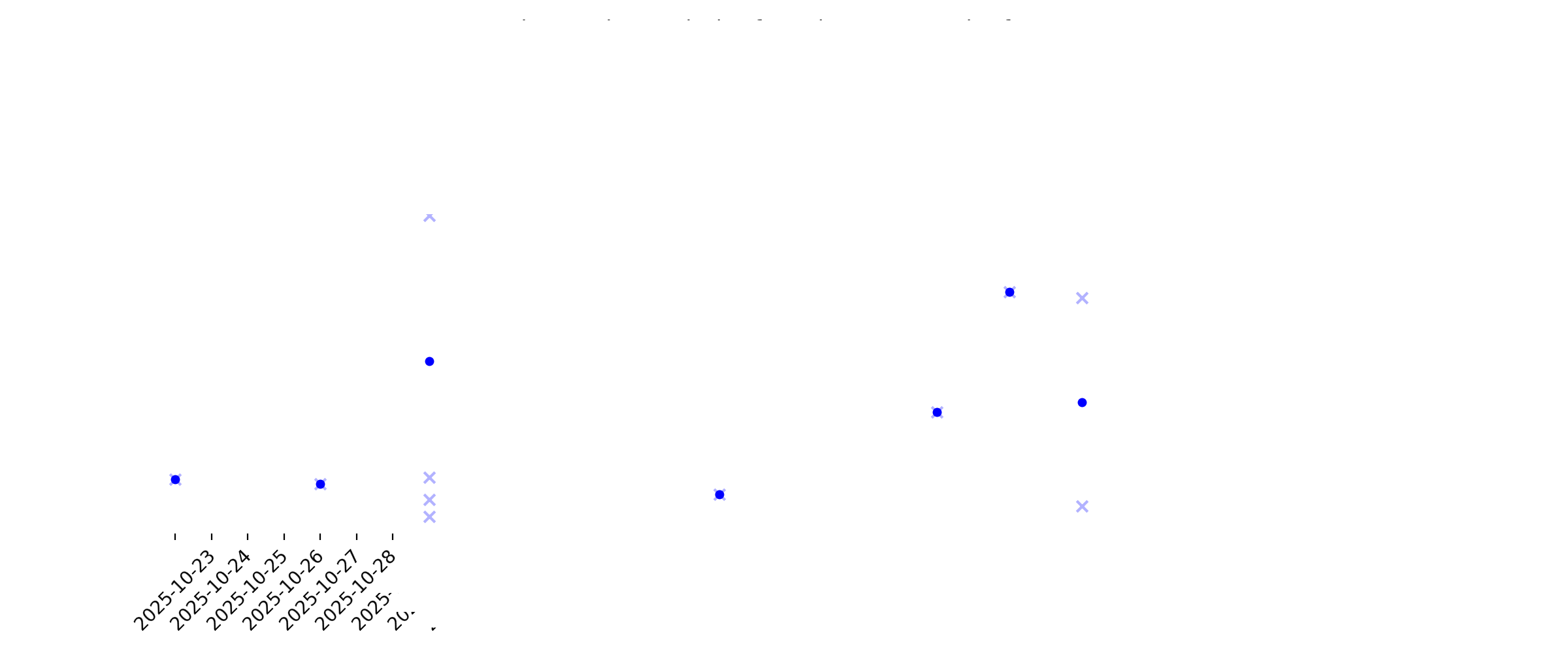

News sentiment analysis for WY

Sentiment chart

2026-01-14

2026-01-13

2026-01-12

2026-01-11

Assessing Weyerhaeuser (WY) Valuation After 2024 Results And Recent Share Price Momentum

Description: Recent performance snapshot for Weyerhaeuser Weyerhaeuser (WY) has drawn fresh attention after reporting 2024 net sales of US$7.1b and net income of US$331.0m. Its US$25.73 share price reflects a mix of recent gains and longer term share price pressure. See our latest analysis for Weyerhaeuser. After a sharp 7.25% 1-day share price return and a 10.00% 30-day share price return, Weyerhaeuser’s recent momentum contrasts with a softer 1-year total shareholder return decline of 2.58%, suggesting...

2026-01-10

2026-01-09

S&P 500, Dow Rally to New Peaks After Jobs Report; Wall Street Posts Weekly Gains

Description: The S&P 500 and the Dow Jones Industrial Average reached new all-time highs on Friday following a ke

Equities Rise Intraday as Markets Weigh Jobs, Other Macro Data

Description: US benchmark equity indexes were higher intraday as traders parsed latest economic data, including a

2026-01-08

2 Wood Stocks in Focus Despite a Tough Industry Climate

Description: More infrastructure spending, a focus on product innovation and efficient cost management are encouraging for the Zacks Building Products - Wood industry players like WY and RYN despite a challenging macroeconomic backdrop.

