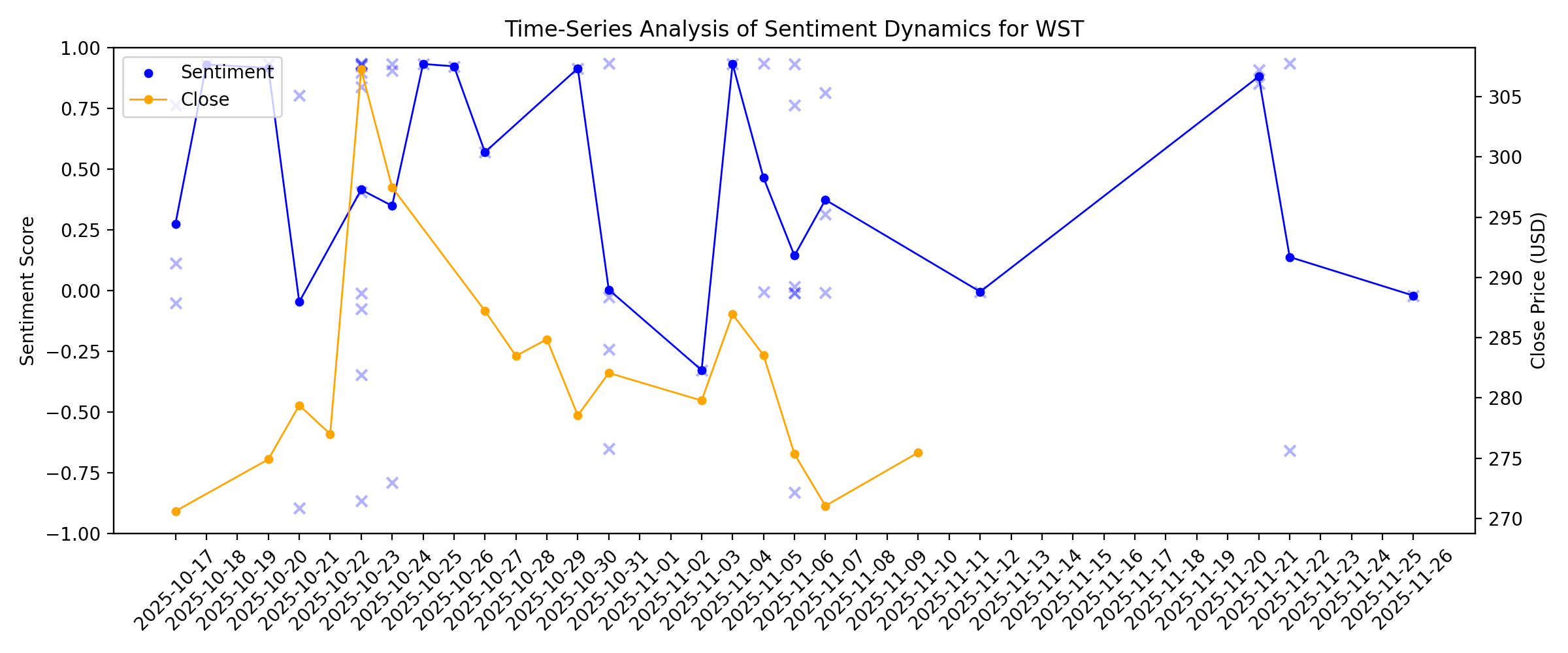

News sentiment analysis for WST

Sentiment chart

2026-01-14

Reasons to Add West Pharmaceutical Stock to Your Portfolio Now

Description: WST is riding on surging GLP-1 demand and HVP expansion. Yet, pricing pressure, tariff risks and contract manufacturing headwinds cloud the near-term outlook.

Is It Time To Reassess West Pharmaceutical Services (WST) After Its Recent Share Price Slide

Description: If you are wondering whether West Pharmaceutical Services is starting to look like value or still priced for perfection, its recent share performance gives you a useful starting point. The stock last closed at US$271.83, with a 3.2% decline over the past week, a 1.6% gain over the past month, a 1.7% decline year to date, and a 17.1% decline over the past year, while the 3 year return stands at 8.3% and the 5 year return at an 8.4% decline. Recent news coverage around West Pharmaceutical...

2026-01-13

Wall Street Analysts See a 26.42% Upside in West Pharmaceutical (WST): Can the Stock Really Move This High?

