRB): Exploring Valuation After Recent 10% Share Price Gain

Description: W. R. Berkley (WRB) has seen its stock edge up recently, drawing attention from investors looking for steady performance in the insurance sector. Over the past three months, shares have gained nearly 10%, which reflects solid market momentum. See our latest analysis for W. R. Berkley. Zooming out, W. R. Berkley’s share price has delivered impressive momentum with a nearly 30% gain year-to-date and a one-year total shareholder return above 31%. This performance suggests investors are starting...

The Top 5 Analyst Questions From W. R. Berkley’s Q3 Earnings Call

Description: W. R. Berkley’s third quarter results outpaced Wall Street’s revenue expectations, but the market response was negative, reflecting investor caution around evolving industry dynamics. Management attributed the company’s performance to disciplined rate-taking, selective underwriting, and growth in specialty lines, particularly in personal lines and accident and health. CEO Rob Berkley emphasized the company’s focus on rate adequacy and risk-adjusted returns over top-line growth, noting, “We are i

2025-10-26

2025-10-25

2025-10-24

2025-10-23

FAF Q3 Earnings Top on Solid Investment Income, Dividend Raised

Description: First American's third-quarter results reflect higher premiums, improved net investment income, expanded pretax margin, and a declining claim loss rate.

Globe Life Q3 Earnings Beat Estimates on Solid Underwriting

Description: GL's third-quarter results reflect higher Life and Health insurance premiums, improved insurance underwriting income, and lower expenses.

SRL Assigns Continuity Opinions to Lloyd’s Syndicates (Arch, Aspen, Axis, Hamilton, Lancashire, RenRe, Tokio Marine HCC, White Mountains, WR Berkley)

Description: LONDON, Oct. 23, 2025 (GLOBE NEWSWIRE) -- Syndicate Research Limited (SRL) has assigned Continuity Opinions (SCOs) to the following Lloyd’s syndicates, reflecting SRL's view of relative performance and continuity prospects for the syndicates over the insurance cycle. SRL commented that following these actions SCOs have now been assigned to 77% of Lloyd’s market capacity and scorecard indicators to 92% of market capacity; research is issued on all trading syndicates. SRL stated that the main SCO

2025-10-22

How Recent Developments Are Rewriting the Story for W. R. Berkley

Description: W. R. Berkley’s stock price target has recently inched higher, with the consensus analyst estimate moving from $73.53 to $74.80. This moderate increase suggests that many analysts remain cautiously optimistic about the insurance company’s outlook, even as mixed opinions persist across the market. Stay tuned to learn how you can keep up with ongoing shifts in the narrative surrounding W. R. Berkley’s prospects. What Wall Street Has Been Saying Analyst coverage of W. R. Berkley offers a...

Chubb Limited Q3 Earnings & Revenues Beat Estimates, Premiums Rise Y/Y

Description: CB's Q3 results reflect strong performance across most of the segments, solid underwriting income, and a lower level of catastrophe.

W. R. Berkley (WRB): Earnings Growth Surpasses 5-Year Trend, Challenging Cautious Sentiment

Description: W. R. Berkley (WRB) reported standout earnings with profits climbing 20.8% in the latest year, handily outpacing its five-year annual average of 19% growth. Net profit margins improved to 13% from 12% a year ago, while the stock trades at $75 per share, which is well below a discounted cash flow fair value estimate of $120.09. This suggests a potentially compelling valuation. With robust earnings quality and improved operational efficiency, the results offer reasons for optimism amid a...

2025-10-21

RLI's Q3 Earnings, Revenues Beat Estimates on Solid Underwriting

Description: RLI posts strong Q3 numbers, with earnings and revenues beating estimates, fueled by solid underwriting and investment income growth.

W.R. Berkley Q3 Earnings, Revenues Top on Solid Underwriting

Description: W.R. Berkley posts strong Q3 results as underwriting and investment income power an 18% earnings jump and a revenue beat.

WRB Q3 Deep Dive: Specialty Focus Supports Margins Amid Market Competition

Description: Property casualty insurer W. R. Berkley (NYSE:WRB) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 10.8% year on year to $3.77 billion. Its non-GAAP profit of $1.10 per share was in line with analysts’ consensus estimates.

W.R. Berkley (WRB) is a Top-Ranked Momentum Stock: Should You Buy?

Description: Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

2025-10-20

WR Berkley Corp (WRB) Q3 2025 Earnings Call Highlights: Strong Financial Performance Amid ...

Description: WR Berkley Corp (WRB) reports robust growth in net income and investment income, while navigating industry headwinds and catastrophe losses.

Compared to Estimates, W.R. Berkley (WRB) Q3 Earnings: A Look at Key Metrics

Description: The headline numbers for W.R. Berkley (WRB) give insight into how the company performed in the quarter ended September 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

W.R. Berkley (WRB) Q3 Earnings and Revenues Surpass Estimates

Description: W.R. Berkley (WRB) delivered earnings and revenue surprises of +2.80% and +0.42%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

W.R. Berkley: Q3 Earnings Snapshot

Description: GREENWICH, Conn. AP) — W.R. Berkley Corp. WRB) on Monday reported third-quarter earnings of $511 million.

W. R. Berkley (NYSE:WRB) Surprises With Q3 Sales

Description: Property casualty insurer W. R. Berkley (NYSE:WRB) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 10.8% year on year to $3.77 billion. Its non-GAAP profit of $1.10 per share was in line with analysts’ consensus estimates.

W. R. Berkley Corporation Reports Third Quarter 2025 Results

Description: W. R. Berkley Corporation (NYSE: WRB) today reported its third quarter 2025 results.

Wall Street Set to Open Higher Monday as Investors Look Ahead to a Week of Earnings Reports

Description: US stocks look set to open higher in Monday's trading session ahead of a raft of earnings coming out

Stocks Rise Pre-Bell as Traders Await Earnings, Key Inflation Data; AWS-Linked Internet Outage Impacts Major Websites

Description: The benchmark US stock measures were tracking in the green before the opening bell Monday as investo

How Slower Revenue Growth but Higher EPS Expectations at W. R. Berkley (WRB) Has Changed Its Investment Story

Description: W. R. Berkley announced its third-quarter earnings on Monday, with analysts expecting revenue to grow by 9% year over year to US$3.71 billion, although this represents a slowdown from the prior year’s pace. An interesting insight is that analysts project earnings per share to increase even as revenue growth moderates, highlighting the company’s profitability focus amidst an uncertain outlook driven by potential trade policy changes and corporate tax discussions. We’ll examine how the...

2025-10-19

Tesla, Netflix set to report earnings as US-China trade fight turns 'unsustainable': What to watch this week

Description: As investors enters shutdown week three, a US-China trade war, credit gesticulation, and an incoming oil glut are weighing on the market.

2025-10-18

W. R. Berkley (WRB) Q3 Earnings Report Preview: What To Look For

Description: Property casualty insurer W. R. Berkley (NYSE:WRB) will be reporting earnings this Monday after market hours. Here’s what to expect.