2026-01-07

2026-01-06

2026-01-05

2026-01-04

2026-01-03

2026-01-02

2026-01-01

2025-12-31

What to Expect From Weyerhaeuser’s Next Quarterly Earnings Report

Description: Weyerhaeuser is set to report its fourth-quarter earnings next month, and expectations are grim, with analysts projecting a triple-digit plunge in funds from operations that could push FFO into negative territory.

2025-12-30

2025-12-29

2025-12-28

DA Davidson Highlights Timberland Upside in Weyerhaeuser’s (WY) Medium-Term Plan

Description: Weyerhaeuser Company (NYSE:WY) is included among the 15 Dividend Stocks with Low Payout Ratios and Strong Upside. On December 15, DA Davidson kept a Buy rating and a $31 price target on Weyerhaeuser Company (NYSE:WY). The firm said it was encouraged by the medium-term goals management laid out at its Investor Day last week. DA […]

2025-12-27

2025-12-26

2025-12-25

2025-12-24

2025-12-23

2025-12-22

2025-12-21

2025-12-20

2025-12-19

2025-12-18

Weyerhaeuser to Release Fourth Quarter Results on January 29

Description: Weyerhaeuser Company (NYSE: WY) will release fourth quarter 2025 results on Thursday, January 29, after the market closes. The company will then hold a live webcast and conference call the following day, on Friday, January 30, at 7 a.m. Pacific (10 a.m. Eastern), to discuss the results.

Should Weyerhaeuser’s (WY) New Biocarbon JV to Replace Metallurgical Coal Require Investor Action?

Description: Weyerhaeuser and Aymium recently entered a memorandum of understanding and formed TerraForge Biocarbon Solutions to convert Weyerhaeuser wood fiber into low-emissions biocarbon for metals production, starting with a joint facility next to Weyerhaeuser’s McComb, Mississippi lumber mill. At full rollout, the partnership aims to turn over 7 million tons of Weyerhaeuser-supplied wood fiber into 1.5 million tons of metallurgical-grade biocarbon each year, offering a coal replacement for iron,...

2025-12-17

Weyerhaeuser’s Push to Replace Met Coal

Description: The quest to find new markets for pulpwood amid the decline of paper demand has led America's largest landowner to steel mills. Weyerhaeuser, which owns a fleet of sawmills and U.S. timberland that covers an area larger than Switzerland, has launched a venture with partner Aymium to turn the small trees and sawdust into a replacement for metallurgical coal used in the production of steel and other metals. It's part of a broad initiative by Weyerhaeuser to boost its bottom line by $1.5 billion by 2025.

America’s Largest Landowner Bets It Can Replace Met Coal With Pine Trees

Description: Weyerhaeuser has launched a venture to turn runty trees and sawdust into a replacement for metallurgical coal used in steel making.

2025-12-16

Weyerhaeuser CEO Says It’s “Well Positioned” to Take Advantage of Industry Upturn

Description: Devin Stockfish said the timber company is “operating from a position of strength” thanks to initiatives taken to lower costs and boost productivity.

2025-12-15

Seaport Research Reworks its View on Weyerhaeuser (WY) After Q3

Description: Weyerhaeuser Company (NYSE:WY) is included among the 13 Best Blue Chip Stocks to Buy Under $50. On December 10, Seaport Research lowered its price target on Weyerhaeuser Company (NYSE:WY) to $33 from $35 while maintaining a Buy rating. The adjustment reflects the company’s third-quarter results. In separate news, Weyerhaeuser Company (NYSE:WY) and Aymium announced that […]

2025-12-14

2025-12-13

Jim Cramer Points to Fed Rate Cuts as a Potential Catalyst for Weyerhaeuser

Description: Weyerhaeuser Company (NYSE:WY) is one of the stocks on Jim Cramer’s radar recently. Cramer noted the company’s investor meeting and the long-term forecast for 2030, as he remarked: “Earlier today, we got an update from Weyerhaeuser, it’s the largest private owner of timberlands in North America, at its investor meeting, where management laid out an […]

2025-12-12

2025-12-11

Weyerhaeuser Outlines Strategy to Accelerate Growth and Drive Significant Value Creation at Investor Day

Description: Weyerhaeuser Company (NYSE: WY), a global leader in sustainable forestry, land management and wood products manufacturing, is hosting its 2025 Investor Day today, beginning at 9 a.m. Eastern, to outline the company's strategic growth plan and financial targets through 2030.