Description: The average of price targets set by Wall Street analysts indicates a potential upside of 26.4% in West Pharmaceutical (WST). While the effectiveness of this highly sought-after metric is questionable, the positive trend in earnings estimate revisions might translate into an upside in the stock.

2026-01-12

COO or WST: Which Is the Better Value Stock Right Now?

Description: COO vs. WST: Which Stock Is the Better Value Option?

West Signs Agreement to Sell the Manufacturing and Supply Rights for SmartDose® 3.5mL On-Body Delivery System to AbbVie

Description: West Pharmaceutical Services, Inc. (NYSE: WST), a global leader in innovative solutions for injectable drug administration, today announced that the company has reached a definitive agreement to sell all manufacturing and supply rights for SmartDose® 3.5mL On-Body Delivery System and associated facilities to AbbVie (NYSE: ABBV) for total consideration of $112.5 million at close, subject to working capital and other adjustments. The definitive agreement, which is subject to certain closing condit

AbbVie to Acquire Arizona Manufacturing Facility, Further Strengthening Manufacturing Capabilities in the United States

Description: AbbVie (NYSE: ABBV) and West Pharmaceutical Services (NYSE: WST) announced today a definitive agreement for AbbVie to acquire a device manufacturing facility in Tempe, Arizona and associated intellectual property from West. The acquisition of the manufacturing site will significantly expand AbbVie's drug delivery device manufacturing capabilities and capacity.

2026-01-11

2026-01-10

2026-01-09

A Look At West Pharmaceutical Services (WST) Valuation After Recent Share Price Moves

Description: West Pharmaceutical Services (WST) is back on investors’ radar after recent share moves, with the stock last closing at $275.35 and showing mixed return figures across the past week, month, and past 3 months. See our latest analysis for West Pharmaceutical Services. Those recent moves sit against a softer backdrop, with a year to date share price return of 0.4% and a 1 year total shareholder return decline of 16.7%. The 3 year total shareholder return is 10.7%, which suggests longer term...

Why The Narrative Around West Pharmaceutical Services (WST) Is Shifting On 2026 Outlook And Valuation

Description: West Pharmaceutical Services just saw its fair value estimate nudged slightly, with the price target essentially steady at about US$345.71 per share, while the discount rate and revenue growth inputs were both adjusted only modestly. These tweaks reflect how recent Street research has folded refreshed EPS assumptions and a more constructive tone on growth drivers into the existing framework, rather than resetting the story around the stock. Stay with this article to see how you can keep on...

2026-01-08

2026-01-07

KeyBanc Sees Injectable GLP-1s Driving Ongoing Demand for WST

Description: West Pharmaceutical Services, Inc. (NYSE:WST) is included among the 14 Best Dividend Growth Stocks to Buy and Hold in 2026. KeyBanc sees limited risk to oral weight loss drugs through 2030, even with the potential approval of an oral version of Wegovy. In a research note, the firm said oral GLP-1 adoption is likely to […]

2026-01-06

2026-01-05

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

2025-12-30

2025-12-29

2025-12-28

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

2025-12-21

2025-12-20

2025-12-19

2025-12-18

2025-12-17

West Pharmaceutical Services Stock: Is WST Underperforming the Healthcare Sector?

Description: Although West Pharmaceutical Services stock has underperformed the broader sector, analysts remain bullish about its prospects.

West Pharmaceutical Services (WST): Reassessing Valuation After a 20% Share Price Decline

Description: West Pharmaceutical Services (WST) has quietly slipped almost 20% over the past year, even as revenue and net income kept growing. That disconnect between share price and business performance is what makes the stock interesting now. See our latest analysis for West Pharmaceutical Services. Over the past year, West’s share price return has fallen sharply even as its three year total shareholder return remains positive. This suggests momentum has cooled lately as investors reassess growth...

2025-12-16

2025-12-15

2025-12-14

2025-12-13

2025-12-12

West to Participate in Upcoming Investor Conference

Description: West Pharmaceutical Services, Inc. (NYSE: WST), a global leader in innovative solutions for injectable drug administration, today announced that it will present at the J.P. Morgan Healthcare Conference on Wednesday, January 14, 2026, at 9:00 am PST in San Francisco, California.

2025-12-11

Reasons to Retain West Pharmaceutical Stock in Your Portfolio for Now

Description: WST leans on strong HVP demand, rising GLP-1 exposure and Annex 1 tailwinds, even as pricing and device margins weigh on near-term performance.

2025-12-10

West Declares Quarterly Dividend

Description: On December 9, 2025, the board of directors of West Pharmaceutical Services, Inc. (NYSE: WST), a global leader in innovative solutions for injectable drug administration, declared its regular quarterly dividend of $0.22 per share on the Company's common stock. The dividend is payable on February 4, 2026, to shareholders of record on January 28, 2026.

2025-12-09

2025-12-08

2025-12-07

2025-12-06

2025-12-05

Why Is McKesson (MCK) Down 5.2% Since Last Earnings Report?

Description: McKesson (MCK) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

The Bull Case For West Pharmaceutical Services (WST) Could Change Following Margin Squeeze And Slower Revenue Growth

Description: West Pharmaceutical Services recently reported that its annual revenue growth over the past two years was about 1.5%, while rising costs compressed its adjusted operating margin by 5.5 percentage points and weakened returns on capital, highlighting pressure on its core injectable packaging and delivery businesses. This combination of slowing top-line expansion and margin erosion raises questions about whether the company’s traditional profit engines can continue to support its long-term...

2025-12-04

Why Is Henry Schein (HSIC) Up 1.2% Since Last Earnings Report?

Description: Henry Schein (HSIC) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

West Pharmaceutical Services (WST) Rebounded in Q3

Description: Brown Advisory, an investment management company, released its “Brown Advisory Large-Cap Growth Strategy” third-quarter 2025 investor letter. A copy of the letter can be downloaded here. The strategy returned -0.88% (net) during the third quarter, underperforming the benchmark, the Russell 1000 Growth Index. Even though the portfolio has significant exposure to AI, its underweight to […]

2025-12-03

2025-12-02

2025-12-01

2025-11-30

2025-11-29

2025-11-28

2025-11-27

2025-11-26

Enterprise Software, Health Care Stocks Miss Out on Broader Rally

Description: Most of the market was feasting on another helping of Thanksgiving week gains on Wednesday, but enterprise software and health care stocks were missing out on the celebration. Workday was the biggest laggard in the S&P 500 and among the fewer than 90 stocks in the index that were trading lower on Wednesday. Salesforce, another major player in enterprise software, reports quarterly results a week from today.

2025-11-25

2025-11-24

2025-11-23

2025-11-22

West Pharmaceutical Services (WST): Gauging Valuation After Q3 Beat, Raised Guidance, and Bullish Market Momentum

Description: West Pharmaceutical Services reported third-quarter results that outperformed expectations, with organic growth driving a 7.7% year-over-year increase in net sales. The company also raised its full-year guidance, supporting recent gains in the stock price. See our latest analysis for West Pharmaceutical Services. West Pharmaceutical’s recent 5.2% one-day share price jump came on the heels of strong quarterly results, a raised outlook, and a dose of positive macro sentiment around potential...

What Catalysts Could Shift the Narrative for West Pharma After Analyst Upgrades and New Guidance

Description: West Pharmaceutical Services' stock narrative has seen little change in its fair value price target, which remains steady at $350.77 following recent analysis. Analysts cite strong quarterly results and stable company prospects as key reasons for this consistency. Market opinions vary from bullish optimism to cautious watchfulness. Stay tuned to see how you can keep informed on future shifts in West Pharmaceutical's evolving market story. Stay updated as the Fair Value for West Pharmaceutical...

2025-11-21

Option Care Health, DaVita, Revvity, West Pharmaceutical Services, and Bausch + Lomb Shares Skyrocket, What You Need To Know

Description: A number of stocks jumped in the afternoon session after comments from a key Federal Reserve official bolstered hopes for an interest rate cut. New York Federal Reserve President John Williams stated he sees “room for a further adjustment” in the near term, sparking a significant market rally. Following his remarks, the probability of the central bank cutting rates at its December meeting jumped from 39% to over 73%, according to the CME FedWatch tool. This positive sentiment provided relief to

What Are Wall Street Analysts' Target Price for West Pharmaceutical Services Stock?

Description: West Pharmaceutical Services has substantially underperformed the broader market over the past year, yet analysts remain bullish on the stock’s prospects, with price targets suggesting significant upside potential.

2025-11-20

2025-11-19

2025-11-18

2025-11-17

2025-11-16

2025-11-15

2025-11-14

2025-11-13

2025-11-12

RGTI Stock Down Despite Q3 Earnings Top Estimates, Revenues Decline Y/Y

Description: Rigetti's Q3 loss is narrower than estimates, but revenues decline as government contract delays hit sales and lower the gross margin.