Weyerhaeuser and Aymium Enter Agreement to Rapidly Scale Biocarbon Market

Description: Weyerhaeuser Company (NYSE: WY) and Aymium today announced they have entered a memorandum of understanding (MOU) to partner to produce and sell 1.5 million tons of sustainable biocarbon annually for use in metals production. As an initial stage of this partnership, the companies have formed a joint venture — TerraForge Biocarbon Solutions — to build a jointly owned facility adjacent to Weyerhaeuser's lumber mill in McComb, Miss., that will convert wood fiber into biocarbon through a combustion-f

2025-12-10

Is Weyerhaeuser Stock Underperforming the Dow?

Description: Weyerhaeuser has underperformed the Dow over the past year, but analysts are cautiously optimistic about the stock’s prospects.

2025-12-09

2025-12-08

2025-12-07

2025-12-06

Weyerhaeuser (WY): Taking a Fresh Look at Valuation After a Steep Year‑to‑Date Share Price Decline

Description: Weyerhaeuser (WY) has quietly slipped this year, with the stock down about 22% year to date, even as its timber and real estate operations continue generating steady cash flow and improving earnings. See our latest analysis for Weyerhaeuser. The recent slide has left Weyerhaeuser’s share price at $21.69, with a 90 day share price return of negative 17.1%, and a one year total shareholder return of negative 28.4%, pointing to fading momentum despite healthier earnings and modest top line...

Is Weyerhaeuser’s 28% Slide in 2025 Creating a Mispriced Timberland Opportunity?

Description: Whether you are wondering if Weyerhaeuser is a quietly mispriced way to gain exposure to timber and real estate, or a value trap in disguise, this article will walk you through what the numbers are really saying about the stock today. Despite its strong asset base, the share price has slid, with Weyerhaeuser down roughly 2.3% over the last week, 3.5% over the past month, and 22.5% year to date, compounding to a 28.4% drop over the last year. Recent moves have come against a backdrop of...

2025-12-05

Weyerhaeuser Stock Trades for Less Than the Value of Its Lumber. It’s Time to Buy.

Description: When it comes to lumber producer Weyerhaeuser investors can’t see the forest for the trees—quite literally. The 125-year-old company is the largest private owner of timberland in North America, with over 10 million acres, including valuable tracts in the Pacific Northwest, where it holds over two million acres. It also operates 33 manufacturing plants across the continent, where it produces wood products.

2025-12-04

2025-12-03

2025-12-02

2025-12-01

2025-11-30

2025-11-29

2025-11-28

2025-11-27

2025-11-26

Plywood Market Competitive Landscape Report 2025: Recent Developments, Strategies, Sustainability Benchmarking, Product Analysis, Key Persons and Revenue

Description: The Global Plywood Market is projected to grow from US$ 48.95 billion in 2024 to US$ 73.01 billion by 2033, at a CAGR of 4.54% from 2025-2033. This growth is driven by booming construction, furniture, and infrastructure sectors, alongside a rising preference for eco-friendly materials. Plywood, known for its strength and versatility, is widely used across construction, furniture, and marine applications. Key market players include Boise Cascade, Weyerhaeuser, UPM-Kymmene, and Georgia-Pacific, wh

2025-11-25

2025-11-24

2025-11-23

2025-11-22

2025-11-21

2025-11-20

2025-11-19

2025-11-18

2025-11-17

JPMorgan Lowers Weyerhaeuser (WY) Price Target to $27, Maintains Overweight

Description: Weyerhaeuser Company (NYSE:WY) is included among the 15 Best 52-Week Low Dividend Stocks to Invest in. On November 14, JPMorgan reduced its price target on Weyerhaeuser Company (NYSE:WY) to $27 from $28 but maintained an Overweight rating. The firm adjusted its estimates following the company’s third-quarter results. In Q3 2025, Weyerhaeuser Company (NYSE:WY) completed two […]

Weyerhaeuser Announces Appointment of Rick Beckwitt to Board of Directors

Description: Weyerhaeuser Company (NYSE: WY) today announced the appointment of Richard "Rick" Beckwitt, former president, chief executive officer and director of Lennar Corporation, to the company's board of directors. His appointment is effective immediately.

2025-11-16

2025-11-15

Is Weyerhaeuser Offering Value After a 26% Drop and DCF Reassessment?

Description: Wondering whether Weyerhaeuser is trading at a bargain, or if there are better opportunities elsewhere? Let’s cut through the noise and see what the numbers are really saying about its value right now. Despite a tough year that has seen the stock drop by 26.3% over the past twelve months and 20.9% year-to-date, these moves could signal shifting market sentiment or fresh possibilities for investors paying close attention. Recent headlines have highlighted Weyerhaeuser’s...