2025-11-11

2025-11-10

2025-11-09

2025-11-08

2025-11-07

AMN Stock Gains Following Q3 Earnings & Revenue Beat, Margins Down

Description: AMN Healthcare beats third-quarter 2025 earnings and revenue estimates despite lower margins and year-over-year declines across key segments.

Doximity Stock Down Despite Q2 Earnings Beat, Revenues Up Y/Y

Description: DOCS Q2 results benefit from the rise in AI-driven engagement. However, the stock plunges nearly 9% in pre-market trading.

What Analysts Say Is Changing the Story for West Pharmaceutical Services

Description: West Pharmaceutical Services stock has seen its fair value estimate rise from $321.45 to $350.77, as analysts respond to recent positive momentum. This upward adjustment reflects increased confidence in the company’s growth prospects and management’s outlook following a strong quarterly performance. Stay tuned to learn how you can stay ahead of further changes in the narrative around West Pharmaceutical Services. Analyst Price Targets don't always capture the full story. Head over to our...

2025-11-06

QuidelOrtho Q3 Earnings and Revenues Beat Estimates, Margins Expand

Description: QDEL tops Q3 estimates as Labs and Immunohematology units drive growth, while margins strengthen despite respiratory revenue declines.

Inogen Stock Dips Despite Q3 Earnings Beat, Revenues Up Y/Y

Description: INGN stock slid despite a narrower Q3 loss and rising B2B demand, as weaker consumer and rental sales weighed on results.

PACB Stock Down Despite Q3 Earnings Beat Estimates, Revenues Down Y/Y

Description: PacBio posts a narrower Q3 loss and margin gains, but shares fall as revenues dip amid softer instrument demand.

CONMED Q3 Earnings and Revenues Beat Estimates, Margins Contract

Description: CNMD beats third-quarter 2025 estimates on strength in surgery segments, but gross and operating margins see sharp contraction.

BD Stock Slips in Pre-Market Despite Q4 Earnings Beat, Margins Up

Description: BDX tops fourth-quarter fiscal 2025 earnings estimates and posts strong margin gains, with growth across all business segments and geographies.

CTS Corporation Announces Appointment of Kimberly Banks MacKay to its Board of Directors

Description: LISLE, Ill., Nov. 06, 2025 (GLOBE NEWSWIRE) -- CTS Corporation (NYSE: CTS), a leading global designer and manufacturer of custom engineered solutions that “Sense, Connect and Move,” today announced that Kimberly Banks MacKay has been appointed to its Board of Directors, effective November 5, 2025, and that she will serve as a member of the Nominating, Governance and Sustainability Committee, as well as the Technology and Transactions Committee. Ms. MacKay comes to CTS with over 30 years of exper

2025-11-05

Hims & Hers Stock Slips Post Y/Y Q3 Earnings Decline, Margins Contract

Description: HIMS reports lower third-quarter 2025 earnings even as revenue and subscriber growth remain strong across its channels.

MASI Stock Gains Post Q3 Earnings and Revenue Beat, Margins Expand

Description: Masimo beats third-quarter 2025 earnings and revenue estimates as operating margins and profits improve on lower expenses.

2025-11-04

INSP Stock Gains Following Q3 Earnings Beat, Gross Margin Expands

Description: Inspire Medical tops third-quarter 2025 estimates as revenue climbs and gross margin improves, with full-year EPS guidance raised.

2025-11-03

TD Cowen Initiates Coverage on West Pharmaceutical (WST) with Buy Rating and $350 Target

Description: West Pharmaceutical Services, Inc. (NYSE:WST) is included among the 13 Best Consistent Dividend Stocks to Buy Now. On October 29, TD Cowen analyst Brendan Smith initiated coverage of West Pharmaceutical Services, Inc. (NYSE:WST) with a Buy rating and a price target of $350, as reported by The Fly. He noted that West is well-positioned at the […]

2025-11-02

2025-11-01

2025-10-31

4 Resilient Dental Supply Players Positioned to Withstand Tariff Risks

Description: Here, we discuss four stocks from the Dental Supplies industry that are likely to generate wealth for investors amid tariff uncertainty. These are MCK, CAH, WST and COO.

Wall Street Analysts Think West Pharmaceutical (WST) Could Surge 25.41%: Read This Before Placing a Bet

Description: The mean of analysts' price targets for West Pharmaceutical (WST) points to a 25.4% upside in the stock. While this highly sought-after metric has not proven reasonably effective, strong agreement among analysts in raising earnings estimates does indicate an upside in the stock.

CFOs On the Move: Week ending Oct. 31

Description: Agilent Technologies appoints a new finance chief, Fiserv shakes up its leadership and railroad operator CSX names a new CFO.

1 High-Flying Stock on Our Watchlist and 2 Facing Challenges

Description: Expensive stocks often command premium valuations because the market thinks their business models are exceptional. However, the downside is that high expectations are already baked into their prices, leaving little room for error if they stumble even slightly.

2025-10-30

The 5 Most Interesting Analyst Questions From West Pharmaceutical Services’s Q3 Earnings Call

Description: West Pharmaceutical Services delivered third quarter results that surpassed Wall Street’s revenue and profit expectations, sparking a strong positive reaction in the market. Management attributed this performance to double-digit growth in High Value Product (HVP) components, particularly the elastomers supplied for GLP-1 therapies, and a robust pipeline of Annex 1 upgrade projects. CEO Eric Green highlighted the company's “trusted reputation for high-quality scale and reliability” as a key facto

2025-10-29

2025-10-28

2025-10-27

West Synchrony™ Prefillable Syringe System Launches at CPHI: Redefining a system-level solution for drug delivery

Description: West Pharmaceutical Services, Inc. (NYSE: WST), a global leader in innovative solutions for injectable drug administration, today announced the launch of its West Synchrony™ Prefillable Syringe (PFS) System at CPHI Worldwide in Frankfurt, Germany. This innovative system marks a significant shift in drug delivery solutions by offering a fully verified platform from a single supplier that will be commercially available in January 2026.

2025-10-26

West Pharmaceutical Services (WST) Is Up 9.9% After Raising 2025 Guidance and Beating Q3 Expectations

Description: Earlier this week, West Pharmaceutical Services reported third-quarter results that beat analyst expectations and raised its full-year 2025 guidance, projecting higher net sales and improved earnings as demand remained strong across key product categories, especially GLP-1 components. The company also introduced fourth-quarter guidance, expanded leadership with a new CFO, and noted a significant increase in forecasted revenue benefits from foreign currency exchange rates. We’ll now explore...

2025-10-25

West Pharmaceutical Services (WST): Evaluating Valuation After Recent Share Price Momentum

Description: West Pharmaceutical Services (WST) shares have seen some movement recently, catching the eye of investors who track shifts in the healthcare supply chain space. The company’s stock is up about 13% over the past month. See our latest analysis for West Pharmaceutical Services. It’s been an eventful stretch for West Pharmaceutical Services, with its 1-month share price return of nearly 14% hinting at renewed optimism following a challenging start to the year. Over the longer term, total...

2025-10-24

Reasons to Hold Fresenius Medical Stock in Your Portfolio for Now

Description: FMS acquisitions, partnerships and global reach fuel growth, though rising costs weigh on near-term prospects.

West to Participate in Upcoming Investor Conferences

Description: West Pharmaceutical Services, Inc. (NYSE: WST), a global leader in innovative solutions for injectable drug administration, today announced that it will present at the following upcoming investor conferences:

WST Q3 Deep Dive: GLP-1 Demand, Annex 1 Upgrades, and Margin Expansion Shape Outlook

Description: Healthcare products company West Pharmaceutical Services (NYSE:WST) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 7.7% year on year to $804.6 million. The company’s full-year revenue guidance of $3.07 billion at the midpoint came in 0.5% above analysts’ estimates. Its non-GAAP profit of $1.96 per share was 16.3% above analysts’ consensus estimates.

2025-10-23

Why West Pharmaceutical Services Stock Was Blasting Higher on Thursday

Description: The company crushed analyst profitability estimates, both for its trailing quarter and for its full-year guidance.

Why Are West Pharmaceutical Services (WST) Shares Soaring Today

Description: Shares of healthcare products company West Pharmaceutical Services (NYSE:WST) jumped 12.3% in the afternoon session after the company reported strong third-quarter 2025 results that surpassed analyst estimates and raised its full-year financial forecast.

West Pharmaceutical Services Inc (WST) Q3 2025 Earnings Call Highlights: Strong Organic Growth ...

Description: West Pharmaceutical Services Inc (WST) reports a robust third quarter with increased revenue and EPS, while setting a positive trajectory for future growth.

Here's Why You Should Add OPKO Health Stock to Your Portfolio

Description: OPK benefits from RAYALDEE momentum, strategic deals and advancing trials amid stiff competition and dependence risks.