2025-11-14

2025-11-13

Weyerhaeuser Company Declares Dividend on Common Shares

Description: Weyerhaeuser Company (NYSE: WY) today announced that its board of directors declared a quarterly base cash dividend of $0.21 per share on the common stock of the company, payable in cash on December 12, 2025, to holders of record of such common stock as of the close of business on November 28, 2025.

2025-11-12

2025-11-11

2025-11-10

2025-11-09

2025-11-08

2025-11-07

Forest Investment Associates Highlights $220 Million Georgia/Alabama Timberland Acquisition

Description: Forest Investment Associates (FIA) today reaffirmed details of its previously announced agreement to acquire approximately 86,000 acres of high-quality timberland in Georgia and Alabama from Weyerhaeuser. The privately negotiated, off-market transaction, valued at approximately $220 million, was originally announced on October 30, 2025, and remains subject to customary closing conditions.

2025-11-06

2025-11-05

2025-11-04

Weyerhaeuser Stock Outlook: Is Wall Street Bullish or Bearish?

Description: Real estate giant Weyerhaeuser has notably underperformed the broader market over the past year, yet analysts remain moderately optimistic about the stock’s prospects.

2025-11-03

Weyerhaeuser (WY) Q3 2025 Earnings Call Transcript

Description: Yesterday, Weyerhaeuser reported third quarter GAAP earnings of $80 million or $0.11 per diluted share, on net sales of $1.7 billion. Adjusted EBITDA totaled $217 million for the quarter. Notwithstanding recent headwinds, we remain well positioned to navigate the current environment, given our deeply embedded OpEx culture and competitive cost structure.

2025-11-02

2025-11-01

The Bull Case For Weyerhaeuser (WY) Could Change Following Earnings Surge and Portfolio Shifts—Learn Why

Description: Weyerhaeuser Company recently reported third-quarter 2025 results, posting net income of US$80 million compared to US$28 million a year prior, alongside basic and diluted earnings per share of US$0.11, up from US$0.04 in the same period last year. A key development was the completion of two acquisitions totaling US$459 million and progress on three planned divestitures expected to generate US$410 million in cash, positioning Weyerhaeuser for further portfolio optimization. Now, we'll assess...

2025-10-31

Weyerhaeuser Co (WY) Q3 2025 Earnings Call Highlights: Navigating Market Challenges with ...

Description: Despite facing headwinds in the Wood Products segment, Weyerhaeuser Co (WY) remains optimistic about long-term growth, supported by strategic timberland transactions and shareholder returns.

Weyerhaeuser Q3 Earnings & Sales Top Estimates, Both Increase Y/Y

Description: WY tops Q3 earnings and sales estimates, boosted by Timberlands' strength and strategic portfolio moves.

2025-10-30

Here's What Key Metrics Tell Us About Weyerhaeuser (WY) Q3 Earnings

Description: Although the revenue and EPS for Weyerhaeuser (WY) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Weyerhaeuser (WY) Q3 Earnings and Revenues Surpass Estimates

Description: Weyerhaeuser (WY) delivered earnings and revenue surprises of +185.71% and +4.12%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock?

Weyerhaeuser: Q3 Earnings Snapshot

Description: SEATTLE (AP) — Weyerhaeuser Co. (WY) on Thursday reported third-quarter profit of $80 million. On a per-share basis, the Seattle-based company said it had net income of 11 cents. Earnings, adjusted for non-recurring gains, came to 6 cents per share.

Weyerhaeuser Provides Update on Timberlands Portfolio Optimization Actions

Description: Weyerhaeuser Company (NYSE: WY) today announced updates on recent actions to enhance portfolio quality and value through a series of strategic and capital-efficient timberland transactions. In the third quarter, the company completed two high-quality acquisitions totaling $459 million, including its previously announced transaction for timberlands in North Carolina and Virginia. Additionally, in the third quarter Weyerhaeuser advanced three divestiture packages of non-core timberlands — two of w

Weyerhaeuser Reports Third Quarter 2025 Results

Description: Weyerhaeuser Company (NYSE: WY) today reported its third quarter 2025 financial results. The company's earnings release and associated materials are available on the Investors section of the company's website, www.weyerhaeuser.com. In addition, the earnings release has been furnished on a Form 8-K with the U.S. Securities and Exchange Commission and is available at www.sec.gov.

2025-10-29

2025-10-28

2025-10-27

Potlatch (PCH) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Description: Potlatch (PCH) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2025-10-26

2025-10-25

2025-10-24

2025-10-23

Earnings Preview: Weyerhaeuser (WY) Q3 Earnings Expected to Decline

Description: Weyerhaeuser (WY) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.