WST Stock Up on Q3 Earnings Beat, EPS View Raised on Demand & FX Benefit

Description: West Pharmaceutical's strong Q3 beat and raised EPS outlook highlight robust demand, FX tailwinds, and solid growth in Proprietary Products.

What Makes West Pharmaceutical Services (WST) a Prospective Investment?

Description: Upslope Capital Management, an investment management company, released its third-quarter investor letter. A copy of the letter can be downloaded here. The third quarter was a strong one for the fund despite unusual volatility in the macro environment. The fund returned +8.8% (net) in Q3 compared to +5.5% and +3.8% for the S&P Midcap 400 […]

Exchange-Traded Funds, Equity Futures Lower Pre-Bell Thursday Amid Oil Surge, Trade Tensions

Description: The broad market exchange-traded fund SPDR S&P 500 ETF Trust (SPY) was down 0.1% and the actively tr

West Pharmaceutical Services (WST) Tops Q3 Earnings and Revenue Estimates

Description: West Pharmaceutical (WST) delivered earnings and revenue surprises of +17.37% and +2.43%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

West Pharmaceutical Services’s (NYSE:WST) Q3 Sales Beat Estimates

Description: Healthcare products company West Pharmaceutical Services (NYSE:WST) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 7.7% year on year to $804.6 million. The company’s full-year revenue guidance of $3.07 billion at the midpoint came in 0.5% above analysts’ estimates. Its non-GAAP profit of $1.96 per share was 16.3% above analysts’ consensus estimates.

West Pharmaceutical: Q3 Earnings Snapshot

Description: WST) on Thursday reported third-quarter net income of $140 million. The Exton, Pennsylvania-based company said it had net income of $1.92 per share. Earnings, adjusted for restructuring costs and amortization costs, came to $1.96 per share.

West Reports Third-Quarter 2025 Results

Description: West Pharmaceutical Services, Inc. (NYSE: WST), a leading provider of innovative, high-quality injectable solutions and services, today announced its financial results for the third quarter of 2025.

2025-10-22

2025-10-21

West Pharmaceutical Services (WST) To Report Earnings Tomorrow: Here Is What To Expect

Description: Healthcare products company West Pharmaceutical Services (NYSE:WST) will be reporting earnings this Thursday morning. Here’s what to look for.

BDX Launches AI-Enabled Platform to Unify Healthcare Connectivity

Description: BD's new AI-driven Incada Platform and upgraded Pyxis Pro system unite connected care, driving its digital healthcare edge.

2025-10-20

West Pharmaceutical Services Stock Sees RS Rating Climb To 71

Description: West Pharmaceutical Svcs shows rising price performance, earning an upgrade to its IBD Relative Strength Rating

Improved Investor Confidence Boosted West Pharmaceutical Services (WST)

Description: Conestoga Capital Advisors, an asset management company, released its third-quarter 2025 investor letter. A copy of the letter can be downloaded here. Equity markets continued their momentum that began in early April, reaching new all-time highs in the third quarter. Conestoga Smid Cap Composite underperformed the Russell 2500 Growth Index in the quarter and returned -1.1% […]

2025-10-19

2025-10-18

Is Now the Right Moment for West Pharma After Its Latest Earnings and 5% Monthly Gain?

Description: If you are thinking about what to do with West Pharmaceutical Services stock, you are not alone. The recent moves in the price chart have sparked fresh debate among investors. After rising 3.4% over the past week and 5.4% in the last month, the stock has signaled some renewed optimism. Still, with year-to-date returns at -17.6% and a decline of 7.5% over the past year, it is clear the journey has not been without turbulence. Over three years the shares are up a healthy 17.1%, though the...

2025-10-17

Avantor Partners With BlueWhale Bio to Advance CAR-T Manufacturing

Description: AVTR collaborates with BlueWhale Bio to speed CAR-T manufacturing using CDNP tech, aiming to scale production and expand patient access.

WST Q3 Earnings Preview: Can GLP-1 Momentum Outweigh Margin Pressure?

Description: West Pharma's Q3 numbers hinge on robust GLP-1 and biologics demand, but labor constraints, tariffs, and plant shutdowns could test its margin resilience.

3 Cash-Producing Stocks That Fall Short

Description: A company that generates cash isn’t automatically a winner. Some businesses stockpile cash but fail to reinvest wisely, limiting their ability to expand.